Latest Post | Last 10 Posts | Archives

Previous Post: Money

Next Post: Trestman for governor?

Posted in:

* This Tribune story doesn’t even begin to tell the coming budget problems…

Gov. Pat Quinn’s administration is projecting a $400 million reduction in education spending in the next budget after the state failed to rein in government worker pension costs.

If that holds up, the governor would unveil a financial blueprint that would result in state education funding going down for the third consecutive year. The move also would be part of a broad-based, across-the-board slice made throughout most of state government. Among major exceptions would be health care spending for the poor, which is expected to rise after cuts last year, and public safety, an area projected to be mostly flat after the recent closure of two prisons, according to new preliminary figures.

“The explosive growth in the state pension payments means every other part of the budget has less money,” said Abdon Pallasch, Quinn’s budget spokesman. “The pain’s going to get worse and worse every year before we fix this pension problem.”

The money pressure is intensifying at a fast clip. The standard annual pension costs are expected to rise from about $5.2 billion this year to $6.2 billion in the new budget that begins July 1, but the overall cost is even higher. The total pension drain could hit almost $7.9 billion — about one-fourth of the state’s operating budget. The higher figure includes $1.66 billion in repayments of loans taken out to cover annual pension costs in previous years.

* And neither does this Lee story…

The General Assembly’s inability to overhaul the state’s pension mess has universities looking at a cut in state aid next year of about 4.6 percent.

That possible reduction, just the latest in a decade-long decline in state assistance for the state’s institutions of higher education, could again mean a new round of tuition hikes, hiring freezes or larger class sizes.

The number was included as part of a budget projection released by Gov. Pat Quinn, who says without action by the legislature, the state’s rising pension costs will mean less spending in other areas of government in the fiscal year beginning July 1.

* The new budget projection is here. By law, the Quinn administration is forced to make these budget projections based on current statutes. So, the projection includes no pension reform and the sunsetting of the tax hike.

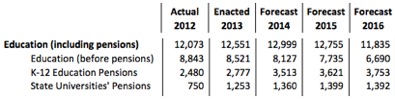

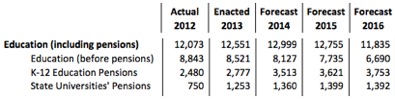

With that in mind, here’s what education spending will look like…

But we can’t do the cost shift because that would raise local property taxes. Whatever. Property taxes are going up without the cost shift, campers. Bet on it.

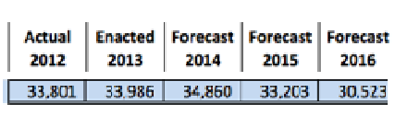

* Now, look what happens to total projected state Fiscal Year 2016 spending. FY 2016 will be the first full fiscal year without the income tax hike revenues, but with additional mandated spending of $2.2 billion on pensions and group health insurance…

* From the governor’s narrative…

The budget will be balanced with across-the-board spending reductions of 5.7 percent and 13.6 percent in fiscal years 2015 and 2016, respectively.

Ugh.

posted by Rich Miller

Thursday, Jan 17, 13 @ 10:45 am

Sorry, comments are closed at this time.

Previous Post: Money

Next Post: Trestman for governor?

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

==The budget will be balanced with across-the-board spending reductions of 5.7 percent and 13.6 percent in fiscal years 2015 and 2016, respectively.==

Wasn’t Bill Brady’s 10% across the board spending cut mocked/attacked as simplistic/cruel by Quinn and his allies during the 2010 campaign?

Comment by so... Thursday, Jan 17, 13 @ 10:50 am

===Wasn’t Bill Brady’s 10% across the board spending cut mocked/attacked as simplistic/cruel===

Also as woefully inadequate, as this clearly shows.

Comment by Rich Miller Thursday, Jan 17, 13 @ 10:54 am

===Property taxes are going up without the cost shift, campers. Bet on it.====

Somehow we need to get the blinders off a whole lot of people. Legislators, mayors, school administrators. We have three major choices and they are not all mutually exclusive. Massive cuts in spending (and not state employees, that doesnt begin to cover it. It means cuts to education spending), keep and/or raise the income tax or shift the cost back to the school districts. These tough choices along with other smaller tough decisions is going make being a legislator a very tough job.

