Latest Post | Last 10 Posts | Archives

Previous Post: Mark Kirk should be so lucky

Next Post: Rauner approval rating drops 11 points in a month

Posted in:

* Kurt Erickson fact checks this excerpt from the governor’s lawsuit against state employee unions…

“Since 2004, the unions have negotiated wage increases of approximately 80 percent during collective bargaining negotiations. By comparison, total inflation over the same time period was approximately 26 percent, and private sector employee salaries increased by a total of 31 percent,” the suit notes.

Erickson calculated that the lawsuit claims a person making $50K a decade ago would be earning $90K right now. Could that possibly be true? He took a look at state union contracts and concluded it wasn’t…

Based on those contracts, workers were in line to receive wage increases totaling just over 32 percent — a figure that matches up more favorably with the private sector number cited by Rauner in his lawsuit.

The Rauner administration’s response…

“It includes overtime and is based on salary averages,” Lance Trover wrote in an email last week.

Overtime costs are mainly driven by worker shortages. Hiring more workers would drastically lower those OT costs, but doing so would also drive up other costs for things like training, health insurance and pensions.

However, there are other ways to get pay raises under the contract, including step increases. I’m no expert here, so maybe some commenters can fill us in. And I have yet to see someone challenge Rauner’s basic fact: State employee salary costs have risen 80 percent over the past decade.

* Meanwhile…

Three top administrators at the Illinois education agency took big bonuses home in their paychecks earlier this month.

According to a review of state payroll records by the Quad-City Times Springfield Bureau, the Illinois State Board of Education paid a total of more than $41,000 in bonuses to the trio.

A state board spokesman said the employees received the extra cash because each of them took on added duties.

“(T)heir salaries will return to the previous levels during the next pay period,” Illinois State Board of Education spokesman Matt Vanover said in an email. […]

“Given the significant reduction in agency headcount and the increased burdens placed on the agency by the Legislature, it is disingenuous to suggest that only the senior level administrators have had to take on additional duties meriting these adjustments in pay,” noted Aviva Bowen, spokeswoman for the Illinois Federation of Teachers.

ISBE employees are represented by the IFT, and those frontline workers have indeed taken on extra duties without additional pay - unlike the top brass.

*** UPDATE *** From AFSCME Council 31…

FALSE CLAIM: “Since 2004, unions have negotiated wage increases of approximately 80 percent”

FACT: Negotiated wage increases since 2004 are 32.25 percent. The average increase over that period is 2.9 percent per year.

FACT: The average wage increase in the current contract is just 1.3 percent per year — below inflation for that period (1.73 percent per year).

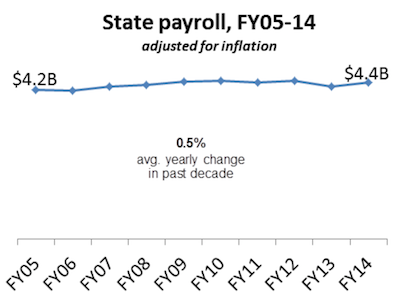

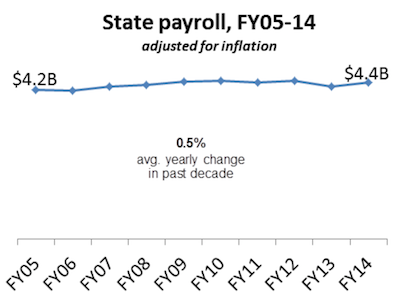

FACT: Adjusted for inflation, payroll is effectively flat since 2004 – up just 0.5 percent per year.

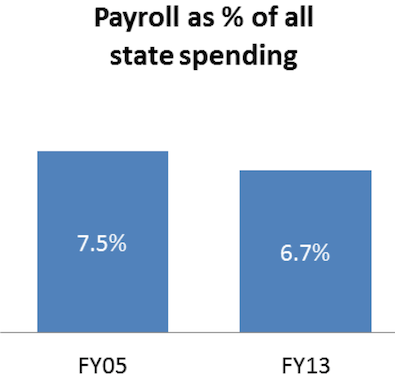

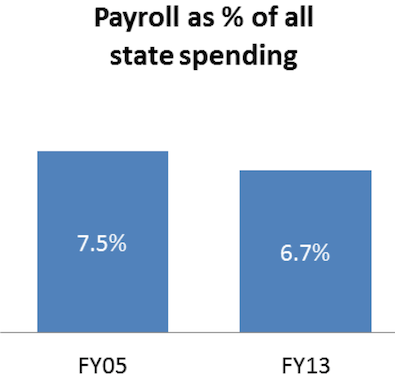

FACT: Payroll is a small share of state spending, and dropped from 7.5 percent in FY05 to 6.7 percent in FY13.

