* Media advisory…

Announcing Build UP Illinois – Coalition for Vertical Construction in Capital Bill

WHAT

Announcement of Build UP Illinois, a coalition to advocate and promote a vertical construction program as part of a comprehensive capital bill. Build UP Illinois is a consortium of groups representing P-20 education – including k-12 school districts and both private and public colleges – the Illinois hospital system and the AFL-CIO and affiliated building trades.

WHO

State Senator Andy Manar – Senate Appropriations II Chairman

Representative Jay Hoffman – Assistant Majority Leader

Michael Carrigan – President – Illinois AFL-CIO

Dr. Larry Dietz – President – Illinois State University

AJ Wilhelmi – President & CEO – Illinois Hospital Association

Dr. David Sam – President – Elgin Community College

Other Coalition Members

WHEN

Wednesday, May 1 at 9:00 AM

WHERE

Blue Room, Illinois State Capitol

Springfield, IL

It’s starting to come together.

12 Comments

|

* The Hill…

Republican Ted Gradel, who is challenging freshman Rep. Lauren Underwood (D-Ill.) for the Illinois House seat she flipped last year, has raised more than $150,000 in the six days since he announced his candidacy, his campaign said Tuesday.

The six-figure haul is the latest sign that Underwood is likely to face a tough reelection fight next year as she looks to hold on to a congressional district that flipped to Democrats in 2018 despite President Trump’s nearly 4-point win there in 2016.

Gradel, a former University of Notre Dame field goal kicker and first-time candidate for public office, announced his bid for the suburban and exurban Chicago district last week in a video narrated by former Notre Dame football coach Lou Holtz.

In declaring his candidacy, Gradel joined a growing field of Republicans targeting Underwood in 2020.

Among the other announced contenders are Illinois state Sen. Jim Oberweis, Danny Malouf and Anthony Catella.

Rep. Allen Skillicorn is also gearing up for a GOP primary bid.

7 Comments

|

* Jacksonville Journal-Courier…

Marquis Energy has “shelved” plans for an ethanol plant in Scott County, the company announced Monday.

Citing state legislation and U.S. trade policy, the Hennepin-based company said it would let more than 800 acres in two-year land options in Scott County expire at the end of April. The plans are being canceled indefinitely, according to spokeswoman Danielle Anderson.

The company had plans to develop a $500 million ethanol plant — to be built near Bluffs, about 60 miles west of Springfield, by 2020. […]

Trade tariffs also were a factor in the decision. According to the company, tariffs have restricted international export markets for ethanol and distilled grains.

“These tariffs caused a reduction in corn value, leading to lower prices for U.S. farmers and adding to an already distressed agricultural economy,” Marquis said.

* From the company’s CEO…

“Illinois government’s anti-business and high tax policies will require us to pursue company expansions in surrounding states. [Senate] bill SB 1407 is an example of legislation that will negatively impact our company’s expansion plans — removing our company’s choice in construction contractors we hire and the agreed upon price between the two parties, reducing competition and inflating costs.”

We’ve talked about SB1407 before. It’s got employer groups up in arms, particularly the manufacturers and the Black Caucus has some reservations as well because of the bill’s strong support by the trade unions. Its passage is not assured, so making a major business decision based on a bill that hasn’t even been voted on yet in the originating chamber is a bit… odd.

* From the Illinois News Network…

Associated Builders and Contractors of Illinois President Alicia Martin said Senate Bill 1407 could be a slippery slope.

“The one component that we feel is very egregious is the fact that prevailing wages will be required on private work in these refineries and then where would the overreach come next,” Martin said.

Supporters of the legislation have told lawmakers in committee that the measure is about ensuring safety at refineries, and prevailing wage jobs are the safest jobs. […]

State Rep. C.D. Davidsmeyer, R-Jacksonville, said if Illinois lawmakers could just get out of the way of businesses, Illinois’ economy could grow.

“If [majority Democrats] would stop doing political favors for their largest political donors I think that we could actually have an economy that thrives and we wouldn’t have to be talking about tax increases or fee increases or any of those things and we could just grow naturally,” Davidsmeyer said.

38 Comments

|

* The Senate Democrats are being briefed today on the newly proposed graduated income tax rates.

The drafters have addressed the criticism of the “marriage penalty” by coming up with different rates for married people and single filers. The language is in Amendment 1 to SB687.

