Latest Post | Last 10 Posts | Archives

Previous Post: The carrot and the stick

Next Post: Question of the day

Posted in:

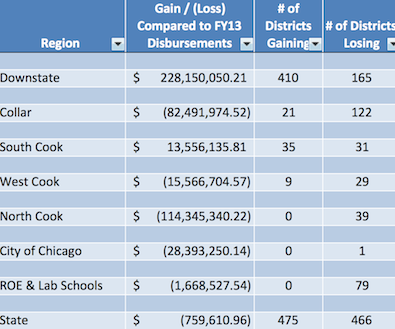

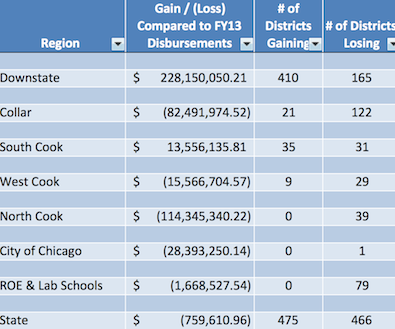

* After Republican outrage that Sen. Andy Manar’s school funding reform plan would provide a windfall to Chicago, it turns out that Chicago wouldn’t do all that well. From the State Board of Education’s analysis of the plan, which weights poverty rates much heavier on school funding…

* Finke…

Manar said the numbers show that the poorer school districts in the state fare better under his revised formula. By poorer, Manar said, that includes both districts with high numbers of students from poverty backgrounds and districts that have lower property values that do not generate enough tax revenue. […]

Manar said that the “most striking thing in the (report) is how far downstate districts lag behind in terms of funding. Downstate is very different than it was in 1997 when the current (funding) law was put in place and we have to account for those things to a better degree than we do today.”

That argument did not necessarily play well with Republicans who represent school districts in the suburban Chicago area. Sen. Matt Murphy, R-Palatine, said school districts in his area already supply 90 percent of their funding from local property taxes. Yet, under Manar’s revised formula, they would lose state assistance, with one district dropping $13 million in state aid.

“If that narrow amount that we get from the state is cut, what do people in my district, who already have high property taxes, do if they want to maintain the current funding level?” Murphy asked Manar at a committee hearing Wednesday. “It sounds like you are telling my constituents to raise their property taxes.”

* AP…

Schools in Palatine, Murphy’s hometown, would see an 87 percent decrease in overall state aid under the funds — about a $13 million dip compared to how much they received in the 2011-12 school year, the year the state board used to make the calculations.

Similarly, schools in Skokie and Evanston in Chicago’s northwest suburbs would lose 85 percent of state aid under the new formula. Meanwhile, Galesburg schools could stand to gain a 30 percent funding boost — about $5 million more a year than they receive now.

Schools in Red Bud, an Illinois suburb of St. Louis, would see an 83 percent decrease.

* Erickson…

State Sen. Dave Luechtefeld, R-Okawville, said many of the schools in his Southern Illinois district would gain under the proposal. He acknowledged it would be a tough vote for lawmakers in areas that would be losing state funds.

“It may not end up a Republican-Democrat issue,” Luechtefeld said.

The measure won approval in the Senate Executive Committee on a 10-3 vote with Luechtefeld voting “present.” He said the overhaul needs more work.

Republicans said the changes might be made more palatable if the state eases back on some of the programs and paperwork it requires of local school districts.

It remains unclear whether the House will take up the proposal if it emerges from the Senate. The plan was developed through a series of hearings in which the House was not involved.

Discuss.

posted by Rich Miller

Thursday, May 8, 14 @ 11:47 am

Sorry, comments are closed at this time.

Previous Post: The carrot and the stick

Next Post: Question of the day

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

So let me get this straight,

This new formula rewards districts who do not fund their school properly?

Comment by Person 8 Thursday, May 8, 14 @ 12:05 pm

==This new formula rewards districts who do not fund their school properly?==

No, the new formula to poorer districts (i.e. districts without a sufficient tax base).

Comment by Demoralized Thursday, May 8, 14 @ 12:07 pm

Should have been “redirects money to poorer districts”

Comment by Demoralized Thursday, May 8, 14 @ 12:08 pm

Well… This is not good…. At least they are talking. When you set up winners and losers that this clearly does, is not helpful. By this logic, those that pay high property taxes in the collar counties will lose the little bit they get from the state and should raise taxes higher to “redirect” the money they pay in taxes to schools downstate? Hmm… If those same people, like me, need to pay even higher taxes to maintain the schools we work hard to pay for? This is going to get ugly. Fast.

