Latest Post | Last 10 Posts | Archives

Previous Post: *** UPDATED x2 *** Punt!

Next Post: Question of the day

Posted in:

* From WUIS…

With college tuition on the rise, Illinois House Republicans say they want to give working class families a break, and an incentive to go to a school in state.

Rep. Adam Brown graduated from the University of Illinois Urbana Champaign in 2007, but in that short time, tuition’s steadily gone up.

BROWN: “The average cost for tuition, fees and books right now – $26,000 and ten years ago that was $19,000.”

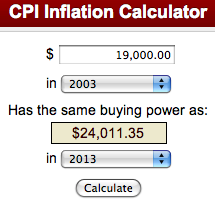

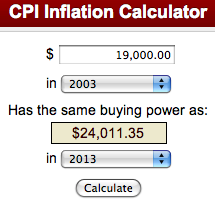

* OK, so I went to the CPI inflation calculator page and plugged in the numbers for 2003 and 2013 and found this…

So, the school cost numbers ain’t a whole lot higher than inflation.

posted by Rich Miller

Friday, Jun 14, 13 @ 12:10 pm

Sorry, comments are closed at this time.

Previous Post: *** UPDATED x2 *** Punt!

Next Post: Question of the day

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

That’s eleven years, fine sir.

Comment by TriggerHappy Friday, Jun 14, 13 @ 12:13 pm

Depending on the meaning of “ten years ago.” I would put that at 2003. But even using 2004, it’s over $23K, which still isn’t all that far off.

Comment by Rich Miller Friday, Jun 14, 13 @ 12:16 pm

Rich is right, 2003-2013 is ten years not eleven. Try plugging in 2013 and you’ll get $19,000 as a result; 2013 is zero years, 2012 is one year…2003 is ten years.

Anyway, I wonder what grade Brown received in intro to finance?

Comment by Robert the Bruce Friday, Jun 14, 13 @ 12:21 pm

Tuition is one part of the problem; admissions is another. How about getting U of I to admit more kids from Illinois? In U of I’s effort to blossom into a “world class institution” and extend its global reach, students from IL are often passed over in favor of foreign students. This is especially true in graduate programs such as the law school. I am not saying foreign and non-IL students shouldn’t be admitted, but they shouldn’t have priority preference. If anything, IL kids should have priority preference.

Comment by Hawkeytown Friday, Jun 14, 13 @ 12:23 pm

And don’t forget the U’s have been living under Kevin’s Joyce wiz bang idea of freezing tuition at the freshman level for all four years.

However the funniest part of Adam’s bold plan is why he wait until after he had his loophole giveaway for the fertilizer plant approved launching this new unfunded spending program

Hey Adma — the House adjourned May 31!

Hello? Hello? Anyone home

Fire, Aim, Ready!

And who said Dorgan was not having an impact.

Comment by CircularFiringSquad Friday, Jun 14, 13 @ 12:24 pm

A for Effort, D for Execution.

Comment by Arthur Andersen Friday, Jun 14, 13 @ 12:24 pm

Given the funding cuts between now and then, that increase is actually not bad. Not good, but not bad.

I am much more thrown off by the fact a member of the GA graduated in 2007.

Comment by Montrose Friday, Jun 14, 13 @ 12:26 pm

Not sure if Rich should take accounting grades from Arthur Andersen…

Comment by Chicago Cynic Friday, Jun 14, 13 @ 12:28 pm

It was ridiculous 10 years ago… and it’s just as ridiculous today….

Comment by BR Friday, Jun 14, 13 @ 12:34 pm

Tuition has gone up as state approps have gone down. Let’s look at that relationship.

Comment by Deep South Friday, Jun 14, 13 @ 12:34 pm

Darn you kids and your calculators these days.

Talk about a fact-check.

Comment by Formerly Known As... Friday, Jun 14, 13 @ 12:36 pm

” We here in Springfield demand that universities get their fiscal houses in order. “

Comment by siriusly Friday, Jun 14, 13 @ 12:37 pm

@ Rich - “So, the school cost numbers ain’t a whole lot higher than inflation.”

It may not be that far off from inflation… but have people’s incomes kept up with inflation?

Regardless, good for the Republicans for recognizing that socialist, public education works although Rep. Brown may want to go back to a few Math 101 classes at Altgeld and skip the Spin 101 classes at Lincoln. (/snark)

Comment by A. Nonymous Friday, Jun 14, 13 @ 12:39 pm

Cynic, well played!