Two charts…

posted by Rich Miller

Tuesday, Feb 17, 15 @ 9:29 am

Sorry, comments are closed at this time.

Previous Post: Mark Kirk should be so lucky

Next Post: Rauner approval rating drops 11 points in a month

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

I know PSA’s who, when they were pulled into the union, got over a $20,000 annual raise immediately. And their raises over the next 10 years were very, very, very good.

And, considering they went from Merit Comp into the union, they were ecstatic. And they were doing the exact same job as before they went into the union - and made more than their Merit Comp bosses.

Comment by Jechislo Tuesday, Feb 17, 15 @ 9:44 am

These cards show that maybe Rauner is right about the unethical relationship between the state employee unions, their Democratic Party patrons, and the taxpayers whom provided the punch bowl. As a PSA, they simply could not afford to give me a raise during the same years.

To be brutally honest, Rauner doesn’t have to decimate the employee unions to fix this, just take away the punch bowl.

Comment by read em and weep... Tuesday, Feb 17, 15 @ 9:45 am

Mrs. Sleep and I are both state employees. She was employed by the state well before I was employed by the state and had an established health insurance plan that covered all of us (including Lil Sleep 1 and Lil Sleep 2). But when I accepted my state job, I was FORCED to take health insurance. That is insane. So, because that arcane law, our combined policies cost the state approximately $30,000 after our premiums are paid. My inclusion in her policy cost us nothing extra, but requiring me to have my own plan costs the state $8,000 or so. That amount to cover both of is the salary amount of a new assistant at IDOT or a new support services staffer at a state-run prison. And therein lies the issues with IDOC. If you hire a new officer - and one who has 2-3 kids and a spouse - then he or she incurs a plan that costs the state approximately $25,000 per year. That does NOT include the cost of co-pays and actual care. That is just the premium amount.

Comment by Team Sleep Tuesday, Feb 17, 15 @ 9:51 am

it`s all public record, look it up. 32% is a lot closer to reality!!

Comment by highspeed Tuesday, Feb 17, 15 @ 9:51 am

In numerous agencies, comparatively large pay raises are given annually to the top executive staff without performance standards (4% to 8%). For union workers, getting 3% is as good as it gets and that is not always paid as promised.

For NON-Union employees, getting even 1% -2% is the best many have seen and numerous employees went a decade or more at 0%.

It seems that the Executives do well regardless, the unions protect pay consistent with inflation and the rest are ignored.

Rauner seems to be continuing the favoritism for the top echelon already and looks like he will try to finance that on the backs of all who are below them.

Comment by SkeptiCal Tuesday, Feb 17, 15 @ 9:52 am

I have friends neighbors working in Corrections and other state facilities. They are regularly putting in 25-40 hours weekly mandatory OT. Why? There is nobody else. In the prisons, someone gets sick, hurt, or goes on vacation there are no subs coming in. With facilities populated far over their designed capacity, what do you do say no to the hours and risk safety issues? Want more people to stay in prison? You need more employees to run the places. Pay in OT or straight time you still need the total FTE work hours for coverage.

Comment by zatoichi Tuesday, Feb 17, 15 @ 9:54 am

The only way I can come anywhere close to that 80% figure is if you factor in the state actually making those pension payments

Comment by Former Merit Comp Slave Tuesday, Feb 17, 15 @ 9:55 am

I’m wondering if that allegation in the Governor’s lawsuit won’t backfire. I mean, it shows that the union has provided substantial benefits to state workers. In my mind, that makes the case for fair share payments stronger, not weaker — state employees who are not members of the union received a big boost in pay and it seems only fair that they should cover some of the costs of making that happen.

