Latest Post | Last 10 Posts | Archives

Previous Post: *** UPDATED x1 - Claims Roskam endorsement *** Who is this and what have you done with Jeanne Ives?

Next Post: The fight over insulin prices

Posted in:

* The New York Times editorial board takes a look at what will happen to state and local tax burdens by income level if the governor’s graduated income tax is approved by voters…

* From the editorial…

Economic inequality in the United States has reached the highest levels since the 1920s, and there is mounting evidence that the unequal distribution of income and wealth is contributing to the nation’s economic and political problems. Reducing inequality ought to be a focus of public policy. Rewriting state tax laws to place the greater burden on those with greater means is an effective and sensible response.

Taxation in the United States remains progressive because the federal income tax remains the largest source of government revenue. But the distribution of the total burden has become much less progressive. In 1961, Americans with the highest incomes paid an average of 51.5 percent of that income in federal, state and local taxes. Half a century later, in 2011, Americans with the highest incomes paid just 33.2 percent of their income in taxes, according to a study by Thomas Piketty, Emmanuel Saez and Gabriel Zucman published last year. Over that same period, the bottom 90 percent of Americans, ranked by income, saw their tax burden increase from 22.3 percent of income to 26 percent of income. […]

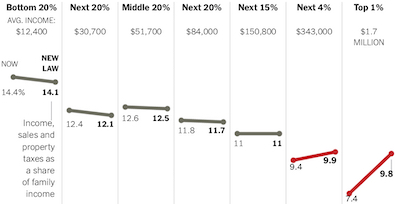

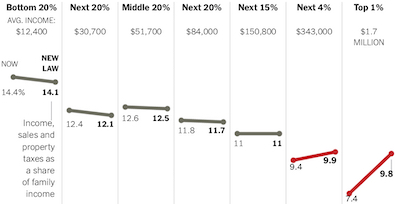

The Illinois plan is a step in the right direction rather than a complete corrective. Under current law, households in the bottom quintile of the income distribution pay 14.4 percent of their income in taxes on average, while those in the top 1 percent pay 7.4 percent of their income in taxes — a difference of 7 percentage points. The proposed changes in the income tax would cut that gap to 4.3 percentage points, according to the Institute on Taxation and Economic Policy.

Illinois is seeking to address longstanding fiscal problems, notably an underfunded pension system, so it is raising taxes on the rich without significantly reducing taxes for everyone else. Other states, however, could do better by raising taxes on the rich and using the money to reduce the taxation of low-income families.

It also dispenses with the notion that legions of high-income people will leave the state…

Indeed, the Stanford sociologist Cristobal Young has calculated that people with million-dollar incomes move across state lines less often than other Americans. They are more likely to be married, more likely to have children, more likely to be involved in civic and social groups — and, in many cases, their wealth stems from their communities. A successful Springfield dentist cannot relocate her patients to Missouri. A man who owns a chain of gas stations around Peoria is likely to remain in Peoria. A company that relies on Chicago’s highly educated work force may not be focused on finding the place with the lowest tax rates.

* The Tribune looks at who will pay more here…

In fact, a quarter of all taxpayers statewide who would be hit by the higher rates — those earning more than $250,000 a year — reside in just 15 of the state’s more than 1,500 ZIP codes, covering places like Lincoln Park, Wilmette, Barrington and Elmhurst, according to a Tribune analysis of Illinois Department of Revenue income tax data from 2016, the most recent year available.

In Lincoln Park, for example, 14% of taxpayers — 4,757 filers, the most in any ZIP code — earned more than $250,000. That includes 1,010 who earned enough to qualify for the top rates under Pritzker’s plan, which would tax individuals earning more than $750,000 and couples earning more than $1 million at 7.99% of their total income. The current rate is 4.95% for all taxpayers.

