Latest Post | Last 10 Posts | Archives

Previous Post: It’s just a bill

Next Post: Question of the day

Posted in:

* From the Illinois Policy Institute’s former news service…

The state constitution requires lawmakers to pass a budget that only spends what’s estimated to come in for the year. While the Senate has passed a revenue estimate in recent years, the House hasn’t. The number is typically a combination of the Commission on Government Forecasting and Accountability, the Governor’s Office of Management and Budget and input from the General Assembly.

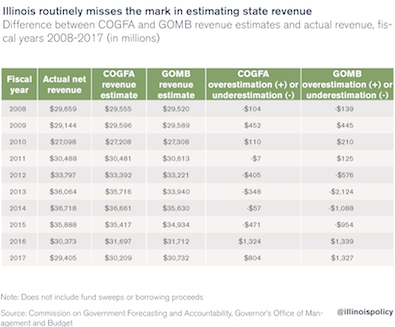

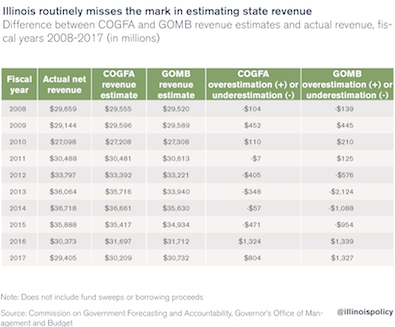

The Illinois Policy Institute put out a study that showed five of the past ten years COGFA and GOMB’s revenue estimates were off by millions. In fiscal years 2013 and 2014, GOMB under former Gov. Pat Quinn was off by $2.1 billion and $1 billion respectively.

* The Illinois Policy Institute and its legislative allies have been loudly harping on this revenue estimate issue for a few years. My ears perked up when Gov. Rauner said this week that an official revenue estimate was one of his chief demands heading into budget talks. Could Rauner and the Institute be doing a bit of reconciling? Stay tuned.

Anyway, this is from that aforementioned study…

Based on the standard for revenue projections used by the National Association of State Budget Officers – estimates within 0.5 percent of actual revenues are considered “on target” – COGFA revenue estimates have been accurate in only four of the last 10 years. GOMB estimates have been on target in only two of the last 10 years.

They include this chart…

Pew took a look at this topic a few years ago and found that states are not nearly as accurate as the Institute suggests. 0.5 percent may be considered “on target,” but it’s not what real world prognosticators always get.

* I asked Clayton Klenke, who runs COGFA, for a response…

The table showing actual revenues and the comparisons to revenue estimates serves as a starting point for the analysis, but it is also important to take into consideration the various factors that were occurring which were leading to increased volatility during this time period.

For FY12, this was the first full year of the implementation of the temporary tax increase. Significant changes to tax structures can lead to increased volatility between estimates and actual receipts. Actual income tax receipts performed better than anticipated in FY12 by $349 million.

Again in FY13, actual income tax receipts performed better than estimated. This variance was largely related to the “April Surprise” in which receipts in April 2013 spiked as taxpayers sought to minimize the impact of recently enacted changes in Federal tax policies. The total difference between the FY13 estimate and actual receipts of $348 million is essentially a difference of 1%.

In FY15, there was increased volatility associated with the partial sunset of the temporary tax increase. Once again, actual receipts from income taxes exceeded estimates, with total variance of about 1.3%.

In each of the examples above, actual receipts exceeded estimates, and the variance was about 1%.

For FY16, at first look there appears to be a large variance, with estimates exceeding actual receipts by $1.3 billion. Remember, this was during a time frame when there was not a comprehensive enacted budget. Further examination of this variance shows that of the $1.3 billion in variance, over $1 billion was associated with Federal Sources. Federal Sources are going to be dependent on the enacted budget, bill payment prioritization, and cash flow at the Comptroller’s office. Aside from the Federal Sources, the revenue estimate for FY16 was within about $300 million of actual receipts, less than 1% variance.

Again in FY17, the vast majority of the $804 million in variance in the table is associated with the $517 million variance in Federal Sources. Controlling for the Federal Source number would leave a variance of $287 million - less than 1%.

Emphasis added.

…Adding… From Adam Schuster, director of budget and tax research at the Illinois Policy Institute…

“We wanted to clarify something about the IPI report you posted on your blog today. The takeaway from that report is not that COGFA does a bad job of estimating revenue (”Both COGFA and GOMB are likely doing their best …”). The point is that revenue estimating is a bad way to do budgeting. As we pointed out in the report, only four states were on target for their revenue estimates in 2017, according to the Spring Fiscal Survey of States put out by the National Association of State Budget Officers.

“Our proposal is to enact a spending cap constitutional amendment that would instead give lawmakers a definite amount of money to spend each year. It has bipartisan support in the General Assembly: SJRCA 21, HJRCA 38.”

Except, COGFA does a pretty good job at estimating, as the post shows.

posted by Rich Miller

Friday, Apr 13, 18 @ 2:10 pm

Sorry, comments are closed at this time.

