Latest Post | Last 10 Posts | Archives

Previous Post: More Jesse Sullivan oppo emerges

Next Post: *** UPDATED x1 - IL AFL-CIO endorses Budzinski *** Some campaign stuff

Posted in:

* COGFA special pension report…

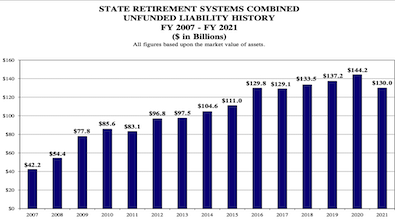

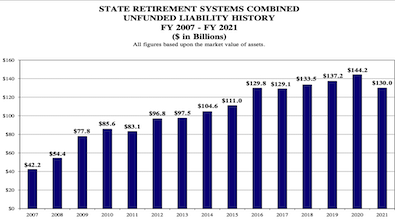

(A) significant drop in unfunded liability was recorded in FY 2021, largely thanks to exceptionally strong investment performances by all the five systems. This allowed the combined unfunded liability to decrease by $14.3 billion, a 9.9% decline from the previous year, to $130.0 billion. During the recent 15- year period, there were only three times that the unfunded liability decreased from the previous year: in FY 2011 (-2.9%), FY 2017 (-0.5%) and FY 2021.

* Chart…

* Crain’s with some caveats…

One, the COGFA figures are based on the market value of pension-fund assets. In other words, they’re not blended or otherwise averaged over five years, as often is the case with such reporting.

Caveat two is that, just like almost any other investor with half a brain, the state funds enjoyed “exceptional” returns on invested capital in fiscal 2021, earning 22.9% to 25.2%. That’s way, way above their assumed rate or return of 6.5% to 7%.

Beyond that, some years in the recent past had unusual bumps, making the new figures look relatively good in comparison. And even with the booming return on investment, the state still is contributing roughly $2 billion a year less than the amount it is actuarially required to reach its eventual full funding.

Ergo, concludes Civic Federation President Lauarence Msall, the new COGFA figures “are not a trend. It’s a data point in the market.”

He continues, “It’s not bad news. But it’s only one data point.”

It may not be a trend, it may be just one data point, it may be a complete fluke, but you gotta take what you can get in this world, so I’ll take it.

posted by Rich Miller

Thursday, Dec 9, 21 @ 9:39 am

Sorry, comments are closed at this time.

Previous Post: More Jesse Sullivan oppo emerges

Next Post: *** UPDATED x1 - IL AFL-CIO endorses Budzinski *** Some campaign stuff

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

“you gotta take what you can get in this world”

2021,1921,1721, or 2521. Same as it ever was, or will be.

Comment by Flyin' Elvis'-Utah Chapter Thursday, Dec 9, 21 @ 9:48 am

===He continues, “It’s not bad news. But it’s only one data point.”===

IF it was a data point in the other direction / bad news, trumpets would blare and it would be loudly heralded, amplified by John Tillman’s media apparatus and Ken Griffin’s money.

Comment by Anyone Remember Thursday, Dec 9, 21 @ 9:52 am

If the unfunded liability had gone up, would Larry Msall be calling it “just a data point?” Good news is bad for business.

Comment by Um, no Thursday, Dec 9, 21 @ 9:56 am

First of all, thank you Mr. Market.

Having said that, I also think a big thank you to the trustees who witnessed a big drop in the shock market, did not panic, followed their respective investment policy statements and stayed invested in the stock market.

Many investors ran to the sidelines, but the public pension system trustees stuck to the idea that it is time in the market and not market timing that works for investors.

Comment by Back to the Future Thursday, Dec 9, 21 @ 9:59 am

I had a grandfather that followed his investments every day. One day he beamed to my father that he had made close to 25K that day. My father deadpanned; did you sell it? Grandpa said no. So, my father said then you really didn’t make anything.

Obviously, having a couple good years of investment returns is positive. But the same analogy can be said in reverse for return losses. They are not losses unless to have to sell the asset to pay a benefit out. That is the critical point here. Mounting pension liabilities are out running inputs into the system. Downplayed in the story seems to be that the pension contributions are $2 billion less than they should be. That is the story.

