Latest Post | Last 10 Posts | Archives

Previous Post: SUBSCRIBERS ONLY - EJackson; Biss; SEIU; Bradley; Syverson (Use all caps in password)

Next Post: SUBSCRIBERS ONLY - Today’s edition of Capitol Fax

Posted in:

POSTED BY WONKISH.COM

For a month, legislative leaders have allowed Governor Pat Quinn’s income tax plan to languish in full public view, stirring up public discord for being both too big (see: politicians), and not quite big enough (see: interest groups). Now, some competing proposals are beginning to emerge, claiming to deliver a softer blow, and/or offered in exchange for tax relief in other areas.

1) Senate President John Cullerton mused:

“We could accomplish the same amount of money the governor acquires with his income tax increase by making it a one percent increase instead of a one-and-a-half percent increase, but without having an increase in the personal exemption.”

2) Cook County Assessor James Houlihan offered his own tinkering, that would accompany some other changes in the sales tax and Property Tax Credit. The income tax plan stands alone, however:

“Illinois’ tax structure must be made more progressive. To that end, relief should be targeted to those most in need. By enlarging the Earned Income Credit to 30 percent of the federal credit, raising the personal exemption to $4,000, and increasing the income tax rate to 4.25 percent, tax relief would be targeted to lower-income families. The changes would bring an additional $2.73 billion to state coffers, even with municipalities getting their 10 percent.”

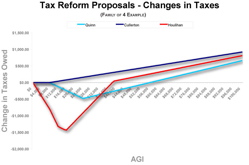

Roughly, all three of these income tax plans claim to generate the same amount of revenue ($2.7 - $2.8 billion). Senator Cullerton is looking for the simpler route - one point and be done with it. Assessor Houlihan is aiming for the same end as Governor Quinn - if you have to raise taxes, make the tax code more progressive while you do it. But which one really would be an easier sell? Which plan would be more progressive?

Take a look at the chart below that shows the tax cut or tax increase by income for a family of 4 for each of the plans. Click the pic for a much larger image…

Which plan would work better for you?

If the State needs to raise $2.7-$2.8 billion in new revenue, what plan do you think would be the best?

(For those of you who can’t play hypotheticals and object to the assumption that more revenue is needed, please make sure to visit the Wonkish.com Budget Tool and share your link here which shows all your cuts).

posted by Wonkish.com

Monday, Apr 20, 09 @ 1:13 pm

Sorry, comments are closed at this time.

Previous Post: SUBSCRIBERS ONLY - EJackson; Biss; SEIU; Bradley; Syverson (Use all caps in password)

Next Post: SUBSCRIBERS ONLY - Today’s edition of Capitol Fax

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Many thanks to the Wonkish.com folks for this post. Hopefully, we’ll have more of these in the future.

Comment by Rich Miller Monday, Apr 20, 09 @ 1:14 pm

Well, I am hosed with any of them, to the tune of 100 extra a month. Now, the Gov’s proposal lets me keep an extra 4 a month, so I guess I can have a bagle and pop on Quinn

Comment by Pat collins Monday, Apr 20, 09 @ 1:35 pm

Great resource! Not much difference for my brood in any of the three scenarios.

Note to Legislature: Please pass one of these ideas.

Please note: Lisa Madigan did not offer up a plan for consideration, she continues to stand in the corner wagging her finger fo all to see…

Comment by Anonymous45 Monday, Apr 20, 09 @ 1:36 pm

Quinn’s, by far, hits me the most.

Comment by Rich Miller Monday, Apr 20, 09 @ 1:37 pm

RICH

I as most taxpayers think we are already taxed to much. However, if I was to choose any plan it would be Cullertons.

Everytime I see plans or suggestions from Houlihan I cannot help but wonder his motives. This guy has totally screwed up the assessment process in Cook and now he is sugesting how to run the State.

Mr. Houlihan start doing the job you were elected to and leave the States problems to those who are qualified!

Comment by MOON Monday, Apr 20, 09 @ 1:38 pm

I believe Lisa Madigan currently is in the “Budget Cut” camp. But I look forward to seeing what else she has.

