Latest Post | Last 10 Posts | Archives

Previous Post: Working the refs

Next Post: Dems again slam Dold on Tea Party ties

Posted in:

* The constant media drumbeat about how public employees need to essentially be punished for their “lavish” pensions isn’t working, according to the Tribune’s latest poll…

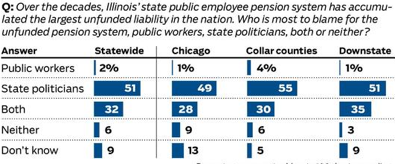

Illinois voters overwhelmingly blame politicians for creating the state’s public employee pension mess, but like elected officials, they’re divided about plans to fix the problem, a new Chicago Tribune/WGN-TV poll shows.

What that lede doesn’t mention is that Illinoisans don’t blame public employees for the pension mess…

Just 2 percent of Illinoisans think the mess is solely the fault of workers…

Brian Foggs, a 29-year-old from the Chicago Lawn neighborhood, blamed politicians for the pension mess, not state workers.

“These people aren’t being unreasonable. They just have to take care of bills,” said Foggs, a poll respondent.

And less than a third blame both politicians and workers.

* On to the solution…

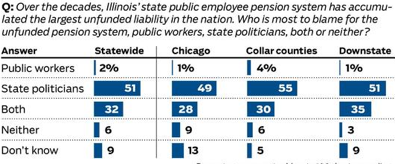

Keep in mind, that’s the Democrats’ proposal. And their own party members don’t support it…

Democratic voters opposed the plan 38 percent to 32 percent, but Republicans were slightly more in favor than against, 35 percent to 32 percent.

The Tribune’s proposal, which the House Republicans have adopted, is a lot harsher to workers.

I’ve said it before and I’ll say it again, Rep. Mike Fortner’s plan definitely needs to be considered.

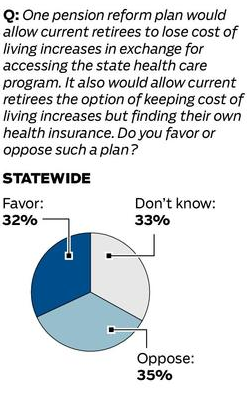

* This was a quickie poll question. The consequences weren’t totally laid out. We need better numbers. But when less than a third of the population supports an idea, it may be time to rethink that idea. And it also means that even harsher ideas should be looked at with much suspicion.

More…

The proposal also drew 55 percent opposition from white suburban women, moderate voters that include so-called soccer moms especially concerned about education. Only 28 percent of that group backed the cost shift. Among independent voters, a key demographic that influences state elections, the idea was rejected 44 percent to 31 percent.

The Chicago Democrats have really shot themselves in the foot with that plan.

posted by Rich Miller

Tuesday, Oct 16, 12 @ 10:46 am

Sorry, comments are closed at this time.

Previous Post: Working the refs

Next Post: Dems again slam Dold on Tea Party ties

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

the direct employer pays proposal is a loaded question–it suggests chicago doesn’t pay for their own teacher pensions when the truth is exactly the opposite. This question is ridiculous

Comment by anon Tuesday, Oct 16, 12 @ 10:51 am

Wonder what the results would have been if “other than Chicago” was left out of the question.

Comment by M O'Malley Tuesday, Oct 16, 12 @ 10:55 am

Doing the “math” …

There are fewer politicians to blame workers in a pol… there are more workers to blame politicans in the same poll. There are probably 177 “workers” in one facility, versus 177 politicans under one Dome.

That being said … the poll is not suprising, but the continued belief that the blame wil stick on the workers, given Illinois’ political culture and recent history, fair or unfair, is … plain silly.

You would think the H&SGOP should be able, somehow …ANYHOW … to make some hay and really gain “something” here … still waiting for that, thanks.

Comment by Oswego Willy Tuesday, Oct 16, 12 @ 10:56 am

Even the things the workers ARE somewhat to blame for - the various “sweeteners” and “spikes” that raid the different pension funds - were adopted by legislators to buy support or votes.

Comment by Excessively Rabid Tuesday, Oct 16, 12 @ 10:59 am

Arrghhh…ok, now how are we going to fund it/fix it? And I don’t want the Legislature to abdiate to Rahm to lead the parade on this issue.

