Graphic of the day

Monday, Jun 22, 2009 - Posted by Rich Miller

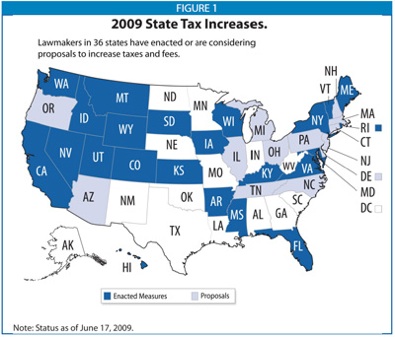

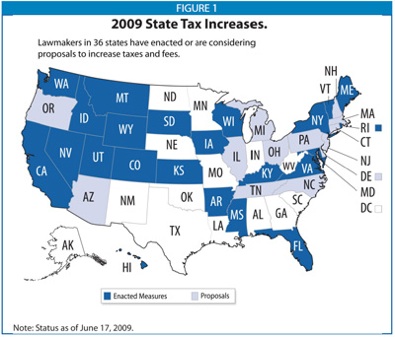

* The Center on Budget and Policy Priorities reports: So far this year, at least 23 states have enacted tax increases, and (as of June 17) another 13 are considering such measures…

From the narrative…

These steps are in addition to revenue actions taken by 10 states in late 2007 and 2008 as the recession’s effects began to be felt. Although some of these measures are relatively small in terms of the amount of revenue raised, others — such as packages enacted in California and New York and under consideration in Oregon — are very significant. […]

Historically, raising taxes in a recession is a common response by states. During the recession of the early 1990s, 44 states raised taxes by a significant margin (at least 1 percent). In the recession of 2001, 30 states did so. These actions increased annual revenue collections by tens of billions of dollars. (States often go in the opposite direction during periods of strong economic growth: 36 states cut taxes from 1994 to 2001.)

More…

Six states have enacted measures that will increase revenues from the personal income tax in fiscal year 2010. These changes include rate increases, the addition of new upper-income tax brackets, and reductions in various credits, exemptions, and deductions. […]

In 2009, 10 states have increased sales tax revenues by such means as raising rates, expanding the tax base to cover previously untaxed goods and services, and administrative changes. […]

At least seven states have enacted business tax increases […]

At least 10 states have increased excise taxes on tobacco and alcoholic beverages. […]

Nine states have increased various fees and taxes related to motor vehicles and fuels

Discuss.

- Ghost - Monday, Jun 22, 09 @ 11:21 am:

Quinn need to lede with stuff like this to draw the argument away from the corruption red herring.

he also needs to run with making the tax hike temporary. And push lgisklaton to ammedn the consitution and put in place an income tax with brackets.

- Anonymous45 - Monday, Jun 22, 09 @ 11:43 am:

As far as I have heard, Gov. Quinn’s tax increase is temporary for two years…

- TaxMeMore - Monday, Jun 22, 09 @ 11:45 am:

“States often go in the opposite direction during periods of strong economic growth: 36 states cut taxes from 1994 to 2001.”

Illinois raised taxes from 1994-2001 while other states did not. How big did the Illinois budget balloon over that time compared to the other states? A lot more than most states. The families in those states can better afford a few more dollars now because of it. Illinois families can not afford to pay hundreds of dollars more now.

How many more Charles Flowers are they going to find? They haven’t even lifted a finger yet to get rid of waste, fraud, corruption, and failed programs that help no one but patronage. Those 23 states with higher taxes this year, have fewer politicians under indictment or in jail.

California has proposed a 5% across the board cut for government union employees along with massive layoffs. Weird how THAT idea doesn’t get play here.

- Downstater - Monday, Jun 22, 09 @ 11:47 am:

Was Illinois one of the states reducing taxes during the economic growth period? If not, why not?

- Greg B. - Monday, Jun 22, 09 @ 11:51 am:

Uh… Illinois raised taxes on alcohol. Shouldn’t it be blue. And the answer isn’t that “Gee, other poorly managed states raised taxes, so it must be ok for us to do so.” The proper thing to ask is “What did Indiana do, or Minnesota, or the other 28 states do (so far) to avoid having to hike taxes.

It’s like you mother said, “Because your friends jumped off bridge doesn’t mean you have to do it, too.”

- Rich Miller - Monday, Jun 22, 09 @ 11:55 am:

===Those 23 states with higher taxes this year, have fewer politicians under indictment or in jail.===

Nevada’s lt. governor was indicted recently, its guv was under a federal probe and its GOP US Senator has a little problem with an alleged payola sex scam.

Florida’s House Speaker was exiled and is now under state indictment and the subject of a federal probe.

New York’s state Senate is deadlocked because of the flips of two Democratic members, and a flip back by one of them. Both are under serious ethical clouds.

