Latest Post | Last 10 Posts | Archives

Previous Post: House Democratic leadership tries to put a scare into members

Next Post: Question of the day

Posted in:

* For decades, business and labor have sat down to negotiate how to solve any issues related to the state’s unemployment insurance program. The resulting compromises were then taken to the leadership in both parties and bills would be passed on a bipartisan basis because the leaders all give their word to stick to the deal. But negotiations apparently aren’t going well and a deadline is looming, so this letter from the House GOP Leader appears to break from the past in a major way…

Governor Pritzker,

Before the pandemic, our state’s unemployment insurance trust fund had a positive balance of more than $2.2 billion. The historic surge of unemployment benefit applications that began with the stay-at-home order quickly drained that balance and has now put the trust fund over $4.5 billion in debt—a debt that continues to grow as interest charges accrue daily. On top of the legitimate unemployment claims, Illinois also experienced a historic level of fraud—the total dollar amount of which your administration still refuses to estimate or release. These claims worsened the fund’s financial condition through no fault of employers or workers.

More than a year ago, my colleagues and I called attention to this debt and warned of the consequences of inaction, specifically that failing to pay off the debt would require a massive tax increase on businesses and a reduction in unemployment benefits for Illinois workers.

Unlike many of the other structural problems Illinois faces, this one-time COVID-related debt also came with a one-time COVID-related solution: Coronavirus Aid, Relief, and Economic Security Act (CARES) and American Recovery Plan Act (ARPA) funds. Many other states faced the same challenge we do, and they responsibly used these federal relief dollars to pay off their unemployment insurance debt and avoid tax increases or benefit reductions.

Unfortunately, the current fiscal year budget passed by Democrats in the House and Senate did not dedicate a single dime to paying off this pandemic-era debt. When the budget came to your desk, you used your amendatory veto authority to make changes to certain enactment dates in the poorly drafted and hastily enacted budget. You had an opportunity to address the unemployment insurance trust fund debt at this point in time, but you instead chose to ignore the problem, just like you ignored the roughly $1.5 billion in ARPA “pet project” spending that was added in by democrat legislators in the final hours of the spring legislative session.

While Illinois cannot recover the $40 million paid in interest due to ignoring this problem so far, it’s not too late to stem the bleeding now. Of the more than $11.5 billion in CARES and ARPA funding the State of Illinois has received from the federal government, it appears that nearly $6.94 billion has not yet been spent. That means we still have sufficient funding to eliminate the unemployment insurance debt entirely and still have almost $2.5 billion remaining to pay for real COVID-related costs.

This problem could have been solved a year ago, and we could have avoided tens of millions of dollars in interest charges. But instead, Springfield is doing what it so often does: playing a game of brinkmanship with an April 1 federal deadline looming.

Let’s not raise taxes on Illinois businesses as they fight to emerge from the pandemic. Let’s not cut benefits for Illinois workers who may soon need the protection that unemployment insurance offers. Instead, let’s use the federal funds we have available to solve this problem once and for all.

Sincerely,

House Republican Leader Jim Durkin

Deputy Republican Leader Tom Demmer

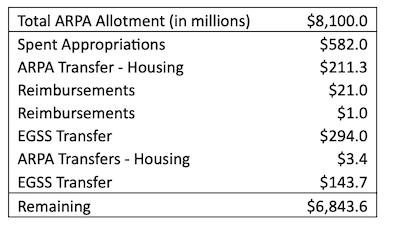

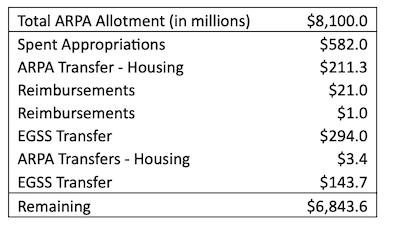

I asked for their breakdown of available ARPA money…

Notice that the chart says “spent” appropriations. According to the governor’s office, another $3 billion or so has already been appropriated by the legislature and is awaiting approval from the US Treasury. This unspent money is mainly capital projects, but there are also several one-time items like violence prevention programs.

What’s actually left, the governor’s office says, is $3.5 billion.

Bottom line is the Republicans don’t want to vote for any election-year employer tax hikes at all even if unions agree to benefit cuts. The agreed bill process may be on its last legs.

…Adding… Similar or coordinated message from the Richard Irvin campaign earlier today…

While JB Pritzker continues to push his election year gimmicks, his failure to lead will result in higher taxes and lower wages across Illinois as the gaping hole in the Unemployment Insurance (UI) Trust Fund continues to grow. Pritzker has thus far refused to use federal ARPA funds to replenish the shortfall and create a reserve balance in this crucial social safety net program. His lack of action results in $2 million in interest charges a week.

