Capitol Fax.com - Your Illinois News Radar

Latest Post |

Last 10 Posts |

Archives

Previous Post: Repeal The Interchange Fee Prohibition Act Now

Next Post: See What Real Shoppers Have To Say About The IFPA

Roundup: Collar counties, labor push back hard on transit funding proposal (Updated)

Posted in:

* Subscribers know more. Sun-Times…

State lawmakers are on track toward overhauling the governance of mass transit across the Chicago area, but a lengthy list of proposed new taxes could derail efforts to stave off the fiscal cliff facing the CTA, Metra and Pace.

Democratic legislators on Thursday were mostly on board with the proposal to replace the Regional Transportation Authority with a strengthened new body known as the Northern Illinois Transit Authority, overseeing bus and rail service In Chicago, Cook County and the collar counties. […]

State Sen. Ram Villivalam, D-Chicago, offered up a list of revenue options that he said reflected the “shared sacrifice” needed to maintain and improve service at the agencies collectively facing a $770 million shortfall next year.

That includes a 50-cent tollway surcharge, a redirection of a portion of suburban sales taxes to the new transit authority, an electric vehicle charging fee, a real estate transfer tax and a 10% tax on rideshares in the region. Interest earnings from the state road fund would also go toward transit projects.

* Daily Herald…

Several Collar County leaders called the revenue suggestions — to fix a $770 million budget hole Metra, Pace and the CTA are facing in 2026 — punitive. […]

DuPage County Chair Deb Conroy, however, told the Daily Herald she felt “blindsided.” […]

Another revenue item would allow NITA to claw back a portion of the RTA sales tax, which is dispensed to DuPage, Kane, Lake, McHenry and Will counties for transportation and public safety.

RTA sales tax money helps pay for services including transportation and the sheriff’s office in DuPage, Conroy said. “They would take that money away and we would never see it again — $72 million (for DuPage). We would have massive layoffs.”

* Capitol News Illinois…

Suburban residents would see several new taxes to fund transit that Chicago residents already pay, among other proposals to raise revenue:

- A tax on real estate transfers in the city would be extended to the rest of Cook County and the collar counties, costing buyers and sellers of real estate $3 in taxes for every $1,000 of the transaction. Funds generated from the tax in the collar counties would go toward transit supportive developments while half the funds from suburban Cook County would go toward the CTA pensions.

- The suburbs also would be subjected to a 10% tax on rideshares.

- Counties would no longer get to keep a portion of the transit sales tax for their own infrastructure projects. Instead, it would be redirected to NITA.

- Anyone traveling on Illinois tollways, which are mostly located in the suburbs, would also have to pay an additional 50 cents per toll, with the money going toward funding public transportation.

- Electric vehicle drivers would also have to pay a tax to charge their vehicles. Drivers would be charged 6 cents per kilowatt hour at public charging stations in 2026, with the tax increasing based on inflation each year after that.

* Crain’s…

Labor joined suburban politicians in opposing the tollway surcharge.

“This proposal is inequitable, as suburban drivers would effectively subsidize urban transit systems such as the CTA, in addition to tolls they already pay,” Marc Poulos, political director for the International Union of Operating Engineers Local 150, testified.

* Tribune…

Tim Drea, president of the Illinois AFL-CIO, said in a statement that the two legislative proposals “(kick) the can down the road and (set) our state up for a future fiscal crisis.” The Amalgamated Transit Union Local 241, which represents CTA bus operators, opposes the Senate bill.[…]

Funding for the proposed CTA Red Line extension south of 95th Street was one point of discussion in a hearing on the House version of the bill Thursday. […]

After Thursday’s House hearing, state Rep. Marty Moylan, a Des Plaines Democrat who heads one of the two House transportation committees, said the removal of the CTA’s bonding authority from the bill was an oversight and should be addressed with another amendment.

“This is a major program that’s going to redo the whole face of transit and you’ve got to look at the greater good, which is we’re going to have an operating transit system, which is going to have reforms and operating more efficiently and safe so that people can actually ride the system,” Moylan said of the transit reforms as a whole.

* WTTW…

The public charging station provision drew a mild rebuke from the Illinois Environmental Council, with the group’s legislative relations director, Dany Robles, calling it “hugely regressive” since those stations are most likely used by people in multi-unit buildings and could discourage low-income people from buying electric vehicles. But despite that caveat, Robles heaped praise on the governance changes and funding proposals.