Comment by Been There Thursday, Jan 17, 13 @ 10:57 am

The IEA cried the Brady 10% accross the board was not realistic. The 2012-2013 funding level for education is 89% of what it was before the election. If you add in grants and transportation cuts, Quinn is already passed what Brady proposed.

Quinn has really screwed up in how he drafted the last 4 budgets. I hope he drafts a balanced budget this year and gets us back on track.

Comment by the Patriot Thursday, Jan 17, 13 @ 10:59 am

Rich, is the increase in pension costs due to the pension ramp law which states this year you will pay back x dollars from the amount you had previously borrowed? Shouldn’t the pension ramp be modified to allow more sustainable payback payments?

Isn’t the unsustainable pension ramp law driving the unsustainable pension ‘costs’ being quoted above? Wouldn’t the public be better served with a breakdown of the normal pension cost, and the pension ramp debt repayment cost?

Comment by Anonymous Thursday, Jan 17, 13 @ 11:04 am

Sorry, that was me @11:04

Comment by PublicServant Thursday, Jan 17, 13 @ 11:05 am

I linked this the other day. Some Red States are looking to cut income taxes and replace them with service taxes. That could be in our future as well, I think.

For state employees and retirees, watch your health insurance subsidies, too. That’s been the cut of choice in the private sector for some time.

http://www.reuters.com/article/2013/01/13/us-usa-tax-states-idUSBRE90C08C20130113

Comment by wordslinger Thursday, Jan 17, 13 @ 11:07 am

Why Education? Why not reduce social programs 15%? Education and Cops affect everyone. Don’t forget, the pension funding was delayed so they could start or increase social programs.

Comment by He Makes Ryan Look Like a Saint Thursday, Jan 17, 13 @ 11:10 am

Right on Annonymous with your statement. Ralph Martire in Crains yesterday had an opinion piece on the adjusting the ramp as a means to solve the problem. He stated “It is this unattainable, unaffordable repayment schedule that is straining the state’s fiscal system - not pension benefits and not losses from the Great Recession. And no matter how much benefits are cut, that debt service will grow at unaffordable rates. Which means decision-makers can’t solve this problem without re-amortizing the debt” Not sure if this is a simplistic statement or kick the can down the road, but there does seem to be a basic logic to it. For example if you have a mortgage payment that is based on a 10 year loan, payments are higher. If you re-amortize the same loan amount over 30 years then the payment decreases. I know we want this debt gone as soon as possible but it is a problem created over time, and it will take time to solve….

Comment by illinifan Thursday, Jan 17, 13 @ 11:12 am

The Gross Receipts Tax should be revisited. The last time it was discussed, it was DOA because the message was delivered by Rod. There are some merits with a GRT or its close cousin the FAIR tax. These revenue streams are much fairer than increased property taxes.

Comment by Endangered Moderate Species Thursday, Jan 17, 13 @ 11:14 am

No matter how you slice it, pain is on the way.

Comment by Fred's Mustache Thursday, Jan 17, 13 @ 11:16 am

To “he makes Ryan…” Social Services also impact significantly and affect issues on health, education and the police. Social Services include mental health treatment…untreated means more people arrested increasing the numbers in jail/prison. We already have a problem with our jail/prison system being the number one mental health problem. Hungry kids don’t learn creating problems down the road. Untreated substance use creates medical problems as well as a crime problem. Health, education, police and social services all are linked together no matter what, so you cut one place you create a hemorrhage in another place. It is never simple which is why the struggle.

Comment by illinifan Thursday, Jan 17, 13 @ 11:24 am

Listen up 10% ATB Brady backers!

Before reminding us about this simple minded campaign pledge here - again, do this thought experiment first to better appreciate how absurd Mr. Brady’s proposal wouldn’t work in the real world.

Cut all your household costs by 10%. Contact your mortgage companies and tell them you need to cut your payment 10%. Repeat that call to everything. Cut your utility costs, call your car title holder, call your credit card holders, cut your monthly payment by 10%. What would you get? 10%?

