Sen. Kirk, GOP congressmen get into the act

Wednesday, Apr 30, 2014 - Posted by Rich Miller

* From a press release…

U.S. Reps. Rodney Davis (R-Ill.), Adam Kinzinger (R-Ill.), John Shimkus (R-Ill.), Randy Hultgren (R-Ill.), Aaron Schock (R-Ill.), Peter Roskam (R-Ill.) and U.S. Sen. Mark Kirk (R-Ill.) today sent a letter to Calvin L. Scovel III, Inspector General for the U.S. Department of Transportation, asking for an immediate investigation to determine the extent to which federal funds were used to subsidize or justify the potentially illegal hiring of dozens of patronage workers at the Illinois Department of Transportation.

In the letter, the group states, “We write with extreme concern that federal funds were directly or indirectly involved in a scheme to subvert state hiring practices as mandated by the Court. Federal funds should never be provided to states to subsidize or justify political patronage. If the State of Illinois misused federally appropriated funds in this way, the American people deserve to know.”

Additionally, as Congress looks for ways to use taxpayer money more efficiently to address problems such as the highway trust fund and other infrastructure funding, the group asked Inspector General Scovel to make recommendations to ensure such misuse of federal funds can never happen again.

The full text of the letter is as follows:

Calvin L. Scovel III, Inspector General

United States Department of Transportation

1200 New Jersey Ave SE, West Blding7th Floor

Washington, DC 20590

Mr. Scovel:

Last week, a motion was filed in U.S. District Court against Illinois Governor Pat Quinn alleging illegal hiring practices at the Illinois Department of Transportation (IDOT), including the appointment of dozens of patronage workers to non-policy making positions in violation of a 1989 Supreme Court decision (Rutan).

According to the Associated Press, Governor Quinn “told reporters Monday that there were federal stimulus dollars that had to be spent quickly and efficiently, along with a massive capital bill” and said “the increase in jobs free from hiring rules at the Illinois Department of Transportation were ‘absolutely’ necessary.”

Additionally, according to the Associated Press, in a court proceeding on April 29, Governor Quinn’s office acknowledged “an ongoing investigation by Illinois’ inspector general of hiring practices”.

We write with extreme concern that federal funds were directly or indirectly involved in a scheme to subvert state hiring practices as mandated by the Court. Federal funds should never be provided to states to subsidize or justify political patronage. If the State of Illinois misused federally appropriated funds in this way, the American people deserve to know.

Therefore, we request that you launch an immediate investigation to determine the extent to which federal funds were used to subsidize or justify the potentially illegal hiring of dozens of patronage workers at IDOT and, further, to make recommendations to ensure such misuse of federal funds can never happen again.

31 Comments

|

Question of the day

Wednesday, Apr 30, 2014 - Posted by Rich Miller

* Greg Hinz writes about yesterday’s widely expected failure of a constitutional amendment for a graduated income tax…

Mr. Harmon’s problem wasn’t with his proposal. It was with the timing of his proposal, which comes at the very same time that lawmakers are preparing to vote on making permanent the “temporary” Illinois income tax.

Instead of being revenue-neutral overall, Mr. Harmon’s proposal and companion bill would have set rates at a level designed to pull in as much money overall as the pending permanent income tax hike. Thus, only individual income below $12,000 a year would be subject to a 2.9 percent rate. Anything above that would be hit with 4.9 percent or 6.9 percent, this at a time when rates are set to revert to 3.75 percent on Jan. 1 unless the Legislature extends the “temporary” hike.

Bottom line: While Mr. Harmon was trying to sell what advocates dubbed a “fair tax,” his plan was easily dubbed a “tax increase.”

If the senator really wants to pass a graduated income tax, my suggestion is to let lawmakers do what they’re going to do this year — and that’s probably to make the current 5 percent individual tax rate permanent. Then next year, he can come back with a proposal that’s truly revenue neutral and only shifts the burden around from the bottom toward the top.

* The Question: If you could give any unsolicited advice to proponents and opponents of a graduated tax for Illinois, what would it be?

38 Comments

|

* Holy moly…

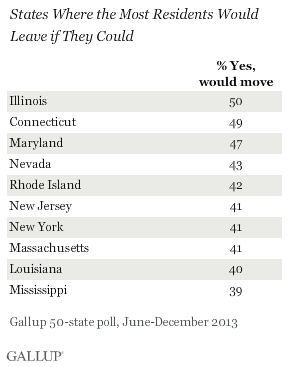

Every state has at least some residents who are looking for greener pastures, but nowhere is the desire to move more prevalent than in Illinois and Connecticut. In both of these states, about half of residents say that if given the chance to move to a different state, they would like to do so. Maryland is a close third, at 47%. By contrast, in Montana, Hawaii, and Maine, just 23% say they would like to relocate. Nearly as few — 24% — feel this way in Oregon, New Hampshire, and Texas.

* Yeesh…

* Context…

Thirty-three percent of [US state] residents want to move to another state, according to the average of the 50 state responses. Seventeen states come close to that 50-state average. Another 16 are above the average range, including three showing an especially high desire to move. In fact, in these three — Illinois, Connecticut, and Maryland — roughly as many residents want to leave as want to stay.

* More…

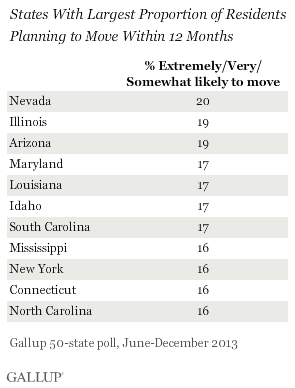

In the same poll, Gallup asked state residents how likely it is they will move in the next 12 months. On average across all 50 states, 6% of state residents say it is extremely or very likely they will move in the next year, 8% say it is somewhat likely, 14% not too likely, and 73% not likely at all.

* Oy…

* Keep in mind that the follow-up question of why they are planning to move has an extremely small sample size…

In most states, it is not possible to view these answers because there are too few respondents, but in each of the 11 states with the highest percentages wanting to leave, roughly 100 answered the question.

* In Illinois, 8 percent of those who said they were leaving claimed it was because of taxes (versus 14 percent of New York respondents, 8 percent of Marylanders, 6 percent of Connecticut folks, and 2 percent of N. Carolinians.

26 percent of Illinoisans who said they were leaving claimed it was work/business related, 17 percent said weather/location, 15 percent said it was for a quality of life change, 9 percent said cost of living, and 6 percent said it was for family/friends or school related.

79 Comments

|

Overtly political

Wednesday, Apr 30, 2014 - Posted by Rich Miller

* There’s no real mystery behind this bill…

An Illinois House committee is again endorsing Speaker Michael Madigan’s plan to offer a $100 million incentive to lure Barack Obama’s presidential library to Illinois.

The Executive Committee voted 7-4 Wednesday to send the plan to the House floor. […]

Madigan believes the public money would be well spent. But public funds have never been used to build an official presidential library recognized by the National Archives.

