Latest Post | Last 10 Posts | Archives

Previous Post: It’s just a bill

Next Post: 800 Solar Projects Waitlisted Across Illinois Because Of The Renewable Funding Cliff

Posted in:

* From Local 150…

This morning, Senators Martin Sandoval (D-Chicago) was joined by a bipartisan group of leaders from government, commerce, organized labor, and the construction industry to announce legislation that will produce approximately $2.4 billion in annual funding for transportation infrastructure throughout the state of Illinois.

Sandoval stated that this funding is necessary to boost the safety of Illinois’ roads, bridges, and transit systems. “We have been underfunding our transportation infrastructure for decades,” said Sen. Sandoval, “and the end result is that we now have pothole-ridden roads that we can’t afford to fix and more than 2,300 bridges rated as ‘structurally deficient.’ This problem has been left to worsen for too long, and now is the tie for leadership and decisive action.”

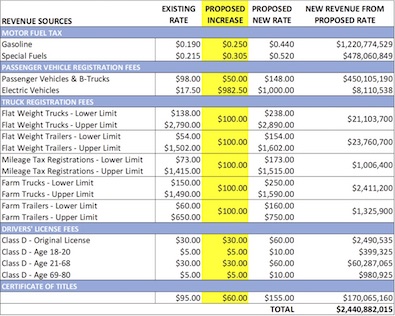

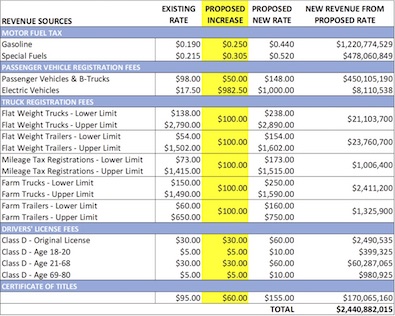

HB3233 will provide the additional funding through increases to Illinois’ motor fuel tax on gasoline and special fuels, vehicle registration fees, driver licensing fees and title certificate fees. The current state tax on gasoline – which has remained at 19 cents per gallon since 1990 – would increase to 44 cents on July 1, 2019. This increase alone would create more than $1.2 billion in additional annual revenue. To offset the increase in special fuel tax rates, the legislation will eliminate the current Commercial Distribution Fee, a tax on all trucks. (Click to view bill summary)

Fuel tax rates will also be indexed to inflation to keep pace with rising costs. Since Illinois last adjusted its fuel tax in 1990, the state’s infrastructure purchase power has been continually diminished by inflation and increased efficiency. A long-term funding solution will allow state agencies to plan projects well into the future.

Sen. Don DeWitte (R- West Dundee), who serves as the Minority Spokesman for the Senate Transportation Committee, attended the press conference as a show of Republican bipartisan support and discussed the need for an infrastructure plan that would be sustainable for years to come. “The proposal put forth today is a good starting point as we work toward a comprehensive infrastructure plan that addresses the critical needs facing our state’s transportation, education and public facilities,” said DeWitte.

The legislation also creates the Illinois Works job program that will help community-based organizations recruit and prepare the next generation of Illinois’ workforce for apprentice training programs. The legislation will encourage the use of apprentice training and provide incentives for contractors to utilize minority, female and veteran workers.

“Illinois has some of the most advanced career training programs in the world,” said Marc Poulos, executive director of the Indiana-Illinois-Iowa Foundation for Fair Contracting. “Our ailing infrastructure demands repair and maintenance, and by addressing that problem, we can also put a generation of Illinois workers into good-paying careers with ongoing education, healthcare, and retirement benefits. Illinois’ workforce will see substantial benefits from this much-needed investment.”

“Almost 20 percent of Illinois’ public roads are in ‘poor’ condition,” said Mark Barkowski, senior vice president of F.H. Paschen and chairman of the Illinois Road and Transportation Builders Association. “The safety of our infrastructure has suffered from the lack of investment, and the deficiencies are on display across the state. Much of the repair work that has been done is temporary, and the time for permanent fixes is now.”

“Infrastructure’s impact upon Illinois’ economy cannot be ignored,” said Tyler Power, director of government affairs for the Quad Cities Chamber of Commerce. “Illinois is the commercial hub of the nation, and our economic strength relies upon being able to transport goods safely and quickly through the state. This legislation would fund the kind of infrastructure investment that will pay massive dividends across all sectors of our economy.”