Comment by Walter Mitty Thursday, May 8, 14 @ 12:16 pm

Walter Mitty -

The elephant in the room is the law of diminishing returns. No district NEEDS to spend $18,000 to educate one student for a year. Sure, if these districts want to “maintain the schools they work hard to pay for,” they will need to raise property taxes. But there is no reason public education needs to be maintained at that level. At some point, a community is essentially deciding they want to pay private school tuition for public schools. If the voters/taxpayers want to do that, bully for them. Don’t make the rest of the state bear that burden.

Comment by Commander Norton Thursday, May 8, 14 @ 12:25 pm

Would this, in some ways, “punish” areas that prioritize school funding with their local tax dollars or pay higher tax rates to fund their schools?

I’m not taking a stance on the plan. I’m just trying to understand the larger view of this.

Comment by Formerly Known As... Thursday, May 8, 14 @ 12:27 pm

So Chicago would lose a net ~$28 million, with precisely zero districts “winning”? Hard to square that with the abject poverty in large swaths of the city.

Comment by The Doc Thursday, May 8, 14 @ 12:28 pm

CN… The flaw in that argument is the relative few districts that pay that much per pupil. The very few that do, not Palatine for one . They are at about $9700 per pupil.. $15,000 when operations included. That is counting the robust community education programs in it as well. This is a bad plan. If you take their state money away, it is the local taxpayers that make up the difference. You can’t say raise state taxes and have the diminished returns for taxes paid. If you want to argue that the retirement is paid more locally then I get that argument better. You should not have to pay for high retirement salaries locally decided. But to argue the taxes paid to the state and not get a return on that money, I don’t agree. The solution is consolidation. Not in the way is discussed. Our legislators think of it opposite. Trying to tie schools in the red to schools in the black. Start in the north shore area. Why are their one school districts for a high school with feeder districts 6-8 and K-5…All separate districts all in the black all with their own administration feeding in the same high school? Start there.

Comment by Walter Mitty Thursday, May 8, 14 @ 12:39 pm

Is there a study listed anywhere that compares the property tax rates for homeowners Downstate compared to those in the Collar Counties? I have heard but uncertain that many of the tax rates are similar, but rural schools districts have such a small tax base that it still becomes difficult to secure adequate funding.

Comment by Central IL Joe Thursday, May 8, 14 @ 12:51 pm

It will be interesting to see if reaction to this is as strong as the reaction to Dillard’s call for sending more money to downstate schools and less to schools in and around Chicago.

iirc, he said something like “Children living in poverty downstate should be equal to children living in poverty in Chicago”

Any time we are talking about taking away from a child, even if it is for giving to another child, it is going to generate some strong opposition and controversy. That is true no matter how charitable the affected parents and communities may be.

Comment by Formerly Known As... Thursday, May 8, 14 @ 1:01 pm

Sounds a little like means testing for social security: even though you pay in you may not get to withdraw as much as someone who has a greater demonstrated need.

Very few statesmen in the Legislature, so I assume everyone will vote in their districts’ best interests. I would hope that those that would fare substantially better under the formula would be required to look to consolidation of school districts and schools to further economize the benefits of the additional aid while reducing their overall costs.

Comment by Tommydanger Thursday, May 8, 14 @ 1:04 pm

No easy solutions certainly….

Comment by Walter Mitty Thursday, May 8, 14 @ 1:07 pm

My grandkids live in deep southern Illinois. They are not assigned homework because the school doesn’t have enough books to go around and therefore cannot have kids taking them home at night. It is, in this case, a vast area of marginal farmland, floodplain, withering little towns, and a coal industry that crashed and died the the last 20 years. Somehow, I cannot but think that a revision in the state assistance formula is a good idea. But this is Illinois, and if it is a good idea, it stands no chance politically.

Comment by Skirmisher Thursday, May 8, 14 @ 1:10 pm

Central IL Joe - Google is such a handy thing! Here is a list of the median taxes paid by County in Illinois. Lake County is the highest at a median cost of over $6,000. Pulaski Count is the lowest at $526. I’m in cook and got my taxes lowered to $7,000 (down from $10,000).

http://www.tax-rates.org/illinois/property-tax#Counties

Comment by The KQ Thursday, May 8, 14 @ 1:11 pm

Skirmisher… My original comment is true… At least there talking… It’s more substantive than in the past… There has to be a better way for sure.

