Latest Post | Last 10 Posts | Archives

Previous Post: Brown fights back

Next Post: “Privatization Lite” for McCormick Place?

Posted in:

* Finke has a very good story today about how state checks are being prioritized right now…

“Our priorities for the remainder of the fiscal year have to be debt repayment, general state aid to schools, expedited Medicaid payments and payrolls to keep government running,” said [Comptroller Dan Hynes] spokeswoman Carol Knowles. “We can’t afford to have our credit rating downgraded even further.”

The single biggest monthly commitment facing the state is repaying short-term loans obtained earlier in the year. Just over $500 million a month is needed through the end of the budget year June 30, except for April, when the repayment jumps to $750 million.

That money is needed just to repay short-term loans the state took out this year. Another $45 million is needed each month to repay pension bonds and $79 million to repay bonds issued for capital improvements.

The second largest monthly commitment is $450 million to make Medicaid payments to doctors, hospitals and nursing homes within 30 days. Making those payments quickly qualifies Illinois to get additional federal Medicaid reimbursements. […]

The state also is trying to keep up with general state aid payments to school districts. However, reimbursements for other school expenses, such as transportation and special education, are lagging. General state aid payments cost about $418 million a month.

Of course, that means that almost nobody else is getting paid. Some of that unpaid cash was also for schools, and the delay is causing big problems out there…

Maine Township High School District 207 in Park Ridge has approved the elimination of 75 teaching and 62 nonteaching jobs.

Plainfield Community Consolidated School District 202 has discussed cutting up to 160 full-time jobs next year and eliminating the fifth-grade band program. […]

Elgin-based School District U-46, the state’s second-largest district, has cut 348 jobs — mostly nonteaching — for the current school year. It also closed five swimming pools and canceled the athletic “B” teams. The district predicted a $15 million budget deficit next school year, on top of the $50 million deficit carried over from this year.

Naperville’s Indian Prairie School District 204 is considering up to $13 million in cuts, including a layoff of non-tenured teachers, increasing registration fees and delaying new textbook and technology purchases.

And general state aid to schools could fall next fiscal year…

State Rep. Linda Chapa LaVia, D-Aurora, who heads a House education committee, said by the time lawmakers are done in May, schools could be looking at hundreds of dollars less per-student in state aid.

“The real price tag could be anywhere from $500 to $700 less,” said Chapa LaVia.

The Republicans say cutting school money is ridiculous…

“I think this is very cynical, and ridiculous to make a show like this. As if this is the only choice. This is the Democrats’ choice,” [GOP Rep. Chapin Rose] said.

Rep. Rose is staunchly against a tax hike and thinks cuts in Medicaid should be looked at first. What he surely understands is the state is facing a $13 billion or so deficit, and cuts to Medicaid alone won’t, um, cut it.

Some relief is coming, though…

The federal government is sending a half-billion-dollars to Illinois schools. Illinois State Board of Education spokesman Matt Vanover calls the $555-million infusion a “relief.” He says the money will pay the general aid the state sends schools twice a month.

* David Vaught, the director of the governor’s budget office, had some plain words for a joint Senate appropriations committee hearing last night…

“We’re beyond a situation where we can do what I call ‘efficiency cuts,’ where we save money and eliminate waste,” he said. “We’re at the point now where cuts are very real. They involve a reduction of services and they involve pain in many communities.”

* CoGFA director Dan Long distributed an analysis at the same hearing last night which you can view by clicking here. Let’s look at a few of his charts. As always, click the pics for better views…

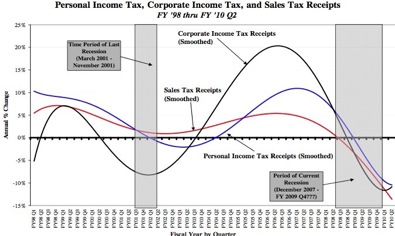

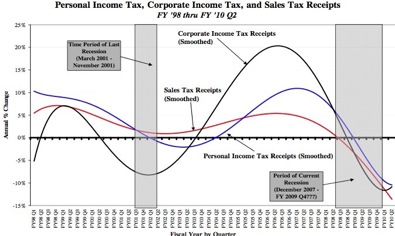

Personal Income Tax, Corporate Income Tax, and Sales Tax Receipts - FY ‘98 thru FY ‘10 Q2…

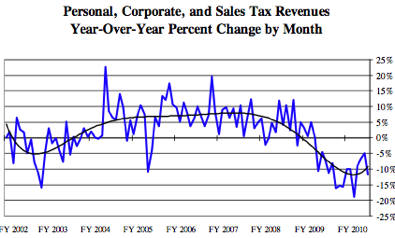

Personal, Corporate, and Sales Tax Revenues - Year-Over-Year Percent Change by Month…

