Latest Post | Last 10 Posts | Archives

Previous Post: Behind Rauner’s bragging on the economy

Next Post: Mrs. Rauner talks about Mrs. Madigan

Posted in:

* Tribune…

With legislative leaders still working on the finer points of a plan to send money to public schools, their efforts risked being derailed amid ongoing rancor between Gov. Bruce Rauner and Mayor Rahm Emanuel as well as pressure from unions. […]

Even before the accord was announced, Emanuel poked Rauner over his decision to shed his new press staff just weeks after bringing them on amid a massive staff shakeup in the governor’s office.

“I kind of think some guy that’s talked about running on a ‘turnaround agenda,’ it’s becoming quite apparent that it’s a ‘turnover agenda,’” Emanuel said, mocking the tagline Rauner had given to his pro-business wish list.

* Press release…

Today, as the Illinois House of Representatives considers revisions to Senate Bill 1, Illinois Federation of Teachers President Dan Montgomery released the following statement:

“We were happy to support Senate Bill 1 as originally passed. For the first time in a generation, it creates an opportunity to fund schools more equitably and adequately by considering regional circumstances and ensuring that no district loses a dollar. But as he did with the bipartisan budget, Governor Rauner vetoed the legislation and is holding our kids’ education hostage to his political demands.

The Governor’s priority is not fair and equitable funding for all of Illinois’ students. This was clear in the 120 changes he made when he vetoed SB1, and it’s clear now in his last-ditch effort to use our students as leverage for private school tax credits.

Taxpayer dollars should be invested in our public school classrooms, plain and simple. The Governor’s proposal gives the wealthy another break while robbing our public schools of students and dollars.

We encourage lawmakers to reject this. Override Governor Rauner’s veto and pass Senate Bill 1 as written. Vouchers should not be the price of progress.”

I’ve asked the IFT if it is willing to allow schools to shut down over this beef with the tax credit proposal. I’ll let you know what they say.

…Adding… From the IFT…

Of course we do not want schools to shut down. That was the Governor’s desire when he completely rewrote SB1 in his AV. Legislators can simply override the veto. (And aside from what private school tax credits do to undermine public school funding, is now really the right budgetary time to do this?)

They can’t “simply override the veto,” but whatever.

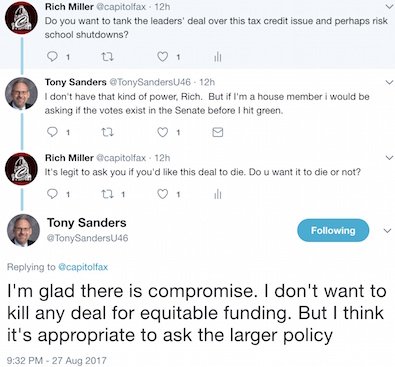

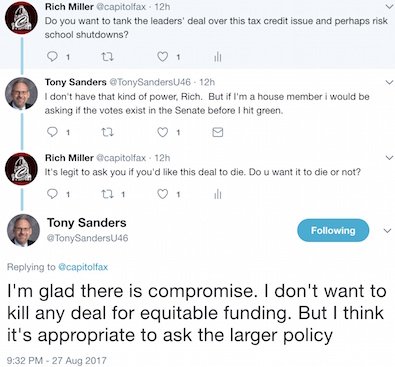

* Meanwhile, the CEO of the state’s second largest school district (Elgin) was bad-mouthing the compromise plan and demanding an override of SB1 on Twitter yesterday, so I asked him some questions…

That’s a lot of dancing.

…Adding… Never bet against the leaders when they’re all pulling in the same direction. If that is truly the case here, then everyone should probably calm down a bit…

After 30 min meeting with Spkr Madigan, GOP leaders say #schoolfunding bill is a go #twill pic.twitter.com/PSSolvD8GU

— Mary Ann Ahern (@MaryAnnAhernNBC) August 28, 2017

…Adding More… This is the standard partisan split on structured roll calls. It’s based on the percentage each party has in the chamber. The object is to meet these minimum targets…

One Insider Prediction: 41 Dem votes, 30 GOP votes … if so then historic school funding will pass #twill pic.twitter.com/Caf7kLlBd5

— Mary Ann Ahern (@MaryAnnAhernNBC) August 28, 2017

* Related…

* What’s going on with Illinois school funding? Here’s a Q and A: What’s with the $75 million in school vouchers? First, they’re not vouchers, which would be public money or tax credits provided directly to families paying tuition. What’s been proposed are tax credits for anyone who donates to organizations that would create scholarship funds for low- and mid-income students attending private schools. At least for the next five years — when the measure will sunset — donors will get a credit for 75 cents on every dollar they give. Though it’s not yet clear how any of that will happen.