Comment by Nagidam Thursday, Dec 9, 21 @ 10:01 am

===contributions are $2 billion less than they should be. That is the story.===

It always has been the story. Hence, the ramp.

Comment by Rich Miller Thursday, Dec 9, 21 @ 10:05 am

= Mounting pension liabilities are out running inputs into the system. Downplayed in the story seems to be that the pension contributions are $2 billion less than they should be. That is the story.=

And yet, over 50 years the unfunded liability as a percentage of obligations has remained nearly the same.

The sky is not falling.

Comment by JS Mill Thursday, Dec 9, 21 @ 10:15 am

===It always has been the story. Hence, the ramp.===

The ramp is just an arbitrary point in time with data backfilled to say what you need to pay out liabilities. Obviously the longer you delay getting to a funding level the less money you have in the system to make returns at 25%. How close does the system get to having to sell assets at a loss to pay benefits is the critical point of this whole debate. The ramp can be changed. But, changing the ramp probably means putting less money into the system which brings in the asset sale for a loss closer to reality.

Comment by Nagidam Thursday, Dec 9, 21 @ 10:19 am

= less than they should be =

Then set the actuarial timeline to 50 years instead of 40.

What ’should’ they be in that case?

Show your work. I want to see if you understand what you are talking about.

Comment by TheInvisibleMan Thursday, Dec 9, 21 @ 10:26 am

It’s almost like there is a 50-year plan to restore financial health to the pension systems and the state is roughly half way through it.

This market performance is good news.

Stay the course.

Could there be more responsible payment plans?

Could they get 30 and 60? (I’m now channeling my inner Oswego Willy)

We have a plan that’s working despite some deserved criticism and flaws.

But that plan is the law, because it passed and was signed.

If you’ve got a better idea for paying down the pension debts, be sure it comes with a 30/60 roll call. Otherwise you don’t really have a plan.

Comment by Michelle Flaherty Thursday, Dec 9, 21 @ 10:27 am

Love these guys who have to eek out that ounce of bad news when the good news doesn’t meet their agenda. Data point…kekekeck.

Comment by PublicServant Thursday, Dec 9, 21 @ 10:30 am

Good news for the pension systems is good news for my 401(k).

Would have been a good time to nudge the discount rates a quarter point. Best to make conservative adjustments in good years than in bad.

Comment by City Zen Thursday, Dec 9, 21 @ 10:34 am

One data point or not - unfounded liability experienced a significant drop. You acknowledge the pain when it goes the other way, acknowledge this to be great news. It’s market driven, not a victory caused by the current administration - but a victory nonetheless.

Comment by Lincoln Lad Thursday, Dec 9, 21 @ 10:35 am

This is good news - of course, the markets are fickle and no one can predict returns. Need to see that funded ratio keep going up - currently, at 46%, that number has to reach the 90% funding goal by FY2045.

“The funded ratios of the respective systems may be compared to the aggregate funded ratio. The combined funded ratios based on the actuarial and market value of assets for FY 2021 were 42.4% and 46.5%, respectively”

Comment by Donnie Elgin Thursday, Dec 9, 21 @ 10:38 am

Hey, $14.3 billion is $14.3 billion. That’s not peanuts. To paraphrase Mr. Mohra in Fargo, end o’ story.

Comment by Tony DeKalb Thursday, Dec 9, 21 @ 10:55 am

There is one and only ONE way to help the State’s pension problem- improve investment returns. It’s is mind boggling that the legislature has defaulted to the Boards of Trustees who for the most part are elected by union members or appointed by the Governor in both instances for political reasons. Why the Stars hasn’t imposed an entity like Blackrock to manage the investments along with the Boards and pension staff is insanity. The consultants hired by the individual Boards are often overridden by Trustees who make politically connected decisions. Illinois can’t reduce benefits, has limits on annual contributions so why not focus on returns.

