Latest Post | Last 10 Posts | Archives

Previous Post: Michelle Obama says she’s “definitely” not interested in running for office

Next Post: Why did they get the money in the first place?

Posted in:

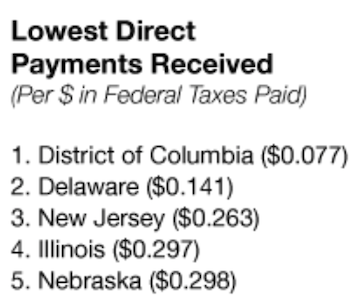

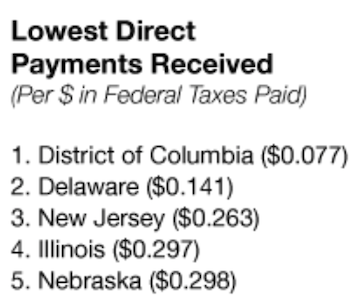

* WalletHub compared “the 50 states and the District of Columbia in terms of three key metrics: 1) Return on Taxes Paid to the Federal Government; 2) Federal Funding as a Percentage of State Revenue; and 3) Number of Federal Employees Per Capita”…

* Overall, Illinois ranked “second least dependent” of all states, behind only Delaware. Here are the categories, the actual numbers for the categories and our individual ranking within those categories…

Return on Taxpayer Investment - $0.56 - 3

Funding as % of Revenue - 26.23% - 8

Federal Employees Per Capita 6.45 - 11

* They weighted the results…

1. Return on Taxes Paid to the Federal Government – Weight: 1

(Federal Funding in $ / Federal Income Taxes in $) This metric illustrates how many dollars in federal funding state taxpayers receive for every one dollar in federal income taxes they pay. We have excluded from the Federal Funding the Loans/Guarantees component because it does not represent permanent transfers from the Federal Government to a state.2.Federal Funding as a Percentage of State Revenue – Weight: 1

(Federal Funding in $ / State Revenue in $) * 100 This metric shows how much of a state’s annual revenue, and theoretically its spending, is provided by the federal government. Without this money, revenue would have to be found elsewhere – perhaps via tax hikes – or else key state services would suffer.3. Number of Federal Employees Per Capita – Weight: 0.5

(No. Federal Workers / No. State Residents) This metric speaks to the federal government’s role as a nationwide employer, indicating the percentage of a state’s workforce that owes its very livelihood to Washington.

* They also used some items to put the numbers in context, such as “Direct Payments,” which “reflects the return on taxpayer investment in terms of federal entitlement payouts“…

And…

posted by Rich Miller

Wednesday, Jun 25, 14 @ 9:55 am

Sorry, comments are closed at this time.

Previous Post: Michelle Obama says she’s “definitely” not interested in running for office

Next Post: Why did they get the money in the first place?

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

So IL is not the evil. miserable place Mitt and his whack job friends want us to think it is?

That will make them sad. Good

Comment by CirularFiringSquad Wednesday, Jun 25, 14 @ 10:03 am

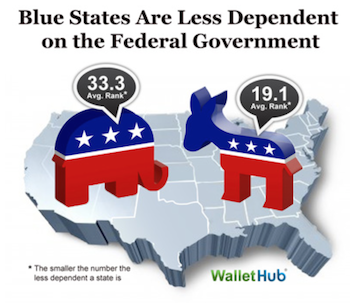

Blue States are less dependent on the Federal government than Red States?

Yikes. Can’t wait for all the comparisons of IL to all these dependent Red States.

Comment by Oswego Willy Wednesday, Jun 25, 14 @ 10:08 am

I’ve seen similiar metrics in the past…amazing how the most rabid “we-hate-big-government” states get the most TLC from the feds. Always reminds me of that story about GOP Congressman Bob Inglis of South Carolina who was told by a constituent at a town hall meeting to “keep your government hands off my medicare.”

Comment by R.T. Wednesday, Jun 25, 14 @ 10:09 am

I actually don’t feel cheated. Anyone and everyone would love to see more Fed dollars coming back, but in the states where they see more, it usually means there’s military bases, national parks and a lot of Fed holdings. When you think of Ft. Sheridan and some other former bases, Illinois actually gained some state tax base returning the land to private use. These reports can occasionally be a bit deceiving.

Comment by A guy... Wednesday, Jun 25, 14 @ 10:09 am

A guy - How is it deceiving? Do you deny that we are a net exporter of dollars to other states? Yet supposedly no one can make a buck here?

Where do those dollars come from?

