Latest Post | Last 10 Posts | Archives

Previous Post: *** UPDATED x1 *** Rauner travels around the state trying to create phony headlines

Next Post: *** UPDATED x1 - Berrios responds *** Study: Appeals lessen property tax fairness

Posted in:

* A good friend of mine, who isn’t directly involved in politics beyond the precinct level (he’s a GOP precinct committeeman), still does a fairly decent job of keeping up with things.

Moments ago, he asked me something I’ve heard time and time again. Where’s all the money being spent without a budget?

* From the Tribune…

In an affidavit filed with the court before the ruling, Assistant Comptroller Kevin Schoeben said that 90 percent of the money that comes into the state’s main checking account is being spent on a “core priority category” that includes paying down state debt and making pension contributions, in addition to spending on elementary and high schools, paying state employee salaries and sending money to local governments. Debt payments, pension contributions and distributions to local governments are required under state law. A state court order requires state employee salaries to be paid in full and on time. Spending on elementary and high schools was approved by lawmakers and Gov. Bruce Rauner last year, but even those payments are behind by more than $1 billion.

The comptroller’s office tries to spread the remaining 10 percent around.

* Back in 2015, the last time we had a kinda/sorta real budget after Gov. Rauner and the Democratic leaders agreed to a patch, which they called a fix, Illinois brought in $35.9 billion (plus some transfers) while spending $35.4 billion. Click here.

But because revenues collapsed after the 2011 income tax hike partially rolled back, the following fiscal year Illinois brought in just $31.9 billion (click here). And because the state didn’t have a real budget, it was obligated to spend $36.6 billion on “auto-pilot.” See above for that explanation.

This fiscal year, which ends in a few weeks, Illinois will bring in $31.97 billion in revenues while auto-pilot spending obligations will rise to $38.2 billion. (Click here.)

Next fiscal year, which starts on July 1st, Illinois is projected to bring in $32.16 billion and be obligated to spend $39.8 billion. (Click here.)

When Gov. Rauner took office, Illinois was paying almost all of its bills within 30 days. However, it was still way behind on paying for state employee group healthcare. That payment cycle is now about two years for some categories. (Click here.)

* Anyway, by the end of June, Illinois is projected to rack up another $6.2 billion in bill backlogs, which will bring the total to $15 billion. If this nonsense continues another year, that backlog will increase by another $7.7 billion and the total backlog will be $22.651 billion. (Click here.)

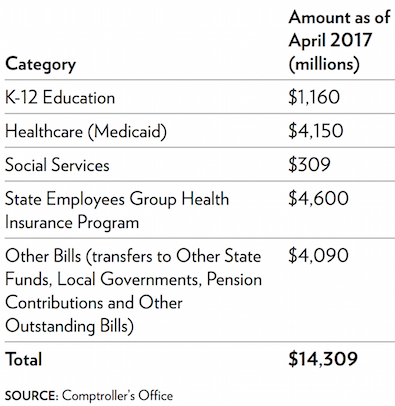

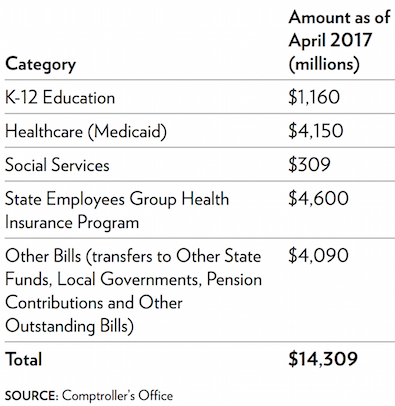

And who is owed this money? Here’s a good chart from April…

The average wait time to be paid by the state is now about 7 months. (Click here for a list of even more craziness deliberately caused by this impasse and click here for an historical chart of the backlog.)

* And that’s why the federal lawsuit over timely Medicaid payments (click here) is so critical. The state owes those folks $2 billion. But they demanded to be paid on time, the same as state workers, bond holders and government pension funds.

Failing that, they want a substantial amount of the money they’re owed and a federal judge agrees…

A federal judge Wednesday ordered Comptroller Susana Mendoza to make a “substantial” dent in a $2 billion backlog of bills owed to Medicaid providers in order to keep doctors and hospitals from cutting off care for the low-income families that rely on the program… The judge gave them until June 20 to reach a deal. She noted that the patients are not seeking immediate payment of the pile of unpaid bills, just payments that would be “sufficient to sustain the services to members of the classes.”