No. Your creditors would politely tell you to take a hike, renegotiate at a higher credit cost, or tell you to cut somewhere else. You wouldn’t be able to do it. Reality prevents it. Instead, you would end up cutting costs by more than 10% to offset the non-negotiable conditions elsewhere. You would discover that you would screw yourself into an unsustainable condition with more dramatic cuts elsewhere

Multiply that a million-fold. Add an interest group of citizens to each outlay. Double it for each preceding year the budget was funded with debt. Put a few hundred people into the decision making mix… Add politics.

Brady’s proposal was a ruse. Unattainable in the real world. Unworkable. It’s as bad as assuming Illinois will find a dozen gold mines, employment drops to zero, or every business and person owed money magically laughs and tells us that they were just joking.

It was a simple minded campaign pledge, not a workable blueprint. Please stop dreaming it can be done.

Comment by VanillaMan Thursday, Jan 17, 13 @ 11:25 am

Besides teh Crain peice which I also agree with,I think this makes it less likely on pension reform. More propserous suburban districts could get nothing after the cost shift or pesnion cuts.

Comment by western illinois Thursday, Jan 17, 13 @ 11:28 am

Time for the state politicians to sit down with the unions, to try to work out something on the pension mess, that will benefit both the state and state retirees in the long run. The politicians trying to shove pension reform down retirees throat, will only be met with resistance and a law suit to the state supreme court, which will likely rule for the retirees!

Comment by Billy Thursday, Jan 17, 13 @ 11:29 am

==Why not reduce social programs 15%==

And what would you suggest we do with all of those people kicked out of those programs? If you can figure out a way to do it (and I’m not suggesting things like that don’t have to be done) then I think you would be welcome in any room during budget negotiations.

It’s easy to go after the poor and mentally ill. That’s the American way lately - bash the poor.

Comment by Demoralized Thursday, Jan 17, 13 @ 11:30 am

Illinifan, I found the Ralph Martire piece in Crains and I’m putting in a piece of it here. I hope that’s alright Rich.

===

It is this unattainable, unaffordable repayment schedule that is straining the state’s fiscal system — not pension benefits and not losses from the Great Recession. And no matter how much benefits are cut, that debt service will grow at unaffordable rates. Which means decision-makers can’t solve this problem without re-amortizing the debt.

Given that the current repayment schedule is a complete legal fiction — a creature of statute that doesn’t have any actuarial basis — making this change is relatively easy. Simply re-amortizing $85 billion of the unfunded liability into flat, annual debt payments of around $6.9 billion each through 2057 does the trick. After inflation, this new, flat, annual payment structure creates a financial obligation for the state that decreases in real terms over time, in place of the dramatically increasing structure under current law. Moreover, because some principal would be front- rather than back-loaded, this re-amortization would cost taxpayers $35 billion less than current law.

One last thing — it actually solves the problem by dealing with its cause.

Read more: http://www.chicagobusiness.com/article/20130116/OPINION/130119858/heres-an-actual-honest-to-goodness-pension-fix#ixzz2IFqsed55

===

Comment by PublicServant Thursday, Jan 17, 13 @ 11:30 am

I always have thought that the greatest failure of this governor and the legislative bosses was when they decided to raise income taxes without going te distance. Since the people were going to be furious anyhow, they should have gone to 7% across the board and tossed in retirement income to boot (Or alternatively simply gone to a cross the board gross receipts basis at lower rates, still including the retirees). A whole lot of business loopholes needed closing as well. They had just one chance to raise income tax and they didn’t have quite the guts to do it effectively. Rather than the half-way measure they passed, they should have gone all the way to solvency or just left it all alone to simmer another year or two. Now they will never get another chance.

Comment by Skirmisher Thursday, Jan 17, 13 @ 11:30 am

If you have unsustainable pension payments, a contract requiring those payments, a GA that decides to do nothing related to solving the pension in lame duck/regular sessions, and ongoing costs in other areas, what do you think is going to happen? Whatever the size of the state’s financial pile actually is, it is clearly not enough to cover all the costs. The result: if pensions must be contractually funded and take increasing larger percentages of the state operating budget to do that, every other group that gets any level of state funding will get commensurate funding cuts because there is only so much money to go around. Do the math. This should not be a surprise. When I used to paint houses you can only paint if there is paint on the brush. No paint = no job.