Previous Post: It’s just a bill

Next Post: Question of the day

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Now I’ve heard it all… IPI is basing it’s argument on a misleading use of numbers.

Comment by Concerned Dem Friday, Apr 13, 18 @ 2:17 pm

This is the corporate-funded IPI trying to delegitimize two formerly credible organizations. THis is very similar to attempt to delegitimize the CBO in DC.

The IPI’s motives are transparent, despicable and a threat to democratic self governance.

Comment by 47th Ward Friday, Apr 13, 18 @ 2:19 pm

So per Clayton’s analysis, the state’s dysfunction resulted in hundreds of millions in lost federal match revenue. We need to begin to discussion the “Dysfunction Tax” imposed by the ineptitude and brinksmanship. If only we’d had an amendatory veto that first year (and every year thereafter) by a person willing to “take the arrows”, be the grown up in the room and “make the tough choices” rather than the “he did it” approach we’ve witnessed under this Governor…..

Comment by Undiscovered country Friday, Apr 13, 18 @ 2:25 pm

Only in Illinois could missing the mark by over $100 million in 8 out of the last 10 years be considered a “pretty good job at estimating.”

Comment by Political Animal Friday, Apr 13, 18 @ 3:10 pm

===Only in Illinois===

Only in IPI Land is missing the mark by less than a point be grounds for blowing up the whole system.

Comment by Rich Miller Friday, Apr 13, 18 @ 3:13 pm

====Only in IPI Land is missing the mark by less than a point be grounds for blowing up the whole system.===

Dorm room perfection meets real world ignorance… IPI

Comment by Oswego Willy Friday, Apr 13, 18 @ 3:16 pm

Political Animal,

The state income tax rate changed four times since 2010. That means the estimators had to guess what the impact of the tax hike would be with lots of unknowns surrounding the economy, and doesn’t include the changes at the federal level.

Given all of that uncertainty and change, you rip them for being off by about 1%?

Comment by 47th Ward Friday, Apr 13, 18 @ 3:17 pm

This is laying down a marker. Why?

There’s a gotcha game afoot.

Could Rauner be laying the groundwork

To normalize bad numbers?

I don’t believe there is a rift between Rauner and IPI.

I believe the breakup was mostly theatrical. Am I wrong?

I really think that ideologically they are on the same page.

But why are they laying down this marker?

Comment by Honeybear Friday, Apr 13, 18 @ 3:35 pm

=== I don’t believe there is a rift between Rauner and IPI.===

Remove tinfoil hat.

Comment by Rich Miller Friday, Apr 13, 18 @ 3:36 pm

When estimating the future with lots of unknowns, 1% is great. Heck, I was happy when I got within 10% given some of the questionable inputs I had to work with.

If I have have to choose between IPI and COGFA estimates, I’ll take COGFA every time.

Comment by RNUG Friday, Apr 13, 18 @ 3:37 pm

==Only in IPI Land is missing the mark by less than a point be grounds for blowing up the whole system.==

They were off by $1.3B in FY16. That’s … not good.

Comment by headdesk Friday, Apr 13, 18 @ 3:38 pm

Is the National Association of State Budget Officers in “IPI Land”?

Comment by headdesk Friday, Apr 13, 18 @ 3:39 pm

Is it just me or is that Pew study Rich linked making the exact same point as IPI?

“No state can entirely eliminate forecasting errors. Unexpected economic turns, new legislation, the rise and fall in housing values, and changes in federal policy, such as the 2013 budget deficit reduction plan known as the “fiscal cliff,” guarantee that estimating revenue will always be imprecise.”

And…

“The increase in errors has not occurred because forecasters are any less adept than in the past. If anything, the science of estimating tax collections has improved markedly due to advances in information technology.”

Comment by Political Animal Friday, Apr 13, 18 @ 3:52 pm

===making the exact same point as IPI?===

If anything, it makes the point that COGFA does much better than the rest of the states.

Comment by Rich Miller Friday, Apr 13, 18 @ 3:54 pm

===They were off by $1.3B in FY16. That’s … not good===

You have obvious reading comprehension problems.

Comment by Rich Miller Friday, Apr 13, 18 @ 3:55 pm

. The point is that revenue estimating is a bad way to do budgeting.

So, instead, we should limit GRF ( only?) growth to the rate of increase in the state economy? Dorm room brilliance. Heres a recurring and refreshing thought–just follow the constitution. Ya know, bills, amendments, hearings, 30/60.

Comment by Langhorne Friday, Apr 13, 18 @ 4:09 pm

IPI goes after COGFA.

The shark has been jumped.

You know, Ec & Fisc never suffered these attacks.

Comment by Leigh John-Ella Friday, Apr 13, 18 @ 4:16 pm

===Dorm room brilliance===

It’s not a bad idea. I could even be for that. Their logic for why we should do it is flawed.

Comment by Rich Miller Friday, Apr 13, 18 @ 4:22 pm

IPI attacking COGFA is as credible as Blago / CMS / Rumman attacking OAG / Bill Holland!

Comment by Smitty Irving Friday, Apr 13, 18 @ 4:34 pm