Latest Post | Last 10 Posts | Archives

Previous Post: Cellini trial live blog

Next Post: Forbes ignores FBI, publishes goofy rankings anyway

Posted in:

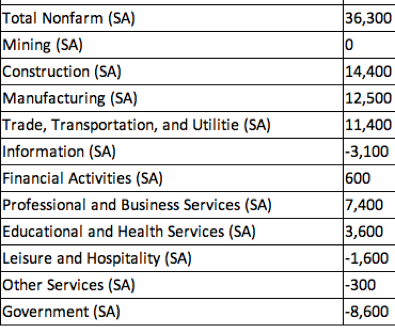

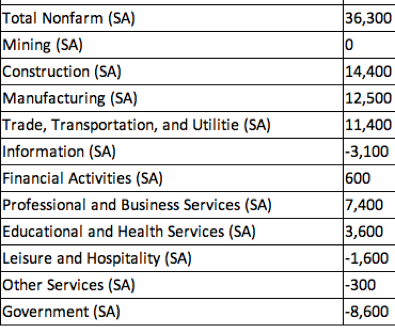

* I asked the Illinois Department of Employment Security to total up seasonally adjusted job growth and declines from January through August, the latest month available. I did this because we’re starting to see questions crop up here and there about whether the income tax hike is hurting Illinois’ economy. There are good arguments that the tax hike will definitely hurt us, and we’ll get into those in another post today, but as you can plainly see, the biggest net job losses since the January tax hike have been in government…

* Here are the monthly job growth/decline figures…

Jan: + 24,200

Feb: + 20,300

March: + 2,600

April: + 9,100

May: +4,900

June: -7,300

July: -20,600

Aug: + 3,100

* More from IDES…

Both the U.S. and Illinois unemployment rates declined in January, February and March. The U.S. rate began to increase in April.

In May, the Illinois unemployment rate followed suit and began to increase.

In July and August, the stagnant national economy finally pushed the Illinois unemployment rate up at a steeper pace than the national average.

Latest revised estimates for Q1 2011 U.S. Gross Domestic Product shows a meager annual rate of 0.4 percent; 2011Q2 was 1.3 percent. These rates indicate that the U.S. will share the fate of most of the world’s largest economies - a period of slower growth.

Housing remains the national economy’s albatross. According to the U.S. Commerce Department, in the second quarter, residential investment — money spent on building, adding to and maintaining homes — accounted for just 2.2 percent of GDP. That’s the lowest level since 1945. If residential investment were to rebound to its average share of the economy from 1950 to 2000 of 4.7 percent, GDP would be 2.5 percent higher than it is now.

* Meanwhile, Gov. Pat Quinn talked to reporters yesterday for the first time since his trip to China. Raw audio…

* Asked about the budget situation, Quinn said…

“The revenues are going pretty well for Illinois in the major areas of revenue that the state receives. There won’t be much of a difference between the expenditures this fiscal year and the revenues that we derive. We may actually have more revenues than expenditures… We just have to get strong economic recovery as the very best way to deal with the budget deficit of the state.”

* The governor is absolutely right about how an economic recovery will help erase the budget problem. You cannot contract your way out of this mess. Just the opposite.

And he’s right that state revenues are doing well so far this fiscal year. Revenues are coming in pretty well. The problem isn’t now, however, the problem is the near future. The Commission on Governmental Forecasting and Accountability’s latest report urges lots of caution…

Caution Urged Despite Early Performance

While the economic sources have met the Commission’s expectations to date, the forward view of revenues should be tempered with the realization that some clouds on the horizon will serve to stymie a repeat of similar growth. […]

In addition, second half revenue performance would not escape if the current economic “soft patch” continues to be accompanied by stubbornly high unemployment. Looking ahead, continued economic malaise would jeopardize even modest revenues expectations well into FY 2013.

In other words, it’s no time to be spending more money. On the other hand, considering the economy, it’s not a good time to be cutting back, either. If this state had its act together, we could better respond to problems like these. We don’t, so we can’t. We’re essentially victims of our own irresponsibility.

* Related…

* Quinn would consider keeping prison open: But Quinn said the money to keep the prison open must come from re-allocation, and that he won’t borrow cash. The General Assembly would have to agree to re-allocate the money.

posted by Rich Miller

Thursday, Oct 6, 11 @ 10:16 am

Sorry, comments are closed at this time.

Previous Post: Cellini trial live blog

Next Post: Forbes ignores FBI, publishes goofy rankings anyway

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Well, since we’re cutting the size of Government in Illinois, it make sense that there are greater losses of jobs in the public sector than in the private. This is actually good news since taxpayers are unburdened of both the salaries AND the benefit packages of the reduced staff. A higher growth in the private sector of the public sector as a general rule of thumb is good, right?

