Latest Post | Last 10 Posts | Archives

Previous Post: Sports betting roundup

Next Post: Capital bill roundup

Posted in:

* Daily Herald…

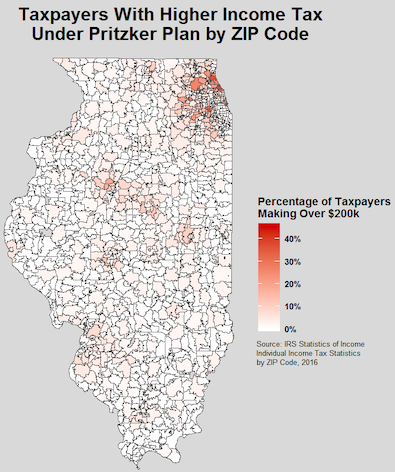

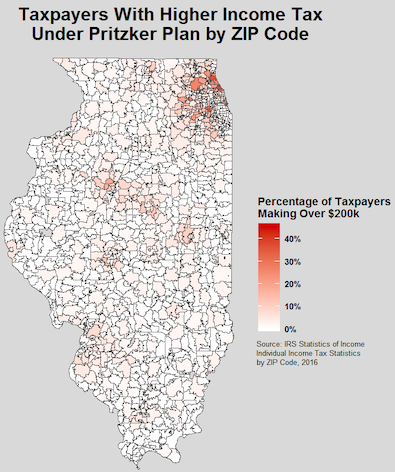

Chicago and the suburbs contribute three-quarters of all income tax revenue collected by the state, and that would increase under a proposed graduated tax.

That’s because 85% of tax filers who would pay higher rates under the two graduated tax proposals live in Chicago and the suburbs, according to a Daily Herald analysis of Illinois Department of Revenue income tax data. […]

Of the 18 Illinois ZIP codes where the average income is high enough to trigger a higher tax rate, 15 are in Chicago and the suburbs. […]

Communities where the average income tops $250,000 are Glencoe, Golf, Highland Park, Kenilworth, Lake Forest, Oak Brook and Winnetka, the analysis of reported income in the state’s 1,450 ZIP codes shows. Some neighborhoods in Chicago and Hinsdale also have average incomes of $250,000 or higher. […]

All of the state’s 13 billionaires live in Chicago and the suburbs, according to a 2018 Forbes magazine report.

Downstate has about 35 percent of the state’s population, but just 15 percent of the pool of taxpayers who would face a tax hike under the current proposal.

* Keep in mind that this Center for Illinois Politics heat map is for taxpayers who make at least $200,000, so some of them will not face higher taxation…

posted by Rich Miller

Tuesday, May 28, 19 @ 11:02 am

Sorry, comments are closed at this time.

Previous Post: Sports betting roundup

Next Post: Capital bill roundup

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

===Downstate has about 35 percent of the state’s population, but just 15 percent of the pool of taxpayers who would face a tax hike under the current proposal.===

Please don’t share this with the Eastern Bloc. “Never interrupt your opponent when he’s making an (deleted) of himself.”

Comment by 47th Ward Tuesday, May 28, 19 @ 11:10 am

Is it just me, or does the Eastern Bloc look mighty pale in that map?

Heck, most of the color is in districts with representatives who voted for the progressive tax.

Comment by Henry Francis Tuesday, May 28, 19 @ 11:14 am

Stop with the facts and clear analysis already. Ideology and fear mongering has no use for such things.

Comment by Montrose Tuesday, May 28, 19 @ 11:15 am

The map is good, but once again, the underlying piece itself ignores effective rates and just focuses on the top marginal rates. If my top marginal rate is 100% but only $1 of my income is subject to that tax, is Illinois a high tax state? These guys would say yes.

Comment by notsosure Tuesday, May 28, 19 @ 11:21 am

I’m honestly surprised it’s not higher. Who in downstate makes more than $200K a year? It looks like there are some in Peoria, Blormal and Chambana but not many in the Metro East.

Comment by Former State Worker Tuesday, May 28, 19 @ 11:23 am

Forbes did billionaire families in 2015.Downstate has one DOT foods the Traceys.

Comment by Not a Billionaire Tuesday, May 28, 19 @ 11:24 am

===but not many in the Metro East===

Lots of trial lawyers in those parts.

Comment by Rich Miller Tuesday, May 28, 19 @ 11:25 am

why hasn’t an enterprising staffer somewhere coined this as the “Chicago Tax” and beaten the Blocheads at their own game

Comment by sewer thoughts Tuesday, May 28, 19 @ 11:25 am

Former state worker, metro east can be a little messy with these as some of the higher earners live across the river and commute. At least that was the case when I lived down there about 10 years ago. Honeybear might be able to give a little better info on it than me though.