Comment by George Monday, Apr 20, 09 @ 1:43 pm

None of them affect me much at all because so much of my income isn’t taxed. I generally like the Houlihan plan conceptually. i don’t think we should raise the state income tax without doing what we can to ameliorate the burden on low income families.

Comment by steve schnorf Monday, Apr 20, 09 @ 1:43 pm

I like Cullerton’s plan. It’s the simplest and leaves room for other tax issues to be resolved later if this does not work.

Comment by ugh it's monday Monday, Apr 20, 09 @ 1:44 pm

With all the ballyhooing over how low Quinn’s plan started raising taxes on people, I don’t know how Cullerton’s plan avoids that same criticism - since it raises taxes on pretty much everyone.

Comment by George Monday, Apr 20, 09 @ 1:45 pm

The bottom line is 3 billion is not enough even counting one time revenue from the “stimulus”.The deficit is 12 billion.

By the way, Quinn’s screws me the most.

Comment by Bill Monday, Apr 20, 09 @ 1:52 pm

Did the numbers. All three options show a $1,000 increase with the totals all falling within a $65 range. Cullerton was the lowest by $50, then Houlihan, with Quinn the highest by $5. I’d go with Cullerton for a flat across the board change and keep all the extra stuff out of the picture. Do the fancier changes later, but start getting some bucks in now. 4% tax is livable compared to the option of less getting done. Get the capital projects done, do all the Fed matches, get the state’s bills paid up, and provide decent payment rates to all the providers, particularly the community based human service organizations who again have no increase of any kind in the current proposed state budget accoding to the Wonkish charts.

Comment by zatoichi Monday, Apr 20, 09 @ 1:54 pm

I pay the least under Quinn. Of note, none of the calculators let you place in your property tax credit.

Comment by Ghost Monday, Apr 20, 09 @ 1:57 pm

Wow this is the most attention Houli’s “plan” has received so far. Too bad he does not work this hard on housing assessments.

Not sure the Quinn plan has languished. I think the leaders have been watching support build

Comment by 2ConfusedCrew Monday, Apr 20, 09 @ 1:59 pm

I think we’re all just waiting for the Speaker’s plan, “2Confused”

Comment by George Monday, Apr 20, 09 @ 2:04 pm

Quinn’s works the best for me.

So I say, none of them.

Comment by VanillaMan Monday, Apr 20, 09 @ 2:04 pm

Wonkish and the rest of you insist that the government needs more money, which means that the people need less.

How about a tax system that encourages the growth of the private sector? Encourages savings and investment which in turn encourages company formation and job growth — instead of encouraging businesses and people to leave the state?

Comment by Truthful James Monday, Apr 20, 09 @ 2:09 pm

===Wonkish and the rest of you insist that the government needs more money,===

Did you not see this at the bottom of the post?

===(For those of you who can’t play hypotheticals and object to the assumption that more revenue is needed, please make sure to visit the Wonkish.com Budget Tool and share your link here which shows all your cuts).===

Take a breath.

What they’re trying to do here is show you what the various plans do, not advocate for any of them.

Comment by Rich Miller Monday, Apr 20, 09 @ 2:11 pm

It’s a toss-up for me…the three differ by all of $35.

Better start setting aside that extra $50/month now.

Comment by Concerned Observer Monday, Apr 20, 09 @ 2:15 pm

As a singleton, with 0 kids, all 3 plans screw me. Quinn’s plan is the worst, followed by Houlihan, then Cullerton. So, I pick Cullerton’s plan.

Comment by Anon, Good Nurse, Anon Monday, Apr 20, 09 @ 2:15 pm

Turthful James, because Reagan showed us that voodoo economics does not work.

Comment by Ghost Monday, Apr 20, 09 @ 2:18 pm

On this section of proposals, Quinn’s is best for me, followed by Houlihan and then Cullerton. Houlihan is about twice the increase for me than Quinn’s and Cullerton’s just bites even harder with another $145 over Houlihan’s.

Comment by Princess Monday, Apr 20, 09 @ 2:21 pm

The Quinn proposal is the fairest in my opinion. Right now in my late graduate studenthood the Houlihan proposal is the best for me. The Cullerton plan is completely unacceptable; it puts a burden on already heavily taxed people near the poverty line who are getting killed with sales taxes and (if they own) property taxes.

