Latest Post | Last 10 Posts | Archives

Previous Post: It’s just a bill

Next Post: Rate the new ILGOP ad: “Drop the Mike”

Posted in:

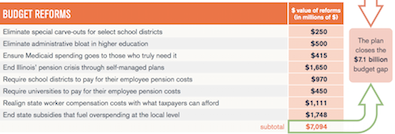

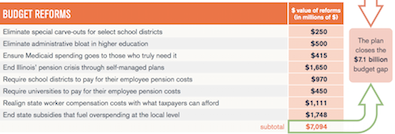

* The Illinois Policy Institute has a new budget plan. I’m still going through it, but it wants a five-year property tax freeze while also taking away billions from local governments and schools…

» Revenue-sharing agreements that fuel excessive local spending, such as the Local Government Distributive Fund – for counties and cities with populations above 5,000 – and the Downstate Transit Fund. (Savings: $1.75 billion)

» State pension subsidies that allow districts and universities to dole out higher pay, end-of-career salary hikes and pensionable perks. Going forward, local school districts and universities should be responsible for paying the annual (normal) cost of pensions. (Savings: higher education: $450 million; K-12: $970 million)

» Special carve-outs in the state’s education funding formula that grant subsidies to a select few school districts affected by local property tax caps and special economic zones. (Savings: $250 million)

So, whack the LDF, transfer pension costs to schools and universities and cut Chicago’s school funding.

* But it does give locals this…

Reform costly state mandates imposed on local governments such as prevailing wage requirements and collective bargaining rules. Ease the process for government consolidation and other cost-saving measures. (Local government savings: $2 billion-$3 billion)

Right. Yeah.

* It also wants a 10 percent reduction in the number of state employees and implementation of Gov. Rauner’s contract terms, for a claimed savings of $500 million for each point.

The group wants to cut higher education spending by $500 million a year. It would cut Medicaid spending by $415 million.

* Its pension proposal looks like it revamps the ramp…

» Phases in the costs of any pension funds’ actuarial changes over a five-year period. This will reduce the required $800 million increase in state contributions by nearly $650 million in 2018.

» Creates a new contribution schedule with a 2018 payment that is $1 billion less than baseline contributions. That will protect overburdened Illinoisans from

tax hikes and allow the state to prioritize funding for social services.

* Its chart…

posted by Rich Miller

Tuesday, Jan 31, 17 @ 10:21 am

Sorry, comments are closed at this time.

Previous Post: It’s just a bill

Next Post: Rate the new ILGOP ad: “Drop the Mike”

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

So…. is this a preview of tomorrow’s State Budget Address???

Comment by Anon221 Tuesday, Jan 31, 17 @ 10:24 am

These are Rauner’s attack dogs. Maybe their doomsday is supposed to make whatever he proposes look more “reasonable” or even centrist. But regardless of their intent, many of these ideas are politically impossible, for Republicans and for Democrats.

Comment by Anonymous Tuesday, Jan 31, 17 @ 10:27 am

The Illinois Policy budget plan is for you, as long as you aren’t poor. /s

Comment by Stark Tuesday, Jan 31, 17 @ 10:28 am

God bless…..I really do dislike having hate in my heart. But so help me….

Comment by Honeybear Tuesday, Jan 31, 17 @ 10:29 am

They’ve got a gaggle of clowns at the IPI. Maybe they should stick with trolling democrats on twitter.

Comment by Rogue Roni Tuesday, Jan 31, 17 @ 10:29 am

Thanks, IPI, for demonstrating that a revenue-free budget would be an utter FIASCO.

Comment by Arsenal Tuesday, Jan 31, 17 @ 10:30 am

IPI does not make the budget for the state. Go away.

Comment by Lew Tuesday, Jan 31, 17 @ 10:30 am

===It also wants a 10 percent reduction in the number of state employees===

Considering that Illinois consistently ranks at the bottom of the list of state employees per capita, this might be hard to do. Some other states already have almost five times the state employees per capita of Illinois.

