Capitol Fax.com - Your Illinois News Radar

Latest Post |

Last 10 Posts |

Archives

Previous Post: DGA tour coverage roundup

Next Post: Why did Lisa Madigan retire?

Currency exchanges say they want higher fees to boost lagging profits

Posted in:

* WUIS…

State financial regulators are recommending an increase in the fees that currency exchanges charge for cashing checks. Opponents say it will hurt Illinois’ poorest residents.

Currency exchanges petitioned the state for the higher rate — which could be up to 3 percent, depending on the amount of the check.

They say the move to direct deposit and pre-paid cards has cut into profits — putting the industry into decline. […]

The plan still has to get through a special legislative committee that evaluates proposed regulations.

* From Sen. Jacqueline Collins (D-Chicago)…

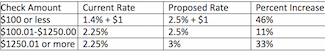

The IDFPR’s proposal, which is now in the midst of the rule-making process would change the service fees associated with cashing checks at businesses like Currency Exchanges as follows:

Collins, who chairs the Senate’s Financial Institutions Committee, said these proposed increases further squeeze the working poor and the underbanked – people who can least afford it. She spoke alongside representatives of advocacy groups – Woodstock Institute and Community Organizing and Family Issues, among others.

“I refuse to stand by and allow the currency exchange industry to increase profits on the backs of the most financially vulnerable,” Collins said. “If IDFPR refuses to appropriately modify its proposal, I plan to explore all legislative options to address this misguided and dangerous plan.”

Thoughts?

posted by Rich Miller

Wednesday, Sep 20, 17 @ 10:16 am

Comments

Add a comment

Sorry, comments are closed at this time.

Previous Post: DGA tour coverage roundup

Next Post: Why did Lisa Madigan retire?

Last 10 posts:

more Posts (Archives)

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Opponents should find a way to tie this bill to the Amazon incentive package. Corporate giveaways on the one hand and gouge the poor on the other.

Comment by The Captain Wednesday, Sep 20, 17 @ 10:23 am

Wah, Wah, Wah.

Too bad. Costs are rising for everyone. The State isn’t allowing increases for medical providers.

Get used to making less.

Comment by BIG R. Ph Wednesday, Sep 20, 17 @ 10:26 am

So Senator Collins voted to make them pay a $15 minimum wage and paid leave which would greatly increase costs but not allow them to increase revenue. Pure genius.

Comment by Anonymous Wednesday, Sep 20, 17 @ 10:39 am

How has the cost of cashing a check gone up for currency exchanges? Paper cuts?

Comment by 360 Degree TurnAround Wednesday, Sep 20, 17 @ 10:48 am

I still see these businesses popping up everywhere; must be making money at it. Tell the businesses to live with the current fees or the State will set a flat $2 fee for transactions under $1,000 and a flat $5 fee for anything over $999. Bet they’ll be happy to keep the current fee schedule instead.

The State really needs incentives for the financial community to serve this segment of the population. I know some banks have a workplace checking account program (paycheck direct deposit required) that partially fills the need, but the number of checks or transactions per month is limited. A better alternative with no fees for a lot of people is a credit union; some only require a minimum of $5 in a savings account.

Maybe any bill will new check cashing fees should include a tax on the businesses to be used to promote credit union use.

Comment by RNUG Wednesday, Sep 20, 17 @ 10:51 am

If they don’t allow fees to rise, will there be fewer places to provide this service? If so, will that hurt “Illinois’ poorest residents” more than the additional costs would?

Have to admit that I didn’t know there were max fees in place for check cashing, but if people really need this service I’d hate to see it go away. I’m sure there are better options for check cashing, but not sure everyone can access them.

Comment by Stormfield Wednesday, Sep 20, 17 @ 10:53 am

First time I’ve ever seen the term “under banked”

Comment by Saluki Wednesday, Sep 20, 17 @ 10:53 am

Why in the world is the state seeking to protect this industry from the economies and efficiencies of the marketplace? They’re losing money because there are better options for the consumer — and that trend will continue, thankfully.

Is that how they “grow the economy and create jobs” out of Springfield? By gouging the poorest-of-the-poor who can’t access better financial services?

The state should be busting its hump to get citizens access to those better financial services so they can keep more of their money, not promoting the currency exchange trap.

Comment by wordslinger Wednesday, Sep 20, 17 @ 10:55 am

The userous rates pay day lenders and titke loan como anies receive is a much larger problem. Why we allow 600-1500% loans on the poorest people is shocking to the conscious. These check cashing fees are another Variant of victimizing the poor that needs to be eliminated. With electronic check verification risk and cost is down, fees should decrease not increase.

We need to stop predatory practices on the poor.

Comment by Ghost Wednesday, Sep 20, 17 @ 10:55 am

Good for Collins. IDFPR is sticking it to the poorest consumers. Currency exchanges current take $28 to cash a $1250 check and, under this proposal, will grab $37.50. If that’s a payroll check, there is almost no risk of it bouncing. And if that’s a payroll check, then the consumer is spending $70 per month to get his own money. That’s outrageous.