Comment by Arthur Andersen Friday, Jun 14, 13 @ 12:51 pm

Decreasing state aid is a major factor in rising tuition costs — “What has changed in recent years is that state subsidies have fallen precipitously, meaning that parents and students are shouldering more of the cost through rising tuition payments.”

In context:

=== But, in truth, tuition—whether we’re talking about sticker price or net price—doesn’t really tell us how much a college education costs. As McPherson, who is president of the Spencer Foundation, pointed out recently at a conference at Princeton, an institution’s total expenditure per student is a much better measure of the cost of a college education. Based on 2012 data from the College Board, expenditures per student, especially at public institutions, have been relatively flat over the past decade, increasing by about 6.4 percent at four-year public institutions and actually decreasing at two-year public institutions. Tuition itself accounts for only a part of the total expenditure per student. At public institutions in particular, the rest is made up largely by state subsidies. What has changed in recent years is that state subsidies have fallen precipitously, meaning that parents and students are shouldering more of the cost through rising tuition payments. From 2000 to 2010, the portion of total expenditures covered by tuition at public institutions went from just over one-third to just over one-half, with subsidies falling accordingly. If we look at the cost of college this way, it’s unlikely that growing inefficiency is the main problem facing institutions of higher education; in fact, they are educating more students than ever and doing so at roughly the same cost per student. ===

http://www.brookings.edu/blogs/brown-center-chalkboard/posts/2013/06/05-postsecondary-education-schools-rouse?utm_source=Twitter&utm_medium=Social&utm_campaign=BrookingsInst&utm_content=BrookingsInst

Comment by Bill White Friday, Jun 14, 13 @ 12:55 pm

We’re all in for a real big problem down the road if we don’t get our State schools’ higher educational costs WAY WAY down. Middle income families cannot afford to send their children to college now. Upcoming generations will not have a better quality of life than their parents unless we find a way to get these costs down. The FEDS screw every borrower because of the costs of borrowing to pay for college. Banks get basically free loans from the Fed and student borrowers are going to have their interest rate double on July 1st from 3.4% to 6.8%. This is billions in more profit for the Federal government. Why? How much is it going to cost us to supplement uneducated workers through food stamps, health care, etc. because they work and still don’t make enough to live on? Everything is backwards! State schools’ higher education should be as close to free as possible for those who qualify via high school performance and entrance exams (SAT, etc.). In the long run it will cost all of us a lot less to educate as many people as possible for as little as possible to have them get well paying jobs and contribute back to society by paying the taxes we all depend on for services.

Comment by Nickypiii Friday, Jun 14, 13 @ 12:58 pm

I think we need to give Math tests instead of debates for State Rep elections. Looking at the last 10, 20, 25 years of budgets, it seems to be an area our elected leaders have failed in.

Comment by frustrated GOP Friday, Jun 14, 13 @ 1:02 pm

How much money did the U of I (or any college for that matter) get from the state in 2003? And now in the FY 2013 budget? My guess is, it hasn’t been the same as inflation.

The tax credit isn’t an awful idea, but wouldn’t it make more sense to fund education appropriately? Although, going through the work of producing a budget plan probably doesn’t get you the media attention this does.

Comment by Ahoy! Friday, Jun 14, 13 @ 1:10 pm

Rich, there were supposed to be a couple 9s in Rep. Brown’s figure. However they haven’t been seen since the phantom House staffer ran off with them and the gaming bill.

Comment by Dirty Red Friday, Jun 14, 13 @ 1:14 pm

It is still an 8% increase, even after adjusting for inflation.

Comment by Just Me Friday, Jun 14, 13 @ 1:15 pm

==It is still an 8% increase, even after adjusting for inflation.==

Yeah, but it sounds like he wanted people to think it was a 37% increase.

Comment by Roamin' Numeral Friday, Jun 14, 13 @ 1:20 pm

I’s still 2K per year more than inflation. That translates to 10K more over 4 years. Not an insignificant amount to a middle class family.

Comment by plutocrat03 Friday, Jun 14, 13 @ 1:21 pm

I graduated from college in 1975. Room, board, book, and tuition for one year was $1800. I had $3000 of student loan debt that I had to pay off.

