Latest Post | Last 10 Posts | Archives

Previous Post: Oops!

Next Post: Pritzker unveils proposed graduated tax rates

Posted in:

* As I told subscribers this morning, the meetings begin Monday…

Illinois Gov. J.B. Pritzker will participate in the state’s upcoming meetings with rating agencies to outline his pension and budget proposals, which have prompted warnings they could drive further credit deterioration.

The meetings are set for next week, according to market sources. Illinois is the lowest-rated state by several notches with its general obligation debt at Baa3 with a stable outlook from Moody’s Investors Service, BBB with a negative outlook from Fitch Ratings, and BBB-minus and stable from S&P Global Ratings.

Pritzker will attend the meetings with the finance team unlike his predecessor, Bruce Rauner, who left that task to his budget and capital markets team. […]

The state’s low ratings leave it with little room to maneuver to avoid a cut to speculative-grade status.

Several analysts said there’s no standard when it comes to a governor’s attendance at rating meetings but one said there “is value” in hearing directly from a new leader on his or her vision.

Do you think it’ll do any good?

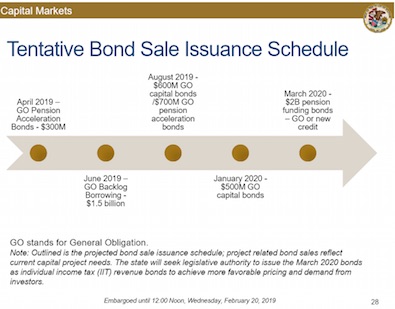

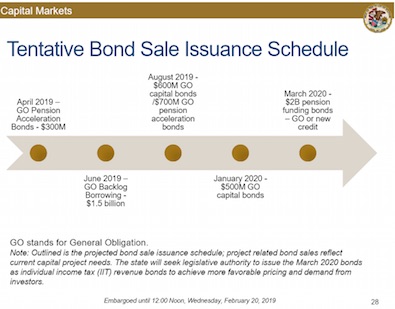

* From the budget book…

posted by Rich Miller

Thursday, Mar 7, 19 @ 11:33 am

Sorry, comments are closed at this time.

Previous Post: Oops!

Next Post: Pritzker unveils proposed graduated tax rates

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Kicking the can and higher spending are not the answer. The state will probably be downgraded to junk under JB.

Comment by Anonymous Thursday, Mar 7, 19 @ 11:35 am

My take is that it will help show the ratings agencies that this is being taken seriously. It will also drum up media coverage without having to downgrade the state.. So there is that.

Comment by Anonymous Thursday, Mar 7, 19 @ 11:36 am

Yes. It will do some good.

Comment by Blue Dog Dem Thursday, Mar 7, 19 @ 11:36 am

Yes. It’ll show he’s trying to fix things unlike his predecessor who instead tried to burn it down and file bankruptcy.

Comment by El Conquistador Thursday, Mar 7, 19 @ 11:39 am

Numbers matter but … it couldn’t hurt. JB seems to be an involved guy.

Comment by Steve Thursday, Mar 7, 19 @ 11:39 am

It’s got to work better than nothing, which was Rauner’s approach.

Comment by Nick Name Thursday, Mar 7, 19 @ 11:41 am

Yes this will be helpful so J.B. can Splain in private his plans to increase revenue.

Comment by Al Thursday, Mar 7, 19 @ 11:42 am

I think Wall Street will like the use of gold coloring in the presentation.

Comment by City Zen Thursday, Mar 7, 19 @ 11:45 am

You can make this a non-issue by copying what Rhode Island did, by passing a law, or in the case of Illinois, a constitutional amendment, giving bond payments priority over pension payments. The State’s bond rating will be AAA overnight.

Comment by Merica Thursday, Mar 7, 19 @ 11:45 am

Take Plummer with you, show em what you got to work with

Comment by Rabid Thursday, Mar 7, 19 @ 11:45 am

It’s good to be involved and give the signal that you’re trying to improve the state’s finances, which is the long-term goal. That requires raising taxes on the rich, for more revenue and fairness.