Comment by Small town taxpayer Tuesday, Jan 31, 17 @ 10:30 am

This is like introducing a new car… that lacks 3 of 4 tires and no engine.

I’m sure Higher Ed is excited by a group that sees Higher Ed is a drain on the state instead of an asset that gives back and feeds the state’s economic engine.

I dunno. I can’t see someone running for governor with $200 million and running on this platform.

Comment by Oswego Willy Tuesday, Jan 31, 17 @ 10:30 am

I believe there are some good suggestions in this proposal. Education pension funding should be shifted to the employer’s but it needs to be phased-in. The LG G F could be frozen at the current level and the state could gain in future growth but you can’t just slash local governments in one fell swoop. We shouldn’t just give up on these sorts of ideas. The unwillingness of IPI to support higher education funding approaches Criminal stupidity.

Comment by Steve Schnorf Tuesday, Jan 31, 17 @ 10:31 am

Outside of raising the state income to say 8%, what is the solution? And I mean what is the solution for everyone, individuals, small businesses, etc.?

Comment by Piece of Work Tuesday, Jan 31, 17 @ 10:32 am

And this is going to be taken seriously by whom?

Comment by Norseman Tuesday, Jan 31, 17 @ 10:32 am

Cullerton should make this the “Grand Bargain” and put it up for a vote. If it gets less than 10 votes the IPI should promise to go away forever

Comment by Wow Tuesday, Jan 31, 17 @ 10:41 am

Plenty of plans haave been offered but compromise has not.

Comment by Liberty Tuesday, Jan 31, 17 @ 10:43 am

Where do they get the $2 to $3 billion in savings to local government from prevailing wage and collective bargaining changes?

Oh, I see the things air above them.

Comment by Sir Reel Tuesday, Jan 31, 17 @ 10:43 am

The shifting of pension cost to education has been tossed around for a few years now. But with the requested five year property tax freeze, how will they pay for it? It would have to be phased in starting in year six.

Two - three billion by eliminating collective bargaining? Are they planning on contracting all local projects to China?

Comment by A Jack Tuesday, Jan 31, 17 @ 10:43 am

That’s thin air.

Comment by Sir Reel Tuesday, Jan 31, 17 @ 10:44 am

Interesting that the figure for the FY15 expenditure per student was the one that was grabbed for this proposal. The source document shows that Illinois Higher education appropriations per FTE went up by 32.5% from FY10 - FY15. However, they conveniently neglect to mention, as the source document does, that 1) For Illinois, a $1.08 billion back payment in FY 2015 to their historically underfunded higher education pension program resulted in past legacy pension funds accounting for 37% of all educational appropriations.

Source: SHEEO FY15 Report, found at http://sheeo.org/sites/default/files/project-files/SHEEO_FY15_Report_051816.pdf

[The case study for Illinois’ situation can be found on p.37-39 of that document, and makes for interesting reading.

Comment by Mr. Smith Tuesday, Jan 31, 17 @ 10:46 am

Schools? Where you’re going, you won’t need schools!

Comment by Anon Tuesday, Jan 31, 17 @ 10:46 am

This was their secret plan that Diana Rickert couldn’t talk about on WTTW last week? Looks like a hill of BS to me.

Comment by Precinct Captain Tuesday, Jan 31, 17 @ 10:48 am

Steve! Nice to read your ideas. You’re a stateman as usual.

It would be nice if Governor Rauner, IPI’s main supporter, would run with this and present it as his balanced budget. Agree on the pension cost shift, but over time, and the reamortization of the pension debt.

After an extreme vetting of their other half-baked ideas aimed at forcing locals to cut wages and salaries in order to even get close to being able to afford their LDF cuts, I’m relegating IPI to the ideologue trashheap with extreme prejudice.

Comment by PublicServant Tuesday, Jan 31, 17 @ 10:51 am

Whatever this is, it isn’t policy. This is a plan to turn Illinois into a ghost town, it’s almost as if they want millions of people to move out of Illinois.

Comment by From the 'Dale to HP Tuesday, Jan 31, 17 @ 10:51 am

@ Wow, I’m with you. Put it on the board, see who votes for it.