HB 3233 will offer flexible funding opportunities to the Regional Transit Authority and allow municipalities to generate infrastructure revenue. A new project selection process will prioritize the most needed transportation and transit infrastructure projects.

* Check out all the tax and fee hikes. The Motor Fuel Tax would rise by 25 cents per gallon, to 44 cents. Vehicle registration fees would be increased by $50 a year. Drivers’ license fees, title fees and electric car and all truck registration fees would be increased…

And that doesn’t include paying for “vertical” projects.

posted by Rich Miller

Wednesday, May 8, 19 @ 12:19 pm

Sorry, comments are closed at this time.

Previous Post: It’s just a bill

Next Post: 800 Solar Projects Waitlisted Across Illinois Because Of The Renewable Funding Cliff

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

–Sen. Don DeWitte (R- West Dundee), who serves as the Minority Spokesman for the Senate Transportation Committee, attended the press conference as a show of Republican bipartisan support…–

It will be interesting to see how deep that bipartisan support is. The No-Tough-Votes-Ever factions are pretty strong in the GOP caucuses.

Comment by wordslinger Wednesday, May 8, 19 @ 12:26 pm

I wonder if “electric vehicle” includes hybrids?

I also did some quick math. The $1,000 fee on electrics is way more than the amount of tax that would be collected from a regular car that gets 30 mpg driven 15,000 miles/year at $3/gallon. (I came up with $660 in gas tax.)

Comment by Lefty Lefty Wednesday, May 8, 19 @ 12:29 pm

A pox on the houses of electric car drivers, huh.

Comment by lakeside Wednesday, May 8, 19 @ 12:30 pm

This January I paid $101 to register a vehicle, not $98. Has it gone down $3 since January 31st?

Comment by Anyone Remember Wednesday, May 8, 19 @ 12:32 pm

===It will be interesting to see how deep that bipartisan support is===

He’s a 150 guy.

Comment by Rich Miller Wednesday, May 8, 19 @ 12:33 pm

Local 150 is back trying to be a bridge, when not trying to work cranes or bulldozers to create something like a bridge.

Infrastructure is bipartisan.

You really don’t wanna be the GA member not invited to a ribbon cutting or shovel picture because you were Red on an infrastructure bill that can be passed and signed.

Plus… a tangible thing that makes lives or transportation better… tough to be Red.

We’ll see if the “Caucuses of No” realize all this too.

Comment by Oswego Willy Wednesday, May 8, 19 @ 12:33 pm

I know Don pretty well. This is something to which he is strongly committed. He has the mayoral background, so he knows how important public works projects are. However, he may be the elephant in the wilderness come voting time.

Comment by Proud Sucker Wednesday, May 8, 19 @ 12:33 pm

Why the hate for electric vehicles? That registration fee is insane. I agree the gas tax should go up but there is no way registering a vehicle should cost $1000

Comment by Maximus Wednesday, May 8, 19 @ 12:40 pm

I feel fairly confident the intent is make the electric registration fee $100, and the person tasked with doing the math went for 92.50 and then corrected to 82.50 without removing the 9.

I’m going to be annoyed if the premise of my joke is flawed. Though likely not as annoyed as folks with electric cars.

Also - $60 for a drivers license is too high. That’s a lot of money for low income folks who need a car to get to work.

Comment by lakeside Wednesday, May 8, 19 @ 12:46 pm

=== A new project selection process will prioritize the most needed transportation and transit infrastructure projects. ===

This very last sentence is not good.

Comment by Cadillac Wednesday, May 8, 19 @ 12:47 pm

I am not one of the “Connected” that I suspect populate this forum to a high degree. I do have a lot of connection to the average, non-connected gal in the street and a lot of people will not be happy with this. The average person will see this as the legislature sticking it to the average person after years of neglect. Also, it doesn’t help to see self-serving industry representatives advocating for this. Same for the unions. Finally, most of do want to see infrastructure work done but we don’t trust the way roads get built in Illinois. As someone who drives a great deal in both Wisconsin and Minnesota we take longer to build roads and they don’t appear to last as long. So if you’re digging deeper in our pocket you better find a way to ensure the lowest cost with the highest quality.

Comment by NeverPoliticallyCorrect Wednesday, May 8, 19 @ 12:50 pm

I can see the ads against the progressive tax now …..look what they did to the price of gas card and so on.