Madigan has made it crystal clear that he will do whatever he can this spring to move legislation that will gin up his party’s base voters.

A recent Rasmussen Results poll of Illinoisans found that President Obama has a 96 percent job approval rating among African-Americans, 89 percent job approval rating among liberals, 85 percent with Democrats, 66 percent with voters 18-39 and 57 percent among women.

Madigan wants the Republicans to loudly oppose this bill, regardless of the financial cost to the state. Bet on it.

51 Comments

|

[The following is a paid advertisement.]

Yesterday, the Rockford Register Star became the third Illinois newspaper – joining the Chicago Tribune and the Chicago Sun-Times – to publish an editorial urging legislators to reject Senate Bill 2187. The bill, sometimes called “RxP,” would allow psychologists to prescribe in spite of having no medical training.

“When something as fragile as the human mind is at stake, the utmost care must be taken to ensure the highest quality of those services,” the Register Star editorial stated. “We encourage representatives to vote no.”

Also yesterday, former Congressman Patrick Kennedy (D-RI), a noted advocate for the rights of mental health patients, wrote to members of the General Assembly urging them to reject SB 2187.

“It is out of deep concern for patients and their families that I urge you to oppose Senate Bill 2187,” Kennedy wrote. “This legislation would undermine mental health care in Illinois and put patients at risk.”

Current Illinois law allows only people who have medical training – doctors, nurse practitioners and physician assistants – to prescribe drugs. Why does medical training matter? Physical illnesses and mental disorders are often intertwined. Additionally, psychiatric medication, such as drugs for schizophrenia and bipolar disorder, can interact negatively with medication for chronic illnesses. Finally, many drugs are powerful and have risky side effects. To understand these complexities, psychiatrists go through four years of medical school and four additional years of residency, on top of their college training in the sciences. They learn to treat the whole patient – not just the brain.

Psychologists should stop insisting on a law that would put patients at risk. To become involved, join the Coalition for Patient Safety, http://coalitionforpatientsafety.com.

Comments Off

|

A double double standard

Wednesday, Apr 30, 2014 - Posted by Rich Miller

* The Tribune editorialized on two topics today, both of which were directed at Gov. Pat Quinn and one of which was the temporary tax hike…

Keep the promise that the income tax hike would be temporary.

This was the second time since mid-April that the Trib addressed this issue…

Quinn already is hobbled by his flip-flop attempt to make permanent the supposedly temporary Quinncome tax increases that are set to roll back in January.

I don’t think the governor ever specifically “promised” - in public, anyway - that the tax hike would be temporary. He was always pretty vague on that topic until his budget address. Tons of articles were written over the past few years about how Quinn wouldn’t talk about what should happen with the tax. When he finally decided he was for making it permanent, that was really huge news.

And here’s how Quinn responded to a question about whether the tax hike would stay on the books the day after the tax hike bill passed…

“We will deal with this one day at time, one week, one month, one year at a time,” Quinn said then. “I think our job now is to take what was passed last night and carry it out.”

But Bruce Rauner has accused Quinn of breaking his promise, and the Trib has now officially sanctioned that line of attack.

…Adding… The Rauner campaign points to statements Quinn made soon after the bill passed where he called the tax “temporary” several times. But he made no specific promise that the temporary tax wouldn’t be made permanent once it partially expired this coming January. Indeed, he was specifically asked whether he’d support making it permanent that day and that’s when he gave his “We will deal with this one day at a time,” comment from above. Watch the video by clicking here. The question was asked at the about the 15:00 mark.

* The rest of the editorial was about pensions, particularly local pensions. The paper reiterated its demand that Quinn sign the Chicago pension reform bill. This is the third time the paper has made that demand, and it has not opposed a property tax hike…

Given the terrible finances of the city’s pension funds, Gov. Pat Quinn has no responsible choice other than to sign the bill, and the aldermen have little choice but to raise taxes. Barring the miraculous appearance of some substitute plan, the likeliest (and unimaginable) alternative is to let city pension funds deteriorate even further — and to send Chicago’s credit ratings even closer to oblivion.

No, we’re not happy with the prospect of higher taxes. But over the years Springfield and Chicago politicians created huge pension obligations that the funds have nowhere near enough money to pay. The consequence for taxpayers is clear. The consequence for the politicians who promised more in pension payments than Chicago could pay is … yet to be determined by voters increasingly stuck with the cost of all the pols’ retirement giveaways to public employees.

* All that despite repeated and emphatic promises by Rahm Emanuel to never raise property taxes to solve the city’s pension problems. From February, 2011…

Mayor-elect Rahm Emanuel on Wednesday ruled out a property tax increase of any size […]

Emanuel’s pledge not to entertain a property tax increase of any size came in response to a question about how he planned to solve the city’s pension crisis.

A bill approved by the Illinois General Assembly over Mayor Daley’s objections would saddle homeowners and businesses with a $550 million property tax increase in 2015 unless pension concessions are negotiated or another new revenue source is found.

During the campaign, Emanuel ruled out raising property taxes that much, which would amount to a 90 percent increase. On Wednesday, he was asked whether he would entertain a property tax increase of any size. His answer was an emphatic no.

Hmm.

* Keep in mind that just about every penny of the income tax increase has been used to make the state’s pension payments. Whatever was said during the time it was passed, taxes were in reality jacked up so the state could responsibly meet its pension obligations. And just as the Tribune has been warning about what could happen to Chicago’s bond ratings if the pension bill isn’t signed into law and taxes aren’t raised, Wall Street pushed Illinois hard to raise taxes to stop its rapid fiscal decline.

So, an income tax hike to make long-neglected pension payments is a bad thing, while a property tax hike to make long-neglected pension payments is an acceptable thing?

And no specific promise of a temporary tax is labeled as a broken promise, while numerous promises never to raise property taxes to make pension payments is jettisoned into a bottomless memory hole?

I’m confused.

37 Comments

|

Candidates argue over a dead idea

Wednesday, Apr 30, 2014 - Posted by Rich Miller

* Sen. Mike Frerichs (D-Champaign) voted to put a constitutional amendment on the ballot in 2011 which would merge the offices of comptroller and treasurer. The measure went nowhere in the House.

But when asked the other day by WBBM’s Craig Dellimore whether he supported merging the office, Frerichs said…

“People have said to me, ‘Wouldn’t it just be a lot more efficient if we just had one financial officer?’ And I’ve said yes, we could become very efficient, efficient like the city of Dixon, Illinois, who just had one chief financial officer and she was able, from this small little town, over several years to take something like $52 million away from them.”

* Rep. Tom Cross’ campaign pounced…

“Mike Frerichs’ opposition to streamlining these offices reveals a troubling lack of consistency and fortitude, which will cost Illinois taxpayers more despite already being victims of the Quinn/Frerichs tax and spend regime,” said Kevin Artl, Campaign Manager for Cross for Treasurer. “After the Quinn/Frerichs team raised taxes, cut funding for education and drove jobs out of Illinois, Frerichs is continuing to punish Illinois taxpayers by opposing one of the most practical, common sense cost-saving measures available to lawmakers.”