Start calling their bluff. Call the GOP talking point “cut waste, fraud and abuse” bluff as well. Find a way to put a “balanced budget” on the board.

Comment by Bobo697 Tuesday, Jan 31, 17 @ 10:53 am

IPI to local gov: how about instead of revenue, we give you magic beans?

Comment by In 630 Tuesday, Jan 31, 17 @ 10:54 am

These smart people just don’t get it. For the rich “solid middle class income 120k plus” or the wealthy this plan is ok but most IL people are barely making it.

Comment by Rocky Rosi Tuesday, Jan 31, 17 @ 10:54 am

3 billion by eliminating collective bargaining seems reasonable. All it would take is paying all current Illinois union employees the wages of 18th century dockhands (say, $1 per week) and watch the billions in savings roll in!

The crack team of public policy experts at the IPI does it again. It’s hard to believe no one has put them in charge of anything.

Comment by PJ Tuesday, Jan 31, 17 @ 10:56 am

Push it to local governments so you can go and purchase them next. Genius.

Comment by Obamas Puppy Tuesday, Jan 31, 17 @ 11:00 am

You might not like the austerity measures in IPI’s proposed budget…but they just did something that the General Assembly has failed to do for years, propose a balanced budget. How many times have people on this very blog told IPI to put up or shut up.

Comment by Realist Tuesday, Jan 31, 17 @ 11:00 am

I’m a conservative; but even I realize the stupidity of this plan. It isn’t realistic and the results wouldn’t be good. For example:

Freeze one major source of local government funding and then cut another major source of their funding?

If something like that passes, ALL local government officials should do their absolute best to show their “appreciation” to any legislator voting in favor of putting them in an untenable position by doing everything possible to ensure they lose their next election. I know I will and I’m downstate so I’m talking Republicans taking out Republicans.

Comment by Anonymous Tuesday, Jan 31, 17 @ 11:01 am

The astronomical property taxes in Oak Park (and many other Chicago suburbs) must be a deterrent to working and middle income families buying homes

in these locales. We don’t talk much about this aspect of socioeconomic inequality, but high property taxes are definitely a barrier to homeownership, and also a barrier to many families’ access to the high quality educational and recreational services provided by many of these suburbs.

Comment by Cassandra Tuesday, Jan 31, 17 @ 11:02 am

==Considering that Illinois consistently ranks at the bottom of the list of state employees per capita==

But we also have the most units of local govt. Are you sure that some of those state employees aren’t employed at the township level? I noticed my township has numerous social service positions that is typically offered at the state level in Minnesota.

Comment by City Zen Tuesday, Jan 31, 17 @ 11:03 am

===propose a balanced budget===

Only if you trust their numbers.

And this isn’t about some sophomoric exercise to balance the budget, it’s an exercise to achieve three simple numbers: 60, 30 and 1. Think that gets them anywhere close to any of those three? Think again.

Next!

Comment by Rich Miller Tuesday, Jan 31, 17 @ 11:03 am

Does Illinois contract out more state work than other states? That could be an explanation for differences in the size of state work forces.

Comment by Cassandra Tuesday, Jan 31, 17 @ 11:07 am

“You might not like the austerity measures in IPI’s proposed budget…but they just did something that the General Assembly has failed to do for years, propose a balanced budget. How many times have people on this very blog told IPI to put up or shut up.”

=====

Proposing a balanced budget is easy. Hell, I can propose one that ensures a budget surplus: cut all government funding of any sort that helps people who bring in less than 100k a year. No public school funding, no Medicaid, no nothing. Hey, I did it! Where’s my medal?

Point being: this is crap. None of this is politically viable (just straight up eliminating collective bargaining?) and some of it probably isn’t even constitutional. They get away with it because no one takes them seriously.

No member of the GA can propose a budget like this because it’s ridiculous garbage that would send every non-millionaire who can afford the transport fleeing across the nearest state border. They don’t deserve any slaps on the back for this lazy trash.