Comment by the Other Anonymous Tuesday, Feb 17, 15 @ 9:59 am

While we are fact checking, has anyone dug into the 6,500 employees opposed to fair share dues? Is that the total of fair share employees, or a subset? How did they express their objection?

Thus far, every major pronouncement from Rauner contains descriptive factoids. That’s to be expected. The problem is his numbers are cherry picked, or distortions. I hope he does better w the budget address. The situation is horrible enough. It would be nice to start w accurate numbers.

Comment by Langhorne Tuesday, Feb 17, 15 @ 10:01 am

==those frontline workers have indeed taken on extra duties without additional pay - unlike the top brass.==

And that is true of pretty near every merit comp employee at every other agency of the State, as well as a lot of unionized employees.

Comment by Anon. Tuesday, Feb 17, 15 @ 10:03 am

FMCS makes some sense. Does actually making full pension contributions the last few years account for the bump?

See what happens when you do the responsible thing? Makes you look bad, lol.

Comment by Wordslinger Tuesday, Feb 17, 15 @ 10:09 am

Rainer points the finger of blame at the unions but the overtime issue is a management issue. If the total costs are increasing at the rare cited by the governor the bulk of it falls on a few agencies with critical functions. The majority of state employees are not gobbling up overtime on a regular basis..

Comment by relocated Tuesday, Feb 17, 15 @ 10:13 am

I think the AFSCME current contract raises are something like 2% per year, except for one year when there was no raise.

Another thing that Rauner doesn’t mention is the increased costs of healthcare in the current contract. This is supposed to save hundreds of millions of dollars.

Comment by Grandson of Man Tuesday, Feb 17, 15 @ 10:16 am

Wait til we see the political adds BR runs to sway the public. These are test runs.

Comment by Tornadoman Tuesday, Feb 17, 15 @ 10:18 am

I love it when a billionaire tells me that I as a state worker making 50k a year is making too much money…

Comment by Shanks Tuesday, Feb 17, 15 @ 10:25 am

The AFSCME charts don’t really mean anything without knowing how many employees there were in each of those years. You can’t just look at state payroll and make any conclusions about salary increases unless the headcount is consistent from year to year, which it is not.

Comment by Demoralized Tuesday, Feb 17, 15 @ 10:32 am

Try to spin it and paint it anyway you want Governor, but facts are stubborn things.

Comment by Tough Guy Tuesday, Feb 17, 15 @ 10:33 am

It’s nice to see that AFSCME has finally responded to the Rauner false figures. As we’ve learned so well, facts are not this guy’s strong suit.

Comment by Norseman Tuesday, Feb 17, 15 @ 10:35 am

Somebody want to explain to me how what a worker makes is relevant to the Fair Share lawsuit?

Comment by Demoralized Tuesday, Feb 17, 15 @ 10:35 am

Trover: “Well, you see, if you add a squiggly line on the left side of the 3, then 30 becomes 80. See how that works?”

Comment by Anonymous Tuesday, Feb 17, 15 @ 10:41 am

Payroll is 6.7 percent of all state spending?

That can’t be right. Yesterday, the deep thinkers on the Tribbie edit board took an excruciatingly long walk around the barn and concluded:

–The truly bottom line here: Illinois politicians have committed so much spending to workers’ salaries and benefits that not enough taxpayer dollars remain to fund everything else.–

“The truly bottom line here.” That’s some fancy searchin’ anda peckin’ on the old keyboard here. Consider yourself lucky. You don’t see that kind of prose in newspapers that have copy editors.

Comment by Wordslinger Tuesday, Feb 17, 15 @ 10:41 am

Let’s just say for the sake of argument that unions have, in fact, NEGOTIATED for so called 80%. Who agreed to that? Negotiations are 2 sided, correct? And furthermore, if private wages have increased at such a slow rate, employees need to understand and realize that they are sacrificing raises so that the millionaires, and multimillionaires that run their companies are skimming those wage increases to better their packages. And I would think, if that made private workers unhappy, they’d so something about that.

