Latest Post | Last 10 Posts | Archives

Previous Post: Kanye West contributes to Chance-backed mayoral candidate Amara Enyia

Next Post: *** LIVE COVERAGE ***

Posted in:

* Institute on Taxation and Economic Policy…

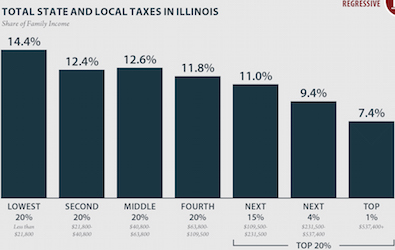

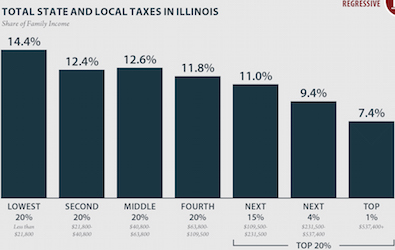

According to ITEP’s Tax Inequality Index, Illinois has the 8th most unfair state and local tax system in the country.

* Click the pics for larger images…

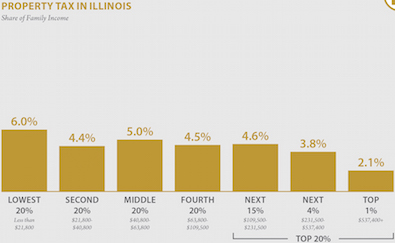

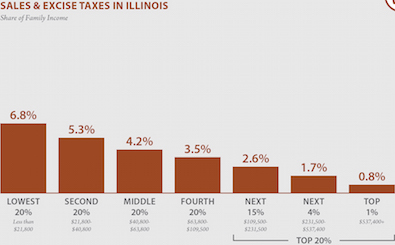

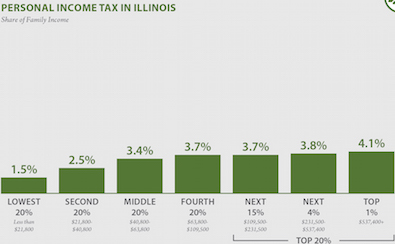

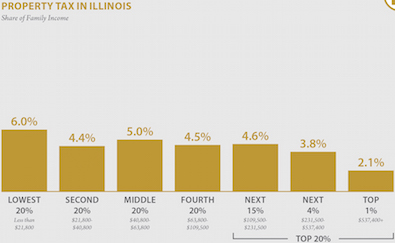

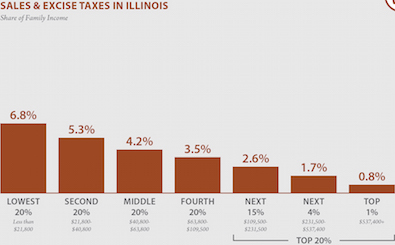

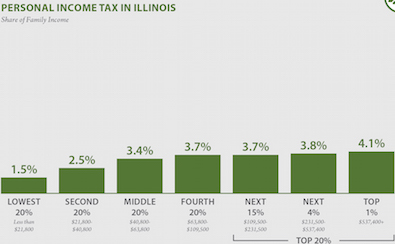

According to ITEP, these are non-elderly households and the figures do not include the 2017 federal limits on SALT deductions.

posted by Rich Miller

Monday, Oct 22, 18 @ 3:19 pm

Sorry, comments are closed at this time.

Previous Post: Kanye West contributes to Chance-backed mayoral candidate Amara Enyia

Next Post: *** LIVE COVERAGE ***

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

That’s the system Bruce Rauner wants to defend, folks.

Comment by Arsenal Monday, Oct 22, 18 @ 3:23 pm

Oh please, Gov. Messiah Complex, save your One Percenters from the traitor to his class, the Mercedes Marxist and his graduated income tax.

Seriously, the Pritzker people couldn’t have come up with this?

Comment by wordslinger Monday, Oct 22, 18 @ 3:27 pm

==these are non-elderly households==

For obvious reasons.

Comment by City Zen Monday, Oct 22, 18 @ 3:35 pm

If you think that the state’s regressive tax structure began with Rauner, you’re part of the problem.

Comment by Mt Monday, Oct 22, 18 @ 3:41 pm

@Monday Rauner is campaigning to keep the existing flat tax in place. Please keep up.

Comment by The Dude Abides Monday, Oct 22, 18 @ 3:44 pm

If you think that the state’s regressive tax structure began with Rauner, you’re part of the problem.

Well, you demolished that straw man.

