|

The public doesn’t want to do it, either

Tuesday, Aug 21, 2012 - Posted by Rich Miller * I wanted to take a closer look at one of the IEA’s poll results…

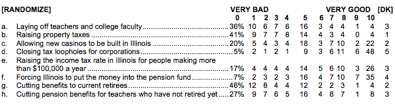

Click the pic for a better look at the responses…  * What I’ve done below is combined the 0-3 and 7-10 responses to give us a better idea of where the opposition and support is…

The public clearly does not want anything bad to happen to anybody except corporations which take advantage of tax loopholes. I’m not sure they really understand the consequences of what “Forcing Illinois to put the money into the pension fund” would do. And, notice, that even though a strong plurality supports raising the tax rate on people making over $100K a year, it’s not a majority by any means. And property tax hikes? Forget it, man. There was no question about raising income taxes again on everyone. I doubt it would be all that popular. * And people wonder why it’s so difficult to pass a pension reform bill. It’s not just the General Assembly which doesn’t want to make tough, grinding choices. The people don’t want to do it, either. I think the General Assembly and the governor need to find another way to do this. It’s probably time that they take a good, long look at Rep. Mike Fortner’s pension proposal. If Fortner’s numbers work, it appears to be a whole lot more doable politically than anything else out there, and it’s a whole lot more humane that what’s on the table right now.

|

|

|

|

- wordslinger - Tuesday, Aug 21, 12 @ 10:52 am:

Everybody’s your brother until the rent comes due.

- Crime Fighter - Tuesday, Aug 21, 12 @ 10:55 am:

I wonder if the “tax on services” was omitted because it is viewed as unconstitutional.(?)

- Billy - Tuesday, Aug 21, 12 @ 11:02 am:

The current plan will be found unconstitutional, and be a waste of state money, fighting the court challenge, plus a waste of time. A better way needs to be found, that will not lose in court!

- The Captain - Tuesday, Aug 21, 12 @ 11:04 am:

Fortner’s proposal is a non-starter because it doesn’t satisfy the bloodlust among the Republican base to punish union workers and poor people for being unionized and/or poor. It’s sick. Look at the outright glee the Republican base took in Wisconsin. Look at the ever present talking point during the Republican presidential debates about how a large percentage pay no federal income taxes. Nevermind that the large percentage is made up of the indigent and fixed income seniors, they have bloodlust and it must be satisfied.

This was never about fixing the pension systems for the Republicans. When it became clear that one of the key elements to fixing the systems was to prevent the local school districts from bumping up teacher salaries and placing the burden of funding those benefits from the state’s largest pension fund on the state with no financial repercussions for local school districts fixing this became part of the bill. The Republicans bailed while loudly pouting.

They screamed, they ranted, they threw their papers in the air. They put on a staged crybaby show because they were supposed to be getting a bill that punished unions and the poor, not one that actually fixed the problems.

Since then they have DEMANDED that the provision that actually fixes the problem be stricken from the bill and they’ve demanded to vote for pension reform. What a sham.

It’s all a load of garbage. Unless Fortner’s plan can be amended to inflict pain on poor people it will never pass. These crybabies don’t actually want to fix anything, they just want their ounce of flesh.

- Publius - Tuesday, Aug 21, 12 @ 11:04 am:

One wonders if the actuaries couldn’t figure a plan to let willing retirees cash out of the pension plan. I suspect some would go for an assured “bird in hand” , take the money and run. And if calculated right each pensioner making that choice would eliminate a part of the future liability.

- sal-says - Tuesday, Aug 21, 12 @ 11:05 am:

“I think the General Assembly and the governor need to find another way to do this. It’s probably time that they take a good, long look at Rep. Mike Fortner’s pension proposal.”

AMEN TO THAT. The pols want simple, easy answers, but don’t really want to look for more possible ways to help solve this.

- DOWNSTATE DEM - Tuesday, Aug 21, 12 @ 11:13 am:

Retires and pensioners don’t pay Illinois income tax. How many tax dollars would become available if retires paid their fair share of income tax like those working? That individual tax rate is 5%.

