Latest Post | Last 10 Posts | Archives

Previous Post: Cannabis roundup

Next Post: When the mayor-elect wants a bricked bill, the mayor-elect usually gets a bricked bill

Posted in:

[The following is a paid advertisement.]

Discussion of Gov. J.B. Pritzker’s progressive income tax amendment has turned to the largest tax Illinoisans pay: property taxes.

Illinoisans’ property tax burdens in 1996 hovered around the national average. By 2016, they had skyrocketed to among the highest in the nation. It’s true that state funding for schools explains much of residents’ high property tax burden, but the key question to consider is: Where is that money going?

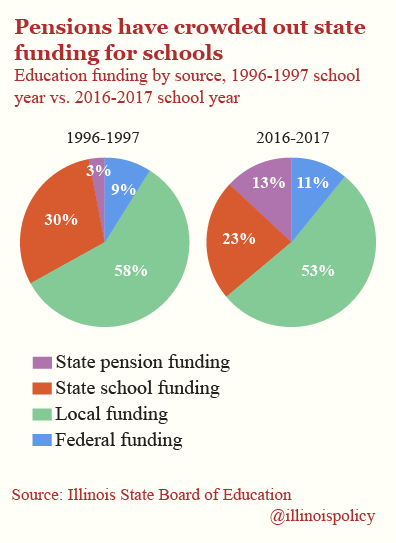

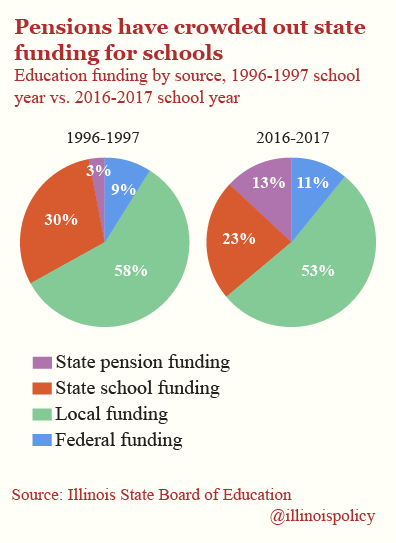

Illinois state government actually contributes a larger share of funding toward public schools today than it did 20 years ago, when factoring in pension spending. The problem is that pensions now take up more than a third of the state’s contribution to education, compared with just over 8% in the 1996 school year.

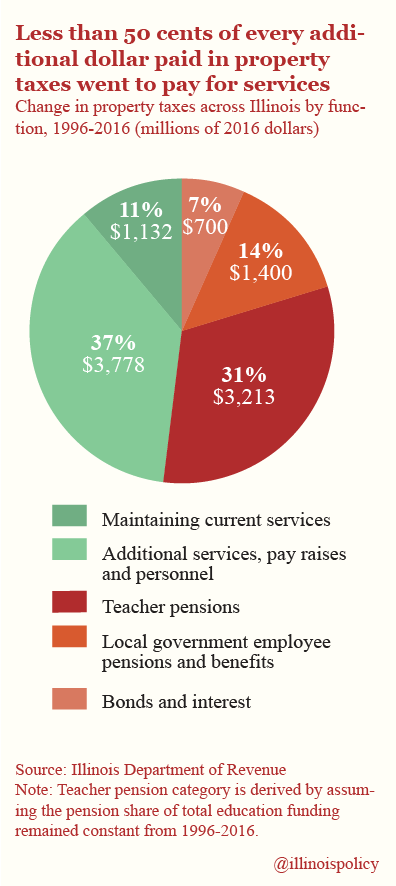

This explains why from 1996-2016, Illinoisans saw less than 50 cents of every additional property tax dollar go toward services. The primary drivers of the rise in property tax bills were pensions, other benefits and debt.

Any promises of property tax relief without pension reform are illusory.

If state lawmakers don’t address this core cost driver, they’ll face continued pressured to enact income tax hikes that do little to solve the problem.

posted by Advertising Department

Tuesday, May 14, 19 @ 10:37 am

Sorry, comments are closed at this time.

Previous Post: Cannabis roundup

Next Post: When the mayor-elect wants a bricked bill, the mayor-elect usually gets a bricked bill

WordPress Mobile Edition available at alexking.org.

powered by WordPress.