Comment by Small Town Liberal Wednesday, Jun 25, 14 @ 10:14 am

Illinois: lowest in pork production.

Comment by walker Wednesday, Jun 25, 14 @ 10:15 am

Remind that to voters who booted Rostenkowski out of office.

Comment by Becasue I say so... Wednesday, Jun 25, 14 @ 10:16 am

Good thing we’ve got Durbin, bringin home the bacon, er gumball, maybe.

Comment by Weltschmerz Wednesday, Jun 25, 14 @ 10:17 am

After following politics in the last few years and watching groups like the tea party and its stance on government and taxes, I’ve come to the following conclusion:

Why should I pay taxes that benefit government haters and tax haters who have power in red states? Why is there not a reverse tea party, a group of people who protest paying taxes that benefit those who hate government when it doesn’t serve only their very narrow interests, and who despise taxes because they help people they don’t like?

These are only thoughts, and they don’t shape my political choices. Those who don’t mind paying taxes, such as myself, don’t create anti-tea-party type of organizations, even though the data almost warrant it.

Comment by Grandson of Man Wednesday, Jun 25, 14 @ 10:17 am

beware of those who complain about “the takers.” they are usually the ones doing the taking. in this case, the southern states, the biggest complainers about the Feds.

Comment by Amalia Wednesday, Jun 25, 14 @ 10:28 am

Boy the south is heavily subsidized bunch of welfare queens.

Comment by Ahoy! Wednesday, Jun 25, 14 @ 10:38 am

- A guy..-

You’re right to a certain extent, military spending plays a role, but poverty rates are a bigger factor. California has far more military bases than any other state and receives a ton of federal dollars in the form contracts held by defense industry businesses based there. But California is always a loser on these federal dollars in/federal dollars out studies. However, three of the poorest states in the Union, Mississippi, Alabama, and Louisiana, always finish near the top of per-capita federal spending lists. Lots of food stamp, TANF and medicaid payments flowing from DC to those states….all the things their politicians complain about and their voters vote against.

Comment by R.T. Wednesday, Jun 25, 14 @ 10:40 am

It’s more than a bit ironic that the state where an extreme Tea Party candidate almost unseated a longtime GOP senator yesterday, Mississippi, is the state most dependent on federal dollars. The Tea Partier’s message was, of course, that federal taxes are too high and that the federal government is unnecessarily intruding on matters that should be left to the states. It’s amazing how blind people can be sometimes.

I understand and support the need for healthcare and for not letting people starve in this country. That said, it is not fair that states like Mississippi keep their own taxes low while they depend on federal revenues to pay a bigger percentage of the costs for education and infrastructure than states with more realistic tax systems like Illinois.

Comment by OldSmoky2 Wednesday, Jun 25, 14 @ 10:40 am

=== Small Town Liberal - Wednesday, Jun 25, 14 @ 10:14 am:

A guy - How is it deceiving? Do you deny that we are a net exporter of dollars to other states? Yet supposedly no one can make a buck here?

Where do those dollars come from?====

STL, I tried to help you in the first post. Many southern states are chock full of military bases, as are some oceanfront states (USN). In truth, those are better places to train military members. Of the blue states, CA is the one that comes to mind that had a lot of military bases.

Other western states have huge tracts of Federal Land including National Parks. The midwest is an Agriculture center. While there may be subsidy, our land is a hell of a lot more productive than desert. This has a lot to do with population centers too. Where a lot of people live (Illinois) Fed money is diluted more than say…New Mexico.

It’s deceiving at first blush. If you look at it closer, it makes more sense. Is this a better explanation?

Comment by A guy... Wednesday, Jun 25, 14 @ 10:45 am

–but in the states where they see more, it usually means there’s military bases, national parks and a lot of Fed holdings–

No, what it always means is they pay less in taxes and get more in return from formula-driven programs.

For crying out loud, you think national parks are some kind of cash cow? That makes sense to you?

The Yankees have been footing the bill for the small-government types in Dixie and the West forever.

Comment by Anonymous Wednesday, Jun 25, 14 @ 10:47 am

RT, we criss-crossed. I buy most of it, but not all of it. LA, MS,AL have huge, huge! FEMA subsidies on account of weather related events too. But there’s no denying, poverty in the Delta is very real and people need help.

Comment by A guy... Wednesday, Jun 25, 14 @ 10:48 am

==For crying out loud, you think national parks are some kind of cash cow? That makes sense to you?===

Quick answer: yes.