Etc.

- Steve - Monday, Jun 22, 09 @ 12:23 pm:

TaxMeMore

“Illinois raised taxes from 1994-2001 while other states did not. ”

Very interesting comment. It’s not something a lot of politicians want to talk about.

- Rich Miller - Monday, Jun 22, 09 @ 12:24 pm:

Steve, correct me if I’m wrong, but as I recall the taxes and fees raised here during that time period went to capital projects.

- VanillaMan - Monday, Jun 22, 09 @ 12:26 pm:

Quinn need to lede with stuff like this to draw the argument away from the corruption red herring.

It shouldn’t be surprising that someone who couldn’t see that something was fishy with Rod Blagojevich’s elections, and supported this guy, would consider corruption in Illinois a red herring.

You don’t put more water into a bucket full of holes. We can expect this General Assembly to take measures to plug those holes before being asked to throw more of our money into to. They have had almost a decade to plug those holes, and they still will not do what any other state government has done during this past decade when their corruption made front page news.

If the GA will not pass meaningful reforms - no money. Considering who they are threatening, I also highly doubt they will carry through with their threats because the threatened folks are those who they depend upon for voters every other year.

Yeah, we’re in mess and it is because of those red herrings flopping around on the Senate, House and Gubernatorial Mansion floors meeting a very bad economic down cycle. They have been screwing us for over three years before the bottom finally fell out.

- Rich Miller - Monday, Jun 22, 09 @ 12:28 pm:

Also, Steve, we had Republican governors and a Republican Senate during that period, and a GOP House for two years.

- Rich Miller - Monday, Jun 22, 09 @ 12:29 pm:

===If the GA will not pass meaningful reforms - no money.===

The problem with that logic is that your idea of “meaningful” and my idea of “meaningful” and Patrick Collins’ idea of “meaningful” and everybody else’s idea of “meaningful” are all different.

- Greg B. - Monday, Jun 22, 09 @ 12:39 pm:

Why would it matter whether taxes were raised for capital projects or GRF? It’s still money, it’s still a tax increase.

- Rich Miller - Monday, Jun 22, 09 @ 12:41 pm:

===Why would it matter whether taxes were raised for capital projects or GRF?===

Because the initial comment implied that it all went to GRF and helped balloon the budget…

===Illinois raised taxes from 1994-2001 while other states did not. How big did the Illinois budget balloon over that time compared to the other states? A lot more than most states. ===

That’s why.

- Leroy - Monday, Jun 22, 09 @ 1:04 pm:

So Illinois is even more of a low tax state than we thought.

- Greg B. - Monday, Jun 22, 09 @ 1:11 pm:

The costs of those tax increases probably did contribute to more GRF spending… albeit on the margins.

And actually, there is only one state budget. Whether you raise taxes to spend more on roads or GRF programs doesn’t matter from an economic perspective. It is an accounting issue. This pot of money is for this and that pot of money is for that…sort of thing.

When taxmemore says “budget” it would be helpful to know whether he means state spending or the GRF. Because depending on how you define things, you are both correct.

- wordslinger - Monday, Jun 22, 09 @ 1:13 pm:

–California has proposed a 5% across the board cut for government union employees along with massive layoffs. Weird how THAT idea doesn’t get play here.–

California is going to empty its prisons, close 200 state parks and enact “painful slashes to K-12 schools, universities, children’s healthcare, programs for the aged and disabled — practically every service the state provides,” according to the LA Times.

Are you proposing that, as well?

- Whatchoo Infer - Monday, Jun 22, 09 @ 1:31 pm:

Quinn really has to change the dynamic of the conversation back to something along the lines of this is going to sting a *little bit*. like getting a shot at the doctor, but that’s WAY better than getting the killer disease the shot prevents. The reason the legislators are all so chicken is that “raised taxes 50%” looks so damaging on campaign literature. They should buck up, and counter with: “I made the tough call and preserved your most essential state services and programs when you needed them most”.

- fed up - Monday, Jun 22, 09 @ 1:32 pm:

Nine states have increased various fees and taxes related to motor vehicles and fuels Blago raised the fees on everthng he could while in office.

- Rich Miller - Monday, Jun 22, 09 @ 1:33 pm:

fed up, to what motor vehicle fee increases during Blagojevich’s term are you reffering?

- Greg B. - Monday, Jun 22, 09 @ 1:45 pm:

Of course the LA Times is reporting that, “California is going to empty its prisons, close 200 state parks and enact “painful slashes to K-12 schools, universities, children’s healthcare, programs for the aged and disabled — practically every service the state provides…”

Because you know… Making office share copy machines, restricting use of state AC, cutting back the bureaucracy, privatizing state services, selling assets, de-regulation and firing regulatory bureaucrats, ending prevailing wage laws and project labor agreements, curtailing extravagant Medicaid services and stop giving money to ACORN and other community organizers would A) require those in charge to sacrifice benefits; B) would require hard choices and priorities and C) could negatively impact political fundraising from the groups and workers using their taxpayer funded pay checks to contribute to incumbents.