I’m guessing billions.

That question didn’t seem to be on the survey list but should be part of the discussion.

- Ronbo - Tuesday, Aug 21, 12 @ 11:15 am:

Long, but worth a look. From Ralph Martire, the Executive Director of the Center for Tax and Budget Accountability.

http://www.youtube.com/watch?v=yUtM2sAis_0&feature=relmfu

- RNUG - Tuesday, Aug 21, 12 @ 11:19 am:

Rep Fortner’s plan is interesting but I’m not sure I see all the ‘new’ in it. Maybe I don’t get it.

As I read it, he is proposing to restore the money already being diverted every year from the actual employer pension payments to pay the 2004 pension bonds. That gets us back to the status quo before Blago; it puts the State back to making their (mostly) full pension ramp-up payment. Or to put it another the way, the State is just back to paying what they were already supposed to pay.

The only ‘new’ revenue for the pension funds comes from more employee contributions. And the ’savings’ comes from trying to cap the pensions, which probably won’t pass legal muster.

I just don’t see how it all adds up …

- Billy - Tuesday, Aug 21, 12 @ 11:22 am:

How many retirees would move out of Illinois if they were taxed on their pensions? A tax on pensions would sure cause me to move out of state, to Florida, where the winters are nice!

- John A Logan - Tuesday, Aug 21, 12 @ 11:24 am:

Captain.

Although I think Bloodlust is a little bit overly descriptive, I agree that Republicans have not been in a hurry to help solve the problems. From the Republican perspective it was the democrats who have controlled the ship for the last 12 years and so it should be the democrats who “take the blame” for the fix.

Also, republicans have always been less sympathetic to the unions , so it should be no surprise that they are the targeted by republicans when they present reforms.

Makes me wish the “memory erase” things from Men in Black were a reality. Then we could erase everyone in Springfield’s memory, present them with the problems and maybe they could address them without the mental baggage of the last 12 years.

- Charlie Leonard - Tuesday, Aug 21, 12 @ 11:25 am:

In the Fall 2011 Simon Institute Poll, about 43% favored taxing retirement income above $50,000; 49% opposed.

- OneMan - Tuesday, Aug 21, 12 @ 11:31 am:

Captain,

At this point pushing the burden out to non-Chicago districts with falling property assessment bases is a political non-starter.

But it isn’t a bad idea, but if we are going to do it I want the state to start funding my schools like they do Chicago

My district k-12 spends 8,856 per student, Chicago 13,078 per student.

My district gets about $1,600 per student in general state aid, CSD gets about $2,500 per student in general state aid.

So if the state wants to cough up an extra 13,000,000 we can talk.

Oh yeah, the bus funding cuts that targeted districts like mine (covers a large area, one of the biggest in the state) would have to be addressed to.

Otherwise, we have a big capital bill we are paying for the building we had to do, so we have a huge part of our school budget that is a fixed cost.

Oh yeah, btw, we pay our teachers less than Chicago on average (our teachers have on average less experience than Chicago as well).

- Captain Illini - Tuesday, Aug 21, 12 @ 11:38 am:

In the spirit of alternative proposals, I’ll give one a try.

A) Compile / benchmark existing tier 1 employee’s who’ve reached the 20 year requirement.

B) Compile all other vested tier 1 employees less than 20 years.

C) Exempt those in A) from any changes to current retirement or insurance obligations, since otherwise will illicit court challenges.

D) Exempt vested employees in B) from any current retirement obligations since it will also be challenged.

E) Fold in Fortner’s proposal to set aside current bond debt retirement funds for pension payments.

F) Include incentive for those willing to voluntarily withdrawl from pension or insurance systems as Publius suggests.

G) Change the ramp legislation to a new timeline and add language to require compliance.

