Latest Post | Last 10 Posts | Archives

Previous Post: *** LIVE *** SESSION COVERAGE

Next Post: Patience, please

Posted in:

* This is definitely not good at all, but it’s not quite as horrible as the headlines make it out to be…

The trouble with the headlines is the way money is classified. From the Auditor General’s report…

In FY12, IDOT noted that Transportation Bond Series A Fund expenditures paid for $419.3 million in road construction costs, and over $2.67 billion over the 10 year audit period.

Yet the interest payments on those bonds were classified as “Non-Direct Road Construction Expenditures.” That seems odd.

* Also, the General Assembly stopped paying state police and secretary of state salaries out of the Road Fund a few years ago, so things are different now. There was a big problem, however…

In 2010, lawmakers stopped the practice of using road fund money to pay salaries in the secretary of state’s office and state police, but health insurance charges to the fund didn’t go down by a comparable amount, auditors said.

State officials said a single employee, who no longer works for the state, was responsible for calculating the health insurance charges that should be made to the road fund. Auditors said those calculations weren’t based on actual insurance costs.

Auditors also found the road fund was billed for $54 million more in workers’ compensation costs than it should have been during a three-year period. State officials said this was because lawmakers capped the amount of general fund money that could be used for workers’ comp costs.

I’m not so sure that throwing one guy under the bus is legit here. It seemed back then that it was a deliberate act. From the audit…

Department of Healthcare and Family Services

Road Fund expenditures by HFS during the audit period totaled more than $1 billion and were for Employer Contributions for Group Health Insurance. Payments for Group Health Insurance by HFS began in FY06 at a cost of $126 million. These expenditures increased in each of the next six years. In FY12, expenditures for Group Health Insurance were more than $165 million.

* Response…

Gov. Pat Quinn’s office and the Illinois Department of Transportation disputed the findings, saying auditors should have included costs such as road construction bond payments, snow removal and other safety upgrades required by the federal government when they calculated the amount spent on “direct road construction.”

Spokeswoman Jae Miller said about 75 percent of the Road Fund goes toward IDOT expenses. She said that’s a “significant increase” over previous administrations.

* But this is from the audit…

Senate Resolution Number 788 asked auditors to examine the uses of the Road Fund, including the amounts used for “direct road construction costs.” Since IDOT did not have an established definition of direct road construction expenditures, auditors worked with IDOT and selected certain detail object codes established by the Comptroller and appropriation codes to identify direct road construction expenditures.

Oy.

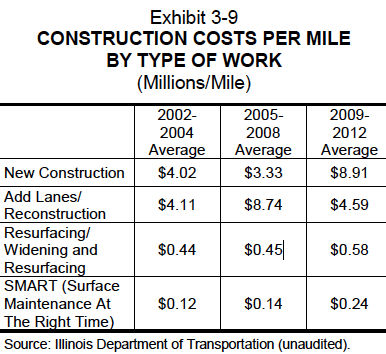

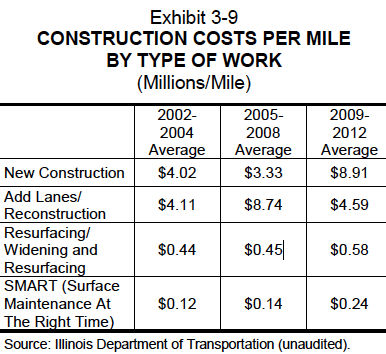

In addition to decreased funding available for direct road construction and an increase in non-direct road construction costs, the costs for road construction are also increasing. Exhibit 3-9 shows the average construction costs by type of work per mile. According to IDOT, between 2002 and 2012, the average costs for every type of construction increased.

New construction has more than doubled from $4.02 million/mile from 2002-2004 to $8.91 million/mile from 2009-2012. Increasing construction and non-construction costs combined with declining revenues has caused IDOT to express concern over the number of roads needing repair. IDOT stated that the backlog of State roadway miles in need of improvement is expected to grow significantly through FY18 unless additional revenues are made available. Even if Road Fund revenue was stable, the increase in construction costs would cause a decrease in the amount of direct road construction projects that could be completed.

The high price of commodities is surely contributing to this problem.

The chart…

Discuss.

posted by Rich Miller

Wednesday, May 15, 13 @ 9:28 am

Sorry, comments are closed at this time.

Previous Post: *** LIVE *** SESSION COVERAGE

Next Post: Patience, please

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

I guess I’m not outraged that road bonds, snow removal and safety upgrades are being paid out of the road fund.