In some tony suburbs, the concentration of high earners is even greater. In both north suburban Winnetka and west suburban Hinsdale, more than 29% of taxpayers — 2,740 of filers in Winnetka and 2,288 in Hinsdale — would be affected by the higher rates that kick in at $250,000.

Overall, roughly 85% of those who would see higher tax rates under Pritzker’s plan live in Cook County and the five collar counties, which are home to about 66% of the state’s population. That means a disproportionate amount of the new revenue generated by the tax hikes would come from the Chicago area.

Aside from partisanship, one of the reasons Downstate legislators opposed taxing the rich is because they have so few high-income people and they worry what will happen when that handful of rich folks has to pay more. Some could, indeed, move their factories to other states. Others, like farm implement dealers, would have to stay.

posted by Rich Miller

Monday, Jul 22, 19 @ 11:19 am

Sorry, comments are closed at this time.

Previous Post: *** UPDATED x1 - Claims Roskam endorsement *** Who is this and what have you done with Jeanne Ives?

Next Post: The fight over insulin prices

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

We will know the outcome soon enough.

Old Blue only knows of two families to relocate in recent months.

Comment by Blue Dog Dem Monday, Jul 22, 19 @ 11:27 am

We have almost no over 250k a year in my zip code. I suspect most are doctors and some farmers. Also the average puts most at just that level.Most big downstate factories are owned by multinationals. The smaller are shops probably not over 250k.

Comment by Not a Billionaire Monday, Jul 22, 19 @ 11:27 am

It’s apparent the fair tax doesn’t tax high enough on top incomes, so as to give more relief to the middle and bottom. Top rates are higher in Iowa and Minnesota, at least pre-deductions, than the rates we’re considering.

As far as corporations, they got a huge federal tax cut. It’s found to not do anything meaningful for job creation or wage boosting.

https://itep.org/congressional-research-service-calls-three-strikes-on-the-trump-tax-cuts/

It is helping drive up deficits. We need more revenue to pay bills.

Comment by Grandson of Man Monday, Jul 22, 19 @ 11:32 am

Grandson. I just googled ITEP. Hardly non-partisan.

Comment by Blue Dog Dem Monday, Jul 22, 19 @ 11:53 am

The progessive income tax is the pinnacle of social equity.

Comment by R. Teague Monday, Jul 22, 19 @ 11:55 am

==As far as corporations, they got a huge federal tax cut. It’s found to not do anything meaningful for job creation or wage boosting.==

This simply isn’t true.

Comment by A guy Monday, Jul 22, 19 @ 11:57 am

…yes for now…but once passed, what makes it from changing or raising tax on the middle/lower class?

Comment by Thinker Monday, Jul 22, 19 @ 12:04 pm

“A guy” explain. And the fact of wages and jobs going up doesn’t show the cause. As in “They told me if I voted for Goldwater there would be a war. I voted for Goldwater and sure enough, there was a war.”

Comment by Streamwood Retiree Monday, Jul 22, 19 @ 12:10 pm

I’m in the $250K+ crowd, and while no one wants a tax increase, I’d be ok with it if all of the windfall went to paying down the bill backlog, pensions, and/or property tax reduction (i.e. education funding). I guess given the history of this state government for the past few decades, I do not have a lot of trust there. I guess we will see what happens in 2020/2021.

Comment by West Town TB Monday, Jul 22, 19 @ 12:12 pm

Actually it is true. The corporate tax cut did little good for the economy and wages. It helped drive up deficits and income to the top (as intended). It was an absolute must for the GOP to pass it, lest they got donation cuts from super-rich right wingers.

https://www.everycrsreport.com/reports/R45736.html

Comment by Grandson of Man Monday, Jul 22, 19 @ 12:12 pm

=This simply isn’t true.=

Yet you offer no citation to support your assertion.

From the Congressional Research Service:

“Moreover, the CRS finds, the 2.9 percent growth rate was firmly “in line with the trend in growth” over the previous half-decade. This means that the economy’s growth rate in 2018 was essentially what it would have been without tax cuts.”