H) Offer employees in A) & B) the opportunity to buy 3 or 5 years of time and service with the caveat they work an additional length of time equal to that which they have bought. Have all funds go toward pensions. This will expedite the cleansing of tier 1 employees from the ranks leaving tier 2 and all new hires under a different system.

I) Offer legislation that drops a defined benefit for all new hires and shifts to individual accounts, or create an investment pool for those willing to subscribe.

J) Offer legislation that assigns a percentage from each school/university district which helps off-set the state’s contribution to the pension systems rather than shifting entirely to locals.

Just trying to offer solutions in the spirit of Rich’s calls sometimes that we tend to err on the side of saying “no” versus saying “how”.

- geronimo - Tuesday, Aug 21, 12 @ 11:40 am:

Do those receiving social security pay state tax on that? Are other pension earnings taxed in Illinois? Maybe a solution to our state’s revenue flow would be to tax all pension income, including social security.

- The Captain - Tuesday, Aug 21, 12 @ 11:42 am:

One Man,

If you want to join those of us who would like to see education funded equally across the state instead of the inequitable locally funded plan currently in place then I enthusiastically join you.

- Crime Fighter - Tuesday, Aug 21, 12 @ 11:50 am:

Courts could uphold retroactive pension regardless of constitutionality. I was involved in case where the 4th district appellate court created an argument on behalf of the state that justified its actions against employees based on the state’s financial situation. Although there was nothing in the record, the 4th District essentially created a sovereign immunity defense for the state and the IL Supreme Court upheld it.

The Courts often bend over backwards for the IL AG when it comes to wrongdoing against employees, so its feasible that they could get away with it.

- RNUG - Tuesday, Aug 21, 12 @ 11:52 am:

geronimo @ 11:40

No. Currently, all pension income from any source is exempt from the STate income tax.

- Crime Fighter - Tuesday, Aug 21, 12 @ 11:53 am:

Sorry for the typo - IL courts could uphold: retroactive pension reductions.

- foster brooks - Tuesday, Aug 21, 12 @ 11:57 am:

With stiff opposition to pension cost shift to the locals from the Republicans why is there even talk about taxing retirement income.Its a dead

Issue

- OneMan - Tuesday, Aug 21, 12 @ 11:59 am:

Captain,

Not sure if you would like my viewpoint but here it goes.

Reasonable baseline funding, if a local district wants to go Cadillac they can do so on their own dime with at some point a ‘cap tax’ like they do in baseball when a team spends to much.

Also a few more state controls on how money is spent in a district.

- Shore - Tuesday, Aug 21, 12 @ 12:09 pm:

I’d be really careful about the $100k number. It’s not what it used to be, particularly in the suburbs. US Senate Democrats made the case earlier this year lead by Chuck Schumer that $250k is middle class and in a lot of areas around major metropolitan areas like the kind Democrats need to keep their majority, $100k includes a lot of people who aren’t considered “rich”.

As for the rest of this poll, blaming the public for “the mess” doesn’t cut it and one of the more frustrating things about this blog and some of the comments sometimes is the defense of Springfield like it’s taxpayers fault for “the mess”. These folks were elected to make tough choices, not blame their constituents, if they can’t we need to find people that are willing to solve the problem. The Governor likes to rip Scott Walker, but that man had a willingness to stand and make tough choices and have an honest debate and then be held accountable. He has yet to show anywhere close to that amount of spine.

- Irish - Tuesday, Aug 21, 12 @ 12:09 pm:

I think the public is slowly realizing the real issues in the pension issue.

The pension problem can be resolved and yes it will hurt some but if the GA and especially our Governor will listen and I am not counting on either, it can be done.

The first thing that has to be done is to re-level the playing field. Our inept Governor has travelled around whacking state employees and exacting his revenge wherever he can and has created a mess. How does he expect to reach any conclusive agreement with all employees and retirees when he has created such diproportionate classes of those folks. He needs to take another fact finding trip to Europe and while he is out of town the GA needs to meet with the unions and work out a solution. Take CMS completely out of the equation. (Any agency that is allowed to charge another agency exorbitant rent for a building that agency already owns is not in the business of saving the state money.)