Comment by Sue Thursday, Dec 9, 21 @ 11:10 am

The pension fund will never go belly up. The unfunded liabilities will continue to decrease in the years ahead . We now have more tier 2 workers than tier 1. There will continue to be a decrease in tier 1 retirees every year as those folks pass on.

Comment by The Dude Abides Thursday, Dec 9, 21 @ 11:24 am

=If you’ve got a better idea for paying down the pension debts, be sure it comes with a 30/60 roll call. Otherwise you don’t really have a plan. =

That has, and continues to be, an absolutely horrible cop-out. It’s a sad day when we don’t judge legislation by the merits of the legislation, but whether or not lawmakers are already willing to vote for it. Imagine if Greg Harris had taken that approach when he filed marriage equality. Instead, he and his supporters worked, for years, to get lawmakers to vote for a bill that was good. Your philosophy would have had him tailor the bill instead to the roll call.

Whether or not lawmakers are willing to vote for a bill today has no bearing on whether or not a plan is good or necessary. Put forward the best ideas, and then hold the GA accountable to advance it.

Comment by phenom_Anon Thursday, Dec 9, 21 @ 11:26 am

Msall seems almost resentful that the good news has denied him the opportunity to scold the state. Sorry, Larry.

Comment by King Louis XVI Thursday, Dec 9, 21 @ 11:27 am

===absolutely horrible cop-out===

Politics is the art of the possible. You’re suggesting something that is currently impossible. And there is no credible person out there actually working to pass your fantasy legislation.

Comment by Rich Miller Thursday, Dec 9, 21 @ 11:28 am

as I repeatedly told my goofd friend Donald Trump, never brag on stock market gains. he didn’t listen either

Comment by Blue Dog Thursday, Dec 9, 21 @ 11:32 am

= my goofd friend Donald Trump =

I know that’s a typo, but part of me thinks that “goof” is more relevant than “good”

Comment by cover Thursday, Dec 9, 21 @ 11:42 am

old people attempt at humor.

Comment by Blue Dog Thursday, Dec 9, 21 @ 11:46 am

==That has, and continues to be, an absolutely horrible cop-out.==

I had high hopes for the millionaires tax, then JB rested on his lead, Frerichs opened his mouth, and Griffin swamped the airwaves with lies.

Comment by Jocko Thursday, Dec 9, 21 @ 11:54 am

===Why the Stars hasn’t imposed an entity like Blackrock to manage the investments along with the Boards and pension staff is insanity.===

Florida Gov. Jeb Bush did that. And $1.7 billion of funds to be invested with fundraisers for … President George W. Bush. Investment returns dropped. As to Illinois, ever heard of Bill Cellini and Stuart Levine?

Comment by Anyone Remember Thursday, Dec 9, 21 @ 11:58 am

=You’re suggesting something that is currently impossible. And there is no credible person out there actually working to pass your fantasy legislation.=

Please feel free to enlighten me on what fantasy legislation I proposed. I’m guessing you confused me with someone else.

I made a comment on the tired cliche around here that legislation is judged by what a roll call is today, more than on the actual merits of legislation.

Comment by phenom_Anon Thursday, Dec 9, 21 @ 12:07 pm

=== … more than on the actual merits of legislation.===

Merits don’t vote.

Comment by Anyone Remember Thursday, Dec 9, 21 @ 12:10 pm

So we’re supposed to be putting in an additional $2B into the pension funds every year?

Isn’t that how much the retirement income giveaway (we don’t assess any state income tax on retirement income) costs the state — so that if we got rid of this giveaway, would that put us on a path to solving the pension problem?

Comment by Dan Johnson Thursday, Dec 9, 21 @ 12:22 pm

===tired cliche around here that legislation is judged by what a roll call is today, more than on the actual merits of legislation===

Merits are often about perception. What you think are good bills can be bad to others, which is why we elect people to vote on those bills, meaning roll calls are hugely important.

Comment by Rich Miller Thursday, Dec 9, 21 @ 12:30 pm

=== what fantasy legislation I proposed===

You didn’t, which is the biggest cop-out of all.