Wouldn’t ya know… It’s much easier to extort tax increases in order to forgo closing the Washington Monument than it is to threaten to fire your driver. It’s kind of like when school districts threaten football and the school band to get property tax hikes passed rather than cut some six figure salaries in the super’s office. People tend to care more about the former than the latter and it allows the people who care more about the latter than the former to keep their cut of pork.

- SangamoGOP - Monday, Jun 22, 09 @ 1:54 pm:

Where’s the cool graphic of the states that have cut government spending? Where’s the cool graphic of the donor states and recipient states of federal tax dollars?

Really, if all the CPBB can come up with is “government by peer pressure”, let’s see all of the color-coded maps.

- Rich Miller - Monday, Jun 22, 09 @ 2:08 pm:

===Where’s the cool graphic of the states that have cut government spending? Where’s the cool graphic of the donor states and recipient states of federal tax dollars?===

If you had clicked through, you might have seen this link

- Rich Miller - Monday, Jun 22, 09 @ 2:09 pm:

State budget cuts are here.

- Rich Miller - Monday, Jun 22, 09 @ 2:12 pm:

===Uh… Illinois raised taxes on alcohol. Shouldn’t it be blue.===

Not signed into law yet.

- fed up - Monday, Jun 22, 09 @ 2:24 pm:

didnt Blago raise the fees on Lic plate renewls, Drivers Lic, along with FOID cards and most proffesional lic.

- Rich Miller - Monday, Jun 22, 09 @ 2:26 pm:

No.

Ryan did the drivers fees (for the last capital bill a decade ago). Not sure when the last time FOID card fees were raised, but RRB promised a billion times never to do it. And he didn’t.

- Greg B. - Monday, Jun 22, 09 @ 2:27 pm:

Rich,

By far very little of the stimulus money has reached anyone, last I heard. And the budgets are balanced on paper, we’ll have to wait and see before passing verdict. And while 2 states “suggest” that’s its working, prudence tells us 2 out of 50 isn’t a lot to go on…

CPBB as their want are also doing some serious cherry picking on the wage and unemployment stats. They, in fact, aren’t very convincing when one considers that the national average of unemployment is the best those states could do and 2) incomes go up statistically when people lose jobs because it’s low wage workers who tend to go first.

Hiking taxes aren’t the answer to economic downturns (as a side note, the idea of Keyensian multipliers, today, has Keynes rolling in his grave). I mean if taxes are the answer, then why so little? why not take it all? And surely, your not going to pull out the laffer curve to justify that taking it all would hurt the economy…

- Rich Miller - Monday, Jun 22, 09 @ 2:29 pm:

===I mean if taxes are the answer, then why so little? why not take it all?===

Specious logic alert.

Move along, please.

- Anonymous - Monday, Jun 22, 09 @ 2:36 pm:

It seems to me lately many on this board have become such a proponent of a tax increase, they dismiss any argument that asks for at least a modicum of review prior to a tax increase. Maybe the State must have a tax increase to prevent catastrophic cuts, but surely pension reform, a careful review of each budget line item, and an elimination of the pork in the capital bill (transfer the money from those legislative initiatives that are not related to infrastruture to the GRF) and a complete freeze on new programs prior to a 50% tax increase is the least the Illinois taxpayers deserve.

- fed up - Monday, Jun 22, 09 @ 2:39 pm:

Rich sorry for posting from another blog. I seem to remember a lot of up roar about blago raising fees on many state services.

Sen. Dan Rutherford’s blog

Legislative Update

Posted April 5th, 2006 at 01:42 PM by Sen. Dan Rutherford in *Uncategorized

We are in the final stretch of the Spring 2006 Legislative Session and Governor Blagojevich is at it again. He is trying to take money from dedicated accounts to use for other purposes. He attempted this in the past, but was blocked.

You may know that the Blagojevich Administration raised hundreds of fees from Camping to Nursing Home Licenses and Boat Registration to Trucking. After raising these fees, the Governor said there were excess funds in those accounts and he is making the move to “sweep” money from them to use for other purposes.

The State Treasurer has not authorized the transfer of funds out of those dedicated accounts. Governor Blagojevich is trying to pass legislation to force the Treasurer to move money from specific purpose accounts, which specific fees were paid into to fund those activities, into general spending.

As examples, Gov. Blagojevich wants to take money from the Youth Drug Abuse Prevention, Illinois Veterans’ Rehabilitation, Military Affairs Trust, Youth Alcohol & Substance Abuse Prevention, and Trauma Center Accounts.

