Latest Post | Last 10 Posts | Archives

Previous Post: SUBSCRIBERS ONLY - Today’s edition of Capitol Fax (use all CAPS in password)

Next Post: Rep. Hammond wants WIU’s state money released, but what money?

Posted in:

The following is a paid advertisement.

Gov. J.B. Pritzker claims one of the reasons Illinois should axe its flat income tax protection is to reduce income inequality.

The numbers aren’t on his side.

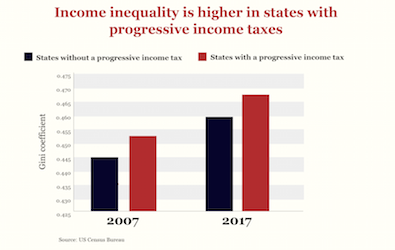

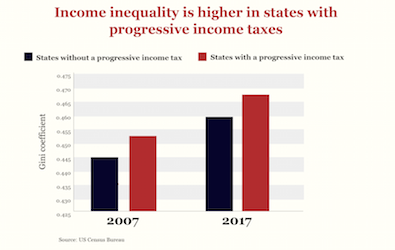

States with progressive income taxes are home to higher income inequality than states without progressive income taxes. And the gap isn’t improving. From 2007 to 2017, states with and without progressive income taxes saw inequality rise at the same rate.

So why hasn’t Pritzker’s preferred tax regime reduced income inequality? One reason is that progressive income taxes have such a negative effect on the economy that they tend to make everyone worse off. Take Connecticut, the only state in the past 30 years to adopt a progressive income tax. Its poverty rate spiked 47 percent in the decade after its tax change while falling in the rest of the nation.

Not only will Pritzker’s progressive tax result in middle-class tax hikes – it won’t do a thing about income inequality.

posted by Advertising Department

Thursday, Mar 7, 19 @ 9:32 am

Sorry, comments are closed at this time.

Previous Post: SUBSCRIBERS ONLY - Today’s edition of Capitol Fax (use all CAPS in password)

Next Post: Rep. Hammond wants WIU’s state money released, but what money?

WordPress Mobile Edition available at alexking.org.

powered by WordPress.