Comment by PJ Tuesday, Jan 31, 17 @ 11:09 am

===No member of the GA can propose a budget like this===

Don’t say “no member.” Rep. Jeanne Ives was at today’s unveiling presser.

Comment by Rich Miller Tuesday, Jan 31, 17 @ 11:12 am

If your philosophy is based on the idea that government should be very small and do very little, this makes a lot of sense. I credit them with putting up some actual proposals that can be vetted and voted on.

The flip side of this proposal is that if the good citizens (and legislators) of Illinois do not like these cuts, they need to accept the fact that government services cost money and that means taxation. If you want the cake, you have to pay for it.

When Gov. Brown put reality in front of CA voters; they chose a tax increase rather than lose services they value. Illinois does not have the initiative options CA does, but it is time for an amendment on the graduated income tax. It is also time for the GA to admit the reality of the need for more revenue. Perhaps the reality of what real cuts would actually entail will wake a few people up.

LOL Who am I kidding?

Comment by Pot calling kettle Tuesday, Jan 31, 17 @ 11:13 am

IPI: Everybody pays but the rich.

Comment by Simple Simon Tuesday, Jan 31, 17 @ 11:13 am

They put together and argument. I don’t agree with 90% of their premise on most things but they put a plan out.

What about raise INCOME TAXES? Maybe that would be an equitable way to start the conversation about property tax freeze? Fund higher ed. (which is an job creator)? Can we get past this crap and just do it?

https://www.youtube.com/watch?v=ZXsQAXx_ao0

Comment by fed up Tuesday, Jan 31, 17 @ 11:14 am

I give them credit for putting a proposal out there with specifics and numbers attached. That’s more than we’ve seen from our Governor or passed out of the House. They also include unpopular things in their proposals. This is behavior I’d like to encourage. I’m not saying I agree with their entire approach or am confident in all their numbers, but good on them for putting something specific out there for people to debate.

Comment by Earnest Tuesday, Jan 31, 17 @ 11:17 am

Finally someone is at least proposing cuts. I have been saying for 2 years LGDF is going to have to be it.

Comment by Blue dog dem Tuesday, Jan 31, 17 @ 11:20 am

Or we could address corporate welfare and try to recoup some of the $2.4B we dole out in property tax abatements, TIF districts, project infrastructure, corporate income tax credits, personal income tax diversions, enterprise zones, training grants, and sales tax exemptions. If we simply ended the antiquated “vendor discount” loophole (sales tax skimming) we’d gain $120M annually.

Comment by Papi Chulo Tuesday, Jan 31, 17 @ 11:21 am

While there are a few good ideas here it’s mostly 50 pages of disinformation and deception. Their lack of higher ed funding is criminal and their pension assumptions are laughable. I love their assertion that the state not paying its share into the pensions is NOT a major factor in their shortfall!

There’s something in here for every fiscal crackpot including municipal bankruptcy. Between their cherry picked numbers and assumptions on savings from waste and abuse as well as streamlined operations it’s quite the fantasy. I love their statement of accuracy at the end though! Sadly this passes for serious research at IPI. My best laugh of the day!

Comment by Old and In the Way Tuesday, Jan 31, 17 @ 11:22 am

“Rep. Jeanne Ives was at today’s unveiling presser.”

Hah. Of course. When she rose in opposition during the energy bill floor debate, you could hear someone on the Democratic side yell “congrats Bob, your bill just passed”.

Comment by PJ Tuesday, Jan 31, 17 @ 11:23 am

Ives and Connelly can sponsor and we’ll see how far it gets.

Ives was on FB wishing Connelly was the GOP Senate leader.

This is their chance.

Comment by Michelle Flaherty Tuesday, Jan 31, 17 @ 11:26 am

Just to speak to Higher Education: the proposal is for $500 million less going in, AND $450 million more going out.(Currently pension payments don’t come out of the universities’ budgets.) So that’s $950 million less in Higher Ed funding.

Perhaps a few million could be saved in administrative costs (though these presumably include people like student advisors: public universities suffer from not having enough of them, so students are poorly advised). But nothing close to $950 million. That’s not cutting fat: that’s bone and muscle gone. Good universities are and enormous long-term benefit to a state. We’ve already inflicted significant damage on ours but this proposal would go a lot further.