* As did the Illinois GOP…

Why did Mike Frerichs switch his position on merging the office of comptroller and treasurer? In 2011, Frerichs voted to support the measure. In January 2014, he answered the Daily Herald Treasurer candidate questionnaire by touting his support of the merger. But now in April 2014, he opposes the merger. Why the change in position?

* Frerichs held a press conference yesterday and was asked about this…

“What I said that I think he misconstrued—or his team that they probably misconstrued—is that we need to make sure that we have proper internal control in place, and checks and balances.”

* More…

“I think you can combine the offices if you have strong controls in place,” Frerichs, of Champaign, told reporters.

“If we can get those strong internal controls and checks and balances, then yes, I think we should take action to save money for the people of the state of Illinois,” he said.

Past corruption led to the creation of separate fiscal offices as part of the 1970 Illinois Constitution.

But the reality is, this idea is going nowhere as long as House Speaker Michael Madigan remains opposed.

* By the way, Cross reported raising $232K last quarter, spent $410K and had $210K cash on hand.

Frerichs raised $375K, spent $127K and had just under $1.1 million on hand.

20 Comments

|

HB 4075: Support Ride-share Protections for All

Wednesday, Apr 30, 2014 - Posted by Advertising Department

[The following is a paid advertisement.]

You know those ride-share companies that operate like taxis?

Well, should those ride-share companies follow the same consumer protection rules as other transportation companies, like police background checks, drug testing and proper insurance requirements?

You can already see what’s happening in the absence of these protections: recently, NBC 5 Chicago investigated an ex-convict on probation with a list of felonies spanning over twenty years who became a ride-share driver almost immediately after she applied, even after her so-called “background check.” And another ride-share driver in San Francisco hit and killed a 6-year-old girl, only to have the ride-share company deny liability and the family proper insurance.

Your elected officials are soon going to decide if you deserve these consumer protections or not.

How do you want them to vote?

Support Ride-share Protections for All. Vote YES on HB 4075.

Comments Off

|

Rauner files over 591,000 term limits signatures

Wednesday, Apr 30, 2014 - Posted by Rich Miller

* From a press release…

The Committee for Legislative Reform and Term Limits, chaired by Bruce Rauner, filed petitions today containing 591,092 signatures, nearly twice the statutory minimum, with representatives from the Secretary of State’s office at the Illinois State Board of Elections.

Term Limits and Reform has been collecting signatures in a statewide petition drive since September in order to place the Term Limits and Reform constitutional amendment on the ballot in November. Because of an outdated requirement for filing a petition with the State Board of Elections, left over from when petitions were divided by county instead of a single statewide filing, the 36-foot long, 67,976 page, 1,600-pound Term Limits and Reform petition was delivered to the Board of Elections by semi truck and required a team of over 20 to deliver.

The amendment limits state lawmakers to 8 years in the general assembly, while also making other structural and procedural changes to the legislature, including raising the threshold to override a gubernatorial veto to bring Illinois in line with 36 other states, and changing the number of state house and senate districts, saving taxpayers millions and bringing house members closer to home.

“All these reforms, especially term limits, will go a long way towards changing the insider culture of Springfield and send a message that power belongs in the hands of the people, not the career politicians and special interests,” Bruce Rauner said.

* From the Tribune…

Rauner has made support for legislative term limits a major plank in his run for governor, his first bid for public office, and the wealthy Winnetka equity investor has given $600,000 of the more than $1.6 million raised by the term-limit committee.

All told, Rauner, national term-limits advocate Howard Rich, conservative donor Richard Uihlein and real estate mogul Sam Zell have donated 76.5 percent of the money raised by the term-limit group.

After the petitions are filed, the State Board of Elections will conduct a random check of 5 percent of the signatures to determine if the proposal has enough valid registered voter names to be submitted to voters for ratification.

The proposal still is likely to face a legal challenge before the Illinois Supreme Court over whether it meets the constitutional requirement to appear before the voters.

* Meanwhile…

Wednesday in Springfield, Senate GOP Leader Christine Radogno argued that limiting the Governor and other top officials to two terms in office would allow for fresh ideas.

“Sometimes we have good and useful people who feel they cannot possibly overcome the disadvantage of incumbency,” said Radogno. “and, this discourages people who are well qualified from running.”

But Democrats on the Senate subcommittee voted down the proposal 2-1.

The proposal never had a chance.

* More…

Senate Minority Leader Christine Radogno, R-Lemont, said 35 other states place term limits on their statewide officials, and most of them are in better shape than Illinois. She said the overwhelming power of incumbency has scared away qualified candidates who might challenge the status quo. She also said voters are ready to “tear their hair out” over the lack of options at the ballot box.

Democrats, though, criticized Radogno for waiting until the last minute to introduce the amendment. Even if the Senate had approved the measure, the House would have had to add additional session days in order to take up the measure before Monday’s deadline. They also noted that a statewide official can pledge not to serve more than two terms without the amendment. Republican gubernatorial candidate Bruce Rauner has said he will not serve more than eight years. Gov. Pat Quinn has also said he will not run again if he is re-elected in November.

* And…

“If you believe in it, you should practice what you believe,” Clayborne told Radogno, trying unsuccessfully to extract a promise from her that should wouldn’t run for re-election as a symbolic show of support for her concept.

Radogno said she would adhere to whatever voters decide on a separate amendment aiming to limit legislators’ terms, assuming it makes it onto the fall ballot.

* The group pushing to change the way the General Assembly draws state legislative district maps is filing its petitions tomorrow.

41 Comments

|

Illinois lagging behind again

Wednesday, Apr 30, 2014 - Posted by Rich Miller

* Pot is really going mainstream in Colorado…

The Colorado Symphony is giving new meaning to hitting a high note, announcing on Tuesday a bring-your-own marijuana concert series, the first of which features its chamber ensemble and South-of-the-border food and booze.

The U.S. states of Colorado and Washington became the first to legalize the possession and use of recreational cannabis in 2012, and the first retail pot shops opened in Colorado in January.

The orchestra’s “Classically Cannabis: The High Note Series” seeks to tap the blossoming market in a series of summer fundraising concerts, at a time when more than half of Colorado voters believe legalizing recreational marijuana has been good for the state, a recent poll showed.

The Denver Post newspaper reported the events are aimed at boosting attendance, including drawing younger concert-goers, at a time when the Colorado Symphony has struggled financially.

* Illinois is nowhere near legalization as of yet, but some folks are hoping to at least get a study going…

The group [of four Chicago-area Democrats] held a press conference Monday at the Cook County building, calling for the state to decriminalize marijuana possession and — eventually — legalize recreational use of the leafy plant.