If the Cullerton plan emerges, it may be time to consider a different political party in Illinois.

Comment by Angry Chicagoan Monday, Apr 20, 09 @ 2:25 pm

I am with Good Nurse. I get hosed either way. Hopefully under all the plans I will at least get dinner and a few drinks beforehand…

Comment by Slick Willy Monday, Apr 20, 09 @ 2:27 pm

Just what are the #’s for the various AGI groupings? What is the Avg / Mean AGI for taxpayers?

Comment by Wondering Monday, Apr 20, 09 @ 2:28 pm

Quinn’s increase mine by 330, Cullerton’s 433, and Houlihan’s 405. Empty nest.

Comment by wizard Monday, Apr 20, 09 @ 2:34 pm

Unlike Rich, Quinn’s proposal has a smaller impact on me. But next year I lose a deduction going from 4 kids to 3 deductible. That closes the gap with Quinns plan hitting me more after the older kid moves on. But Cullerton costs me the most but only by $200 over Quinns.

Comment by Been There Monday, Apr 20, 09 @ 2:45 pm

I don’t like any of the plans. What is the Republican plan?

Comment by Ron Monday, Apr 20, 09 @ 2:47 pm

Ron, there won’t be any Republican plan. Why? Because they can’t make it add up without some new revenues and they (we) are unwilling to do that.

Comment by steve schnorf Monday, Apr 20, 09 @ 2:50 pm

I used numbers from my taxes this year and Cullerton’s plan hits me the least but since I was recently laid off, my income will be down considerably this year, so I’m not sure.

Comment by susie Monday, Apr 20, 09 @ 2:53 pm

According to the Illinois State Constitution: progressive income taxation is unconstitutional.That’s what a flat rate means.Now,I realize many people in Illinois today could care less about placing restrictions on the government.Pat Quinn should try and change the constitution if he wants progressive income taxation.

Comment by Steve Monday, Apr 20, 09 @ 2:57 pm

The Cullerton plan is the easiest sell, no matter how individuals fare under “quasi progressive” alternatives. The tax rate is lower, the constitutional issue is avoided, and frankly the public isn’t clamoring for progressivity through complicated formulas. Don’t underestimate the eventual backlash; just look at Cook County. The majority party has no reasonable alternative but to raise taxes, and the best bet is to make it as minimal as possible (Cullerton).

Comment by George Monday, Apr 20, 09 @ 3:20 pm

None of them hit me particularly badly. However, if I was in my twenties or thirties I would start pumping out kids as fast as possible - they’re just plain golden.

Comment by A Citizen Monday, Apr 20, 09 @ 3:22 pm

**ahem**

That “George” @3:20 pm wasn’t the real George.

Comment by George Monday, Apr 20, 09 @ 3:28 pm

A Citizen, you mean they are bleepin golden don’t you?

Comment by Ghost Monday, Apr 20, 09 @ 3:44 pm

What Obama giveth Quinnn taketh away. The prez is stimulating me and the mrs $80 per month or $960 a year. Quinn takes $885 of it back.

Comment by Leave a light on George Monday, Apr 20, 09 @ 3:54 pm

- Ghost -

Obviously you are better with asterisks than I am

Comment by A Citizen Monday, Apr 20, 09 @ 3:58 pm

I agree that the Cullerton plan is best for higher income families - and therefore is the best option for attracting key Republican votes in both chambers.

And - to Steve Schnorf and others - we wouldn’t have to raise the income tax so much if seniors paid state income taxes on some or all of their pensions (myself and my wife included).

Comment by Capitol View Monday, Apr 20, 09 @ 4:26 pm

Me: Cullerton +526, Houlihan +573, Quinn +609

My live-in girlfriend with a lower income: Quinn +120, Houlihan +165, Cullerton +200

I prefer Cullerton’s plan for the sake of simplicity and because it hurts me less, but Quinn’s plan is clearly better for those with low incomes. I’d settle for Quinn’s plan. In any event, I guess I’d better figure out a way to cut my expenses by $50/month.