And the analysis of what this has meant from a wage standpoint isn’t nearly as kind.

Comment by Pundent Monday, Jul 22, 19 @ 12:13 pm

Thinker-what stops them from changing the income tax right now? This will make it less likely middle and low income pay more taxes in the future

Comment by Nothing changes Monday, Jul 22, 19 @ 12:15 pm

Adam Smith observed that the larger the market the greater the degree of specialization. I don’t remember him saying that the larger the market, the greater the difference in income and wealth between the people on top of organizations and those at the lowest level. But the latter also seems to be true.

Few begrudge Bill Gates his billions. He and Microsoft have added immense value to society. Few begrudge Beyoncé or Tom Brady their millions. Few outside of the entertainment industry have benefited as much from the expansion of the market.

So who are the wealthy that make life so unfair?

For the record, I support progressive taxation. It is the most effective way of funding public goods. I worry less about whether it is fair or unfair.

Comment by Last Bull Moose Monday, Jul 22, 19 @ 12:26 pm

If the NYT piece correct, all universities should start paying taxes on their landholdings . Is Northwestern and University Chicago going to move out of state if they had to pay real estate taxes?

Comment by Steve Monday, Jul 22, 19 @ 12:38 pm

“Indeed, the Stanford sociologist Cristobal Young has calculated that people with million-dollar incomes move across state lines less often than other Americans.”

According to a BGA study (is that a partisan org. too?), Illinois gained upper-income people after the 2011 tax hike. The wealthy also got much wealthier.

https://www.chicagobusiness.com/government/heres-what-happened-after-illinois-income-tax-jumped-67

“Grandson. I just googled DemandProgress. Hardly non-partisan.”

Ad hominem attacks do not an argument make. Here is the Congressional Research Service report.

https://www.everycrsreport.com/files/20190522_R45736_8a1214e903ee2b719e00731791d60f26d75d35f4.pdf

Comment by Grandson of Man Monday, Jul 22, 19 @ 12:42 pm

==Top rates are higher in Iowa and Minnesota==

Iowa lets you deduct federal taxes paid from state taxable income. Minnesota has married tax brackets. Both states index their tax brackets to inflation.

But don’t let facts and details get in the way of your argument.

Comment by City Zen Monday, Jul 22, 19 @ 1:10 pm

I see it now. IPI is terrified that their high roller donors might leave. Sill another benefit of the pit.

Comment by oh? Monday, Jul 22, 19 @ 1:21 pm

“But don’t let facts and details get in the way of your argument.”

I said pre-deductions. Don’t let bias get in the way of your reading comprehension.

The marriage penalty is a red herring. The state income tax will increase only for upper incomes, over $250,000 a year, married or not.

Comment by Grandson of Man Monday, Jul 22, 19 @ 1:30 pm

As someone mentioned previously, most people wouldn’t like paying more but would accept doing so provided their extra payments truthfully went to their dedicated places. But just like those in the state pension plans, money just seems to magically vanish and no one knows where it went. There needs to be far more transparency and accountability with taxpayers money.

Comment by AnonymousOne Monday, Jul 22, 19 @ 1:31 pm

Pundent - the editorial provides no citation to support its central claim that income inequality is the root cause of political and economic problems and therefore must be reduced. Although it claims there is “mounting evidence” of this claim it provides not a shred of it. Of course since you likely agree with the editorial I am guessing you overlooked that.

Comment by Captain Obvious Monday, Jul 22, 19 @ 1:31 pm

==The marriage penalty is a red herring.==

Not to married people.

==The state income tax will increase only for upper incomes, over $250,000 a year, married or not.==

Year 1. Year 2, taxes begin to go up across all tax brackets and each year thereafter. No inflation indexing, remember?