Except, as explained above, there is no money to do that. Illinois cannot print money like the federal government and borrowing for operating expenses is out of the question because we are literally one step above junk bond status.

* Any other questions?

*** UPDATE *** I didn’t notice that Mark Brown also tackled this very same question in the Sun-Times today. Click here to read it.

posted by Rich Miller

Thursday, Jun 8, 17 @ 9:33 am

Sorry, comments are closed at this time.

Previous Post: *** UPDATED x1 *** Rauner travels around the state trying to create phony headlines

Next Post: *** UPDATED x1 - Berrios responds *** Study: Appeals lessen property tax fairness

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

That all makes sense Rich. However, explain why the state still seems able to do things like … sign an overpriced lease on a building. What is authorizing us to spend THAT and other money on items not covered by court rulings or state law?

Comment by Thoughts Matter Thursday, Jun 8, 17 @ 9:39 am

Yes, one last question, can we run another series of articles in major newspapers to try to figure out whose “fault” it is, and then use those headlines to run campaign ads for the next 18 months?

Comment by OkComputer Thursday, Jun 8, 17 @ 9:40 am

Good post.

One question - if the judge does order the Medicaid payments to be made and there’s no money to pay it, what can the judge do about the state’s ignoring the order?

Comment by Robert the Bruce Thursday, Jun 8, 17 @ 9:45 am

==This fiscal year, which ends in a few weeks, Illinois will bring in $31.97 billion in revenues while auto-pilot spending obligations will rise to $38.2 billion. (Click here.)==

The table from “Click here” lists payments for higher ed as auto pilot payments. I didn’t realize that higher ed is part of the auto pilot payments. I don’t think higher ed realizes it either. What am I missing?

Comment by Joe M Thursday, Jun 8, 17 @ 9:48 am

Well, K-12 spending has not been authorized for FY18, so that frees up about $1.1 Billion to spend on Medicaid. /s

Comment by SAP Thursday, Jun 8, 17 @ 9:48 am

Good thing Munger raided GRF on her way out the door at comptroller to make sure those clouted IT consultants got paid.

Even better, their dedicated fund was untouched, so they’ll get paid lots more.

How many hundreds of millions does it take to produce financial reports that say “FUBAR?”

Whatever happened to Munger and her posse after that suspicious midnight fund raid? Did they land on their feet?

Comment by wordslinger Thursday, Jun 8, 17 @ 9:48 am

===what can the judge do about the state’s ignoring the order?===

Unclear. Federal judges have a lot of power, just ask anyone from the Old South. She can pretty much do anything. We’ll have to wait and see how far she is willing to go.

Comment by Rich Miller Thursday, Jun 8, 17 @ 9:49 am

===explain why the state still seems able to do things like … sign an overpriced lease on a building. What is authorizing us to spend THAT and other money on items not covered by court rulings or state law? ===

The governor has the legal right to sign contracts and leases, regardless of the money coming in. Most state contracts specify that they’re “subject to appropriation.” We’ve got a lot of people out there waiting for an appropriation.

Comment by Rich Miller Thursday, Jun 8, 17 @ 9:51 am

Also, many contracts and leases are currently “overpriced” precisely because the state isn’t paying up. The only way to convince vendors, etc. to sign those contracts is to promise to pay lots more money than they’d normally be worth.

Comment by Rich Miller Thursday, Jun 8, 17 @ 9:53 am

The Great Deluge, brought to you by Intelligent Chaos.

All the designers of this chaos, Rauner/ILGOP and Madigan/Dems, want to flood out the other guy, sweeping the rest of us away.

Time to move to higher ground? Not sure where that would be….

Thanks for the nice overview of where some of the flood waters are.

Comment by cdog Thursday, Jun 8, 17 @ 9:56 am

Rauner, Comptroller or AG can go to court and ask for employee pay to be reduced to FLSA minimum. Let’s see who does?

Comment by old pol Thursday, Jun 8, 17 @ 9:56 am

=== One question - if the judge does order the Medicaid payments to be made and there’s no money to pay it, what can the judge do about the state’s ignoring the order? ===

They can hold respective parties that failed to follow the judge’s order in contempt of court. That is the nuclear bomb, but I wouldn’t rule it out.