But transit advocates and many legislators broadly praised the transit proposals at Thursday’s hearing, saying they represented meaningful reform and much-needed funding arrived at through a deliberative and collaborative process. And they lauded Villivalam, the committee’s chair, for shepherding hours upon hours of hearings from a wide array of stakeholders and everyday riders.

The presidents of the Civic Committee of the Commercial Club of Chicago and the Civic Federation largely praised the measure in a statement.

“This legislation creates a governance framework that prioritizes safety, service, consolidation, modernization, accountability, and effective governance. If applied with rigor, it could lead to the desired future of an integrated, accountable regional system that fosters economic growth and opportunity in a manner expected of our world-class urban region,” they said. “This is not to say that the work is done—improvements to oversight and efficiencies among others, are still needed—but the legislation maintains a fair regional balance and avoids the gridlock caused by overly burdensome voting thresholds that have historically impeded fiscally responsible decisions.”

…Adding… RTA Chairman Kirk Dillard…

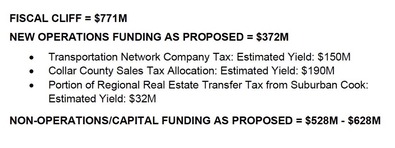

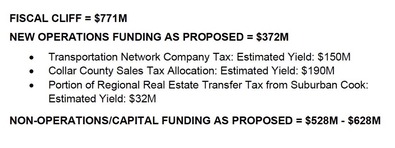

We are grateful the Senate is focused on the fiscal cliff, however, as proposed, the new revenue included in yesterday’s Senate bill fails to address the region’s $771M operating budget gap and would result in significant service cuts in 2026.

Multiple revenue streams in the bill are deposited into a new transit-supportive development incentive fund and others are dedicated to capital needs, leaving less than half of the new funding available for operations.

While the bill also requires the regional entity to take on additional costs for new initiatives like a police force without dedicated funding, which could further limit available funding, our focus today is closing the budget gap to avoid service cuts in 2026.

[The] following is analysis based on best available revenue estimates:

* More…

* AP | Chicago risks severe cuts to transit. Its poorest suburbs could be hit even harder: Technically, the money doesn’t run out until the end of the year, and there will likely be a veto session that could provide another shot at an 11th-hour rescue. But transportation officials say they’ll have to start laying out the specific cuts next week if the funding doesn’t come through by then. “It’s not a light switch we can just turn on or off,” said Leanne Redden, executive director of the Regional Transportation Authority, which oversees planning and funding for the area’s transit agencies. “Even if we find funding at a future point, it’s a slow process to kind of unwind the unwinding.”

* Center Square | Mass transit reform legislation revealed but funding stream finds pushback: State Sen. Seth Lewis, R-Bartlett, a member of the Senate Transportation Committee, said a recently filed amendment to mass transit legislation appears to confirm Republicans’ fears that it is a Chicago-Cook County takeover of regional transit funding. “Senate Republicans have engaged in good faith negotiations for over a year now with our Democratic counterparts on the Senate Transportation Committee. But what House Democrats have put forward is essentially a bailout for Chicago, giving the city a bigger share of future revenues while cutting the suburbs out of key decisions. We are continuing to work with our Senate colleagues with hopes that the ultimate solution is fair and equitable for the entire region, including the suburban riders we represent,” he said in a statement.

* NBC Chicago | Chicago transit plan that would raise rideshare taxes, tolls blasted by critics: Under the terms of the proposed plan, the Regional Transportation Authority would be replaced by a new entity called the Northern Illinois Transit Authority, which would oversee the CTA, Metra and Pace. Governing that new organization would be a 20-member board, which would have five members appointed by the governor, five by Chicago’s mayor, five by the Cook County Board President, and five members appointed by county board chairs representing each of the five “collar” counties serviced by public transit lines.

posted by Isabel Miller

Friday, May 30, 25 @ 9:23 am

Comments

Add a comment

Sorry, comments are closed at this time.

Previous Post: Repeal The Interchange Fee Prohibition Act Now

Next Post: See What Real Shoppers Have To Say About The IFPA

Last 10 posts:

more Posts (Archives)

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Did the CapFax filters block inclusion of Poulos’s most excellent quote about the revenue package to Crain’s reporter Justin Laurence? Specifically that the revenue options are “a handful of sh** sandwiches.”

If there is a Golden Horseshoe for “Statehouse quote of the year” I rise to nominate that one.

