Latest Post | Last 10 Posts | Archives

Previous Post: This is what passes for “controversy” in the US Senate

Next Post: This just in… Appellate court judgment reversed - Unanimous verdict

Posted in:

* As you might expect, this is very bad news for Illinois’ credit rating, at least with Moody’s…

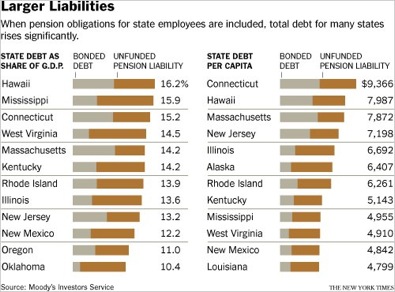

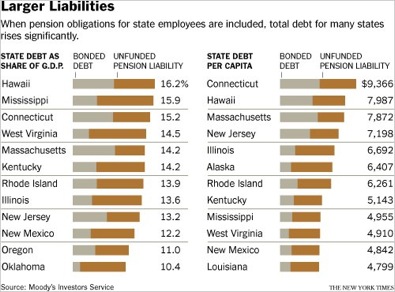

Moody’s Investors Service has begun to recalculate the states’ debt burdens in a way that includes unfunded pensions, something states and others have ardently resisted until now.

States do not now show their pension obligations — funded or not — on their audited financial statements. The board that issues accounting rules does not require them to. And while it has been working on possible changes to the pension accounting rules, investors have grown increasingly nervous about municipal bonds.

Moody’s new approach may now turn the tide in favor of more disclosure. The ratings agency said that in the future, it will add states’ unfunded pension obligations together with the value of their bonds, and consider the totals when rating their credit. The new approach will be more comparable to how the agency rates corporate debt and sovereign debt. Moody’s did not indicate whether states’ credit ratings may rise or fall. […]

In the past, Moody’s looked at a state’s level of bonded debt alone when assessing its creditworthiness. Pensions were considered “soft debt” and were considered separately from the bonds, using a different method.

“A more standard analysis would view both of these as liabilities that need to be paid and put stress on your operating budgets,” said Robert Kurtter, managing director for public finance at Moody’s.

* From the accompanying graphic…

* From Moody’s…

Moody’s presentation of combined debt and pension figures as part of a more integrated view of states’ total obligations follows a period of rapid growth in unfunded pension liabilities.

“Pension underfunding has been driven by weaker-than-expected investment results, previous benefit enhancements, and, in some states, failure to pay the annual required contribution to the pension fund,” says Hampton. “Demographic factors — including the retirement of Baby Boom-generation state employees and beneficiaries’ increasing life expectancy — are also adding to liabilities.”

Moody’s says that the evaluation of current and projected pension liabilities is an important area of focus in its rating reviews. For some states, such as Illinois, which is rated A1 and has a negative outlook, large and growing debt and pension burdens have already contributed to rating changes.

As I’ve said before, when New York says “Jump!” Illinois, with its huge bonded indebtedness, has no choice but to ask “How high?” If I had to bet, it would say we’ll see more pension reform stuff soon, including forcing government employees to pay lots more into the system.

posted by Rich Miller

Thursday, Jan 27, 11 @ 2:34 pm

Sorry, comments are closed at this time.

Previous Post: This is what passes for “controversy” in the US Senate

Next Post: This just in… Appellate court judgment reversed - Unanimous verdict

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Yep…the taxpayers took a hit. Now it’s time for the beneficiaries to so do. Future and current. No other way to go about it. Pay more in and pay a goodly portion of their health care costs. Best to take the medicine now, lest avoid the State IOU’s in the future.

Comment by Anonymouse Thursday, Jan 27, 11 @ 2:49 pm

How about making the state pay it share first? What do you say state employees union? Are your ready to sue the state for non-payment? It is the states contractural obligation to make their payment. Employees have already made their payment.

Comment by No Slacker Thursday, Jan 27, 11 @ 2:49 pm

Ehh…”and avoid the State IOU’S”, should be. Sloppy editing fingers.

Comment by Anonymouse Thursday, Jan 27, 11 @ 2:50 pm

Well, at least Illinois has less debt per capita than NEW JERSEY.

