* Suburban Detroit has jumped into the grab a headquarters game…

A package of incentives worth at least $50 million is being offered to Sears to relocate its headquarters and some 5,000 jobs to the Detroit metropolitan area, two sources familiar with the talks said Friday.

Two potential sites in metro Detroit are being offered to Sears. One is Regent Court, a Ford Motor office building in Dearborn. The other is the former Blue Cross Blue Shield of Michigan complex in Southfield, which is on the market as BCBSM moves employees to downtown Detroit.

Both Wayne and Oakland counties, as well as the Michigan Economic Development Corp., are participating in the attempt to lure the Sears headquarters, the sources said. MEDC had no comment.

The incentives being offered are said to include a mix of tax breaks, relocation grants, housing incentives and more. […]

Kimberly Freely, a spokesperson for Sears Holdings Corp., issued a noncommittal statement Friday. “We do owe it to our associates and shareholders to consider options and alternatives and intend to be very thoughtful and thorough in our deliberations,” the statement said. “Speculation about whether Sears will remain in Hoffman Estates is not fair to our associates, particularly so early in this process.”

* More…

If Sears were to take Michigan up on its offer, it would mark a homecoming of sorts. Sears Roebuck & Co. bought Troy, Mich.-based Kmart Corp. in 2005 to form Sears Holdings.

Gov. Pat Quinn has said he would work with Sears to find a way to keep it from leaving Illinois.

The retailer is among 107 companies that will see tax breaks expire in the next three years, a situation that could lead to a number of defections.

* Jim Thompson was the father of Illinois corporate chasing tax breaks, and he reminisced recently with the Tribune’s Melissa Harris

“I think it would be fair to say, that 25 years later, Mitch Daniels next door has the attitude toward his job — as chief salesman for his state — that I did,” Thompson said. “It’s not just the laws of Indiana. It’s what’s the attitude of the state officials? And don’t leave out the legislature. They have as much responsibility for giving the governor the tools, as he does for using the tools.” […]

The Mitsubishi agreement was enormous, even by today’s standards, totaling an estimated $276.1 million when it was announced in 1985, or about $580 million in today’s dollars. The package included everything from $40 million for job training to $11 million for buying the land and $29.7 million in savings on federal import duties. The Tribune reported that Michigan bowed out of the competition the week before, calling the automaker’s requests “excessive.” But Illinois’ package for Sears in 1989 eclipsed it.

Thompson acknowledged it’s harder for Illinois to play offense today because of the state’s fiscal crisis and underfunded pensions. But he said Illinois can still put together a strong pitch based on its transportation infrastructure, universities, cultural attractions and workforce.

The rest, he said, comes down to personality and instinct — “knowing the people and judging their credibility.” Thompson said he couldn’t recall ever turning down a company threatening to leave; nor could he recall writing job-creation or retention requirements into an incentive agreement. Omitting job requirements is rare in the incentive business today.

* In other news, the Post-Dispatch looks at the costs and other drawbacks of smart grid technology…

Across the country, smart grid projects, especially those involving new digital smart meters, have sparked a backlash. In Texas, regulators were asked to investigate the accuracy of the new meters. In San Francisco, customers are worried about electromagnetic radiation. A few California cities have declared moratoriums on the new meters. Privacy advocates worry about what utilities will do with the data they collect on consumer energy use. […]

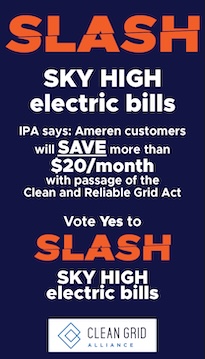

In Illinois, it’s the debate over the regulatory framework being proposed by utilities that’s raising second thoughts. David Kolata, executive director at Citizens Utility Board, a Chicago-based utility watchdog, said the group backs the bill’s smart grid provisions. What it objects to are more sweeping changes in the legislation that could expose consumers to higher rates. […]

But getting from here to there won’t be easy or cheap. The Electric Power Research Institute estimates implementation of a nationwide smart grid will require investment of as much as $476 billion. […]

.

Advancing the smart grid also requires consumers to buy in. And it has been a tough sell so far. Earlier this month, Kansas City-based Black & Veatch released results of an industry survey showing the main impediment to smart grid implementation is a lack of customer interest and knowledge.

Much of the controversy has focused on the new digital meters. Some consumer advocates, like John Coffman, an attorney for the Consumers Council of Missouri and AARP, worry the devices will prove too expensive and need replacement too quickly. Coffman also worries it could make it too easy for utilities to disconnect customers who fall behind on bills.