Comment by Rich Miller Thursday, Dec 9, 21 @ 12:35 pm

While I certainly credit pension fund trustees, I believe that the investment staff at the individual funds, as well as at the Illinois State Board of Investments deserve the real credit for the phenomenal investment returns this past year. As for the future, the picture will get better as Tier II employees continue to grow.

Comment by Retired SURS Employee Thursday, Dec 9, 21 @ 12:48 pm

- phenom_Anon –

It’s called democracy. You might think something is 100 percent the best approach. You might then find that a majority of lawmakers don’t agree with you. Their views are just as legit. What you think has merit might not have any merit with others.

That’s the legislative/democratic process.

Working roll calls is exactly what lawmakers do. It’s exactly what Rep. Harris did to get that landmark legislation passed.

And his lesson on deciding when to call a bill in order to maximize it’s chance of passing is a great lesson that lawmakers and advocates can learn from.

If you don’t know your headcount, you limit your ability to get anything done.

So … if you have a better idea on pension funding … go work your roll call and get your headcount.

When your idea has support from a majority of lawmakers, then it’s a real plan.

Comment by Michelle Flaherty Thursday, Dec 9, 21 @ 12:52 pm

5 years ago the Dow Jones was at 19,864 and the unfunded pension liability was $129.1 billion

Today the Dow Jones is at 35,825 and the unfunded liability is 130.0 billion

The unfunded liability before this year only dropped in 2017 from 129.8 to 129.1

Mind boggling that the investment returns have not been better and this is not a major topic of discussion given how much of our taxes go to fund pensions

Comment by Lucky Pierre Thursday, Dec 9, 21 @ 12:56 pm

=There is one and only ONE way to help the State’s pension problem- improve investment returns.=

No, you are wrong. There are multiple ways and one is to pay our bills.

=Please feel free to enlighten me on what fantasy legislation I proposed.=

Let me guess, you want to see some kind of pension diminishment legislation?

The cliche that I like is “put up or…” you know the rest.

Comment by JS Mill Thursday, Dec 9, 21 @ 1:07 pm

==I believe that the investment staff at the individual funds, as well as at the Illinois State Board of Investments deserve the real credit for the phenomenal investment returns this past year.==

State pension systems across the country posted similar record returns. It’s not like we hold some secret recipe.

Comment by City Zen Thursday, Dec 9, 21 @ 1:40 pm

Good. Even less of a reason to cut pensions.

Our state’s financial outlook is night and day better than it was when Rauner and the pension debt scolds starved our finances. He and his allies wanted nothing to do with 60+30+1 to enact state budgets. They’re working mailers instead, trying to get public employees to leave their unions.

Comment by Grandson of Man Thursday, Dec 9, 21 @ 2:21 pm

–State pension systems across the country posted similar record returns. It’s not like we hold some secret recipe.–

True, but the point that I was making is that the Trustees of the different plans are not the only individuals deserving credit.

Comment by Retired SUR Employee Thursday, Dec 9, 21 @ 2:25 pm

So, the State is still broke by $130 billion dollars. At $2 billion a year short, the ramp become at least 65 years long. And that’s assuming a whole lot of things happen, or don’t happen, to throw the calculations out the window. Wonderful.

Comment by thisjustinagain Thursday, Dec 9, 21 @ 2:39 pm

===At $2 billion a year short, the ramp become at least 65 years long.===

It’s a ramp, not a flat bridge.

Comment by Rich Miller Thursday, Dec 9, 21 @ 2:40 pm

Amanda Kass is one of the few sane heads in the room.

When the stock market drops and pension funds drop, Republicans believe its a problem that should be blamed on too generous benefits and must be fixed by slashing benefits.

When the stock market climbs and pension funds surge, we should ignore the markets, and still slash benefits because “we haven’t slashed benefits yet so the gains must be ephemeral.”

Comment by Thomas Paine Thursday, Dec 9, 21 @ 2:47 pm

==contributions are $2 billion less than they should be. That is the story.===

I could see legislation introduced to reduce the state’s ramp because the pension system was overfunded by $14.3 billion this year. Lol

Comment by Tombrady Thursday, Dec 9, 21 @ 9:23 pm