Comment by Tim Monday, Apr 20, 09 @ 4:40 pm

I wonder what these results are when compared to surrounding states? Do the “Wonks” address that ?

Comment by A Citizen Monday, Apr 20, 09 @ 4:43 pm

I kinda prefer the “Heck with it I’m moving to Montana” plan. I’m actually considering this….Been in Illinois over 60 years and I’ve just about had it. You all can pay my share when I relocate.

Comment by Jechislo Monday, Apr 20, 09 @ 4:51 pm

Dual income - 3 kids

Quinn +450

Houlihan +700

Cullerton +900

So Quinn’s plan is cheaper for me, but I don’t like the idea of implementing it without changing the state constitution regarding flat v. progressive tax.

Comment by Worker Monday, Apr 20, 09 @ 4:54 pm

Jechislo, if you’re about to retire, you’d be a fool to leave. No state income taxes, man.

Comment by Rich Miller Monday, Apr 20, 09 @ 4:54 pm

==No state income taxes, man. ==

Not yet, anyway.

Comment by Bill Monday, Apr 20, 09 @ 4:57 pm

Plus, Jechislo, you’d be paying 6.9% income tax in Montana.

Comment by George Monday, Apr 20, 09 @ 5:03 pm

I do the best under Quinn’s because I have a family, but I have to say that I come down on the side of the legislature on this one. The difference to me between the best and worst is $400 per year. I’m not trying to give my money away, but honestly if you are going through all of the “pain” of raising taxes you better be able to pay for the state’s needs with the revenue you raise. Don’t come back and tell us you still need to cut programs that matter to me if you raise my taxes.

Comment by Hon. Cranial Lamb Monday, Apr 20, 09 @ 5:08 pm

The retirement income exemption from the income tax is an earned benefit from a lifetime of working, paying taxes, supporting society, schools etc. It is fair. An exemption from property taxes would also be fair as they rise so rapidly as to become virtually confiscatory to those retired and on a fixed income that does not keep pace.

Comment by A Citizen Monday, Apr 20, 09 @ 5:10 pm

A,

You are suffering from that Republican malady called “cut everybody but me”. The party of no quickly becomes the party of maybe when it starts to strike a little too close to home.

Comment by Bill Monday, Apr 20, 09 @ 5:27 pm

Wow! 6.9% Now we’re talking! That would just about bail Illinois out of its mess.

Comment by Bill Monday, Apr 20, 09 @ 5:29 pm

The problem with all of these plans is that 30+ Senate Democrats have signed a letter saying property tax relief and education funding reform are an essential part of any tax increase, and NONE generates enough revenue to fund both of those priorities while still plugging the budget hole.

Comment by Yellow Dog Democrat Monday, Apr 20, 09 @ 5:30 pm

=== You all can pay my share when I relocate. ===

Actually, senior citizens are a big drain on the tax base, second only to children.

Don’t let the door hit you on the way out!

Comment by Yellow Dog Democrat Monday, Apr 20, 09 @ 5:32 pm

Although I should add that spending on children is mostly an investment in the future, while spending money on senior citizens doesn’t offer much of a return.

Logan’s Run, Baby!

Comment by Yellow Dog Democrat Monday, Apr 20, 09 @ 5:34 pm

Hey, now wait a minute. A Citizen resembles that remark.

Comment by Bill Monday, Apr 20, 09 @ 5:34 pm

Bill, perhaps you would kick that little old lady down the Social Security stairway I was suggesting the formula be broadened to include an offset to the subjective and abusive property tax. As the home and real estate values plummet the R.E. Taxes should also . . . but they seem to just keep rising. That cannot be explained without smoke and mirrors - it is a sham and should be ended.

I was suggesting the formula be broadened to include an offset to the subjective and abusive property tax. As the home and real estate values plummet the R.E. Taxes should also . . . but they seem to just keep rising. That cannot be explained without smoke and mirrors - it is a sham and should be ended.

Comment by A Citizen Monday, Apr 20, 09 @ 5:35 pm

Up $1,080.00-1,095.00. Sigh. I’d feel a whole lot better about paying more taxes if Quinn would get busy and fumigate–and not just people. Some of the Blago-inspired nonsense (CMS-the money-laundering agency, Shared Services, the Premier recycling contract,the whole procurement process) MUST go. If those things were to happen, I would gladly double my contribution to the cause.

