Latest Post | Last 10 Posts | Archives

Previous Post: *** UPDATED x1 *** OK, now I’ve (kinda) seen everything

Next Post: Former township assessor busted after stealing to feed her OxyContin addiction

Posted in:

* Yesterday, Gov. Rauner was near the Indiana border talking about people and businesses fleeing for the Hoosier State. He made some good points…

“We have the highest property taxes in America. We are literally two minutes from the Indiana border, and property taxes over in Indiana are between a half and a third on average of the property taxes for the same type of property here in the state of Illinois. That makes it unaffordable to compete here. That forces [businesses] to have higher prices to cover the high property taxes here. Customers can go across the border and have cheaper costs in large part because the property taxes are cheaper.”

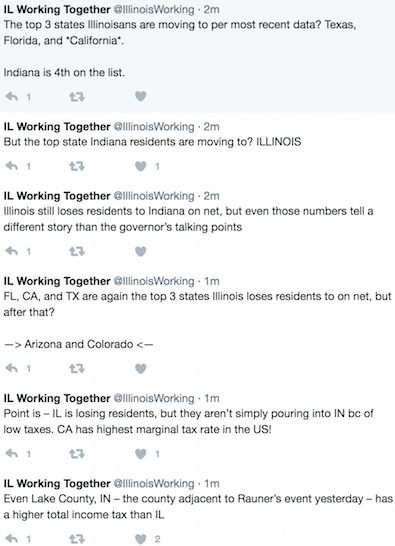

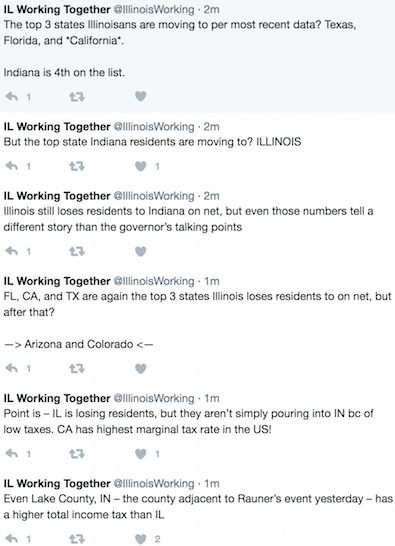

* But the folks at Illinois Working Together took a look at some Census numbers (click here for the raw data) and tweeted out a storm…

posted by Rich Miller

Wednesday, Jun 7, 17 @ 12:30 pm

Sorry, comments are closed at this time.

Previous Post: *** UPDATED x1 *** OK, now I’ve (kinda) seen everything

Next Post: Former township assessor busted after stealing to feed her OxyContin addiction

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

And how high are the income tax rates in Texas and Florida?

Oh, that’s right….zero

Comment by Doug Wednesday, Jun 7, 17 @ 12:32 pm

Lol. Great effort by the organized (heh) labor to re-direct/re-fashion the discussion. Except even having this “argument” about Indiana is a loser for them & Democrats … and Illinoisans in general.

It’s all too embarrassing. All of it.

Comment by Deft Wing Wednesday, Jun 7, 17 @ 12:37 pm

When the higher income and other taxes are approved, to pay for all the debt we have acquired, watch business and tax payers leaves in much higher numbers.

Comment by Anonymous Wednesday, Jun 7, 17 @ 12:39 pm

Rauner can say whatever he wants, which he does, because this blog and Illinois Working Together are about the only outlets calling him out.

Comment by CCP Hostage Wednesday, Jun 7, 17 @ 12:42 pm

Rauner doesn’t pay any attention to the facts, he just keep repeatin’ the talkin’ points until it becomes real in the minds of the voters.

Comment by Chicago 20 Wednesday, Jun 7, 17 @ 12:43 pm

Illinois Working Together has consistently been the best messaging the Democrats have had.

Comment by The Captain Wednesday, Jun 7, 17 @ 12:46 pm

Retiring baby boomers making like snowbirds, black residents fleeing the shooting galleries and lack of affordable housing, years of net migration back to Mexico.