Comment by Anonymous Thursday, Jan 27, 11 @ 2:52 pm

===Are your ready to sue the state for non-payment? ===

You can’t. Get over it. Besides, “the state” just did its part with a huge tax hike. You’re next.

Comment by Rich Miller Thursday, Jan 27, 11 @ 2:52 pm

I guess Moody’s, S&P and the other credit rators are overcompensating for their role in the mortgage bond fiasco. They didn’t seem to have much trouble handing out A ratings for mortgage-backed securities, even though they (and no one else) had any idea what was in those bundles of mortgages. Turns out, there were time bombs in those bundles and they all exploded.

Now they’re getting serious with state debt? No state has missed a payment since reconstruction. But now Moody’s is sending out the alert? Please.

Comment by 47th Ward Thursday, Jan 27, 11 @ 2:56 pm

I think it is time we all, everyone under, say 40, had a moment of clarity and just face up to the facts that we are not going to have the retirement that our grandparents and parents, in some cases, may have, which was essentially a 25 year vacation.

But keeping things in perspective - for most of history here in the US, and for most people in the world still - the idea of retirement as a 25 year vacation (say 60 - 85) would be stunning.

Let’s get over it and get on with it. Our great-great grandparents likely worked until they couldnt work. Some generations in between were more fortunate - but things change is the point.

Comment by Peter Snarker Thursday, Jan 27, 11 @ 2:57 pm

Rich, why not? Everyone else sues the state and wins.

Comment by No Slacker Thursday, Jan 27, 11 @ 2:57 pm

- Yep…the taxpayers took a hit. Now it’s time for the beneficiaries to so do. -

I’m not a state employee, but if I were I’d be pretty angry about this. State employees are taxpayers too, so now they’re being hit from both sides. Maybe it’s the only option at this point, but people should remember it wasn’t the employees who haven’t met their obligations.

Comment by Small Town Liberal Thursday, Jan 27, 11 @ 2:59 pm

NS, you seriously think that? You can only sue through the court of claims. They won’t take this one.

Comment by Rich Miller Thursday, Jan 27, 11 @ 2:59 pm

You can’t. Get over it. Besides, “the state” just did its part with a huge tax hike. You’re next.

I agree you can’t sue the state for non payment. But the tax hike didn’t go toward pension, at least this year. Quinn’s plan was to borrow more money to make this years payment.

No Slacker is correct, the employees have already made their contribution.

Comment by Leave a light on George Thursday, Jan 27, 11 @ 3:00 pm

47th Ward beat me to it!

Comment by chiatty Thursday, Jan 27, 11 @ 3:02 pm

This isn’t that “new” — it’s not like the folks at Moody’s discovered pensions this week. Most of this is covering their butts as the issue heats up. They did such a crackerjack job on AIG, ya know.

Comment by vibes Thursday, Jan 27, 11 @ 3:03 pm

===No Slacker is correct, the employees have already made their contribution. ===

That’s true, but I do believe they’re gonna have to pay even more.

Comment by Rich Miller Thursday, Jan 27, 11 @ 3:03 pm

Sorry, I don’t think that is true. To many others have sued the state through the court system and won.

Comment by No Slacker Thursday, Jan 27, 11 @ 3:05 pm

“If I had to bet, it would say we’ll see more pension reform stuff soon, including forcing government employees to pay lots more into the system.”

It’s about time. Like it or not and regardless of who is to blame the deals made in the past have not been realistic or sustainable and should never have been granted.

Blame the politicians for using the granting of too generous pensions to get votes in return. Blame the reciepients for taking too much, more that was warranted.

And blame the public for not standing up to all of the abuses until recently.

None of it diminished the fact that we don’t have the money to pay for these benefits as they have been accrued and trying to get the money from the public in a manner like tax increases or additional borrowing would be the makings for a disaster.

Comment by Wondering... Thursday, Jan 27, 11 @ 3:05 pm

Everyone complaining about how the state can’t afford the pensions should have spoken up 20+ years ago, when the state began failing to contribute enough to for all of the benefits. If we couldn’t afford the benefits then, they should have been reduced then. You can’t blame the state’s employees for expecting the benefits they were promised when they came to work for the state. Perhaps you and the other voters should have held your representatives responsible for their fiscal mismanagement over the decades.