Remember that these rates only apply to income earned within the brackets. Here are the proposed rates for joint filers…

4.75% $0-10,000

4.85% $10,001-100,000

4.95% $100,001-250,000

7.75% $250,001-500,000

7.85% $500,001-1,000,000

7.99% $1,000,000+ (includes all income)

For taxpayers who do not file a joint return…

4.75% $0-10,000

4.85% $10,001-100,000

4.95% $100,001-250,000

7.75% $250,001-350,000

7.85% $350,001-750,000

7.99% $750,000+ (includes all income)

* Meanwhile, the state’s estate tax would be repealed on January 1, 2021 (Amendment 1 to SB689).

And I’m not quite sure yet what Amendment 1 to SB690 does to property taxes (it’s supposed to be a freeze of some kind), but click here and maybe some of you smart people can explain this in comments.

All three bills must move forward together, I’m told. One goes down, they all go down.

*** UPDATE 1 *** I’ve been advised to tell you that this is the Senate Democrats’ proposal. It’s not yet an agreed proposal. This is a step in the process. There’s still more negotiating to do, apparently.

*** UPDATE 2 *** House GOP spokesperson Eleni Demertzis…

We have said this since day one: A progressive tax is just a blank check for Democrats. They’ve already changed the rates from their initial proposal– without a care of the effects to middle class families and Illinois businesses. Democrats simply can’t be trusted with the ability to manipulate these rates anytime they want to spend more taxpayer dollars.

*** UPDATE 3 *** From the Senate Democrats…

Revenue:

Individual Income Tax Rates: $3.570 billion

Corporate Tax Rate: Increase from 7% to 7.99%: $350 million

Increased funding for programs/property tax relief:

Local Governments (LGDF) $100 million increase

Child Care: $130 million

Individuals receive a $100 income tax credit per child

Eligibility: Single filers ineligible if making over $80,000. Married filing jointly ineligible if making over $100,000

Property Tax Relief: $365 million

· School district tax freeze: $265 million. (SB690) If the state funds special education, transportation, free and reduced meal programs and other mandated categorical programs AND funds the Evidence Based Funding formula at a minimum increase of $350 million, then the local property tax rates for school districts are frozen for that year. It remains frozen so long as the state continues to meet those funding levels.

Illinois State Board of Education will certify funding levels, and if the levels aren’t met, districts can adjust rates as allowed under current law.

· Property tax credit: $100 million. (Contained in SB 687)Increases income tax credit for property taxes to 6 percent from 5 percent.

Total Estimated New Revenue (minus additional funding/property tax relief): $3.325 billion

SB 689 Repeal Death/Estate Tax

What it does:

Repeals what’s often referred to as the “death tax” in Illinois, the tax on the value of an estate that someone inherits. Of note, the agriculture community has been particularly critical of this tax. This provision is linked to voters approving the Fair Tax (SJRCA1).

Details:

SB 689 repeals the Illinois Estate and Generation Skipping Transfer Tax Act. It eliminates the Illinois Estate Tax on estates of persons dying on or after July 1, 2021, or for transfers made on or after July 1, 2021, only if Senate Joint Resolution Constitutional Amendment 1 of the 101st General Assembly is approved by voters prior to that date.

Background:

Currently, the exclusion amount in Illinois is $4.0 million for persons dying on or after January 1, 2013. At the federal level, the exclusion amount is currently $22.4 million for deaths occurring between 2018 and 2025 for married couples aggregating their exemptions and $11.2 million for all other taxpayers.

If the amount of the estate exceeds ($4 million state, $22.4 million federal) either of these amounts for those affected taxpayers, it is subject to a 40% estate tax at the time of death. SB 689, as amended, eliminates the state tax imposed under this Act.

SB 690 Property Tax Relief

What it does:

As long as the state lives up to its responsibilities to fund school districts’ breakfast and lunch programs, student busing costs, etc., AND continue to invest an additional $350 million annually in overall school funding, then school districts tax rates are frozen. This provision is contingent on voters approving the Fair Tax (SJRCA1) Amendment.

This would be an annual process. The freeze would be contingent on the state meeting its obligations to fund education and thereby offset the need for local school boards to go to property taxpayers.

Note: All components would be effective Jan, 1, 2021, if and only if the Fair Tax Constitutional Amendment (SJRCA1) is put on the ballot by lawmakers and then approved by voters.

*** UPDATE 4 *** Sen. Dale Righter (R-Mattoon) just asked if the governor supports this specific rate structure. Sen. Toi Hutchinson (D-Olympia Fields) who chairs the Revenue Committee, did not give a direct response, mentioning negotiations and saying the governor is supportive of the general principles of a graduated income tax.

*** UPDATE 5 *** No surprise here, but the Senate Executive Committee passed the rates bill and the estate tax bill. No debate yet on the property tax bill.