Comment by A guy... Wednesday, Jun 25, 14 @ 10:49 am

=== it usually means there’s military bases, national parks and a lot of Fed holdings====

Oh, please. Somebody already mentioned California. But look at Washington State. Think: Boeing. Consider all those government contracts. Look at the state’s ranking.

Comment by Rich Miller Wednesday, Jun 25, 14 @ 10:54 am

A Guy, enough with the national parks and land holdings. That explains nothing.

By and large, with some exceptions, the Red States pay less in taxes because they don’t make the money; they have small economies and less income.

That’s whey they receive a disproportionate share in federal formula-driven programs. It ain’t for Smoky the Bear.

Wealthy states like Illinois foot the bill. Goofy spin like “national parks” doesn’t change the facts.

Comment by wordslinger Wednesday, Jun 25, 14 @ 10:56 am

Speaking of rankings, Illinois is 27th in CNBC ranking of business friendly states. http://www.cnbc.com/id/101758236

Looks about right but behind our neighboring states.

Comment by Ben Wednesday, Jun 25, 14 @ 10:58 am

Just think how much more distorted these numbers would be had a majority of red states approved medicaid expansion say Texas for example.

Comment by Jorge Wednesday, Jun 25, 14 @ 10:58 am

What do the numbers look like if you exclude military base spending (which is one of two types of gubmint spending that Tea Partiers like, the other being military supply contracts)? My guess is that Red States still come out as net “takers.”

Comment by Concerned Wednesday, Jun 25, 14 @ 11:03 am

Word and Rich,

I started out with “I don’t feel cheated”. Federal money goes to plug holes. I’m not disagreeing with either of you. At the same time, enormous money goes to federal holdings and military installations. You cherry pick Washington State, fine. Why Maine? Population bases have plenty to do with it too.

Some days you guys are even hard to agree with. lol

Comment by A guy... Wednesday, Jun 25, 14 @ 11:03 am

===Looks about right but behind our neighboring states.===

Illinois is not…Indiana, Wisconsin, Missouri, Iowa, or Minnesota. Not in economics, demographics, or population and urban/rural make up.

It’s a tired argument.

Comment by Oswego Willy Wednesday, Jun 25, 14 @ 11:04 am

===Concerned - Wednesday, Jun 25, 14 @ 11:03 am:

What do the numbers look like if you exclude military base spending (which is one of two types of gubmint spending that Tea Partiers like, the other being military supply contracts)? My guess is that Red States still come out as net “takers.”===

Good soil and black oil. Cotton ain’t what it used to be.

Comment by A guy... Wednesday, Jun 25, 14 @ 11:06 am

I wish they’d also overlay the average income per state, as well as maybe the average corporate taxes paid, and not put it into a top 5. Percentages and ratios are fun, but mean nothing without context. At first glance, the greenish states look like the ones with major corporate headquarters.

I liked this quote from the link:

“So lower-income states generate a smaller percentage of total federal income tax receipts, but because the majority of federal income tax receipts are spent on health and welfare, these lower-income states receive a disproportionately greater amount of federal expenditures since lower-income individuals are more likely than wealthier individuals to receive their health and welfare benefits from the federal government.”

So for all the Democrat’s feeling cheated, isn’t this how they want things to work? Money goes from the rich to the people who need the benefits?

Comment by ChrisB Wednesday, Jun 25, 14 @ 11:08 am

So lemme see if I get this.

Illinoisans are suppose to be proud that we pay into a Federal tax system and don’t get back our fair share because we are less dependent on Federal money?

Yay…lol.

What about wasted State, city and county taxes?

Talk about dependency.

USA today just did a spin piece titled

“Public sector job growth is good news for Chicagoans”

http://www.examiner.com/article/public-sector-job-growth-is-good-news-for-chicagoans

In this story they blurr the line between public and private sector jobs.

Glorying public jobs under the proposition that public job growth is only a direct result of increased tax revenue from private job growth. (which in the example they provide can not be further from the truth in Illinois)

Over the time period specified we are told that 48,000 PUBLIC sector government jobs were created in Illinois.

Then the author compares that to Texas which for one month created 57,000 PRIVATE sector jobs!

We are then showed the unemployment percentages dropped in Illinois.

However!

Go to the bls.gov website and we find that Illinois did not grow private sector jobs. In fact we lost 14,000 non-farm payroll jobs over the period specified.

And as far as the drop in unemployment numbers the number counted as unemployed dropped by roughly a whopping 77,000. HA! Do the math and tell the class where the people went when non-farm payroll declined and we added only 48,000 government jobs.