Comment by Fixer Tuesday, May 28, 19 @ 11:28 am

I think it high time Cook and the collar counties form their own state and keep all the money. And to show we are good sports we can send back all they money downstate has sent us over the last decade

Comment by DuPage Saint Tuesday, May 28, 19 @ 11:32 am

The Metro East use to have Yadier Molina. But, Yadi is a smart guy and he moved to Florida.

Comment by Pick a Name Tuesday, May 28, 19 @ 11:36 am

–Chicago and the suburbs contribute three-quarters of all income tax revenue collected by the state, and that would increase under a proposed graduated tax.–

Well, yeah.

And Downstate GOPers are hoping that they can hook some super-rich Chicagoans or suburbanites to bankroll them now that Rauner is gone.

That’s who they’re working for.

Comment by wordslinger Tuesday, May 28, 19 @ 11:36 am

yep. now the antis will try to gin up the Cook County area against it. it’s kinda how to lie with maps. because, say 20 % of a downstate area is a small number cause population, and 20% of upstate would be a greater number of people. the bottom line is that it taxes higher earners. and that is fair.

Comment by Amalia Tuesday, May 28, 19 @ 11:40 am

===All of the state’s 13 billionaires live in Chicago and the suburbs, according to a 2018 Forbes magazine report.===

That new 51st state with NO billionaires?

Hmm.

Comment by Oswego Willy Tuesday, May 28, 19 @ 11:42 am

=Former state worker, metro east can be a little messy with these as some of the higher earners live across the river and commute. At least that was the case when I lived down there about 10 years ago. Honeybear might be able to give a little better info on it than me though.=

I lived in Fairview Heights and O’Fallon for a few years and almost everyone around me worked for the Scott Air Force Base.

High earners are much more likely to be in Missouri, especially the western part of St. Louis County and Chesterfield.

Comment by Former State Worker Tuesday, May 28, 19 @ 11:46 am

Rich is correct. Plenty of trail lawyers as well as a good number of highly paid folks in Glen Carbon/Edwardsville, SIUE, L&C administrators.

But as a percentage…..

That’s what gives us just a slight tinge.

You have to keep in mind

51% of Illinois School children get free or reduced price lunch.

I just read today that Marion is serving lunch to kids over the Summer.

You don’t do that unless you know a critical mass of kids rely on that meal to be the best meal of the day.

Folks

As I have said for years

It’s getting real bad

If you don’t know that

If you can’t see that

You’re living in a gated mind and reality.

78% percent of US workers live paycheck to paycheck.

Comment by Honeybear Tuesday, May 28, 19 @ 11:49 am

I’m with DuPage Saint on this one. I am so sick and tired of the Eastern Caucus and their brethren in the red states constantly whining about how the blue states (and the Chicago area) are leeches when it is 100% backwards. Let’s start a movement to secede from Illinois and call their bluff.

Besides, it would be awesome if my drive to the State Capitol was only 30 minutes instead of three hours, especially with all the I55 work zones these days.

Comment by Chicago Cynic Tuesday, May 28, 19 @ 11:56 am

–The Metro East use to have Yadier Molina. But, Yadi is a smart guy and he moved to Florida.–

When did Yadi share with you where he claims residence and files his taxes? You two must be tight.

Did he tell you that professional athletes’ playing income is taxed on a pro-rated basis in the states and some cities where they play?

So, half his games at the 5.9% MO. rate and 1% City of St. Louis rate.

Comment by wordslinger Tuesday, May 28, 19 @ 12:07 pm

We are tight Word. All that other income is based on his Florida residence, so zero.

I know how the gig works with Athletes and Entertainers.

Comment by Pick a Name Tuesday, May 28, 19 @ 12:23 pm

The map may show a trend, but it is not accurate. One would have to earn a taxable (not gross) income over $251,400 before paying a single dollar in additional tax. The map shows gross incomes over $200,000.

Comment by James Beal Tuesday, May 28, 19 @ 12:23 pm

The silence of the vultures on this post is deafening.

Comment by Henry Francis Tuesday, May 28, 19 @ 12:24 pm

===The map shows gross incomes over $200,000===

Yes. If you had bothered to read my post, you would’ve seen that I clearly pointed that out.

Comment by Rich Miller Tuesday, May 28, 19 @ 12:31 pm

=When did Yadi share with you where he claims residence and files his taxes? You two must be tight.

Did he tell you that professional athletes’ playing income is taxed on a pro-rated basis in the states and some cities where they play?

So, half his games at the 5.9% MO. rate and 1% City of St. Louis rate.=

He lived in Caseyville, IL and moved to Creve Couer, MO “to be closer to St. Louis” according to this article:

https://www.realtor.com/news/celebrity-real-estate/cardinals-catcher-yadier-molina-selling-mansion-in-illinois/

I have no idea where he currently lives or what state of residency he claims.

Comment by Former State Worker Tuesday, May 28, 19 @ 12:31 pm

If this is all true then this measure should pass and become a part of the

constutution.