*** UPDATE 6 *** From the governor’s press office…

From day one, Governor Pritzker has made clear that he prioritizes negotiations with the General Assembly on the fair income tax. Today represents another important step in the negotiations, and we look forward to continuing those conversations with stakeholders in the House as well. Governor Pritzker’s focus on making our system more fair means that 97 percent of Illinois taxpayers will pay the same or less in income taxes, while only those making more than $250,000 will pay more.

*** UPDATE 7 *** The property tax freeze component just passed Senate Exec on a partisan roll call.

48 Comments

|

* I told subscribers about this poll earlier today…

The Illinois Education Association (IEA) today released the State of Education report, a first of its kind, bipartisan poll asking Illinoisans about all aspects of public schools. The results show most of those polled give Illinois schools (not teachers) a poor grade, think the state should be spending more money on students and believe teachers are undervalued, underpaid and should have a voice in what happens in schools.

“The State of Education report tells us what Illinoisans believe our students deserve when it comes to public education,” IEA President Kathi Griffin said. “The people have spoken, and I hope are lawmakers are listening. We are in the middle of a teacher shortage, and this poll shows us exactly why. We need to improve, enhance and address the inadequacies of our schools now so we can continue to ensure that every student has access to a high-quality, equitable public education.”

The data show that on the whole, Illinoisans believe fixing our schools should be a top priority, although there was no clear consensus on how to fix them. However, we do know Illinoisans overwhelmingly believe teachers’ and parents’ perspective are the most important when it comes to determining how schools are run.

“We know everything that happens inside a classroom is governed by decisions made outside of it,” Griffin said. “From the school board to the Statehouse to Congress and the White House, elected officials are determining what our students are learning, how they’re learning it and what resources are available. We need to start listening to those who are on the front lines with our students. Our parents, our teachers and our support staff should have a louder voice when it comes to decisions that impact our children’s futures.”

When asked if funding for schools should increase, 71 percent of those surveyed said yes. Those polled were then told student spending in Illinois is $13,000 per student per year, and nearly two thirds of those surveyed still thought that funding should increase. When it comes to teachers’ pay, those polled were six times more likely to believe teachers were underpaid versus paid too much or just right. A whopping 75 percent of those surveyed believe teachers should keep their full pension.

“We need career sustainability for our teachers — proper salary to start and one that fairly compensates our teachers throughout the life of their careers. Our students deserve the best and brightest facilitating instruction in our classrooms, and we need to do a better job of attracting and retaining high-quality teacher candidates,” Griffin said. “We’re in the midst of a teacher shortage, and this poll proves that Illinoisans understand that pay and benefits are important to address this crisis.”

The poll, conducted by Normington Petts and We Ask America, surveyed 1,000 Illinoisans between March 14 and March 27. It has a margin of error of +/- 3.1 percent with 95 percent confidence.

“These data points are unique because, as far as we can tell, no one has done this before in Illinois,” Jill Normington of Normington Petts said. “It makes sense, as well, to ask the people that public education serves what they expect from their schools.”

“By creating a bipartisan process, the IEA has produced an unbiased look at views around public education in Illinois and we were proud to be a part of it,” Mike Zolnierowicz of We Ask America said.

* The IEA asked me not to link to the crosstabs, but I went through them and something stood out for me in the responses to this question…

Priority for proposals to change IL Schools - Spending more money on technology to help long distance learning in rural schools in Illinois?

Respondents were asked to assign a number between 0 and 10 to the priority level, with 10 being the most urgent.

According to the poll, 71 percent of Chicagoans gave the issue a top priority of between 8 and 10. Just 56 percent of Downstaters in the northern half of Illinois gave it an 8-10 and only 51 percent of Southern Illinoisans assigned the issue the same priority.

* The moral of this story is that while some Downstaters like to complain that Chicagoans don’t care about them, Chicagoans in this poll were far more likely to support spending their own tax dollars to help rural schools than were Downstaters.

Now, maybe Downstaters don’t like the idea of distant learning. I have no idea. I’m just saying…

40 Comments

|

* Ana Espinosa…

A man’s girlfriend has been arrested for allegedly murdering his 8-year-old daughter earlier this year.

Cynthia Marie Baker (a.k.a. Cynthia Marie Clay), 41, was indicted by a McLean County Grand Jury on Wednesday for three counts of murder, one count of aggravated battery of a child and one count of aggravated domestic battery. […]

According to the indictment, Cynthia allegedly kicked the 8-year-old in the abdomen which resulted in peritonitis due to intestinal perforation from blunt force trauma. […]

Rica’s mother Antionetta Simmons, said she warned DCFS this would happen. She spoke with NewsChannel 20’s reporter Ana Espinosa on the case.

