Latest Post | Last 10 Posts | Archives

Previous Post: Today’s number: 39 percent decrease

Next Post: How did we get here?

Posted in:

* Sun-Times…

The Illinois Appellate Court on Monday lifted a temporary restraining order that had kept south suburban Harvey from receiving $1.4 million in tax revenue as it fights its police pension board over millions in back payments.

A Cook County Circuit Court judge had blocked the cash-strapped city from collecting the money last week, a move that forced officials to lay off dozens of police officers and firefighters.

Harvey will now have access to the funds — which were collected by the state, mostly through sales taxes — as the pension board’s lawsuit continues. The suburb is saddled with $5 million to $7 million in pension debt.

* Tribune…

Prior to Monday’s appellate court decision to grant the TRO, State Sen. Napoleon Harris, D-Harvey, said he was considering introducing a measure amending the state law that requires the Illinois comptroller’s office to seize a municipality’s tax revenues when a community is delinquent funding pensions.

“We need to explore options that keep Harvey on track to fund police and fire pensions without putting them in a complete financial crisis,” Harris said in a statement. “The citizens of Harvey should not be penalized or subjected to this type of situation due to missed pension payments.” […]

“What Harvey is experiencing is a contagion that has spread throughout the state,” said [Rep. Jeanne Ives], who asserted that allowing municipalities to declare bankruptcy in the face of mounting financial pressures was “the only way out.” […]

“We can say that pensions are the problem, if we know that the money is being managed correctly,” [Alderman Chris Clark, a critic of Mayor Eric Kellogg’s administration] said. “But you cannot say that pensions are the problem when there is rampant — not just mild — but rampant mismanagement. And that’s basically what this is.”

* From Heyl Royster…

Under federal law, units of local government cannot petition for bankruptcy unless they have express and specific authority from the state to do so

From Chapman & Cutler…

Until such time as the State of Illinois legislature provides specific authority to units of local government to petition for municipal bankruptcy, no such petition will be permitted.

* In the interim, there are two mechanisms in state law that might benefit Harvey…

The Fiscally Distressed City Law allows the Governor to create an authority comprised of five directors to provide a secure financial basis for and to furnish assistance to a financially distressed city according to the guidelines outlined in the statute. The Local Government Financial Planning and Supervision Act allows the Governor to create a commission comprised of 11 members, primarily charged with developing a detailed financial plan and other recommendations to ensure proper financial accounting procedures, budgeting and taxing practices to assure the fiscal integrity of the unit of local government. The state can also provide loans and state bonding authority to assist the municipalities.

The Local Government Financial Planning and Supervision Act only applies to municipalities with populations under 25,000 and Harvey just barely qualifies.

* It’s not at all certain that legislators will want to set a precedent with Harvey…

* The dollar amounts are kinda small for some of these towns, however…

Thoughts? And, please, don’t just post a drive-by “Bankruptcy!” or “Pay up! comment. This isn’t Facebook.

…Adding… Amanda Kass…

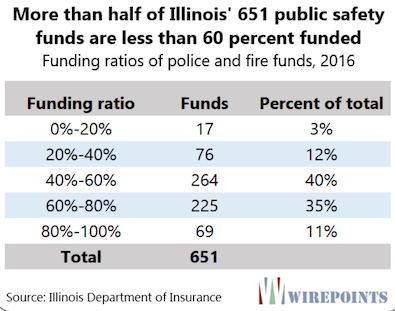

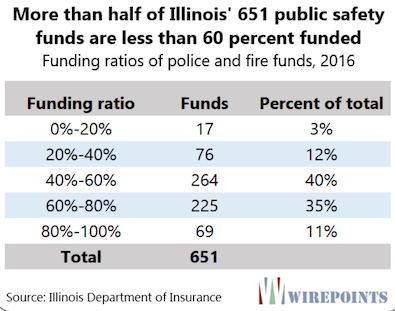

Out of 632 police and fire funds, I identified 71 (or 11%) in which actual contributions were 50% or less than what the Department of Insurance said the total contributions should have been during that time. Those funds are located in 54 municipalities, the majority of which (49 funds) are in Cook County or DuPage County. Among the group of 71 funds, the average amount that was contributed between 2003 and 2010 was only about 39% of what DOI said should have been paid. And 24% of the funds received no money from their respective municipality at least once between 2003 and 2010. As a group, these 71 funds are also in worse financial shape than most police and fire pension funds. While the average funded ratio for all funds in 2016 was 60% the average for these 71 is just 47%.