* Legislative Leaders Inch Toward School Funding Deal: “It’s time for everyone, if they have minor objections, look at the goal. Who gets hurt? No one gets hurt, everyone succeeds under this. Every student in Illinois is going to be a beneficiary of what we have to come to a conclusion in,” Durkin said.

* GOP leaders: School funding reform plan still on track

* IL Lawmakers Working To Hammer Out Details On School Funding

* Rep. David McSweeney Says The New School Funding Plan May Cause More Harm Than Good

posted by Rich Miller

Monday, Aug 28, 17 @ 9:29 am

Sorry, comments are closed at this time.

Previous Post: Behind Rauner’s bragging on the economy

Next Post: Mrs. Rauner talks about Mrs. Madigan

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

How can a state that is “broken” afford $75 million for private schools?

Comment by Seymourkid Monday, Aug 28, 17 @ 9:34 am

Sanders isn’t a real Super. He got special legislation passed to allow him to be the “CEO” of U-46. IMO, he’s been far too political and far too vocal on this issue.

Comment by Anon Monday, Aug 28, 17 @ 9:36 am

“We support 99 percent of the deal. Please oppose it. Thanks!” - IFT, CTU, & IEA

Comment by hot chocolate Monday, Aug 28, 17 @ 9:38 am

@Seymourkid….hedge fund managers and real estate developers (Rauner’s pals) don’t quite see it that way.

Comment by Flynn's mom Monday, Aug 28, 17 @ 9:38 am

Quasi-Hot Take on the $75 Million: Let them pass it. If you are against it, have an educational non-profit that helps create scholarships for low-income families file an injunction.

Because donors to their organization cannot receive this tax credit, they will lose donors and this creates an undue hardship. It will spin in the courts for a while (not to mention any Church/State separation arguments) - it won’t see the light of day for most of those five years.

Comment by Dee Lay Monday, Aug 28, 17 @ 9:40 am

Amazing. All we hear from these folks is “extremism, extremism, extremism.” But Lewis’ histrionics on the call yesterday reveal the true ideologues. CTU is willing to tank a massive spending package that gives Chicago everything it wants over a tax credit that’s 1% of the spend. Quoting Michael Moore’s Broadway show as a justification for blowing this up shows us how out of touch these people are.

Comment by revealed Monday, Aug 28, 17 @ 9:45 am

Isn’t the tax credit plan better than vouchers? What am I missing here? Private development of private schools is fine, and a tax credit steers the market in that direction. As government interventions go, it seems like a less invasive option than vouchers.

Comment by Schoolwise Monday, Aug 28, 17 @ 9:50 am

Oddly enough, Chicago public schools and Chicago private schools receive more resources in this approach. I do not understand why downstate Republicans like this compromise.

Comment by PragmaticR Monday, Aug 28, 17 @ 9:54 am

The tax credit scholarships are bad education policy, bad fiscal policy, and bad charity policy. On top of that, the way they have been introduced is bad process.

Comment by Christopher Ball Monday, Aug 28, 17 @ 9:56 am

@Schoolwise This is still a $75 million tax break for the wealthy and for firms at a time when the state scrounges for every $1. If $75m is small potatoes, then the legislature can add another $75m to the education appropriations. The evidence-based model shows that IL is short as much as $6.5 billion over what is needed to fully fund K12 education.

Comment by Christopher Ball Monday, Aug 28, 17 @ 10:01 am

Take the deal. Then work to oust Rauner and as many of his minions as you can. When you accomplish that task and have the votes, then go after the tax credit program.

Comment by Norseman Monday, Aug 28, 17 @ 10:01 am

This is not a 1% spend in Chicago. First, it brings vouchers in, which will cause long term damage. Secondly, where do you think most of those private schools are located?

Comment by Carhartt Representative Monday, Aug 28, 17 @ 10:02 am

As long as the organized opposition remains mostly (all?) on the left, I think this helps get it done, though it depends on how many votes Durkin/Brady can put on the bill. Rauner was only gonna get on board if he could “prove his virility”, and he can’t do that if the unions are urging a signature.