“I begged DCFS in January and I told them I didn’t care where Rica went, but somebody needs to go check on my daughter because they were going to kill her,” Simmons said. “I’m just so hurt that she’s not here. She didn’t even have a chance.”

* From the indictment…

A SEARCH WARRANT WAS EXECUTED ON THE ICLOUD BELONGING TO THE DEFENDANT’S PHONE WHICH REVEALED THE FOLLOWING IN VIDEO FORMAT WHILE R.R. WAS LIVING WITH THE DEFENDANT AT AN APARTMENT LOCATED AT 208 VALLEY VIEW CIRCLE IN BLOOMINGTON, ILLINOIS: MAY 26, 2018 - THE DEFENDANT SLAPPED R.R. WHILE R.R. IS STANDING BEHIND A RECLINER ATTEMPTING TO AVOID GOING INTO THE DEFENDANT’S ROOM FOR A PUNISHMENT. THE DEFENDANT SLAPS R.R. AS R.R. IS RUNNING AWAY FROM THE DEFENDANT IN ORDER TO AVOID GOING INTO THE DEFENDANT’S ROOM. AUGUST 23, 2018 - THE VIDEO DEPICTS THE DEFENDANT DRAGGING R.R. INTO THE BEDROOM BY HER NECK AS SHE YELLS AT R.R. TO STAND IN HER BEDROOM NAKED HOLDING CANS OUT TO HER SIDE DRIPPING WET AND SHIVERING. LATER R.R. IS STANDING NAKED IN THE DEFENDANT’S BEDROOM HOLDING CANS WHEN THE DEFENDANT COMES BACK INTO THE ROOM AND HITS R.R. ON THE BARE BUTTOCKS SAYING, “MAYBE YOU DON’T UNDERSTAND ENGLISH.” SHE THEN ASKS R.R. “WHERE ARE THE CANS SUPPOSED TO BE?” THEN THE DEFENDANT HAS R.R. SHOW HER WITHOUT HOLDING THE CANS. AS R.R. IS DOING SO, THE DEFENDANT SAYS “COLD, AREN’T YA?” AS R.R. IS SHIVERING. LATER, THE DEFENDANT RE-ENTERS THE ROOM AND YELLS AT R.R. FOR NOT KEEPING HER ARMS STRAIGHT OUT. THE DEFENDANT HITS BOTH SIDES OF R.R.’S EARS/FACE ASKING, “DO I NEED A COLLAR FOR YOU?” THEN SHE PUTS HER HANDS AROUND R.R.’S NECK. WHEN R.R. CRIES, “NO” THE DEFENDANT FORCEFULLY PUTS R.R.’S ARMS BACK IN THE STRAIGHT POSITION TO CONTINUE HOLDING THE CANS. THIS GOES ON FOR OVER 23 MINUTES. SEPTEMBER 8, 2018

A VIDEO DEPICTS R.R. HOLDING THE CANS OUT TO HER SIDE IN THE CORNER WHEN THE DEFENDANT COMES UP BEHIND HER ON AND KNEES HER IN THE LOWER RIGHT BACK WITH THE DEFENDANT’S RIGHT KNEE SAYING, “THIS IS STRAIGHT” AS THE DEFENDANT STRAIGHTENS R.R.’S ARMS OUT. FURTHER INTO THE VIDEO, THE DEFENDANT COMES UP BEHIND HER AGAIN AND KNEES HER IN THE LOWER RIGHT BACK WITH THE DEFENDANT’S RIGHT KNEE TWO ADDITIONAL TIMES. ON THE FOURTH KNEE TO THE BACK, R.R. SCREAMS LIKE SHE IS IN PAIN. LATER IN THE VIDEO, THE DEFENDANT TAKES R.R.’S HEAD WITH BOTH OF HER HANDS AND BANGS IT OFF THE WALL.

I cannot come up with adequate language to describe how that makes me feel.

* DCFS’ sterile statement…

DCFS is deeply saddened by the loss of Rica Rountree. DCFS’ involvement with Rica began in 2014 while she was living with her biological mother and continued after she was removed from her mother’s home and placed with her biological father. During her time with her father, DCFS conducted multiple investigations into allegations of abuse and found these allegations to be unfounded. There is currently a pending investigation into this death and we are committed to understanding exactly what happened in this case and being fully transparent with the public. DCFS is working closely with the new administration to review our practices, policies, and procedures in order to fully live up to our mission to protect vulnerable children in Illinois.

