The bad news gets worse

Tuesday, May 12, 2009 - Posted by Rich Miller

* Oy…

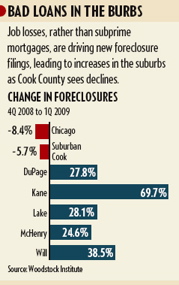

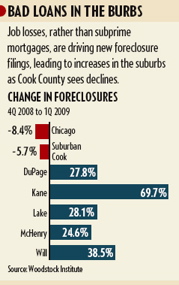

Home foreclosures are surging in Chicago’s suburbs just as they level off or decline in many city neighborhoods already ravaged by mortgage defaults.

Home foreclosures are surging in Chicago’s suburbs just as they level off or decline in many city neighborhoods already ravaged by mortgage defaults.

Foreclosure cases filed in the first quarter jumped between 25% and 70% from the fourth quarter in DuPage, Will, McHenry, Lake and Kane counties, according to new data provided to Crain’s by the Woodstock Institute, a Chicago-based housing advocacy group. Meanwhile, foreclosures fell 8% in Chicago, the first quarterly decline in a year.

Across the six-county Chicago metropolitan area, foreclosure filings rose 6% in the first quarter to 17,819, the highest one-quarter total since the housing crisis began in mid-2006.

According to the article, 9 percent of the homes for sale in St. Charles are either foreclosures or short sales. And while foreclosures are slowing in poorer Chicago-area neighborhoods, mainly because all homes that would’ve been foreclosed have already been foreclosed, they are rising in more affluent areas of the city…

The Near South Side, home to a condominium boom for much of this decade, had a 35% increase in the first quarter.

I thought we’d see far more Statehouse activity on this issue during session. The governor signed a bill in April giving homeowners an extra 90 days before they can be forced out of their homes, but that’s the only major highlight.

* Assessor Houlihand stepped in yesterday with an announcement…

Citing the battered real estate market, Cook County Assessor Jim Houlihan says he’s going to lower assessments on suburban residences, even though they’re not up for reassessment until 2010 and 2011.

With foreclosures and stalled housing values, homeowners shouldn’t have to wait to get relief, he said: “In view of the economy, it is something we must do.”

A few details…

Townships such as Cicero, hit by high foreclosures, will get a 15 percent reduction in assessments. Townships with stronger real estate, such as River Forest, will get a 5 percent cut. Most townships will see assessments drop 4 percent to 15 percent.

This isn’t a tax cut, as the Trib explains…

But Houlihan couldn’t promise that his initiatives would translate into tax cuts for many homeowners, and if they did come, it wouldn’t be until next year.

The reason lies in a tax system so complicated that projections can defy even experts. If assessment levels dip, then schools, municipalities and park and library districts are likely to increase tax rates to compensate. The net effect would be that homeowners could pay the same, perhaps more, even if assessments fell.

Yep.

* Meanwhile, Phil Kadner bemoans the fate of the south suburbs…

Commuting times for south suburban workers are among the longest in the nation.

While the northwest suburbs average two jobs per household, in the the southwest suburbs the average is about one job per household.

Unemployment rates in some areas of the Southland were more than 10 percent before the current national economic collapse.

Dozens of communities devastated by the demise of the steel industry have never recovered. Those high-paying jobs for working-class folks have never been replaced.

* And the Chicago Tribune continues to slam Cook County Board President Todd Stroger’s sales tax hike, and yesterday’s veto of a proposed roll-back. I don’t recall the Tribune explaining how to pay for services if the tax hike is repealed in full or in part, however. You’d think that would be the responsible thing to do.

* Related…

* Economy no joke, even for lawyers

* Todd Stroger stands by sales tax increase

* Todd Stroger veto: Cook County sales-tax hike stays

* Brown: As father’s heir, what else could Stroger do?

Home foreclosures are surging in Chicago’s suburbs just as they level off or decline in many city neighborhoods already ravaged by mortgage defaults.

Home foreclosures are surging in Chicago’s suburbs just as they level off or decline in many city neighborhoods already ravaged by mortgage defaults.

- Vote Quimby! - Tuesday, May 12, 09 @ 9:42 am:

Property tax relief may have to wait, but it is frustrating to understand. I wrote a column in a tiny Illinois newspaper after park board candidates were fighting. Challenger said the park raised taxes because total collections were hgiher, while the incumbent said taxes were lower because the tax rate dropped due to growth. They were both right!