There is no fair way to cut and it will be brutal. This is not 100% Quinn’s fault.

Comment by zatoichi Thursday, Jan 17, 13 @ 11:30 am

You can’t keep delaying the ramp forever. Like your own IRA, the more you put in sooner, the more you make over time thanks to compounding interest.

Local taxes are going to keep going up. We see it locally just trying to keep up with police and fire pension funds. Our community is not unique in requiring us to put over 30% of salary away as the employer’s share for police and over 40% of salary away for fire pensions. And that’s with us meeting or exceeding the Dept of Insurance required set asides for all the previous years. And the state isn’t even talking about those pensions.

So with local taxes going up for education and public safety pensions, do we really want to throw in teacher pensions? Most rankings put Illinois in the top ten for property tax as it is.

Comment by Shemp Thursday, Jan 17, 13 @ 11:33 am

I could deal with a service tax if I thought it would be spent appropriately.

Comment by LincolnLounger Thursday, Jan 17, 13 @ 11:34 am

Illinifan, I totally understand what you are saying, however the point being there were many new services started with money that was deferred by from the pensions. Kids care is a great example, I beleive it is a great program, but it was started by funds that were swept. It became additional spending that we cannot afford. Things need to be cut. Social Programs should be a part of it.

Comment by He Makes Ryan Look Like a Saint Thursday, Jan 17, 13 @ 11:35 am

This is such a big issue that has hardened positions on both sides. To get movement we will need big plans that will ensure that whatever is done will forever more get our fiscal house in order and change the political and legislative culture in our state. I sometimes fear that previous hard feelings and the continuing harsh rhetoric will be too much to overcome. Folks, it is our future that is at stake and we got to think big and show more respect for one another and be prepared to give in on some things.

Comment by RMD Thursday, Jan 17, 13 @ 11:38 am

==Somehow we need to get the blinders off a whole lot of people==

That’s going to occur when people are paying $12,000 a year to live in a house worth $150,000.

Comment by Anonymous Thursday, Jan 17, 13 @ 11:39 am

If you actually read Martire’s piece that I’ve linked to above, you’ll find that your ‘unsustainable’ wording only applies to the current pension ramp law. Pension benefits are not the cause of the problem. Aside from attempting to use the unsustainable wording a lot in relation to pensions in the hopes that if it’s used enough it will stick, what specifically do you refute in the Martire piece, Zatochi?

Comment by PublicServant Thursday, Jan 17, 13 @ 11:40 am

2 proposals were on the table during the 2010 campaign:

1.) Pat Quinn: Raise income taxes 1% as an “education surcharge”.

2.) Bill Brady: 10% across the board spending reductions.

Quinn wins. What do we get?

1.) A 2% income tax increase. Double the amount claimed necessary to support education funding. Pushed through via a party-line vote.

2.) Larger reductions in education funding than what Brady proposed.

In hindsight, at least Brady was attempting to be honest with the public and media.

Meanwhile, media coverage, surrogates and voters seemed more interested in some of Quinn’s mocking comments directed at Brady than examining the Governor’s planning and vision.

In reality, both campaign proposals were relatively simplistic, neither delving very deeply into details. “Cut spending 10%”. “Raise taxes 1%.”

And what about all the moving parts in between? Pension obligations, bond debt, population expansion, etc.? “Never mind those”.

One “plan”, however, was outright mocked and dismissed. The other “plan” was greeted as a salve.

Reality is now slowly settling in.

Comment by Formerly Known As... Thursday, Jan 17, 13 @ 11:47 am

Martire’s plan calls for reamortizing $85 billion in pension debt over 44 years. Keep in mind the actual unfunded liability is geting closer to $100 billion, his plan does not account for the normal pension cost and it will result in a higher upfront payment over the next few years as compared to the current ramp.

Long term - good idea.

Short term - even more increased pain.