24 Comments

|

* I’m not sure that LaHood’s testimony convinced a single legislator to vote for doubling the Motor Fuel Tax, or that Barack Obama’s Secretary of Transportation cooled out any Republicans, but whatevs, he was in town so that’s news…

Former Republican congressman and U.S. Transportation Secretary Ray LaHood said Monday that Illinois lawmakers need to hike the state’s motor fuel tax, but they’ll also need to convince some residents that they will spend the new revenue wisely. […]

“Illinois is one big pothole right now,” he said. “If the General Assembly raised the gas tax and fixed up the roads and bridges, people would be very happy.”

While the state needs to raise the gas tax, LaHood said he worried that lawmakers would have to convince Illinois residents who already shoulder one of the nation’s highest motor fuel taxes to trust them with spending the new revenue responsibly.

“The money has to be spent on roads and bridges. You can’t defer this money to pay for state police salaries or to pay for other things related to road safety or whatever,” he said.

* Also, lemme know when Quincy Republicans Rep. Randy Frese and Sen. Jil Tracy are ready to double the MFT…

LaHood and Tom Oakley, a former newspaper publisher in Quincy, told the committee they would help lobby for an infrastructure bill when the legislature heads back to Springfield for the final legislative push Tuesday.

“What you have today, Mr. Chairman and members of the committee, are two Republicans from downstate Illinois who are promoting to fix up our infrastructure and raise the gas tax to do it,” LaHood said.

LaHood’s testimony was followed by eight panels of speakers requesting added infrastructure spending that would benefit their varying organizations, businesses, agencies and boards. Those representatives were from transportation agencies, port authorities, higher education institutions, environmental organizations, pedestrian and bicycling advocates and other groups.

Mary Sue Barrett of the Metropolitan Planning Council — an independent, nonprofit, nonpartisan organization focused on regional growth — said those debating infrastructure spending often ask the wrong questions.

“First, we have to ask what’s the cost of inaction,” she said.

But, hey, so far it’s the only funding plan on the table and it’s strongly backed by Local 150 and has the support of the Illinois Chamber (albeit coupled with the phase-out of the sales tax on fuel). Even Senate GOP Leader Bill Brady wants to use MFT money. So, who the heck knows what will happen?

It would be helpful if the governor picked a lane, however.

10 Comments

|

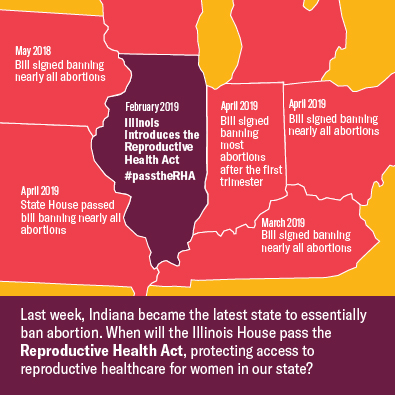

Cannabis legalization details emerge

Tuesday, Apr 30, 2019 - Posted by Rich Miller

* Sun-Times on the cannabis legalization bill…

Under the legislation, which is being backed by Gov. J.B. Pritzker, misdemeanor pot convictions would be expunged, people with cannabis convictions would be allowed to work in the industry and diversity hiring goals would be set for firms in the industry.

Additionally, [sponsoring Rep. Kelly Cassidy, D-Chicago] said, the legislation would provide support for minority-owned businesses by offering technical assistance, as well as access to capital, loans and relief from fees that have posed a barrier to entry for smaller businesses. To further crack that barrier, the measure would also create new cannabis licensing categories for “craft” grow operations and companies that process and transport the drug.

“I’ve said for a long time that other states that have tried this have tended to try with a solution, but that presumes there’s a singular barrier to minority engagement in the industry,” Cassidy said. “And that’s simply not the case. These conversations have been about the best way to set up sort of a buffet of responses to the array of problems.” […]

“The proposal that I’ve seen has some really good language in it and now it’s just the part of fine-tuning and making sure that advocates remain in support and removing as much opposition as you can,” said [Sen. Kimberly Lightford, D-Maywood, the chair of the Illinois Legislative Black Caucus], who couldn’t say whether any members of the black caucus are opposed to the legalization plan.

* Politico…

Concerns center on ensuring that minority business owners have a stake in the industry and making sure new money generated is channeled to communities that have historically suffered from the impact of drug abuse. Another flashpoint in the process is potentially expunging criminal records for offenders found guilty of possessing or selling marijuana prior to legalization. These are largely the same issues that tanked New Jersey’s plan last month to approve recreational marijuana, and that New York lawmakers are still debating. […]

The Black Caucus is in regular discussions with the governor’s office and lawmakers carrying the measure. “We’d like to create model legislation for the nation,” [Sen. Elgie Sims, D-Chicago] said. “We want the strongest social equity program in the country and to be the most progressive on criminal justice reform issues.”