Comment by Not a Billionaire Wednesday, May 8, 19 @ 12:50 pm

A thousand for an electric vehicle isn’t a tax but likely an unlawful penalty

Comment by Sue Wednesday, May 8, 19 @ 12:52 pm

So, passenger vehicle registration goes up 51% and large trucks goes up 3.5% for the heaviest trucks. Brilliant!

Comment by pool boy Wednesday, May 8, 19 @ 12:54 pm

I hope lakeside is right. I figure a person would have to drive an electric vehicle almost 194,000 miles per year to justify the electric vehicle fee.

Comment by vole Wednesday, May 8, 19 @ 12:55 pm

–I do have a lot of connection to the average, non-connected gal in the street and a lot of people will not be happy with this. The average person will see this as the legislature sticking it to the average person after years of neglect.–

Quite a heavy load you’re carrying, as spokesman for all the “average” people.

How did you get that gig, anyway? Did it come in a box of cereal or something?

Comment by wordslinger Wednesday, May 8, 19 @ 12:55 pm

DOA.

Comment by Wylie Coyote Wednesday, May 8, 19 @ 12:55 pm

==A new project selection process will prioritize the most needed transportation and transit infrastructure projects.==

We needed a new process to prioritize the most needed transportation and transit infrastructure projects? That’s not happening now?

Comment by City Zen Wednesday, May 8, 19 @ 12:57 pm

Electric vehicles do just as much damage to the road as my gasoline powered car. If I have to pay hundreds more a year, so should they.

Comment by JB13 Wednesday, May 8, 19 @ 1:02 pm

…And that should just about kill any and all sales of electric vehicles in the State of Illinois. Hopefully nobody needs that sales tax money locally. Plus encouraging folks to add more NOx and CO and CO2 into the air seems ill-advised. They may want to rethink that $1000 number.

On the plus side, if it stands, there should be a flood of electric cars headed toward the used market soon if folks in surrounding states are looking for a deal.

Comment by benniefly2 Wednesday, May 8, 19 @ 1:05 pm

== A new project selection process will prioritize the most needed transportation and transit infrastructure projects. ==

IDOT has already reprioritized how projects are selected. The FHWA has required IDOT to develop a transportation asset management plan (TAMP) with emphasis on the National Highway System. The plan is to make strategic choices to increase the condition of the NHS roads and bridges at the expense of non-NHS routes.

http://www.idot.illinois.gov/transportation-system/transportation-management/planning/tamp

Comment by Huh? Wednesday, May 8, 19 @ 1:06 pm

Total projected revenue increase from electric vehicle fleet is only about $8 million. That would equal about 8000 electric vehicles (X$1000/vehicle). Is this all Illinois has on the road?

Comment by vole Wednesday, May 8, 19 @ 1:07 pm

“Fuel tax rates will also be indexed to inflation to keep pace with rising costs.”

-Oh so now the tax will go up automatically without any of those pesky votes to get in the way?

Comment by Tax Rx Wednesday, May 8, 19 @ 1:13 pm

===As someone who drives a great deal in both Wisconsin and Minnesota we take longer to build roads and they don’t appear to last as long.====

It seems your experiences with Wisconsin roads are different than mine.

My wife and I travel into Wisconsin several times a year. Mostly it is to go to the Madison Farmers Market. We live in the Far Northwest Suburbs of Chicago so usually take I-90 to WI 90 up to Madison, WI. Wisconsin has been working on Highway 90 for the last SEVERAL YEARS!! It never ends! In that time Illinois completely rebuilt I-90 from Rockford to Chicago and added lanes and rebuilt bridges.

Also we frequently travel to Door County, WI. The Milwaukee highways are horrible and Highway 43 from Milwaukee to Green Bay is like driving the Baja 1000 desert race. The pavement is buckling, etc.

Wisconsin USED TO have highways that were like driving on glass. No more.

Comment by Big Jer Wednesday, May 8, 19 @ 1:15 pm

Labor hates electric vehicles sooo bad because they don’t pay gas tax. It is almost Trumpian. This seems punitive because it is intended to be.

It’s as if the only reason there is a problem with infrastructure spending is because EVs don’t pay the gas tax.