Comment by City Zen Monday, Jul 22, 19 @ 1:38 pm

The BGA study shows that in Illinois, upper-income tax filers grew substantially and the highest incomes had huge gains after the 2011 tax hike. That’s a message that should be pounded home by fair tax proponents.

Comment by Grandson of Man Monday, Jul 22, 19 @ 1:55 pm

City Zen, you seem to be under the impression that without the “fair tax” rates won’t go up at all.

Face it, more tax revenues are needed to fix some of the mess, so rates are going up on someone regardless. This just puts the burden on the $250K plus folks.

Comment by JT11505 Monday, Jul 22, 19 @ 3:21 pm

The ‘Millionaire tax’ that was so widely advertised at one time became 1/4th of that. And since there it is not tied to inflation over a period of time it will put ever more people in the ‘rich’ category’ even when they don’t even come close to that.

Of course, it does not surprise me that so many who post are in favor of it but I am wondering how many will be affected by it. Easy to shift taxes to someone else.

Comment by Nonbeliever Monday, Jul 22, 19 @ 3:37 pm

===but I am wondering how many will be affected by it. Easy to shift taxes to someone else===

You just answered your own question. It’s tougher to tax middle- and low-incomes.

Comment by Rich Miller Monday, Jul 22, 19 @ 3:43 pm

===but I am wondering how many will be affected by it.===

3% of the income tax payers.

Keep up.

Maybe this blog is too much for you?

Comment by Oswego Willy Monday, Jul 22, 19 @ 3:44 pm

“(Gov. Kim) Reynolds signs largest state tax cut in Iowa history. Here’s how much taxpayers could save.” — Des Moines Register headline, May 30, 2018.

From the story about the phase-in of these tax reductions:

“Beginning in 2019, the plan reduces the tax rate in each of Iowa’s nine existing tax brackets. If revenue estimates are met in 2023, the plan reduces the number of tax brackets from nine to four and reduces the top bracket from 8.53 percent to 6.5 percent.”

Comment by Moody's Blues Monday, Jul 22, 19 @ 3:46 pm

==rates are going up on someone regardless==

That’s a good slogan for the Fair Tax.

Comment by City Zen Monday, Jul 22, 19 @ 4:14 pm

===That’s a good slogan for the Fair Tax.===

“Only 3% will see a tax increase”

When will these “other new” increases happen?

Comment by Oswego Willy Monday, Jul 22, 19 @ 4:15 pm

==When will these “other new” increases happen?==

Year 2. No inflation indexing.

Comment by City Zen Monday, Jul 22, 19 @ 4:44 pm

- City Zen -

So 2023?

Four years, from now… maybe?

Comment by Oswego Willy Monday, Jul 22, 19 @ 4:51 pm

Blue Dog Dem, it seems not wise to bail to a state with higher taxes right now based on the possibility that starting in 2021 there might be higher taxes. It seems like that isn’t the most rational decision for people who are theoretically smart enough to make 6 or 7 figure incomes. But apparently the thought of taxes makes people not think in a logical manner.

Comment by MyTwoCents Monday, Jul 22, 19 @ 5:56 pm

MyTwoCents. I am not trying to justify moving. I am just relaying some info on two moves by multimillionaires who are leaving,so am told, becsuse of the political climate. I have another couple who just returned from Florida looking to move because of state income taxes. Also millionaires. Not a done deal yet.

Comment by Blue Dog Dem Monday, Jul 22, 19 @ 6:37 pm

===I am just relaying some info on two moves by multimillionaires who are leaving,so am told, becsuse of the political climate.===

Trolls are gonna troll.

Pretty soon you’ll hear “I heard they have gold plated u-hauls heading to the promised land of Mississippi”

Ugh.

Comment by Oswego Willy Monday, Jul 22, 19 @ 6:46 pm

My trolling is evidence based and data driven at least.

Comment by Blue Dog Dem Monday, Jul 22, 19 @ 7:00 pm

===Not to married people.===

Of the 3%, how many are married?