* Related…

* Appeals court: Comptroller can’t embargo over $1M from cash-strapped Harvey at pension fund’s request

* ADDED: Harvey fire pensioners paid $1.1M into fund, have collected $25M: Of the 42 Harvey fire retirees, 24 contributed zero to their pension fund. Those retirees have received $17.4 million in benefits over their retirements.

posted by Rich Miller

Tuesday, Apr 17, 18 @ 11:58 am

Sorry, comments are closed at this time.

Previous Post: Today’s number: 39 percent decrease

Next Post: How did we get here?

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Rampant mismanagement.

What’s a solution to that?

Comment by VanillaMan Tuesday, Apr 17, 18 @ 12:03 pm

All police and firefighter pension funds need to be consolidated under one financial institution or manager. The fees are eating away at gains and municipalities to contribute more.

How we Harvey is in its own category, I don’t understand how that mayor keeps getting re elected

Comment by Almost the Weekend Tuesday, Apr 17, 18 @ 12:08 pm

I don’t think Harvey’s neighbors are looking to annex.

Looks like Harvey needs to act and request a state authority to take over its finances under current law.

Comment by wordslinger Tuesday, Apr 17, 18 @ 12:08 pm

Bill the Feds?

Seriously, the FBI made this problem by massively funding the Kellogg campaign as part of an undercover corruption sting that failed.

Shouldn’t Colin Powell’s Pottery Barn rule apply here? The FBI broke it, so they bought it. They need to make it right.

Comment by statehoss Tuesday, Apr 17, 18 @ 12:10 pm

Sun-Times has it wrong. The appellate court did not lift a TRO issued by the circuit court. The circuit court denied the TRO and the appellate court ordered it to issue one.

Comment by Anonymous Tuesday, Apr 17, 18 @ 12:11 pm

Obviously they need to generate more revenue (raise taxes) to pay for their local government costs. Elections have consequences.

Comment by Phenomynous Tuesday, Apr 17, 18 @ 12:17 pm

It sounds like the state has a law that should be applied

And I think whenever that law is applied a thorough audit of city funds and expense should go with it. Then any corruption uncovered should be federally prosecuted and the minimum sentence should be Blago like.

Comment by DuPage Saint Tuesday, Apr 17, 18 @ 12:19 pm

Combine all the local pension funds into one, and give that pension fund the authority to intercept state funds if municipalities to not remit the correct payments.

Comment by truth Tuesday, Apr 17, 18 @ 12:24 pm

Corporate sponsorship? Like they tend to do with stadiums and parks. Imagine all the police cars and fire trucks with “Sponsored by….” on the sides. They may even get to rename the town as part of the deal.

Comment by A Jack Tuesday, Apr 17, 18 @ 12:25 pm

Yes, what *do* you do when the state constitution and law say you can’t run out of money, but fiscal reality says the opposite? Obviously, you just keep raising taxes and stop funding city services. Sounds sustainable to me.

Comment by JB13 Tuesday, Apr 17, 18 @ 12:29 pm

At some point, public employees are going to have to decide whether they want a job with minimal pension benefits or whether they want no job.

Comment by Reality Tuesday, Apr 17, 18 @ 12:37 pm

“The citizens of Harvey should not be penalized or subjected to this type of situation due to missed pension payments.”

Yes they should Senator. They keep voting in the same individuals year after year.