If there are 8,000 electric vehicles in Illinois as they say, and the average car uses 480 gallons per year of gas, at $0.19 that is a loss of about $750,000 a year to the gas tax.

Out of a billion dollars.

Irrationally obsessed, I tell ya.

Comment by Ok Wednesday, May 8, 19 @ 1:16 pm

=…And that should just about kill any and all sales of electric vehicles in the State of Illinois. Hopefully nobody needs that sales tax money locally. Plus encouraging folks to add more NOx and CO and CO2 into the air seems ill-advised. They may want to rethink that $1000 number.=

So much for Democrats caring about the environment I guess.

=Electric vehicles do just as much damage to the road as my gasoline powered car. If I have to pay hundreds more a year, so should they.=

$1000 is substantially more than the average driver would be paying in gas taxes. Not sure why we should be charging them more than drivers of ICE cars. Especially when they tend to be smaller lighter cars with low rolling resistance tires that actually do less damage to the roads (not to mention the environment).

It’s a big swing to go from discounting plates and offering tax rebates for ev purchases with the hope of encouraging adoption, to a situation where EVs are severely financially penalized. This is a bad idea that moves us in the wrong direction.

Somebody go tell that Rivian factory in Bloomington (and their potential jobs) that they aren’t welcome here.

Comment by m Wednesday, May 8, 19 @ 1:17 pm

=== - Huh? - Wednesday, May 8, 19 @ 1:06 pm:

IDOT has already reprioritized how projects are selected. ===

I don’t believe this bill is referring to IDOT doing the prioritizing. Think lawmakers and “stakeholders”.

Comment by Birdseed Wednesday, May 8, 19 @ 1:19 pm

I feel for low income workers: these increases really will hurt them hard. Their standard of living struggles in Illinois.

Comment by Steve Wednesday, May 8, 19 @ 1:21 pm

Borrowing rhetoric from the income tax debate:

The electric vehicle fee is a progressive tax on the wealthy. If you’re rich enough to buy an electric vehicle, you can afford the electric vehicle fee.

Comment by ChrisB Wednesday, May 8, 19 @ 1:22 pm

Motorcycles and bicycles use roads too. Just sayin.

Comment by Cailleach Wednesday, May 8, 19 @ 1:28 pm

vole - that’s right. At $100/vehicle, it’s about 100k vehicles, which seems more reasonable, and part of why I think it’s a typo.

chris - oh my.

Comment by lakeside Wednesday, May 8, 19 @ 1:31 pm

Sen. DeWitte is also a former board member of the RTA. He is deeply aware as a Mayor and a mass transit board member of our crumbling State. The GOP should take note that Senators like DeWitte, Fowler and Anderson all won by working WITH Local 150. Other Republican legislators should take note of this labor backing and why they still have seats in the General assembly while lots of the always “No” GOP votes are now FORMER legislators. Republican Sen. Laura Kent Donahue lost her seat from Quincy to Sen. John Sullivan in part because she voted no on a major infrastructure bill and the owner of the Quincy newspaper and local electronic media stations helped take her out because Forgotonnia needs roads.

Comment by Transit Guy Wednesday, May 8, 19 @ 1:33 pm

I can’t get past that $1000 per year for an electric car. $1000/$0.44 equals the functional equivalent of paying the tax on 2273 gallons of fuel per year. The average mpg on new cars these days is 25 miles per gallon. So essentially electric vehicles would be taxed on the basis of being assumed to drive 56,818 miles per year. That is utterly ridiculous.

With the current range and charging limitations on existing electric vehicles, almost no one in the US is putting 50,000 miles per year on a personal use EV. The Federal Highway Administration pegs the average car is driven 13,476 miles per year.The whole thing is crazy.

How about charging $148 + the amount of gas tax missing from driving 14,000 miles per year (So roughly $148 + $246 = $394… Round it up to an even $400 to make it look nice). $400/year might still hurt the industry a little, but it wouldn’t decimate it and it would be defensible.

Comment by benniefly2 Wednesday, May 8, 19 @ 1:33 pm

They need to look at the backlash here when the House is actually cutting far more popular programs. Yes infrastructure is important but this is over the top.

Comment by Not a Billionaire Wednesday, May 8, 19 @ 1:42 pm

Big Jer - Wednesday, May 8, 19 @ 1:15 pm:

We have different experiences. I go to Green Bay at least four times a year and Kenosha at least 50 times and Twin Lakes at least two times and Milwaukee at least four times.