State Rep. Kelly Cassidy tells POLITICO that the concerns of the Black Caucus “have been part of our discussion from day one.” The Chicago Democrat is pressing legalization in the Assembly while state Sen. Heather Steans (D-Chicago) pushes for it in other chamber. Cassidy says that nationwide, the recreational marijuana industry is only 4 percent minority-held. “No state has gotten this right so far. We want to get it right.”

* Jaclyn Driscoll…

As political negotiations on recreational marijuana continue, one prominent group, has not yet taken a stance: the Legislative Black Caucus. These are the African-American lawmakers in the Illinois House and Senate.

They are involved in the talks, though, according to state Rep. Jehan Gordon-Booth, a Peoria Democrat and leader in the caucus.

“Any adult-use bill has to have specific consideration as it relates to restoring some of the harm that was done during the war on drugs to communities of color,” she said. “There should be ownership of people of color in this space.” […]

“We don’t want an adult-use program to look like the medical program which essentially is completely and wholly owned by rich people and none of them are people of color,” Gordon-Booth said.

True.

* More from Driscoll…

Reporter: I understand this is a massive piece of legislation, but if there was one goal in passing recreational cannabis, what is it?

Cassidy: I’ve said this before. I want to pass the gold standard for cannabis legislation that the rest of the country can follow. That means a model that taxes at a level that allows the industry to grow, that allows patients and users access in a way that gets them into the legal markets, that creates an industry and allows an industry to grow that looks like the state of Illinois, that looks like communties we come from.

Lots more in that interview, including home-grow info, so click here.

* Can it pass?…

“This is a nearly 300 page pieces of legislation,” said Rep. Kelly Cassidy, D-Chicago, who has been working on the issue for more than two years. “We want to make sure we’ve dotted all of the “I’s” and crossed all of the “t’s”.

There are potential hang-ups as the bill works its way through the legislature. Rep. Martin Moylan, D-Des Plaines, is sponsoring a resolution co-signed by 59 other House members of both parties to slow down the process of legalization. Cassidy scoffs at the need to slow down the process.

“This has been the most deliberative process I’ve seen on anything this big,” Cassidy said. “Sen. (Heather) Steans and I have been working on this for over two years. Dozens of town halls, multiple public hearings, hundreds of stakeholder meetings. There’s nothing rushed about this.” […]

“I think in the House, (legalization) is going to garner serious opposition,” [Rep. Tim Butler, R-Springfield] said. “I think it is going to be very difficult to get 60 votes in the House right now.”

* Leader Harris disagrees…

House Majority Leader Gregory Harris of Chicago said he thinks a legalization bill has enough support to pass.

“I’m told it does. I’m not counting votes on it, understanding this is a topic where there can be strong opinions on both sides,” he said. “I think members are going to be very carefully taking the temperature of their district. But if you look around the country, this is where the trend is going.”

* And Rep. Moylan’s blatant insult of his colleagues isn’t doing his cause any good…

“The proponents are trying to pull a con game on the state of Illinois,” [Rep. Marty Moylan, D-Des Plaines] said Thursday. “I have almost more than 60 people who’ve signed on is because nobody else’s talking about what the harmful effects are.” Moylan said he’s been talking to nurses and law enforcement officials “on the ground” in states that have legalized recreational use to help gather information.

* Related…

* Analysis: How legal recreational marijuana works in other states

24 Comments

|

What Is The Credit Union Difference?

Tuesday, Apr 30, 2019 - Posted by Advertising Department

[The following is a paid advertisement.]

It’s simple. Credit unions are member-owned, so any earnings are simply returned in the form of lower loan rates, higher interest on deposits and lower fees. Credit unions create a fair financial alternative for the taxpayers of Illinois. Credit unions are not-for-profit financial cooperatives that don’t focus on increasing revenue or paying dividends to outside stockholders. Illinois credit unions are focused on the member-owners we serve. Visit www.YourMoneyFurther.com to learn more about the benefits of credit union membership.