Comment by Honeybadger Tuesday, Apr 17, 18 @ 12:38 pm

https://amandakass.blog/2018/04/15/the-illinois-comptroller-is-withholding-funds-from-a-chicago-suburb-and-other-towns-could-follow/

A different perspective pointing to high poverty rates and sky high property taxes are also important factors

Comment by very old soil Tuesday, Apr 17, 18 @ 12:46 pm

The best way to approach this is for the state to consider legislation that would require municipalities to maintain a set level of funding for their public pensions at a minimum.

This legislation could be combined with a state revenue increase through a variety of different tax options and then in addition to addressing the structural gap between revenues and spending, also allocating significantly more funds towards the evidence based funding model for education.

The increased state education dollars would allow for localities to reconsider their millage rates on property taxes as local property tax plays less of a role in funding K-12 education. This would allow for those localities to become/remain fiscally prudent in supporting their current spending while also creating the opportunity for local dollars to be invested in their communities instead of being spent on k-12 education.

Comment by Anon Tuesday, Apr 17, 18 @ 12:47 pm

*** “We need to explore options that keep Harvey on track to fund police and fire pensions without putting them in a complete financial crisis,” Harris said in a statement.***

I’ll take “Things that should have been done 10 years ago” for $1,000 Alex.

Comment by Occam Tuesday, Apr 17, 18 @ 12:50 pm

==All police and firefighter pension funds need to be consolidated under one financial institution or manager.==

Not unless all villages reached the same funding level first and commit to their proportionate share of funding every year. Fiscally sound villages.

==The best way to approach this is for the state to consider legislation that would require municipalities to maintain a set level of funding for their public pensions at a minimum.==

Better yet, mandatory full pension payments before any salary or benefit increases. If you can’t afford the pension, you can’t afford the salary upon which it’s based.

Comment by City Zen Tuesday, Apr 17, 18 @ 12:59 pm

First, can we have the feds pass Sen. Harris’ proposal, and apply it to states? /s

An incomplete list, but some thoughts:

- Never allow local govts to declare bankruptcy. If we got into this mess w/out them having this option, imagine what reckless commitments they’d make, and the increase in prices charged to them by their vendors, if they were even less accountable for the future impact of their decisions.

- They need to extend the length of tenure for full pensions while maintaining, as close as possible, the current level of benefits. I recognize that this would need to be negotiated, but 20 years and out for a full pension just ensures you’ll lose people when they hit their peak productivity, and makes the liability growth curve more vertical.

- To the extent they can outsource positions that have pensions associated with them, they should do so. Philosophically, I hate this idea, and you really shouldn’t do it with police and perhaps fire, but they’ve got to start limiting their future liabilities. Outsourcing contracts can require that the functions be performed with locally-based employees with certain benefits required of the outsourcing vendor.

Like I said, incomplete, but, man, they’ve got to start doing something. Right now, they’re hoping it gets so bad so that the only option is someone bailing them out or someone else being the bad guy.

Comment by Johnny Tractor Tuesday, Apr 17, 18 @ 1:04 pm

Wow there are some ridiculous shortfalls on that list. It’s almost like East St. Louis & Harvey are competing to see how high up they run the bill.

I like @Almost The Weekend’s and @truth’s idea about consolidating. Fees can be a beast and more direct oversight would be useful. Though it’s probably too late to do anything about some of these towns/cities on the list.

Comment by Chicago_Downstater Tuesday, Apr 17, 18 @ 1:10 pm

Let’s expand a chicago city earnings to a Cook county earnings tax…. or….allow munincipal bankruptcy….or….cut services until enough revrnue is recaptured to make the payments….or punt.

Comment by blue dog dem Tuesday, Apr 17, 18 @ 1:18 pm

Question for the experts: do these figures assume continued pension contributions for roughly the existing workforce? In other words, if we went to “Tier III” today, would that worsen the funding ratio, because there would be no new contributions coming in for future employees, only a wind-down of the existing ones? I think the answer is yes, but not sure.