“The main difference between the War on Drugs and Prohibition is that, after 40 years, this country still hasn’t acknowledged that the War on Drugs is a failure,” Cook County Commissioner John Fritchey said, drawing a parallel with the outlawing of booze in the early 20th Century. […]

The group has yet to drop a bill in Springfield to legalize the drug and, in reality, substantive change is likely a ways off, the group acknowledged. At this point they just want fellow Democrats in the General Assembly to green-light a task force to study the issue. The hope, they say, is that Illinois will eventually develop a more laissez-faire approach to pot, which for now is classified a “dangerous” Schedule I narcotic by the federal government.

* Two bills have been introduced to decriminalize weed, and another would lower penalties. A poll taken in late March found that 63 percent of Illinoisans support a $100 non-criminal fine for possessing an ounce or less.

* From an ACLU study…

The national marijuana possession arrest rate in 2010 was 256 per 100,000 people. The jurisdictions with the highest overall marijuana possession arrest rates per 100,000 residents were:

D.C. 846

New York 535

Nebraska 417

Maryland 409

Illinois 389

• Cook County, IL (includes Chicago) made the most marijuana possession arrests in 2010 with over 33,000, or 91 per day. [Emphasis added.]

Sheesh.

But I’m not really a fan of decriminalization for two big reasons. First, criminals would still be controlling the cultivation and distribution of the drug. Second, decriminalization means no tax revenues. If it’s a step toward legalization, then fine. But only like civil unions were a step toward gay marriage. Decrim is not the final answer here.

Just legalize it already and let’s have a concert.

34 Comments

|

* Tribune…

Cook County State’s Attorney Anita Alvarez has launched a probe of a troubled $55 million anti-violence program Democratic Gov. Pat Quinn put in place in 2010 amid a tough election battle.

A grand jury issued a subpoena seeking documents related to the Neighborhood Recovery Initiative Program, which funneled money to various community groups in what Quinn billed as an effort to target crime in some of Chicago’s most dangerous neighborhoods.

Republican critics contend the program was a slush fund designed to shore up support for Quinn in heavily Democratic Cook County, while a recent scathing state audit found the initiative was “hastily implemented” and failed to track how taxpayer dollars were spent.

Alvarez sought documents pertaining to the names and identities of those who received grants under the program, as well as copies of all payment invoices and related audits and compliance reports.

* The Sun-Times broke the story and shares what may be the most important part of the grand jury probe…

The request was issued to the Illinois Department of Commerce and Economic Opportunity on March 19 and sought records tied to the Neighborhood Recovery Initiative — including those for the Chicago Area Project, a program tied to the husband of Cook County Circuit Court Clerk Dorothy Brown.

The Sun-Times previously reported that almost seven percent of the $2.1 million in funds given to the Chicago Area Project meant to combat crime in West Garfield Park went to Brown’s husband, Benton Cook III.

Actually, the state’s attorney went out of her way to point in Brown’s and Cook’s direction…

Correspondence from Alvarez’s office asked for “names and identities of all grantees participating in the Neighborhood Recovery Initiative, including, but not limited to Chicago Area Project.”

* From that earlier Sun-Times story…

In 2011 and 2012, the West Side [Garfield Park] neighborhood got more than $2.1 million from Gov. Pat Quinn’s administration through his Neighborhood Recovery Initiative anti-violence program, state records show.

But instead of all that public money going toward quelling the shooting and other violence there, a substantial chunk of it — almost 7 percent — appears to have gone into the pocket of the husband of Cook County Circuit Court Clerk Dorothy Brown.

Benton Cook, Brown’s spouse, was paid more than $146,401 in salary and fringe benefits from state grant funds to serve as the program coordinator with the Chicago Area Project, the agency the Quinn administration put in charge of doling out anti-violence funding to West Garfield Park, state records show. […]

Separately, Cook is at the center of a newly opened investigation by Cook County’s inspector general into a June 2011 deal in which he was given land on the South Side for free by a campaign donor to his wife.

A Better Government Association/Fox 32 investigation published in the Sun-Times found that Cook, once he’d obtained the land, added his wife’s name to the property’s deed, conveyed it to a corporation they both own, then sold it for $100,000. Brown never disclosed the transaction on her county economic interest statement.

51 Comments

|

Group launches $310K radio buy against Durbin

Wednesday, Apr 30, 2014 - Posted by Rich Miller

* From a press release…

Americas PAC has just completed a $310,000 radio ad buy opposing Dick Durbin’s reelection to the US Senate. The ads will begin running in late April.

“I fully anticipate Americas PAC, and myself personally, to be attacked by the full force of the Federal Government and given the full Al Salvi/Tea Party treatment,” Chairman of Americas PAC Tom Donelson said. “I expect to be audited by the IRS, to have my tax returns leaked to the media, to be investigated by multiple government agencies and be raided late at night.”

Donelson was referring to the letter Senator Dick Durbin sent to the IRS asking the agency to investigate a particular conservative group and the comments made by Mr. Salvi about his US Senate campaign against Durbin in 1996.

“I should probably just turn over my passport to a judge now,” Donelson continued.

The state-wide radio advertising campaign by Americas PAC will highlight many of Durbin’s shortcomings and liabilities including, but not limited to, the pay discrepancy between women and men on his US Senate Staff, his worthless guarantee that people could keep their health insurance plan under the Affordable Care Act and his desire to bring back pork spending.

“Durbin is only polling around 50%. That is a pretty weak number for a member of leadership who has not faced a strong campaign in nearly two decades,” Donelson said. “Rather than sit on the sidelines and see what happens, Americas PAC is proactively framing the debate about Durbin.”

A recent Rasmussen poll had Durbin leading JIm Oberweis 51-37.

* The spot he sent me deals with Obamacare…

Rate it.

36 Comments

|

Credit Unions – Paying it Forward in their Communities

Wednesday, Apr 30, 2014 - Posted by Advertising Department

[The following is a paid advertisement.]

Credit unions have a well-recognized reputation for providing exemplary service in meeting their members’ daily financial needs. A “People Helping People” philosophy also motivates credit unions to support countless community charitable activities on a continual basis. Financial Plus Credit Union is no exception, having raised and donated tens of thousands of dollars for many worthwhile causes throughout north central Illinois. This includes serving as the main sponsor and co-host of the local Easter Seals telethon, conducting food drives for local food pantries, collecting supplies during times of disaster such as last year’s flooding, and much more. Members are also seeing new donation canisters in the credit union’s lobbies this year that facilitate collections for a different local organization each quarter. Staff members has also come to the aid of the community via donating individual funds to help families facing significant medical crises, and purchasing holiday gifts on a private basis for foster children. Credit unions are able to wholly serve their communities because of their not-for-profit cooperative structure and leadership of a volunteer board elected by and from the local membership. Financial Plus has been family managed since its inception in 1951 and for the past 38 years under the leadership of Jack Teausant. Credit unions– locally owned, voluntarily led, and Paying it Forward in your community.