Instead of using the federal funds to fill this hole, Pritzker chose to pledge them towards one-time election year gimmicks of fake tax relief. If Pritzker continues to withhold the federal bailout funds, employers could see their unemployment taxes go up and employees could see their benefits cut.

The state’s Unemployment Insurance Trust Fund currently has a deficit of over $4 billion – plus interest. That number would just cover the deficit; much more will be needed to replenish the fund’s reserves. Even worse, a recent news investigation found the Department of Employment Security knowingly gave money to scammers and the Pritzker Administration refuses to disclose how much the Unemployment Insurance Trust Fund has lost due to fraud.

“JB Pritzker has never seen a tax increase he didn’t like, so it’s no surprise he’s angling to pull the wool over the eyes of Illinoisans once again,” said Irvin for Illinois spokesperson Eleni Demertzis. “This is his failure that taxpayers are now on the hook for, something that could have and should have been prevented.”

According to IRMA, state law has ‘speed bumps’ written into it that are expected to trigger $500 million in tax increases for employers and $500 million in benefit cuts for employees. Despite lawmakers pushing for Pritzker to use federal funds to replenish the debt, he has continued to stall as an April 1st federal deadline looms. Without action, higher taxes on employers and reduced benefits for workers are inevitable.

…Adding… Pritzker campaign…

At a time when working families across the state need assistance, we need to be honest about what Richard Irvin is objecting to in the governor’s budget proposal: tax relief for Illinoisans. Ken Griffin’s hold on Irvin remains so tight that even Bruce Rauner would blush at his rejection of policies that would help working families. Voters can see this candidacy and these embarrassing objections for exactly what they are and no amount of spin from Irvin’s team of Rauner rejects can change the truth.

…Adding… Jordan Abudayyeh…

Following the established agreed bill process, that for years has resulted in compromise, there have been 13 formal meetings and countless discussions since January 11th between business and labor along with lawmakers from both sides of the aisle. Earlier this year, Rep. Demmer asked the Governor’s Office what it means to have a seat at the grown-ups table. We would tell the Representative it means not abandoning a bipartisan and sincere effort to follow a decades long agreed bill process in favor of scoring cheap political points at a critical moment in the negotiations. The Pritzker administration will continue to convene all parties and negotiate in good faith for a compromise that is fair to both businesses and workers.

posted by Rich Miller

Tuesday, Mar 22, 22 @ 9:58 am

Sorry, comments are closed at this time.

Previous Post: House Democratic leadership tries to put a scare into members

Next Post: Question of the day

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

===The agreed bill process may be on its last legs.===

Those sounds you hear are Jim Thompson rolling over in his grave and Jim Edgar slapping his head.

Comment by Anyone Remember Tuesday, Mar 22, 22 @ 10:01 am

Once again the GOP proves they don’t care about governing effectively, they only care about headlines.

Comment by Long year Tuesday, Mar 22, 22 @ 10:04 am

Although starting a rainy day fund is desperately needed capital needs to be put to work to pay down/off bills that are currently due. Separately, redirecting the incremental (at best) “relief” of suspending a $0.02 gas tax increase and grocery tax should be redirected to this. If that doesn’t cover it along with ARPA excess of $3.5Bn then you look at the proposed property tax relief that was proposed. Providing property tax relief to some while raising payroll taxes on all wage earners doesn’t seem like a smart strategy.

Comment by 1st Ward Tuesday, Mar 22, 22 @ 10:15 am

Governing effectively is not paying avoiding overdue bills when the Federal government provided the funds to do so?

Raising taxes on Illinois employers is governing effectively?

Comment by Lucky Pierre Tuesday, Mar 22, 22 @ 10:25 am

This issue is ripe for the GOP to exploit. JB was glacially slow in taking steps to fix the IDES fraud issues - in 2020 there wasn’t an employer that did not have fake IDES claims come in for their employees. There were obvious steps and resources that many other states utilized to fight UI fraud but Illinois did not use them. JB has a really poor track record of running his administrative depts, IL Va is a train-wreck, and the IL AG’s OMA portal was down for over 9 months. The $3 billion left in the Fed funding should be used to shore up the Unemployment Insurance Trust fund.

Comment by Donnie Elgin Tuesday, Mar 22, 22 @ 10:28 am

As I recall the republican’ts were squeaking about the length of time it was taking to approve unemployment benefits. Now they don’t want to pay the expenditures.