Comment by Walter Mitty Thursday, May 8, 14 @ 1:17 pm

Well if pulaski county is paying $526 dollars in property taxes they need to look in the mirror when they complain about not having money for schools.

Comment by fed up Thursday, May 8, 14 @ 1:18 pm

Red Bud is a suburb of St. Louis? What planet are they from?

To the post: One problem with reliance on property taxes in rural areas is that it hits farmers hardest. And often, those farmers don’t have kids in the schools and fight hard to keep taxes down.

Comment by Skeptic Thursday, May 8, 14 @ 1:20 pm

@fed up:

It has to do with the value of their property and not the rates they are charging. It’s a sparsely populated county at the southern tip of Illinois. If you have some miraculous tax base for them to draw upon I’m sure they’d be interested to know about it.

Comment by Demoralized Thursday, May 8, 14 @ 1:23 pm

“The elephant in the room is the law of diminishing returns. No district NEEDS to spend $18,000 to educate one student for a year.”

The Illinois State Board of Education calculation shows the difference in state aid if Sen. Andy Manar’s school funding reform plan is passed. My question is what is the effect of this proposed change on educational outcomes, as measured in numerical terms, will there be? What is the formula for the “law of diminishing returns” when applied to educational outcomes in Illinois? If, as an example, Skokie schools lose 85 percent of their state aid will the number of students meeting or exceeding state standards go up or down by 85% or 8% or .8% or .08% or by something else? How big, or small, is “The elephant in the room”?

Comment by Hit or Miss Thursday, May 8, 14 @ 1:29 pm

I live in a rural school district that spends just over the bare minimum on our kids (Le Roy, McLean Co) and I pay ~$5,200 in property taxes total and ~$3,900 of that goes to the school district. Most houses here sell for between $70,000 and $225,000, and the county assessor thinks my house is worth about $180,000. If I put my house value into Lake County property tax rates, the property taxes only go up a smidge. But if I want to buy a single family home in Highland Park for between $70,000 and $225,000 only three properties are for sale versus 21 for sale in LeRoy despite Highland Park having a population 8x LeRoy. It’s not that we value our kids education less or that we as individuals pay a lower rate, it’s that property values drive the bus.

Comment by Rayne of Terror Thursday, May 8, 14 @ 1:46 pm

==So Chicago would lose a net ~$28 million, with precisely zero districts “winning”? Hard to square that with the abject poverty in large swaths of the city.==

Chicago has only one district.

Comment by Abe the Babe Thursday, May 8, 14 @ 1:47 pm

As mentioned by others, some school districts have much higher property wealth to tax. For example, compare these recent Equalized Assessed Values per student of these two school districts:

Naperville School District in the Chicago suburbs:

$295,590 EAV per pupil

Bushnell-Prairie City School District in West Central Illinois:

$67,200 EAV per pupil

Comment by Joe M. Thursday, May 8, 14 @ 1:58 pm

Remember a bill that passed years ago called the Farmland Assessment Law? That changed the way that farmland was assessed for taxes.

Here is what I found on the DeWitt County Government website on property tax complaints–

“The State of Illinois property tax requires that all non- farm property be assessed at 33.33 percent of fair market value and that like property be assessed in a like manner (equity).

All farmland assessments are based on a total agriculture use value as determined by the State Farmland Assessment Review Committee rather than fair market value. The DeWitt County Board of Review will review complaints of assessed values on farm residences, farm home site and farm buildings. The Board of Review does not have authority to adjust the certified farmland equalized assessed values received annually from the Illinois Department of Revenue as legislated by the Farmland Assessment Law passed in 1981.”

Since that time, rural school districts have received less in taxes from farmers. A person living in the country but not farming does not get that sort of a tax break.

Comment by Nearly Normal Thursday, May 8, 14 @ 2:08 pm

Oppose to comparing what on average homeowners pay in taxes, one should compare the tax rate for the school district. That is comparing apples to apples. As Rayne mentioned, within a county there may be a few properties where their EAV doesn’t match with their fair market value, but as a whole, they do. That is why the Department of Revenue calculates equalizers. That way, you can compare Cook to whichever county, even though Cook values property at other than one third of market value.