But a non-zero number of Democratic legislators are going to jump ship over this, and that’s gonna need to be made up on the other end.

Comment by Arsenal Monday, Aug 28, 17 @ 10:03 am

The tax credits for scholarships would generate new funding streams for education from private sources. In an environment where educational funding is deeply constrained, this is a very good thing.

If you think they are mere tax breaks for wealthy parents, you have not done your homework.

Comment by Sillies Monday, Aug 28, 17 @ 10:05 am

The tax credit scholarship program will drain students and scarce resources away from our public neighborhood schools, leading to the extinction of free public schools. It won’t happen right away, but it will happen.

That’s the choice - free public neighborhood schools or no free public neighborhood schools.

Comment by TinyDancer(FKASue) Monday, Aug 28, 17 @ 10:05 am

Well said, Norseman at 10:01 am.

To the critics of the deal - do you have a better idea for a deal that both Rauner and Madigan will agree to? Or would you prefer that struggling school districts not open?

Comment by Robert the Bruce Monday, Aug 28, 17 @ 10:06 am

I hardly think a $75 million scholarship donation credit is going to bring the end to public schools as we know it. There are 2 million kids in public schools. Given the tuition at private schools I’m guessing that even if kids are moving from public to private schools as a result of these scholarships the numbers will be less than 1%. I think people need to calm down.

Comment by Demoralized Monday, Aug 28, 17 @ 10:08 am

Gotta go with Tiny Dancer on this one. Seems like just one more way to back door privatization of the public education system - something Rauner is entirely in favor of.

Comment by Galena Guy Monday, Aug 28, 17 @ 10:15 am

Interesting to see which GOP members who claim to support “free market” policies vote for a bill that uses public tax policy to direct private charity to a very specific private market.

Wonder have many of them would also support a similar tax credit for donations to a group like Planned Parenthood? After all, both would support “choice”.

Comment by Dance Band on the Titanic Monday, Aug 28, 17 @ 10:16 am

==I hardly think a $75 million scholarship donation credit is going to bring the end to public schools as we know it. ==

It won’t happen right away.

But like a row of falling dominoes, it will happen.

It’s like tugging on a small thread - eventually the whole fabric unravels.

Comment by TinyDancer(FKASue) Monday, Aug 28, 17 @ 10:16 am

I’m guessing here that some think if they can kill the deal with the scholarship tax credits, enough GOPers will join for a House override of the SB1 veto.

That’s probably a reasonable bet on Aug. 28. Something has to be done in a hurry.

Comment by wordslinger Monday, Aug 28, 17 @ 10:19 am

TinyDancer(FKASue) - Monday, Aug 28, 17 @ 10:05 am:

===The tax credit scholarship program will drain students and scarce resources away from our public neighborhood schools….===

The agreement won’t do this, I assume “hold harmless” still applies?

It looks like the people among us who refuse to compromise are going to snatch defeat from the jaws of victory. I gave this great state 32% more income tax, so I want my school funds NOW!

Comment by GoIllini1972 Monday, Aug 28, 17 @ 10:19 am

So everyone is grumbling about some part of this deal? Must be a pretty good compromise then.

Comment by Ron Burgundy Monday, Aug 28, 17 @ 10:20 am

==The tax credit scholarship program will drain students and scarce resources away from our public neighborhood schools, leading to the extinction of free public schools.==

After reviewing my property tax bill, I can assure you my local public school is not free.

Comment by City Zen Monday, Aug 28, 17 @ 10:22 am

If The IFT and IEA don’t like the deal then it must be in the best interests of Illinois parents and school children to approve it

Comment by Sue Monday, Aug 28, 17 @ 10:22 am

The education monster will not easily let its money be taken away despite the fact that how we educate kids doesn’t need to be rooted in the 19th century. While many public school districts operate well (in other words-they achieve good outcomes for students and carefully manage their funding) some don’t. The poster child for poor schools is CPS. While I hope this bill goes through so those kids don’t have to suffer any additional pain the biggest issue on this deal is that it still doesn’t force needed changes/accountability to CPS. It just keeps pushing the problem down the line.