So we would like to know how this is good news for Chicagoan’s as the city and State continue to spend beyond their means borrowing more money that will eventually be put on the taxpayers tab.

http://www.bls.gov/eag/eag.il.htm

They say this is “FANTASTIC News” lolololol More government bureaucracy

Comment by oz Wednesday, Jun 25, 14 @ 11:12 am

- ChrisB - Wednesday, Jun 25, 14 @ 11:08 am:

“So for all the Democrat’s feeling cheated, isn’t this how they want things to work? Money goes from the rich to the people who need the benefits?”

I don’t think Dems are feeling cheated. I think the Dems point is that Tea Partiers are hypocrites for arguing against tax and redistribution when their home states are the net beneficiaries of that system.

Comment by Concerned Wednesday, Jun 25, 14 @ 11:12 am

A most telling graphic AND shows that it is primarily ‘red states’. Shouldn’t they be branded the real ‘welfare queens’ that the right wing is always complaining about?

The more interesting thing is that despite their Federal largess these more dependent states are generally far less desirable places to live than the states ‘in the green’ when you look at other quality of life factors as well. Perhaps these ‘dependent states’ are too comfortable in that ‘hammock’ Congressman Paul Ryan was yammering about [snark].

Comment by HGW XX/7 Wednesday, Jun 25, 14 @ 11:14 am

There’s a saying in the I/T programming industry.

GIGO. Garbage In == Garbage Out.

It all depends on what your definition of “is” is. What direct payouts are, yeah?

There’s no time frame that I can find that tells us over what period this information is based upon.

Maybe it was when the nation got a huge Federal payroll tax break and Illinois in turn grabbed the money with it’s 66% State income tax increase.

Naw man, see, don’t feel cheated it’s all good.

Smoke and mirrors baby. Sell it to someone else.

Comment by oz Wednesday, Jun 25, 14 @ 11:20 am

With powerful Illinois Democrats at every level from the White House and Senate down through the Governors mansion, ILGA and many counties…

You would think someone somewhere could keep their eyes or make a few phone calls to help secure more federal funding opportunities for our state as we drown in red ink.

Comment by Formerly Known As... Wednesday, Jun 25, 14 @ 11:25 am

The rich *should* be taxed at a higher rate, and the proceeds should be given to the less fortunate.

Please don’t insinuate the poor are poor because they are lazy, and deserve what they get. That is insulting.

Comment by Anonymous Wednesday, Jun 25, 14 @ 11:27 am

–There’s no time frame that I can find that tells us over what period this information is based upon.–

How’s about forever? Does that time frame work for you?

I take it this is news to you. You’ve been asleep a long time, Rip. It’s hardly a shock to anyone who’s been awake the last 80 years or so.

Comment by wordslinger Wednesday, Jun 25, 14 @ 11:36 am

IL’s senior US Senator has decades of seniority, but doesn’t have the wherewithal to bring home the bacon. President Obama also resides here in IL. Seems to me that IL Dems don’t offer enough ROI.

Look at Texas when GWB was President and all their nice new freeways.

We are getting short changed…

Comment by Allen Skillicorn Wednesday, Jun 25, 14 @ 11:48 am

State: Mississippi

Expert Commentary: Thomas Garrett, The University of Mississippi

Thomas Garrett“The results of the study are not surprising if one considers the progressive nature of the federal income tax and the growing percentage of federal expenditures allocated to health and welfare (about 30 percent of federal expenditures in 1950, now about 65 percent), which are primarily consumed by lower-income individuals. So lower-income states generate a smaller percentage of total federal income tax receipts, but because the majority of federal income tax receipts are spent on health and welfare, these lower-income states receive a disproportionately greater amount of federal expenditures since lower-income individuals are more likely than wealthier individuals to receive their health and welfare benefits from the federal government.

Interesting comment by this person and it goes along with the fact that a lot of Red states have heavy minority populations (Alabama, Mississippi, Louisiana, South Carolina, Arizona). Of course, the minorities in these states do not vote heavily for Republicans but it still accounts for at least some of this. And there are exceptions, West Virginia (Purple state) is heavily poor White.

Montana and South Dakota?? Heavily White Red states yet receive a lot of federal money back. Is there another reason such as a lot of national parks and BLM land? I do not

know but it would be interesting to see a more micro analysis of this.

As to Illinois, these type of studies have been done many times before and they always show Illinois at the low end of federal giveback. And it never changes.