How typical.

Comment by Huh? Tuesday, Mar 22, 22 @ 10:28 am

Wow ‘Riffie lets Durkie and sidekick Dems go first for a change. Then RichieRich gets to blurt somethin’ out. Would love to see the calculations on what part of this from the Trump decision to give US $ to part timers/gig workers etc. Seems like that should go back to DC

Comment by Annonin' Tuesday, Mar 22, 22 @ 10:32 am

The ILGOP lyin their way to oblivion.

I wonder if this is how these guys negotiate in the personal jobs?

Comment by JS Mill Tuesday, Mar 22, 22 @ 10:38 am

Comical, given their GOP contemporaries did not support the federal legislation for the funding in question.

Comment by Moderately Down South Tuesday, Mar 22, 22 @ 10:52 am

JS Mill - The ILGOP lyin their way to oblivion.

Can you point out the lies in this GOP press release/letter?

Asking for a friend.

Comment by allknowingmasterofraccoondom Tuesday, Mar 22, 22 @ 11:19 am

== But instead, Springfield is doing what it so often does==

Leaders, you are part of Springfield

Comment by low level Tuesday, Mar 22, 22 @ 12:38 pm

Money should go to reducing state debt at all levels. Time act like responsible adults and pay off the ‘credit card’.

All back debts owed, unemployment compensation and if anything is left to pensions.

Comment by Unconventional wisdom Tuesday, Mar 22, 22 @ 12:56 pm

==Bottom line is the Republicans don’t want to vote for any election-year employer tax hikes at all even if unions agree to benefit cuts. The agreed bill process may be on its last legs.==

The Republican do-nothing approach will lead to even greater tax hikes on employers because tax hikes for unemployment insurance are automatic when the fund balances are at certain low levels.

https://taxfoundation.org/state-unemployment-trust-funds-2021/

https://www.uschamber.com/employment-law/u-s-chamber-supports-ui-trust-fund-relief

Comment by Google Is Your Friend Tuesday, Mar 22, 22 @ 1:16 pm

Governing is hard. Coorperation and compromise are hard.

Posturing is easy.

Guess which one the GOP chose?

Comment by PublicServant Tuesday, Mar 22, 22 @ 1:24 pm

Advocating for responsible fiscal behavior is posturing? I guess you missed the part about a 6 billion dollar negative swing in UI fund that needs to be made up. Attack the GOP all you want but tell me, genius, how would you make up the shortfall?

Comment by Captain Obvious Tuesday, Mar 22, 22 @ 1:36 pm

- Captain Obvious-

===Bottom line is the Republicans don’t want to vote for any election-year employer tax hikes at all even if unions agree to benefit cuts.===

It’s obvious you can’t grasp what is different here, the politics superseding what has been the path toward agreed policy.

Is it smart politics, that is what the coordinated messaging of Irvin is pointing to, the politics towards a smarter angle

It’s not genius to choose a path of politics over agreed policy, fiscal policy, it’s gambling on being right, and if it works out, then even better.

Comment by Oswego Willy Tuesday, Mar 22, 22 @ 1:42 pm

So Pritzker answered with a non answer. What is the real story here?

Comment by DMC Tuesday, Mar 22, 22 @ 2:15 pm

=== how would you make up the shortfall? ===

Sit down at the table with business and labor, and negotiate a deal, then vote for it…genius.

Comment by PublicServant Tuesday, Mar 22, 22 @ 2:26 pm

You got the money to pay off a debt, but would rather use it to pay for new programs. Sigh.

Comment by Bruce( no not him) Tuesday, Mar 22, 22 @ 4:36 pm

=== You got the money to pay off a debt, but would rather use it to pay for new programs. Sigh. ===

So, when you’re finished sighing Bruce, Can you site those new programs you’re sighing about that we’re using federal Covid funds to pay for? I won’t hold my breath for a response.

Comment by PublicServant Tuesday, Mar 22, 22 @ 5:50 pm

News from the take it back slate

Comment by Rabid Tuesday, Mar 22, 22 @ 6:19 pm

Cite, not site. I blame lack of coffee, and, uhm, Spell-correct…yeah, that’s it, spell-correct.

Comment by PublicServant Wednesday, Mar 23, 22 @ 3:31 am

If there’s no agreement on filling the unemployment insurance deficit, could this mean state agency budget and service cuts? Which ironically could mean state employee layoffs?

Comment by NonAFSCMEStateEmployeeFromChatham Wednesday, Mar 23, 22 @ 4:18 am