Comment by Henry Thursday, Jan 27, 11 @ 3:11 pm

What percentage to state workers pay now? I’m putting 4% of my salary into my retirement account, and the workplace kicks in 6%. I could kick in more, but they won’t match anything above that.

Comment by Cheryl44 Thursday, Jan 27, 11 @ 3:12 pm

Henry… I can, I do and I will.

The money isn’t there. What would you have us do?

Comment by Wondering... Thursday, Jan 27, 11 @ 3:13 pm

You can’t sue the State for money, but you can sue to enjoin the state from violating a contract or to mandate the state to follow the law. A court may say funding is a political question not for the courts to deal with.

Comment by Alexander cut the knot. Thursday, Jan 27, 11 @ 3:14 pm

Cheryl44, 4% for me too.

Comment by Cindy Lou Thursday, Jan 27, 11 @ 3:14 pm

Increasing curent employee contributions without a corresponding increase in benefits is diminishment and would be declared unconstitutional.

Comment by Bill Thursday, Jan 27, 11 @ 3:18 pm

hey, doesn’t hawaii throw retired state workers in the volcano as a sacrafice to the gods?

could by why they don’t worry about such things

Comment by frustrated GOP Thursday, Jan 27, 11 @ 3:21 pm

I am a state employee and I pay 10 percent. That is up from 0 ten years ago.

I don’t mind contributing my fair share to help. I think I have helped by paying more into my pension, more into my healthcare over the past ten years. That is with more responsibilities, less staff, furlough days, and no raises.

I am happy to have a job and will continue to do what I can to help.

Please, just keep in mind current state workers have sacrificed a lot over these last several years to help. Many, like myself will be happy to give up more.

Just remember these two things. We have made sacrafices. We don’t all have 6 figure pensions.

Comment by Pete Mitchell Thursday, Jan 27, 11 @ 3:22 pm

=What percentage to state workers pay now? I’m putting 4% of my salary into my retirement account, and the workplace kicks in 6%. I could kick in more, but they won’t match anything above that=

When I left my contribution was 12.5%.

Comment by Leave a light on George Thursday, Jan 27, 11 @ 3:23 pm

===I am a state employee and I pay 10 percent.===

No, you don’t.

Comment by Rich Miller Thursday, Jan 27, 11 @ 3:24 pm

I’m with you Pete. State employees have been hit, little by little, for years now. I’m not saying we shouldn’t share in the sacrifice - we should. however let’s spread the pain around evenly. Legislators’ pensions? Different pension plans for different unions and/or employees? I personally like HB 146 for a start. Too many people with their 6 figure pensions that (1) didn’t deserve the salary they made while under State employ and (2) therefore sure as heck don’t deserve it in retirement.

Comment by Former Merit Comp Slave Thursday, Jan 27, 11 @ 3:31 pm

Sorry, it is 8.

That’s not the point.

The point is ten years ago it was zero.

I am not saying saying 8 is enough. I don’t know what enough is but I do know that 0 to 8 in ten years with furloughs and zero raises is not not doing anything.

Comment by Pete Mitchell Thursday, Jan 27, 11 @ 3:38 pm

Rich -

My guess is that he pays a total of 10%, the “automatic” contribution to SERS (or whatever plan he is on) and then the “deferred compensation” the difference up to 10%.

Comment by Peter Snarker Thursday, Jan 27, 11 @ 3:40 pm

Deferred comp ain’t pension.

Comment by Rich Miller Thursday, Jan 27, 11 @ 3:41 pm

If I recall correctly, the only years I had no contribution was when the state agreed to ‘make the contribution payment’ in place of a raise.

Comment by Cindy Lou Thursday, Jan 27, 11 @ 3:44 pm

Well said FMCS.

Comment by Wondering... Thursday, Jan 27, 11 @ 3:45 pm

If these data are accurate, this pension reform should be done as soon as possible. Quinn should tell the unions that look, this has to happen, or the alternative will be far worse. You’re standing on very shaky ground, and your opponents are going after you hard. Others had to give with the tax increases, a great many of whom do not enjoy the same job security as you do. Help preserve your future by having to contribute now.

If what 47th says is true, that’s also another valid issue, that some major risky holdings in the private sector got A ratings. That sounds like hypocrisy. But people should be talking about borrowing and trying to slow it down, no doubt.