Comments Off

|

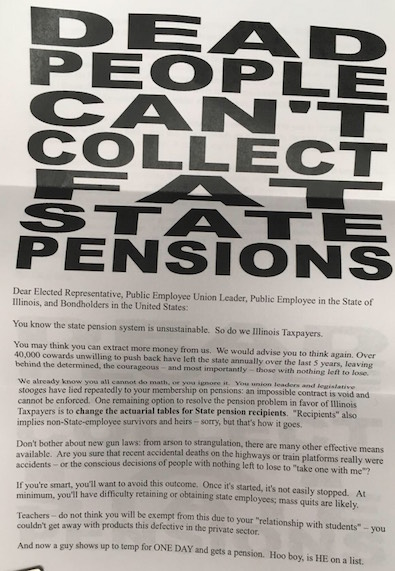

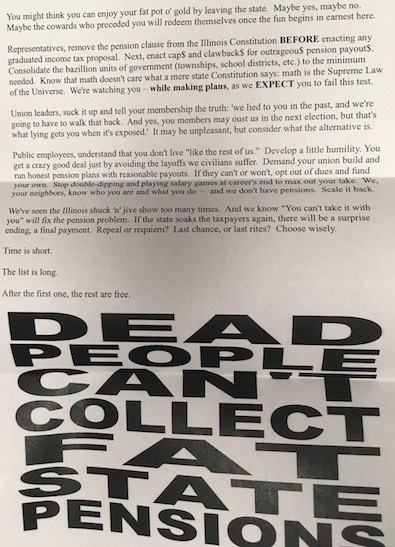

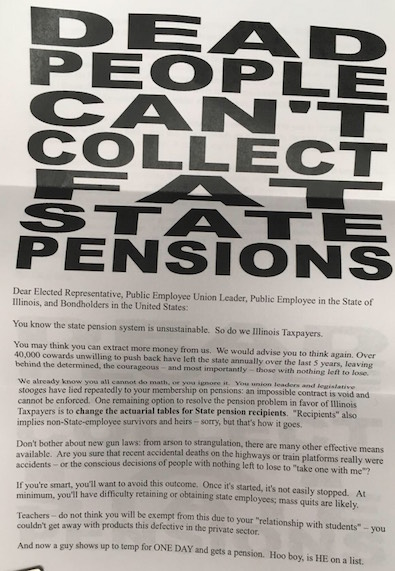

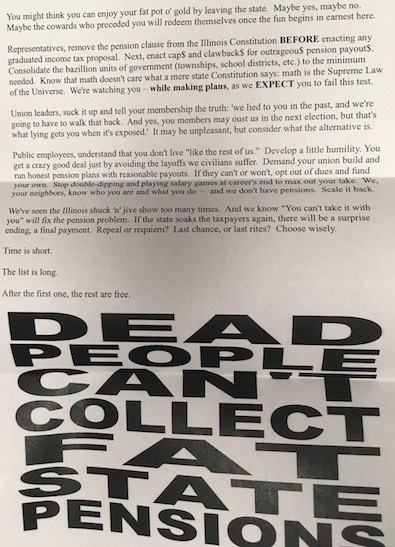

* As I told subscribers earlier today, this letter was sent to several legislators. The Illinois State Police has been notified…

The above letter was postmarked in Champaign.

And people wonder why I’ve been urging a calming of the rhetoric on this topic for years.

*** UPDATE 1 *** Oy…

*** UPDATE 2 *** The IEA got one too The IEA president was only reacting to news of the letter. It didn’t receive one that we know about. The IEA did, indeed, receive one of those letters…

Kathi Griffin, president of the state’s largest teachers’ union, says she’s more concerned getting mental health services for the letter-writer than she is about her own safety.

“People who are well do not make threats like this. And I am hoping that nothing happens to anyone, and I’m hoping that we find whoever this person is, and I hope that we’re able to help them,” she says. “I feel confident that our police will find who is behind this, and I feel confident that this is someone who is acting solo, and I‘m going to be just fine.”

Earlier today, before learning about the letter, Griffin held a press conference to announce the results of a union-sponsored statewide survey. In an unplanned irony, the survey showed that 75 percent of Illinois residents want teachers to receive their full pension payment.

*** UPDATE 3 *** Finke…

The exact number of lawmakers who received the letter is unclear. Senate Democrats said they are aware of one member getting it. Senate Republicans said at least four members got it. Several House Republicans received it said spokesman Eleni Demertzis.

“Several of our members have received the letter, including Leader (Jim) Durkin,” she said. “We receive or are subject to numerous letters of a threatening nature. Unfortunately, it seems the rhetoric and intensity of these letter campaigns has increased in recent weeks.”

I know of two Senate Democrats who received the letter.

104 Comments

|

Rauners put their Winnetka house on the market

Tuesday, Apr 30, 2019 - Posted by Rich Miller

* Dennis Rodkin at Crain’s…

Former Illinois Gov. Bruce Rauner and his wife, Diana, on Monday listed a Winnetka home they’ve owned for more than two decades.