Comment by Bluefish Thursday, Jan 17, 13 @ 11:47 am

==Isn’t the unsustainable pension ramp law driving the unsustainable pension ‘costs’ being quoted above? Wouldn’t the public be better served with a breakdown of the normal pension cost, and the pension ramp debt repayment cost? ==

Isn’t restructuring the ramp just taking a pension “holiday” and puts the state at risk of a default?

Comment by Jimmy Thursday, Jan 17, 13 @ 11:53 am

How do the credit rating agencies feel about Martire’s plan?

Comment by Jimmy Thursday, Jan 17, 13 @ 11:55 am

===Pension benefits are not the cause of the problem===

And, if I’m not mistaken, haven’t at least one of the unions offered to increase their employees contributions by 2%. If you assume that is going to help pay off the pension shortfall then those employees are already having a tax increase.

Comment by Been There Thursday, Jan 17, 13 @ 11:57 am

As to Ralph’s piece in Crains, keep in mind that last year’s pension payment was 5.2 billion, this year its 6.2 billion and he is proposing increasing it to 6.9 billion, thereby making the cuts in the near future greater than the original piece cited. Add the income tax increase going away soon…

Comment by Other Thursday, Jan 17, 13 @ 11:59 am

Similarly horrible forecast last year, and similarly painful potential fixes. And yet people walked away from any comprehensive reform this month, based on narrowly-focused complaints. It’s been a leadership failure on all sides so far.

Part of that failure is too many legislators waiting for guidance from above, when alternatives are on the table. They should be joining their peers in pushing their leaders, not sitting and waiting. A “membership” failure?

Comment by walkinfool Thursday, Jan 17, 13 @ 11:59 am

===How do the credit rating agencies feel about Martire’s plan? ===

We’ll get to that in a bit.

Comment by Rich Miller Thursday, Jan 17, 13 @ 12:00 pm

–Isn’t restructuring the ramp just taking a pension “holiday” and puts the state at risk of a default?–

How so?

Comment by wordslinger Thursday, Jan 17, 13 @ 12:04 pm

Go here to discuss the Martire idea: https://capitolfax.com/2013/01/17/its-not-a-total-fix-but-martires-plan-should-be-incorporated/

Comment by Rich Miller Thursday, Jan 17, 13 @ 12:12 pm

TRS Tier 2 employees are already contributing a higher percentage of their salary to the fund, are required to work longer….AND are paying the same tax increase that everyone else is paying. It’s not as if there have been no concessions from them.

Comment by geronimo Thursday, Jan 17, 13 @ 12:14 pm

A lot of opportunities were missed due to pure partisanship. The can has been kicked until it can no longer be kicked. While as a State employee I am not very happy with the past GAs and Govs I doubt that they could see the recession that was coming and foretell it’s impact. However as I tell my kids always have a plan b and a plan c. They didn’t.

They should have borrowed to pay off the outstanding bills a couple of years ago. And don’t even start with “we don’t need more borrowing.” The borrowing has already been done. The state is borrowing from people who did not agree to lend. And the influx of 9 billion dollars into the state economy a couple of years ago might have helped job growth which in turn would have helped the economy.

All that being said we are now at a place where something has to be done. It is time for all parties to be honest and forthright.

As many have stated before this is a problem that has been created over decades. It is not going to be solved in ten years. The steps to be taken must be well thought out.

The governor needs to drop his animosity and adversarial Blagoesque way of dealing with those that disagree with him.

The GA needs to set politics aside.

And both of them need to sit down with the unions and TALK! The union folk need to understand that while this was not their fault they need to be part of the solution.

The ramp needs to be changed.

The union offer to pay 2% more into their pensions should be accepted.

If the elimination of some holidays really helps the situation then do it. If the insurance plan that was passed is not unconstitutional then let’s see some figures put to the plan so we know how much that will save. If the insurance plan is thrown out then let’s start looking at other reasonable ways that will generate savings and lessen the impact on everyone.

Pass a law that penalizes school districts’ state aid if they give more than the CPI + 1% in raises in a teachers last four years of employment.