When the layoff threat was happening in 2009, there was much protest by AFSCME, which included protest against the two-tier pension recommendation. When pension reform passed, I do not recall so much as a whimper from AFSCME. This tells me that workers may be much more concerned about having a job with benefits rather than having to sacrifice something but also keeping a lot.

Comment by Grandson of Man Thursday, Jan 27, 11 @ 3:45 pm

===When pension reform passed, I do not recall so much as a whimper from AFSCME—

You must be deaf.

Comment by Rich Miller Thursday, Jan 27, 11 @ 3:48 pm

Rich -

If the state employee works at ISBE, for example, then yes they do pay about 10% for their pension.

Now, to all of you telling me to pay more as a state employee I don’t know what else you want me to do. I’m not in the union. I’m taking furlough days and haven’t had any raises. Now you want to take even more money from me. I think I would rather be on unemployment. I could make just as much by the time they get done . . .

Comment by Demoralized Thursday, Jan 27, 11 @ 3:49 pm

For Grandson of Man…

http://www.youtube.com/watch?v=UQAyvknyM60

Comment by Rich Miller Thursday, Jan 27, 11 @ 3:49 pm

. . . not to mention I’m paying the same tax and fee increases as everyone else.

Comment by Demoralized Thursday, Jan 27, 11 @ 3:50 pm

47, I used to work in the muni business. The rating agencies analysts are brilliant, really the best of the best in their fields. When you read their stuff, you cut through all the nonsense and get realistic pictures of what’s going on.

But then there are those higher up the pay scale, the ratings committees within the agencies, those that assign the letter grades that determine the juice you pay.

It’s such a very small, incestuous community, concentrated in Lower Manhattan — rating agencies, underwriters, bond counsel, financial advisors — that you really can’t shake the feeling that it’s a fixed game. Heck, from what I’ve seen it would be easy enough to fix both ends of the deal over lunch or drinks.

Subprime mortages got a AAA until they tanked the economy (nobody saw it coming? not true). States that have never missed a payment get pummelled.

Japan, the world’s second-largest economy, got downgraded yesterday. Do they really think Japan’s going to miss a bond payment, yet the mortgage hustlers were golden? Not possible, in good faith. It’ll move the market for a couple of days, though, and someone will score.

Now these ratings committees are talking about downgrading the United States debt. How can anyone take that seriously?

Who are these guys? Read their analysis, absolutely. But the ratings themselves? Meaningless.

Comment by wordslinger Thursday, Jan 27, 11 @ 3:57 pm

Rich,

I do not recall protests and marches on Springfield when the pension reform was enacted the way I do when we were protesting in 2009 against layoffs and the two-tier pension proposal. Perhaps they happened, but I was a bit burned out by then and needed a break from activism; I could say the same for others in my local.

My local was strangely silent during enactment, but it was heavily engaged in activism in 2009. We joined up with Diane Doherty of the Illinois Humger Coalition and others, and there was much more clamor. We did a news conference in front of a DHS office with Ms. Doherty, rode with her to Springfield in June 2009 and met with her and other nonprofits in a demonstration at the Thompson Center later that year. I’m not trying to drop names, I’m just illustrating a point. If I missed something, I’m very sorry.

Comment by Grandson of Man Thursday, Jan 27, 11 @ 4:01 pm

Pardon me if I am misunderstanding, but isn’t the unfunded pension obligation mostly the missed payments and borrowed money that the past Administrations and GAs “stole” from the pension system?

I understand that there would also be a portion that would be underperforming investments but if the amount that should be in there, was in there, that performance might be a little better.

If I am correct in the above statement then I have done my part as I have made my payments in a timely manner. I have funded earmarks, with my pension payments, that did not necessarily benefit me, and had no choice in the matter.

I am also a taxpayer, so I will be a part of the ” partial solution” which is the tax increase that “the state” just passed. I am doing my part twice.

Add to that the fact that I have also taken furlough days to help with the balancing of the budget. And I will add that my furlough days cost me more than the GA’s furlough days cost them. So I have done my part three times.

Add to that the 5 years I went with no pay raises back when everyone in the private sector was getting theirs.

So I won’t bow my head and act properly apologetic for taking my pay check.

