Latest Post | Last 10 Posts | Archives

Previous Post: Senate leaders crow about bipartisan budget deal

Next Post: *** UPDATED x1 *** Moody’s warns against reducing pension contributions

Posted in:

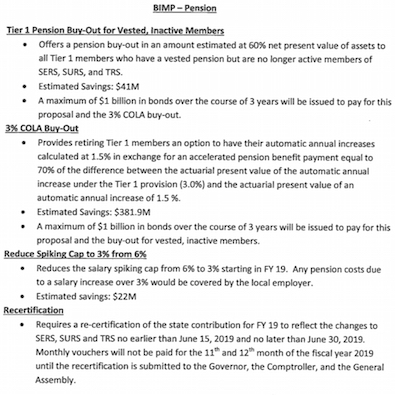

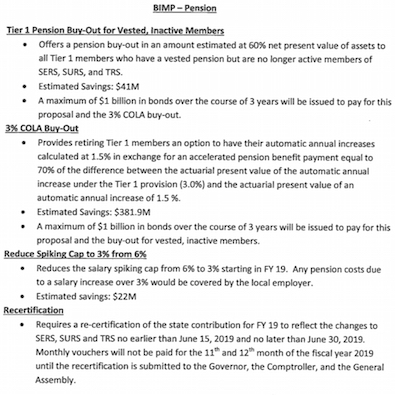

* Click the pic for a larger image of these internal legislative dot points…

I’m told the savings were calculated by the pension funds’ actuaries.

*** UPDATE *** From Rep. Mark Batinick (R-Plainfield)….

There are a lot of misconceptions about the pension buyouts. Let me clarify a few things:

Is the only savings the “haircut” annuitants take to get the lump sum?

No. Depending on the system, we have an expected rate of return of 7-7.25%. Therefore the unfunded portion of the shortfall grows at that amount each year. By bonding to buy people out of the system we are saving interest costs because we can sell bonds at less than 7% right now. The spread between 7-7.25% and whatever we sell the bonds for is additional long term savings.

Will anyone take the buyout?

When I introduced HB4427 in Jan 2016, buyouts had only been done in the private sector. But since then, Missouri passed a bill very simliar to the HB315 I filed last Jan. That bill is for vested inctives. In Missouri there was a 22% take-up rate. That is the take-up rate that is being used.

What is done with the money?

It does need to be rolled into a qualified retirement account. It will not be immediately taxed by the Feds. But, once it is in the account the annuitant can do with it whatever it wants to do.

What about negative-selection?

The reason there is a “time-window” for these buyouts is to limit negative selection. People have to decide quickly. Plus, at a haircut of 30%-40% we would have to have a whole bunch of sick people in the state to have to plan lose money.

posted by Rich Miller

Thursday, May 31, 18 @ 9:40 am

Sorry, comments are closed at this time.

Previous Post: Senate leaders crow about bipartisan budget deal

Next Post: *** UPDATED x1 *** Moody’s warns against reducing pension contributions

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

I’m guessing the demand for pension buyouts is way over-estimated, just like the private school scholarship tax credit.

The circumstances where a buyout favors the pensioneer are quite narrow.

Comment by wordslinger Thursday, May 31, 18 @ 9:44 am

The savings is way overestimated and minuscule in relation to the overall system debt. But it’s an election year, so everyone needs the sound byte for their commercials.

In the long run, this legislation has the potential to seriously depress already low wages in Illinois public schools. What kind of talent do they expect to draw in some areas of the state where wages start around 30k and can only grow by 3% each year?

Comment by Travel Guy Thursday, May 31, 18 @ 9:48 am

Will the buyouts be taxed as ordinary income?

Comment by a drop in Thursday, May 31, 18 @ 9:52 am

How many years did it take to be vested for the tier 1 people and what kind of deal would this be for them?

Comment by Spliff Thursday, May 31, 18 @ 9:53 am

Who wants 60% of what they could get? I don’t go to a restaurant and buy food, but tell them to give me 60% of what I ordered.

Comment by 360 Degree TurnAround Thursday, May 31, 18 @ 9:53 am

So, they raise teacher salaries and then penalized schools for raising teacher salaries. Got it.

