Latest Post | Last 10 Posts | Archives

Previous Post: Planned Parenthood launching mobile abortion clinic in Illinois

Next Post: SUBSCRIBERS ONLY - Fundraiser list

Posted in:

* From the U of I’s Institute of Government and Public Affairs…

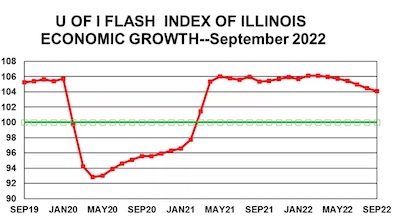

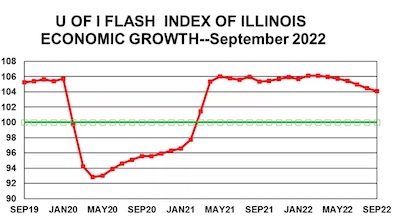

The University of Illinois Flash Index for September continued its gradual decline, falling to 104.1 from its previous reading of 104.5 in August.

The lower index reading does not mean the Illinois economy is contracting because any reading above 100 indicates growth.

“The uncertainty that has characterized the U. S. and Illinois economies the last six months shows no signs of resolving although the scales are gradually tipping to the side of a pronounced slowdown if not a recession. Unemployment remains low with jobs appearing to be plentiful. Consumer sentiment is relatively strong after recent fuel price increases have moderated.”

Giertz said that this is balanced against negative GDP growth for the first two quarters of 2022, often but not always a sign of a recession. Even though the rate of inflation has decreased monthly and expectations that it will gradually fall well below the current 8 percent range, it is still unlikely to return to the Federal Reserve’s 2 percent target without further monetary tightening. This has not escaped investors’ notice, resulting in declines in the equity market.

Illinois’ revenues (the basis of the Flash Index) remain strong with large year-to-year increases. However, the September numbers compared to the same month last year after adjusting for inflation are not as buoyant. Corporate tax receipts continue their strong performance while individual income tax receipts are up slightly, and sales tax receipts are down.

“The Illinois and U. S. unemployment rate ticked up slightly, to 3.7 and 4.5 percent respectively, but the readings represent anything but recessionary levels.”

The Flash Index is a weighted average of Illinois growth rates in corporate earnings, consumer spending, and personal income as estimated from receipts for corporate income, individual income, and retail sales taxes. These revenues are adjusted for inflation before growth rates are calculated. The growth rate for each component is then calculated for the 12-month period using data through September 30, 2022. After more than two years since the beginning of the COVID-19 crisis, ad hoc adjustments are still needed because of the timing of the tax receipts resulting from state and Federal changes in payment dates.

* The green line is the demarcation between growth and contraction…

The trend does not appear friendly

posted by Rich Miller

Monday, Oct 3, 22 @ 2:24 pm

Sorry, comments are closed at this time.

Previous Post: Planned Parenthood launching mobile abortion clinic in Illinois

Next Post: SUBSCRIBERS ONLY - Fundraiser list

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Real estate not looking that hot either according to one group.

https://www.attomdata.com/news/market-trends/attom-q2-2022-special-housing-risk-report/

Comment by Notorious JMB Monday, Oct 3, 22 @ 2:59 pm

What’s helping working Illinoisans the most is the tripled energy bills.

Comment by Mr. Potato Head Monday, Oct 3, 22 @ 10:28 pm