Comment by Grandson of Man Thursday, Mar 7, 19 @ 11:47 am

Not sure it will change ratings. JB may learn something useful. An outside critique of his plans will give him another perspective.

Comment by Last Bull Moose Thursday, Mar 7, 19 @ 11:49 am

Medical - your clueless. First bonds already have priority but what you fail to recognize RI passed a bill reducing pension benefits. RI didn’t have our lousy impairment language.

Comment by Sue Thursday, Mar 7, 19 @ 11:50 am

I think it will have a huge effect. Pritzker is fantastic in person. As much as folks look at the numbers. Having the Governor there lets you hear it from his mouth and also let’s you ask any questions

Directly from the Governor.

I think it will have a good effect.

Those Wall Street folks love a billionaire.

It’s smart and a good play.

Remember JB is just one of the Pritzker billionaires.

Put them together and the Wall Streeters

Are going to listen.

I hate to say it but

Money Talks

Comment by Honeybear Thursday, Mar 7, 19 @ 11:52 am

==RI didn’t have our lousy impairment language.== RI keeps some of its promises. IL keeps all of them.

Comment by SAP Thursday, Mar 7, 19 @ 11:53 am

I hope it will do some good. I want it to do some good. But if JB’s emerging lack of attention to detail in many areas, and his seeming lack of understanding about the can-kicking ramifications becomes apparent, then the meeting could be catastrophic. I hope he and his staff are prepared for this.

Comment by Responsa Thursday, Mar 7, 19 @ 11:55 am

$5.6B total, $3B just for pension payments, $1.5B for past bills, only $1.1B capital projects

Definitely kicking the can on pensions. And not much of a capital project, relatively speaking.

Comment by RNUG Thursday, Mar 7, 19 @ 11:56 am

–Several analysts said there’s no standard when it comes to a governor’s attendance at rating meetings but one said there “is value” in hearing directly from a new leader on his or her vision.–

There shouldn’t be, among objective graders.

But, then again, ratings don’t have any relationship to the risk involved in a state’s GO bonds. All states should be AAA. Ratings are a grade on a state’s fiscal practices compared to other states.

By law, Illinois GO bonds get paid first, in full, always. Rauner running up the unpaid bill pile to $16B while bond debt service was paid at 100% on time should have made that clear to anyone.

Comment by wordslinger Thursday, Mar 7, 19 @ 12:02 pm

As Rich said in another story “…but in the end we’re all human beings.” And this applies to people at ratings agencies.

For that reason, Pritzker going to New York can be a positive on the margins.

Comment by Old Illini Thursday, Mar 7, 19 @ 12:43 pm

Apparently Rich doesn’t like my commenting, but basically I said that this is showmanship and won’t do anything for us.

Comment by Romeo2 Thursday, Mar 7, 19 @ 1:25 pm

==our lousy impairment language==

Yes, because we should all support reneging on contracts. When did it become a conservative principal to not want to pay what you owe?

Comment by Demoralized Thursday, Mar 7, 19 @ 1:46 pm

Let’s look at everybody’s agenda on this it seems the new Governor has followed the old beaten path roll up your sleeves Mr Governor stay home and fight for Illinois we need jobs and no more taxes

Comment by No money Thursday, Mar 7, 19 @ 1:53 pm

JB needs to hear the street tell him to change the state constitution to fix the pension clause and reduce pension futures … Like Arizona has recently done. Current plan postpones the inevitable. That should mitigate ratings downgrades. Then consider lump sum cashouts and switch to 401k like the rest of the world.

Comment by Texanoisan Thursday, Mar 7, 19 @ 2:53 pm

== Like Arizona has recently done. ==

AZ may have passed it but it hasn’t been litigated yet … and the AZ language was/is a bit weaker than IL and NY.

Comment by RNUG Thursday, Mar 7, 19 @ 3:55 pm

== When did it become a conservative principal to not want to pay what you owe? ==

Ever since bankruptcy for profit became just one more business strategy in the private sector. I

Comment by RNUG Thursday, Mar 7, 19 @ 3:57 pm

The same rating agencies that participated in the 2008 economic collapse.

Comment by m4a Thursday, Mar 7, 19 @ 7:25 pm