Comment by Pot calling kettle Thursday, May 31, 18 @ 9:56 am

Good luck with enticing anyone to take them up on any of these options.

60% of the value for inactives? That is only a deal if it is more than what they put in which they can get 100% of less taxes.

If I understand correctly the 3% only applies to end of career increases. Which, in current times could be less than CPI which is awfully sweet of them. /S

Comment by JS Mill Thursday, May 31, 18 @ 9:57 am

You know, we didn’t hear a peep about that billion dollars in new debt that goes along with the pension “savings” until the skids were well greased for this clinker of a deal.

word, the buyouts may prove to be even less appealing when folks learn their proceeds can only be rolled into an IRA or similar tax-advantaged account, not used to buy a bass boat.

Comment by Arthur Andersen Thursday, May 31, 18 @ 9:58 am

I would think it would not be subject to Illinois tax as it is still described as a pension benefit. However, I would also think it could result in a higher federal tax rate due to the lump sum causing one to cross tax rate boundaries.

Any savings basically comes from the annuitant receiving less money overall, correct?

Comment by Thoughts Matter Thursday, May 31, 18 @ 10:01 am

== How many years did it take to be vested for the tier 1 people and what kind of deal would this be for them? ==

Vest in 8 years. They take a 30% haircut.

Comment by Anonymous Thursday, May 31, 18 @ 10:02 am

Never mind about the federal tax issue.? The IRA type requirements should negate that.

Comment by Thoughts Matter Thursday, May 31, 18 @ 10:02 am

There may not be many who opt for these pension modifications, but they at least seem to be reasonable offers of consideration as opposed to the ‘agree to this reduction or you’ll never get a raise’ plans. Although a small step, it is a step in the right direction, and more importantly likely to survive a court challenge.

Comment by Swift Thursday, May 31, 18 @ 10:06 am

The only advantage to taking a lump sum is if you are in poor health and don’t expect to live for an extended period, or if you believe your future payments could be at risk.

Perhaps the federal government would decide to let states declare bankruptcy, as municipalities can do today. May seem unlikely, but the federal government doesn’t want to be on the hook to bail out fiscally mismanaged states, like Illinois. That would make some pensioners a little nervous. Since states like Illinois are unwilling or incapable of addressing their fiscal disasters, the federal government should seriously start exploring this option.

Comment by SSL Thursday, May 31, 18 @ 10:06 am

I would like to know how the actuaries dealt with adverse selection. I would expect those with a short expected life span to take the buyout.

Comment by Last Bull Moose Thursday, May 31, 18 @ 10:06 am

I am curious about what they do if employees already have agreement in place with employers. For example, a teacher who is in fourth year of four year pension spike. Many districts have type of incentive in place. Any ideas?

Comment by Sparky791 Thursday, May 31, 18 @ 10:11 am

RNUG should guest post on this issue.

Comment by Blue Bayou Thursday, May 31, 18 @ 10:24 am

I have suggested pension buyouts for a long time, “its my money and I want it now.” There are two problems, people take the money, blow it, then go on state aid. Shift from one state obligation to another.

Two, in dealing with this issue on a regular basis, I can tell you with absolute certainty the State of Illinois does not have people employed that are intellectually capable of properly handling this.

Comment by the Patriot Thursday, May 31, 18 @ 10:26 am

Sparky, current agreements are exempt from the 3% cap (they stay at 6%) until expiration.

Comment by Arthur Andersen Thursday, May 31, 18 @ 10:26 am

BTW, there is no way to know which years will be the last before retirement, so the cap will be applied to everyone (as was the 6%).

Comment by Pot calling kettle Thursday, May 31, 18 @ 10:32 am

== I am curious about what they do if employees already have agreement in place with employers. For example, a teacher who is in fourth year of four year pension spike. Many districts have type of incentive in place. Any ideas?==

Short answer: Districts with contracts containing end of career salary spikes will incur the fairly onerous excess compensation TRS penalties.

Comment by Occam Thursday, May 31, 18 @ 10:39 am

I’m no actuary, but it looks like this plan saves $.5 B by borrowing $1 B. I think I remember an episode of Leave It To Beaver where Eddy Haskell used similar reasoning to pay his credit card bill.