Comment by NeverPoliticallyCorrect Monday, Aug 28, 17 @ 10:23 am

What Norsemen said

besides an agreement that everyone is unhappy with usually is a sign that its fair 😀 (emoji to show we are all besties here)

side note, I do not like the teachers telling my kids school will shut down in jan because they dont have money. Dont talk uninformed politics to my kids.

Comment by Ghost Monday, Aug 28, 17 @ 10:27 am

==The tax credit scholarship program will drain students and scarce resources away from our public neighborhood schools, leading to the extinction of free public schools. ==

Histrionics much? If the neighborhood public schools were working properly, so many parents who can barely afford it would not be trying to remove their kids from the public schools. How many generations of kids are you willing to sacrifice on the alter of the IFT and IEA without at least trying/testing a different approach to educating our children while the more marginal public schools hopefully are motivated to get their acts together?

Comment by Responsa Monday, Aug 28, 17 @ 10:37 am

==It’s like tugging on a small thread - eventually the whole fabric unravels. ==

Well-made garments are durable.

More money for education is a good thing, not a bad thing.

Comment by Sillies Monday, Aug 28, 17 @ 10:40 am

==If the neighborhood public schools were working properly==

Institutional racism and the resulting generational poverty are what’s wrong in the “marginal” public schools. That’s what needs to be fixed.

Comment by Anonymous Monday, Aug 28, 17 @ 10:41 am

==If the neighborhood public schools were working properly==

Institutional racism and the resulting generational poverty are what’s wrong in the “marginal” public schools. That’s what needs to be fixed.

But that’s hard. Much easier to just cherry-pick the better students and the cash out of the neighborhood schools and say you “fixed” them.

Comment by TinyDancer(FKASue) Monday, Aug 28, 17 @ 10:44 am

SB 1 supporters: I can’t believe Rauner would veto a bill he agrees 90%. He just just learn to take a win.

Rauner: Okay, same bill but this one will have a tax credit for donations to schools.

SB1 supporters: This is going to DESTROY public education as we know it. This cannot stand.

Pot, meet kettle.

Comment by ste_with_av_en Monday, Aug 28, 17 @ 10:45 am

==Quoting Michael Moore’s Broadway show …===

is just flat out nuts. Karen Lewis is nuts. Nice that the group got a full audience with the caucus. Any wonder how we get to the places we do?

Comment by A guy Monday, Aug 28, 17 @ 10:46 am

Sorry, Anonymous @ 10:41 was me. Accidentally hit the wrong key.

Comment by TinyDancer(FKASue) Monday, Aug 28, 17 @ 10:47 am

I’m irritated by the ‘they’re not vouchers’ argument, as this tax credit definitely IS part of the turn away from free, open to all public education in this state. 20 years ago we were told that we should just embrace these few charter schools because they were experiments and new ways of doing things. Now we have all these schools that divert public money into private organizations, some of which stolen millions through fraud and abuse. At best, charters are selective, cherry-picking kids from neighborhood schools, and dumping them if they don’t fit or have challenges.

And here, now, is another program that is ‘just an experiment’ that will take money away from public education (because that $75 isn’t available for public ed funding) and support more private (in this case, also, some religious) institutions, all of which also aren’t open to all students.

So in another five or so years, we’ll hear about how public schools are failing more than ever, and shouldn’t we really just embrace vouchers because it’s for the best?

This is just another gear in the slippery slope of dismantling public education. It’s not a “well you’re getting 99% of what you want” - it’s the cornerstone of the entire system. This is a ‘vouchers-next’ proposal.

Comment by Logan's Run Monday, Aug 28, 17 @ 10:47 am

===in the slippery slope===

I’m betting you don’t buy into slippery slope arguments on other topics.

They’re little more than rhetorical gimmicks. Stop using them.

Comment by Rich Miller Monday, Aug 28, 17 @ 10:49 am

You’re right, Rich. Plus, don’t need it - sentence is cleaner without it:

This is just another gear in the dismantling [of] public education.

Comment by Logan's Run Monday, Aug 28, 17 @ 10:57 am

Logan’s - my kids’s school (which is private and run by our church) does not turn anyone away. In fact we just added another kindergarten class and had to hire more teachers. The school has in the past and in the present accepted several learning disabled children who will require extra help and we hired T.A.s for that specific reason.

Comment by Curl of the Burl Monday, Aug 28, 17 @ 10:59 am

===After reviewing my property tax bill, I can assure you my local public school is not free.===

Yes.