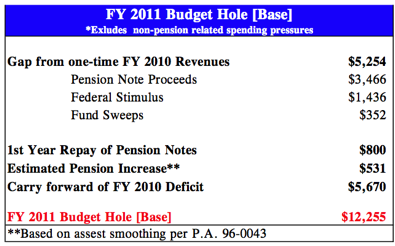

FY 2011 Budget Hole [Base]…

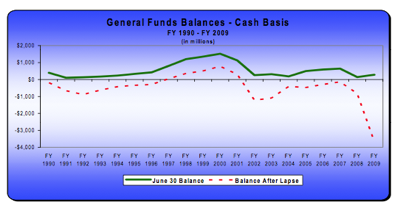

Check out that dotted red line on this chart. It’s the General Funds balance after lapse spending. Oof…

* Not surprisingly, the governor is still talking about raising taxes…

Gov. Pat Quinn says he thinks it’s “necessary” the Illinois House consider a plan to raise the state income tax that passed the Illinois Senate last year.

* Related…

* Quinn warns of ‘very real’ budget cuts

* Illinois stuck in a ‘historic, epic’ budget crisis

* Illinois must reform pensions, make cuts before tax talk

* From the right, civic duty in Illinois

* Politicians can’t sugarcoat Illinois’ dire straits

* Senator seeks open school enrollment statewide

* Legislative scholarship perk defended: The Illinois senator put in charge of overseeing efforts to reform controversial legislative scholarships defended those scholarships Tuesday, denying they are perks and saying they should remain in lawmakers’ control.

* No vote on lawmaker scholarhships

* New state law causes changes in driver’s ed programs

posted by Rich Miller

Wednesday, Feb 24, 10 @ 10:35 am

Sorry, comments are closed at this time.

Previous Post: Brown fights back

Next Post: “Privatization Lite” for McCormick Place?

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

I want to see Chapin Rose’s budget. How he closes a $13 billion gap without touching education or raising taxes. Put the details on paper. Prove to me it can be done. I am waiting.

Comment by Montrose Wednesday, Feb 24, 10 @ 10:45 am

Excellent nuts-and-bolts story by Finke. Everybody has to make their nut every month, so it brings the problem down to the very basic level that all can understand, if they care to.

Comment by wordslinger Wednesday, Feb 24, 10 @ 10:46 am

I don’t like repeating myself but at this point you really need the Apocalypse for something to happen…

To many false warnings from Quinn at this point.

Comment by OneMan Wednesday, Feb 24, 10 @ 10:48 am

So funding is going to pay loans that were made bcause the Gov/GA did not do their job last year and balance the budget? THe sad part is the great majority of these people won their primaries and will probably win their general elections.

Comment by Jim Wednesday, Feb 24, 10 @ 10:49 am

Eight scholarships per legislator? Howsa ’bout paring that down to two per? We cannot afford that amount of largesse, and clearly these scholarships should go to students that have scholastic merit plus financial need..

Comment by Loop Lady Wednesday, Feb 24, 10 @ 10:57 am

OK, let’s review. This whole house of cards was predicated on the assumption by the governor that the GA would pass a tax increase after the primary. Well, they probably won’t. I think that was clear to most of us last June. They passed a 6 month budget last year, told Quinn to expect no more money, passed supplemental appropriations and let Quinn dole that out, again told him publicly not to expect more money. He has continued to borrow and spend hoping that the GA will do the right thing even though they made it crystal clear that he would get no more money. OK so now what? There is no more. The money tree appears to be dead. Maybe he should pull a Clinton and let the house of cards collapse under its own weight. Then maybe someone will do something.

Comment by Bill Wednesday, Feb 24, 10 @ 11:03 am

===Howsa ’bout paring that down to two per?===

Actually, it is two. It’s two, full, four-year scholarships. Some legislators break those up into 8, one-year scholarships.

Comment by Rich Miller Wednesday, Feb 24, 10 @ 11:14 am

Bill,

That someone will have to be us voters.

Fumigate in November!

Comment by dupage dan Wednesday, Feb 24, 10 @ 11:15 am

I agree with Bill…the leaders and the rank and file need to know that that can’t abdicate responsibility any longer…I hope IL goes into default by summer…then, in November the electorate can vote for a non incumbent (if they aren’t knocked off the ballot by the powers that be) or write in candidate…I’m sick of the lot of them…let them go to hell, that’s where they have put state finances, so they can join them there…

Comment by Loop Lady Wednesday, Feb 24, 10 @ 11:20 am

The Blame Game is already at fever pitch, and we are only just starting this fiscal crisis, compared to what is coming soon.

