|

There’s no real mystery here

Monday, May 20, 2024 - Posted by Rich Miller * Daily Herald…

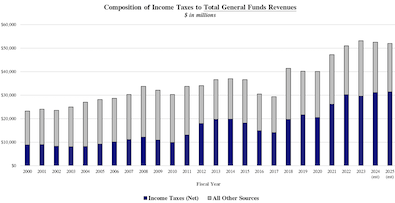

Sales taxes are less volatile than income taxes? * OK, here’s a brief explanation from COGFA: “(T)he composition of income tax receipts has primarily been influenced by changes in income tax rates, stagnant or declining revenues from other sources, and favorable economic conditions driving income tax growth.” It basically boils down to the fact that the income tax rate has been increased, wages have risen and other taxes haven’t kept up with the income tax’s growth, partly because those tax rates haven’t been increased. I’m a fan of broadening the tax base. We artificially narrow too many taxes. Services aren’t taxed (to be more aligned with the economy), retirement income isn’t taxed, food and medicine aren’t taxed, etc., etc., etc. Politically, though, some of these are very difficult to touch. Retirement income is like the “third rail” of Illinois politics, as the 2018 Democratic gubernatorial primary clearly showed. It polls horribly here. And it ain’t much better for the service tax. * Anyway, click the COGFA chart for a larger image…  Income tax receipts as a percentage of the General Funds budget fell during the big crash, rose after tax rates were increased, fell when the tax hike expired, rose after the tax hike was restored and dipped during the first year of the pandemic.

|

|

|

|

- Mason County - Monday, May 20, 24 @ 11:50 am:

Interesting data.

So what is the point? Is it to raise other taxes or lower the state income tax? Something else?

Article by the Daily Herald needs further explanation.

- City Zen - Monday, May 20, 24 @ 11:52 am:

==it is a more volatile mode of taxing==

Keeping it flat makes it less volatile.

- Three Dimensional Checkers - Monday, May 20, 24 @ 11:56 am:

I am sure it is just coincidence that sales taxes are more regressive and much easier on the very wealthy.

- Donnie Elgin - Monday, May 20, 24 @ 12:13 pm:

So what is the point?

The trend analysis clearly shows that in the past five years, the % of income tax as a part of overall revenue has been increasing. If you go to a 20-year moving average it also would show a steady increase. Additionally one could also divine that if that trend continues and the “third rail” taxes like retirement income remain off limits - when then JB and his party can make another push for a graduated Income tax.

- Give Us Barabbas - Monday, May 20, 24 @ 12:38 pm:

I’m on retirement income now, and am barely treading water. Taxing it would drive me into needing public assistance, which spends more tax dollars. Taxing retirement income is like cutting social security; it’s money we spent a lifetime putting in, on the promise of it being there when we need it. That’s why it’s the third rail; it’s literally powering our train.

- City Zen - Monday, May 20, 24 @ 1:02 pm:

==I’m on retirement income now, and am barely treading water==

Then that working person at your same level of income is barely treading water as well. Why should they pay income taxes while you don’t?

I get not taxing social security. You already paid taxes on those wages. Otherwise, though, the state shouldn’t differentiate between a $30,000 pension and $30,000 working income.

- JS Mill - Monday, May 20, 24 @ 1:45 pm:

=I get not taxing social security. You already paid taxes on those wages. Otherwise, though, the state shouldn’t differentiate between a $30,000 pension and $30,000 working income.=

I don’t. If we are taxing income then we are taxing income. I paid taxers on the wages my pension contributions were paid from. All or none. I am ok with both being taxed.

- SWSider - Monday, May 20, 24 @ 1:49 pm:

Hey, maybe someone can put this in front of Pritzker before he shifts into WH mode next year?

- very old soil - Monday, May 20, 24 @ 1:57 pm:

Give Us Barabbas.

Maybe the solution is a graduated income tax.

- Rich Miller - Monday, May 20, 24 @ 2:02 pm:

===maybe someone can put this in front of Pritzker===

You don’t think he knows basic stuff like this? I mean, the Civic Fed’s leader may be confused, but most people who read this blog have a decent understanding of this concept.

- Langhorne - Monday, May 20, 24 @ 2:34 pm:

I attended a luncheon in the last days of the Thompson years, and was seated at his table. I asked him if he could wave a magic wand, and an act any law, what would it be? He quickly said a tax on services.

- RNUG - Monday, May 20, 24 @ 2:42 pm:

== Retirement income is like the “third rail” of Illinois politics … ==

Aside from that, it’s one of the few good things left to keep better off retirees in the State. The only other tie a lot of retirees have is family as a reason to stay.

If anything, I would expect a service tax would be the broadest untapped revenue source. Admittedly, it would have some of the same faults the sales tax does in that it would likely also contract during economic downturns. The trick with it would be to exempt some to the critical services everyone needs while hitting enough services to raise the needed revenue.

The alternative would be a graduate income tax, which hasn’t flown so far.

- James in Little Italy - Monday, May 20, 24 @ 2:58 pm:

==I am sure it is just coincidence that sales taxes are more regressive and much easier on the very wealthy.==

The most frequent coincidence known to man.

- Donnie Elgin - Monday, May 20, 24 @ 2:59 pm:

Ding Ding Ding - we have a winner.

=very old soil - Maybe the solution is a graduated income tax=

- City Zen - Monday, May 20, 24 @ 3:07 pm:

==I paid taxers on the wages my pension contributions were paid from==

No you didn’t. Your pension (and my 401k) contributions were deducted from gross wages before determining taxable income. They are tax-deferred. You pay taxes when you start withdrawing after retirement.

You don’t deduct social security contributions from taxable income. Hence the differentiation and why most states do not tax social security despite taxing retirement income in general.

- Sue - Monday, May 20, 24 @ 4:29 pm:

Longhorne- unfortunately the Governor decided to wave that magic wand to magically increase his own pension by nearly 50 percent on his way out instead

- Annonin' - Monday, May 20, 24 @ 4:42 pm:

Seems like a tax income is the most stable and less regressive. Not sure what point Ferguson was making, but he is a “watchdog” now so who cares.

Still looking for his alternatives…or the list of programs he wants to repeal

- Nick - Monday, May 20, 24 @ 4:54 pm:

===Sales taxes are less volatile than income taxes?===

Generally speaking, yes.

They tend to be easier to administer, easier to track, and consumer spending is less volatile than wages. Which might sound weird to people but it’s for the same reason that people criticize sales taxes for being regressive. Poorer people tend to spend larger proportions of their income.

- Only yesterday - Monday, May 20, 24 @ 5:40 pm:

I remember the time when Illinois’ tax problems related to low revenue growth in relation to income. The most common suggestion was greater reliance on income taxation. This has happened. The individual and corporate income taxes (even without progressive rates) have given us what we asked for, but now this is too much of a good thing.