What’s the mystery?

Visit Site Selection magazine website, and you’ll see that Illinois is consistently top five in the country for new and expanded business locations. Indiana ain’t in the ballpark.

That’s why it’s population and GDP are so small compared to Illinois, despite sharing the same geography.

Comment by wordslinger Wednesday, Jun 7, 17 @ 12:48 pm

= And how high are the income tax rates in Texas and Florida?

Oh, that’s right….zero =

Hey Doug —

See if you can figure out how to get 105 MILLION tourists to visit Illinois each year — as they do Florida — and we can recalibrate the Illinois income tax to match the Sunshine State’s.

Don’t compare Florida oranges to Cobden peaches.

Comment by Wallinger Dickus Wednesday, Jun 7, 17 @ 12:52 pm

DW, facts embarrass you?

Anything else?

Comment by wordslinger Wednesday, Jun 7, 17 @ 12:56 pm

And Doug - Try the local and sales tax rates in Florida. Their sales tax rate is higher than almost 60% of other states. And they pay property taxes, too. You need money for services from somewhere.

Comment by Archiesmom Wednesday, Jun 7, 17 @ 1:04 pm

Great article from Homewood Flossmoor native Ben Bradley about the population loss to neighboring states that have the exact same weather as we do but a better business environment.

http://wgntv.com/2017/06/06/the-border-war-how-illinois-is-losing-out-to-surrounding-states/

Comment by Lucky Pierre Wednesday, Jun 7, 17 @ 1:09 pm

Archiesmom. Sales tax in Citrus County Florida is only 6%. Property tax is way cheaper then Illinois!

Comment by Anonymous Wednesday, Jun 7, 17 @ 1:18 pm

People have figured out they can have the best of both worlds. Live way more cheaply in Indiana and still commute to Chicago area for work.

See Harrelson:Hawk

Comment by Responsa Wednesday, Jun 7, 17 @ 1:30 pm

Do we need to have a conversation about the difference between correlation and causation?

Comment by Montrose Wednesday, Jun 7, 17 @ 1:41 pm

For the record, it was the high property taxes that made us relocate to another State. Even now, when I tell my local friends about the taxes we were paying to the schools, they cannot believe it. The income tax was not a factor for us.

Comment by No Raise Wednesday, Jun 7, 17 @ 1:42 pm

The news broadcast on WGN - Channel 9 highlighted the same story last night. Huge savings in taxes and cost of living advantages across the Indiana border.

For businesses, the rate of taxation was $2.00 per square foot in IL and $0.43 in IN.

Loads of empty business storefronts in Hegewisch.

Comment by Hobson's Choice Wednesday, Jun 7, 17 @ 1:51 pm

LP, I guess you didn’t make it all the way through that heavy lift you posted.

– In February the state (Illinois) posted the highest number of jobs in its history.–

Was that the point you wanted to make?

Seriously, Hoist Lift, again? You Raunerbots have been flogging that corporate welfare grifter for two years now (see Crains 8-12-15). Get some new material.

Hoist is only in business because Lipinski muscled them the welfare of a contract the Pentagon didnt want to give them. Later, they landed another corporate welfare deal in Indiana.

Make an effort, dude.

Comment by wordslinger Wednesday, Jun 7, 17 @ 1:54 pm

==And Doug - Try the local and sales tax rates in Florida. Their sales tax rate is higher than almost 60% of other states. And they pay property taxes, too. You need money for services from somewhere. ==

Sales Tax in Miami 7%

Sales Tax in Dallas 8.25%

Sales Tax in Chicago 10.25%

Yeah, tell me again why people are fleeing?

Comment by Doug Wednesday, Jun 7, 17 @ 2:01 pm

Just a simple thought before going deep into the numbers: if people are fleeing a state because it’s government is failing, then the man who has been governor of that state for 2.5 years is failing too.

Comment by Roman Wednesday, Jun 7, 17 @ 2:03 pm

Since the Republicans have not controlled property tax assessments in Cook County since Louis Emmerson was governor, does that mean that the Democrats “own” the scandals in the Assessor’s office?