The Rauners are asking just under $3 million for the eight-bedroom, 6,800-square-foot house on Rosewood Avenue. They bought the half-acre site for $830,000 in May 1995, according to the Cook County Recorder of Deeds. They finished construction of the house the following year, the listing from Jena Radnay of @properties indicates. […]

The Nantucket-style house has wood shingles, multiple high roof peaks and a white-pillared front porch. It was “designed to have total privacy while maximizing natural light throughout,” according to Radnay’s listing. Finishes inside include “finely crafted millwork, soaring ceilings and custom glass display cabinets,” it says. […]

The Rauners also have two downtown Chicago condominiums, both in a building on Randolph Street near Millennium Park. They have a 41st-floor unit that they bought for almost $1.23 million in 2008 and a 61st-floor penthouse that they bought the same year for a little more than $4 million, according to the Cook County Recorder of Deeds. Neither of these units was listed for sale as of Monday night.

* Tribune…

The Rauners built the Winnetka mansion in 1996 on land that they had bought the previous year for $830,000. It has six baths, four fireplaces, millwork, high ceilings, a living room with a library, a dining room with a butler’s pantry, a great room, a kitchen with a breakfast room, a roof deck, a master suite with a spa bath and a lower level with a rec room.

The house sits on a 0.51-acre property in a neighborhood just west of Green Bay Road. […]

The Rauners also own numerous other homes around the U.S., including a penthouse co-operative unit at 50 Central Park West in New York City, which they purchased in 2005 for $10 million, and a four-bedroom, 5,370-square-foot mansion on Card Sound in Key Largo, Fla., which they purchased in 2003 for $5.6 million.

43 Comments

|

Caption contest!

Tuesday, Apr 30, 2019 - Posted by Rich Miller

* The governor is holding a press conference today about hemp cultivation…

…Adding… Apparently, people are wearing these shoes for cancer awareness. But we can still have a bit of fun.

28 Comments

|

* WCIA TV…

[Senator Dale Righter, R-Mattoon] characterized the $15 minimum wage law as “economic loss” for his district and for the rest of the state. He also criticized several portions of Pritzker’s budget proposal, including a plan to legalize recreational marijuana.

Since the downstate Republican opposes nearly all of Pritzker’s budget proposals, Righter was asked if that conflict might complicate his ability to barter for capital projects in his district.

Righter says he was not in closed door negotiations about infrastructure projects in a capital spending plan, but the Senator claimed Pritzker administration staffers “have been quoted as saying, ‘You know what, if you don’t vote for some of these policies or if you don’t vote for the tax increases to fund this, then by golly, you can look forward to getting nothing in your district.’”

“I hope that’s just bluster,” Righter said. “I hope that’s just talk and it’s not actually the attitude of the administration. In the end, past administrations or elected officials who have taken that attitude, things wind up usually not working out well for them.”

I’ve never seen any quotes like that in public, nor have I heard any threats being delivered through private channels. Plus, that’s not how every other capital plan has been crafted, so I reached out to the governor’s office.

* Jordan Abudayyeh…

As the governor has said repeatedly, he is committed to passing a capital bill because our state is in dire need of better infrastructure. The governor won’t play political games with Illinois’ future, and he hopes all lawmakers come to the negotiating table in good faith to pass a statewide capital bill.

18 Comments

|

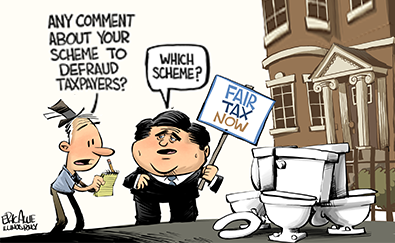

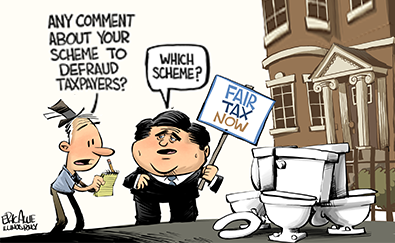

Scheme

Tuesday, Apr 30, 2019 - Posted by Advertising Department

[The following is a paid advertisement.]

Another Illinois governor has drawn the attention of the feds, according to WBEZ.

Four of the last 10 Illinois governors have gone to prison. But this probe is different, because it drives at the core of Pritzker’s policy agenda: making Illinoisans pay what he thinks is “fair.”

The governor’s family took outlandish steps to hide their wealth and lower their tax burden. This hypocrisy reveals reality: Illinois’ middle class will be tapped for future tax hikes when revenues don’t come in as expected under Pritzker’s “fair tax” plan.

Comments Off

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS

SUBSCRIBE to Capitol Fax

Advertise Here

Mobile Version

Contact Rich Miller

|