Comment by Anon Thursday, May 8, 14 @ 2:29 pm

Demoralized, Pulaski co has a population of 6,161 they need to be combined with adjacent counties. These unneeded units of government are a waste of money

Comment by fed up Thursday, May 8, 14 @ 2:43 pm

The reason the state is involved is to augment education across the state where it is needed. Otherwise it would be all local funding. It makes sense the poorer districts, in terms of property tax base, would be augmented more.

Of course, the political power is in the richer districts, like around Murphy.

This will become a problem between the two power bases of the Illinois GOP, downstate vs. well-off suburbs.

Comment by Walker Thursday, May 8, 14 @ 2:45 pm

Often times the “rich” districts pay a significantly lower tax rate (the dollar amount might be high due to value of their property) and benefit from a commercial or industrial base that downstate does not have, which in turn keeps their tax rate low. Tax payers in my district pay a high tax rate and raise much less money. We also have high (90%) low income students. We struggle to provide adequate facilities and programs for our many high needs students. Often times people in the wealthier districts benefit from district boundaries that were drawn over 100 years ago that no longer reflect the student populations in those areas and result in the vastly uneven funding of school districts in this state. Couple this fact with the reduced General State Aid funding (the foundation level, which is prorated, is not based on anything other than a number that the General Assembly decides on), the loss of grant funding, transportation reductions that impact rural and downstate districts, and we have the very complex and confusing situations which cause certain people to assume that poor districts either don’t tax appropriately or are poor money managers. This superficial assessment promotes the ignorance and allow for the continued polices that so negatively impact poor kids.

Comment by Nobody Thursday, May 8, 14 @ 2:46 pm

We do need to compare tax rates. If Murphy’s constituents are paying at higher tax rates than Manar’s, then I don’t understand why Palatine’s state $ should go to schools in Manar’s district where property owners make less effort.

Comment by Assess Thursday, May 8, 14 @ 2:51 pm

Famous quote: “All politics are local”. Same thought, all school districts are local. You could probably count on two hands (with a couple of fingers left over) the number of legislators (Democrats and Republicans) who would vote for mandated school district consolidation.

Comment by Buzzie Thursday, May 8, 14 @ 3:13 pm

Assess - I do hope that was sarcasm…and the only $ that belong to Palatine are those that originate in Palatine. Our small district provides a respectable education for less than 7k per student, and that includes operations.

Comment by countyline Thursday, May 8, 14 @ 3:17 pm

No one appears to be taking cost of living into account. Downstate areas certainly have less EAV per student and therefore less ability to raise enough taxes to fund their schools with massive state assistance. But why should be $$/student be the same in a lower EAV as in a high EAV area - the cost of living is a lot lower there, too. And the largest expense is salary. If every teacher downstate was paid the same as a teacher in Winnetka, but lived off that salary in Red Bud, they’d be among the highest paid workers in town. The goal shouldn’t be equal funding, it should be equitable funding. Less funding to areas where the cost of living is less IS equitable.

Comment by Anonymous Thursday, May 8, 14 @ 3:21 pm

==We do need to compare tax rates. If Murphy’s constituents are paying at higher tax rates than Manar’s, then I don’t understand why Palatine’s state $ should go to schools in Manar’s district where property owners make less effort. ==

Surely you jest in thinking that Palatine residents pay a higher rate than those on district with less property value.

Let’s compare rates.

Palatine CCSD 15:

EAV per pupil: $385,416

Total School Tax Rate per $100 EAV: 2.60

Panhandle CUSD2 (Raymond, IL in Manar’s district):

EAV per pupil: $164,146

Total School Tax Rate per $100 EAV: 5.37

Edinburg CUSD 4 (in Manar’s district):

EAV per pupil: $133,929

Total School Tax Rate per $100 EAV: 4.51

Bushnell-Prairie City CUSD 170 (near me):

EAV per pupil: $67,200

Total School Tax Rate per $100 EAV: 4.70

One of the main differences is that many of the downstate districts don’t’ have a a business and manufacturing property base like those districts in the Chicago Suburbs do.

Comment by Joe M Thursday, May 8, 14 @ 3:31 pm

Joe M. You need to factor in the fact the most suburban communities do not have unit districts. If you add in HS District 211’s 2.20 rate, the Palatine community is taxing itself at 4.80 for schools, not far off from Sen. Manar’s districts.