* Related…

* 10 brands that won’t be around in 2012: The parent of Sears and Kmart — Sears Holdings — is in a lot of trouble. Total revenue dropped $341 million to $9.7 billion for the quarter which closed April 30, 2011. The company had a net loss of $170 million. Sears Holdings was created by a merger of the parents of the two chains on March 24, 2005. The operation has been a disaster ever since. The company has tried to run 4,000 stores which operate across the US and Canada. Neither Sears nor Kmart have done well recently, but Sears’ domestic locations same store numbers were off 5.2 percent in the first quarter and Kmart’s were down 1.6 percent. Last year domestic comparable store sales declined 1.6 percent in the total, with an increase at Kmart of .7 percent and a decline at Sears Domestic of 3.6 percent. New CEO Lou D’Ambrosio recently said of the last quarter that, “we also fell short on executing with excellence. We cannot control the weather or economy or government spending. But we can control how we execute and leverage the potent set of assets we have.” D’Ambrosio needs to pull a rabbit out of his hat soon. Sharex are down 55 percent during the last five years. D’Ambrosio only reasonable solution to the firm’s financial problems is to stop supporting two brands which compete with one another and larger rivals such as Walmart and Target. The cost to market two brands and maintain stores which overlap one another geographically must be in the hundreds of millions of dollars each year. Employee and supply chain costs are also gigantic. The path D’Ambrosio is likely to take is to consolidate two brand into one — keeping the better performing Kmart and shuttering Sears.

* Quinn to sign workers’ compensation reform Tuesday

* Tribune editorial: Conventional wisdom: Whatever it takes. Better union rules are only the beginning. To remain a world-class convention venue, Chicago needs to make sure exhibitors and attendees get good value at every turn. That means reining in operating costs unrelated to trade-union rules. It means improving the McCormick Place experience by tying together the convention floor with mobile applications and social-media innovations.

* Federal government takes over fund with ties to Daley’s son, Patrick

* CTA cuts 54 jobs, details $15M in savings

* Indiana Economy Stronger Than Others, but at a Cost

* Sears to spin off hardware chain Orchard Supply

* Motorola Mobility, RIM having a ragged day

* Emanuel announces plan to expand teacher training program - Academy for Urban School Leadership matches National-Louis graduate students with failing schools

* Chicago test scores up, but officials not satisfied - More kids meet standards on ISAT, but other tests show students are not prepared.

* Troubled West Side School Celebrates a Milestone

- Cheryl44 - Monday, Jun 27, 11 @ 12:36 pm:

So Sears won’t exist by the end of the year, but we’re supposed to ante up big incentives to keep them here.

- OneMan - Monday, Jun 27, 11 @ 12:46 pm:

With all of the issues Sears is facing right now, putting a major move into the mix seems like future fodder for a HBR business case on what not to do.

- RMW Stanford - Monday, Jun 27, 11 @ 12:54 pm:

“If Sears were to take Michigan up on its offer, it would mark a homecoming of sorts. Sears Roebuck & Co. bought Troy, Mich.-based Kmart Corp. in 2005 to form Sears Holdings.”

Small error there, Kmart corp bought Sears to form Sears holding.

- Northsider - Monday, Jun 27, 11 @ 1:00 pm:

Cheryl44 @ 12:36:

My initial reaction was yours, but then I read the story more closely. It suggests the holding company may well keep Kmart open while closing Sears. Since the holding company’s HQ is here, the question becomes, what price do we want to pay to keep them here?

I honestly don’t have an answer to that one.

- Redbright - Monday, Jun 27, 11 @ 1:05 pm:

Here is a website with basic info on the cost of relocation for business employees. http://www.costhelper.com/cost/small-business/corporate-relocation.html

Please do the math and ask yourself whether Sears can afford to move anyone anywhere. And the costs on the website are optimistic in that they don’t include the likely situation of people not being able to sell their IL homes.

- Angry Chicagoan - Monday, Jun 27, 11 @ 1:09 pm:

I hope they transfer the Kenmore brand to KMart if Sears closes. I need vacuum cleaner bags and filters.

As to why the state of Illinois would get all desperate over this failed behemoth of a company, I’m less sure. In 1990, KMart, Sears and WalMart were in approximately a three-way tie for the status of America’s leading retailer, with, as I recall, about $30 billion in annual sales each. Now the combined KMart-Sears is down around 70 percent from that point, while WalMart has grown something like five-fold.

- Sue - Monday, Jun 27, 11 @ 1:14 pm:

The folks who visit this board continue to miss the big picture - ILLINOIS UNDER THE CURRENT GOVERNOR’S POLICIES IS LOUSY FOR BUSINESS- Governors in NY, OH, WI,NJ etc are confronting problems with their expenditures while not raising taxes- Losing 5500 jobs is nothing short of a disaster- the question is can Illinois survive until the next election when hopefully we can get a business minded moderate Republican through the primary?

- Bill - Monday, Jun 27, 11 @ 1:18 pm:

Sue,

You’ll never get a moderate business minded republican through the primary.

- TwoFeetThick - Monday, Jun 27, 11 @ 1:25 pm:

Bill beat me to it. Dillard would’ve creamed Quinn. Though a Dem, I might’ve even voted for him. Instead, Republican voters gave us Bill Brady.

