Latest Post | Last 10 Posts | Archives

Previous Post: Support House Bill 4781

Next Post: Class action lawsuit filed over Illinois counties selling houses for unpaid taxes and not reimbursing owners for their equity

Posted in:

* Center Square…

Illinois Gov. J.B. Pritzker wants $40 million in taxpayer funds over four years to pick up the tab for hundreds of thousands of individuals’ medical debt. […]

However, a study released this month by the National Bureau of Economic Research concluded while there is a statistical significant reduction in payment of existing medical debt, there is “no impact of debt relief on credit access, utilization, and financial distress on average” and “no effect of medical debt relief on mental health on average.”

State Rep. Dan Caulkins, R-Decatur, said it may sound like a good idea, but the legislature must balance priorities especially as he said state agencies are requesting increased budgets across the board. He also warned, taxpayer subsidies to a nonprofit to liquidate select medical debt may not provide the benefits supporters are looking for.

“It does not solve your credit problems nor does it really address the mental health issues that we have,” Caulkins told The Center Square. “If the research is factual, the governor is trying to pander. I know he’s still interested in a political career outside of Illinois.”

Um, if the governor’s debt relief numbers are correct, it will eventually provide on average about $4,000 in debt relief per person. That ain’t nothing.

However, Cook County’s program hasn’t performed to that level. The county has helped more than 200,000 residents by eliminating nearly $350 million in medical debt. That’s about $1,750 per person. Even so, that ain’t nothing, either.

It won’t solve all their problems, but no program can do that. I’ve seen too many friends living in too much fear of medical debt during my lifetime. Yes, it’s not as bad as it was back when hospitals and other providers were regularly taking people to court over their debts and then having them thrown in jail if they didn’t show up for hearings. But it’s still upsetting.

* Meanwhile, in other news…

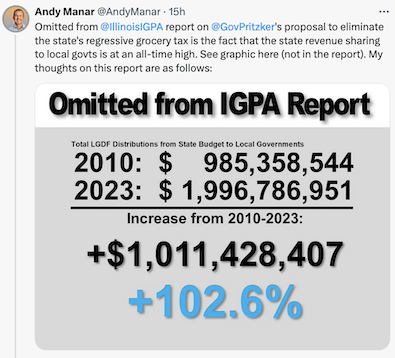

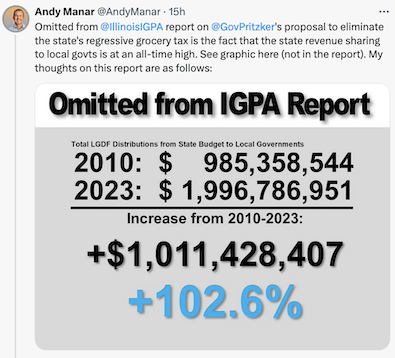

As Gov. JB Pritzker has proposed to eliminate the state’s sales tax on groceries, a new University of Illinois study suggests the idea hurts cities more than it helps families.

“I think there is a perception that the grocery tax is very regressive,” said Elizabeth Powers, an associate professor of economics at the U of I and interim associate director of its Institute of Government and Public Affairs. “That it causes very low-income people to pay more than their fair share of taxes.”

Those families, Powers says, pay roughly $3600 a year in groceries and thus would save $36 per year.

As for cities. Powers says, “It’s estimated that municipalities lost about $360 million; municipalities are perceiving this as a significant hit to their budget.”

Deputy Gov. Andy Manar was not amused…

Andy makes some very valid points. I just don’t see it passing. But the proposal has so far put the Illinois Municipal League back on their heels and prevented the IML from making a strong, coordinated push for more state money.

posted by Rich Miller

Tuesday, Apr 16, 24 @ 11:55 am

Sorry, comments are closed at this time.

Previous Post: Support House Bill 4781

Next Post: Class action lawsuit filed over Illinois counties selling houses for unpaid taxes and not reimbursing owners for their equity

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Any study that says eliminating thousands of dollars of debt has no effect on your mental health should be ignored because it’s clearly not serious. Anyone who has ever been in debt can tell you the enormous feelings of relief and satisfaction that come from eliminating large debts.

Comment by New Day Tuesday, Apr 16, 24 @ 12:27 pm

The messaging could use some work on both sides. One side is saying the $36 savings is nothing while at the same time arguing it is huge. The other side is using 14 year old numbers without adjusting for inflation, arguing that it isn’t a cut to that funding source by including other sources, and using emojis that are too cute by half.

Comment by thechampaignlife Tuesday, Apr 16, 24 @ 12:39 pm

Manar is a very sharp guy. I disagree with some of his positions in the past, but when he comes with the facts they usually are facts.

Comment by JS Mill Tuesday, Apr 16, 24 @ 12:43 pm

The U of I study is incorrect to the extent that it indicates that muncipalities currently have any authority to replace state grocery tax with their own grocery tax. (see p. 5, paragraph 2) Current law forbids home rule and non-home rule municipalities from imposing a local tax on anything subject to the state 1% grocery tax.

Comment by Just the Facts Tuesday, Apr 16, 24 @ 1:17 pm

I get it. My $36 is probably more important to my city than it is to me.

But I also relish the opportunity to see my local alderman squirm on his way to having to back a tax increase to keep city services fully funded.

He has to be fuming at our tax cutting and progressive Governor.

Comment by Cool Papa Bell Tuesday, Apr 16, 24 @ 1:17 pm

===Current law ===

Laws can be changed.

Comment by Rich Miller Tuesday, Apr 16, 24 @ 1:20 pm

Point #4 is beyond asinine. Schools don’t collect their property tax money. The state doesn’t collect the money that comes from the federal government for things like Medicaid. He just looks petty. This is, once again, the most cowardly tax cut the administration could propose. They lose no revenue while starving someone else. I’m amazed Bruce Rauner didn’t come up with this idea.

Comment by Ducky LaMoore Tuesday, Apr 16, 24 @ 1:31 pm

Regarding the statement that “…those families pay roughly $3600 a year for groceries…”, that number seems a little low at less than $10/day.

Comment by Siualum Tuesday, Apr 16, 24 @ 2:13 pm

=====2) Current law forbids home rule and non-home rule municipalities from imposing a local tax on anything subject to the state 1% grocery tax.=====

Feel free to correct me if I’m missing something, but if the state eliminates the grocery tax, making nothing subject to that tax, then those other bodies would, if they chose, be allowed to add their own, no?

Comment by Mike Sorensen Tuesday, Apr 16, 24 @ 3:56 pm