Latest Post | Last 10 Posts | Archives

Previous Post: It’s time to change the state’s forfeiture laws

Next Post: Some House Democrats are facing a real dilemma

Posted in:

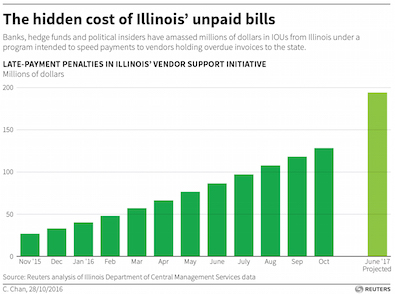

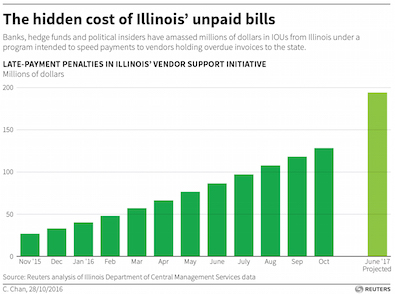

* Unpaid state vendors can get 90 percent of what they’re owed up front by using a state program that allows them to borrow cash from private sector interests. They get the rest when the state pays up and the lender keeps the late fees. Those fees are really piling up, according to Reuters’ Dave McKinney and Karen Pierog…

Illinois owes a handful of financial consortia more than $118 million under an obscure program intended to speed up overdue payments to the cash-strapped state’s vendors, an analysis of state records shows. […]

But it comes at a heavy cost with unlimited late-payment fees now approaching 20 percent in some cases for Illinois’ cash-strapped government, whose general obligation (GO) low-investment grade credit ratings are the lowest among U.S. states. […]

Fees on unpaid bills in the program have been growing by more than $2.6 million per week and could exceed $194 million by June 30, according to a Reuters analysis of state data as of Sept. 28. […]

By the end of Rauner’s term in January 2019, total interest on unpaid receivables in the program could exceed $351 million if there is no progress in reducing the bill backlog, Reuters calculations show. […]

As of late September, four participating VSI lenders had bought 15,369 unpaid receivables worth $1.12 billion under the program. Late-payment penalties on those billings surpassed $118 million and continue to grow, Reuters has found.

Illinois law places no limit on how long the late fees can accrue and since 2010 the state has spent about $929 million in late-payment penalties, according to state comptroller data.

* A handy, and striking, visual aid…

posted by Rich Miller

Wednesday, Nov 23, 16 @ 9:55 am

Sorry, comments are closed at this time.

Previous Post: It’s time to change the state’s forfeiture laws

Next Post: Some House Democrats are facing a real dilemma

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Pay me now or pay me later, you still have to pay.

For the companies buying up the debt, this is a close to a sure thing as you can get in easy profit.

Comment by RNUG Wednesday, Nov 23, 16 @ 10:03 am

This program finally caught the attention of someone in the media. Perhaps one of our higher-up government officials can find a way for that interest to be paid into the pension funds instead of just seeing it stream out the window.

Comment by Winnin' Wednesday, Nov 23, 16 @ 10:07 am

So instead of paying 1-2% by borrowing money from the Feds, they end up paying 12-20% to these VSI vulture lenders. Real Smart

Comment by Rufus Wednesday, Nov 23, 16 @ 10:08 am

Major kudos to McKinney and Pierog. I’ve passed this piece on to 4 people already.

It’s critically important to the fiscal understanding here in Illinois that this “time bomb” is discussed beyond abstract theory and, again, McKinney, working with Pierog this time, tells the realities of what Illinois is facing in the “real”.

The partisan points that both side try to push can’t ignore realities like this when the dollars and dates don’t worry about posturing, but require action by a state not prepared for this next fiscal pitfall.

Great work.

Comment by Oswego Willy Wednesday, Nov 23, 16 @ 10:09 am

Notably, Governor Pension Ramp appears to be profiting quite nicely from this wasteful government program. Perhaps he could donate his profits to help levelize the pension ramp.