Pass a bill that changes the payback ramp to a rate recommended by experts in the field.

Honor the agreements of the past so all employees are on the same level.

Get CMS off their butts to put a figure on what the health care savings will be in lieu of SB1313. ( No one has calculated the savings on this to even say if it will help and how much.)

Look at putting a moratorium on grants whose sole purpose it to get votes and put that money into paying bills.

Look at possible savings by combining all the pensions plans into one plan where all employees are covered by one pension board and receive equal benefits. This might get the GA to make sure the payments to the pensions are timely.

Then look at other ways to save money in the pension system. I have often wondered about an offering of buying three to five years of pension time but don’t just offer it to employees who would retire. Allow employees to buy and stay. I am wondering if employees who are close to vesting in the pension would buy time to reach that point. This influx of money by employees who wouldn’t retire for a while would give the system cash now and the payout would not be for a while. It might not be much but every little bit accumulates.

As a state employee if I was given what I am owed up to this point in time I would forego any increase for the next two years, no cola or anything. We are not unreasonable people. But it is difficult to have meaningful discussions when you are covering your head, protecting yourself from the blows that are raining down on you. A little increase in pension contributions is not out of the question either. But before you start laying out what you want me to give up give me some honest figures on the savings that each of these concessions are going to generate. I am already going to be paying more for my healthcare, how much? what is that going to save the state? Answer; it is a secret we can’t tell you that yet. Is it a secret because the percentage I pay will depend on how much more they can take away from me? If they can’t get any more out of me then I will pay 75% more for health care. But if they can cut me 5% of my salary then they will only make me pay 40% more for health care? There is absolutely no trust between the employees and this administration. Nothing has changed from the Blago years.

- mokenavince - Tuesday, Aug 21, 12 @ 12:13 pm:

Looking at IEA’S poll we will never ever get pension reform. If the people don’t have the courage what makes us think the pols will have

any.foster brooks is right it’s dead,like in forever.

- Skirmisher - Tuesday, Aug 21, 12 @ 12:25 pm:

Amen to Downstate Dem. I am retired, but I absolutley agree that no one should be exempt from state income tax, including retirees. We burn up State services as fast or faster than anyone else. I hoped this would be a part of the last deal on income tax, but it obviously wasn’t. The “leaders”, Quinn included, have no stomach for firing up the old folks, so this isn’t going anywhere soon. But it should. While we are at it, how about basing State tax on taxable income rather than the federal adjusted income? Then we avoid all of the complexities of the awful federal tax code with all of its ever-changing loopholes and deductions. No matter how much more the State takes in income tax, it is certainly much more fair than continuously increasing property taxes.

- Just Because - Tuesday, Aug 21, 12 @ 12:40 pm:

Captain Illini - Tuesday, Aug 21, 12 @ 11:38 am:

I like your idea. why cant the GA see it that way? this is fixable

- Ghost of John Brown - Tuesday, Aug 21, 12 @ 12:43 pm:

This is precisely why we have a Representative form of government instead of a pure democracy. We are supposed to elect our representatives who can study the issues before the State and the Nation and come to wise decisions. Sadly, the wisdom and the ability to make decisions is sorely lacking.

- GA Watcher - Tuesday, Aug 21, 12 @ 12:45 pm:

FYI, a 2010 report I have estimates that ending the income tax exemption for retirment income would yield $814 million. It was done before the income tax was increased, so the potential revenuw increase is probably more like $1.35 billion.

- Pelon - Tuesday, Aug 21, 12 @ 12:48 pm:

@Publius

“One wonders if the actuaries couldn’t figure a plan to let willing retirees cash out of the pension plan. I suspect some would go for an assured “bird in hand” , take the money and run. And if calculated right each pensioner making that choice would eliminate a part of the future liability.”