- Cassandra - Tuesday, May 12, 09 @ 9:47 am:

Will the failure to roll back sales taxes in Cook County affect Daley’s and Quinn’s efforts to raise taxes this spring?

Daley seems to have decided not to try–this year. Quinn and his squad of Blagojevich appointees are still advocating for a highly regressive middle class tax hike at the state level, with minimum or no cuts in state government. The great money grab.

Will this be the last staw for Cook County taxpayers, a sizeable chunk of the state’s population, or will they decide it’s hopeless and cave.

Anway, if the Republicans could get themselves off the floor, this massive tax-hiking in the middle of a recession could make for some great campagin commercials in the fall. Especially, as is almost inevitable, some of that money falls into the wrong pockets. Ethics reform still hasn’t happened after all.

- Anonymous - Tuesday, May 12, 09 @ 10:02 am:

Thanks, Rich, for pointing out the obvious. You can’t cut $300 million or more out of Cook County’s budget without dramatic service cuts. There just aren’t that many no-show patronage workers to total that much. For example, even if a payroll accountant at Cook County Hospital got their job through patronage, if you fire them, you’re still going to need a payroll accountant at the hospital. Eliminating “family and friends” may result in better workers, but not much in savings. Some, but nothing nearing $300 million.

- Rob_N - Tuesday, May 12, 09 @ 10:03 am:

“If assessment levels dip, then schools, municipalities and park and library districts are likely to increase tax rates to compensate.”

….er, no. Tax cap laws affect a great many of those bodies which means they can’t just decide to raise rates on a whim to counterbalance a drop in assessments, though Quimby does have a good point.

CPI, a major component of the tax cap formula, was .1% last year. It’s awfully difficult to manage actual hard cost increases against that brick wall (utilities, commodities, increases in minimum wage, etc). Not saying it’s impossible, but still.

- wordslinger - Tuesday, May 12, 09 @ 10:28 am:

Just anecdotal evidence, but the number of “For Sale” signs in River Forest is striking (Oak Park doesn’t allow “For Sale” signs).

Some beautiful houses and estates, and I’m sure they’re priced to sell.

Lot of folks bought high and bet the ranch on that never-ending real estate rise.

- Mighty M. Mouse - Tuesday, May 12, 09 @ 1:13 pm:

“If assessment levels dip, then schools, municipalities and park and library districts are likely to increase tax rates to compensate.”

….er, no, and double NO!!

Local units of government do NOT raise tax rates. Rather, they pass a levy, and approximately one year later the county clerk calculates the tax rates necessary to generate the exact amount the local units of government requested, assuming the tax caps don’t kick in and limit a rate increase.

This is just more smoke-and-mirrors accomplishing nothing from our flim-flam man, the Cook County Assessor, trying to shift the blame as always and make it appear as if he were really a “good” guy.

- curly - Tuesday, May 12, 09 @ 1:32 pm:

State law requires the sum of any county’s assessments to reflect 33% of the the sum of the market values. If assessments come in under this level, a county multiplier is assigned annually by the State Department of Revenue.

All counties, except Cook, assess all property at 33% of market value, so multipliers in these counties are 1.00 or slightly higher, reflecting minor underassessment by the local assessors.

Since Cook County classifies, we have a built-in multiplier, since so many of Cook’s properties are residential, which have been assessed at 16% of market value, even tho that is somewhat offset by commercial (38%) and industrial (36%) assessments. In 2007, the Cook County multiplier was an all time high 2.8439. This multiplier is applied to every assessment in the county, before the application of exemptions and tax rates, to calculate tax bills.

The new county ordinance, proposed by Assessor Houlihan to the County Board to promote “simplicity”, lowers the levels of non-residential assessments from 38% and 36% to 25%, and residential assessments from 16% to 10%. This will have the effect of putting upward pressure on the Cook County multiplier, since both levels of assessment are now even further from the statutory command of 33%, and the commercial assessments no longer offset, but now exacerbate, the overall underassessment. The 2009 multiplier will be calculated in July 2010, and will soar, in my opinion, possibly above 4.00. This can be expected to cause tax revolt when Cook County tax bills are issued in September 2010, right before statewide and county elections. The revolt will occur because people expect lower taxes to result from lower assessments, and their expectations will be frustrated.