Comment by Winnin' Wednesday, Nov 23, 16 @ 10:09 am

glad we have a businessman to shake up Springfield. Looking forward to the interest on my 15 month old dental bill. I heard of a local dentist getting a $900,00 check and a $100,000 interest check !

Comment by Anothereetiree Wednesday, Nov 23, 16 @ 10:10 am

Wouldn’t be surprised if it turns out Rauner has a stake in the companies buying up the debt.

Comment by Anon Wednesday, Nov 23, 16 @ 10:12 am

This is how you have an approximately 300% pay increase while being the governor and taking a $1 annual salary for it.

Comment by Fixer Wednesday, Nov 23, 16 @ 10:15 am

Rauner owns this mess. He asked for the legislature to not extend the higher tax rate. He then signed bills increasing the K12 education while holding the rest of the budget hostage to his TA. He knows what he has to do. Nearly two years in and what can he list as accomplishments?

Comment by Thoughts Matter Wednesday, Nov 23, 16 @ 10:16 am

Anon, I believe you’re correct. They need to report who’s buying all the debt and who they’re affiliated with. You don’t become a millionaire by making poor investments. Every dime Rainer put into these elections has been an investment.

Comment by Tired of it Wednesday, Nov 23, 16 @ 10:16 am

- Winnin’ -

I was looking for a way to express that same thought.

I like yours better!

Comment by WhoKnew Wednesday, Nov 23, 16 @ 10:18 am

This financial bomb wasn’t started by Rauner, but he’s been pouring the powder into it throughout his term.

When this thing blows up will we repeat Rauner’s praise to his staff for keeping the state running without a budget?

Comment by Norseman Wednesday, Nov 23, 16 @ 10:25 am

If I recall the Madison genuflectors correctly, $2.4 million a week is a small price to pay for not giving into terrorists.

Comment by lake county democrat Wednesday, Nov 23, 16 @ 10:32 am

Many thanks, WhoKnew.

Comment by Winnin' Wednesday, Nov 23, 16 @ 10:33 am

(Horrified that I just promoted Madigan to Madison-like stature, even though he’s kinda my least favorite founding father…)

Comment by lake county democrat Wednesday, Nov 23, 16 @ 10:33 am

If I were a newly elected Comptroller I would be planning a nice press release for the day that Illinois’ late penalty payments cross that $1 billion line!

Comment by Out Here In The Middle Wednesday, Nov 23, 16 @ 10:33 am

This program was designed as a stopgap to fix temporary cash shortfalls. It has turned into a permanent borrowing at 12% per year.

Have any of the providers with contracts based on money that was not appropriated used this? That could get very interesting.

Comment by Last Bull Moose Wednesday, Nov 23, 16 @ 10:34 am

Time to cut up Bruce Rauner’s credit card and pass legislation ending this program, GA Dems.

Comment by hisgirlfriday Wednesday, Nov 23, 16 @ 10:37 am

Government profiteers who decry government spending are the lowest forms of life out there:

“Vendor Assistance Program February 2014 disclosure, its latest available, identifies six funding sources [including] Manchester Securities, which is owned by billionaire hedge fund manager Paul Singer and had a 4 percent stake. State records show Singer donated $250,000 to Rauner in September 2014, two months before Rauner’s election…”

2 super rich guys getting richer while the poor suffer. This induces nausea.

Comment by Handle Bar Mustache Wednesday, Nov 23, 16 @ 10:37 am

“Wouldn’t be surprised if it turns out Rauner has a stake in the companies buying up the debt.”

Read closely he got a pile of cash from one of the big donors — some like to it call pay to play — we will never know what the “blind trust” owns.

Comment by Annonin' Wednesday, Nov 23, 16 @ 10:38 am

Why not have the pension funds do the financing? The ROI would be much better than what they are receiving and projecting now.

Comment by MikeMacD Wednesday, Nov 23, 16 @ 10:41 am

No worries. Once the Turnarund Agenda is passed, that projected extra $500 million in revenue will pay off the real increase in the backlog of bills during Rauner’s tenure in about 25 years or so.