Mike Madigan, Tom Cross, Chris Radogno, and John Cullerton, please join Quinn in a real effort to fix this problem or get the hell out of the way.

Comment by Loop Lady Tuesday, Oct 16, 12 @ 11:06 am

Glad to see the public is seeing the truth behind the pension “crisis”.

While, in my opinion, it needs some minor tweaking, HB 6204 is a better proposal / starting point for pension “reform”.

The tweaking I would like to see is the (SERS) employee share being capped at a maximum of 6% (it’s 4% today) or 1/2 of the normal cost of the define dbe3nefit plan (if that cost is lower). The actual proposal is the higher of the two, which would let to more uncertainity on the parts of the employees. Or in the alternative, I would like see the “normal cost of the defined beneft plan” calculation spelled out in more detail and overseen by an independent organization.

That proposal could, I think, be rationally discussed by both parties …

Comment by RNUG Tuesday, Oct 16, 12 @ 11:10 am

The first thing that needs to be fixed is the rules.

-The loop holes that allow multiple pensions. (Pensions are intended to take care of a person for a lifetime of dedicated service, not a reward for a day of service.)

-Union leadership that are not performing a service FOR THE TAXPAYER should be excluded from pension eligibility.

(Tax-payer funded benefits are for those that serve the tax-payer. If you serve the union/workers you’re providing a service for the union.)

-Retirement at the age of 55. This needs to be revisited. (If SS can move to 68, so can the state.)

-Individual control. (Let’s start with a roll-over plan. You can’t borrow against your pension, but you can borrow against your 401k. If a state employee leaves, give them the option of a lump sum payout into a 401K. Make their retirement options flexible.)

These are things that the lawmakers can control and should be work towards. The current pension system is broken beyond funding issues.

Comment by Suburban Resident Tuesday, Oct 16, 12 @ 11:38 am

–Just 2 percent of Illinoisans think the mess is solely the fault of workers…

That Civic Committee advertising and Tribbie employee-bashing sure hasn’t moved the needle.

Comment by wordslinger Tuesday, Oct 16, 12 @ 11:54 am

The “We are One” framework included significant increases in employee contributions along with closing tax loopholes. Why hasn’t a bill come forward based on that? It would likely be constitutional, and would put more of the burden on employees than this pooling would even suggest. Plus, it would be progress, and more than the legislature accomplished on the pension issue this year.

Comment by AC Tuesday, Oct 16, 12 @ 11:56 am

Actually, the pension question wording is slanted. It shouldn’t be “Public Workers or State Politicians” but instead “Public Sector Unions or State Politicians.” Decade after decade, the public sector unions relentlessly lobbied the legislature for increased benefits, even to the detriment of increased state funding for pensions. “Give us the increased benefits and don’t worry about the funding,” legislators were told, “The State Constitution guarantees the funding.” Both public sector unions and state politicians were willing to kick the can down the road for somebody else to pick-up the mess.

Comment by Louis Howe Tuesday, Oct 16, 12 @ 12:00 pm

I don’t have a problem with multiple pensions, provided the person met the rules for each without combining service, and that each pension is only paid for the years of service/rate of pay for that pension. I think that reciprocal pensions where the person can put all the years of service towards whatever pension plan pays the best is what is unethical.

For example. 10 years at ABC = pension 1. 10 years at DEF = pension 2. That is not the same as adding 10 + 10 for 20 years at ABC because that pension pays better. It is not the same as 10 years at DEF, plus 1 year at ABC for 11 years at ABC. 1 year at ABC should not be enough to earn any kind of an pension for ABC. But the 10 years at DEF should remain payable.

Comment by mythoughtis Tuesday, Oct 16, 12 @ 12:04 pm

interesting and a little surprising to see a fair level of understanding of the issue by the public. i always thought if you get more than 30 miles from the capitol, the public was not aware and didnt care about the issue. so i suppose all the ads and editorials are having an effect.

Comment by langhorne Tuesday, Oct 16, 12 @ 12:08 pm

Like the favorable teachers poll that was done around a month ago, this is also a favorable poll, from my standpoint. Rich conservatives’ attempts to demonize goverment employees appear to be failing. Their “divide and conquer” strategy is not working. One one hand, they try to stir up resentment by asking private sector workers why should they pay for the lavish compensation of goverment workers when they are not getting it themselves. On the other hand, they tell government workers that they should not be getting the compensation that has been cut back in the private sector.