We all pay property taxes. It’s the price we pay for civilization.

Our property taxes support our schools, police, fire, etc.

The fire department doesn’t charge you when they come out, the police department doesn’t charge you when they come out, and no one’s collecting tuition at the schoolhouse door.

Private schools charge you at the schoolhouse door.

And when the “scholarships” dry up are they going to keep letting those poor kids in for “free?”

Comment by TinyDancer(FKASue) Monday, Aug 28, 17 @ 11:03 am

Like many other graduates of Catholic schools, I send checks to my high school alma mater for their scholarship fund. I know where the money is going and that it is earmarked for the scholarship fund. I get an annual report from the school as to where the money was spent.

And I get a tax deduction to boot.

I don’t make a lot of money with my pension and annuities so I am not attracted to the tax credits proposed by this bill. I am wondering if there are enough contributors in Illinois to make this viable.

Comment by Nearly Normal Monday, Aug 28, 17 @ 11:05 am

==Much easier to just cherry-pick the better students and the cash out of the neighborhood schools and say you “fixed” them.==

CPS does have 11 selective enrollment high schools. Maybe they’ve already cashed out.

Comment by City Zen Monday, Aug 28, 17 @ 11:06 am

Absolutely against tax dollars for private education.

Just more of this states will to harm the young, old and those least able to take care of themselves. I gladly pay my taxes for NEEDS of the everyday people but not the WANTS of the rich.

Comment by cc Monday, Aug 28, 17 @ 11:06 am

CC - then you must hate MAP grants for places like the University of Chicago or DePaul or Millikin or Lincoln College. Right?

Comment by Curl of the Burl Monday, Aug 28, 17 @ 11:09 am

The tax credit is a classic symbolic action that will largely benefit lower middle class students that already attend private schools. These schools do not have the capacity to educate tens of thousands of poor students in Chicago or in any other city.

Comment by PhD Monday, Aug 28, 17 @ 11:10 am

I am not in favor of credit but why would this take money away from public schools? Most money comes from real estate taxes. I would think TIF is far worse for schools.

Comment by DuPage Saint Monday, Aug 28, 17 @ 11:10 am

Here are some ideas for fixing the ‘tax credit for private scholarships. These scholarships are directly a burned on all taxpayers. Thus we have right to know.

(1) Open to all education institutions – public and private.

(2) A public, state maintained web site lists each scholarship amount, funder, date start – end, and funded institution.

(3) Every school receiving scholarship funds must quarterly publish in newspaper and internet media the amount and name of individuals receiving the scholarship. It is common practice in most school districts to release name of scholarship winning students.

(4) School receiving funds must quarterly publish in newspapers and internet media an accounting of receipts and disbursements including name and amount. Annually this report must be signed by certified public accountant.

Comment by Jim O Monday, Aug 28, 17 @ 11:16 am

=then you must hate MAP grants for places like the University of Chicago or DePaul or Millikin or Lincoln College. Right?=

We wouldn’t need MAP grants if we had free or nearly free college tuition like 24 other countries.

Comment by TinyDancer(FKASue) Monday, Aug 28, 17 @ 11:17 am

Tiny Dancer - way to divert the subject. The fact of the matter is that MAP grants can be used for private institutions - including Christian- and Catholic-run schools. People can already claim a tax credit for private K-12 education expenses. The cost of this new program (or expansion - depending on your take) is less than 1% of all GSA funding. Less than 1%.

Comment by Curl of the Burl Monday, Aug 28, 17 @ 11:21 am

For all those who fear a loose thread to pull, or a slippery slope, please step up and run for office or directly support those who do — to keep these things from happening.

Comment by walker Monday, Aug 28, 17 @ 11:23 am

Curl - it is commendable that your school community made that decision. You’re under no obligation to do so, however, and could change that policy at any time - whereas neighborhood schools/the public school system are obligated to place and educate all students.

Comment by Logan's Run Monday, Aug 28, 17 @ 11:32 am

Never grab a loose thread while trying to navigate a slippery slope.

Comment by City Zen Monday, Aug 28, 17 @ 11:33 am

@CB

= way to divert the subject=

I believe the subject is education funding, specifically this tuition tax plan which is not a true tax deduction, but (as I understand it) a dollar for dollar or 75% tax rebate and possibly more.

How is free or nearly free college tuition not a part of an education-funding conversation?