Comment by ChicagoBars Friday, May 30, 25 @ 9:45 am

History on two issues:

Suburban sales tax for transit: There has always been a .25% sales tax in the collar counties for transit. P.A. 95-708 (the last transit bill) increased that to .75%, which half of the increase (or .25%) to go to the county board to use for transportation. Towards the end of that bill making its way through the process DuPage County had a budget problem with their county jail, so the reluctant agreement was to allow it to also be used for “public safety” which then brought then DuPage Senator Dillard to vote for the bill, which was a crucial vote that was needed. It didn’t take too long for all the collar counties to use that money for “public safety” which then freed up money for other needs.

Tolls for Transit: Chicago politicians have long pointed out that New York City bridge tolls support the New York City transit. However, they conveniently leave out that the governing body that manages those bridges is the same as the transit, and there is definitely overlap for jurisdiction and constituencies. I’m not sure you can make the same argument in Chicago since tolls are primarily used by surbanities who don’t have transit options for their suburb-to-surburb commute, and transit is primarily used by people who live in Chicago or are going to Chicago. Using tolls for transit here is definitely the suburbs supporting the City.

Comment by Just Me 2 Friday, May 30, 25 @ 9:50 am

This bill seems to be a mish mash of bad ideas thrown together at the last minute to create a sense of urgency. Yes, fixing the transit system is important. But this proposal isn’t the way to go.

Comment by Friendly Bob Adams Friday, May 30, 25 @ 9:51 am

At what point will fares be discussed as a part of additional revenues? I know that Metra reduced fares during COVID to try and increase ridership.

Comment by Remember the Alamo II Friday, May 30, 25 @ 9:55 am

I understand the funding pushback, but the collar counties are mainly built to be extremely car dependent, and should pay more for mass transit infrastructure as that is where many of the ‘end-points’ in the transportation hub are going to be.

“RTA sales tax money helps pay for services including transportation and the sheriff’s office in DuPage, Conroy said.”

Transportation spending, that’s fine. Spending that money on anything other than transportation was your local choice though. That’s not a transit problem. To me, this complaint falls on deaf ears.

Labors claims in opposition are also questionable;

“This proposal is inequitable, as suburban drivers would effectively subsidize urban transit systems such as the CTA”

There’s nothing in the plan that says this is effectively what is going to happen. Yes, CTA is part of public transportation, but it is not the only part. If the revenue is all arriving in the same pot, it’s effectively impossible to say that specific toll money is going to the CTA in any meaningful way. Because the converse is also true. CTA fare revenue is arriving into that same revenue pot, this making just as much sense to say CTA fares are subsidizing suburban transportation projects under this plan. It’s a true statement, it’s just not a useful statement in the full context.

Which of course means it is equitable, as everyone is getting treated the same way.

As a resident of a collar county(At least for a few more years), I’m fine with more funding for regional mass transit coming from suburban locations and tolls.

Comment by TheInvisibleMan Friday, May 30, 25 @ 9:57 am

The proposed tax of &0.50 per toll is galling. Not everyone works in Chicago. I live west of 355 in central DuPage County. I work in an office in the area around O’Hare. I could theoretically take four different pace busses over the course of a three hour journey each way to my office and back, but that would be absurd. I have to drive if I want my paycheck.

If you want commuters to help pay for transit, why not do what NYC did? Congestion pricing tolls into the downtown area are working great there. Congestion is down. Public transportation ridership is up. Funds are being generated for public transportation projects. It would have the added benefit of specifically targeting the suburban commuters and tourists that this kind of thing should really be targeting.

Additionally, CTA is allowed to raise prices, right? Minimum wage in Illinois on January 1, 2020 was &9.25 and the CTA fare was $2.50 for a train and $2.25 for a bus. Minimum Wage on January 1, 2025 in Illinois is now $15 and the CTA fares are the same as they were when the minimum wage was 38% lower. Would it kill them to raise the fares by $0.25 a ride? Same goes for Metra. It looks like their monthly passes are actually substantially cheaper now than they were pre-pandemic.

Any suburban politician that votes for the toll increase for non-tollway funding deserves to get voted out immediately.

Comment by benniefly2 Friday, May 30, 25 @ 10:06 am

==Anyone traveling on Illinois tollways, which are mostly located in the suburbs, would also have to pay an additional 50 cents per toll==

Ridiculous. These tollways cover existing gaps in the transit system. Why should they pay a surcharge where no viable public transit alternative exists?