Comment by HearMeRoar Monday, Apr 20, 09 @ 5:39 pm

A,

It sounds like you should be a proponent of SB 750. The current class warfare is fun enough without adding age warfare to the mix.

I don’t necessarily disagree with you but when do taxes of any kind ever go down, and don’t say during the Reagan administration.

Comment by Bill Monday, Apr 20, 09 @ 5:40 pm

Bill, I guess we need a Mulligan - a DoOver _ we should secede from Britain again and declare ourselves independent. Or we could do a Rahm E. and declare our homes religious temples. My wife used to worship me . . . not so much any more though.

Comment by A Citizen Monday, Apr 20, 09 @ 5:46 pm

LOL, I can almost hear her now.

“A, get off that stupid blog and take out the garbage. Do something useful for a change.”

Too much togetherness!

Comment by Bill Monday, Apr 20, 09 @ 5:53 pm

Bill, Oh Man! Does your abuse never end? I just yelled at her to bring me an adult beverage - I am king of my castle, er church. Besides the ice will help on the lump on my head!

Comment by A Citizen Monday, Apr 20, 09 @ 6:00 pm

CV-couldn’t agree more!

Comment by steve schnorf Monday, Apr 20, 09 @ 6:33 pm

Cullerton is cheapest for me; Quinn takes the most.

On another subject, imagine five months ago having a discussion about actual policymaking in Illinois instead of speculating about indictments. Say what you will about Quinn, but at least we are discussing how to make the state function again.

And thanks to Rich for hosting this discussion. More like this, please.

Comment by Boone Logan Square Monday, Apr 20, 09 @ 7:12 pm

Quinn’s plan hits me for an additional $44; Houlihan’s $102; and Cullerton $149.00. As a single person with grown kids and low income, I pick Quinn.

Comment by Cheswick Monday, Apr 20, 09 @ 7:37 pm

None of them are “acceptable” without a $12,000 exemption for seniors and Real Estate Tax relief. Otherwise this creeping up of the taxation becomes punitive and confiscatory. Enough is enough!

Comment by A Citizen Monday, Apr 20, 09 @ 7:42 pm

For decades increases in taxes and expenditures have been done for the “Children”. Now those children are parents with children. What about the debt owed to Grandma and Grandpa for these decades of sacrifice. Throw them on the heap or treat them with the honor and respect they deserve? Your call!

Comment by A Citizen Monday, Apr 20, 09 @ 8:27 pm

What the heck are you talking about A Citizen?

To answer your earlier question, I suspect Obama and his Chicago millionaire staff paid exactly 3% of their income last year in Illinois. I haven’t run the numbers yet, but my guess is they’d get a better deal under Cullerton’s plan under the very cool Wonkish tool that is the subject of this post. Not sure why Obama needed to be brought in, but whatever. I guess we should get used to it.

As for your 8:27 post, is it Houlihan’s plan that makes my parents children pay our grandparents back for their debts and sacrefice? Which one treats them with honor and respect again? Cullerton’s plan?

Dude, I’ve read a lot of stupid comments here, including many of my own, but your 8:27pm was the craziest rant I’ve seen in a while. Good job!

Comment by 47th Ward Monday, Apr 20, 09 @ 8:39 pm

- 47th Ward -

So, I guess from your viewpoint it’s the heap. And what’s wrong with asking about our president and his inner circle of Chicago millionaires - A little touchy on the “One”, huh?

Comment by A Citizen Monday, Apr 20, 09 @ 8:47 pm

- 47th Ward -

The issue at hand is raising taxes in Illinois - by the Democrats. A tangential and coupled issue since we pay both state and federal taxes is Obama’s and the Democrat Congress’s multi trillions in spending. The resultant tax burden of this Democrat, state and federal, mammoth spending binge is on the taxpayers, You and Me and our children, grandchildren etc. It is Outrageous, reformer, messiah, or whatever you want to call it - Irresponsible is a good start.

Comment by A Citizen Monday, Apr 20, 09 @ 9:45 pm

It basically worked out that all the money in my “raise” from the stimulus package would go to more taxes for the year.