- Old Milwaukee - Monday, Jun 27, 11 @ 1:30 pm:

Sue,

You are exactly right. This board is populated with smart people who want to rationalize why we don’t need these companies, why other Governors are jerks for wooing our businesses and why businesses looking to move are simply greedy or are stupid because they don’t understand that other states are really not better than Illinois.

They want to make excuses for Illinois instead of facing up to the reality that Illinois is not seen as being business friendly by the people who run businesses. And that’s all that matters.

Until we change that, our businesses will continue to be recruited and they will continue to weigh their options. And this will not change until Republicans control some part of government.

- Yellow Dog Democrat - Monday, Jun 27, 11 @ 1:42 pm:

Is the Tribune editorial board reading Crain’s or CapFax?

They came >thisclose

- downstate republican - Monday, Jun 27, 11 @ 2:15 pm:

Sue and Old Maulwaukee

You guys are so right I was telling my husband the same thing about this blog. As small business owners we live this nightmare called the state of Illinois every day just trying to deal with increased taxes, workers comp and unemployment. I can understand why companies want to move if they can I would to if we could but we cannot. We do businesses in Indiana and Kentucky and our employye cost are much lower go figure!!!

- Wumpus - Monday, Jun 27, 11 @ 2:17 pm:

Sears has been on that list for the past 4-5 years.

- Ghost - Monday, Jun 27, 11 @ 3:07 pm:

Rich its time to jump on the bandwagon with something like:

BREAKING NEWS: Rich Miller threatens to move Cap Fax to Wisconsin and take his entire staff with him. Demands 5 million in tax breaks to remain in the state…

- Pat Robertson - Monday, Jun 27, 11 @ 3:55 pm:

More likely would be a headline “Rich Miller offered $5 million to move to Michigan”, and you would have to read to the 3d paragraph to find out that the offer was from the Illinois Democrat and Republican parties.

- Redbright - Monday, Jun 27, 11 @ 4:32 pm:

I do wonder if anyone on this board has ever worked in a corporate office. The (Fortune 500) C-level folks I’ve worked for cared more about the personal income tax than the corporate. A lot lot more - and IL is still cheap.

Except it seemed no one minded whatever the situation was in Calif as long as it was a great place to live and the supply of talent was good.

I missed it if this board discussed the move of Pabst to California from IL. Even the press couldn’t explain it. My guess it is because the press (and others) don’t understand that it can be as simple as that is where the CEO wants to live. Corporate taxes are not a decision factor and other benefits can trump income tax.

IL needs to develop some other benefits and stop harping about taxes. A higher quality workforce is a place to start. It can be built it in 5-6 years and imported even faster.

The City of Chicago has a long-term plan to turn the South Loop area into one big college town. The plan should be speeded up so that education-minded kids are attracted to Chicago.

- Retired Non-Union Guy - Monday, Jun 27, 11 @ 4:35 pm:

Rich,

Hold out for $5M per year …

- Rich Miller - Monday, Jun 27, 11 @ 4:41 pm:

Taking money to stay would be dishonest. Taking money to leave, however…

- Skirmisher - Monday, Jun 27, 11 @ 6:01 pm:

From all I have read in the financial journals, Sears is unlikely to survive another 2 years. I think Michigan may be making another bad bargain.

- Emily - Monday, Jun 27, 11 @ 6:32 pm:

I love Sears. I hate K-Mart. Sigh.

- Retired Non-Union Guy - Monday, Jun 27, 11 @ 7:14 pm:

At least I’ll still be able to get Craftsman hand tools at K-Mart and some hardware stores.

It would be a shame if Sears died off; they were one of the few American corporations who really supported employees in the National Guard during their deployment. Sears did it quietly without publicity just because it was the right thing to do.

- VanillaMan - Monday, Jun 27, 11 @ 7:19 pm:

Competing with Michigan for Sears is like competing with Louisiana for governors.

- Gregor - Monday, Jun 27, 11 @ 9:01 pm:

In the same thread, we have the info that Sears is trying to muscle Illinois for a handout to stay in Illinois, and also that it’s holding company is at death’s door.

I may not be the world’s best negotiator, but I’d say at first blush, Sears is bluffing, taking an aggressive position to hide it’s weakness. I would counter with some modest offer, tied to long-term stays, and parceled out over a longer time.

- chi - Monday, Jun 27, 11 @ 9:15 pm:

Sue-

What would it take for you to realize that NY, NJ and WI all have higher taxes than Illinois? Or that Illinois cut spending by 2 billion this year? What if Quinn switched parties, or if the other states elected Democrats- would that help it to sink in?

- park - Monday, Jun 27, 11 @ 9:38 pm:

Makes sense for Troy, Michigan, just doesn’t make sense for Sears. Too much disruption. Settle with Gov. Wierdo for $20MM and stay.