Comment by Ole' Nelson Monday, Oct 22, 18 @ 3:44 pm

Good documentation of something Illinoisans alert to taxation policy can understand.

Honestly, regressive taxes bad, progressive taxes good - if you want a society anywhere near approaching economic equality, that is.

If you don’t, then the current system is working okay, although I suppose it could be made even more regressive - IL should be no. 1 in something, after all. /s

Comment by dbk Monday, Oct 22, 18 @ 3:45 pm

This is again why we need to right-size state income taxes to get more revenue from the top 1%, who could most easily afford it. But Rauner and the ILGOP are not change people.

Comment by Grandson of Man Monday, Oct 22, 18 @ 3:57 pm

Real takeaway here is how much the state is already taking from households. Guessing most of these numbers will be in the mid to high teens by the time JB is done

Comment by Sportscenter Monday, Oct 22, 18 @ 4:00 pm

Helps explain why Pritzker can’t say what the rates ought to be. I think it has to depend on how you want to treat sales taxes and a fairer way of taxing property (if one exists). Setting income tax rates before you adjust for other taxes won’t help make overall taxes less regressive. But it is certainly part of the solution.

Comment by 47th Ward Monday, Oct 22, 18 @ 4:07 pm

It is useful and interesting. I think it should present some data for the elderly population. How about exactly the same charts but for the elderly only? Income and taxes would be fascinating, especially since we’re talking about taxing retirement income.

Comment by NoGifts Monday, Oct 22, 18 @ 4:07 pm

===especially since we’re talking about taxing retirement income===

Nobody, but nobody running for office in this state is talking about that.

Comment by Rich Miller Monday, Oct 22, 18 @ 4:08 pm

May try to dig deeper into this. It looks like 70% of the lower 20% income is not subject to Illinois income tax. Are they including non-taxable things like rent subsidies in income?

How do they calculate property tax on rented housing?

The sales tax figures seem questionable. With a 10% sales tax rate, they have to spend 68% of their family income on taxable items. Hard to do that when spending so much on rent that 6% of your income goes to property taxes.

They may be able to justify the numbers, but my initial reaction is the numbers are squirrelly.

Comment by Last Bull Moose Monday, Oct 22, 18 @ 4:09 pm

“Guessing most of these numbers will be in the mid to high teens by the time JB is done.”

That is correct. You are guessing.

Comment by Montrose Monday, Oct 22, 18 @ 4:12 pm

Anyone out there willing to wager that when it’s all said and done ,JB settles for nothing other than an increase to the base income tax rate? Property tax formula stays the same?

Comment by Blue Dog Dem Monday, Oct 22, 18 @ 4:18 pm

I believe if we simply inverted the rates so that instead of the lowest income people paying 14% and the highest 7%, and flipped the percentages on the other quintiles we would have sufficient revenue.

Should make conservatives happy. Rates stay the same and those who can best afford it pay the most for education, health care, public safety and other public services.

Tell me why that’s not fair.

Comment by Truthteller Monday, Oct 22, 18 @ 4:19 pm

Guess I just missed all the times the Democrats brought this to the floor in Springfield and had it shot down by those mean, regressive Republicans or how they tried to get the constitutional amendment on the ballot for this election.

I guess along with missing all of the state reps and state senators up for election and re-election who are running on this issue. Mine said at an event it wasn’t her decision to make….

Comment by OneMan Monday, Oct 22, 18 @ 4:19 pm

===That is correct. You are guessing.===

That… is Restaurant Quality.

To the Post,

I think - 47th Ward - is onto something important;

===I think it has to depend on how you want to treat sales taxes and a fairer way of taxing property (if one exists). Setting income tax rates before you adjust for other taxes won’t help make overall taxes less regressive.===

Here’s why, for me…

If there are mixes of raised revenues, along with some bonding, or legal medical marijuana, or sports gambling.., the revenue picture takes shape and while it might go up until 2021, if there is a progressive income tax, when it goes on that ballot in 2020, the policy will have a much broader picture in the revenue area and if Pritzker can get this bipartisan, that’s cooking with some serious gas.

That’s governing.

The problem is Pritzker signed on to an exacting progressive income tax where his signing on made the boxing into exacting rates tougher to politically discuss without digging a deeper hole. That’s what happens when you politic the policy outside where wonks play. Ask “1.4% or $500+ million” politics about policy half baked.

Pritzker can figure this out, pivoting of Thompson’s move after winning will be the first step.

We need governing.

Comment by Oswego Willy Monday, Oct 22, 18 @ 4:20 pm

“That is correct. You are guessing.”

Maybe JB can clear some of those rates up for us?