Comment by Federalist Wednesday, Jun 25, 14 @ 11:49 am

Federalist did a nice job there of explainging an aspect of this.

As to red staters being hypocrites, if would have to come down to what voters are taking what benefits. If those receiving benefits are voting Democratic, and those not are voting GOP, there’s no hypocrisy.

It’s very simplistic to assume that all, or even a high percentage, of those voting Republican are on the receiving end of the government money.

Comment by Fed 2 Wednesday, Jun 25, 14 @ 11:56 am

Those Red State Republicans are still the benficiary of the federal dollars coming into their state. Those federal benefit dollars get spent in that Red State. Cut off that flow of federal dolars and the Red State’s economy gets worse. I can hear the Tea Partiers howling at that propsect!

Comment by Concerned Wednesday, Jun 25, 14 @ 12:01 pm

“the fact that a lot of Red states have heavy minority populations”

Romney won 213 of the 254 counties in which SNAP use doubled recently. Who did these people think Romney was talking about when he made his 47% comments?

http://www.bloomberg.com/news/2013-08-14/food-stamp-cut-backed-by-republicans-with-voters-on-rolls.html

Comment by Grandson of Man Wednesday, Jun 25, 14 @ 12:08 pm

Maybe the pre-1990 Big Ten states should form a breakaway republic. lol Wonder how that would work out for ocean-dependent imports/exports.

Comment by Illiana Wednesday, Jun 25, 14 @ 12:18 pm

@Grandson of Man,

“Romney won 213 of the 254 counties in which SNAP use doubled recently. Who did these people think Romney was talking about when he made his 47% comments?”

That does not necessarily mean that those who were eligible for food stamps voted for Romney.

You are making a huge leap of illogic in assuming this. To carry a county requires a majority voted for that candidate and unless a majority of the county were food stamp participants one can not assume that those eligible voted for Romney.

Must admit though this would be a great Doctoral dissertation topic for further analysis.

Comment by Federalist Wednesday, Jun 25, 14 @ 12:34 pm

This paragraph is what grabbed me:

=== What if, for example, a particular state can afford not to tax its residents at high rates because it’s receiving disproportionately more funding from the federal government than states with apparently oppressive tax codes? That would change the narrative significantly, revealing federal dependence where bold, efficient stewardship was once thought to preside. ===

Eh, Texas anyone?

Comment by Bill White Wednesday, Jun 25, 14 @ 12:38 pm

There are disparities that cannot be explained by public lands, military bases, and poverty. A good place to look is the U.S. Census Bureau Statistical Abstract. It issued a report for 2007 on federal aid per capita per state that showed that 21 states rank above the national average in that category. Of those, only six could be called “Blue” states. It also breaks it down by federal department. While higher-ranked states like Mississippi do get a lot of aid on housing and human services, they also get more aid per capita for transportation, education, and agriculture than states such as Illinois, which ranked 36th overall, far below the national average.

Comment by OldSmoky2 Wednesday, Jun 25, 14 @ 12:43 pm

@OldSmoky2,

You made a very good point. And as I stated in my original comment, a great deal of detailed analysis would have to be done by “objective’ researchers to gain any real insight on this matter.

To be honest, the original part of my post was just to question the previous posters who talked about the hypocrisy of the the “Red states” and or “Tea-Partiers” without obviously giving too much thought that there may be other considerations they had not considered in their statements.

In any case, Illinois always has come out on the short end of the stick and it would be interesting to have more information on this matter.

Comment by Federalist Wednesday, Jun 25, 14 @ 1:08 pm

“That does not necessarily mean that those who were eligible for food stamps voted for Romney.

You are making a huge leap of illogic in assuming this.”

I don’t think so–unless Bloomberg’s numbers are wrong. Here is a quote from the article:

“The Bloomberg review of 2,049 counties where the data was available included the 250 with the highest concentration of food stamp recipients. Among that group, 227 are wholly within one congressional district, with 160 represented by Republicans and 67 by Democrats.”

Comment by Grandson of Man Wednesday, Jun 25, 14 @ 1:24 pm

WV used to be bluer. Senator Byrd saw to it that the entire state was paved, every mountain had a bridge to the next one and coal remained king. With Uncle Teddy of Alaska on the GOP side, the sty was never short on slop. It’s not leadership Dick Durbin should’ve shot for, it’s appropriations. Smaller states with long term senators always seem to eat at that table. Another place where term limits might be a reasonable discussion.

