Latest Post | Last 10 Posts | Archives

Previous Post: Them’s fighting words, governor

Next Post: Miller, Bailey, Rabine and DeVore campaigns are gonna make for one long and comically ridiculous year

Posted in:

* Institute of Government and Public Affairs…

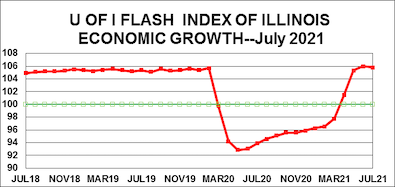

The University of Illinois Flash Index in July ended its rapid climb from the depth of the COVID-19 crisis, falling to 105.8 from the 106.0 level in June. This does not signal a flagging Illinois economy, only that the rate of increase has plateaued.

The monthly indicator of Illinois economic activity had risen for 13 consecutive months since bottoming out at 92.8 in May 2020 due to the COVID-19 pandemic-induced economic slowdown. As always, the 100 level is the dividing line between economic growth and decline. See the full Flash Index archive for monthly readings.

“In retrospect, the recovery both nationally and Illinois has been remarkable, exceeding the expectations of almost all observers,” said U of I professor emeritus J. Fred Giertz, who compiles the monthly index for the university’s Institute of Government and Public Affairs. “Overall, the economy is now above the pre-crisis level achieved in early 2020.

“It is not surprising that the rate of increase has stopped rising,” Giertz said. “There are now mixed economic signals with bottlenecks arising in some areas, the result of labor or materials issues along with the threat of renewed COVID impacts. However, consumers remain a source of strength with substantial spending power coupled with pent-up demand resulting from depressed spending opportunities during the shutdown.”

The decline in the Illinois’ unemployment rate has also stopped, remaining at more than 7 percent for the last three months. This is more than one percentage point above the national average. However, the bond rating agencies have upgraded Illinois after years of continuing downgrades.

Illinois sales tax receipts were up almost 17 percent from last year’s depressed level, Giertz said. However, individual income tax and corporate income tax revenue was down significantly from July of last year. Fortunately, this does not imply a weakness in economic activity since July 2020 was the filing deadline for income tax returns when final payments boost receipts. This is one reason why state tax receipts were so strong in fiscal 2020 with two filing deadlines in the same fiscal year—July and May.

The Flash Index is normally a weighted average of Illinois growth rates in corporate earnings, consumer spending and personal income as estimated from receipts for corporate income, individual income, and retail sales taxes. These are adjusted for inflation before growth rates are calculated. The growth rate for each component is then calculated for the 12-month period using data through July 31, 2021. Even though more than a year has passed since the beginning of the COVID-19 crisis, ad hoc adjustments will still be needed for some time because of the timing of the tax receipts resulting from state and federal changes in payment dates both this and last year. For example, the change in the filing date from 2020 to 2021 necessitated ad hoc adjustments this month as will the recently approved changes in the Illinois corporate tax.

* Chart…

posted by Rich Miller

Monday, Aug 2, 21 @ 10:31 am

Sorry, comments are closed at this time.

Previous Post: Them’s fighting words, governor

Next Post: Miller, Bailey, Rabine and DeVore campaigns are gonna make for one long and comically ridiculous year

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

What ever you do don’t tell the IL GOP! They and Turning Point can’t handle optimism and the state doing better. Doesn’t fit their narrative.

Comment by Old and In the Way Monday, Aug 2, 21 @ 11:45 am