Behind the TRS headlines

Monday, Apr 9, 2012 - Posted by Rich Miller

* The state government owes the Teachers Retirement System $43 billion in unfunded liabilities, about half of the state’s unfunded pension liability total. The State Journal Register got ahold of a memo sent by Dick Ingram, who runs TRS…

“This painful collision between what is fair and what is real is the outcome of the fact that the unfunded liability has grown to such a level that no one has been able to determine a reasonable plan or expectation to pay down this amount,” Ingram wrote. “If that is the case, the only other option available that would significantly change the amount owed is to reduce past service costs for active members and retirees.”

Changing pension benefits for already retired employees has not been embraced even by House Republicans, whose leader, Rep. Tom Cross of Oswego, has pushed strongly to reduce benefits for people who are on the job now but not yet retired.

But in an interview Friday, Ingram said the state might have to target cost-of-living pension increases for retirees. Retirees now receive automatic COLA increases of 3 percent annually, which is compounded.

“What we’re saying is that the number is so bad is that you have to start having those conversations,” Ingram said. “The reality is that if you look at the pension math, the single biggest cost is the COLA.

“I’m really stuck. I have to say that the math is not trueing up with what is constitutional or fair or earned or whatever else.”

* The Tribune piled on…

[Gov. Pat Quinn and Mayor Rahm Emanuel] were abundantly aware of the startling news that the state’s biggest pension fund, the Illinois Teachers’ Retirement System, now warns that it may need to cut payouts promised to teachers, starting with those already retired.

* Ingram later clarified his position…

In February, I informed the system’s board of trustees that TRS can no longer be confident that the General Assembly will appropriate all of the money to TRS that is required by law. The state of Illinois’ growing budget deficit and the system’s $43 billion unfunded liability is together causing this “new reality” at TRS.

If the General Assembly does not continue to provide all of the funding called for in state law, calculations done by TRS actuaries show that the system could become insolvent as soon as 2030.

Last year, TRS reported that the system’s financial status was good. For the last several years, the state has been able to make its legally required annual contribution to TRS. As long as the state makes that payment, TRS can “tread water” indefinitely and be viable well into the future. The system has carried an unfunded liability since 1953 and has never missed a check.

I told the board that preventing insolvency may include significant changes for TRS. New revenues must be generated, and if they are not, benefits may have to be reduced. Any of these significant changes can only be made by the General Assembly.

* It’s doubtful that the General Assembly would allow the TRS to become insolvent. These were pure numbers games. They’re helpful to policy-makers, but the state’s constitutional requirements on pensions would undoubtedly force the government to write monthly checks to retirees, regardless of the condition of TRS.

For instance, here’s the scenario for the TRS 2030 insolvency…

The FY 2012 contribution is cut to 60% of the original level and stays frozen at $1.4 billion for 37 years

Nobody anywhere is talking about that.

If the state’s TRS contribution is frozen right where it is now, TRS isn’t insolvent until 2038. But nobody’s talking about that, either.

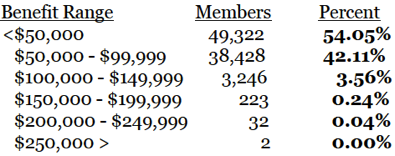

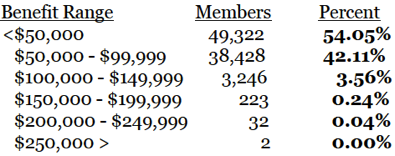

* By the way, TRS has a new chart about benefit levels…

* Related…

* One sentence at core of pension reform debate - State constitution offers guarantee, but Democrats and Republicans disagree on how far it extends

* Quinn on pensions: But future Illinois road projects could be jeopardized unless budget action is taken now, added the governor. “This is our hour, our rendezvous with reality,” said Quinn, citing Medicaid restructuring and pension reform as “the two big budget items we need to focus on in the next 60 days.” The governor used the pension commitment for state transportation workers to make his point. “We need to reduce the $800 million paid in pensions for workers so we have more money for roads.” Workers deserve “a decent retirement but not an extravagant one,” said Quinn.

* Teacher pension funding unfair to Chicago?