Comment by Mahna Anon Thursday, Jun 8, 17 @ 9:57 am

== The governor has the legal right to sign contracts and leases, regardless of the money coming in. Most state contracts specify that they’re “subject to appropriation.” We’ve got a lot of people out there waiting for an appropriation. ==

I still question whether those contracts without an approp at time of signing will ever be paid or just dismissed as not appropriated.

Comment by RNUG Thursday, Jun 8, 17 @ 10:01 am

Nice job on the primer Rich. Thank your pal for this as well. A few more primers like this one will certainly be helpful in bringing this impasse to an end.

Comment by Louis G. Atsaves Thursday, Jun 8, 17 @ 10:01 am

Numbers don’t lie and math is math.

Throw in the institutional knowledge and historical context, you have what Rich cobbled, when put before us, it’s top shelf work. Whew.

“Any other questions?”

Perfect.

Comment by Oswego Willy Thursday, Jun 8, 17 @ 10:04 am

You mean in 2015 we spent less money than we brought in?? With that terrible Mike Madigan on the purse strings? Well, I do declare!

Things have gone downhill since Bruce, haven’t they?

Comment by Union Man Thursday, Jun 8, 17 @ 10:05 am

==The governor has the legal right to sign contracts and leases, regardless of the money coming in. Most state contracts specify that they’re “subject to appropriation.” We’ve got a lot of people out there waiting for an appropriation.==

Yup. This is the problem many social service providers are facing. The Governor’s administration issued contracts with providers, and the parties entered into those contracts. Community-based social service agencies provided those services. They’ve met deliverables required by the state. The state has even checked up on them to make sure they’re meeting deliverables.

The missing piece is payment. It’s absurd, unconscionable and unsustainable, and for the most part, is entirely intentional.

Add social service contracts to the list of lawsuits to watch when we talk about the state being required by law to pay out more than it has in available revenue.

It adds up to a staggering amount.

Comment by Emily Miller Thursday, Jun 8, 17 @ 10:08 am

Rich, I think the question your friend is asking is about state agencies. These agencies normally would be directed how to spend their money in a budget/appropriations bill. We haven’t had that budget, so how do we know what they are spending their money on? There is no oversight. They could be spending it on travel and bonuses. How do we know?

Comment by 360 Degree Turnaround Thursday, Jun 8, 17 @ 10:21 am

==A federal judge Wednesday ordered Comptroller Susana Mendoza to make a “substantial” dent in a $2 billion backlog of bills owed to Medicaid providers in order to keep doctors and hospitals from cutting off care for the low-income families that rely on the program…==

Beyond recognizing the dry legality of the consent decree, the most needy and vulnerable of our citizens are also being recognized and looked after by the judge, here. This appears to be a priority for most of the people who comment here at CapFax regardless of our other politics.

I think campaigns need to be very, very careful how they respond to the federal judge’s ruling. I am not impressed with the Pritzker campaign’s response. It’s fine to say the judiciary should not be in the business of choosing winners and losers. But that is sorta their job and it goes on all the time because of situations such as this where conflicting rights, assets and property need to be allocated and the parties are unable/unwilling to do it.

Laypeople in Illinois know that as much as a budget is needed, that even the welcome and sudden appearance of a budget will not immediately and automatically solve the problem of paying the state’s existing, huge outstanding bills and obligations. There will need to be difficult allocation decisions made for years to come. It is likely the judiciary will continue to be involved.

Comment by Responsa Thursday, Jun 8, 17 @ 10:21 am

Thanks Rich for both answers.

It’s time for the state agencies to have to justify every contract they sign to a third party. In order to get out of a joke, we have to stop digging.

And before I get asked. I believe we need a tax increase. I believe the state is supposed to be helping those who need it and social service agencies are vital to that.

Comment by Thoughts Matter Thursday, Jun 8, 17 @ 10:24 am

—It’s absurd, unconscionable and unsustainable, and for the most part, is entirely intentional.—

Jackie Chiles /s

If not so deadly serious this whole mess could be a sitcom just as OW produces for HBO.

Comment by don the legend Thursday, Jun 8, 17 @ 10:24 am

– A few more primers like this will certainly be helpful in helping in bringing this impasse to an end.–

LOL, think so, Louis? You must think the governor is an idiot who doesn’t know what he’s been doing for the last two years.