Pay the state employees what they were owed in that last contract and stop wasting state dollars on court costs when you know you are wrong. To pay or not pay employees based on what agency they work for and their union affiliation is discrimination pure and simple. Really Gov. what are you trying to prove and what do you hope to gain? Put some credibility back into the chief exec. office.

Put all of the above on paper and saee what savings are generated. And show your work. That is a step and it beats the H%^& out of what is being done now.

And finally the temp income tax is going to be permanent get used to it and get over it.

Comment by Irish Thursday, Jan 17, 13 @ 12:14 pm

Even with Ralph’s and others’ proposals we will be short in the near term.

Does anyone who can add and subtract think that the current income tax rates won’t have to be extended?

Will any public official stand up and admit that publicly?

I had a lot of problems with Quinn’s tax increase, (which I ultimately supported), one of which was that if we really needed it, we should admit that it wouldn’t necessarily be temporary.

Comment by walkinfool Thursday, Jan 17, 13 @ 12:15 pm

Well, the dysfunction capitol has moved from California to Illinois, according to Bloomberg.

http://www.businessweek.com/news/2013-01-17/fighting-irish-make-illinois-center-of-fiscal-dysfunction

First time I ever saw Mike Madigan’s photo on national media. According to Bloomberg, Illinois debt is trading at an increased premium due to the recent failure of pension reform. And I don’t think I would refer to Quinn, Madigan and Brady as the “Fighting Irish.”

Illinoids is increasingly in the national spotlight due to its fiscal profligacy, and that is not good for business.

The only solution I see on the horizon is stick it to homeowners on their property taxes. How this is going to work I haven’t a clue, considering 8-10,000 folks are turning 65 in our nation every day. In Cook County that means they can qualify for the Senior Property Tax Exemption, the Senior Assessment Freeze and the Senior Property Tax Deferral. These freebies of course will be passed on to the younger property tax payors who are struggling with unemployment, along with the tax increase. I’m sure the realtors are tickled with this prospect: home prices driven lower and lower by ever increasing property taxes.

Comment by Cook County Commoner Thursday, Jan 17, 13 @ 12:36 pm

To anyone who has been paying attention, there’s no news here.

Comment by steve schnorf Thursday, Jan 17, 13 @ 12:37 pm

“And show your work.”

My favorite quote of the day.

Comment by LincolnLounger Thursday, Jan 17, 13 @ 12:38 pm

–Illinoids is increasingly in the national spotlight due to its fiscal profligacy, and that is not good for business.–

People always say that, but they never show give examples.

Small business, those whose markets are in Illinois, get stuck, because they have to pay taxes on their sales. Big business, international companies and exporters that don’t pay Illinois taxes, aren’t on the hook for the problem, anyway.

Comment by wordslinger Thursday, Jan 17, 13 @ 12:44 pm

A reminder from that story:

“The next day, Madigan, who has been speaker of the House for 28 of the past 30 years…”

Comment by Formerly Known As... Thursday, Jan 17, 13 @ 12:44 pm

==TRS Tier 2 employees … It’s not as if there have been no concessions from them. ==

They didn’t make concessions. That’s the system those employees were hired under. They knew the plan when they were hired.

Comment by Demoralized Thursday, Jan 17, 13 @ 1:01 pm

I know we’ve hit on this cost shift idea before, but as a conservative from the suburbs, I’m actually for it. I believe in cost-internalization generally. Meaning, if you’re going to be the one benefiting from it, then you should be the one paying for it too. Having school districts shift the cost of the pensions onto the state is just a bad way to go financially. Sure, it’s smart for the individual school districts to push as much off their plate as they can. But it totally distorts their judgment RE: salaries and thus future pension costs.

And tax rates don’t AUTOMATICALLY have to go up. All that’s changing is the school districts would be responsible for paying what the state pays now. Nothing says that they can’t economize, cut some adminstrative costs, or have the local teachers pay more out of their own paychecks to fund the pensions.

The assumption that the property taxes will go up is simply an assumption that the local school districts will do nothing except pass 100% of the cost shift down to the taxpayer, and that the taxpayers will somehow agree to this arrangement rather than insist on a different solution from the school boards.