Comment by UIC Guy Tuesday, Jan 31, 17 @ 11:29 am

So after their proposed cuts to higher ed how much would actually be spent on higher ed? Are the eliminating it altogether or just reducing it to a very low amount?

Comment by The Captain Tuesday, Jan 31, 17 @ 11:31 am

==When Gov. Brown put reality in front of CA voters; they chose a tax increase rather than lose services they value.==

Define “they”. California’s new tax rates raised taxes on income over $250K and slightly lowered it on everything below. But even after those large hikes, their budgets still were never balanced (sound familiar?). And now they’re back to billion dollar deficits:

http://www.latimes.com/politics/la-pol-sac-jerry-brown-budget-trump-risks-20170110-story.html

Comment by City Zen Tuesday, Jan 31, 17 @ 11:32 am

As much as I want a watchdog out there calling for reforms and countering the continuing descent, this shows a wanton disregard for understanding local government budgets. Yes, there are savings in prevailing wage reform and some small savings in collective bargaining reform, but fire/police pensions are eating city budgets in huge chunks. Collective bargaining and prevailing wage reforms won’t come close to making up the loss of LGDF. IPI is essentially telling cities to slash the number of firefighters and police officers with this idea. That doesn’t tend to go over well, even with some of the biggest anti-tax crusaders.

Comment by Shemp Tuesday, Jan 31, 17 @ 11:33 am

“Education pension funding should be shifted to the employer’s but it needs to be phased-in. …”

Back in 2013 I believe the UI offered to shoulder the responsibility for pension payments if they were transferred at the rate of .5% per year. I think at the time the cost was about 11% of the budget so it would have taken 22 years. Don’t recall why the offer was ignored.

Comment by CapnCrunch Tuesday, Jan 31, 17 @ 11:36 am

Kicking the pension can down the road- now that’s a new idea. And shifting pension costs to local schools is a Madigan idea. Rest of the savings come largely from made up numbers. What a sad outfit!

Comment by Truthteller Tuesday, Jan 31, 17 @ 11:39 am

Credit to IPI for finally moving past empty talking points and putting some numbers on paper. Some of their savings are mythically inflated, and many of their calls are politically unachievabe, but they put their cards on the table.

We’ve been asking that of IPI for two years now, so thanks.

Comment by walker Tuesday, Jan 31, 17 @ 11:40 am

I agree with Steve that all the school districts should be paying into the pension fund for their teachers. While I understand the reasons the State handles TRS the way they do, I’ve always thought the way it is done is crazy.

The issue is how to handle the transition, especially if property tax caps are part of the plan. Will the state now send their normal pension contribution directly to each school district and have the district return it to TRS? Will the ramp / makeup payment also go through each district or will it be sent directly to TRS?

If we’re going to do all that, then maybe TRS should be restructured along the lines of IMRF.

Comment by RNUG Tuesday, Jan 31, 17 @ 11:43 am

While I agree the pension ramp needs to be reworked, I don’t think this is the way to do it. Mandating fixed payments below the actuarially required amount is nothing more than the Edgar Ramp V 2. Passing the buck to someone down the road doesn’t fix it; all it does is relieve the pressure on the current budgets in exchange for much greater future pain.

If you’re going to redo the ramp, structure it like a fixed mortgage, and since it will cost more than today’s contributions, find the needed revenue through a (dedicated?) tax increase.

Comment by RNUG Tuesday, Jan 31, 17 @ 11:48 am

The IPI is objectively and universally anti-government. Why the news media even still treats them as a serious participant in the political process is beyond me.

Comment by CEA Tuesday, Jan 31, 17 @ 11:54 am

Return on investment in higher ed is $25 for every $1 the state spends. Yeah, cut make even deeper cuts. Geesh!

Comment by Because I said so..... Tuesday, Jan 31, 17 @ 12:04 pm

At least the IPI is talking somewhat realistically about cuts that probably have to happen. I guess they can start the discussion that isn’t really happening in Springfield….