I spend a lot of time in Wisconsin and think that the roads are great except during construction

Comment by Evanston Wednesday, May 8, 19 @ 1:42 pm

“I don’t believe this bill is referring to IDOT doing the prioritizing. Think lawmakers and “stakeholders”.”

Oh I see, ear marks.

Comment by Huh? Wednesday, May 8, 19 @ 1:54 pm

For reasons stated above, $1k is an excessive registration on passenger EV’s in today’s dollars. But in our eventual move to an all-electric future, I’m guessing that $300 or $400 per passenger vehicle(as benniefly2 suggests), and indexed to inflation will be needed for road funding to have parity with gasoline vehicles as they are replaced in the overall fleet, whether paid as a mileage tax or registration fee (or maybe a tax on charging stations added in). Since we don’t have a good way of doing a mileage fee yet, we are stuck with the registration fee increase as the best way to immediately address it.

Comment by Six Degrees of Separation Wednesday, May 8, 19 @ 2:05 pm

=== spend a lot of time in Wisconsin and think that the roads are great except during construction===

Evanston - thanks for offering your view. I appreciate the feedback.

We disagree on the highway to Green Bay. I tend to agree that the highways TO Kenosha, Twin Lakes, and Milwaukeee are good. Also Route 43 to Milwaukee is high quality.

IMO once you get into downtown Milwaukee the highway system is a mess.

Lastly to avoid the construction on WI-90 on our way back from Madison we have tried to take Rt. 14 near Milton back home. Rt. 14 from Milton/Janesville to Woodstock, IL is one pothole filled bumpy mess.

Thanks again for offering your experiences.

Comment by Big Jer Wednesday, May 8, 19 @ 2:10 pm

==Electric vehicles do just as much damage to the road as my gasoline powered car.==

Electric cars do much less damage to the environment than gasoline powered cars.

Electric cars do much less damage to our health than gasoline powered cars.

Electric cars reduce the cost of health care and help save on the cost of cleaning up the environment.

Comment by Enviro Wednesday, May 8, 19 @ 2:14 pm

Electric cars also need fossil fuel power plants to produce the electricity to charge their batteries. Somewhere there’s a trade-off.

Comment by Wylie Coyote Wednesday, May 8, 19 @ 2:26 pm

Some states offer incentives for electric vehicles; California, for example, will mail a $2,500 rebate check to electric car buyers, while Colorado offers a $5,000 tax credit.

Comment by Enviro Wednesday, May 8, 19 @ 2:38 pm

I’d guess that the $1000 figure from electric simply comes from what non-electric cars would pay through the gas tax (on average) It might be a pretty realistic number.

Comment by A guy Wednesday, May 8, 19 @ 2:43 pm

Interestingly the price of regular unleaded dropped 25 cents per gallon at the station I use in Springfield. $2.87 to $2.62

Comment by LTSW Wednesday, May 8, 19 @ 2:46 pm

Why not a variable tax rate that increases when gasoline is cheap and decreases when gasoline is expensive? Peg it to the 200-day moving average of Brent Oil. Let’s say it is $70/barrel today and we create a new $0.25 standard rate. If the price of Brent moves down to $60, the tax goes up to $0.35. If the price of Brent moves to $100, the tax stays at $0.25. This would help smooth out fluctuations at the pump.

Comment by supplied_demand Wednesday, May 8, 19 @ 2:59 pm

“Why the hate for electric vehicles? That registration fee is insane. I agree the gas tax should go up but there is no way registering a vehicle should cost $1000″

It’s not hatred. They are also using the infrastructure and this is a way to get them to also pay for it since they wouldn’t be paying for it through the increase in gas taxes.

Comment by Former State Worker Wednesday, May 8, 19 @ 3:25 pm

If they raise the registration fees much, I will switch a couple of my vehicles that qualify from standard plates to Expanded Antique (EA) plates since they are stored in the winter anyway; the State will end up losing money from me. And I’ll have to see if putting my alternate fuel antique vehicle back on the road makes financial sense, so I won’t be paying the gasoline tax.

Comment by RNUG Wednesday, May 8, 19 @ 3:37 pm

Another way to get the limited public funds to build more roads, bridges, etc., eliminate the prevailing wage requirement. It is crazy to require public entities to pay prevailing wages when the private sector does not. This prevailing wage requirement is anti-capitalist and does not allow truly competitive project bidding.