Comment by Bubs Wednesday, Feb 24, 10 @ 11:28 am

What’s missing from this discussion, of course, is the economic situation of Illinois’ and the country’s middle class. Quinn and the Democrats’ tax increase proposes that the state’s middle class residents will carry the water not only for the current predicament but also for future state governmental spending sprees when the economy recovers, in a decade or so-hopefully.

According to many economists, US incomes are likely to remain stagnant for many years, for a variety of reasons including global competition,

the widespread shift from manufacturing to lower-paying service jobs, and the large pool of unemployed workers driving down wages. So while we

will, under our Pat and the Democrats, be turning

over even more of our wealth to the government,

we won’t be seeing replacement any time soon.

And by soon, I mean, a decade or more.

Unlike the middle class as a group, there are many who, nevertheless, won’t be sitting at the sacrifice table our Pat is so fond of mentioning. State employee unions and their members, for example. Our Pat has already excused them from the table and is actually transferring more of our wealth to them every year. And does anyone seriously believe he’s going to close any corporate loopholes. Please. Look for the parallel corporate income tax proposal–he already lowered his proposal once last year—to go down again.

Mayor Daley, profligate as he and Chicago Dems have been, at least emits the occasional apologetic sputter when he talks about taxes.

Not our Pat though. He thinks we should be happy to give him more of our wealth to spend as he wishes—-it’s all for our own good.

Comment by cassandra Wednesday, Feb 24, 10 @ 11:29 am

I guess that Senator Kimberly Lightford looks at these lawmaker scholarships as being “inconsequential” in regard to the state’s “Big Picture” and, perhaps she is right. However, it appears to many of us voters as endemic of what is currently (and has been) going on down in Springfield for “way too long” and that has led us to the economic precipice where Illinois now finds itself at. Senator Lightford reminds me of the Mexican bandit in the film “Treasure of the Sierra Madres” with Humphrey Bogard when the bandido says, “Badges? What badges? We don’t need no stinking badges, gringo!”

I can only speak of what I have seen occur in our local area. Not to pick on either party but our current and former Democrat senators and our incumbent Democrat state rep have managed to help obtain these “lawmaker scholarships” for the children of their active campaign supporters and campaign contributors. Granted, chances are that if our district had Republican senators and representatives the same thing would probably have also occurred. But purely from a voter/Illinois citizen standpoint, it seems to most if not all of us as wholly unfair to the other deserving kids out there whose parents are struggling and are unable to put their kids into even a local community college. The argument that these “lawmaker scholarships” are available to “everyone” rings hollow with many of us because the general population does not know about these scholarships nor how to get one of the few available. The politicians use them as “political plums” for their faithful supporters and campaign “worker bees”. This “political perk” is something that should not be handed out to politicians in office. It is wrong and is just “one more example” of why the people look down their nose upon the “ethical credibility” of their state politicians. Kimberly Lightford seems to have been down in Springfield for far too long. She has caught that same fatal political disease called “I am entitled”. I am surprised Kim didn’t say, “Let them eat cake.” She may not have said it but my guess is that “she was thinking it”.

Comment by Beowulf Wednesday, Feb 24, 10 @ 11:55 am

Rep. Rose is part of the problem. He is one of those Reps who still refuses to recognize how serious the situation is. You don’t fix a $13 billion budget hole without touching the big sacred cows, like General State Aid. It’s a $5 billion program for goodness sake. You have to chop at these large programs to make progress. Nobody likes it and I’m sure not for it, but I understand that it may have to be done. Rep. Rose has just laid his cards on the table that he has no interest in helping to solve the problem. Medicaid is but one program and you aren’t going to save nearly what the Republicans may have told you, even if you do managed care and other reforms.

Comment by RJW Wednesday, Feb 24, 10 @ 11:57 am

Cassandra, you bang the same drum over and over…even if Quinn got rid of every state employee, that would only save about 3 billion or 25% of the hole we’re in…BTW, Daley is in favor of spending cuts AND and income tax hike, as is Quinn, so put your soapbox away…the pain will be shared by all residents of the state whether it comes in cuts and/or increased taxes…

Comment by Loop Lady Wednesday, Feb 24, 10 @ 12:11 pm

It’s easy to make fun of the magic beans caucus with MAGIC BEANS, but we’re going to have to come up with something to make fun of the magic cuts caucus.