Recently, I visited the website for the same college. Room, board, and tuition is now $16,000 a year. Books, not included.

I’d be in serious financial trouble if I had to go to college now on money saved from babysitting, birthday gifts, and odd jobs, plus student loans.

Comment by Aldyth Friday, Jun 14, 13 @ 1:26 pm

==Not an insignificant amount to a middle class family.==

I totally agree. But the problem is that people (not just politicians although they do it a lot) know they can throw out these soundbites, and feel comfortable that the average person isn’t going to whip out the inflation calculator app on their smartphone, to compare apples to apples.

Comment by Roamin' Numeral Friday, Jun 14, 13 @ 1:29 pm

A. Nonymous - “Socialist, public education…Brown ought to have … taken more math asses at Altgeld Hall”.

Lmao! He seems to have wound up in the dark anyway

yet another RepubliCON that claims fiscal knowledge yet absolutely nothing, totally sold on the notion that any public institution should somehow run without cost.

Was Brown a frat guy also? He should have stayed out of those houses and gone to the quiet study areas deep underground at the library.

Comment by low level Friday, Jun 14, 13 @ 1:44 pm

Getting slightly off topic, but the next financial crisis will absolutely involve student loan debt. It’s completely out of control and getting worse.

Comment by Hawkeytown Friday, Jun 14, 13 @ 1:57 pm

CFS hit on a key factor: in order to hold tuition flat for each cohort of incoming freshmen, the University has to build inflation into its tuition model, meaning year-to-year increases are higher than normal because you have to capture four years of inflation at the beginning of each new class.

So that and with the decreasing state support, tuition is only place left to get the revenue needed to operate without huge cuts. As the universities pick up their pension costs, the pressure on tuition will only increase, so of course tuition will rise much faster than inflation.

Comment by 47th Ward Friday, Jun 14, 13 @ 2:07 pm

I had a child graduate from a state university in 2007 and another graduate from a state university in 2013. Total cost for for 2003-2007 was $85K. In 2013, cost for 2009-2013 came to $130K. There weren’t frilly expenses connected, just normal expenses. College tuition is a runaway train moving well faster than inflation and salary stagnation. A LOT of private colleges will now match in state tuition in Illinois. It’s a huge worry.

Comment by A guy... Friday, Jun 14, 13 @ 2:26 pm

Too bad they didn’t think of this idea DURING session.

Comment by Michelle Flaherty Friday, Jun 14, 13 @ 2:32 pm

My son applied to 6 state universities, 3 Big Ten. He’s a good student and got merit scholarships to every school except Illinois. ASU offered him so much that our community college might have cost more (tuition). Needless to say, he’s attending out of state at one of the Big Tens and as an Illinois alum, I encouraged him to do so. If that’s the way my son was treated, then they don’t need our money. He’s been happy with his choice for 3 years now and we’re still paying less than in state Illinois.

Comment by geronimo Friday, Jun 14, 13 @ 2:35 pm

When I started at Illinois in 1972, tuition was $283 per semester. When I finished after my masters in 1977, it was $465. Numbers based on memory, but they will be close. Run those through the calculator and see what you get! Then compare that to the current cost…

Comment by Cincinnatus Friday, Jun 14, 13 @ 3:48 pm

Thank goodness for our community colleges. Went to mine for two years and earned an associate’s degree and then transferred to a state university and earned a bachelor’s. Saved a TON of money on the first two years.

Comment by Anonymous Friday, Jun 14, 13 @ 3:49 pm

General State appropriations to the U of I system in 2005 (earliest I can find) were about $654 million, with an additional $66 million in capital appropriations.

General state appropriations to the U of I system in 2012 were $710 million and capital appropriations were $31 million.

If appropriations grew at the same rate as CPI, those 2005 general appropriations would have been $769 million in 2012 ($59 million more than the actual amount) and those 2005 capital appropriations would have grown to $78 million ($47 million more than actual). Overall, state funding to the U of I system has effectively fallen by over $100 million in 7 years.

Note that this does not include on-behalf payments for fringe benefits, which is a huge source of state support that many peer institutions in other states do not receive.

Also note that state appropriations for higher ed are still amongst the highest in the country, yet tuition rates are in the top tier nationally as well.

Comment by jerry 101 Saturday, Jun 15, 13 @ 9:46 am