Comment by Put the fun in unfunded Tuesday, Apr 17, 18 @ 2:05 pm

municipal bankruptcy

Best I have been able to see is that pensions come out of bankruptcy better than bonds. Before looking to bankruptcy as a solution the effect on interest rates municipalities will have to pay should be considered.

Comment by Bigtwich Tuesday, Apr 17, 18 @ 2:11 pm

==Never allow local govts to declare bankruptcy.==

You do realize that allowing a local govt to declare bankruptcy and the local govt declaring bankruptcy are two separate things, right? Consider it just another negotiating tool. I want my town to have that power, not necessarily exercise it. But it’s there…looming…

Comment by City Zen Tuesday, Apr 17, 18 @ 2:19 pm

Unfortunately this is part of a common cycle. Good municipal services reinforce good property values (and vice versa), which gives the office holders more leeway to make choices about tax rates. And bare bones services and low property values not only feed into one another, they also lead to local officials having to max out every revenue source they have available just to keep the bare bones services operating- and even then you end up here. I’ve never really seen a good idea that would break that cycle.

Comment by In 630 Tuesday, Apr 17, 18 @ 2:21 pm

==I don’t think Harvey’s neighbors are looking to annex.==

As a Chicagoan, I’d be happy to welcome our neighbors in Harvey into our city. I’ve grown fond of the annexation solution.

Having a state authority come in and solve the problem makes it seem like it’s an eminently solvable problem and that the people in charge are incompetent. They might well be, but what’s the obvious solution that someone else can implement? Raise taxes? Cut pensions? Lay off the entire fire department? Emergency financial managers aren’t miracle workers.

Bankruptcy isn’t a solution at all, so let’s just let it go.

Coming up with solutions that might have worked if implemented in the 1980s won’t help either.

I have yet to see a better solution than annexation that’s reasonable, realistic, implementable, and useful for right now.

Comment by ImNotTaylorSwift Tuesday, Apr 17, 18 @ 2:27 pm

1) combine all police pensions into one system and all fire pensions into one system and run them like IMRF.

BUT,officers and firefighters fear the state running their pensions, even though IMRF is doing a far better job than most local fire/police pensions. Also, most local pension board attorneys, accountants, actuaries and money managers hate the idea because they get paid nicely to service this niche sector and thus pump more fear into the officers and firefighters who then lobby their State reps to leave their pensions alone. And representatives don’t tell firefighters “no.”

2) allow for and incentivize the creation of regional fire departments. Volunteer districts running low on pools and every small city can’t afford a $1,000,000 aerial truck and a $500,000 pumper a $300,000 tanker, brush truck, reserve engine etc. every 20 years plus the now mandatory bargaining over staffing levels. Ridiculous for neighbors to have the same equipment. A larger department also creates a larger pool for coverage of sick and other leaves of absence.

BUT, a regional f.d. means fewer administrative positions and fire unions have fought reducing the number of promotional opportunities caused by consolidation. And some places just can’t handle the thought of not seeing their village’s name on a shiny fire engine.

Comment by Shemp Tuesday, Apr 17, 18 @ 2:40 pm

3) Harvey should just turn policing over to the County and consider contracting with another village or fire district until its house is in order. I know it is a diminished service (well, maybe…) from a policing side and maybe longer response time on the fire side, but if you don’t have the cash, you don’t have it.

You’re not going to crawl out of the hole by digging it deeper.

Comment by Shemp Tuesday, Apr 17, 18 @ 2:43 pm

? 632 police and fire funds,?

Might be the issue

Agreed it almost the weekend..

Similar to the 800 some odd state funds,,

This is way to many and way to much bloat

Comment by sharkette Tuesday, Apr 17, 18 @ 2:49 pm

Harvey: The largest percentage of unpaid real estate tax bills for any city. There is serious blight in the city and few good solutions. Needs outside help.