If we used an acturarially equivalent buyout for retirees, it would make no difference in the real pension liability. The nominal liability would be less, but the State would have to come up with all the cash immediately. It is extremely unlikley that the markets would lend the State that much money, but even if they did, the State would still have a large debt to pay each year.

- illilnifan - Tuesday, Aug 21, 12 @ 12:59 pm:

Irish ….well said.

- Billy - Tuesday, Aug 21, 12 @ 1:09 pm:

All this talk about taxing pensions. People who can, will move out of state, if this is enacted! Any tax increase hurts the economy. Would you trust our politicians with more tax money? They will just spend it, and ask for more! The answer is cutting spending. Illinois can not keep spending like it is the 1980’s. The jobs that were lost are not coming back. The politicians must learn to live with reduced tax revenue. Any more tax increases will cause people and business to flee the state. Have we not learned this lesson from the last income tax increase!

- The Captain - Tuesday, Aug 21, 12 @ 1:12 pm:

One Man, sign me up.

- Demoralized - Tuesday, Aug 21, 12 @ 1:18 pm:

Thanks for that Republican talking point @Billy. But the fact remains that the problems go well beyond simply “cutting spending.”

- Cook County Commoner - Tuesday, Aug 21, 12 @ 1:25 pm:

Does anyone know if the new Government Accounting Standards Board’s requirements for public pension accounting are mandatory in Illinois? I think the trigger date is in June, 2013, and their application would make Illinois and local government public employee plans look worse than they already are. Has anyone commented on this for Illinois?

- Yellow Dog Democrat - Tuesday, Aug 21, 12 @ 1:38 pm:

@Billy -

I agree. No more handouts for corporations. Close unneeded prisons. Sell off the state universities in DeKalb, Charleston and Bloomington-Normal.

YDD

- foster brooks - Tuesday, Aug 21, 12 @ 2:39 pm:

Sell off the tollway too YDD

- DOWNSTATE DEM - Tuesday, Aug 21, 12 @ 2:41 pm:

There are nine states that exempt all federal, military, and in-state pensions as well as all Social Security benefits from income tax: Alabama, Hawaii, Illinois, Louisiana, Massachusetts, Michigan, Mississippi, New York, and Pennsylvania. Alabama, Hawaii, and Illinois also exempt income from certain types of private pensions.

Pennsylvania and Mississippi are unique in that they are the only states in the country that exempt all retirement income, even IRA and 401(k) distributions.

39 states all collect income tax on retirement income, Some here think it unfair to have their retirement income taxed, but the majority of Americans do pay tax on retirement income.

The top 100 retirees collecting pensions in Illinois are getting over $200,00 per year and many get way over $300,000. How is this fair to the rest of the taxpayers in this state.

- Billy - Tuesday, Aug 21, 12 @ 2:43 pm:

Demoralized, the politicians have gotten us into this mess, and I for one will not pay more to get us out of their mess. I already pay more than my share to live here! I think it is time for me to start getting ready to move to my winter home in Florida, full time, and say goodbye to Illinois!!

- capncrunch - Tuesday, Aug 21, 12 @ 2:57 pm:

oops…2012 not 2912

- wordslinger - Tuesday, Aug 21, 12 @ 2:59 pm:

Billy, life must be rough when you have to move to your “winter home” in Florida full time. Try to get through the day.

- Billy - Tuesday, Aug 21, 12 @ 3:07 pm:

Wordslinger, life is fine, but always have a plan for the future!

- Arthur Andersen - Tuesday, Aug 21, 12 @ 3:33 pm:

Downstate Dem, can you provide a source for your assertion that there are “many..pensions over $300000 a year.”

Thanks.

Secondly, hasn’t the idea of letting vested members trade out their pension benefits in exchange for upfront cash been tried before? I’m thinking of the “Alternative Retirement Cancellation Program” or something like that which was a window program under Blago. Had few takers if I recall correctly.

- PublicServant - Tuesday, Aug 21, 12 @ 3:43 pm:

Billy, those politicians are your elected representatives. So your elected representatives got us into this mess. It’s not their mess, it’s our mess; yours, mine and every other Illinois taxpayer. Ya see, in America, the government is us.