Comment by AnonymousOne Tuesday, Feb 17, 15 @ 10:53 am

Word - if you assume that the average state worker earns $50,000 year and figure there are 65,000 state workers, then the salary alone totals $3.25 billion. Given how much overtime is paid out each fiscal year, $50,000 might actually be a low average. As noted in my earlier post, each state worker is required to have his or her own health insurance plan. State workers are also given the option to purchase fairly generous life insurance plan at a cost of pennies on the dollar. Both types of insurance are heavily subsidized by the state; the employees’ share of the cost is fairly minimal.

I think that is where Governor Rauner’s eventual rhetoric and stumping will land. The tagline will be how much the state spends on ALL personnel costs - not just salary. Salary is easy to compute. Covering over 85-90% of all health and life insurance costs and forcing all state employees to purchase “Cadillac” health insurance plans will be a better sticking point (I would assume) than a basic “state workers are overpaid” meme. And that will resonate with people. How many currently employed persons who work for a private company or own their own business pay only $100 a month towards a health insurance plan that costs $20,000 a year? How many people can by 4x (or more) salary-based life insurance from their employer for less than $10 a month?

AFSCME is betting that people will look only at salary structure and not fringe benefits.

Comment by Team Sleep Tuesday, Feb 17, 15 @ 10:54 am

Rauner does not seem very concerned about the salaries of his staff — everyone needs to sacrifice, except for his folks. snark.

Comment by facts are stubborn things Tuesday, Feb 17, 15 @ 10:59 am

“Let’s just say for the sake of argument that unions have, in fact, NEGOTIATED for so called 80%. Who agreed to that? Negotiations are 2 sided, correct?”

The Governor’s “corrupt bargain” language negates your point. He is portraying it as government union bosses and the ‘other side’ are working in tandem.

Comment by Shark Sandwich Tuesday, Feb 17, 15 @ 11:03 am

I think Erickson is wrong…33% is only reflecting COLA’s and does not include step increases. Some of those step increases can be big (like 6 - 7%) on top of the COLA. When Blago agreed to two separate COLA’s in the same fiscal year, some employees we’re seeing 10% annual increases, when factoring in both COLA and steps.

Comment by Fred Garving Tuesday, Feb 17, 15 @ 11:13 am

I’m thinking the truth is in between the two sides. If I look at the IPI’s own report:

https://www.illinoispolicy.org/reports/contract-with-top-union-yields-big-payouts-for-state-workers-2/

The numbers from 2006-2013. The Illinois Head Count decreased 11%. The wages paid increased 18%. So, the average wage per employee increased about 4.8% per year. Not the 8% Rauner claims, and not the 3% AFSCME claims - although AFSCME is closer….

I think Rich is correct - Step increases were not included in the AFSCME numbers(not all staff get step increases - depends where they are on the scale). On an individual increase - if the person were at the bottom of the scale, received all the COLA increases AND received a Step increase each year - I wonder if that would come to his 80% figure?

Note that Rauner is claiming “wage increases” were 80% over the ten year period - not total compensation (such as pensions and other benefits). Wages are defined as hourly rate of pay or annual salary as appropriate and by accounting and business definition do not include benefits.

Comment by archimedes Tuesday, Feb 17, 15 @ 11:16 am

I went from contributing 0% tward my pension to 8.5%

Comment by foster brooks Tuesday, Feb 17, 15 @ 11:22 am

Here we are again talking about less than 7% of the state budget. Why can’t Rauner get off of this and focus on the larger portions of the budget that will actually mean something instead of playing tiddlywinks with state employee salaries and fair share payments. Start governing governor, that is what you were elected to do.

Comment by I Don't Get It Tuesday, Feb 17, 15 @ 11:35 am

Ouch

All these numbers are givin’ us a headache

Let’s stick to broad, make believe, bumper stickers

Comment by Anonin' Tuesday, Feb 17, 15 @ 11:38 am

==why can’t Rauner get off of this (7% of state budget) and focus on the larger portions…….==

OCD?

Comment by AnonymousOne Tuesday, Feb 17, 15 @ 11:52 am

All posturing. Each group can cherry pick whatever stat they need to support their position and ignore all the other stuff.