Comment by Steve M Thursday, May 8, 14 @ 3:43 pm

Check your school district on this ISBE page–

http://www.isbe.net/EFAC/default.htm

Comment by Nearly Normal Thursday, May 8, 14 @ 3:43 pm

== then I don’t understand why Palatine’s state $ should go to schools in Manar’s district where property owners make less effort. ==

We need to debunk this idea that downstate property owners make less effort.

Let’s say someone in Manar’s district in the Panhandle CUSD2 school district builds a $200,000 house.

- EAV (a third of market value): $66,666

- Divided by 100: $666.66

- Times Districts 5.37 rate per $100 EAV: $3580 in property taxes going to the school district

Construction cost new are going to be similar on a $200,000 house, but for the sake of argument, let’s say a house that cost $200,000 to build in Raymond, Il might cost $240,000 to build in Palatine, Il

- EAV (market value divided by 3): $80,000

- Divided by $100: $800

- Times Districts 2.60 rate per $100 EAV: $2080 in property taxes going to the school district

Comment by Joe M Thursday, May 8, 14 @ 3:51 pm

Steve M, You are right. I didn’t realize that Palatine CCSD 15 didn’t include a high school. So one would have to add the high school’s 2.20 rate to the K-12’s 2.60 rate, for a total school tax rate of 4.80 for Palatine residents.

So the $240,000 house in Palatine at the 4.80 rates would pay $3840 in school taxes.

The $200,000 Raymond, Il house at the 5.37 rate would pay $3580 in taxes. But I would hardly say that the person in Raymond is not paying his share. Household incomes in Raymond are greatly lower than in Palatine.

And frankly, I’m guessing there aren’t too many $200,000 houses in Raymond. That is the whole point, some downstate school districts have far lower EAV’s than Chicago Suburban districts. That is the main reason for the huge differences in school funding per pupil in Illinois - not that the downstate property owners aren’t doing their part.

Comment by Joe M Thursday, May 8, 14 @ 4:05 pm

http://webprod.isbe.net/ereportcard/publicsite/getSearchCriteria.aspx

also has the EAV per pupil for each school district, as well as the tax rates per $100 EAV.

Comment by Joe M Thursday, May 8, 14 @ 4:07 pm

Knowing both areas rather well… Bushnell and Naperville… Comparisons make no real sense. If someone moves to Naperville and a modest home is $400,000 and they pay close to $10,000 in property taxes… Bushnell is not a collar County with the same access to Chicago for the job market… So by the logic of this proposal is to punish the areas that pay 90-95% of the school funding already through property tax. This is a great deal for us collar folks if we are exempt from paying the disproportionate amount of our state taxes we already do not receive for state school funding. Like when all the threads talk about if you don’t like it move… Many parents move and struggle to afford their homes for the school district their kids to attend….. Punishment is not fair for either side.

Comment by Walter Mitty Thursday, May 8, 14 @ 4:26 pm

Again… Consolidation like your Naperville k-12 district 203 and 204 for the collar County single school districts in the black solves almost all of this… But North verses South is so much better for the ruling class in Springfield…. Why really solve anything?

Comment by Walter Mitty Thursday, May 8, 14 @ 4:30 pm

Rep. Lou Lang’s and Sen. Ira I. Silverstein’s school districts take a serious beating in this plan losing between 80 and 88% of their state funding. But this is nothing compared to COMMUNITY CONS SCH DIST 180 which is jointly in Sen. Christine Radogno district and also in Rep. Jim Durkin district loses 93.6% of state funding which I think is the most of any district percentage wise in the state.

Manar sure put a spanking on some folks normally not getting smacked. This is a real good way for the Freshman Senator to make friends.

Comment by Rod Thursday, May 8, 14 @ 4:34 pm

@Walter:

Equitable solutions are sometimes not the most palatable solutions. Like it or not the richer parts of the state have to subsidize the poorer parts. A child’s access to quality education shouldn’t depend on where one lives. All schools deserve the same access to the same kinds of learning materials (i.e. technology, updated books, etc.).