- DOWNSTATE DEM - Tuesday, Aug 21, 12 @ 3:45 pm:

ARTHUR ANDERSON follow this link

http://www.championnews.net/2011/11/28/top-100-illinois-state-pensions-as-of-november-2011/

I was mistaken also, my data was old, there are 2 pensioners receiving over $400,000 per year from the State of Illinois. AVERAGE INCOME FOR TOP 100 IS OVER $227,000 PER YEAR!

BILLY . . . if you have to move to Florida, remember you WILL BE paying income taxes on your retirement income.

- Yellow Dog Democrat - Tuesday, Aug 21, 12 @ 4:00 pm:

@Downstate Dem -

Unless I’m mistaken, Florida has no income tax. However, it makes up for it through other taxes.

According to the Tax Foundation, Illlinoisans pay a combined 10% of their income for all state and local taxes (including sales and property). Floridians pay 9.2 percent. So, depending on just how wealthy Billy is, it might actually be worth his while.

That said, Florida has serious pension problems of their own. Their public employees contribute ZERO to their pension fund, and a judge ruled that legislation requiring current employees to contribute to the pension was unconstitutional.

My advice Billy: if you like living in Florida better, by all means go. You’ll probably end up losing money and equity in the relocation and at best break even in the long run. But can you really put a price on happiness?

- Colossus - Tuesday, Aug 21, 12 @ 4:00 pm:

Downstate Dem -

I couldn’t find the source for that information in the article - I’d love to see A) where it came from and B) a full breakdown of all the pensions being paid, not just the cherry picked cream of the crop.

I agree that those are some pretty sweet pensions at the top, but that’s the top 100 individuals and in no way representative of the vast majority of retirees and I think it’s pretty irresponsible to present this information without anything that puts it into context.

- PublicServant - Tuesday, Aug 21, 12 @ 4:11 pm:

Eliminating the top 100 pensions…22.7 million

Using them to demonize the pension system…priceless

- RNUG - Tuesday, Aug 21, 12 @ 4:11 pm:

I’m not sure it is complete (seems to be missing the actual elected constitutional officers from the data), but I often use the Open the Books web site www.openthebooks.com

I know the number they have in there for myself is accurate and I assume they obtained it from either SERS or the Comptroller.

By their numbers, in all (apparently non-elected) government retirees at any level, there are 9 people taking home $300K or better. It shows 84 people taking home $204K or higher pensions … 50 SURS, 18 TRS, 11 Cook County, plus a scattering of others.

- dirt diver - Tuesday, Aug 21, 12 @ 4:16 pm:

Pelon,

I think the “buy-out” proposal has it’s merits, but given the fact that the Retirement Systems are not receiving their money from the State in a manageable time period, and given the fact that the funding ratios are around 43%, the “buy-out” proposal won’t work for Illinois funds, it would disrupt the equilalibrium of assets, would require the Systems to liquify assets, increase “benefit payouts”, and drop the funding ratio. Yes, it would reduce future liability, but I would have to believe the pain would far outweigh the gain. Plus, it would provide further headline risks as those that would normally only be eligible for a modest “refund” for terminating service to game the system by cashing in.

Unfortunately, there aren’t many “creative solutions” that will provide signficant savings. Your only options are to challenge the Pension Protection Clause and reform benefits, increase revenues, amend the Constitution, or move to a more conservative funding plan that utilizes frontloading the debt. All of these scenarios are unlikely. The fact of the matter is Illinois can’t escape the debt it took decades to create. Until decision-makers realize this simple fact, pension reform will only continue to waste everyone’s time.

- dirt diver - Tuesday, Aug 21, 12 @ 4:22 pm:

As much as I respect Rep. Fortner, I don’t think his proposal has traction. I think establishing the “pensionable salary cap” is a great idea. I think establishing a cap and earnings over the cap shall be subject to a modest “DC” plan with modest employer match is a very creative idea.