We shall see.

Comment by Nonbeleiver Tuesday, May 28, 19 @ 12:36 pm

Will this stop the seccesh talk from the Eastern Bloc? Just a rhetorical question, not likely.

Comment by West Side the Best Side Tuesday, May 28, 19 @ 12:58 pm

I’ve always found it unfair on a national level that someone making the same taxable income in different areas pays the same effective tax rate. You are living large on $250K in Mississippi but a far different story in Manhattan for the same amount of money. Based on an index of 100 as the average The cost of living is 86 in Effingham and 109 in Cook County. How about we index the tax rates to the cost of living?

Comment by midway gardens Tuesday, May 28, 19 @ 1:15 pm

As a retired state worker this tax is a great idea since I pay no state income tax. I would guess that is the case with a lot of the people that follow this blog. On the other hand if that ever changes and I live to be 150 years old the compounded raise I get every year should put me in the 250 k bracket…

Comment by Nieva Tuesday, May 28, 19 @ 1:53 pm

Did Rep. Halbrook vote in favor of giving $3.5 billion in tax breaks to primarily benefit:

A) Chicago

B) Millionaires

C) Trial lawyers

D) All of the above

Comment by Thomas Paine Tuesday, May 28, 19 @ 2:03 pm

The Eastern Bloc sure is looking white (pun intended)

Comment by I Miss Bentohs Tuesday, May 28, 19 @ 2:13 pm

Blue Dog reporting in.

A month or so ago i wrote that i knew a wealthy couple moving to Missouri. Estimate $5 million /yr income.

Over mothers day i was visiting son up in Columbia. In order to get to his home, i had to drive thru an upscale subdivision. I noticed the for sale sign. My son explained that the owner was moving to Missouri. His salary, verified is $9.7million/yr. Told my son, he had enough

Comment by Blue Dog Dem Tuesday, May 28, 19 @ 3:24 pm

–A month or so ago i wrote that i knew a wealthy couple moving to Missouri. Estimate $5 million /yr income.–

Yeah, the income tax is higher in Missouri.

But you don’t really need a point to make a post.

Comment by wordslinger Tuesday, May 28, 19 @ 3:30 pm

7.95%>7%.

Comment by Blue Dog Dem Tuesday, May 28, 19 @ 3:38 pm

Word. Google is your friend. As you would often say, you haysticks should stop the whittling on the front porch and do some research.

Comment by Blue Dog Dem Tuesday, May 28, 19 @ 3:44 pm

–7.95%>7%.–

What states have those rates? Not Illinois and Missouri.

Comment by wordslinger Tuesday, May 28, 19 @ 3:46 pm

This is a Hail Mary and it won’t work.

Comment by Best of luck Tuesday, May 28, 19 @ 4:51 pm

–Word. Google is your friend. As you would often say, you haysticks should stop the whittling on the front porch and do some research.–

Yes, it is.

The Missouri 2018 tax rate for income over $9,253 is 5.9%. The 2018 individual income tax rate for Illinois is 4.95%.

But in your totally believable story, some dude in Columbia, IL with a $9.7 million “salary” is moving to Missouri to pay higher rates for 2019 and 2020 because of the possibility of a higher Illinois rate in 2021.

Doesn’t really compute, if taxes are the issue.

By the way, where does this guy earn his $9.7 million “salary?” In Illinois, Missouri, Mars?

https://smartasset.com/taxes/missouri-tax-calculator

Comment by wordslinger Tuesday, May 28, 19 @ 5:02 pm

–All of the state’s 13 billionaires live in Chicago and the suburbs, according to a 2018 Forbes magazine report.–

There are 15 in the 2019 report.

Six of them are Pritzkers, including the governor.

I bet they have a pretty good laugh when they hear lectures from the Usual Suspects in troncsylvania, at IPI and in the GOP GA caucuses as to what motivates billionaires.

https://www.chicagobusiness.com/news/heres-who-tops-batch-locals-forbes-billionaires-list

Comment by wordslinger Tuesday, May 28, 19 @ 5:58 pm

Yet another mail in theEastern BLOCKHEADS coffin. #forgetit51

Comment by Elliott Ness Tuesday, May 28, 19 @ 7:07 pm

I wonder how much Illinois income tax those 6 Prtitzkers worth $17B paid in the last few years. Maybe JB held tax dodging parties for the family?

Comment by SSL Tuesday, May 28, 19 @ 8:12 pm

==I wonder how much Illinois income tax those 6 Prtitzkers worth $17B paid in the last few years.==

I don’t know but you don’t pay taxes on assets, you pay taxes on interest, income and capitol gains.

Comment by Da Big Bad Wolf Wednesday, May 29, 19 @ 6:44 am

JB is a known tax dodger. He doesn’t care what rates are, he won’t pay them anyway.

Comment by Bavette Wednesday, May 29, 19 @ 9:01 am