Comment by Phenomynous Monday, Oct 22, 18 @ 4:21 pm

===Maybe JB can clear some of those rates up for us?==

“Campaign in Poetry, Govern in Prose”

By its sheer design, a progression income tax is about exacting numbers, boxing in those wading in that pool.

Unforced policy “oopsie”.

Comment by Oswego Willy Monday, Oct 22, 18 @ 4:23 pm

Maybe we will settle for a progressive income tax on par with Missora.

Comment by Blue Dog Dem Monday, Oct 22, 18 @ 4:28 pm

“Guess I just missed all the times the Democrats brought this to the floor in Springfield and had it shot down by those mean, regressive Republicans or how they tried to get the constitutional amendment on the ballot for this election.”

The Democratic House supermajority failed to pass the CA, thanks to Franks and Drury (and maybe Dunkin and/or a few other Dems). Zero House Republicans voted for it. What was the prize? A regressive flat tax hike.

Comment by Grandson of Man Monday, Oct 22, 18 @ 4:34 pm

= Guess I just missed all the times the Democrats brought this to the floor in Springfield and had it shot down by those mean, regressive Republicans or how they tried to get the constitutional amendment on the ballot for this election. =

Speaker Madigan attempted to run the “millionaire’s tax” in the 99th General Assembly - when he had 71 Democrats - and it failed on a 68-47 vote. Drury and Franks voted no, Dunkin was conspicuously absent. Maybe the Speaker’s motives were questionable, but a graduated income tax of any form can only be put in front of voters if the legislature approves.

Had any form of a progressive income tax proposal been attempted during the 100th, with only 67 Dems, it likely would have received no more than 66 votes (assuming another no from Drury). At that rate, what would have been the point?

Comment by cover Monday, Oct 22, 18 @ 4:36 pm

The study cites that 45 states have regressive tax structures. Even Oregon, with a very progressive income tax structure and no state sales tax, is labeled regressive.

The elephant in the room is property taxes. For those who think a progressive income tax will solve the issue, take a look at the total tax burden Delaware, one of the 5 progressive states, across all income levels.

Overall, interesting stuff from ITEP.

Comment by City Zen Monday, Oct 22, 18 @ 4:42 pm

Capping the SALT deduction will have a major impact on this discussion when people get their tax bills next year.

It will be a big tax increase on the same households the progressive tax is going after, and I am not sure what the appetite is going to be for it at that point.

The IRS isn’t accepting any work arounds so at least until 2021 we are stuck with the increased taxes capping SALT brings.

In many ways the timing is terrible luck for JB because it represents a big tax increase on Illinois tax payers of means and yet Illinois gets none of the benefit from the increase.

People are going to feel like they already got hit with a big increase even though it does nothing for the state.

That will absolutely have an effect on JB’s push for another big tax increase on that crowd (many of whom won’t see themselves as “rich” at all).

The SALT cap is the elephant in the room that no one ever talks about or factors in to these discussions, but it will make itself a factor next year when people start getting their tax bills.

I can only imagine what the messaging will look like when they tell people that their increased taxes really weren’t a tax increase, so it should have no effect on the push for a progressive tax.

Comment by Anon Monday, Oct 22, 18 @ 4:48 pm

Everyone’s complaining about Pritzker’s lack of specificity on a graduated tax.

How about some specifics on where the GOP would cut if there isn’t more revenue.

And how about explaining why the upside down tax structure we have is fairer than a progressive one

Comment by Truthteller Monday, Oct 22, 18 @ 4:51 pm

There are several components to this that need to be sorted out, beyond just a graduated income tax. An overall progressive, as opposed to regressive tax structure includes the relative mix of all three tax types. Property taxes, which are essentially a flat tax, can be made more progressive with income-based exemptions. This is also what is proposed as a proxy for a graduated income tax until an amendment is passed. Sales taxes are mostly regressive. So to improve our overall score, we need to lower our reliance on sales taxes which means we need to raise even more from income taxes. Same with property taxes in that if the state more fully funded schools, we could see overall property tax burdens fall. And we need to look at who is paying shares of the tax base. Large corporations (Motorola, McDonalds, etc) typically pay miniscule income tax because they claim a variety of deductions and exemptions. So we have to look at what each component of the taxpayer base (rich v. poor, business v. individual) is currently contributing and determine if we want to change that as well.

If we are really going to open up to make unpopular changes, and why not since the amount of pushback on income tax changes is going to be huge, then let’s do the whole shebang. How many more groups can we honk off anyway?