The pension problem is big enough that it doesn’t require any demonization. No one, in my opinion, has to be pounded into compliance or softened up with propaganda attacks to get people to realize that this is a major problem.

Comment by Grandson of Man Tuesday, Oct 16, 12 @ 12:13 pm

===Why hasn’t a bill come forward based on that? ===

Perhaps you should talk to the coalition. Anybody can bring language to LRB, and those lobsters surely know somebody who would sponsor it.

Comment by Rich Miller Tuesday, Oct 16, 12 @ 12:28 pm

Whose to blame is a red herring. Unless the state claws back money from people who gamed the system e.g Carol Ronen’s pension spike or benefited from poor system design eg. Art Berman’s three govt. pensions, the guilty parties are not going to pay for the clean up. Completely innocent tax payers will to the extent they tolerate higher taxes and degraded public services and so will public employees who cannot receive what they were promised, however unrealistic to begin with.

Comment by Carlos S. Tuesday, Oct 16, 12 @ 12:30 pm

It seems like the public clearly understands that it’s corrupt politicians that created this mess for campiagn contribution bribes. The rank and file didn’t have the power to enact the laws or fund the pensions. It was the pols that had the power and responsibility and abused both.

Dems made pension promises they couldn’t keep (what a surprise!). Now it’s time to pay the piper, and they want to hand off the bill to someone else.

A lot of GA faces have changed for the Dems, but the puppetmaster responsible is still calling the tune.

Until we get rid of him, the same sad music won’t change.

Comment by Palos Park Bob Tuesday, Oct 16, 12 @ 12:32 pm

Check in on the North Shore School District 112 website, which is posting data on offers from its teachers which are on strike. This appears to offer more clarity than what happened in Chicago. I understand the district sent parents a schedule of all teacher salaries by name. I also understand that a major sticking point is a major salary spike for each of the four years at the end of a teacher’s career to inflate the pension. The northshore is not a monolithic bloc of rich folks, and the numbers being demanded are certainly giving people pause as to future property tax increases. Sooner or later, the private sector workers are going to open their eyes and realize there is a retirement wealth transfer in this state from the private sector to the public sector and the true extent of the bill is starting to sink in. It is irrelevant who the voters blame, although striking, well paid teachers will sour the public on much lesser paid gov workers whose pensions and other retirement benefits are not so generous. There is a bill coming due and the taxpayers can’t pay it, unless someone figures out how to re-inflate home prices in two years.

Comment by Cook County Commoner Tuesday, Oct 16, 12 @ 12:38 pm

“Individual control. (Let’s start with a roll-over plan. You can’t borrow against your pension, but you can borrow against your 401k. If a state employee leaves, give them the option of a lump sum payout into a 401K.”

This already exists! All the ‘experts’ want to fix the pensions. How about actually studying them first. I am so tired of ‘experts’ who really don’t know what they are talking about. To every complex problem there is a simple solution and it is generally wrong!

Comment by Old and In the Way Tuesday, Oct 16, 12 @ 12:52 pm

- ===Why hasn’t a bill come forward based on that? ===

Perhaps you should talk to the coalition. Anybody can bring language to LRB, and those lobsters surely know somebody who would sponsor it. -

Unfortunately the leadership has convinced the members that it’s more productive to run around the state protesting Governor Quinn.

Comment by Small Town Liberal Tuesday, Oct 16, 12 @ 1:07 pm

The politicans in Springfield only have to look in the mirror to find out where the 1st cuts should come from.

They have no shame,they would throw anybody

but them selves under the bus.

Comment by mokenavince Tuesday, Oct 16, 12 @ 1:22 pm

to Suburban resident…..I agree the rules need to be fixed.

But if a person works for multiple pension systems why shouldn’t they be able to get pensions from each. Think about it this way, when I worked for the state I had a lot of people who had previously worked in private industry and were getting a defined benefit pension from a prior job. They now work for the state. No one had a problem with the multiple pensions they had. I had some employees who worked all day at the job, then worked in the evening teaching. So they had to pay into 2 pension systems. No different than when my husband worked 2 jobs and paid into both pension systems. The issue is not multiple pensions. Other people get to do this both in public and private employment. What most people seem to resent is the defined benefit plan public employees have, since there are so few jobs that offer this benefit through private employment (there are a few out there). But if you worked multiple jobs with multiple pensions wouldn’t you believe you earned each one?