However, the funding component of his proposal (HB 6204) isn’t really that signficant. Basically, he’s earmarking cash from GRF that will be freed up when the 3 different sets of pension bonds mature (2003, 2010, 2011 issued pension bonds). It’s just a shell game.

However, I do believe he’s on to something by establishing the pensionable salary cap. Unfortunately, it’s a drop in the bucket and it too is un-Constitutional.

- RNUG - Tuesday, Aug 21, 12 @ 4:22 pm:

I take back the part about elected officials not showing up in the Open the Books data; I was just looking at the wrong part. Plus I was expecting the elcted officials to have even higher pensions than they apparently do …

- Depressed - Tuesday, Aug 21, 12 @ 4:22 pm:

There is really no hope here.

The only solution the unions are offering is to increase taxes on employers — which just means the flight of jobs out of the state will increase.

The Democrats are so obsessed with maintaining their majority, that they only want to play games and toss out votes to be used on mail pieces.

House Republicans are paralyzed by fear of the Civic Committee and the threat of future primaries.

The Civic Committee wants to screw public employees so that their own workers don’t get any ideas about actually having a retirement plan.

Most legislators of both parties know in their hearts that none of these ideas are constitutional.

Quinn is in way over his head and has no clue.

Personally, I’d just as soon they go ahead and pass something, so it can be declared unconstitutional and we can get to the real negotiations and real solution.

Unfortunately, I am afraid that when that finally happens, the unions will remain obstinately opposed to realistic solutions.

- dirt diver - Tuesday, Aug 21, 12 @ 4:25 pm:

I’m all for taxing retirement income. Even if you exempt Social Security, you’re talking a serious new revenue source. However, our legislators do not have the courage to vote for such a bill as retirees pay attention to these issues and vote.

- Rich Miller - Tuesday, Aug 21, 12 @ 4:30 pm:

===It’s just a shell game.===

No, it’s not. It’s pretty smart, actually.

- dirt diver - Tuesday, Aug 21, 12 @ 4:30 pm:

Cook County Commoner,

Do not buy what the Republicans are selling. The GASB reporting and accounting only provide additional requirements on the reporting liabilities/assets of public pension funds. These are numbers that the Systems are already reporting (just not shining a bright line on it like GASB is recommending). It is doubtful the ratings agencies will downgrade based on these recommnedations. Don’t buy into the scare tactics Cross and the Republicans are selling as it relates to the new GASB standards.

- RNUG - Tuesday, Aug 21, 12 @ 4:32 pm:

Dirt diver,

I’d be OK with taxing retirement income but how do we then make sure the GA uses it to retire the pension debt?

The only idea I’ve managed to come up with is to make it a new ‘pension repayment tax’ of 1% or 2% that everyone, both working and retired, pays, put it on the IL-1040 just like the ‘internet sales tax’ as a straight percentage calculation of the ‘non-taxable’ pensions, and have it go directly to the pension funds, bypassing the GRF.

Then we’d still have the challenge of making sure the GA also continues a given level of the current pension funding from the GRF … or we’d just end up with another Lottery type ‘bait and switch’.

- dirt diver - Tuesday, Aug 21, 12 @ 4:34 pm:

Rich,

How so?

We aren’t changing the certified number and therefore aren’t “frontloading” the debt. I guess if anything it helps further prevent underfunding by taking more money away from the GA’s discretion, but this will have little impact. It would be “pretty smart” if these contributions were in addition to the contribution as certified, but it’s not. I don’t follow your logic.

- Rich Miller - Tuesday, Aug 21, 12 @ 4:36 pm:

It’s smart because, if the numbers work, it uses existing public funds, increases in employee contributions and zero hit on retirees to get the same result in the same year as Quinn’s quite harsh forumula.

- dirt diver - Tuesday, Aug 21, 12 @ 4:46 pm:

Actually, my bad, it does increase employee contributions, those Tier 1 members have to pay 1/2 of Tier 1 normal cost. My fault.