Comment by eva0r89 Monday, Oct 22, 18 @ 4:52 pm

How can you uncritically post this nonsense without any of the responses from serious researchers pointing out what nonsense this is?

https://ussanews.com/News1//News1/2018/10/18/who-pays-doesnt-tell-us-much-about-who-actually-pays-state-taxes/

Comment by Political Animal Monday, Oct 22, 18 @ 5:16 pm

So the constitutional amendment came to the floor? Seriously, when did that happen? Because wikipedia says it didn’t.

https://en.wikipedia.org/wiki/Illinois_Fair_Tax

The millionaire thing did

The revenue committee has 11 members

http://www.ilga.gov/house/committees/members.asp?CommitteeID=1951&GA=100

And had 11 members in the 98th GA

http://www.ilga.gov/house/committees/members.asp?CommitteeID=1951&GA=98

It had 7 Ds and 4Rs, nearly half the Ds voted no (3 of 7), but because the 4 Rs didn’t vote for it, it is the Rs fault…

Got it.

Looked up Senate Joint 40 from the 98th GA, it also died Sine Die. It did make it out of subcommittee on a 2 1 vote, that is as far as it went.

So obviously a lot of Democrats were pushing hard for it.

Comment by OneMan Monday, Oct 22, 18 @ 5:16 pm

Rich, the Tax Foundation outlined a number of issues with this study that should be noted. https://taxfoundation.org/itep-who-pays-analysis/

Comment by Anonymous Monday, Oct 22, 18 @ 5:49 pm

If you look at the charts it is the flat income tax that is the most progressive feature in the Illinois tax picture. It’s the only category shown where the rich pay a higher percentage of their income than the poor. The top 1% pays three times the percentage of total income compared to the bottom 20% (1.5% compared to 4.6% at the top). That’s due to the effect of the personal exemption and EITC.

The regressive impact of the high property tax completely negates any progressive advantage from the income tax credits. Because property taxes are so high they contribute a lot more to housing expenses than they would in other states. Since the poor spend a higher proportion of their income on housing than the rich they pat a bigger fraction (6.0% compared to 2.0% for the top 1%).

The impact of the narrow sales tax only makes things worse (6.8% for the lowest wage group compared to 0.8% for the top 1%). The poor are far more likely to be do-it-yourselfers by necessity than the wealthy who can afford to pay someone else to do the work. But in Illinois a DIY project collects the full sales tax, while most services collect no sales tax and the service company’s tax for materials consumed can often be deducted from the company’s earnings.

What a progressive income tax will do is try to compensate for the other more regressive weaknesses in the Illinois tax system. Why not start with the most regressive parts first?

Comment by muon Monday, Oct 22, 18 @ 6:29 pm

–Capping the SALT deduction will have a major impact on this discussion when people get their tax bills next year.–

That was the plan. To have the discussion “next year.”

Roskam is counting on it.

Comment by wordslinger Monday, Oct 22, 18 @ 6:36 pm

It was the millionaire surcharge that failed in the House, with a Democratic supermajority, so my bad. No Republicans voted for it, and some peddled the same old bogus right wing scare tactics, that millionaires would leave Illinois as well as it would hurt “job creators.”

Comment by Grandson of Man Monday, Oct 22, 18 @ 6:41 pm

I get tired of hearing that excise taxes are necessarily regressive. The first excise tax I ever paid was a 2-% federal tax on jewelry, left over from the Korean War. Hardly regressive.

Comment by Last Bull Moose Monday, Oct 22, 18 @ 7:22 pm

According to this data, if Illinois were like everyone’s favorite Minnesota, someone earning $225,000 would pay 1.5% less of their family income towards taxes. So when we adopt Minnesota’s progressive tax rate, Mr. and Mrs. $225K can expect a tax refund of $3,375.

Truly magical.

Comment by City Zen Monday, Oct 22, 18 @ 8:43 pm

BS charts % of income. How about total dollars. Would be off the chart. State income tax may be “low” but you are telling me CHICAGO property and sales tax doesn’t “correct” that. Nope. Taxing a bunch of farmers isn’t going make anything fair.

Comment by 44th Monday, Oct 22, 18 @ 10:12 pm

People want the government to fix things but don’t want to give the government the money to actually do it

Comment by Ihatepolitics Tuesday, Oct 23, 18 @ 12:51 am

all the more reason to restructure state income flat tax into a progressive tax rate

Comment by truthteller Tuesday, Oct 23, 18 @ 6:01 am

Sangamon County will have a school referendum 1% sales tax increase on the ballot. There is an area by the name of Legacy Pointe where retailer Scheels is located. If passed, the sales tax there will be 10.75%, other places 9.75%.