This is all news to him?

Comment by wordslinger Thursday, Jun 8, 17 @ 10:25 am

Sorry, remove ‘ to a third party’.

Comment by Thoughts Matter Thursday, Jun 8, 17 @ 10:25 am

Created debt….ahhh….why would GOP want that? Maybe Rauner did not know cause and effect … but wait he was elected because of his business skills…GOP still thinks there is no way they would create Debt…

Comment by richman Thursday, Jun 8, 17 @ 10:25 am

And replace joke with hole. Really, I do have a brain.

Comment by Thoughts Matter Thursday, Jun 8, 17 @ 10:26 am

===I think the question your friend is asking is about state agencies===

Since my friend is at my house at the moment, I can safely say you should stop reading his mind.

Comment by Rich Miller Thursday, Jun 8, 17 @ 10:28 am

My real name is Claire Voyant. I can’t help but read people’s minds.

Comment by 360 Degree Turnaround Thursday, Jun 8, 17 @ 10:35 am

Question: why don’t the Dems just pass a budget on their own? They pass bills all the time they know the Governor will veto, why is a budget any different?

Comment by Not It Thursday, Jun 8, 17 @ 10:37 am

===why don’t the Dems just pass a budget on their own?===

The Senate Democrats did.

Comment by Rich Miller Thursday, Jun 8, 17 @ 10:41 am

NI @ 10:37.

It doesn’t work that way…especially now with the Gov bashing the GA (minus the GOP members he owns) at every opportunity.

As the saying goes, “The Governor proposes, the legislature disposes!”

Comment by Jocko Thursday, Jun 8, 17 @ 10:41 am

== The Governor’s administration issued contracts with providers, and the parties entered into those contracts. … Add social service contracts to the list of lawsuits to watch when we talk about the state being required by law to pay out more than it has in available revenue. ==

Better hope those social service agencies have assurances in writing that they will be paid even without an appropriation, or a written promise there will be an appropriation, or tape recordings of same, or multiple witnesses to oral promises. Because from where I sit, if they were new contracts (not renewals / extensions), I don’t see them as legally enforcable in court due to the non-appropriation clause in the boilerplate.

The only path I see is having the proof they were convinced / coerced by the State to sign, and then claiming fraud on the part of the State, i.e., the State knew they had the non-appropriation out and never intended to pay.

And if you can prove that was at the direction of the Gov (I suspect very hard to do unless you can find a paper trail), establishing it as a pattern in Rauner’s business dealings shouldn’t be too hard.

Comment by RNUG Thursday, Jun 8, 17 @ 10:43 am

===why don’t the Dems just pass a budget on their own? They pass bills all the time they know the Governor will veto, why is a budget any different?===

Why?

Any budget, like the SenDems budget requires a 100% revenue increase.

Dems will not 100% do a budget alone precisely because of Rich’s First Post today.

Here’s how it would go down;

Dems pass a budget that gets to Rauner, Rauner vetoes the budget in its entirety. Rauner begs and pleads (internally) that the Dems override.

Magically (I’ll get to the real magic here in a second) the Dems get 71 and 36, override the veto, and we have a budget, with significant revenue, and including “Dem” priorities as framed by Raunerites.

As the Senate “takes the record”, even right before that… Ads on a “huge Dem tax increase” begin airing wall to wall… the fly around, already planned since 2015 begins, even on a campaign’s dime begins, with Rauner IN the plane, awaiting takeoff.

It’s never BEEN about the budget, it’s the whole leverage of the budget to…

Make Dems solely raise taxes

Starve social services

Close state universities

Increase unsustainable debt…

…

Destroy Labor at all these costs including the cost of Illinois

The saving grace, which is where the magic comes in… (rolls up sleeves, shows off hands in magician-like flair)… ready… Dens don’t have 71 and 36 and getting 71 and 36 now (ala Kansas just days ago) isn’t happening anytime soon, so…

Rauner having no budget is “Plan B” to “Plan A”…. Rauner hoping for budget votes and veto overrides that includes arguably, the single largest tax increases in state history without Rauner’s signature…

… to allow Rauner to win re-elect… so Rauner is the signer to the next Maps of the GA… but that’s me digressing to a much larger picture.