* Quinn responds to Topinka budget criticism

* Quinn cuts inspire harsh union ads

* Our View: Horse racing deal key to Rockford casino’s future

* Greg Harris: “Illinois Budget Choices Before Us Are Dire”

- Yellow Dog Democrat - Monday, Apr 9, 12 @ 1:12 pm:

1. Glad Eric Madiar is finally getting his due.

2. Glad SOMEONE is finally writing about the legal facts surrounding this debate.

3. I marvel that ANYONE with a law degree would seriously argue that the Contracts Clause and thus the pension guarantee are not prospectively enforceable.

What they are arguing is basically this: if you hire a contractor to build you a new roof, sign a contract, pay half upfront, and the roofer only does half the work, you’re SOL, because despite having a contract, the only thing you are legally entitled to is what you have already paid for.

The argument is ludicrous on its face.

BTW, don’t hire Sidley Austin to represent you in a contract dispute. If I was opposing counsel, their memo would be Exhibit A.

- wordslinger - Monday, Apr 9, 12 @ 1:15 pm:

With pensions, the sky has been falling for decades. Yet no one has missed a check.

- CircularFiringSquad - Monday, Apr 9, 12 @ 1:18 pm:

Wow no comments on the “biggest issue” of the year. What gives people? Guess the work force is taking a breather

Perhaps Mr. Ingram might have clarified his thoughts a little more with the notion that the GA is highly unlikely to write blank checks to cover pay raises they do not approve or poor investments decisions they cannot impact or new efforts like the handy work of former board members.

- wishbone - Monday, Apr 9, 12 @ 1:29 pm:

I simply don’t understand how you can have a cost of living allowance that is unrelated to say THE COST OF LIVING. COLA’s are there to protect retirees from inflation which could ravage their income not to enrich them beyond what they are entitled to receive.

- Yellow Dog Democrat - Monday, Apr 9, 12 @ 1:49 pm:

@Wishbone-

I can only guess that either you haven’t been near a gas pump lately or you don’t consider transportation to be part of the Cost Of Living.

I’ve always been amazed that the federal poverty guidelines are only tangentially related to poverty, or that stock market valuations are only tangentially related to the actual value of a company.

But, the fact remains that COLA’s are part of the contractual guarantee we made to state employees. Presumably, they were made in consideration of lower starting salaries or some other sacrifice by employees. Regardless, once proffered, pension benefits are guaranteed prospectively, unless Tom Cross, Ty Farhner and the lot have opened up a space-time portal out at Fermi so that state employees can go back in time 15 years and renege on THEIR commitments.

- Reality Check - Monday, Apr 9, 12 @ 2:41 pm:

@Wishbone, the COLA for public employees and retirees hired before 2011 is 3% per year.

For the last 20 years (1992 to 2012), CPI increased on average 3.1% per year.

For the 20 years before that, 11.8%.

20 years before that, 2.9%.

20 years before that, 4.67%.

Any questions?

- Yellow Dog Democrat - Monday, Apr 9, 12 @ 2:59 pm:

@Reailty Check -

So, what your saying is that anyone who retired before 1952 got a “sweetheart deal”, atleast from 1952-72.

Can we round them all up for a public stoning before they turn 110?

- Judgment Day - Monday, Apr 9, 12 @ 5:58 pm:

Tried to see what the annual ROI (Return on Investment) is for the time period where TRS remains ‘in the black’ until 2038. Didn’t see it, probably missed that information on the link. That information will tell me volumes about how realistic the TRS ‘assumptions’ and ‘projections’ are.

Looks like it’s going to come down to a financial version of a caged deathmatch of:

State Pensions/retiree benefits vrs. State Programs/employment vrs. holders of State bonds vrs. substantially higher State taxes.

- DuPage Dave - Monday, Apr 9, 12 @ 6:20 pm:

If the contract clause is meaningless the whole state constitution is meaningless. The ConCon members who wrote that are mostly still alive and can testify to their intent, if it comes to that.

But that one sentence is about as clear as the English language can be. So please, Chicago Trib and the Commercial Club, don’t pretend it’s written in pig latin.

- Arthur Andersen - Monday, Apr 9, 12 @ 7:17 pm:

Judgment, I believe all 3 scenarios assumed an 8.5% average annual investment return.

- wishbone - Monday, Apr 9, 12 @ 7:25 pm:

The consumer price index averaged a 2.5% annual increase from 1999 through 2011. Using a flat 3% so called COLA simply screwed the taxpayers. I am retired and my pension is tied to the CPI which is fair.