Comment by Irish Thursday, Jan 27, 11 @ 4:01 pm

Irish, the answer is: Life ain’t fair.

Comment by Rich Miller Thursday, Jan 27, 11 @ 4:02 pm

I wonder how much I, as a state employee, would have to “kick in” w/increased contributions to make up for the perfidy of the state, over-reaching by the union and inattention of the electorate with regards to the failure to keep up with the pension payments.

I have no problem with sharing the pain but am leery of folk whose rhetoric about greedy state employees colors the discussion. Comparatively speaking, the pensions of most front line state staff is modest in comparison to elected officials and judges. It is the double dipping elected official who gets splashed on the headlines and the rest of us are damned by association.

Comment by dupage dan Thursday, Jan 27, 11 @ 4:02 pm

The taxpayers have gotten off easy for years, while the state skipped payments and underfunded the pensions to “balance” the budget and help avoid tax hikes. Eventually, the bill was going to come due.

So, while I’d like to tell Moody’s to stick it where the sun doesn’t shine - who believes a word out of those corrupt, incompetent bozos anyway - the reality is that the State’s been short-shrifting the pension funds for the better part of 15 or 20 years.

So, yeah the taxpayers got hit with a tax hike, but why should the pensioners get hit with reduced benefits?

They did their part. The people of this state failed to do their part by allowing the Governors and the Legislature to get away with kicking this can down the road for so long. If we’d passed a tax hike back in the mid-90’s and earmarked the proceeds for the pension plans, then that unfunded liability might be $0 right now. And this month’s tax hike might have been much smaller (or even nonexistent!).

At the same time, the things about pension liabilities is that they are estimates. The liability is based on projections for a 25 or 30 year period with all sorts of assumptions built in. If those assumptions or projections are wrong, then the liability (or asset, since you can actually have an OVERfunded pension) can be way off - for better or worse.

And, the worst case scenario is that the pension runs out of money, and then the state has to pay benefits in real time.

Anyway, the good thing about a move like this is that it’ll make it a lot harder for the legislature and the Governor to kick the can down the road instead of making good on our obligations.

The other good thing is that it makes it pretty clear (yet again) that New Jersey is in a worse fiscal situation than Illinois. So take that Chris Christie!!

But yeah, Moody’s can stick it where the sun doesn’t shine. I wouldn’t rely on them to assess the likelihood of me getting a year older sometime within the next 365 days.

Comment by jerry 101 Thursday, Jan 27, 11 @ 4:07 pm

Rich,

Thanks for the youtube link.

In 2009, two congressional proponents of the tax increase, who are in the Responsible Budget Coalition, told us we have to make sacrifices and scolded us for our reluctance to do that.

Comment by Grandson of Man Thursday, Jan 27, 11 @ 4:08 pm

for the record, I do not work for the state or any other government entity. I am a 100% private sector work, stuck with a crappy 401k, crappy benefits, and everything.

Comment by jerry 101 Thursday, Jan 27, 11 @ 4:09 pm

Of course, life isn’t fair - only an idiot would not see that. However, I see here, as elsewhere, the impassioned pleas of many who would seek to have the program(s) they support maintain full funding, even increases (needed, presumably, to assist disadvantaged folk harmed by the poor economy). I would hope that altho we acknowledge that their program may be vital and viable they, too (like all other deserving folk in this state) must share the pain. Share being the operative term. After all, (un)fair is (un)fair.

Comment by dupage dan Thursday, Jan 27, 11 @ 4:09 pm

Rich,

Believe me if you work below a certain level in state agencies that is very evident long before you have served your probationary time.

I have earned a decent living, raised a family and for that I am grateful. As the saying goes, “I drink from my saucer as my cup is overflowing.”

But what really irks me is when people pee in my cup because they are bitter.

Comment by Irish Thursday, Jan 27, 11 @ 4:12 pm

===the State’s been short-shrifting the pension funds for the better part of 15 or 20 years===

Double that.

Comment by Rich Miller Thursday, Jan 27, 11 @ 4:14 pm

I just wanted to add that I noticed when AFSCME won its court case and Illinois had to go back to the bargaining table in regards to layoffs, that seemed to have begun the cooling process. Then we got the temporary layoff freeze deal with pay raise deferment. That took a lot of pressure off of us. I remember workers with less seniority in deep fear during the layoff threat. Because the pension reform affects new workers, I didn’t perceive it resonating like the layoff threat did.