Comment by Former Resident Thursday, May 31, 18 @ 10:44 am

Occam, that’s incorrect. The legislation excludes all existing contracts.

Comment by Juice Thursday, May 31, 18 @ 10:48 am

As long as current State employees have an option to retain the level of retirement benefits available when they joined a given retirement system, no problem legally. The choices provided will not benefit the vast majority of vested Tier 1 employees.

Comment by kitty Thursday, May 31, 18 @ 10:50 am

SSL: states can only authorize municipalities to declare bankruptcy. Only about half of them have done that. Illinois does not allow it.

Comment by GA Watcher Thursday, May 31, 18 @ 10:57 am

== RNUG should guest post on this issue. ==

Most all ‘ve f it has been proposed before and I’ve covered it before. Also, anon at 10:02 was I.

Comment by Anonymous Thursday, May 31, 18 @ 11:01 am

Translation: Moody’s believes the pension savings won’t happen, so don’t recalculate this year’s contribution

Comment by RNUG Thursday, May 31, 18 @ 11:07 am

The interesting thing about the COLA buyout is that it is money you can leave to your heirs. Right now heirs only get whatever is left of your contributions.

You may also want that lump sum as an insurance policy in the unlikely event the feds do allow state bankruptcy. I don’t think state bankruptcy will ever happen except maybe in an alternate universe where Donald Trump could be elected President.

Comment by A Jack Thursday, May 31, 18 @ 11:08 am

“But once it is in the account the annuitant can do with it whatever it wants to.”

That sentence sounds like it was written by a Luckybot 3000.

Yeah, “it” technically can do “whatever,” but not without major tax consequences.

Comment by Arthur Andersen Thursday, May 31, 18 @ 11:13 am

If it is allowed, rolling the lump sum to the State’s 457 Deferred Comp (SERS) might make a bit of sense. You can take money out of that 457 any time / any age after you leave government service. Still be federally taxed at withdrawal.

The other possibility would be if it qualified to move into a Roth IRA. Don’t think it would unless you paid Fed taxes on it.

I’d advise current employees against taking this deal, but if they do, get competent retirement planning and tax advice first.

Comment by RNUG Thursday, May 31, 18 @ 11:17 am

==I don’t go to a restaurant and buy food, but tell them to give me 60% of what I ordered.==

Unfortunately, Illinois has been the Cheesecake Factory of pensions.

Comment by City Zen Thursday, May 31, 18 @ 11:19 am

Huh. The “making money off positive arbitrage” benefit sure didn’t come up yesterday.

Comment by Arthur Andersen Thursday, May 31, 18 @ 11:25 am

Last year Batnick said there were about 60,000 “pension inactives” in the state who are vested but no longer working for the state or retired, so they are counting on about 13,000 taking this deal. I think that’s the same or more # who took the last ERI in 2002. http://www.sj-r.com/news/20170325/state-lawmakers-look-again-at-pension-buyouts

Comment by Six Degrees of Separation Thursday, May 31, 18 @ 11:39 am

Actually, 11,039 took the 2002 ERI.

http://www.ilga.gov/commission/cgfa/2006_June_ERI_Report.pdf

Comment by Six Degrees of Separation Thursday, May 31, 18 @ 11:43 am

One report had the State counting down n 22% of active Tier 1 take ng the AAI buyout.

Don’t see it happening.

Comment by RNUG Thursday, May 31, 18 @ 11:55 am

A gambling establishment, when establishing a new “game”, is going to set it up so that the house wins. The same is true, I believe, with these pension buyouts. Using the best information available and experienced and smart actuaries, the State (we hope) created these pension buyouts so that the house wins. Otherwise, what would be the point in making these offers? I can’t see that there would be too many win-win situations here. Anyone considering these buyouts should proceed with caution and do his homework well.

Comment by Nanker Phelge Thursday, May 31, 18 @ 11:56 am

They should have an ERI

Buy time and retire earlier

Comment by Anonymous Thursday, May 31, 18 @ 12:44 pm

“Is the only savings the “haircut” annuitants take to get the lump sum?

No.” I’d argue YES.

“Depending on the system, we have an expected rate of return of 7-7.25%. Therefore the unfunded portion of the shortfall grows at that amount each year.”