Comment by Taxed to Death Wednesday, May 8, 19 @ 3:39 pm

Just an observstion. Spent a couple of days in Indiana and Michigan last week. Maybe it was just the area I was in, but the roads I used, especially in Indiana, made the Illinios roads look good.

Comment by RNUG Wednesday, May 8, 19 @ 3:40 pm

Assuming cars of approximately the same size create the same wear and tear on roads, bridges and infrastructure, their fair share should be similar. The collection method is different with electric cars since they don’t (or more rarely with hybrids) go to the pump.

One would assume they’re saving a lot of money on gas. Maybe subjecting electric cars to the proposed mileage tax might be more fair in that category, and gas cars would naturally pay at the pump?

Comment by A guy Wednesday, May 8, 19 @ 3:41 pm

===Why not a variable tax rate===

Because infrastructure needs a *predictable* revenue stream, and jerking the tax collections around every time the price of gas goes up or down is the opposite of predictable.

Comment by Six Degrees of Separation Wednesday, May 8, 19 @ 3:45 pm

Does’t John Cullerton drive a Tesla electric car? Can he stop this madness?

Comment by E. Musk Wednesday, May 8, 19 @ 3:48 pm

The increases in driver’s license fee to $60 and the vehicle registration fee to $148 amount to regressive taxation that will have the hardest impact on lower income people who don’t have public transit options. That $1,000 fee on EVs is going to be a real shocker to people planning to buy a Tesla.

Comment by Earl Hickey Wednesday, May 8, 19 @ 4:11 pm

“Fuel tax rates will also be indexed to inflation to keep pace with rising costs”

Yet we can’t index the income tax brackets to inflation to keep pace with rising costs?

Comment by City Zen Wednesday, May 8, 19 @ 4:16 pm

The roads in Illinois are fine and better than most states in the Midwest. The road builder’s lobby has to be the neediest lobby in the state. I wonder if Sandoval even realizes how regressive his proposed bill is?

Comment by Chicagonk Wednesday, May 8, 19 @ 4:35 pm

“Yet we can’t index the income tax brackets to inflation to keep pace with rising costs?”

Bracket creep caused by inflation is important to those who want the government to have more money. The AMT established in 1969 has hit middle class families.

Of course, you knew that.

But those who want an ever expanding government hope the general public does not. And that is why the Illinois graduated income tax proposal makes certain that such indexing is somehow ‘missing.’

Comment by Nonbeleiver Wednesday, May 8, 19 @ 4:46 pm

Does the taxing and spending every end in Illinois?

Comment by Anonymous Wednesday, May 8, 19 @ 6:04 pm

Electric cars do less to the environment than internal combustion engines….Where does the electricity come from to power the batteries for those cars in IL? Coal (the Taylorville “clean coal” electricity plant was shot down a few years ago due to exorbitant costs to end-users) and Nukes (yeah, where is that spent uranium going?). Have you checked the strip mining operations to extricate lithium from the earth? Just saying. Electricity is not so “clean” in IL.

Comment by Taxedoutwest Wednesday, May 8, 19 @ 6:31 pm

==Electricity is not so “clean” in IL.==

Therefore we have a greater need for solar and wind power.

Comment by Anonymous Wednesday, May 8, 19 @ 6:50 pm

Pritzker will increase every service and license possible in Illinois,.

Comment by Viking Wednesday, May 8, 19 @ 8:28 pm

Rather than Wind and Solar….we need fracking in Southern Illinois…lots of money for the Treasury and jobs..as opposed to taxing.

Comment by Viking Thursday, May 9, 19 @ 12:27 pm

Electric vehicle registration over 57 times higher than current amount. Way to congratulate people for doing the right thing.

Seriously. EV owners have no problem paying their fair share, but this ain’t it chief.

Comment by John Watts Thursday, May 9, 19 @ 4:52 pm

===….we need fracking in Southern Illinois…lots of money for the Treasury and jobs..as opposed to taxing.===

Until the state has to spend more money on disaster relief for all the new earthquakes and all the farmers who can’t grow their crops anymore because the groundwater has poison in it.

But yes some people will make money.

Comment by New Madrid Seismic Zone Friday, May 10, 19 @ 8:13 am