Comments Off

|

|

Comments Off

|

Playing Frisbie

Tuesday, Apr 29, 2014 - Posted by Rich Miller

* I worked with Sun-Times editorial writer Tom Frisbie back when I wrote columns for the paper. He’s a good guy and a smart guy and I’m really enjoying his posts at the paper’s website. Let’s look at a few.

For starters, DNR really needs to get its act together…

Last year, Illinois patted itself on the back for enacting legislation to govern hydraulic fracturing, or fracking, that has what Gov. Pat Quinn called the best environmental protections in the nation.

Now, some of those involved in the negotiations are fretting that the deal could become the legislative equivalent of a dry well. […]

(T)he rulemaking process under the original legislation is moving slowly. An original draft of proposed rules was released earlier this year, and both environmentalists and industry made suggestions for improvements. Environmentalists believed the rules were weaker than the legislation envisioned, and the drilling industry had its own concerns. Both sides are now awaiting a revised draft that will go to the Joint Committee on Administrative Rules. The Illinois Department of Natural Resources hasn’t missed its deadline yet, but all signs are the department has fallen far behind in processing the thousands of comments it received. Energy companies that have invested leases expiring in Southern Illinois are getting antsy because they’re not sure what is happening in Springfield.

“It’s kind of come to a grinding halt,” says Mark Denzler, vice president and chief operating officer of the Illinois Manufacturers’ Association.

* Unintended consequences…

In its law allowing video gaming, the Illinois Legislature included truck stops as places where people could gamble. The thinking was that the pool of potential players was pretty much limited to truck drivers, and a lot of them are from out of state, which means video gaming would bring money into Illinois’ economy.

But it turns out owners of some ordinary gasoline stations have decided to redefine themselves as truck stops so that they can get a piece of the action.

“Right now there are gas stations trying to redefine themselves as truck stops,” said state Sen. Dave Syverson, R-Rockford. “They put up a diesel pump and purchase some land so they get can get three acres [the minimum for being designated a truck stop].”

Flower shops also are getting into the act by obtaining liquor “pouring licenses” and then qualifying as a bar, where video gaming is permitted, he said.

Syverson has a bill that has a much better definition of what a truck stop is. The problem with the bill, though, is that Syverson also wants to double the number of video gaming machines that truck stops could have. Legislators worry that if they give more to truck stops, taverns will want the same treatment. So, the bill stalled.

* And here’s something you almost never see in a Chicago newspaper: A nuanced look at the patronage system. Frisbie writes about a visit to the paper’s editorial board by former anti-machine Ald. Marty Oberman, the new Metra chairman, who has pledged to root out patronage at the commuter agency. Oberman put patronage into the perspective of his city hall service…

Back when he was elected to the City Council as an idealistic 29-year-old, Oberman said, he learned that “people, even if they got hired through patronage, most people want to come to work and do their jobs. They would much rather be rewarded for doing their jobs than having to turn in the votes on Election Day. … Now, some didn’t mind doing both.”

“What I learned in the City Council is that a lot of the people [who were called] patronage hacks, they were good people,” Oberman said. “Their way to get a job was to get a letter from their committeeman. …. I went in and I railed against all these awful people that are working for the city. [But] one of the things that happens when you are alderman is you get to know these people individually. The guy who is on the garbage truck, you’ve got to talk to him. Most of these people, they were really decent people.

“[But]… they didn’t get rewarded for doing their jobs. They got rewarded for bringing the votes in on Election Day.”

13 Comments

|

Question of the day

Tuesday, Apr 29, 2014 - Posted by Rich Miller

* The setup…

Governor Pat Quinn says his next—and second term—would be his last if he’s re-elected, because he’s long believed in term limits for top officials.

WBBM Political Editor Craig Dellimore reports that at a City Club of Chicago lunch, Governor Quinn suggested it is no surprise that he would only want to serve two terms as governor.

“I believe in term limits. I practised the petition drive in 1994. I gathered nearly half a million signatures with many others for term limits and at that time I thought executive statewide officials should have a term limit,” said Quinn.

* The Question: Post gubernatorial job opportunities?

59 Comments

|

*** UPDATE *** AP…

Republican U.S. Sen. Mark Kirk says he doesn’t agree with proposals in Illinois to impose term limits on elected officials.

Republican governor candidate Bruce Rauner is pushing a voter initiative to limit state lawmakers. This week, the Republican leaders of the Illinois House and Senate backed an amendment to the state’s constitution that’ll limit statewide officers to two terms. The officers include the governor and comptroller.

[ *** End Of Update *** ]

* From a press release…

The Illinois Republican Party National Committeeman today called on Governor Pat Quinn, House Speaker Michael Madigan and Senate President John Cullerton to approve a Republican proposal to impose term limits on constitutional office holders and reject a Democrat proposal to impose a progressive income tax on Illinois families.

With both legislative proposals moving through the General Assembly this week, the choice before Illinois Democrats is historic and their decisions will send a clear message about their values and priorities.

“The people of Illinois want term limits and they want lower taxes,” said Illinois Republican National Committeeman Richard Porter. “Pat Quinn, Michael Madigan and John Cullerton have a choice: Do they support more job-killing tax hikes, or do they want to restore Illinois to economic prosperity? The people of Illinois are watching and they will hold Democrats accountable for their choices in November.”

Last week, House Republican Leader Jim Durkin and Senate Republican Leader Christine Radogno introduced a constitutional amendment that would allow Illinois voters to approve term limits on constitutional office holders this November. At the same time, Senate Democrats are expected to consider today a progressive income tax hike for Illinois.

This term limits thing appears to be little more than a game. The GOP introduced it this month and Bruce Rauner promptly jumped on board. There are enough calendar days to get the constitutional amendment onto the ballot, but the House would have to add at least one and maybe more session days to accommodate the proposal.

Not to mention that the GOP’s most popular incumbent is Comptroller Judy Baar Topinka, who has held statewide office for 16 years. Before that, she served 14 years in the General Assembly.

Topinka has called legislative term limits a “stupid” idea. I’m more of an agnostic, but you gotta wonder why the state party would essentially be saying that JBT shouldn’t run for another term.

* You can always count on somebody around here to gin up an empty, last-second and hopeless political battle. Speaker Madigan’s spokesman said yesterday that he seriously doubted the House would schedule any additional session days if the Senate passed this proposal.

* And as far as the other issue goes, I’m with Doubek on this one…

Word is state Sen. Don Harmon, an Oak Park Democrat, is planning to seek a vote Tuesday on his proposal to ask voters if they want to change the state constitution to move from a flat to a graduated income tax system, where people pay higher tax rates as their incomes rise. People who make more already pay more, of course, because 5 percent of $200,000 is more than 5 percent of $20,000. Harmon has a separate bill to set rates at three levels. The first $12,500 would be taxed at 2.9 percent, income above that up to $180,000 would be taxed at 4.9 percent, and income greater than $180,000 would be taxed at 6.9 percent. That sounds to me like most of us working Illinoisans would be paying more than the 3.75 percent the law provides for next year. […]

Every House Democrat would have to vote for Harmon’s amendment this week to get it on the ballot. At least one, state Rep. Jack Franks, a Marengo Democrat, has vowed to oppose it.