Comment by A guy... Wednesday, Jun 25, 14 @ 1:25 pm

It doesn’t matter to me whether people who get government help are white conservatives or black Democrats. People in need are people in need. I just wish we were less hypocritical about it. There but for the grace of God go many of us.

Comment by Grandson of Man Wednesday, Jun 25, 14 @ 2:02 pm

Bloomberg cherry picks all the time. They are not unique as many other MSM outlets do also. Take yur choice either ‘liberal’ or ‘conservative.’

I have not done that nor have I cited any source that does. I gave one quote that was included in the WalletHub info that was cited at the beginning of this blog. I then questioned those who pointed all of this lead to their conclusion that the Red States and Tea-Partiers are hypocritical on this issue.

I have made several rational observations that at least led to intelligent and rational alternatives to the above CW. I also observed that I would like to see a more comprehensive and detailed study.

If that upsets some, so be it. Enough of this on this topic on this site. Bye, Bye!

Comment by Federalist Wednesday, Jun 25, 14 @ 4:28 pm

@anonymous

=Please don’t insinuate the poor are poor because they are lazy, and deserve what they get. That is insulting.=

Surely you’re not insinuating that lazy people aren’t often poor, are you?

When I taught high school, I told my kids that America was one of the few places on this earth where if you studied hard, worked hard, saved hard and deferred gratification, invested wisely and didn’t have children until you were financially and emotionally prepared to take care of them while in an emotionally and legally committed relationship, success is almost certainly guaranteed here.

What overwhelmingly makes people poor and unsuccessful is making bad choices, not lack of opportunity in America.

Family, church, and school used to do a pretty good job of helping American students make good choices up until the 1970s. That’s when we started to take away social stigmas which stopped a lot of bad behavior and replaced it with “tolerance” of dysfunctional choices.

We told kids there are “no wrong answers” instead of letting them know there ARE bad choices they should avoid. Society stopped doing its job, and turned it over to dysfunctional, self serving government and that’s why we have a lot of the social ills we have today.

Here endeth the rant.

Comment by Arizona Bob Wednesday, Jun 25, 14 @ 4:53 pm

So let me get this right–the tea party almost helped elect someone who did not support as much federal spending…but they’re hypocrites because that state gets a lot of federal aid? What?

If I come from a state with a lot of corruption (like, dunno, IL) and I fight for anti-corruption bills, does it make me a hypocrite that I’m from Illinois? Heck no, what kind of dumb logic is that?

The tea party doesn’t like big government. If they vote in people who vote out there OWN government money, that doesn’t make them hypocrites–that makes them principled. The criteria for “hypocrite” is not “someone whose politics I disagree with”, sorry.

Comment by Liandro Wednesday, Jun 25, 14 @ 6:07 pm

- Arizona Bob - Wednesday, Jun 25, 14 @ 4:53 pm:

@anonymous

=Please don’t insinuate the poor are poor because they are lazy, and deserve what they get. That is insulting.=

Surely you’re not insinuating that lazy people aren’t often poor, are you?

This. Poor does not mean lazy, but lazy can often turn into poor. Having a great work ethic rarely hurts the pocketbook.

Comment by Liandro Wednesday, Jun 25, 14 @ 6:12 pm

===Having a great work ethic rarely hurts the pocketbook. ====

Lots of people work really hard and are barely making ends meet. I know plenty. And one thing goes wrong, a car breaks down, the store closes, somebody gets sick, and they’re in danger of serious poverty.

Comment by Rich Miller Wednesday, Jun 25, 14 @ 6:16 pm

@oz-11:12=they blur the line between public and private sector jobs.=

It gets very blurry, but do increased public sector jobs always cost “more tax money”? Example, if the state hires workers who work for half of contractor cost, the state can cut back on contractors and it would result in “less tax money” spent.

Comment by DuPage Wednesday, Jun 25, 14 @ 7:07 pm

Not disagreeing with that at all. Most of us are one or two major medical problems away from being broke.

Just pointing out that having a work ethic doesn’t hurt the odds, in my experience, of having some money in the bank. Being poor doesn’t mean you’ve been lazy, but being lazy often leaves you poorer.

Comment by liandro Wednesday, Jun 25, 14 @ 7:48 pm

If Illinois wants a bigger share of the pie, then:

1. Reduce per-capita income substantially

2. Get older (probably requires getting a warmer climate)

3. Convert land of militarily value for training to bases

4. Attract more defense contracts/contractors

5. Attract more medical & scientific research dollars

1-3 are not desirable/practical.

Do 4 & 5.

Comment by east central Wednesday, Jun 25, 14 @ 11:05 pm