Latest Post | Last 10 Posts | Archives

Previous Post: Appellate court finds judge abused discretion; reverses, vacates contempt rulings against DCFS Director Smith, but doesn’t let agency off hook

Next Post: Christine McVie

Posted in:

* Background is here if you need it. Wirepoints…

Gov. JB Pritzker on Tuesday announced the terms on which Illinois will finally repay the remaining debt owed by the state’s unemployment insurance trust fund to the federal government. […]

It was political theater — spin and fiction — with lawmakers slapping themselves on the back for yet another supposed triumph of fiscal prudence. […]

Repayment of the loan doesn’t solve the problem. Aside from paying off the loan, the trust fund must be restored to a positive balance sufficient to cover claims. The fund depleted a little over $1 billion that it had before the pandemic, which was already insufficient at the time. It now needs another $1.7 billion to be restored to solvency, which came out in the Q &A at the Tuesday press conference.

Where will that additional $1.7 billion come from? Nobody said and no reporter asked. Pritzker did say that, aside from paying off the loan, the state will provide the trust fund with another $450 million towards that $1.7 billion which, he said, will “replenish the fund for the future.”

But that additional $450 million is only a loan to the trust fund, to be paid off over ten years. In other words, the state is just swapping one debt for another.

And how about the remaining $1.25 billion the fund needs? Nobody addressed that on Tuesday.

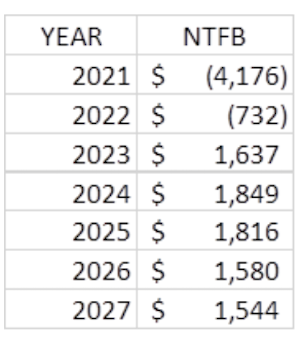

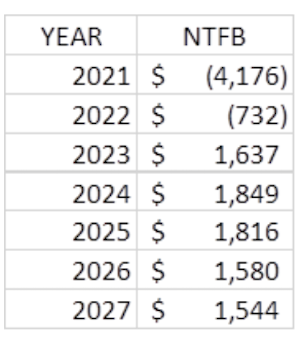

I reached out to the business folks from the agreed bill process and was told that the repayment actually does restore the trust fund balance sufficient to cover claims – and then some. I was pointed (not wirepointed, just pointed) to this IDES projection showing the end-of-year net trust fund balances produced by the deal…

This deal was backed by more than 30 employer groups. The Illinois Retail Merchants Association’s president Rob Karr said the agreement would ensure employers “pay over $900 million less in taxes over the next five years than they otherwise would have.” Mark Denzler at the Illinois Manufacturers’ Association echoed the $900 million tax savings and said the deal preserves “the solvency of the Trust Fund at a time of economic uncertainty.”

So you can believe those two guys or a group that runs down the state at secessionist conventions.

posted by Rich Miller

Wednesday, Nov 30, 22 @ 12:41 pm

Sorry, comments are closed at this time.

Previous Post: Appellate court finds judge abused discretion; reverses, vacates contempt rulings against DCFS Director Smith, but doesn’t let agency off hook

Next Post: Christine McVie

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Some folks just don’t like to accept good news.

Comment by Friendly Bob Adams Wednesday, Nov 30, 22 @ 12:50 pm

Reason number 579 that shows why Wirepoints is a joke.

Some people just absolutely refuse to take good news as good news. They will do their utter best to spin it as bad, regardless of whether all of the facts that are against them.

Comment by Demoralized Wednesday, Nov 30, 22 @ 12:51 pm

I am normally suspicious of the motives and doubtful as to the validity of statements made by these two Associations and am honestly surprised at their positive take on this plan. That being said It is very refreshing to find them on this side of an issue involving taxes. I hope it gets a positive reception from our legislators,

Comment by illini Wednesday, Nov 30, 22 @ 12:52 pm

Now fiscally incompetent too. Republicans have jumped the shark.

Comment by Lurker Wednesday, Nov 30, 22 @ 12:54 pm

This is what you get when people who were not part of the process or results try to talk about the process and results. Wirepoints has gone downhill (I do believe they USED to do good things).

Comment by JustAThought Wednesday, Nov 30, 22 @ 12:54 pm

== runs down the state at secessionist conventions.==

That’s a great Illinois centric Final Jeopardy category.

Comment by don the legend Wednesday, Nov 30, 22 @ 12:55 pm

So Wirepoints made a claim that’s mathematically false. About as cut and dry as it gets. Will they post a correction? I can’t find any evidence on their site suggesting that they’ve ever run a correction on anything.

Comment by vern Wednesday, Nov 30, 22 @ 12:57 pm

The grifters need to keep they’d marks happy, and by happy I mean speaking ruinous to good news to Illinois.

===or a group that runs down the state at secessionist conventions.===

That is what I call …Restaurant Quality

Comment by Oswego Willy Wednesday, Nov 30, 22 @ 12:57 pm

The state could find ten billion dollars in gold buried under Lincoln’s Tomb and groups like this would still try to find a way to portray it as bankrupt.

Comment by lollinois Wednesday, Nov 30, 22 @ 12:57 pm

To be fair, Dabrowski has to give Greg Bishop something to regurgitate.

It’s not like Bishop is an actual journalist or anything.

Comment by Flying Elvis'-Utah Chapter Wednesday, Nov 30, 22 @ 12:58 pm

Wirepoints isn’t disingenuous or “fibbing”… they are pushing the vertical integration narrative to be cited later.

Once you realize Wirepoints sole purpose of existing, all these disingenuous acts make sense.