So, I suspect the veteran statehouse observers at the Illinois State Chamber of Commerce had it right when they suggested to their members that it would be politically unwise for Harmon to pursue a vote on a progressive tax plan sure to fail in the House. Why would Senate Democrats want to go on record for what amounts to a tax increase that won’t ultimately pass?

Unless Harmon has a secret grand plan to get three-fifths in both chambers, he’s gonna be stringing out a whole lot of colleagues if he calls his proposal for a floor vote today.

* As always, keep a close eye on our live session coverage post for updates to these stories and more.

31 Comments

|

Specifics, please

Tuesday, Apr 29, 2014 - Posted by Rich Miller

* Madeleine Doubek…

The frustrating part of this election year is that few politicians are willing to commit to details that could come back to haunt them. Give Quinn credit for announcing he wants to go back on his word, change the law, and raise taxes to 5 percent. Yet neither he nor Republican challenger Bruce Rauner nor anyone else is giving any of us much detail about how we might create more jobs or live within the 3.75 percent tax rate Democrats passed into law in 2011.

Actually, Gov. Quinn has detailed what would happen if the income tax hike is allowed to expire. It’s all right here.

* What frustrates me so much about the governor is he keeps talking about tons of new spending, like the $700 million net annual cost of sending property owners a $500 check before election day, and every year thereafter.

And then there’s this…

Gov. Pat Quinn [yesterday] dangled a possible replacement to Mayor Rahm Emanuel’s plan to raise property taxes to restructure two Chicago pension funds: give the city a bigger cut of state income taxes. […]

Mr. Quinn did not discuss how to fund the move given his prior ideas to boost aid to education, pay off state bills, and hand each homeowner an annual $250-a-year state property tax “refund.”

But Mr. Quinn left little doubt in his remarks to the City Club and in answering reporters’ questions that he thinks a deal is available that would be good for him and the mayor, as well as for suburban communities which face their own woes paying for pensions. […]

Until the “temporary” income-tax hike went into effect in 2011, local municipalities received an automatic 10 percent cut of all state income-taxes raised from their residents. That was not the case with the incremental $7 billion or so a year the state gets from the “temporary” income-tax hike.

If the traditional 10 percent share were applied to the entire proposed permanent income-tax hike, Chicago alone would net $140 million to $150 million a year, according to a revised rough estimate by Laurence Msall, president of the Civic Federation.

Subscribers know more about how Quinn plans to pay for some of this.

But time is fast running out on the spring session. And legislators who are already nervous about voting to make the tax hike permanent before an election may not be amenable to new revenue streams.

* The truth is that Mayor Emanuel badly botched his pension reform bill. He negotiated an agreement with the unions which included a state-mandated local property tax hike without first checking with anybody to see if it could pass the General Assembly or be signed into law. As it turned out, the plan was dead before the ink was dry on the proposal.

And now Quinn is in a huge bind because he’s claiming that Rauner will raise property taxes with his proposed budget cuts.

But that doesn’t give Quinn an excuse to wish into existence magic budget dust.

So, yeah, Rauner is definitely guilty of running away from all specifics. But Quinn can’t continue to hammer his opponent while also refusing to specify how he plans to address this local pension funding issue.

And if he is “open” to discussions, it’s past time that he got those talks off the ground.

17 Comments

|

* A patronage hiring controversy at IDOT started cranking up while I was on break. Today’s update from the AP…

Gov. Pat Quinn says the increase in jobs free from hiring rules at the Illinois Department of Transportation were “absolutely” necessary.

He told reporters Monday that there were federal stimulus dollars that had to be spent quickly and efficiently, along with a massive capital bill. He says policy makers were needed.

Documents released last week by his office showed an increase of 57 percent from 2003 to 2011. The documents showed that in 2011 there were 369 jobs at IDOT that could be given without restriction to those with political connections. That was up from 234 in 2003.

Umm, OK.

* The document release came after a lawsuit was filed April 22nd…

A Chicago lawyer asked a federal judge yesterday to order an investigation into hiring under Gov. Pat Quinn, saying there’s an “embedded culture of patronage practices” in Illinois government and anyone who improperly got a job should be fired.

Michael Shakman, known for bringing the decades-old court case that led to bans on politically based hiring in Chicago and Cook County, filed his motion in U.S. District Court in Chicago as part of that ongoing lawsuit.

The filing accuses Quinn of improper hiring and reclassification of employees in the Illinois Department of Transportation. It cites a 2013 report by the Better Government Association, a watchdog group, that concluded hundreds of IDOT jobs may have been wrongly filled based on “clout instead of competence.”

* The BGA has been pushing this story for a while now, claiming that the hirings were illegal. Transportation Secretary Ann Schneider has avoided commenting on the issue, but finally sat down with the BGA last week. Here’s some of what she had to say…

Patrick McCraney/BGA: As you see it, what did IDOT do wrong when it comes to Rutan?

Ann Schneider/IDOT Secretary: Well, the way that I look at this is that we had gotten position descriptions that were sent over to [the Illinois Department of Central Management Services] for classification, and when they came back, they came back as Rutan-exempt [the job classification that allows a hire to be made based on politics]. We went through the Rutan-exempt hiring for those positions and, I think that as your story rightly pointed out last year, some of those people brought in under those position descriptions ended up performing duties outside of those position descriptions. Thankfully, to you, really, for bringing this to our attention, we found that perhaps people were not performing Rutan-exempt duties that they were hired to perform.

At that point, I thought it was important that we stopped hiring any of these staff assistant positions, and that we do a review of the processes related to the positions, and at the same time that we reviewed the process, that we also audited those positions. In other words, we did a desk audit, there was a team, a third-party, that we brought in to conduct interviews of the people in these positions to find out what their job duties were, also to interview their supervisors, to find out what it is their supervisors expect of those positions.

As a result of those interviews and that desk audit, we drew up these new job descriptions that more accurately reflect the work that these people were doing. Those descriptions were sent to CMS for re-classification, and we have just gotten back, really, just a couple days ago, and we were going through what we got back from CMS, but it appears based on what they sent back to us, that, it appears right now that 48 of the 60 positions, they’re performing Rutan-covered duties, so those are Rutan-covered positions, and 12 of those positions that were sent over came back as retaining their Rutan-exempt status.