I know that for me, I’d rather have to give a little more and keep something than have to give everything up, and that’s a legitimate fear in this political climate.

Comment by Grandson of Man Thursday, Jan 27, 11 @ 4:17 pm

Has anyone ever noticed all of the A grades these rating services provide? There are AAA, AA and then As along with AAA+ and A- and then of course we have the under review and we are not even to the BBB+s yet. I am to where I question any of the ratings and as a prior poster pointed out, those mortgage bonds got AAAs. Its all over my head

Comment by Bond_player Thursday, Jan 27, 11 @ 4:25 pm

Jerry 101:

You mean the state workers got off easy by going for years without having to contribute to their retirement while the vast majority of the private sector was.

Comment by Christine Kaplan Thursday, Jan 27, 11 @ 4:28 pm

But wait, I thought the argument from legal corners and edit boards was that the debts are the responsibility of the pension systems and not the state, so if they go broke it’s not the state on the hook but rather the systems.

So does this mean those theories are now actually bunk? Heavens. That’d really sully some ivory towers.

Comment by piling on Thursday, Jan 27, 11 @ 4:29 pm

You have those questions and you’re a bond player? lol

Comment by Rich Miller Thursday, Jan 27, 11 @ 4:34 pm

Wow 2 years after a catastrophic recession caused by wall street greed bankers are getting record bonus’s again and were going to go after the guys making $40,000-$90,000. Im not a big fan of unions but this is getting silly.

Comment by fed up Thursday, Jan 27, 11 @ 4:38 pm

The problem here is that we inadequately recognize our obligations. In the real business world this is called accrual accounting. The ability to accurately know what is coming in, going out and what our obligations are.

Furthermore, look at how many different responses we get to what program an employee is on. Why do we not have just one system for:

Government Employee Health Care

Government Employee Retirement

etc

etc

etc.

Think about the millions & billions that have been wasted just with inefficiencies of scale!

Comment by BIG R. PH Thursday, Jan 27, 11 @ 4:43 pm

–Think about the millions & billions that have been wasted just with inefficiencies of scale!–

How many? Is that snark or is it part of a lecture series about the “real business world” and “accrual accounting?”

Has to be snark.

Comment by wordslinger Thursday, Jan 27, 11 @ 4:57 pm

8 1/2 percent contribution here, i guess everyone would be happy if they worked until there 70’s and had pennys to live on. Its a walmart world for sure.

Comment by foster brooks Thursday, Jan 27, 11 @ 5:04 pm

>- Rich Miller - Thursday, Jan 27, 11 @ 4:02 pm:

>Irish, the answer is: Life ain’t fair.

Yeah, but Rich, you got the question wrong. It’s “why do taxpayers have to make good on the pension obligations their reps incurred on their behalf?” - because life’s not fair.

Anyway, I’m glad they’re now making their ratings based on the entire picture. If they’d done that a decade ago, we couldn’t have sunk this deep.

Comment by irv & ashland Thursday, Jan 27, 11 @ 5:15 pm

The chickens are coming home to roost. Pension reform is way over due.

Comment by Palatine Thursday, Jan 27, 11 @ 5:23 pm

I’m a State Worker. My salary is around $60,000, after 20 + years. I pay $500 a month into retirement…not def comp.(I will show my paycheck stubs). We pay our fair share–they deduct every two weeks- we have NO choice to take a “pension holiday”. This mess is completely caused by the state not paying what they are required by law to pay each year. This is NOT State workers fault or blame by any means. Leave the front line workers alone. If you want reform, have the state make their OBLIGATED payments.

Comment by soxfan Thursday, Jan 27, 11 @ 5:24 pm

ME too SoxFan. I don’t mind paying my ‘fair’ share but is the GA, Judges, and the other retirement plans going to pay their FAIR share. It should be based on what their retirement will be. We don’t get 100% retirements and we probably won’t have SS either. I will work till I die.

Comment by Ain't No Justice Thursday, Jan 27, 11 @ 5:43 pm

Rich, don’t you mean, Illinois, “with its huge unfunded pension liability”, as opposed to “bonded indebtedness”? It looks to me as though the state’s bonded indebtedness is fairly reasonable; it’s the pension liability that threatens to sink the ship.