Comment by Scooby Wednesday, Feb 24, 10 @ 12:23 pm

“I think this is very cynical, and ridiculous to make a show like this. As if this is the only choice. This is the Democrats’ choice,” [GOP Rep. Chapin Rose] said.

Rep. Rose, look in the mirror.

Comment by Rob N Wednesday, Feb 24, 10 @ 12:24 pm

If the Democrats in Springfield, who enjoy overwhlming majorities, feel that massive hikes in taxes are justified, then they can go ahead and enact them any time they want. No one has been able to explain, to my satisfaction, why a single Republican vote is needed. Why work so hard to amass those majorities if your not going to use them? The only logical explanation is that the Democrats in Springfield want to use Republicans as a political and public relations fig leaf. Not exactly a profile in courage.

Comment by GoldCoastConservative Wednesday, Feb 24, 10 @ 12:50 pm

From time to time people post comments on the blog that to me appear to be whisteblowing,which is a good thing in my view. Yesterday for example yet another comment appeared about how, despite the state’s financial woes, the Quinn administration keeps on filling high-priced patronage jobs with the “generous” state government pension plan perk.

Can David Vaught speak plainly on how and why this is the case? Exactly how many people has Quinn hired post June 1, 2009 at the $70k+ range? Can all of those new hires truly be justified as vital to day-to-day state government operations?

I understand that the new hires post June 1, 2009 constitute the $13 billion deficit, but as a matter of principle these positions probably did not need to be filled, as Quinn was threatening front-line workers with layoffs and furloughs.

Also, there are several state agencies that do work already covered well by the federal government in terms of providing services to the public. I have questioned the efficacy of these agencies in the past and continue to do so. I’m not sure if it is possible or easy to eliminate these agencies outright, but they can surely withstand a serious reduction in terms of staff (though I would keep the front-line workers on a reduced work hour basis and get rid of the figure heads running the agencies. maybe by fy13 i would reassess whether or not these agencies need to be made whole again moving forward. )

And for crying out loud Quinn needs to cut executive level operations by 30-40 percent!

Comment by Will County Woman Wednesday, Feb 24, 10 @ 1:02 pm

Cassandra says, “Quinn and the Democrats’ tax increase proposes that the state’s middle class residents will carry the water not only for the current predicament but also for future state governmental spending sprees when the economy recovers, in a decade or so-hopefully.”

To add to Loop Lady’s comments about your need to get real, Quinn’s proposed formula (the original) was weighted toward upper brackets. My squarely middle class family would only see an extra $5 per month for example.

Yes, the middle class is in a pinch. But that’s because tax cut after tax cut has been doled out to the uber-wealthy. That load had to fall somewhere and it’s squarely on the backs of the middle class.

Tinkle on economics doesn’t work.

Comment by Rob N Wednesday, Feb 24, 10 @ 1:07 pm

If our legislators won’t even consider giving up their ability to award scholarships, to schools that are already suffering from the State’s failure to pay its bills, what hope do we have that they will do anything to address this problem? I think it’s going to take the banks refusing to loan any more money, or a failure to buy Illinois bonds, etc to get their attention.

Comment by Champaign Dweller Wednesday, Feb 24, 10 @ 1:17 pm

Rob N.

“Yes, the middle class is in a pinch. But that’s because tax cut after tax cut has been doled out to the uber-wealthy. That load had to fall somewhere and it’s squarely on the backs of the middle class.” You like to point out tax cuts for the wealthy as a problem and they may well be but the real problem is the huge numbers that dont pay any tax at all. So many are getting a free ride and asking for more handouts. I believe the lowest 35% in income pay no income tax at all. Maybe a little shared sacrafice and a few less handouts.

Comment by Fed up Wednesday, Feb 24, 10 @ 1:22 pm

===I believe the lowest 35% in income pay no income tax at all.===

Just about everybody pays income taxes in Illinois.

Comment by Rich Miller Wednesday, Feb 24, 10 @ 1:25 pm

I’m assuming you’ve mistaken federal for state taxation. Try to stay on-topic here. This blog is about the state.

Comment by Rich Miller Wednesday, Feb 24, 10 @ 1:27 pm

None of this is a surprise. We’ve seen this coming for years.

What is surprising is how those in charge will not do something about it. They don’t want to cut. They don’t want to raise revenues somewhere. They don’t want to raise taxes. They are paralyzed and fingerpointing at the few Republicans in the GA, as the cause of their paralysis.

They don’t do something because they are afraid if they do something, they will lose in November. This was their fear in 2002, 2004, 2006, 2008, and 2010. We have seen them float ideas during off years, shoot the ideas down, then sit on their hands during election years.