Comment by Uh oh Wednesday, Jun 7, 17 @ 2:05 pm

=Indiana is 4th on the list.=

=FL, CA, and TX are again the top 3 states IL loses residents to on net, but after that Arizona and Colorado=

Anyone else confused by these 2 tweets? Aren’t they contradicting themselves?

Comment by Robert the 1st Wednesday, Jun 7, 17 @ 2:14 pm

We wouldn’t have such high property taxes is the State did its constitutionally mandated job of providing 51% of our education costs. Half of my property tax bill goes to my school districts. We need a progressive income tax swap in exchange for a property tax reduction, along with legalization of marijuana. Throw in some workers comp reform, term limits for leaders, education reform, and expanded gaming and you got yourself a budget deal.

Comment by Ratso Rizzo Wednesday, Jun 7, 17 @ 2:15 pm

Hey Doug —

==See if you can figure out how to get 105 MILLION tourists to visit Illinois each year — as they do Florida — and we can recalibrate the Illinois income tax to match the Sunshine State’s.

Don’t compare Florida oranges to Cobden peaches. ==

Here is where you are wrong. Re-calibrate the spending that Illinois does, and maybe your tax rate could be lower. As long as it it high, Illinois will bleed taxpayers to lower tax states.

Comment by Doug Wednesday, Jun 7, 17 @ 2:19 pm

Doesn’t change the fact the lack of a budget drove my fiance from her non-profit. We have lived in Wisconsin since September.

Comment by Millennium Wednesday, Jun 7, 17 @ 2:25 pm

=Indiana is 4th on the list.=

=FL, CA, and TX are again the top 3 states IL loses residents to on net, but after that Arizona and Colorado=

Anyone else confused by these 2 tweets? Aren’t they contradicting themselves?

Indiana is fourth on the list gross, but not net because a lot more Hoosiers move to Illinois than Coloradoans do–although come to think of it, I have a lot of friends who moved her from Colorado

Comment by Carhartt Representative Wednesday, Jun 7, 17 @ 2:34 pm

I wish it weren’t so but there does appear to be a clear association between higher state + local tax burdens and population growth. Cross-sectionally across the 50 states, the correlation between percent change in population (2016 vs. 2010, Census Bureau estimates) and percentage tax burden (using either Wallet Hub’s 2017 estimates or the Tax Foundation’s for 2012) is about -0.4, implying that states with higher tax burdens had lower population growth. Similarly, if you regress population growth on tax burden by itself, or on both tax burden and household income, either way the coefficient on tax burden is sharply negative and highly statistically significant.

However, the more important question is this: how much does population growth matter? By itself, rapid population growth does not make for better living conditions - would you rather live in Germany (where, as in Illinois, the population is shrinking) or in India (where population is growing rapidly)? Obviously, at the margin, a shrinking population might have a negative impact on the state government’s ability to pay back its accumulated debt, but this impact is really small. The total decline in Illinois’ population between 2010 and 2016 was tiny (-0.31%). Even if, in response to the state doubling the income tax, 10% of the population were to move out of state (highly unlikely), income tax collections would still increase 80% and the amount the state would have to spend on current services would presumably fall 10% as the latter is tied to population. The bottom line is that a shrinking population is not a legitimate excuse for failure to pay contractual obligations.

Comment by Andy S. Wednesday, Jun 7, 17 @ 2:35 pm

WGN TV will be surprised to learn they are Raunerbots

If only the CEO of Hoist Lift Truck had read your beloved Site Selection Magazine , I am sure he would have been happy to pay $2 a square foot in property taxes after paying a property tax lawyer than 43 cents a square foot in Indiana.

After reading your super smart publication, I am sure he would not have minded paying 3 million dollars more in workers comp insurance.

He probably would have gladly paid the proposed privilege of doing business in Illinois tax.

Of course there is linkage between high property taxes and workers comp and companies relocating.

None of your condescension can change that unfortuantley.

That’s one of the reasons Illinois lost more than 37,000 residents last year, a greater population loss than any other state.