Comment by Oswego Willy Thursday, Jun 8, 17 @ 10:50 am

===Any budget, like the SenDems budget requires a 100% revenue increase.

Dems will not 100% do a budget alone precisely because of Rich’s First Post today===

To competely clarify, as precise as possible…

Indeed, the Senate Dems did, the HDems are “stuck” at 46. Further, it’s after May 31st, so 71 in the House, “Dems only” is mathematically impossible with 66 (+ Drury)

Apologies

Comment by Oswego Willy Thursday, Jun 8, 17 @ 10:53 am

RNUG, I’m certain that it’s been part of the Rauner plan all along to just walk away from as much of the backlog as possible. It’s the only thing that makes sense.

He stiffed plenty in the private sector.

“You want to do business with me now? Eat what I owe you from before.”

Good old Main Street conservative GOP business ethics.

Comment by wordslinger Thursday, Jun 8, 17 @ 10:55 am

==I’m certain that it’s been part of the Rauner plan all along to just walk away from as much of the backlog as possible==

reminds me of another Businessman we recently hired to run things…

Comment by Anotheretiree Thursday, Jun 8, 17 @ 11:01 am

A grand kabuki dance is underway to see who wears the jacket for a substantial tax increase. The only analysis I haven’t seen is one laying out what IL’s private sector employees and retirees can afford, taking into account the current status of IL economic and demographic trends. Or maybe there is one in hiding, and our solons of IL governance don’t like what they see.

Comment by Cook County Commoner Thursday, Jun 8, 17 @ 11:31 am

Cook county….

Public sector employees and retirees pay taxes at exactly the same rate as private sector employees and retirees. We will be hit by a tax increase also. However, maybe our health insurance claims will actually be paid then.

Comment by Thoughts Matter Thursday, Jun 8, 17 @ 12:25 pm

== … Or maybe there is one in hiding, and our solons of IL governance don’t like what they see. ==

Well … we already know a 5% flat income tax rate won’t kill the State from having been there, done that. And for those who attended last month’s RSEA meeting, we heard a minimum of 5.25% plus sales tax on services is needed. That was before the last round of game playing. Add in real increased school funding and true property tax relief (from the State picking up more than half the K-12 school funding) and you are probably somewhere north of 7% but under 10%. Where you fall in that range will depend on exactly what the property tax relief portion looks like.

Comment by RNUG Thursday, Jun 8, 17 @ 1:06 pm

Thoughts Matter-

Didn’t mean to imply that the public sector employees are irrelevant.

But private sector employees and retirees don’t seem to have the leverage on wage increases, and their retirement checks are typically a fixed amount. And they are the majority of taxpayers.

Kudos to the public sector employees, but I still wonder as to the trend line impact of tax increases on essentially flat wage employees and fixed income retirees with escalating taxes at seemingly all state and local gov levels. And then there’s the likely additional taxes on businesses which tamp down wages and benefits for the portion that can’t be passed through to consumers.

Comment by Cook County Commoner Thursday, Jun 8, 17 @ 2:51 pm

@wordslinger, I didn’t realize that you liked government finances 90% of which are spent because of court orders. Now with the latest order coming at this state, the remaining 10% is gone.

So certain structural changes are in fact required so we can get away from that nonsense that has been building up for many years now? Or are you going to continue to defend such appalling dysfunction?

Comment by Louis G. Atsaves Thursday, Jun 8, 17 @ 2:59 pm

===certain structural changes are in fact required so we can get away from that nonsense that has been building up for many years now? Or are you going to continue to defend such appalling dysfunction?===

The measurables are 1.4% or $500+ million

I know that people that aren’t the best at math go to Law School often, Counselor, but Rauner’s measurables aren’t even close to anything of what’s needed.

If I ignore math and logic and the laws of budgeting… you could be remotely right… lol

Comment by Oswego Willy Thursday, Jun 8, 17 @ 3:05 pm

== So certain structural changes are in fact required ==

Yes, they are. The structural change that is needed is matching revenue to expenses. Since we now have court ordered expenses in excess of revenues and not everything is being paid, it can honestly be said new revenue is required.

The only debate left is how much new revenue and which group(s) it is raised from?

Comment by RNUG Thursday, Jun 8, 17 @ 3:28 pm