Comment by Angry Chicagoan Thursday, Jan 27, 11 @ 6:03 pm

https://self-evident.org/?p=884

Comment by little mushroom Thursday, Jan 27, 11 @ 7:08 pm

part of the problem with underfunded pension obligations is the lack of stock market gains in the last 10 years as two bubbles burst. Here is summary of what happened in the last bubble. http://www.calculatedriskblog.com/2011/01/financial-crisis-inquiry-commission.html

Read the last about the ratings agencies. There have been attempts to sue the ratings agencies but they argue they are like movie critics and have freedom of speech protection. So far they have been successful with this defense.

Comment by little mushroom Thursday, Jan 27, 11 @ 7:16 pm

I am a former U of I faculty member, retired just before my 69th birthday. This not unusual, as many faculty work into their 70s.

I have paid my 8% into retirement. And my SURS account listed the State 8% contribution. I also transferred my University of California retirement plan into SURS, as I was allowed to do. In short, I have played by the rules.

Twenty years ago, faced with a retirement cut, I could have earned my way out of it. Today, my options are limited.

So I understand that there is a lot of anger out there, but don’t understand why it is directed at retirees.

I understand there is anger out there, but don’t understand why it is directed at retirees.

Comment by OldIllini Thursday, Jan 27, 11 @ 7:38 pm

==You mean the state workers got off easy by going for years without having to contribute to their retirement while the vast majority of the private sector was.==

That is laughably wrong. State workers have and continue to pay into their pensions. Try and have a fact before you comment.

Comment by Anonymous Thursday, Jan 27, 11 @ 8:16 pm

Sorry . . . that was me above.

Comment by Demoralized Thursday, Jan 27, 11 @ 8:17 pm

I am rather encouraged by the 13.6% number for our debt as a fraction of GDP. While it will not be fun to dig out from under that, it should be feasible. Also nice that we are not the worst off. Kentucky, for example, is really badly off, because they have a similar fractional debt, but their per capita GDP (and therefore income) is so much smaller than ours. Thus their sacrifices will be much closer to the bone than ours, in terms of impacts on people.

Comment by jake Thursday, Jan 27, 11 @ 11:15 pm

then the next rage will be how retirees bring home more in retirement than when they were working, bring it on race to the bottom (i want to be like mexico) fans.

Comment by foster brooks Friday, Jan 28, 11 @ 6:11 am

Rich,

Have you heard what the odds are of HB0146 making it out of Rules? Jack Franks is known as a bit of a publicity hound. Does this bill hit current employees only, or does it effect current retirees too? What actually has been the historical average of 1/2 of of the annual percentage increase in the consumer price index-u? If this bill is challenged as being unconstitutional, would it’s effective date slip from July 1st 2011, or would it, if it’s challenges fail, cause those nearing retirement to have to decide prior to the challenge whether they would be better off making their retirement decision before July 1?

Comment by Anonymous Friday, Jan 28, 11 @ 6:59 am

“What actually has been the historical average of 1/2 of of the annual percentage increase in the consumer price index-u?”

Historical average of the SSA COLA is close to 3%.

Comment by OldIllini Friday, Jan 28, 11 @ 8:40 am

Anon:

No its a fact that for years state workers were not required to pay into their pension funds.

I find it ironic also that a lot of people are screaming about the “STATE” paying its obligations, but I ask you - who the hell is the STATE? Its you, its me, its all of us. So in essence you are saying you want the taxpayer to pick up the tab.

Reform is needed, defined pension funds are the way of the past and can no longer be adequately supported, not unlike the social security system which is collapsing under the weight of its own flawed design.

Comment by Christine Kaplan Friday, Jan 28, 11 @ 9:30 am

foster brooks … yep, and most of us aren’t in that position and won’t be for a long time … just ran the numbers and at 3% COLA compounded I’ll have to be retired about 24 years before I match my last year’s salary.

Comment by Retired Non-Union Guy Friday, Jan 28, 11 @ 9:42 am

Actually it would not be 3% COLA compounded, but 1/2 of 3% COLA

Comment by OldIllini Friday, Jan 28, 11 @ 10:14 am