Latest Post | Last 10 Posts | Archives

Previous Post: Showcasing The Retailers Who Make Illinois Work

Next Post: Liberty Justice Center lawsuit claims Illinois is operating an unconstitutional ’system of dragnet surveillance’

Posted in:

* Click here for more background on Governor Pritzker’s sports betting tax rate increase. Hannah Meisel of Capitol News Illinois breaks it all down…

In order to boost infrastructure spending and avoid a projected fiscal cliff facing the state in the next couple of years, Democrats who control state government are betting on two of its most rapidly growing revenue sources: sports wagering and video gambling. […]

Organized labor, a top funder and ally for Democrats, balked at the plan to deposit the extra tax dollars from sportsbooks into GRF instead of dedicating it to infrastructure projects, where current sports betting revenues are directed. And major sportsbook operators threatened to stop advertising or even withdraw from the state as the legislature’s scheduled adjournment date drew near last week. […]

Despite other states taking similar steps to Illinois, the companies threatened to push the nuclear button in the final days of session, with a source close to DraftKings and FanDuel telling Capitol News Illinois that “all options are on the table, including withdrawing from the state.”

But skeptics say the companies are making more from Illinois’ market than they let on, especially as parlay bets – multiple wagers bundled together into one bet – have overtaken any other sort of bet in popularity, upending models that were used to arrive at Illinois’ 15 percent tax rate during negotiations five years ago. Parlay bets made up more than 60 percent of all sports wagers made in fiscal year 2023, according to state records.

Because bettors are more likely to lose their parlay bets than straight bets like on the outcome of one game or a point spread, the sportsbooks earn much more from these riskier bets. Sportsbooks also promote parlay bets, often enticing bettors with offers to make the parlays. […]

Like in many other states, DraftKings and FanDuel have cornered roughly three-quarters of Illinois’ sports betting market. … Though the law that legalized sports betting in Illinois had intended for casinos to get an 18-month head start in the sports betting market before big online operators like DraftKings and FanDuel became licensed, those companies got around the law by partnering with downstate casinos to operate their sportsbooks.

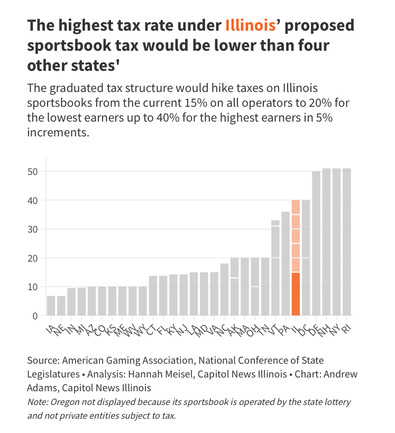

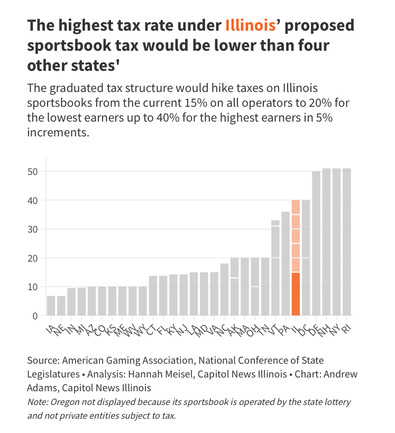

* Illinois’ tax will be lower than four other states…

posted by Isabel Miller

Tuesday, Jun 4, 24 @ 11:05 am

Sorry, comments are closed at this time.

Previous Post: Showcasing The Retailers Who Make Illinois Work

Next Post: Liberty Justice Center lawsuit claims Illinois is operating an unconstitutional ’system of dragnet surveillance’

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Just because you can doesn’t mean you should, I don’t think having the fourth highest tax in the country is something to brag about. It will end up watering down the product and hurting the players.

Comment by Parlay Player Tuesday, Jun 4, 24 @ 11:23 am

I was astounded at how parlay betting has boomed tbh. The Wall Street Journal had a really good New Years Day article on how the sportsbooks try to manage all setting lines on all that action in near real time. https://www.wsj.com/business/media/the-sports-betting-traders-deciding-how-much-you-win-or-lose-a3bceda2

Comment by ChicagoBars Tuesday, Jun 4, 24 @ 11:31 am

@parlay, if four states are higher, would we be 4th highest? I think with your math skills, gambling may not be your forte. Besides, we’d still be below the great non-taxing state of New Hampshire and we all want to celebrate Living Free or Dying amirite?

Comment by Lurker Tuesday, Jun 4, 24 @ 11:31 am

==I don’t think having the fourth highest tax in the country is something to brag about. It will end up watering down the product and hurting the players==

Sports betting was illegal everywhere except Vegas until very recently–sports existed and thrived during that time. And what, exactly, is the product that will be watered down by raising taxes? The dopamine rush of winning? I don’t think that’s going anywhere.

Comment by Lakeview Looker Tuesday, Jun 4, 24 @ 11:40 am

The sports betting industry would have been the least sympathetic industry in Springfield this session if not for the Bears/Sox stadium pushers.

Comment by Michelle Flaherty Tuesday, Jun 4, 24 @ 11:46 am

=It will end up watering down the product and hurting the players.=

I view taxes on gambling like other sin taxes, I just don’t care how high they are.

I want someone to explain to a non-gambler exactly how this hurts players and the product. I would like them to do it with some evidence. Because gamblers do not seem to care that the odds are always in favor of the house, they still gamble. They lose often and still gamble. So what exactly is harmed?

Comment by JS Mill Tuesday, Jun 4, 24 @ 11:47 am

What Flaherty said.

Comment by Rich Miller Tuesday, Jun 4, 24 @ 11:47 am

There was never any way any of these companies were going to close their operations in Illinois even if the tax was 90%.

Would a company choose to collect 10% of 100M dollars, or 0% of 0 dollars?

That had to be one of the most laugh out loud threats anyone has ever made over taxes.

Comment by TheInvisibleMan Tuesday, Jun 4, 24 @ 1:54 pm

It’s a sin tax which usually is higher.

Comment by flea Tuesday, Jun 4, 24 @ 5:18 pm

Late response but by watered down I mean the companies will offer less free bets and profit boost promotions, along with worse odds. This will make black market bookies a more compelling option to many. Also, the fifth highest tax is still not something to write home about.

Comment by Parlay Player Wednesday, Jun 5, 24 @ 8:59 am