Comment by City Zen Friday, May 30, 25 @ 10:13 am

Remember the Alamo II - the quirky thing about the farebox recovery ratio requirement is that if subsidies go up then fares must also go up at a similar level. So while it isn’t in the legislation, it will happen.

There are proposals to make adjustments to that ratio, but nobody is saying we should get rid of it.

Comment by Just Me 2 Friday, May 30, 25 @ 10:18 am

==could discourage low-income people from buying electric vehicles==

They should maybe go out and talk to actual low-income people before saying stuff like that.

Comment by yinn Friday, May 30, 25 @ 11:08 am

Tax tax tax…any new,ideas? Let the transit system collapse..

Comment by Red headed step child Friday, May 30, 25 @ 11:12 am

Yinn - you can purchase a used Chevy Volt for less than $10,000. In just a few more years the used car market for electric vehicles will be pretty big.

Comment by Just Me 2 Friday, May 30, 25 @ 11:23 am

A crazy idea from the urban planners circle is to drop transit fares completely. The idea being to fund it completely out of taxes, and to charge at most a token flat fee of a dollar. The theory is that you drive car use for commuting way down, with positive environmental benefits. The argument goes that you can’t fund transit on fares alone and need to subsidize it anyway, and fares restrict usage by the very people who need transportation access most.

Comment by Give Us Barrabbas Friday, May 30, 25 @ 11:23 am

==Let the transit system collapse==

That would be a huge blow to the economic engine of the entire state. Chicago is not the same without transit and transit actually saves us a lot of money by keeping a lot of cars of the road. This is frankly, just not an option.

Comment by Cole Friday, May 30, 25 @ 11:53 am

===Congestion pricing tolls into the downtown area are working great there===

What part of “Manhattan is an island and Chicago is not” do you folks not comprehend?

Comment by Rich Miller Friday, May 30, 25 @ 12:00 pm

Congestion Pricing has been used in downtown London for about 22 years and they are not an island. They use plate readers.

https://en.wikipedia.org/wiki/London_congestion_charge

Comment by no relation Friday, May 30, 25 @ 12:15 pm

@friendly Bob Adams: I agree with you on fares.

A single fare, cash fare should be the most expensive.

The new transit agency, as part of the restructuring, needs to come up with an updated pass system. The biggest discount would be offered on the largest pass (I.e, monthly) and it can be used universally.

Comment by Jerry Friday, May 30, 25 @ 12:24 pm

Lotta Democrats suddenly adopting a “taxation is theft” posture.

Comment by DS Friday, May 30, 25 @ 12:27 pm

How about getting rid of gas taxes and moving towards a universal “I-Pass” style system universally?

Comment by Jerry Friday, May 30, 25 @ 12:42 pm

===What part of “Manhattan is an island and Chicago is not” do you folks not comprehend?===

C’mon, Rich. We have all sorts of technology options available to us now.

But to your point, which I don’t agree with, I’ll also point out the downtown area is mostly surrounded by the Chicago River to the north and west, and Lake Michigan to the east, only leaving the southern border to figure out.

Comment by Just Me 2 Friday, May 30, 25 @ 12:45 pm

- City Zen - Friday, May 30, 25 @ 10:13 am:

No viable public transportation in the burbs is the result of the express desires for decades of suburban leadership.

Comment by Google Is Your Friend Friday, May 30, 25 @ 12:53 pm

I am all for the “congestion” license plate scanners. Put them up on every road where it enters Chicago proper. Same for rail passengers.

Let Chicago politicians charge whatever they want and let them spend it on whatever they want.

What do you think would happen to the inbound traffic to the city?

We don’t have a revenue problem, we have a gross mismanagement problem.

Comment by Flat Bed Ford Friday, May 30, 25 @ 12:53 pm

I never ever knew that the RTA tax could be used by county governments. I am old enough to remember when it was introduced and I complained like many. But in all the years since I never heard a politician say they were using tax to fund county

I do not use mass transportation but I find that totally unfair. It is an RTA tax that is where it should go. But then the lottery is paying for schools

Comment by DuPage Saint Friday, May 30, 25 @ 12:57 pm

===I’ll also point out the downtown area is mostly surrounded by the Chicago River to the north and west, and Lake Michigan to the east, only leaving the southern border to figure out.===

Agree that technology, like license plate readers could work, but your description above wouldn’t include the Mag Mile, River North or the Fulton Market/Halstead area, with major employers and presumably many commuters who could take mass transit. The Loop isn’t what it used to be in terms of a major destination for commuters.