The only way to reduce property taxes is to reduce spending. The only significant property tax reform we have seen in the last ten years is Jim Edgar’s property tax extension limitation law that limits non-home rule units to annual 5% or cost of living spending increases. (By the way, I am a Democrat).

- Rob_N - Tuesday, May 12, 09 @ 2:04 pm:

Curly said “limits non-home rule units to annual 5% or cost of living spending increases.”

To clarify, it’s 5% or CPI, whichever is less. CPI hasn’t hit 5% in years.

Again, CPI was 0.1% last year even though a variety of hard costs clearly increased at a greater rate (gas, for one).

Local governments can reduce spending on … what? Utilities can be used less by turning off lights, not running A/C, etc and perhaps cars and vehicles not used as often to save on gas.

Minimum wage increases can be counteracted by not hiring as many school kids for the summer or closing up shop earlier (and opening later).

Commodity increases can be mitigated by using less paper, pens, and other consumables.

But by far the biggest cost in any agency’s budget is going to be labor - salaries and benefits.

How many cops do you want fired in your town? Could a few secretaries or others be let go? Are there too many administrators and managers?

Perhaps… but many local agencies over the last few years have cut to the bone as it is.

You pay for what you get — it’s true in the private sector and it’s true in the public sector.

- Mighty M. Mouse - Tuesday, May 12, 09 @ 2:20 pm:

“Chicago Sun-Times: Break for suburban homes? LOWER ASSESSMENTS | ‘This is not a gimmick,’ Houlihan says, but taxes could still increase.”

H. L. Mencken is said to have noted that “when someone says it’s not about the money — it’s about the money.” Arguing in support of his fellow Arkansan during Bill Clinton’s impeachment trial, former Senator Dale Bumpers offered a variation on that theme: “When someone says it’s not about the sex — it’s about the sex.”

And when Cook County Assessor James Houlihan says “‘This is not a gimmick,” you can be sure it’s absolutely, positively, one big fat gimmick.

- Anonymous - Tuesday, May 12, 09 @ 4:32 pm:

Ditto re Houlihan. This is a total sham.

- jr - Tuesday, May 12, 09 @ 7:25 pm:

This whole Cook County thing is a joke to all that continue to debate this issue (i.e the Chicago Media. In interest of full disclosure I am a Cook County Employee and happen it be an African American Male. However, I don’t live in the 8th Ward, City of Chicago or Cook County. I live in Naperville (fyi On December 5, 2000 a Cook County residency requirement “grandfathered” all residing outside Cook). However, I’m a little upset about the Chicago Media attention and the County Commissioners in this matter. For example, President Stroger did NOT raise Cook County’s Sales Tax to 10.25%. The media knows that isn’t the true. The State Sales Tax is 6%, the RTA Sales Tax is 1%, the CITY OF CHICAGO sales tax is 1.75% and Cook County went from 0.75% to 1.75% the SAME as Chicago. This totals 10.25% in downtown CHICAGO only. If you are in suburban areas it’s not 10.25%. Cook County Government is a government for poor people. Public Safety and Public Health is 90% of the mission of Cook County mandated by the State of Illinois. This is often mandated without any funds from the State. If extra funding were coming from Washington D.C. and/or Springfield there would not be any taxes.

Public Health is the Hospitals and Clinics for Poor People, the majority are minorities. However, as layoffs continue to occur even at the Chicago Tribune lack of insurance would bring you to Cook County’s Health System. For example, when the Blackhawks win the Stanley Cub in June at the United Center (a few blocks away from County Hospital) and god forbid someone is hurt (but lost their job and doesn’t have insurance) they will be a County Hospital. To operate County Hospital revenue has to come. You can name all the political hacks you want to name from the 8th Ward (which is 99% black) but that doesn’t reduce and/or stop any taxes. The media has played this City/Suburban, North Side/South Side, Republican/Demoractic and yes Black/White. Cook County’s Public Safety is the Courts and Jails which in a County as big as Cook about a $1 billion operation. My question on the Health part of it is why the County has to pay the entire cost of its operation. Chicago Residents and as I mentioned earlier residents in the six county area all may use its operation. It was smart for Stroger to rally his base, which don’t believe Preckwinkle will be in it for the long haul the cards are still being moved around. Furthermore, its interesting how the Daleys haven’t said much recently. Please note, that Stroger’s Chief of Staff is from the 11th WARD and most in his top cabinet are white committeeman.