* When told that Shakman believes IDOT should only have 20 or so “double-exempt” positions, which are exempt from both US Supreme Court’s Rutan ruling, and the personnel code, Schneider said this…

I think that 20, for an organization of more than 5,200 people, that’s statewide, that covers nine different districts, and beyond those nine districts we have three other offices, people obviously have to run all of those locations, and make sure that the vision and mission of the administration is being carried out appropriately. And then, when we looked at the auditors, and the attorneys, obviously they are all privy to a lot of confidential information, and as we get into labor relations, for obvious reasons we want them to be double-exempt, non-union people, the legislative and governmental affairs are obviously speaking on behalf of the administration, and helping us to move policy through the General Assembly, and our local community liaisons are the same. I think if there was a review done of everybody who is classified for every position as double-exempt, I don’t think there would be much disagreement that where we’re at is closer to the appropriate level.

* She also went into more detail about who was double-exempt…

(W)e have 13 different offices and divisions, each of those offices and divisions have directors. It’s very important in those positions to have people that are able to carry out the mission and the vision of the governor and the administration. Within that, we’ve also got deputy directors, there’s a number of deputy directors. We also have, there are 40 engineers at IDOT that are double-exempt positions… And, those 40 engineers are all a five or above, so they’re all in managerial roles, they’re all in roles to carry out what the agency does. We also have over 20 attorneys that are double-exempt. Our audit staff is also double-exempt. Our labor relations staff, our legislative and governmental affairs staff are double exempt. We also have what we call “Local Community Liaisons,” and these are folks that work for us that are out in the community and dealing with the mayors and the local elected officials and even with constituents, to address their transportation concerns, and also to help us with carrying out the mission of the organization, so they are also double-exempt. We have some support staff, we have some executive secretaries and administrative assistants, that support all of these people in these roles, that are privy to confidential conversations and information, and they are also considered double-exempt.

Discuss.

41 Comments

|

HB 4075: Ride-sharing Protections for All

Tuesday, Apr 29, 2014 - Posted by Advertising Department

[The following is a paid advertisement.]

In an era of on-demand service, you shouldn’t have to trade in your safety and peace of mind when it comes to transportation. People have the right to know that the same public safety protections are in place for everyone in the transportation business, regardless of what kind of car service they use.

That should include ride-sharing companies, but they currently ignore several state and local laws protecting consumers, including police background checks, drug testing, proper licensing and 24/7 commercial insurance.

You can already see what’s happening in the absence of these important protections: recently, NBC 5 Chicago investigated a ex-convict on probation with a list of felonies spanning over twenty years became a ride-share driver almost immediately after she applied, even after her so-called “background check.” And another ride-share driver in San Francisco hit and killed a 6-year-old girl, only to have the ride-sharing company deny liability and the family insurance.

Allowing multi-billion dollar companies to leave people without basic protections is not an improvement to the public marketplace.

The Illinois legislature should protect consumers and demand the same requirements for ALL drivers. Vote YES on HB 4075!

Comments Off

|

The rest of the numbers

Tuesday, Apr 29, 2014 - Posted by Rich Miller

* A recent Gallup poll is getting a lot of play…

The phrase “if you don’t like it, then you can leave” might be a dangerous thing to say in Illinois.

According to a recent Gallup poll, the state would lose a quarter of its population if every resident who didn’t like it decided to leave it. The poll asked survey-takers to rate their state as a place to live, and Illinois had the highest percentage of people who said it is the worst place to live, at 25 percent.

Illinois was followed by Connecticut and Rhode Island, 17 percent of whose residents rated their states as the worst place to live.

The states with the highest rates in the “best possible state to live in” category were Texas (28 percent), Alaska (27 percent), Hawaii (25 percent) and Montana (24 percent). Only 3 percent of Illinoisans put their state in the same category.

* From Gallup…

Illinois has the unfortunate distinction of being the state with the highest percentage of residents who say it is the worst possible place to live. One in four Illinois residents (25%) say the state is the worst place to live, followed by 17% each in Rhode Island and Connecticut.

Throughout its history, Illinois has been rocked by high-profile scandals, investigations, and resignations from Chicago to Springfield and elsewhere throughout the state. Such scandals may explain why Illinois residents have the least trust in their state government across all 50 states. Additionally, they are among the most resentful about the amount they pay in state taxes. These factors may contribute to an overall low morale for the state’s residents.

* Some state residents are, indeed, just bursting with local pride…

When asked to rate their state as a place to live, three in four Montanans (77%) and Alaskans (77%) say their state is the best or one of the best places to live. […]

Residents of Western and Midwestern states are generally more positive about their states as places to live. With the exception of the New England states of New Hampshire and Vermont, all of the top 10 rated states are west of the Mississippi River. In addition to Montana and Alaska, Utah (70%), Wyoming (69%), and Colorado (65%) are among the 10 states that residents are most likely to say their state is among the best places to reside. Most of these states have relatively low populations, including Wyoming, Vermont, North Dakota, and Alaska — the four states with the smallest populations in the nation. Texas, the second most populated state, is the major exception to this population relationship. Although it is difficult to discern what the causal relationship is between terrain and climate and positive attitudes, many of the top 10 states are mountainous with cold winters. In fact, the two states most highly rated by their residents — Montana and Alaska — are among not only the nation’s coldest states but also both border Canada.

* But Gallup didn’t publish results from another poll question it posed in that survey. When asked to describe their state, one option was “As good a state as any to live in in the United States.”

I asked the company for the responses to that question and they sent it to me late yesterday. Read all responses to all questions in all states by clicking here.

* According to the document, 54 percent of Illinoisans said their state was as good a place to live as any other state. Another 16 percent said Illinois was “One of the best possible states to live in in the United States.” And 3 percent said it was the best possible state to live in.

So, 73 percent had basically positive or neutral things to say about Illinois.

* Do not get me wrong here. We are obviously a messed up place if a quarter of all Illinoisans believe their state is the armpit of the universe. I just thought you’d like to see the rest of the poll.

* Meanwhile, Gallup released another national poll result earlier this month. Respondents were asked if they believed their state taxes were too high.

71 percent of Illinoisans said their taxes were too high, while only 26 percent said they weren’t too high.

Illinois ranked fourth, behind New York (77-21), New Jersey (77-22) and Connecticut (76-23).

Wisconsin residents, which pay higher personal income tax rates than Illinoisans, were way down the list at 51-46. That’s slightly above the 50-47 national state average.

Also, 51 percent of Hoosiers, who have high state rates, say their taxes are not too high, compared to 48 percent who said they were too high.

* The takeaway? The income tax hike is hugely unpopular and in the media almost daily. And the state government appears inept and floundering. It’s not hard to see why residents feel this way.

56 Comments

|

* From February 27th…

Gov. Pat Quinn is doing a national search for the next chief of the Illinois Department of Children and Family Services in the wake of the current director resigning after only a month on the job, the governor’s office said Thursday.

* Fast-forward to today. No more national search. Quinn has instead nominated his current interim director..

The interim director of the state’s Department of Children and Family Services, which has had four leaders in six months, on Tuesday received Gov. Pat Quinn’s nomination to continue heading the agency.

Bobbie M. Gregg, who has been the interim director since late February, must be confirmed by the state Senate. In the meantime, she’ll assume the title of acting director.