- Anonymous - Monday, Apr 9, 12 @ 7:30 pm:

Heard that Mr. Dick has ordered some more ciphering. This time he said let’s figure out what happens if TRS makes 24% on its money for each of the next 20 years instead of the 8.5. Turns out that not only is that nasty unfunded thing go away, but there’s enough dough left over to raise the COLA to 4% and buy every family in Illinois a chicken dinner.

- Judgment Day - Monday, Apr 9, 12 @ 8:29 pm:

“Judgment, I believe all 3 scenarios assumed an 8.5% average annual investment return.”

WHAT?? 8.5%!!! What world are these people living in? Maybe, maybe for 1 or 2 years - if they’re lucky (unless the Fed gets super crazy with inflation). But 8.5% annually ongoing (for 20 years???)…. under these fiscal conditions. Ain’t happening.

Looks like the TBTF ‘Banksters’ are alive and well and are busy running the newest ponzi scheme - IL TRS.

- Anonymous - Tuesday, Apr 10, 12 @ 5:36 am:

I’ve paid my mortgage every month , but I’ve now lost my job, making it extremely difficult to both pay my mortgage and pay my son’s tuition when he starts college next year.I’m sure my banker will agree to lower my payments so I can have what I need to spend on education.

And if the banker is unreasonable, the courts will let me off the hook. Right?

- PublicServant - Tuesday, Apr 10, 12 @ 6:25 am:

@Judgement - Read it and weep - Average stock market returns for different time periods. 8.5% doesn;t look so ridiculous now, does it?

Since 1900 (end-of-year 1899), through 2011, I estimate the average total return/year of the DJIA (Dow Jones Industrial Average) was approximately 9.4% — 4.8% in price appreciation, plus approx 4.6% in dividends. (Some numbers won’t add up due to rounding.)

Since 1929 (year-end 1928 — i.e., before the crash), thru 2011, the return was 8.8% (4.6%, plus 4.3%) [note: see The 1929 Stock Market Crash]

Since end-of-year 1932 (i.e., after the crash): 11.1% (7.0%, plus 4.2%)

The average annual stock market return for the past twenty-five calendar years, was 10.5% (7.7%, plus 2.7%)

Stock market returns for the last 20 years: 9.4% (7.0%, plus 2.4%) [see below for additional 20-year periods]

- Shemp - Tuesday, Apr 10, 12 @ 9:17 am:

The State’s unrealistic rate of return projections are one more reason that the pension funds are worse than they appear. If the funds make anything less than the 8.5%, they are even more underfunded than they look and bound to run out of funds sooner. But if the State lowers their expected rate of return, they’d have to contribute more and well….

- Yellow Dog Democrat - Tuesday, Apr 10, 12 @ 9:44 am:

@Shemp-

Since you obviously havent bothered to read the posts, let me boil it down for you:

The state’s average rate of return on pension investments is actuarially sound.

The COLA for state employees is below the actual CPI.

Go back in history and you’ll find that pension increases and skipped pension payments had bipartisan support.

- dupage dan - Tuesday, Apr 10, 12 @ 11:29 am:

= @ wordslinger - Monday, Apr 9, 12 @ 1:15 pm:

With pensions, the sky has been falling for decades. Yet no one has missed a check. =

Yeah, and all was fine in Hiroshima just before the A bomb exploded (snark).

I wonder who to believe here - especially since I am a state employee nearing retirement. We know the fund has been “underfunded” per some, is paying out massive amounts to folks who worked a few months to get a 100% bump (per some) and is overestimating the rate of return (per some). On the other hand we are told all is well - “hey, the check cleared today”.

No one will ever accuse me of being an expert in this area. To say I am concerned would be putting it too mild.

- Judgment Day - Tuesday, Apr 10, 12 @ 12:24 pm:

“Average stock market returns for different time periods. 8.5% doesn;t look so ridiculous now, does it?”

Yeah, well I’m not concerned about ‘past history’ of return right now. You want to use past history to project 8.5% annual returns over the next 10/20 years, have at it. In these times, that’s on par with Bernie Madoff financing. Remember, housing prices were going up over that same time frame. We’re back to approx. 2002 right now, and it’s even money odds that we haven’t hit bottom yet.

8.5% going forward looks to be totally unrealistic. And that’s going to change the rules for everybody. IMO, don’t bet the farm on that pension plan staying the way it is.

- wordslinger - Wednesday, Apr 11, 12 @ 7:02 am:

–Yeah, and all was fine in Hiroshima just before the A bomb exploded (snark).–

What is that supposed to illustrate?