Comment by Cincinnatus Thursday, Oct 6, 11 @ 10:25 am

*over

Comment by Cincinnatus Thursday, Oct 6, 11 @ 10:26 am

That information number is surprising, wonder how the define that.

Comment by OneMan Thursday, Oct 6, 11 @ 10:43 am

Sure would be nice to have a real rainy day fund cuz it’s been raining for a LONG time.

Comment by thechampaignlife Thursday, Oct 6, 11 @ 10:44 am

–According to the U.S. Commerce Department, in the second quarter, residential investment — money spent on building, adding to and maintaining homes — accounted for just 2.2 percent of GDP. That’s the lowest level since 1945.–

Since 1945? For God’s sake, what an embarrassment to this generation of Americans. There’s your American Dream, George Bailey, rolling down the tracks.

Maybe when the Civic Federation solves the crisis of janitors and lunch ladies pulling in $30K pensions after a lifetime of work, they can point their big, big brains to this one.

Comment by wordslinger Thursday, Oct 6, 11 @ 10:45 am

That Quinn Press Conference was at All Cell Technologies, who make battery packs for e-bikes and e-scooters, mostly for export. As well, they test modules for use in large format, electric vehicle applications.

Comment by JBilla Thursday, Oct 6, 11 @ 10:47 am

I wonder how much of the Government job loss is State and how much is local. I also wonder how much of the local job loss might be because of the State’s slow payment process. Of course that is a hard number to get.

Comment by Ahoy Thursday, Oct 6, 11 @ 10:52 am

Once again, we should thank God that those government jobs aren’t real jobs and they didn’t spend real money at real local businesses so this won’t have a real effect on the real economy.

Thank God!

– MrJM

Comment by MrJM Thursday, Oct 6, 11 @ 10:56 am

“OUR irresponsibility”? No way. It is the irresponsibility of our political leaders who put the protection of their personal power and career well ahead of the long-term interests of the people of this state.

Comment by 42nd Ward Thursday, Oct 6, 11 @ 11:00 am

42nd Ward, in case you didn’t notice, there’s this thing in America called “elections.” They occur on a regular basis.

Comment by Rich Miller Thursday, Oct 6, 11 @ 11:01 am

The “job creator” taking the biggest hit over the last year has been government (at all levels). When you hear about “job creators” needing more money, it makes you wonder which ones will actually create some jobs. There is plenty of demand for patching up infrastructure and educating the populace and doing research to develop new technology, all things the government does very well.

Robert Reich commentary on this topic: http://marketplace.publicradi

o.org/display/web/2011/10/05/pm-borrow-and-

build-commentary/

Comment by Pot calling kettle Thursday, Oct 6, 11 @ 11:09 am

No employment problems at idot. You would think its christmas everyday the way they are spending.

Comment by foster brooks Thursday, Oct 6, 11 @ 11:34 am

Quinn will work hard to see that private job cuts

meet the government number. Raise taxes plus borrow more. That’s the ticket. Please eat carp.

Comment by mokenavince Thursday, Oct 6, 11 @ 11:49 am

Quinn will work hard to see that private job cuts

meet the government number.

Sigh… how does it feel to have your opinions continually be discredited with facts?

Comment by dave Thursday, Oct 6, 11 @ 2:11 pm

Cinci

Losing a gov’t job is a good thing, unless it’s your job or that of a family member. It’s a good thing, except for mortgage holders who may not get their payments because the unemployed gov’t worker can’t make payments anymore.

It’s a good thing, except for all the other vendors who lose business because there are 8,000 fewer workers spending money and paying bills.

Comment by reformer Thursday, Oct 6, 11 @ 3:04 pm

It’s unfair for you to think that I want to see anyone lose their job, that is not the case.

In a macroeconomic sense, it is better to have the maximum amount of jobs in the private sector, and the minimum number of public service workers possible.

That statement is true no matter if the economy is flush with cash, or suffering as it is now.

Comment by Cincinnatus Thursday, Oct 6, 11 @ 3:46 pm

“In a macroeconomic sense” without government investment in infrastructure, transportation, water and sewage, security, education, and regulation, private jobs do not exist for long, or increase. That has been true for every civilized society. There is no credible real world case I have ever seen that fewer public service jobs are always automatically beneficial. Of course it depends on your definition of the “minimum number” required to support and defend modern markets, organizations, and society.

Comment by walkinfool Thursday, Oct 6, 11 @ 4:04 pm