Quinn touted Gregg, a DCFS veteran who has also worked in county and federal government, as the right person to head the child welfare agency.

* From David Ormsby at the Illinois Observer…

Quinn’s choice of Gregg is likely to be, however, a disappointment to lawmakers who sought national talent and to those who witnessed her dismal performance at recent legislative budget hearings.

“We’ve had a rotating door, unfortunately, in the last several months in this department. So it’s been hard for any leadership to gain traction,” said State Senator Julie Morrison (D-Deerfield) when Gregg’s interim appointment was announced in February. “I would encourage the governor to look within the state and outside the state for a director who brings some innovation along with the experience”.

At recent House and Senate budget hearings, Gregg’s performance was panned for her lack of grasp of basic agency financial and operational details, according to accounts. Gregg fumbled for answers regarding recent cuts to the agency’s budget despite being spoon-fed questions by lawmakers. Legislators – Democrats and Republicans – were privately stunned by Gregg’s lack of preparation.

Word is that the governor’s office did interview other potential talented candidates, but political uncertainty over Quinn’s hold on office beyond January 2015 doomed the other candidacies.

25 Comments

|

Here’s how we can thank Barton

Tuesday, Apr 29, 2014 - Posted by Rich Miller

* Barton Lorimor did a fantastic job while I was on break. I think the best way we can thank him for his services to us here is to donate to his favorite cause. Barton sent me this e-mail today…

Rich,

As you and I discussed earlier, a former colleague and fellow Saluki passed away on this day six years ago. He was 22.

Ryan Rendleman, a student at Southern Illinois University Carbondale and photojournalist for the Daily Egyptian newspaper, was on his way to O’Fallon, Ill., to meet a young girl with Tay-Sachs disease. It’s an incurable and unfortunately fatal illness he was hoping to make more people aware of. Sadly, he was killed en route while his car was stopped in a construction zone just north of Pickneyville, Ill.

I don’t want to sound like I was one of Ryan’s best friends. Ryan and I worked together. My desk in the newsroom was close to the photo lab he managed during my first semester in Carbondale. This anniversary means a lot more to his fellow shooters.

That said, after his passing I realized what Ryan meant to me personally. He was the first person to introduce himself to a scraggly ginger freshman from Carlock, IL on his first day as a reporter. He and a couple of the other upperclassmen even took that runt to lunch that afternoon. It was a little thing, but it made a big difference. I think a lot of us that knew Ryan changed something about ourselves because of him - especially after his passing. My change was to strive to be the first one to welcome the new guy.

Shortly after his death, the SIUC College of Mass Communication and Media Arts established a scholarship that carries Ryan’s name and is awarded annually to a photojournalism student. Since you have used your network to help good causes in their fundraising efforts, I thought your readers might help us keep this scholarship alive. Donations to the scholarship can be made by contacting Ron Graves at the SIU Foundation. Your readers should mention they saw this post on Capitol Fax and would like to contribute to the Ryan Rendleman Scholarship. Ron is a good guy. He will take care of the rest.

Another good way to honor Ryan would be to make a contribution to National Tay-Sachs & Allied Diseases Association, which strives to find a cure to the disease Ryan was on his way to write about. In the years immediately after his death, some of the images Ryan captured were professionally printed and auctioned off at fundraisers with the proceeds benefiting a Tay-Sachs cure. Pretty cool legacy, if you ask me. NTSAD accepts donations online. The link is here.

If anyone is interested in learning more about Ryan, a recent SIUC graduate wrote an amazing tribute to him last year. Based on my interactions with Ryan and the stories I have heard about him over the years, this article seems to have captured him to the tee.

I appreciate your consideration and help with both of these causes.I think you would have liked Ryan. He was a silly guy that loved Bob Dylan’s music, free pizza, and pressing the shutter button on images that would provoke thought and change. Although we cannot take his pictures, perhaps we can still help him provoke change.

All the best,

Barton

5 Comments

|

* Whenever government agencies are threatened with budget cuts, they can usually be counted on to highlight the most draconian possibilities which could result. From Illinois Public Radio…

Gov. Pat Quinn and other Democrats say if the [income] tax rate is allowed to drop, there would have to be massive cuts across state government.

For example, Secretary of State Jesse White said his office would have to cut nearly $39 million under the “not recommended” budget. […]

The threatened cuts include the entire state Capitol Police force, which was established about a decade ago, after a deranged man shot and killed an unarmed security officer. The shooting led to the installation of metal detectors and x-ray machines, and hiring sworn, armed law enforcement personnel.

White said unless the legislature makes the temporary tax increase permanent, the entire force will be eliminated — leaving just the unarmed guards.

“We just believe if we have to revert back to the days when this gentleman was killed, that it may not be in the best interests of the members of the Illinois General Assembly, or the people at large,” he said.

There’s no doubt that the cuts would be huge. And there’s also undoubtedly no small amount of poetic justice to White’s argument.

But could it really happen? I’m not so sure.

By the way, White also said he’d have to close 25 drivers license facilities and lay off 200 people and wouldn’t be able to mail notices to remind motorists to renew their licenses and their plate stickers.

42 Comments

|

Rate Rauner’s three new TV ads

Tuesday, Apr 29, 2014 - Posted by Rich Miller

* From a press release…

Bruce Rauner’s gubernatorial campaign began airing three new television advertisements today, highlighting his extensive efforts to help the community and improve education as well as his cross-party appeal.

The ads all feature racial minorities.

* The first ad we’ll look at is called “Beautiful Thing”…

Script…

“My name is Cornell Nelson. I’m from the South Side of Chicago. I support Bruce Rauner. Early on, I stayed out of trouble. Later on, I got captured by the streets. I ended up at this place called A Safe Haven. Bruce made a great difference. He’s helped provide meals in these neighborhoods. He’s helped provide clothing. People don’t know he’s had his hand in doing this for a very long time. Bruce did that. It’s a really beautiful thing.”

* The next ad is entitled “Principle”…

Script…

“My name is Lula Ford and I taught public school for 22 years, I was a principal for 5 and I was an assistant superintendent. That’s why as a Democrat I’m voting for Bruce because I realize he’s very much about education for children, especially in underserved communities and the inner city. He will follow through on every promise he has made about education, and he is not afraid of a fight. And I think he knows he’s in for one, but I think he’ll be triumphant. Bruce is the real deal.”

* And the third ad is called “Wrong Direction“…

Script…

“I’m Manny Sanchez, former co-chair of Latinos for Obama. The state is going in the wrong direction and has been going in the wrong direction for too long. I absolutely think that Bruce Rauner would be the right and the perfect and the optimal candidate for Democrats, for Independents and for Republicans. We need to have a leader who’s honest, who’s fresh and who’s willing to tell the people, whether they want to hear it or not, the truth and that’s what Bruce Rauner brings to this race.”

100 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS

SUBSCRIBE to Capitol Fax

Advertise Here

Mobile Version

Contact Rich Miller

|