- dirt diver - Tuesday, Aug 21, 12 @ 4:50 pm:

Let’s be clear though, money freed up as a result of the fact that the State no longer has to pay debt service for the bonds issued is not a “new source of revenue”, it’s a benefit of the bonds maturing.

- DOWNSTATE DEM - Tuesday, Aug 21, 12 @ 5:44 pm:

COLOSSUS

I agree the top 100 Illinois pensioners is not representative of everyone getting a pension.

Those top 100 do little to inspire sympathy however. It also doesn’t show the elected officials pensions. Some who qualify for pensions after only a brief time in public service.

- geronimo - Tuesday, Aug 21, 12 @ 6:14 pm:

Where, if anywhere, can you see elected officials pensions posted?

- geronimo - Tuesday, Aug 21, 12 @ 6:28 pm:

Sorry……needed to backtrack to see openthebooks. The reason legislators pensions are lower is because they don’t work full time for 37 years.

- Mama - Tuesday, Aug 21, 12 @ 7:01 pm:

I totally agree with Irish! However, AFSCME is still negotiating with CMS over how much retirees will have to pay for health insurance, etc..

- Mama - Tuesday, Aug 21, 12 @ 7:10 pm:

The only way out of this financial mess is to raise income taxes on everybody! The State needs more revenue!

- RNUG - Tuesday, Aug 21, 12 @ 9:07 pm:

geronimo,

You’ll have to register (it’s free) and put up with the occasional nag for a donation, but look at www.openthebooks.com

select as follows:

state = Illinois

category = employee data

employee status = pensions

area of government = elected state officials (or any other choice)

Then if you want to play around a bit, in the lower left is a sliding bar (min/max) for a given monthly pension level. Depending on the category, the finest you can select is either $500 or $1,000 increments.

- western illinois - Tuesday, Aug 21, 12 @ 9:25 pm:

i saw on evening new that Quinn wants a referendum on pension? I dont know if that could be a ref in Illinois

I really want to know the color of the sky in Pat Quinns world

- RNUG - Tuesday, Aug 21, 12 @ 9:40 pm:

Irish,

I agree with most of what you said.

The one thing I would point out is the health insurance is ‘pay as you go’ so it directly has no effect on the pension mess; it is a seperate mess the State didn’t save for. The effect is indirect in that insurance is competing with pensions for limited dollars. The only advantage to the State of implementing SB-1313/PA97-0695 is it has the potential to free up GRF revenue to be spent on something else.

The health premium numbers are only kind of secret; there are credible rumors of the numbers floating around … but they still aren’t final.

- Norseman - Tuesday, Aug 21, 12 @ 10:50 pm:

Geronimo - Be aware that www.openthebooks.com is operated by Adam Andrzejewski. Not exactly a source I care to trust.

- Rich Miller - Wednesday, Aug 22, 12 @ 7:16 am:

===i saw on evening new that Quinn wants a referendum on pension? ==

Which news show said that?

- KurtInSpringfield - Wednesday, Aug 22, 12 @ 8:16 am:

@Depressed

===The only solution the unions are offering is to increase taxes on employers===

Not true. This is from the proposal:

“•With a guarantee that the state would pay its portion, current employees who are reliant on the pension systems for their retirement security would help address the crisis by paying a little more, even though they have contributed their portion over the years.”

I myself would be willing to “help address the crisis by paying a little more” if my employer would guarantee they pay their share.

Ultimately, this crisis is a debt crisis created mostly by underfunding the Pension System. If the problem stems from a lack of funding, then it stands to reason the solution would be some type of guaranteed funding for the future.

Let’s say a pension reform bill that cuts benefits for current members in tier 1 is passed and passes the constitutional test. If the state continues what it has done for the last 50 years or so regarding funding, the problem will be delayed, but we will still have a continuing pension debt crisis caused by underfunding. Nothing will have been done to solve the underlying problem.