Comment by Anonymous Tuesday, Feb 17, 15 @ 12:05 pm

It’s also important to note that union employees at the ISBE have been attempting to negotiate a contract with management for the past 18 months. Many of the same managers who took hefty bonuses for themselves, have sat on the other side of the bargaining table trying to convince the rank and file that there is no money in the budget for raises.

This is also not the first time that Don Evans has been publicly called out regarding his salary and benefits. This story from a few years back, brought to light excessive reimbursements he received for travel back and forth from his home in Chicago:

https://www.illinoispolicy.org/isbe-road-trips-cost-taxpayers-millions/

Maybe it’s time Rauner jettisoned some baggage left on the platform from Blagojevich and Quinn.

Comment by Here we go again... Tuesday, Feb 17, 15 @ 12:08 pm

=== All posturing. Each group can cherry pick whatever stat they need to support their position and ignore all the other stuff. ===

That’s why we have fine journalists like Rich to fact check these Cherries.

Comment by Norseman Tuesday, Feb 17, 15 @ 12:20 pm

Step increases only work about the first 10 years of your state employment and then you are topped out. (I topped out in 8.5 years because of superior performance increases, which are no longer given out). AFSCME has only had a 4% salary increase the last 3 years (2012 - 0%, 2013 - 2%, 2014 -2%).

Comment by Rusty618 Tuesday, Feb 17, 15 @ 12:51 pm

The trio; Susie Morrison, Nicole Bazer and donald evan’s bonuses had to be approved by the Superintendent Christopher Koch who makes $223,000 in salary a year not including his perks {yearly bonus, a new car to drive for work every two years, gets to work from home as he pleases}. So much unnecessary spending is going on at this agency. The Board of Education just asked for $$$$$ hundrends of millions of dollars because they can’t make budget and they allocate bonuses because the 3 did extra work? I believe its time to clean house at The Board of Education and stop being so top heavy.

Comment by Fed-up Tuesday, Feb 17, 15 @ 1:02 pm

== How many people can by 4x (or more) salary-based life insurance from their employer for less than $10 a month? ==

Admittedly I’ve been retired for a while but at one point when I was working the State life insurance carrier was MetLife. I checked on the rates for buying the 4X versus my own individual policy from MetLife. Being in good health and able to pass the physical required, I actually purchased much more level payment term life coverage than the state offered for less money than through the state sponsored plan. I still have that preferred individual policy today.

So while I don’t know about today, back when I was employed, the State was NOT necessarily subsidizing the term life.

Comment by RNUG Tuesday, Feb 17, 15 @ 1:09 pm

I have been on step 8 for the last 3 years, I just got my longevity increase of $100.00 gross monthly, before taxes. So any raises I have gotten in the last 3 years were because of the union, no step increases for me and if it wasn’t for the union, no increase at all. And yes there are others out there just like me, no increases except for what the union got for me for all my hard work, and I have been a dedicated employee for 40 years.

Comment by Challengerrt Tuesday, Feb 17, 15 @ 1:17 pm

AFSCME is playing defense with Rauner on this. What they need to do is start telling Illinoisans how they are more than just a wage expense to taxpayers.

It is time for AFSCME to resell what it is unions do besides what they are being criticized by Rauner for doing.

Comment by VanillaMan Tuesday, Feb 17, 15 @ 1:19 pm

A union salary reality check of my own revealed that my pay is about $5k more than median for someone with 6 years of experience. I have 15.

Comment by Politix Tuesday, Feb 17, 15 @ 1:32 pm

Term life from the state is cheaper until you hit your 40’s or so then make a call to Selectquote etc.

My spouse got a 10% raise last year in the private sector. I got 2% I believe.

My two children are on my wife’s insurance, Blue Cross of Illinois because it is cheaper and much better than my state insurance. I tried to get off the state insurance but I don’t have the option of not participating.

At my agency I pay 12.5% toward retirement. I’m pretty sure that is higher than most agencies and my Union negotiated an increase in contribution several years ago.

Comment by Freeze up Tuesday, Feb 17, 15 @ 1:39 pm

Rauner’s numbers work in fantasyland.