97% of ALL paying taxpayers are not getting a tax increase.

Please, can you keep up or try to pretend you read for comprehension?

It’s tiring with you.

Comment by Oswego Willy Monday, Jul 22, 19 @ 7:01 pm

===trolling is evidence based and data driven at least.===

Hmm.

===I am just relaying some info on two moves by multimillionaires who are leaving,so am told, becsuse of the political climate.===

Anecdotal isn’t evidentiary based.

See, you troll so much you got me correcting an obvious grab for attention.

I fed you. Good for you.

Comment by Oswego Willy Monday, Jul 22, 19 @ 7:03 pm

OW. Curious. Have you had any friends or acquaintance leave the state? Is so, do you know why? It is relevant.

Comment by Blue Dog Dem Monday, Jul 22, 19 @ 7:12 pm

- Blue Dog Dem -

If i have, that too is antidotal.

Seriously, I’m not feeding you here, I’m really trying to help you learn how to add here, or maybe realize what you’re doing.

We all have opinions, there are facts, and then there are amusing stories trolls attempt to pass off as this “super facts” to prop up an argument that lacks.

Your schtick to this to get attention, please, you can add to the discussion, you’ve shown you can at times, try to be that person.

Dragging me into antidotal repartee isn’t adding.

Comment by Oswego Willy Monday, Jul 22, 19 @ 7:17 pm

To bring this back, and to the Post,

===Aside from partisanship, one of the reasons Downstate legislators opposed taxing the rich is because they have so few high-income people and they worry what will happen when that handful of rich folks has to pay more. Some could, indeed, move their factories to other states. Others, like farm implement dealers, would have to stay.===

(Sigh)

If that is the argument downststers want to make, I can seriously live with that argument. It’s a fear argument, I grant you, but the argument is economic not to “millionaire tax” thinking, which the ridiculous first thought was solidly pushed back.

The fear to that factual “thing” of the economic engines (business investors and owners of businesses that hire) make that case about that, and don’t say “we did” (banned punctuation).

No, the argument was the wealthy paying more would leave to the point that the 3% test would be effected could be nullified as an increase, thus needing to then, you guessed it, raise taxes on “the poor and middle class”

How that all sorts out in the wash, that’s where speculation and time will give into facts and antidotal stories will again seem trivial.

The Trib can’t help but be partisan, but if these downstate rich folks are the economic engines, and how Republicans treated higher education, huge economic downstate engines is an indication how the former Raunerites care, downstate better focus on Dems who see the need to worry, but are willing to pay bills to keep businesses bullish on Illinois.

Comment by Oswego Willy Monday, Jul 22, 19 @ 7:38 pm

My using personal stories are as valid as some think tank, paid for by some donors looking for validstion. To make the claim that in 2011,after the state income tax increase there was a huge increase in upper income filers without giving any backup is by definition antidotal,coincidental or both.

Comment by Blue Dog Dem Monday, Jul 22, 19 @ 7:40 pm

===My using personal stories are as valid as some think tank, paid for by some donors looking for validstion.===

Yeah, no. No.

You must miss when they are mocked here, on this blog, be it from the blog itself or comments. So no. If you want the credibility of, at times, IPI, have at it, lol

===To make the claim that in 2011,after the state income tax increase there was a huge increase in upper income filers without giving any backup is by definition antidotal,coincidental or both.===

You questioning the validity, use the google, search DOR, we’re not your google to points you want made.

Comment by Oswego Willy Monday, Jul 22, 19 @ 7:44 pm

For those who can see the actual editorial, did it link to the methodology used to determine the percentages in each quintile? Specifically, did it include estimated real estate taxes indirectly paid by renters (which would make the percentages even higher in the lower brackets), or just use homeowner data? But either way, this study shows there was more room to increase graduated rates higher than the what was proposed, and also more broadly.

Comment by Stuntman Bob's Brother Monday, Jul 22, 19 @ 10:24 pm