There are no easy choices. The status quo in Springfield doesn’t want anything but easy choices. They didn’t even want to make challenging choices ten years ago when doing something wouldn’t have jeopardized their political careers. Their procrastination has cause us to lose billions of dollars, and we stand to lose billions more.

Illinois is broken. Would anyone like to try and fix it, please?

Comment by VanillaMan Wednesday, Feb 24, 10 @ 1:29 pm

unless i’m misunderstanding some things, these are some salient points in my mind:

1)we started the fiscal year with a $3.7 bn backlog of unpaid bills

2)current FY10 operating budget deficit is “only” $2 bn

3)so FY11 will start with a $5.7 bn backlog

4)FY11 tax revenues are expected to increase by at most $0.5 bn over FY10

5)FY11 will see mandatory increases in expenditures of $1.3 bn

6)$5.3 bn of one time revenue sources will not be available in FY11

7)So, FY11 revenues will be at least $6.1 bn short of FY11 expenditures if there are no spending cuts or tax increases. That’s the gap we need to fill just to keep the backlog of bills from getting worse.

Comment by in the left lane Wednesday, Feb 24, 10 @ 1:46 pm

So I shouldnt expect the few hundred dollars the state owes me for a tax refund anytime soon.

Comment by Fed up Wednesday, Feb 24, 10 @ 2:20 pm

fed up dem,

someone at the state dept. of revenue office(i think the spokeswoman’s lastname is Hoffer?)stated the other day that il tax refunds have not been effected by the budget problem, so far as early filers are concerned. the turn around time has been about a week for internet filers. people who wait until the deadline (april 15th) to file will probably have to wait 8-10 weeks for their refunds.

Comment by Will County Woman Wednesday, Feb 24, 10 @ 2:34 pm

I think Vanilla Man has finally jumped the shark.

Comment by John Boy Wednesday, Feb 24, 10 @ 2:38 pm

I think Vanilla Man has finally jumped the shark.

Not when compared to this state government.

Comment by VanillaMan Wednesday, Feb 24, 10 @ 3:31 pm

Alright, we’ve got two separate issues now. It will be easier to solve if we recognize that.

First: Unpaid bills. No one, R or D, can argue that these bills don’t need to be paid on a timely basis. If they do argue that, trash them immediately. The debt is the debt. Responsible people pay their debts and we have to pay what we owe. Period. How to do that? got to get more revenue. How? sales tax or income tax. Sales tax is already crazy high, and not terribly fair when you get down to it. Poor guy and rich guy buy about the same amount of food to stay alive, and (making this up now), pay about the same amount of tax on that. But for poor guy its a lot higher percentage of his income. Not a good place to increase.

FLAT income tax (not PQ’s wet dream, but flat tax) just seems fair. You make 10K, you pay $350. You make $1MM, you pay $35,000 for the same services, even though poor guy is more likely to use them. But you don’t complain because it seems fair.

We have to pay our bills…income tax needs to go up.

Second: Spending. Here’s where the argument is totally legit, and the D’s deserve to fail miserably. There’s been an unprecedented spending spree, starting in 2002, continuing to today. This is where there’s a legitimate argument. R’s should hammer, hammer, hammer the CCD’s who’ve totally screwed the State and its taxpayers. They’ve made drunken sailors look prudent. They should be relegated to the ash heap of Illinois history, starting with the King.

But in the meantime, raise the revenue and pay the bills.

Comment by Park Wednesday, Feb 24, 10 @ 7:27 pm

Actually, this analysis probably substantially understates the ‘11 problem. One reason is that it doesn’t address the ‘10 under-approp at Medicaid And Group Insurance, which likely totals in excess of $1B, so add that to the ‘11 shortfall.

Comment by steve schnorf Wednesday, Feb 24, 10 @ 10:19 pm

Just one of so many ill-effects of the irresponsible, illegal, and unconstitutional, under-funded state budget:

I notifed my doctor that Cigna and the state are not giving any timeframe for paying our med bills (and our deductables are way up), even though we’re forced to pay premiums every month.

My last med bills were paid after 15 months of the service date.

My doctor this time was kind enough to give me a sliding scale very low bill.

It’s like I have no insurance at all.

I have notified Sen. Heather Steans and Rep Greg Harris of how the state budget crisis (ongoing) is affecting me, and us, state workers. I have also reported this to a Governor’s hotline, set up just for this issue (wasteful, another job/s just to take reports on this hotline!).

Still no resolution, no raising of revenue, no closing of corp loopholes, no progessive taxation talk, after months and months and months.

Comment by state employee Thursday, Feb 25, 10 @ 12:02 am