Those new jobs you speak of certainly weren’t high paying manufacturing jobs.

If we had a healthy job market in Illinois the 15 dollar and hour minion wage would occur naturally without a government mandate.

Comment by Lucky Pierre Wednesday, Jun 7, 17 @ 2:36 pm

Thanks Carhartt. That makes sense.

Comment by Robert the 1st Wednesday, Jun 7, 17 @ 2:36 pm

LOL, LP, you’re not informative or thoughtful, but you’re occasionally entertaining.

Comment by wordslinger Wednesday, Jun 7, 17 @ 2:40 pm

LP, the Raunerbots were blaming almost all our problems 2.5 years ago on the lack of “right to work.” Then it was workers’ comp. Now it’s property taxes.

I happen to agree with a freeze, but stop spinning that freezing taxes for a few years will create some sort of nirvana.

Comment by Rich Miller Wednesday, Jun 7, 17 @ 2:41 pm

==Even if, in response to the state doubling the income tax, 10% of the population were to move out of state (highly unlikely), income tax collections would still increase 80% and the amount the state would have to spend on current services would presumably fall 10% as the latter is tied to population. The bottom line is that a shrinking population is not a legitimate excuse for failure to pay contractual obligations. ==

That only works if the people leaving are equal across the board in income. What you are failing to see is that high income earners are leaving high tax states at a greater amount than their poorer counterparts.

What you are left with is an ever increasing burden on fewer people that make less money. More corporations move their headquarters to low tax Texas and Florida, moving with it their highest paid corporate employees.

If you want an example of that very thing happening, just look no further than Connecticut

https://www.wsj.com/articles/connecticuts-tax-comeuppance-1496443958

Comment by Doug Wednesday, Jun 7, 17 @ 3:03 pm

@Lucky Pierre:

Don’t forget the one business committed to remaining in Hegewisch (a frozen pizza company) was able to do so because it received a package of tax breaks and incentives to stay put. WGN included this business in the same special report.

Let’s see where the pizza maker is once the tax breaks expire.

Comment by Ouch! Wednesday, Jun 7, 17 @ 3:05 pm

I wish Rauner would accept the two-year property tax freeze, and that the House would subsequently do its part, so we can pass a desperately-needed budget to begin bringing stability to this state.

Comment by Grandson of Man Wednesday, Jun 7, 17 @ 3:08 pm

Not spinning it will be a Nirvana Rich, just trying to make the point that both of these issues are significant to our problems and it should not be so difficult to make progress.

We are Nirvana to trial lawyers in workers comp and property tax field though apparently.

Comment by Lucky Pierre Wednesday, Jun 7, 17 @ 3:08 pm

In 2014, over 33,000 graduating HS Seniors left Illinois for greener Higher Ed pastures. Maybe some more of those outmigrating folks are following their children.

How about beefing up Higher Ed? How about making it so that some of those 33,000+ keep their bodies and their brains in Illinois? How about looking for ways to increase the number of incoming college freshmen (about 16,000 in 2014)? Maybe some of them will stay. Maybe a better educated workforce would attract some of the high tech industries the gov claims to want.

Nah. Let’s just let Higher Ed fall deeper and deeper into a hole and complain some more about folks leaving Illinois.

Comment by Pot calling kettle Wednesday, Jun 7, 17 @ 3:15 pm

I thought the issue was term limits, LP. I guess it’s whatever the hot topic of the day is.

Comment by Demoralized Wednesday, Jun 7, 17 @ 3:56 pm

==maybe your tax rate could be lower==

How does lowering taxes fix the current situation? No matter what sort of calculator you’re using you don’t get out of the current mess without additional revenue.

Comment by Demoralized Wednesday, Jun 7, 17 @ 4:00 pm

=exact same weather as we do but a better business environment.=

LOL- Then tell me how Illinois’ GDP rose at a higher rate according to the most recent data? Like double.

Hmmmm….math is hard huh little guy.

Comment by JS Mill Wednesday, Jun 7, 17 @ 7:05 pm