Comment by Blimp Tuesday, Apr 17, 18 @ 3:18 pm

The “Feds” should have started indicting Harvey politicians years ago; there is more than enough dirt on current and former ‘pols’ (some going back decades now) that a fairly good (not perfect like the Feds want) set of indictments beyond the Harvey Park District ones should be possible. A recent news item alludes to more shenanigans between corrupt Harvey and Markham pols, apparently it is still under investigation…

Comment by revvedup Tuesday, Apr 17, 18 @ 3:18 pm

Just a note to point out that Amanda Kass has done excellent work on this issue and deserves our thanks.

Comment by Arthur Andersen Tuesday, Apr 17, 18 @ 3:45 pm

Harvey threatened to withhold water from Dixmoor way back in the late 90s/early 2000s. sad when a community can’t pay their bills. remember how that feels, Harvey?

Comment by Amalia Tuesday, Apr 17, 18 @ 5:38 pm

IIRC, something like 53% of all of the property tax bills located within the boundaries of the Village of Harvey went delinquent.

If unpaid, property goes to tax sale and is offered to sale to tax buyers.

If not ’sold’ to a tax buyer, property is acquired by the Cook County Tax Buyer, Trustee. But no money changes hands.

Which means there is a shortfall in tax collections of the amount levied by the different tax districts, including the village of Harvey.

Hint: It’s called “Collection Loss”.

So the entire sordid cycle starts over again, with the Village of Harvey having an even larger budgetary hole to fill. And since tax bills keep increasing, the delinquency rate keeps increasing, and even less money gets collected.

So, why would anybody neighboring municipality with their head on straight want to acquire/annex a bunch of property (from what is currently part of the Village of Harvey) that requires services, but offer no accompanying revenue stream to support their needs?

Answer: They wouldn’t (and won’t). Annexation really isn’t a solution for Harvey.

Comment by Anon Downstate Tuesday, Apr 17, 18 @ 8:25 pm

Anon, no one wants to annex Harvey. It is a great reason for municipal bankruptcy to be allowed.

Comment by Ron Tuesday, Apr 17, 18 @ 9:07 pm

Good points. Sad that they can’t make payments. And sad so many properties are lost to tax sales and just sit there. And it’s the “City of Harvey.”

Comment by Mike Tuesday, Apr 17, 18 @ 10:56 pm

Harvey is a 3rd world lawless community and it starts with its elected officers.

The state and feds have failed the residents of Harvey, fiscal crimes have been over looked.

So I guess their corruption is acceptable.

Comment by Anonymous Wednesday, Apr 18, 18 @ 7:23 am

==So the entire sordid cycle starts over again, with the Village of Harvey having an even larger budgetary hole to fill. And since tax bills keep increasing, the delinquency rate keeps increasing, and even less money gets collected.

So, why would anybody neighboring municipality with their head on straight want to acquire/annex a bunch of property (from what is currently part of the Village of Harvey) that requires services, but offer no accompanying revenue stream to support their needs?==

There would be a revenue source. If the City annexed Harvey, the property tax rates in Harvey would decrease. By your own logic, if the tax rates decrease, there should be an accompanying decrease in delinquency rates. Furthermore, with those lower taxes, it should, theoretically, spur additional development. If consolidated into the City and into the other districts that are coterminous with Chicago, Harvey could avail itself of better services and turn around. Just because it wouldn’t offer much additional revenue in the first year doesn’t mean that it won’t offer any long-term. Consolidation would also allow elimination of a number of administrative positions that the City wouldn’t need and would no longer have to pay for.

The only downside to annexation so far is lack of a partner. But once a partner is found, it will work. And it’s better than any other solution that has been offered. As far as “no one” wanting to annex Harvey, I’ve already made it clear that I would like to. Now I just have to convince the rest of the City to go along with this plan.

Comment by ImNotTaylorSwift Wednesday, Apr 18, 18 @ 9:00 am