Comment by BK Bro Tuesday, Jan 31, 17 @ 12:04 pm

I missed something, I didn’t see the 700 million savings in interest payment’s that our Govenor and State Rep’s have racked up and pushed onto the citizens of Illinois bye creating a 12 billion$ unpaid bill debt. I also don’t understand how 4 billion$ debt over several years under Madigan’s rule is worst than 8 billion addition $ debt in 2 years under Ruaner’s rule. Plus I’m still trying to wrap my head around the fact that spending 700 million a year in interest is ok as long as you destroy unions, venerable citizens, and schools to save 2-3 billion over several years.

Comment by So tired of the political hacks Tuesday, Jan 31, 17 @ 12:17 pm

Steve Schnorf: the LGDF has been frozen since the Quinn temporary income tax was passed back in 2011.

Comment by GA Watcher Tuesday, Jan 31, 17 @ 12:17 pm

Libertarians should stay out of politics, the way they think churches should too. They are a cult and in Illinois, the IPI is their pastor.

Comment by Union Man Tuesday, Jan 31, 17 @ 12:21 pm

=Education pension funding should be shifted to the employer’s but it needs to be phased-in.=

Like RNUG I don’t disagree with this concept. Admittedly, from a more self serving perspective the state can never be trusted to properly fund the pension system.

The “cost shift” can’t happen along with a property tax freeze, even with collective bargaining changes. The cost is too high. A phased in approach would be best, along with providing local discretion (local control) for levying for the cost of the pension just like we do for the Illinois Municipal Retirement Fund (IMRF) pensions and social security.

If the revenue isn’t available one of two things will happen that will not be good for the economy

1) Increased unemployment due to layoffs - fewer people employed is bad for the economy and for the tax base in every economic model I am aware of.

2) Major reductions in compensation and benefits (only IF collective bargaining rules are changed and communities have the stones to do it) which is also bad for the economy.

Comment by JS Mill Tuesday, Jan 31, 17 @ 12:22 pm

– The “cost shift” can’t happen along with a property tax freeze, even with collective bargaining changes. The cost is too high. –

Well, here’s a solution: Just pass a constitutional amendment requiring the school districts to pay the pensions. Then cost doesn’t matter, because, constitution. See? Simple. NEXT!

Comment by JB13 Tuesday, Jan 31, 17 @ 12:37 pm

As an employee of a private university, I have never understood why public U employees haven’t had their retirement accounts shifted to TIAA-Cref years ago.

Comment by Cheryl44 Tuesday, Jan 31, 17 @ 12:52 pm

I don’t see how the pension shift and other cuts to local government will work out if there is also a property tax free.

People will quickly be unhappy with 50 kids in a classroom and reduced police/fire department staffing.

Comment by titan Tuesday, Jan 31, 17 @ 12:58 pm

Question..how much money has Rauner gave to the Il policy

Comment by Applecity Tuesday, Jan 31, 17 @ 1:23 pm

…Phase 3, Profit!

Comment by Bill F. Tuesday, Jan 31, 17 @ 1:27 pm

IPI can call for the destruction of local government because they also propose giving them the ability to file bankruptcy “as an option of last resort.” (see p. 21). Clever, huh?

Comment by Robert Montgomery Tuesday, Jan 31, 17 @ 1:35 pm

==high property taxes are definitely a barrier to homeownership, and also a barrier to many families’ access to the high quality educational and recreational services provided by many of these suburbs==

They’re also why those educational and recreational services are so good.

Comment by whetstone Tuesday, Jan 31, 17 @ 2:04 pm

Take your choice! The other solution raising taxes and causing the tax payers to move out of state in higher numbers, and thus reducing the tax base!

Comment by Anonymous Tuesday, Jan 31, 17 @ 2:05 pm

It’s not an either/or thing. You can do a combination of both, and anyone who is serious about fixing the problem knows that’s what must be done.