Comment by Demoralized Thursday, May 8, 14 @ 5:27 pm

I agree with you Demoralized… But these areas that support their schools at 90% and above with property taxes and contribute to state taxes and get nothing back is not the answer… The issue of quality is negligible…. Those communities that choose to fund more locally do so… No offense… But where one lives does and doesn’t matter. It’s if the education that is provided is taken advantage of by the parents expecting the child to achieve and the student delivering… Life ain’t fair… Work hard and make your station in life better…

Comment by Walter Mitty Thursday, May 8, 14 @ 6:03 pm

–Our small district provides a respectable education for less than 7k per student, and that includes operations.–

Where is this Utopia?

Like Murphy’s constituents, I made a choice to pay out the nose in property taxes to give my kids educational opportunities that most kids in the state don’t have.

My choice. I’m not crying about it. And I don’t begrudge paying taxes to support less wealthy school districts to give those kids a better shot.

It’s called community.

Comment by wordslinger Thursday, May 8, 14 @ 6:15 pm

As long as the major source of school funding in wealthy districts is local property taxes there will always be winners and losers.

Parents who live in “wealthy” districts want their property taxes to pay for good schools for THEIR children. They do not want their property taxes to pay for other schools instead of their own school.

Parents in districts with lower property tax revenues in most cases simply can’t pay any more. They know other people’s children get better schools. They quite justifiably want the same for their children.

We find ourselves between a rock and a hard place.

One possible way to change our approach might be to force all school funding to flow from the state. The state would need a broadly based revenue source to pay for this like a statewide tax based on something like income. (fat chance)

All federal money would go directly to the state to be distributed. (not to school districts) There would have to be be NO local property tax funding at all.

In this scenario the state’s foundation level of funding might actually mean something.

The equation could be $x.xx per student, $y.yy add on per special needs student, and $z.zz add on per “free or reduced lunch” student.

Level the playing field for every district. The state would for the first time actually have to try to meet it’s obligation to fund education properly for everyone.

The powerless would no longer be the only students shortchanged if inadequate funding is provided to schools.

Wouldn’t that be fun?

Until then, it is just more of the same.

Comment by vttk17a1 Thursday, May 8, 14 @ 6:22 pm

Word… That’s respectful and hope to be in that position some day. But now the rules are I bought a smaller home, drive an older car, passed on vacations to pay high taxes for better schools…. My choice too. I don’t have much extra to give for others right now… But I hope someday I can. I appreciate their are folks like you that can… do…

Comment by Walter Mitty Thursday, May 8, 14 @ 7:05 pm

Walter, I don’t understand your point. You don’t think taxpayers should support state schools, no matter where you choose to live?

What’s your alternative?

Comment by wordslinger Thursday, May 8, 14 @ 7:27 pm

Word… I made sacrifices to live in an area with great schools. That choice means less of a home or nicer car. If my taxes I pay like all of us go to fund our local schools . The little bit the state gives us now goes elsewhere. The system can’t change that radically. What happens if the costshift for pensions comes back? How much in taxes iis enough for the middle class?

Comment by Walter Mitty Thursday, May 8, 14 @ 8:03 pm

The alternative is simple. Consolidation of schools that are in the black that serve the same communities. All K-12 unit districts. No more 1 high schools that are districts . That have 6-8 grade separate districts. With K-5 that feed in that same high school… That’s a great start.

Comment by Walter Mitty Thursday, May 8, 14 @ 8:09 pm

Grow. The. Pie.

I tend to agree with Walter on one important point: focusing on winners and losers makes it more difficult to build a majority.

Figure out something - quickly - that affluent districts want or need and expand the discussion. That is what any smart negotiation professional would suggest.

Comment by Yellow Dog Democrat Friday, May 9, 14 @ 9:02 am

Looking through the PDF of changes for each school district organized by senator I can’t help but be surprised at some of the schools around me losing money. If Deland-Weldon loses some funding under this plan what kind of dire straights must the districts who are gaining a thousand per student be?! I would love to have a tool or have enough understanding of how the numbers work to be able to combine school districts and see what happens.

Also, I cruised through the real estate listings for Highland Park last night to see what a comparable home to mine would cost there. Couldn’t find any with a 3/4 acre yard, but same bedrooms/bathrooms/level of finishes plus a lot 1/2 the size of mine runs about $600,000 and pays over $13,000 a year in property taxes. WOO WEE, I think the answer is buying a house in DeWitt county and homeschooling.

Comment by Rayne of Terror Friday, May 9, 14 @ 9:26 am