Carving out a congestion zone would be like drawing political maps: not easy but very consequential. I am not currently on-board with congestion taxes, even though I don’t drive for work.

Comment by 47th Ward Friday, May 30, 25 @ 1:17 pm

===No viable public transportation in the burbs is the result of the express desires for decades of suburban leadership.===

There is a lot of public transportation in the suburbs, with varying degrees of effectiveness. Regardless of political posture, spread-out and less dense suburbs are inherently more difficult to serve effectively by public transit. When you have a multitude of Point A’s and Point B’s to serve, fixed routes with transfers are often too inefficient to attract users and on-demand type systems work better.

Comment by Six Degrees of Separation Friday, May 30, 25 @ 1:20 pm

A point of clarification on the toll surcharge: I believe the language states that NITA could levy up to 50¢ per toll, but it’s also capped at no more than $1 per car per day.

Comment by StarLineChicago Friday, May 30, 25 @ 1:22 pm

Let the suburbs put up congestion scanners where ever they want and charge what ever they want. OakBrook Mall….$25? $50? $75?a mile.

Since Chicago is next to the big pond it would only be fair to charge more for water the further it travels if you want access to that resource.

Someone wise said: “We don’t have a revenue problem, we have a gross mismanagement problem.”

Comment by Jerry Friday, May 30, 25 @ 1:23 pm

I did not realize that DuPage county had routed the entirety of the RTA taxes to funding the Sheriff’s department, but that appears to be its primary source. Digging around the 2025 budget document it looks like because their gas and fuel taxes pay for *all* Department of Transportation expenses 100% of the RTA taxes go to Public Safety of which 92% of the budget appears to be the Sheriff’s Department. While that’s strictly allowed (and another commenter provided the historical context) this feels like a short term fix that should have been addressed in the last 17 years and I’m not super sympathetic to complaints now. Maybe those super low property taxes should have been actually going up to fund services for residents.

Comment by Number Cruncher Friday, May 30, 25 @ 1:23 pm

== transit is primarily used by people who live in Chicago or are going to Chicago. Using tolls for transit here is definitely the suburbs supporting the City. ==

The city bulldozed entire city blocks that paid property taxes just to create superhighways so suburban folks can drive in with their polluting cars on their commute in to the city, or for enjoying the amenities that a large city offers.

Suburbs don’t exist without a city, and a city needs transit to exist. In fact, fewer folks on the road make it easier for suburban people to drive into the city.

The entire structure of our system is the city subsidizing the suburban lifestyle.

Comment by Incandenza Friday, May 30, 25 @ 1:24 pm

CTA Monthly Pass Prices

2019: $105

2025: $75

This was decreased due to COVID in 2021.

Why doesn’t the CTA restore the original price to raise revenues?

Comment by Flax Seed Friday, May 30, 25 @ 1:28 pm

“Flat Bed Ford” commented “We don’t have a revenue problem, we have a gross mismanagement problem.”

It seems to me that if someone actually wanted to support a statement like that (rather than just make a provocative remark) they would need to show:

1) What is “good” transit service (what would the bus and train network look like, and how early/late and frequently would the buses and trains run on weekdays/weekends/holidays etc?)

2) How much revenue “should” such service generate (how many trips would be taken at what fares?)

3) How much “should” such service cost (presumably with comparative stats on costs per service hour from other parts of the country and world?)

4) What’s the difference between what it “should” cost versus what we’re being asked to pay (fares plus public support?)

There’s clearly a budget gap. To support a claim that “we don’t have a revenue problem” it would be helpful to see your evidence.

Comment by sim1 Friday, May 30, 25 @ 1:32 pm

CTA shouldn’t get another dime from taxpayers until they at least have a plan to address fare evasion. I’m a daily bus rider. Large segments of ridership, particularly teenagers, are well aware they can board a bus and walk right past the fare box without any chance of consequences.

Comment by Count Floyd Friday, May 30, 25 @ 1:49 pm

Incandenza - I don’t disagree with you, but that argument doesn’t work very well for suburban legislators who have to answer to their voters. As Rich always says, you have to get to 60/30/1.