Comment by Oswego Willy Wednesday, Nov 30, 22 @ 1:03 pm

It seems like the right wing has concluded that if they tell the truth voters will not be interested in what they have to sell. So it’s all lies all the time. Add this to litter boxes in schools.

Comment by Big Dipper Wednesday, Nov 30, 22 @ 1:04 pm

This sort of reporting is just propaganda. Not much different from Proft’s papers. Or Fox News. The conviction of the Oath Keepers was the lead story on all legitimate news websites yesterday. Foxnews didn’t even mention it. Apparently trying to spin that favorably for “the cause” was beyond their editorial powers.

Comment by Henry Francis Wednesday, Nov 30, 22 @ 1:16 pm

So my question is, if we already know Wirepoints is baseless propaganda, why elevate their story by talking about it?

Comment by Commissar Gritty Wednesday, Nov 30, 22 @ 1:25 pm

=== why elevate their story by talking about it? ===

lol

Wishing them away ain’t gonna work.

Comment by Rich Miller Wednesday, Nov 30, 22 @ 1:26 pm

Also comment of the day goes to Big Dipper @ 1:04 pm, that cracked me up.

Comment by Commissar Gritty Wednesday, Nov 30, 22 @ 1:29 pm

Shaming the peddlers of false information, fabricated facts, it’s the idea that Wirepoints *LOVES* when their work gets cited or “picked up”…

… I’m sure they can’t stand when searchable things about them turn to those who point out what flat out frauds they are.

More sunshine, not less… more exposure, more wilting.

Comment by Oswego Willy Wednesday, Nov 30, 22 @ 1:31 pm

OK so I went down the rabbit hole with the Wirepoints link. Can someone here explain the “Pritzker Lied about using ARPA money for pension debt” topic? Why did negotiations take place instead of just using the federal money?

Comment by Lefty Lefty Wednesday, Nov 30, 22 @ 1:36 pm

===Why did negotiations take place instead of just using the federal money? ===

Because the federal money was used on other things. In the end, they got there. What’s the gripe?

Comment by Rich Miller Wednesday, Nov 30, 22 @ 1:39 pm

–why elevate their story by talking about it?–

There’s a difference between ‘talking about it’ by just randomly posting their nonsense and saying “hey look at this propaganda”, and doing the work to show exactly why their statements are false with multiple outside independent sources showing that to be the case.

Now if Rich was just posting a direct link to the wirepoints story and saying “LOL”, then yes that type of engagement is not only useless but actively spreads their message with no counterpoint. That’s what CenterSquare already does, but without the lol.

See the difference?

Comment by TheInvisibleMan Wednesday, Nov 30, 22 @ 2:03 pm

@Commissar Gritty: Personally, I appreciate Rich running down the news coming from these yahoos so I don’t have to do so myself.

Comment by Benjamin Wednesday, Nov 30, 22 @ 2:17 pm

=== why elevate their story by talking about it? ===

Because that “story” is probably going to be reprinted in local newspapers across the state even though it’s a bunch of garbage.

Comment by 47th Ward Wednesday, Nov 30, 22 @ 2:39 pm

===In the end, they got there. What’s the gripe?===

The did get over $100 million in federal penalties because it wasn’t paid off right away with ARPA. So they got there, but not without bruises.

Comment by JustAThought Wednesday, Nov 30, 22 @ 4:03 pm

For the love of *&%!. Just take the good news. You “yeah but” people are just plain pathetic.

Comment by Demoralized Wednesday, Nov 30, 22 @ 4:22 pm

adp isn’t playing.

(my payroll processor)

Email from them today.

It appears there only four states in the nation that couldn’t figure out how to avoid this.

2022 Federal Unemployment Tax Act (FUTA) Tax Assessment

Hello,

Our records indicate your company will be assessed additional Federal Unemployment Tax Act (FUTA) tax by the federal government for 2022 because you have employees working in one or more FUTA Credit Reduction states: California, Connecticut, Illinois, New York.

This means a state has taken loans from the federal government to meet its unemployment benefits obligations and has not repaid the loans within the allowable time frame. As a result, the usual credit against the full FUTA tax rate is reduced, and additional FUTA tax of .3% will be due for employers in these states.

For more information about FUTA Credit Reduction visit http://bit.ly/irs_futa_credit_reduction or search RUN Powered by ADP® (RUN) Help and Support for “FUTA Credit Reduction”.

What You Need to Know:

Refer to your draft Form 940, where FUTA tax is reported and scroll to Schedule A for a list of your impacted states. Here’s how to view your Form 940:

Log in. Click the Taxes tab, then select Tax Returns. Select Q4 2022, then click Done. Choose 940 Employer’s Annual Federal Unemployment (FUTA) Tax Return. Box 11 will display a preliminary calculation of additional FUTA taxes. Please note: this amount will change as the end of the tax year approaches.

ADP® will mail an invoice with the finalized amount due between January 13 and January 19, 2023.

Your account will be debited on January 23, 2023. If your funding method is Direct or Reverse Wire, it is imperative that funds are wired or available to debit by this date.

Please note: ADP will debit and remit this amount if you are an active tax filing client and ADP is responsible for your annual Form 940. If you are not an active tax filing client, or if ADP is not responsible for your annual Form 940 filing, this liability will be your responsibility. You can determine who is responsible for filing and depositing by reviewing your Qtr Tax Verification report in RUN and referring to the row labeled Federal Unemployment Tax Act.

This message is informational. No action is required at this time.

Thank you,

ADP

Comment by 40,000 ft Wednesday, Nov 30, 22 @ 7:22 pm