Comment by TinyDancer(FKASue) Monday, Aug 28, 17 @ 11:36 am

“I cannot balance $75M against $450M CPS would benefit from” new SB 1

Now $450 million in new money for CPS (that 30 GOP will vote for) and Public money for Private schools (that 41 DEMS will vote for).

AMAZING

Comment by winners and losers Monday, Aug 28, 17 @ 11:44 am

=CPS does have 11 selective enrollment high schools. =

Right. And they keep comparing their performance to the performance of neighborhood schools.

Selective enrollment schools even outperform Northshore neighborhood schools - gee, I wonder why.

Comment by TinyDancer(FKASue) Monday, Aug 28, 17 @ 11:46 am

TD - with respect this thread is about less than 1% of the GSA funding. You are talking about a massive, multi-billion dollar program that would be next-to-impossible to fund (and maybe even implement). I brought up MAP grants because as we discussed last week there are a lot of private, religious-based schools that accept MAP grant vouchers.

Comment by Curl of the Burl Monday, Aug 28, 17 @ 11:57 am

TD - to be honest I am fine with having that discussion. There is nothing wrong with having an open, honest debate about a “college for all” program. But it is not necessarily relevant here. Just my take.

Comment by Curl of the Burl Monday, Aug 28, 17 @ 12:03 pm

@- TinyDancer(FKASue) - Monday, Aug 28, 17 @ 11:03 am:

===The fire department doesn’t charge you when they come out===

Some towns do. Typically $500 for a fire truck, $1000 for paramedics and ambulance to a hospital. It usually is covered by homeowners or auto insurance, but if you have a high deductible, you have to pay it all out of pocket.

Comment by DuPage Monday, Aug 28, 17 @ 12:09 pm

Wait I thought TIFs were bad. How is this not a state income tax/private school TIF, income tax revenue is indirectly diverted to promote private schools.

Also, are there any requirements for the scholarship programs? I have heard this ideal being sold as a way to get public school students into private schools, but the school’s scholarship program could just redistribute state tax dollars to all current students.

Comment by RD55 Monday, Aug 28, 17 @ 12:24 pm

===are there any requirements for the scholarship programs?===

Read the bill: https://capitolfax.com/2017/08/28/school-funding-reform-language-filed/

Comment by Rich Miller Monday, Aug 28, 17 @ 12:25 pm

on a side note I do agree with A Guy Karen Lewis needs to learn to accept small victories and dump the rauner like nut appearing ranting when you only get 90% of what you wanted approach. Karen dont be Rauner.

Comment by Ghost Monday, Aug 28, 17 @ 12:27 pm

The new line that overriding on SB1 is the preferable outcome might make sense outside Chicago but it’s nonsense in the city. You’d rather CPS get LESS money now? You want to face a primary voting like that?

Comment by Will Caskey Monday, Aug 28, 17 @ 12:33 pm

@CB

Free college tuition would probably pay for itself:

Consumer spending = 70% of GDP

No college loan debt = more discretionary spending

more discretionary spending = business growth

business growth = more taxes

No college loan debt = get married/buy house/buy furniture

Etc., Etc., Etc.

Comment by TinyDancer(FKASue) Monday, Aug 28, 17 @ 12:37 pm

Oh, and I almost forgot -

free college tuition = well-educated, well-trained, well- informed, job-ready population

Comment by TinyDancer(FKASue) Monday, Aug 28, 17 @ 12:41 pm

Thanks Rich. I saw the post right after I posted my question on the scholarships.

Comment by Anonymous Monday, Aug 28, 17 @ 12:48 pm

- Logan’s Run - Monday, Aug 28, 17 @ 10:47 am: =

You are right on the money.

Comment by Mama Monday, Aug 28, 17 @ 2:16 pm

Anybody want to bet the Rauner will actually sign the compromise bill?

Comment by downstate commissioner Monday, Aug 28, 17 @ 2:58 pm

===How can a state that is “broken” afford $75 million for private schools?===

How can a state that is “broken” afford to give hundreds of millions of dollars to CPS?

Comment by Anon Monday, Aug 28, 17 @ 3:51 pm

–How can a state that is “broken” afford to give hundreds of millions of dollars to CPS?–

Refer to your Illinois Constitution.

Comment by wordslinger Monday, Aug 28, 17 @ 4:49 pm