Comment by John Galt Thursday, Jan 17, 13 @ 1:02 pm

@Formerly Know As:

That’s not why Brady lost.

Comment by Demoralized Thursday, Jan 17, 13 @ 1:03 pm

$8 billion?

I have enough faith in this state to believe that its government could find a way to collect 620 bucks on 13 million potheads annually….if it were off schedule 1 & legal.

Comment by Kasich Walker, Jr. Thursday, Jan 17, 13 @ 1:09 pm

’shift the cost back to the school districts’

There are quit a number of school districts that already receive a very small share of their educational costs from the state. The biggest pain will in Chicago and the other districts that get an outsized per student share of the State’s revenue.

Comment by Plutocrat03 Thursday, Jan 17, 13 @ 2:19 pm

Vanilla,

I could reduce my household budget by 10%. But I do not deficit spend. This is the problem with our whole society. Everyone is spending 120% of what they bring in and acting like it is sustainable. Budgets in teh 90s on both the state and federa level were built on a concept that the economic growth was sutainable. Anyone who has read a history book knows that was not possible. Time to reap the consequences.

The Brady plan would work if implemented. It was a ruse to some extent because Madigan would never pass it. He does not have the guts to pass a 3% acccross the board cut. Well he has his Governor now, he has a vetoproof legislature, so lets see the democrats fix it. With the Feds raising taxes, Springfield can’t. This has to be done with cuts.

Comment by the Patriot Thursday, Jan 17, 13 @ 2:34 pm

I am never in favor of cuts for education ….but…with that said Superintendents and school administrator salaries are OUTRAGEOUS. In my small rural county, and we are on the poverty warning list, we have three (out of four) school superintendents making OVER $250k/year and continue to increase their own salaries EVERY year while they implement program/budget cuts. These guys don’t even possess an appropriate degree in administration…simply a certificate attached to their teaching requirements.

This going on state-wide. How about some legislation to control this enormous waste of financial resources.

Comment by Anon Thursday, Jan 17, 13 @ 4:10 pm

@the Patriot:

A 10% cut wouldn’t come close to fixing the problem. Try multiplying that by about 3 if you want to just fix the problem with the state’s general fund. That’s why such simplistic solutions don’t deserve the time of day.

By the way, there have already been significant cuts around state government. This notion that there haven’t been any cuts is utter nonsense.

Come back with facts.

Comment by Demoralized Thursday, Jan 17, 13 @ 4:11 pm

@Anon:

Illinois is a local control state in terms of schools. If you have a problem talk to your local school board. I’m quite sure you don’t want the state involving itself with salaries for certain occupations if you really stopped to think about it.

Also, cuts such as those you are asking for are merely for PR purposes. They don’t make any difference in the scheme of a school district budget.

Comment by Demoralized Thursday, Jan 17, 13 @ 4:14 pm

Anon

And the oft quoted OUTRAGEOUS pension benefits are almost always admnistrators, not the grunts who do the work of teaching our children. Some administrators not only get the sum you mentioned, but no cost health care and no deduction from their paycheck into TRS.

Comment by geronimo Thursday, Jan 17, 13 @ 4:15 pm

For years, from my observation, many have been going to the trough as often as they can. Those that control the legislators, and the legislators themselves. This has happened under Madigan’s watchful eye and with his nod of approval for many years.

I place the bulk of the blame squarely at his feet. He needs to grow some and offer solutions to fix this problem. That should include cuts in all areas and tax increases.

Madigan has managed to dodge the blame and people are finally starting to realize that he owns this. Now his test is to prove that he can lead when tough choices must be made.

Comment by Sunshine Thursday, Jan 17, 13 @ 4:40 pm

The Legislature should be ashamed of itself as all Illinoisans continue to sickeningly dish out $17 Million a DAY (throw out the window may be a BETter analogy) because of this mess which they have not acted responsibly upon to fix already…Cmon people, just shameful…! There is no sound reason it should not be fixed by Easter, if not sooner.

Comment by Just The Way It Is One Thursday, Jan 17, 13 @ 5:38 pm