Is “direct road construction” defined by statute governing the road fund, or was it something made up by those calling for the audit.

Comment by wordslinger Wednesday, May 15, 13 @ 9:44 am

Not surprised at the percentage-it seems like the legislature or governor was always dipping into the road for something or other (most of it with good intentions).

As for material costs, road oils and rock prices have doubled since the last MFT Fund increase; labor has risen (aided by the legislature and the prevailing wage laws, which they keep expanding); and the actual allotments have dropped, due to less travel and more efficient vehicles.

Many, if not most, Road Districts are turning oil & chip roads back to gravel due to the high cost of oils. The bad thing is that gravel roads aren’t really any cheaper to maintain; the costs don’t just occur all at once.

Sorry I got off subject, but the problem isn’t just limited to the state highways. Unless some other funding comes along, we can expect that all roads overall will continue to deteriorate.

Comment by downstate commissioner Wednesday, May 15, 13 @ 9:53 am

“Senate Resolution Number 788 asked auditors to examine the uses of the Road Fund, including the amounts used for “direct road construction costs.” Since IDOT did not have an established definition of direct road construction expenditures, auditors worked with IDOT and selected certain detail object codes established by the Comptroller and appropriation codes to identify direct road construction expenditures.”

Okay, folks. On June 1, you know it’s coming. You know how the auditor’s office works. So by June 15, you need to have a working, official definition of “direct road construction” costs. Otherwise — well, this happens.

Just wanna say this, though — did the auditor’s report look at the quality of road construction? Did they compare cost per mile with other comparable states? In other words — are we taxpayers getting good value from our road construction expenditures? Geez, I wish the auditor general would focus on the big issues.

Sign me,

Frustrated Taxpaying Soccermom

Comment by soccermom Wednesday, May 15, 13 @ 10:05 am

==Is “direct road construction” defined by statute governing the road fund, or was it something made up by those calling for the audit.==

As quoted above from the audit report, “Since IDOT did not have an established definition of direct road construction expenditures, auditors worked with IDOT and selected certain detail object codes established by the Comptroller and appropriation codes to identify direct road construction expenditures.”

My own reaction to the parts about overcharging the fund was “New management, same old s___. Oh, wait, what new management?”

Comment by Anon. Wednesday, May 15, 13 @ 10:17 am

There are many ways to rob the road fund. For instance, don’t let IDOT buy their own computers. Have CMS buy the computer, printers, vehicles, etc. and then charge IDOT (read road fund) outrageous monthly rentals for that equipment and you have transferred huge sums of money from the road fund to the general fund. Been doing this since Blago but expanding it all the time.

Comment by Caveman Wednesday, May 15, 13 @ 10:22 am

Downstate roads, both state and county/township/municipal, are likely to take a beating over the next ten years, as grain is being hauled in overweight containers (empties from goods deliveries from the Far East which are being repurposed before being shipped back), as well as pressure from Chicago and the suburbs to change the 55% downstate/45% NE IL formula more favorably to NE Illinois. With downstate’s 80% of the road mileage but only a third of the population (and representation in the GA) it’s not a pretty scenario for those like our friend, the commissioner.

Comment by Six Degrees of Separation Wednesday, May 15, 13 @ 10:22 am

I’m strangely happy that the state is dipping into the road fund to pay other bills.

If it didn’t do that and instead spent all the road fund money on roads, the other bills would not have been paid, thus increasing the amount of bill backlog the state has, right?

Comment by Robert the Bruce Wednesday, May 15, 13 @ 10:25 am

Something is skewing the new construction and add lanes/reconstruction costs. New construction went down, then shot way up while add lanes/reconstruction went way up and returned almost to 2002 levels. The nature of the work between both categories is similar, and can’t be explained away by land costs or some other variable not in common. My guess is that there were a lot more urban add lanes projects in the middle period, and a lot more urban new reconstruction projects in the latter period. The state isn’t doing much new construction any more…the days of putting in new Interstates are mostly behind us.

Comment by Six Degrees of Separation Wednesday, May 15, 13 @ 10:31 am

Brady says the audit proves taxpayers are being cheated— somehow that principle doesn’t apply to employees. The legislature has complete control over every fund except what has been already paid into pensions does it not? Sweeping funds was upheld by the courts I believe…

Comment by Liberty First Wednesday, May 15, 13 @ 10:35 am

The IDOT was involved in determining what the definition of direct costs are? And they left off the costs of servicing the bonds that are sold to pay for construction? Oy indeed.

