Latest Post | Last 10 Posts | Archives

Previous Post: Chicago experienced a 50 percent increase in asylum-seekers housed in staging centers last week

Next Post: *** UPDATED x2 *** Pritzker says person who threw rocks at his home may be charged with stalking

Posted in:

* COGFA…

Year to Date

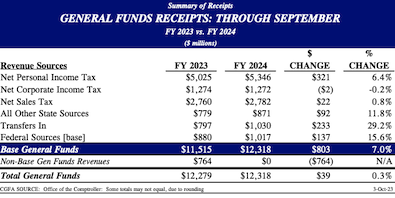

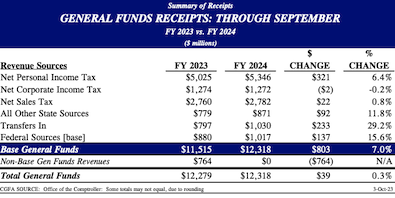

Through the first quarter of FY 2024, overall General Funds revenues are $39 million above last year’s pace. This comparison, however, includes $764 million in FY 2023 Federal reimbursements that will not repeat in FY 2024. Excluding these one-time revenues, FY 2024 “base” receipts are up a noteworthy $803 million or +7.0% through September. But, as mentioned in the previous paragraphs, Illinois’ revenue totals are aided by the timing of reallocations and transfers that slightly distort its year-to-date performance. With that being said, Illinois’ economy has avoided a significant downshift to this point, which has allowed its primary revenue sources to continue to generate respectable totals through the first quarter of the fiscal year.

Personal Income Taxes are up $391 million through September or +$321 million on a net basis. While part of this growth is due to the first of five “true-up” reallocation installments, most of the year-to-date growth stems from steady employment levels and higher wages. The previously mentioned adjustments, as well as modified percentages of current business income tax disbursements, have factored into the slight $12 million decline in Corporate Income Tax receipts through September [-$2 million on a net basis]. Without these adjustments, corporate income tax receipts would be modestly higher through September.

Sales Tax receipts have continued to stay in positive territory through the first quarter of the fiscal year with growth of $57 million [or +$22 million net of non-general fund distributions]. All Other State Sources have combined to grow $92 million through September. This growth is primarily due to the $105 million rise in Interest Income, which has benefitted from comparatively higher interest rates. Other first-quarter increases have come from the Inheritance Tax [+$39 million]; Insurance Taxes [+$12 million]; and the Corporate Franchise Tax [+$3 million]. Other tax sources that are lower through the first three months include Other Sources [-$32 million]; Public Utility Taxes [-$25 million]; the Cigarette Tax [-$9 million]; and the Liquor Tax [-$1 million].

General Funds revenues from Transfers In are a combined $233 million higher through September, again mainly due to the timing of this year’s Income Tax Refund Fund Transfer [up +$259 million]. As alluded to previously, a sharp decline in this transfer category is expected by the end of the fiscal year due to the size of the FY 2023 Income Tax Refund Fund transfer, which was completed in January. Lottery Transfers have performed quite well so far this fiscal year, up $65 million. On the other hand, Other Transfers are down $79 million, mainly due to significantly lower Capital Projects Fund transfers into the General Revenue Fund. Gaming Transfers from casinos are down $10 million, while Cannabis Transfers are $2 million lower.

Despite the September decline, Federal Sources (base) are up $137 million year to date. However, if the $764 million in one-time ARPA Reimbursements receipted in FY 2023 are included in the equation, Federal Sources are down $627 million through the 1st Quarter of the fiscal year.

* More…

posted by Rich Miller

Tuesday, Oct 10, 23 @ 12:35 pm

Sorry, comments are closed at this time.

Previous Post: Chicago experienced a 50 percent increase in asylum-seekers housed in staging centers last week

Next Post: *** UPDATED x2 *** Pritzker says person who threw rocks at his home may be charged with stalking

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

= …most of the year-to-date growth stems from steady employment levels and higher wages. =

Good!

Comment by Dirty Red Tuesday, Oct 10, 23 @ 12:52 pm

This will certainly make the spelunkers of doom very sad.

Comment by JS Mill Tuesday, Oct 10, 23 @ 12:55 pm

“or +7.0% through September.”

The BLS report released in mid- September showed a trailing 12mo CPI-U inflation rate in the midwest region of 3.4%.

Total numbers increasing is good. Even better they are increasing more than the reported rate of inflation for the region. Other good news is the increase in income taxes collected seems to point to wages keeping up with inflation, because the labor participation rate in Illinois has been stagnant at best at 64.4% for both the start and end of the time period.

Overall, good report.

Comment by TheInvisibleMan Tuesday, Oct 10, 23 @ 12:58 pm

Good report, the silence of the doomsayers is always interesting to context to why this is good.

Up there with trying to say Illinois’ trillion (with a T) dollar GDP is really a bad thing… they can’t.

Tough to be about the negative, even tougher trying to grift off good news you can’t recognize

Comment by Oswego Willy Tuesday, Oct 10, 23 @ 2:38 pm

Failing again. /snark/

Comment by JoanP Tuesday, Oct 10, 23 @ 3:54 pm