Comment by Precinct Captain Tuesday, Feb 17, 15 @ 2:12 pm

=I tried to get off the state insurance but I don’t have the option of not participating.=

There is the option to opt out of state health insurance. The employee must fill out an Opt Out Election Certificate and furnish proof of enrollment in another benefit plan. However, if a husband and wife are both state employees, then they both must have separate policies, which makes no sense.

Comment by tired Tuesday, Feb 17, 15 @ 2:23 pm

RNUG -

I compared what I am paying per paycheck with what it would cost for me to get life insurance through my agent, a friend who works for an agent and an aunt who works for an agent. All three emphatically told me that if I were to request $200,000 for term life through their companies - even with being in good health - that it would cost much more per month (and obviously not be tax-exempt since it is being withheld from my direct deposit). I am but one example, but from I was told by a staffer at CMS most employees pick the 4x option (to save the physical) or go all out for 5x-8x and risk the physical because the benefits are too good to pass up.

Some people think that all sounds silly and ticky-tack. However - as with anything else - those numbers add up very quickly if tens of thousands of state employees take advantage of such services and prices.

Comment by Team Sleep Tuesday, Feb 17, 15 @ 2:26 pm

== I was told by a staffer at CMS most employees pick the 4x option (to save the physical) or go all out for 5x-8x and risk the physical because the benefits are too good to pass up.==

Look at the CMS website.

http://www2.illinois.gov/cms/Employees/benefits/StateEmployee/Pages/Employee-Life.aspx

The State provides Basic Life Coverage for an amount equal to annual basic salary at no cost to eligible employees. All premiums for Optional Life insurance coverage are at the employee’s expense.

Comment by Bigtwich Tuesday, Feb 17, 15 @ 2:42 pm

Big - employees are still receiving a form of subsidized insurance if they choose the optional coverage. If you earn $100,000 and choose 4x coverage, then the state is still paying for the first portion of the coverage. I know of very few state employees who just go with basic coverage.

Comment by Team Sleep Tuesday, Feb 17, 15 @ 2:55 pm

Erickson is looking at yearly raises but he is not looking at step increases, which are given on an employee’s anniversary date. In effect, the average union employee gets two raises, a step increase (roughly 4%) and a COLA adjustment (3%) at the beginning of the new fiscal year. When you factor in steps, Rauner’s numbers should be pretty close to accurate.

Also, the payroll chart is misleading. Pension obligations and insurance also needs to be considered.

Comment by Anon Tuesday, Feb 17, 15 @ 2:56 pm

Team,

The State pays for the Basic Life Coverage for an amount equal to annual basic salary. This is not an unusual benefit in the private sector. That has nothing to do with the optional coverage which is entirely paid for by the employee. Your argument that the optional coverage was too good to pass up and cost the State a lot of money is not supported by facts.

Comment by Bigtwich Tuesday, Feb 17, 15 @ 3:33 pm

I think these governors need to save money and quit paying all these legal fees to go to court over the law! Quinn, L. Madigan and now Rauner all want to fight in court. At the expense of the taxpayer.

Comment by Mitch59 Tuesday, Feb 17, 15 @ 3:37 pm

@Anon - Tuesday, Feb 17, 15 @ 2:56 pm

==the average union employee gets two raises, a step increase (roughly 4%) and a COLA adjustment (3%) at the beginning of the new fiscal year==

You are not very well informed, because as I said previously step increases stop after about 10 years of employment, and there is no COLA adjustment, just a negotiated increase, that have averaged 1.34% the last 3 years.

Comment by Rusty618 Tuesday, Feb 17, 15 @ 3:49 pm

==How many people can by 4x (or more) salary-based life insurance from their employer for less than $10 a month? =

A lot depends on one’s age and salary.

from the current Illinois state employees benefit choice booklet.

age and rate per $1000 of coverage:

Under 30 $0.06

Ages 30 - 34 0.08

Ages 35 - 44 0.10

Ages 45 - 49 0.16

Ages 50 - 54 0.24

Ages 55 - 59 0.44

Ages 60 - 64 0.66

Ages 65 - 69 1.28

Ages 70 and above 2.06

So a 60 year old making $60,000 per year would pay around $158 per month for $240,000 of converage. And that would double when they turned 65.

But yes, someone with a lower salary and who is very young, could only be paying $10 per month.