Comment by wordslinger Wednesday, Nov 23, 16 @ 10:42 am

$200M per year is about half of Rauner’s anticipated savings from his Draconian increases in employee health care contributions. How about balancing the budget, paying off the backlogged bills, and halving the serious impacts to employees? Not while someone is making money on the debt financing, of course \s

Comment by Simple Simon Wednesday, Nov 23, 16 @ 10:43 am

=== MikeMacD - Wednesday, Nov 23, 16 @ 10:41 am:

Why not have the pension funds do the financing? The ROI would be much better than what they are receiving and projecting now.====

Isn’t that what we were doing the 40 years prior to get to where we are today?

Comment by Shemp Wednesday, Nov 23, 16 @ 10:50 am

I wondered when they passed the prompt payment act the impact on taxpayers but never imagined it would get this bad. Makes you wonder if some of the VSI vendors were involved from the start.

Comment by Patty T Wednesday, Nov 23, 16 @ 10:53 am

One could classify this as waste.

What’s our Republican Governor have to say about this waste on his watch? Remember, it’s Republicans who are always decrying the waste in government.

Comment by Sir Reel Wednesday, Nov 23, 16 @ 10:55 am

Waiting for the Trib to run this story and their edit board to comment on it.

Comment by Anonymous Wednesday, Nov 23, 16 @ 10:56 am

The point about Rauner’s blind trust brings up the question of whether there is a deficiency in the state’s conflict of interest disclosure requirements.

Comment by Winnin' Wednesday, Nov 23, 16 @ 10:59 am

Keep following the money…I’ve suspected for a long time that Rauner is involved - behind the curtain - and manipulating the process for his venture vulture pals. Nothing like brown envelopes ending up on your desk unseen to the lower classes (the rest of us), but in the end it may just be another house of cards and a ticket to BlagoRyanville crossbar motel.

Comment by Captain Illini Wednesday, Nov 23, 16 @ 11:19 am

=that projected extra $500 million in revenue will pay off the real increase in the backlog of bills during Rauner’s tenure in about 25 years or so.=

Well, it might not really be $500 million if the Raunerites get rid of the estate tax which is a loss of $300 million.

For numbers guys, Raunerites kind of suck at math.

Comment by JS Mill Wednesday, Nov 23, 16 @ 11:22 am

How dare any of you think Rauner has something to gain from this. He wears flannel and goes to the fair!!!

Comment by Rogue Roni Wednesday, Nov 23, 16 @ 11:45 am

-MikeMacD- makes a good point. Reuters calculated the average rate on the payments at 8.14 % which is higher than the pension managers’ 7.5% assumed rate of return.

Comment by CapnCrunch Wednesday, Nov 23, 16 @ 11:50 am

$350M in extra, completely unnecessary annual costs!

Holding hostages can be expensive!

Comment by walker Wednesday, Nov 23, 16 @ 12:18 pm

Folks, Rauner ain’t in this for the money. Doesnt make sense to drop tens of millions for the opportunity to commit felonies to chase relative chump change.

He could convert his fortune to T-bonds and still live like a Russian czar on the juice.

He’s in it for the power, the title and the public ego-stroke that comes with them.

For years, he was the faceless billionaire that funded the guys who got on TV, had bodyguards, the motorcade and had power to make things happen, for good or ill.

Now, he’s that guy, and he still has plenty of money.

Comment by wordslinger Wednesday, Nov 23, 16 @ 12:21 pm

Yesterday you asked if the Democrats had a plan, they could start here.

Comment by Anonymous Wednesday, Nov 23, 16 @ 12:37 pm

Show of hands who picks this up first Tribbies —kassamoron, Katrina, etc.— or America’s only zero depth think tank and Austin Berg or Edgar County Wwatchdogs?

Tick tock

Comment by Annonin' Wednesday, Nov 23, 16 @ 12:41 pm

Call me naïve, but wouldn’t it be a good idea to CHANGE the law(s) that allow this, say starting at least Jan 2018? Use an interest rate tied to the Fed or SOMETHING else. 12% is beyond ridiculous and very outdated. Rauner’s all for savings to the State. Well, here’s a place to start. Reform This!

Comment by Anon221 Wednesday, Nov 23, 16 @ 1:50 pm