Comment by 47th Ward Wednesday, Sep 20, 17 @ 11:11 am

That “+$1″ seems the most onerous and regressive of the fee schedule. Cashing a $50 check today costs 3.4%, a higher rate than cashing a $1,250 check. Have them drop that flat fee first.

I’d wager most folks depositing $1,250+ checks have other banking options.

Comment by City Zen Wednesday, Sep 20, 17 @ 11:14 am

Torn by this. First, in this day and age of internet banking and direct deposits, it appears that even low income people have plenty of options other than currency exchanges. On the other hand, if currency exchanges are seen as the only business that can handle their financial transaction needs, there should be some recognition of (1) the cost of doing business, but also (2) the need not to impose usurious rates upon the poor.

Comment by phocion Wednesday, Sep 20, 17 @ 11:33 am

Would this be the rate they have to charge or the maximum rate they can charge?

As for why the costs have gone up, I suspect that cost increases for other things, labor, utilities, security, etc have had an impact…

Comment by OneMan Wednesday, Sep 20, 17 @ 11:42 am

If the pop tax is bad because it’s regressive, then this proposal is terrible because it gouges “the poorest-of-the-poor who can’t access better financial services.”

Comment by anon2 Wednesday, Sep 20, 17 @ 12:17 pm

DOA

Comment by walker Wednesday, Sep 20, 17 @ 12:19 pm

Check cashing services only exist to fill a market hole caused by the difficulty of people needing to cash checks. Lack of market demand for check cashing services is simply something these businesses need to deal with.

Comment by Illinoisian Wednesday, Sep 20, 17 @ 12:19 pm

This proposal takes more money from poor folks who already have very little to hold on to. And for what? To increase the profits for currency exchanges? An insult to injury.

I don’t begrudge the Rauner Administration from giving an audience to this industry, that is part of the job. However, to promise an even bigger cut from the pockets of the poor is an affront to common decency.

How are poor folks able to develop the economic skills to compete in today’s economy when there are no banks in their communities and the currency exchanges make it expensive to save?

Does this Administration even value poor people saving money? Out of one side of his mouth they say tax increases disincentive income and out of the other side of their mouth they say “let’s make it tough for poor people to save.” Discordant values between rich and poor people illuminates this Administration’s true constituency.

Bruce Rauner shows, once again, that he is more loyal to dubious business than he is to flesh-and-blood Illinoisans.

Comment by buffalo soldier Wednesday, Sep 20, 17 @ 12:49 pm

I wish check cashing were another function of the post office. It is expensive to be poor.

Comment by Jack Wednesday, Sep 20, 17 @ 12:54 pm

Let them raise the fee’s, if just to keep the currency exchanges open so I can get my license renewal done by anyone but the rude Sec of State employees. Yes you pay a convenience fee, but you get to deal with decent folks and you are out the door quickly.

Comment by Texas Red Wednesday, Sep 20, 17 @ 12:56 pm

A split fee schedule, lower for government-backed checks with no attached risk, and a higher one for paychecks, etc. is a good idea that keeps things somewhat more fair. The Treasurer’s Office could perhaps spearhead an effort to help un-banked people find better alternatives than currency exchanges.

Comment by Newsclown Wednesday, Sep 20, 17 @ 1:13 pm

My one and only venture into a ‘currency exchange’ was in Springfield over 15 years ago. I had returned from Mexico with a few large Peso bills that I hadn’t used.

The ‘currency exchange’ told me I needed to go to a bank, because they didn’t exchange currency.

The irony wasn’t lost on me, but I’ve never gone into one since. In 5 years I think they will be lucky to be around with the explosion of mobil banking.

Comment by How Ironic Wednesday, Sep 20, 17 @ 2:32 pm

TR, the state should promote gouging the working poor for an industry that can’t compete with technological change to make one day out of the year for you a wee bit easier?

Quite a sense of entitlement you have there.

Comment by wordslinger Wednesday, Sep 20, 17 @ 3:35 pm

The rate hike would exacerbate disparities that already exist in our financial system. Consider the unbanked. According to the FDIC, in the Chicago region, only 1.1% of whites are unbanked compared to over 25% of blacks. Top reason cited for not having a bank account: they don’t have enough money. The rate hike would make it even more difficult for the unbanked to enter the financial mainstream.

Comment by BAdams Wednesday, Sep 20, 17 @ 6:42 pm

== Top reason cited for not having a bank account: they don’t have enough money. ==

That I just don’t understand. It only takes a few dollars to open an account at most credit unions and they usually offer a completely free checking account (no interest) with debit card, online access, electronic bill pay, etc. Can be as little as $25 to open a checking account and as little as $6 to open the matching savings account. You often don’t get interest on savings under $100, but you aren’t losing much there.

Comment by RNUG Wednesday, Sep 20, 17 @ 7:52 pm

RNUG, thanks for raising that. They have enough money to open an account, but the low account balance, infrequency of deposits, overdraft, and not having direct deposit can result in fees such that it is more economical to not have the account.

Comment by BAdams Thursday, Sep 21, 17 @ 9:57 am