This is only true if you do not appropriate the actuarily required annual contribution. The unfunded liability grows based on the difference of the projected return on investment versus the actually realized return if it is less than projected (which it is). Unfunded liability is further compounded by inadequate annual actuarially required contributions. Bonding mitigates the annual underfunding to a certain degree but merely shifts the burden of payment to the bond obligation pot.

“By bonding to buy people out of the system we are saving interest costs because we can sell bonds at less than 7% right now. The spread between 7-7.25% and whatever we sell the bonds for is additional long term savings.”

Not really, as mentioned bonding merely mitigates some of the compounding effect from inadequate

annual actuarially required contributions. If the spread argument was valid, we should bond out the entire underfunded liability and argue about where to spend the windfall. Bonding is like taking out a home equity loan to pay bills you have been neglecting for a long time. It may be the responsible thing to do but when your pension bills are not accruing interest payments, you are not saving any money other than the haircut on principle payment the pensioner is owed.

Any “savings” derived from bonding result from recovering actual annual returns on investment of the actuarially required contribution forfeited by inadequate funding versus the annual bond interest payment and issuing costs for the bonding.

An unrealistically high projected return on investment artificially lowers unfunded liability and artificially increases projected savings for this plan. That said, making good on your obligations is the right thing to do.

Comment by Markus Thursday, May 31, 18 @ 12:47 pm

*Markus* “your pension bills are not accruing interest payments”

Our unfunded pension liability is accruing interest. Most of our pension payment is interest. Our ongoing cost is only a couple billion.

Comment by Anonymous Thursday, May 31, 18 @ 1:20 pm

Reduction doubtful too many interest look at SbB119,no savings there just an ilusion of a cut with a major gain.

Comment by Annoyance Thursday, May 31, 18 @ 2:04 pm

RNUG maybe you know this in relation to a lump sum and Social Security rules. Under current rules the benefit from the government pension and there is no Social Security or limited Social Security contribution could result in a reduction or elimination of spousal benefits through Social Security. If a person takes the lump sum and did not contribute to Social Security will the lump sum receipt negate the impact of Government Pension Offset/Windfall Elimination Provision under Social Security rules or would this still be a factor?

Comment by illinifan Thursday, May 31, 18 @ 2:21 pm

*Anonymous*- You are confusing the calculated future pension payment obligations with “interest”. There is no interest owed on the unfunded liability. The pension liability is the amount owed to each pensioner calculated over their projected lifespan. None of that amount is interest. The unfunded liability is the difference between the total amount owed and the balance residing in the pension funds. Again, none of which is interest. Projected return on investment for the pension fund balances is part of the calculation to determine the current pension fund balances required for the pension plan to be considered fully funded.

What you are considering as “interest” is really the compounding effect of not paying your bills. That includes the principal amount never paid when due and the forfeited additional value that principal would have earned if the pension payment obligation was paid when due and invested.

Comment by Markus Thursday, May 31, 18 @ 2:49 pm

-illinifan-

I don’t know for sure. The various offset rules can get complicated.

You will remember that I do advise people to get professional advice on those kinds of issues and tax implications.

Comment by RNUG Thursday, May 31, 18 @ 2:54 pm

== Our unfunded pension liability is accruing interest. Most of our pension payment is interest. ==

While everyone refers to it as interest, it is actually lack of investment returns due to the missing capital that wasn’t there to invest. And that is the majority of the annual State payements to the 5 pension funds.

Comment by RNUG Thursday, May 31, 18 @ 2:58 pm

Took a look at SSA POMS and it may not negate GPO/WEP. Like you said RNUG it is complex. If folks take the lump sum like RNUG says talk to experts as this could be a major pitfall (no monthly benefit/no AAI/no Social Security).

Comment by illinfan Thursday, May 31, 18 @ 3:15 pm

It’s simple

If the state is in favor for it and it saves the state money…

Then it’s bound to bad for the employee

Money saved to the state is money taken from the employee

Comment by Anonymous Thursday, May 31, 18 @ 3:30 pm

== Took a look at SSA POMS and it may not negate GPO/WEP. ==

Hate trying to figure it out from policy guidelines and administrative rulings. Rarely seems to be black or white. Probably won’t happen, but if it was me, I would try to get any interpetation from the SSA in writing.