Agree with you on the union leadership…they should not get service credits for state employment while working for the union.

Retirement is based on years of service and an age so to retire at 55 most people need to have 30 years of work. Maybe this rule should change, but it was something that was obtained in lieu of pay raises during a prior contract negotiation. Social Security does allow for an early retirement at 62 so maybe that should be the thresholds for the pension.

On individual control, if you leave the state now you can withdraw your money from the pension system and roll it into a 401K rather than take the pension. You get only what you put into the plan, there is not money for employer match or interest earned. (that is for some pensions, the university pension system, does have a plan which is more like a 401K). It is important to understand there are 5 pension systems with 5 different set of rules, some of the deals read about are not available through all of the pension systems.

So lets’ save some really money and get one pension system for all state employees, with one set of rules. Keep it simple, so it is harder to hide the sweeteners.

Comment by illinifan Tuesday, Oct 16, 12 @ 1:34 pm

Every single proposal is about making public employees pay more and get less. No proposal makes the government pay its share or else. How about a slight increase in the employee share with an agreement that the employee gets reimbursed his or her annual payment with no loss of benefits every time the government decides not to fully fund the plan?

Comment by wert Tuesday, Oct 16, 12 @ 1:57 pm

According to the graph Rich posted yesterday, in 1972 the pensions were only 35% funded, yet in the past 40 years they’ve never missed a payment to a retiree. If, historically, 35% funding has paid the retirees, why is the goal 90% or even 80 or 70?

Comment by Anon Tuesday, Oct 16, 12 @ 6:06 pm

Anon - The madness of the bond ratings agencies, that’s why.

Comment by Small Town Liberal Tuesday, Oct 16, 12 @ 7:07 pm

–According to the graph Rich posted yesterday, in 1972 the pensions were only 35% funded, yet in the past 40 years they’ve never missed a payment to a retiree. If, historically, 35% funding has paid the retirees, why is the goal 90% or even 80 or 70?–

Ask the Money Honey, or any of the other millionaire media shills who have sinister interests in peddling ignorance about finance to the ribbon-clerks and nebbies.

How about this one? Illinois has been a state since 1818. It’s never missed or been late on a bond payment, not through many recessions, Civil War, WWI, Depression, WWII, etc.

How’s that for a credit history? The state should be AAA, like sub-prime MBS and Enron, don’t you think?

Instead, we get hosed by the credit agencies and the weirdos on the WSJ edit board.

Meanwhile, the politically wired wise guys on LaSalle and Wall streets run our boiler-plate bonds, do no work, but take half a point off the top in profit to go to market at a price where demand exceeds supply by a factor of four.

Not exactly Macro 101. But good work, if you can get it.

Comment by wordslinger Tuesday, Oct 16, 12 @ 7:44 pm

The more this pot gets stirred the more obvious that only across the board cuts of the entire state budget can generate the needed revenue to solve this problem. A 4% cut applied to the entire budget would produce well over a billion a year to apply to the pension problem. That revenue along with reasonable pension reforms will solve the problem, and spread the pain so that no one constituent group is devastated. People who argue that we need to set priorities, and zero out entire programs are really arguing for no change at all.

Comment by wishbone Tuesday, Oct 16, 12 @ 7:45 pm

Amen wordslinger!

Comment by Norseman Tuesday, Oct 16, 12 @ 7:56 pm

wishbone - A billion a year? Wow, considering no other factors it would only take 83 years to get to the ratings agencies target. Think they’re on board?

Comment by Small Town Liberal Tuesday, Oct 16, 12 @ 10:36 pm

“wishbone - A billion a year? Wow, considering no other factors it would only take 83 years to get to the ratings agencies target. Think they’re on board?”

Yea, a billion a year and freeze it at that level. Also do the pension reforms (you forgot I said that didn’t you). I really find it interesting that those who criticize across the board cuts never have their own proposed solution.

Comment by wishbone Tuesday, Oct 16, 12 @ 11:37 pm