Comment by Joe M Tuesday, Feb 17, 15 @ 4:07 pm

As for step increases, I believe many employees in the private sector get promotions after putting in some time on the job and are not locked forever into entry level plus COLA. As many have pointed out, steps come early in your tenure and reflect the greater productivity of the experienced employee, just as pay raises and promotions do in the private sector.

Comment by anon Tuesday, Feb 17, 15 @ 4:39 pm

Why aren’t we asking the administration to provide the data sources and calculations to support the 80%. Hasn’t the administration assured us that they are committed to transparency?

Ideally they would provide the costs per employee for salary, overtime, healthcare, pensions, and other benefits. Pensions and healthcare have been increasing much faster than inflation. Much of the increase in pension costs, however, is related to the underfunding of employees already retired,

Comment by PublicMath Tuesday, Feb 17, 15 @ 5:48 pm

==much of the increase in pension costs, however, is related to the underfunding of employees already retired==

What? Underfunding’s cause is due to the legislature skipping payments to pension funds and spending the money anywhere BUT the pension funds. It has nothing to do with workers, then or now. Workers never skipped a payment……..had no way to do so, if they had wanted to. Underfunding is in no way related to worker contributions.

Comment by AnonymousOne Tuesday, Feb 17, 15 @ 6:49 pm

I think (hope) Public Math meant that much of the increase is the debt the State racked up by not paying their share - and many of the employees are now retired so there is nothing that can be done about this cost. I didn’t read into it any accusation that workers skipped on payments.

Comment by archimedes Tuesday, Feb 17, 15 @ 7:48 pm

Afscme step increase is 4.5 a year, plus the 2-3 percent cola. Afscme is deceptively only mentioning the cola, not the step. So workers pay with step increases went up am average of 7% a year. Thats compounded. So over 8 uears they went up 56% percent without taking into account the compundong natire of the increases.

Comment by Ghost Tuesday, Feb 17, 15 @ 8:34 pm

I think it is important that we not bulk all state employees and all unions together. There are some state employees that have received 1 step in the last 6 years and zero colas in that same 6 year period. management, who are nonunion and negotiate the contracts with union staff have continued to receive raises and bonuses while continuing to tell staff there is no funding for raises or colas. Although some unions and some state employees have received raises and/or colas that is not true for all.

Comment by Anonymous Tuesday, Feb 17, 15 @ 8:56 pm

==management, who are nonunion and negotiate the contracts with union staff have continued to receive raises and bonuses while continuing to tell staff there is no funding for raises or colas.==

Which management are you talking about? The vast majority of merit comp have gotten a lot less than the unionized employees over the years.

Comment by Anon. Tuesday, Feb 17, 15 @ 9:54 pm

=== The vast majority of merit comp have gotten a lot less than the unionized employees over the years. ===

Try no increases in the last 8 years, not to mention the furloughs that actually decreased MC earnings. Any MC who could have retired by the end of the year should have done so because the annuity just went down as a result of the furloughs.

Comment by Norseman Tuesday, Feb 17, 15 @ 9:58 pm

In comparing state payroll over time, do not ignore the costs of jobs left vacant filled by temps or other outsourcing such as consultants, generally at a higher cost, but paid for out of a non-payroll pocket. Need a measure other than “payroll” to realistically monitor true labor costs.

Comment by Mister M Tuesday, Feb 17, 15 @ 10:19 pm

80 percent cannot be right. I recently checked ITAP and added together all the reported salaries and the increase from 2008 to 2014 was exactly 18 percent.

Comment by lost in the weeds Tuesday, Feb 17, 15 @ 11:27 pm

18 percent increase was rounded up from 17.74 percent. Spreadsheets can make a fool of the operator.

Comment by lost in the weeds Tuesday, Feb 17, 15 @ 11:35 pm

Anon - this is exactly why I say we can’t bulk all state employees and all unions together - each have been very different over the past few years. in the specific instance I am referring to you can see the above article about the agency in which members of management recently received large bonuses. I am in no way saying every agency and/or union is the same- they are all different and need to be looked at individually.

Comment by Anonymous Wednesday, Feb 18, 15 @ 8:34 am