I would rather the fed gov’t just give it straight to IL than me.

Comment by heet101 Monday, Apr 20, 09 @ 10:57 pm

How about some budget cuts as promised - if there is none - does that mean Blago did that already? Let’s stop all those gambling dollars from crossing our boarders. indiana does not have our taxes and debt issues because they benefit form our gambling dolloars crossing the boarders. Allow a couple new boats on the boarder and do not raise taxes. Illinois will keep taxing business out of our state - and that means those jobs are gone. With unemployment what it is, we can not charge taxpayers anymore. The combined taxes we pay are about the highest in the country. My hopes are that we can cut some expenses and increase revenues without costing taxpayers and businesses anymore.

Comment by Capital Bill Tuesday, Apr 21, 09 @ 7:23 am

(Family of 4-me, wife, son, live in mother-in-law)

If I can claim my mother-in-law it is Quinn +0, Houlihan +$260, and Cullerton + $480.

Since the M-I-L started drawing Social Security last week, I highly doubt that I’ll be able to claim her. That puts me at Quinn + $210, Houli +$370, and Cuillerton +$500. Now I haven’t taken into account that both the wife and myself have taken paycuts this year, so it will probably be less of an increase for all the plans than what I have above.

I also tried to cut $12.4 from the budget, but only got about 10% of that out. It seems that statements like “Cut the budget to the bone” are pretty easy to make, but the reality of actual cuts is much more difficult.

train111

Comment by train111 Tuesday, Apr 21, 09 @ 8:24 am

The numbers are smoke-screen. While it could be perhaps nice to see theoreticals regarding who would pay what regarding each proposal, they are proposals with little reason to believe they would be passed as-is.

The bigger questions is regarding who pays more. Should couples with large families pay more? I have a large family and all these proposals force additional burdens on my family. Who do they think they are helping by burdening my family of toddlers and pre-schoolers? I do not believe in raising taxes on families with children. We wouldn’t have anyone to pay taxes in twenty years if we didn’t raise the next generation for this greedy state.

Should the poor pay more taxes? I don’t think that is right either. Just as a case is made that poor people benefit from social spending, and children benefit from social spending - the social spending we have witnessed in Illinois is not worth an dime. The taxes we are spending now are falling into a black hole of stupid spending and special interest’s pockets.

Seniors are on a fixed income. While that may sound appealing to jealous citizens, we haven’t seen inflation kick in yet - and it will with this administration in Washington. So they’re screwed too.

The mentality that tax payment should be based on income is also a bad idea. Sure, people with money can afford higher taxes, but why are we thinking that they are supposed to pay more because they have more? Talk about rewarding failure and penalizing success! You work hard so that the Illinois General Assembly can jack your taxes? Your business is finally successful after years of endless work, so that the greedy politicians and lobbyists can ride you back down?

Taxes are bad. Especially when they rob you not only of your wages, but also of your freedom of choice. I don’t care if Pat Quinn wants to give me $5000 for each of my kids, it is our money to begin with!

Now a lot of you bloggers love playing government games and try to outdo one another in solving our state government’s disaster. Try harder. Imagine reality as it really is - Illinoians are suffering economic hardships and should not be expected to pay more for a state government that over the past decade has ruined the state’s image, wrecked it’s business climate, spends it’s pension, and has been basically paralytic in it’s refusal to address the loopholes which allow it to balance it’s budget and kick a can of fiscal mismanagement and massive structural deficit into an even bigger mess.

Illinois state government’s politicians and favored special interests owes us. We don’t owe them. It is time for them to get off the gravy train and stop demanding that we pay more.

Comment by VanillaMan Tuesday, Apr 21, 09 @ 9:09 am

Why can’t we drop this whole income tax and move to a sales tax increase? I have no idea how much money this would generate for Illinois, but it would target the people that get paid under the table and don’t claim it on their income tax forms. How much does Illinois lose on unclaimed income/year?

As I see it now, responsible people who claim all income are going to get hurt the worst, those who don’t claim all income (if any) are still sitting high and dry.

Comment by Yadi Dog Tuesday, Apr 21, 09 @ 9:54 am