Comment by Demoralized Tuesday, Jan 31, 17 @ 2:18 pm

==They’re also why those educational and recreational services are so good==

But…but…I thought everything was free and I shouldn’t actually have to pay to get services! I shouldn’t have to pay taxes at all! /snark

Comment by HangingOn Tuesday, Jan 31, 17 @ 2:25 pm

=It’s not an either/or thing.=

Amen!!

Comment by JS Mill Tuesday, Jan 31, 17 @ 2:41 pm

==Question..how much money has Rauner gave to the Il policy==

According to Wikipedia: $525, 000 between 2008 - 2013.

Comment by TinyDancer(FKASue) Tuesday, Jan 31, 17 @ 2:42 pm

The Illinois Policy Institute having a hand in shaping state government policy is like putting Betsy DeVos in charge of the department that oversees public education.

DeVos doesn’t believe in public education and the Illinois Policy Institute doesn’t believe in government.

Comment by TinyDancer(FKASue) Tuesday, Jan 31, 17 @ 2:49 pm

“Take your choice! The other solution raising taxes and causing the tax payers to move out of state in higher numbers, and thus reducing the tax base!”

The above sort of says it all. I’d like to see a vote in the GA that would require the legislators to vote for the IPI budget OR a commitment to raise the income tax to the 8-10 per cent level that would support current spending and eliminating the $130B pension shortfall. Wont happen but it sure would be interesting.

Comment by Dave in Chicago Tuesday, Jan 31, 17 @ 2:50 pm

YES. YES, YES, YES, YES, YES!

Comment by One of many Tuesday, Jan 31, 17 @ 3:00 pm

That settles it, raise the state income tax to 8% and pass the “opportunity tax” so businesses will gleefully pay an annual tax for the privilege of operating in the great state of Illinois!!

Comment by Piece of Work Tuesday, Jan 31, 17 @ 3:36 pm

But then we can give back taxes back thru EDGE.

Comment by blue dog dem Tuesday, Jan 31, 17 @ 3:58 pm

The most common sense thing that Illinois could do about pension benefits is to link the benefits to actually years of service in a given position. The system is rife with abuse for those who are promoted shortly before retirement and go out at the highest pay grade as opposed to where actually worked for most of their careers. We also need to limit pols drawing multiple pensions.

Comment by Anonymous Tuesday, Jan 31, 17 @ 4:16 pm

IPI…..ummmmmmm…..this sounds a bit like…..

class warfare?

Right?

I mean the second it’s socially appropriate you’re going to advocate for a tax cut for corporations and the wealthy right?

Comment by Honeybear Tuesday, Jan 31, 17 @ 4:22 pm

The IPI says; You’ll get nothing and like it!

Comment by Anonymous Tuesday, Jan 31, 17 @ 4:43 pm

People always say ‘don’t raise taxes’ but if you want them to totally freak out, cut some of their beloved services.

People want their services … they just want them for free (or at least free to them personally - if paid for at all, “other people” should pay for them).

Comment by titan Tuesday, Jan 31, 17 @ 4:59 pm

Sounds like the opening salvo in a plan to blame the eventual tax hike on local governments. We could have balanced the budget without a hike but the locals need money because of the property tax freeze.

Comment by LTSW Tuesday, Jan 31, 17 @ 6:50 pm

If Rauner wants government to be like business he could just layoff 10% of staff now. Of course I assume that this is IPI and not his plan?

Comment by Cleric Dcn Tuesday, Jan 31, 17 @ 7:10 pm

So, instead of raising taxes on millionaires to generate $1 billion, the IPI wants to borrow $1 billion per year from the pension fund at 7.25% interest?

I can’t wait to hear the Chicago Tribune’s response.

Comment by Yellow Dog Democrat Tuesday, Jan 31, 17 @ 7:47 pm

==the LGDF has been frozen since the Quinn temporary income tax was passed back in 2011.==

No, the % of income taxes that go to LGDF was reduced when the tax rates went up, so that all of the revenues from the rate increases would go to the state. The % went back up when the rates went down. There wasn’t a “freeze.”

Comment by Whatever Tuesday, Jan 31, 17 @ 8:15 pm