Comment by RNUG Thursday, May 31, 18 @ 3:43 pm

Here’s a curve ball on the ‘consideration’ issue: by forcing retirees to take a 40% cut to their pension funds being released early, the State is still diminishing or imparing the retirees pensions. The State is trying to have its cake and eat it too. Now if the State refunds 100% of all employee contributions it might have a leg to stand on by arguing that they allowed voluntary withdrawal from the affected pension plans. Otherwise it’s back through the courts again with the same answer highly likely.

Comment by revvedup Thursday, May 31, 18 @ 5:54 pm

===by forcing retirees===

It’s voluntary.

Comment by Rich Miller Thursday, May 31, 18 @ 6:09 pm

People are focusing on the haircut which is optional. The real killer here is the spike cap moving to 3% from 6%. Many districts have applied the 6% cap to all salaries since one can’t be sure who is retiring. In districts with a salary schedule (most districts), the cap is applied to the total salary increase which includes both the COLA applied to the entire schedule and the step for those receiving it. With the cap changing to 3%, it is hard to see how step increases can continue if district view the spike cap as a cap on all raises (as many have with the 6% cap). This means that a new teacher will just get 3% raises maximum even if they get promoted or get an additional degree. There will be almost no way for a teacher starting in the future to make a good middle class living 30 years from now. These people who be most hurt by this cap are not even Tier 1 employees so they are going to be punished to save money on pensions that they already were never going to be eligible for. I really think lawmakers have not thought through the unintended consequences of the “spike cap”.

Comment by Joliet Orange Sox Thursday, May 31, 18 @ 11:19 pm

Joliet - Most teacher contracts state these 6% salary increases are available only after the teacher provides an irrevocable, advance written notice of an intent to retire. Any other raises should not be impacted by this.

Comment by City Zen Friday, Jun 1, 18 @ 9:09 am

Joliet, in short, you are completely wrong. The salary caps, now and prospectively, only apply if a school year’s salary is going to be included in the final average salary for pension calculation purposes. The entire idea behind offering the 6% payments is to encourage teachers to provide the district with the longest possible advance notice of their intent to retire.

Comment by Arthur Andersen Friday, Jun 1, 18 @ 9:19 am

==encourage teachers to provide the district with the longest possible advance notice of their intent to retire.==

Why school districts need a 2-4 year notice to fill a vacancy is another matter…

Comment by City Zen Friday, Jun 1, 18 @ 9:38 am

To my - revvedup - Thursday, May 31, 18 @ 5:54 pm (and Rich’s reply): Yes, the withdrawal from pension plan is voluntary, and upon further review, I argued the wrong point.

My correction, which may still get the State dragged into court, involves the 40% “haircut”. Now the example: If I want, I can withdraw 100% of my IMRF* contributions, and I forfeit my right to a pension. Why should State employees be denied the same right to 100% of their contributions?

*IMRF covers non-State (municipal) employees, and the State only gives IMRF an operating appropriation; the State does not contribute to the pension fund.

Comment by revvedup Friday, Jun 1, 18 @ 9:50 am

Wordslinger — not sure where you get that tax credit scholarship demand is overestimated when there are over 60,000 kids who applied for them. These are hard facts, recorded through online portals. Parents want the best option for their kids and it is a no-brainer that just like all of us, low income parents too want access to quality private schools too.

Comment by Ed Equity Friday, Jun 1, 18 @ 1:14 pm

I am basing my previous comment on my experience, yours may be different. I have led negotiations for an IFT Council several times. We have had no real issues with the 6% spike cap for teachers who are planning to retire. However, the district has been very concerned about ANY teacher getting more than a 6% overall raise. Talking to the local, this happens at many districts. I understand the intent of the law is only limit those teachers who are in their final four years. The problem is that the district can honestly say it is hard to know with certainty that someone is not in their best 4 consecutive years. I understand the circumstances under which a 35 year old is in his/her best 4 consecutive years to count toward a pension are rare but the district can point out that those circumstances do exist. If you are in a district that has not had the board and administration very concerned about the 6% rule (soon to be 3% rule) for all teachers, consider yourself fortunate.

Comment by Joliet Orange Sox Friday, Jun 1, 18 @ 2:50 pm