Comment by Just Me 2 Friday, May 30, 25 @ 1:50 pm

==The city bulldozed entire city blocks that paid property taxes just to create superhighways so suburban folks can drive in with their polluting cars on their commute in to the city, or for enjoying the amenities that a large city offers.==

Yes. 100%

Comment by low level Friday, May 30, 25 @ 1:54 pm

There have been many comments about pass prices and why are they lower now than they were before covid. Here’s the reason: pass prices are set as a multiple of single-fare rides taken by a “typical” commuter in a month, and that number has decreased and not yet bounced back.

For example, before COVID typical commuters commuted approximately 4-5 days per week on average. So that’s a base of about 18-22 days per month, or 36-44 rides per month (assuming two trips per commute day). So let’s say at 40 rides per month a $105 monthly pass works out to about $2.65 per trip.

But post-COVID commuting behavior hasn’t returned to pre-COVID levels. Nowadays a substantial share of transit commutes have reduced to 2-4 days per week, or 10-18 days per month, or 20-36 rides per month. If we assume 28 trips per month for a “typical” post-COVID commuter, a $75 pass also works out to about $2.65 per ride. At $105 that would work out to $3.75 per ride, drastically limiting the pool of commuters for whom a pass would be cost competitive.

It’s difficult to create a monthly fare that would work for everyone, but if it’s too expensive to be of value, hardly anyone would use it. They would just revert to single fares and not actually generate more revenue for the transit operator.

Comment by sim1 Friday, May 30, 25 @ 2:03 pm

@ Jerry

Apples to oranges point.

Water is a natural resource that isn’t owned by the City of Chicago. State, Federal and international law dictate who can take what.

But go ahead, withhold water from the collars and see what happens. We all know what will happen if the collars keep their money.

Comment by Flat Bed Ford Friday, May 30, 25 @ 2:07 pm

===But go ahead, withhold water from the collars and see what happens===

It’s weird that so many people forget how many Democratic state legislators represent the suburbs and how many Democratic county officials are in the ‘burbs.

Comment by Rich Miller Friday, May 30, 25 @ 2:15 pm

===The entire structure of our system is the city subsidizing the suburban lifestyle.===

Most of the research states that downstate gets the best return for their tax dollars, the suburban collar counties have the lowest return, and Chicago and suburban Cook are somewhere in between.

https://www.illinoistax.org/wp-content/uploads/2018/05/21_MayJune2011TaxFacts.pdf

https://news.siu.edu/2018/08/081018-research-shows-state-funding-disparities-benefit-downstate.php

Comment by Six Degrees of Separation Friday, May 30, 25 @ 2:29 pm

@flaxseed:

I disagree. If a rider is paying for 30 days upfront…there should be a significant discount there. And riders have complained for ages about universal fares across all 3 systems.

Comment by Jerry Friday, May 30, 25 @ 2:34 pm

@Sim1

Then the CTA should also increase single fares.

I live in the City and would happy pay an extra $0.50 to $1.00 per ride.

It seems weird to try and get suburbs to subsidize my transportation expenses.

Just raise all fares and be done with it.

Comment by Flax Seed Friday, May 30, 25 @ 2:37 pm

@flat bed

I agree with you about water. I was being sassy. No offense was meant.

How come Hinsdale can’t pay for its own roads and quit mooching off of Chicago?

Metra fares could quadruple after you pass the Berkeley stop (Westbound) on the UP West line.

Comment by Jerry Friday, May 30, 25 @ 2:40 pm

Jerry,

No offense ever taken here on CapFax. It’s the state budget process that’s offensive. Same stuff, every year. Wait until the last minute when everybody just wants to get out of town. Budget for a year, zero long-term goals that make Illinois a place people want to move to (don’t get me going about the “population boom’) and make sure all the special interests are taken care of. It’s an ongoing recipe for poor finances but I digress…

Comment by Flat Bed Ford Friday, May 30, 25 @ 3:16 pm

The CTA could cancel their red line extension unless and until the federal government resumes major funding of such projects.

Comment by Dupage Friday, May 30, 25 @ 3:36 pm

Tax the Parking Meter deal, tax surface parking lots in the loop, and be done with it.

Comment by Yellow Dog Democrat Friday, May 30, 25 @ 4:23 pm

YDD - how exactly do you tax the parking meter deal?

Comment by Just Me 2 Friday, May 30, 25 @ 5:29 pm

The argument that transit should be funded because the economic benefits the services generated are a significant percentage of Illinois economic GDP outputs is true. The main constituent of those profits are businesses. Why aren’t these businesses making all this money not paying their fare share towards the transit system they depend on???

Comment by Transit Questioner Saturday, May 31, 25 @ 11:04 pm