Comment by dupage dan Wednesday, May 15, 13 @ 10:42 am

We were shocked to see how eidtors across the state censored NoTaxBill’s explanation of how the state might meet with costs of ISP/SOS etc without the road Fund diversion. We are advised he “plan” was truly gifted.

Perhaps Capt. Fax can share with this audience?

Comment by CircularFiringSquad Wednesday, May 15, 13 @ 11:23 am

I’m sure there’s a legitimate reason to care about where funds are spent but I honestly don’t have a problem with which funds expenditures come out of. They can throw all the money in one great big pot for all I care. The average person just cares that the roads are taken care of, not that it had to be paid for out of GRF, Road Fund, a capital plan, etc. And if the road fund is shorted, that’s not an issue until a road can’t be built/repaired because of it (and no transfers from other funds can be made). Now if it was shown that road projects were down, that’s something worth pointing out.

It’s rather like having a household budget. If I allocate $200 for groceries and $50 for clothes, it’s not a problem if I spend $200 on groceries but take it $150 out of the grocery budget and $50 out of the clothes budget. It’s a problem if I spend more than $250 total. It’s also a problem if I need a new new shirt and can’t get it because I spent the clothes money on groceries. But if I can buy the shirt on the grocery budget, what does it matter? I still got the shirt and groceries.

Comment by thechampaignlife Wednesday, May 15, 13 @ 12:14 pm

Soccerm: You quote the resolution for what they were directed to do . For the auditors to look at cost per mile or quality, it would have had to have directed that. The cost per mile vs other states should be easy to find I would think.

Comment by Patty T Wednesday, May 15, 13 @ 12:19 pm

Labor has also done a nice job of making it nearly impossible for the little guys to bid projects. Bidding a local project is bad enough, but especially if MFT funds are involved. I have seen firsthand a contractor lose a project because of a missed check box in a stack of forms. We’ve seen most of our smaller contractors get taken over or go out of business because of DBE rules, or apprenticeship rules or prequalification rules, etc. Everytime we make it harder for a small contractor, we lose one more potentially competitive bidder and we see the bids increase. We do it to ourselves.

Obviously commodity prices do matter, but if we wanted, we could fix the problem with our labor and contracting rules much more easily than we can change commodity prices.

Comment by Shemp Wednesday, May 15, 13 @ 12:21 pm

And people wonder why taxpayers resist new taxation?

Comment by Plutocrat03 Wednesday, May 15, 13 @ 12:21 pm

Oh, and for good measure, I spoke with a civil engineer today who said they did more surveying and plan drawings for the sidewalks at an intersection than they did for the intersection to meet IDOT’s requirements in a neighboring city. That doesn’t keep the overall price of projects down. His words, even as the engineer making money off of this was, “Have we lost our minds?”

Comment by Shemp Wednesday, May 15, 13 @ 12:23 pm

Back with Cellini, after he took his 20% for him and his pals, the rest got spent on roads and union jobs. Now, who knows?

I know, kinda like pining for the good old Vegas run by the mob…

Comment by Quinnella Wednesday, May 15, 13 @ 12:46 pm

If you want to make your blood boil, just read over invoices that CMS charges IDOT for truck maintenance. As someone in the trucking industry, I have a decent idea of what truck maintenance costs and have seen invoices that my local township received with a purchased state dump truck. There are many jobs that CMS charges over twice the average time for simple repairs. In fact, based on the invoices I have observed, it would have been cheaper for the local state maintenance shed to have sent their units to the local International dealer for repairs.

Comment by Anonymous Wednesday, May 15, 13 @ 12:58 pm

Anon 12:58, I’m not challenging your point about CMS’ prices, just wondering if anyone in your agency has complained and what happened. As you know, a fair amount of routine or scheduled maintenance on those trucks should have a flat-rate established for the job. Agencies shouldn’t pay the tab if CMS’ techs can’t turn the wrench fast enough.

Comment by Arthur Andersen Wednesday, May 15, 13 @ 4:02 pm

It doesn’t affect me so why would I complain. I just happened to see the invoices CMS had charged to the particular truck that was purchased by my township. As an example, I know that the average wheel seal replacement for a tandem axle tractor is between 2 & 2.5 hours, yet CMS charges IDOT over 5 hours for the same repair.

Comment by Anonymous Wednesday, May 15, 13 @ 6:25 pm