So, combine sales tax, the ever increasing real estate taxes, the now almost 5% state income tax and tell everybody how IL needs a progressive income tax.

Good grief!

Comment by Pick a Name Tuesday, Oct 23, 18 @ 6:49 am

–Capping the SALT deduction will have a major impact on this discussion when people get their tax bills next year.–

Keep in mind, the SALT deduction was also regressive. Higher earners were far more likely to be itemizing, and were saving at a higher rate when they did.

Comment by Andyillini Tuesday, Oct 23, 18 @ 8:27 am

The late Rep. Mike Smith had a proposed constitutional amendment (HJRCA 42) that would’ve raised the income tax rate on incomes over $250,000. It came up for a vote on April 10, 2008, and lost 52-60. There were no GOP yes votes.

Comment by anon2 Tuesday, Oct 23, 18 @ 10:17 am

@City Zen on why the report excludes elderly taxpayers:

Which taxpayers are included in Who Pays?

The report’s universe of taxpayers includes most, but not all, residents of each state. We exclude elderly taxpayers because state tax structures routinely treat elderly families more generously than other families; for this reason, including seniors in distributional analyses of state tax systems can present an inaccurate view of how tax systems affect most families. Additional discussion of elderly taxpayers is available in the report’s methodology, starting on page 137.

Comment by Lisa Tuesday, Oct 23, 18 @ 3:12 pm

@Last Bull Moose

“May try to dig deeper into this. It looks like 70% of the lower 20% income is not subject to Illinois income tax. Are they including non-taxable things like rent subsidies in income?

How do they calculate property tax on rented housing?

The sales tax figures seem questionable. With a 10% sales tax rate, they have to spend 68% of their family income on taxable items. Hard to do that when spending so much on rent that 6% of your income goes to property taxes.

They may be able to justify the numbers, but my initial reaction is the numbers are squirrelly.”

Find a lot of answers to your questions about what is included in income and sale tax incidence calculations here: https://itep.org/about-who-pays/

In terms of rent, property taxes on rental properties are distributed partly

to property owners and partly to tenants (assumed by the latter in the form of higher rent).

Comment by Lisa Tuesday, Oct 23, 18 @ 3:20 pm

@Political Animal–

The Tax Foundation’s criticisms of the report are highly problematic for the following reasons:

•Factually inaccurate. If these “serious researchers” had bothered to read the report text or methodology, they would have learned that some of their criticisms are plainly erroneous (e.g., the report includes estate and inheritance taxes).

•Contradictory. Different Tax Foundation staff made these contradictory arugments within a matter of hours of each other:

o Jared argued: “Two highly progressive taxes–the corporate income tax and property taxes on businesses–barely show up in ITEP’s analysis. Little wonder ITEP finds that state tax codes are almost invariably regressive, when the study functionally omits some of the most progressive provisions.”

o Kyle argued: “some states levy taxes that are easily shifted to out-of-state residents. It makes sense that these are not included in a state’s distributional table”

•Unsupported by the literature. Tax Foundation claims that taxes omitted from the ITEP report are “highly progressive” unsupported by any facutal basis for doing so.

•Mischaracterizations:

o Annual tax incidence is the standard lens. It is not “controversial.” Between the two, lifetime analysis is less common lens.

o ITEP’s database is calibrated to match published IRS data from 2015, not 1988.

• Distractions. E.g., Why not expand your study of state and local tax systems to be a federal study as well?

Comment by Lisa Tuesday, Oct 23, 18 @ 3:35 pm

@44th

There are many different ways of measuring tax burden–effective tax rates (percent of income) is important to gauge the impact of individual taxpayers ability relative ability to consume/save post taxes if one is sensitive to economic/political/moral concerns about ability to pay. Yes, when you look at total $s paid, obviously richer taxpayers pay more in total dollars. The more meaningful metric if you want to compare aggregate dollars by income group is to compare share of total taxes to share of total income.

The only group in Illinois that pays a smaller share of total taxes than they have in income is the Top 20%.

Bottom 20%: Has 3% total income; pays 3% total taxes

2nd 20%: Has 7% total income; pays 8% total taxes

Middle 20%: Has 12% total income; pays 14% total taxes

4th 20%: Has 19% total income; pays 21% total taxes

Next 15%: Has 25% of total income; pays 25% of total taxes

Next 4%: Has 15% of total income; pays 13% of total taxes

Top 1: Has 19% of total income; pays 15% of total taxes

Comment by Lisa Tuesday, Oct 23, 18 @ 3:51 pm