To see a complete list, go to http://www.committeeforlegislativeaction.org/hb2316.asp

The effort is embodied in HB 2316. There are 176 funds which would be swept and the Bill is likely to be voted on before this Spring Session adjourns.

If you care to e mail the Governor on this matter, you may do so at: governor@state.il.us

A number of years ago I launched the ‘Committee for Legislative Action’ (CLA) to help keep people informed about legislative issues (such as Governor Blagojevich sweeping dedicated funds). CLA has graciously agreed to let us use their network to spread the word about the Governor’s plan.

Please join in expressing your opposition to Fee Increases and these types of sweeps. You may do so at the CLA Website: http://www.committeeforlegislativeaction.org/SignPetition.asp

- Greg B. - Monday, Jun 22, 09 @ 3:01 pm:

It is specious logic. A British policy maker once defended a 99% tax rate on the idea that people would work that much harder for the extra 1%.

If its specious logic it’s also logic that European welfare states have operated on for decades. It’s a direction many in the US want to see us go.

And doesn’t the Senate tax plan as passed take more than Quinn’s?

- Rich Miller - Monday, Jun 22, 09 @ 3:04 pm:

Greg, pointing out one unnamed British loon to make your point only underscores the specious nature of your logic. And even that loon didn’t ask for 100 percent taxation.

- Steve - Monday, Jun 22, 09 @ 3:19 pm:

Rich, your point on Republicans is 100% true.The facts are the facts. No doubt Republican Governors have raised taxes in Illinois. Some taxes dollars have gone to capital projects. No doubt . But, the bottom line is taxes have gone up overtime in Illinois. Can they continue to go up while many in the private sector’s wages are going down? If you want taxes raised you don’t need Jim Edgar or George Ryan style Republicans: vote Democratic. At least the Democratics don’t pretend to be something they aren’t

- VanillaMan - Monday, Jun 22, 09 @ 3:26 pm:

The problem with that logic is that your idea of “meaningful” and my idea of “meaningful” and Patrick Collins’ idea of “meaningful” and everybody else’s idea of “meaningful” are all different.

How about just trying? They haven’t!

- Anonymous - Monday, Jun 22, 09 @ 3:28 pm:

I don’t care what party is in the Majority, we don’t need to raise taxes. If we don’t have the money then we need to cut. Just like I do at home. it hurts for a little while but you live through it and learn to live within your means.

- fed up - Monday, Jun 22, 09 @ 3:56 pm:

” At least the Democratics don’t pretend to be something they aren’t.”

Clinton pretended not to be an adulterer, Blago pretended not to be a criminal, Roland Burris is doing alot of pretending, Charlie Rangel pretends not to understand the tax laws he supposedly helped write, Obama pretended that he was going to open up govt,But still refuses FOIR for who visits the white house pretended he was not going to hire lobbyist except well the one he hired. Lots of pretending to go around.

- Greg B. - Monday, Jun 22, 09 @ 4:19 pm:

Well… Harold Wilson defended his 83% tax rate in GB stating that it would make people work harder for the other 17% and he was Prime Minister. While I can’t find the particular loon at the right rate, right now, I think we can safely say that the attitude exists.

And I’d note my words above, “It is specious logic.” But I’m not the one making the argument that higher taxes will help the economy. CPBB is.

- CircularFiringSquad - Monday, Jun 22, 09 @ 4:21 pm:

How can all these states need tax hike when the problem is All the IL Ds?

Hmmmm..Guess StateWideTom blew it — again.

- Ghost - Monday, Jun 22, 09 @ 4:30 pm:

=== It shouldn’t be surprising that someone who couldn’t see that something was fishy with Rod Blagojevich’s elections, and supported this guy, would consider corruption in Illinois a red herring. ====

Me? Support Blago? not sure what you base that upon. Not that it matters, but I voted for Jim Ryan and then JBT. but coruption in the state is very much a red herring from the need to pay for the States fiscal crisis. Everything blago did was illegal. He did it anyway and now he looks to be going to jail.

We still have the bills to pay.

- TaxMeMore - Monday, Jun 22, 09 @ 4:31 pm:

-California is going to empty its prisons, close 200 state parks and enact “painful slashes to K-12 schools, universities, children’s healthcare, programs for the aged and disabled — practically every service the state provides,” according to the LA Times.

Are you proposing that, as well?-

If the people can’t pay for those things, they can’t pay for those things. Illinois can’t print money like the Fed.

Although it is silly to talk about cutting those things when plenty of other things could be considered first. Illinois Sports Facility Authority whatever. Sell the stadiums, not to mention stop subsidizing them. If Chicago can afford $1 billion for the Olympics, they can afford $1 billion cut from state. End horse racing subsidies. End ALL entertainment subsidies. Sell the Governor’s mansion in DuQuoin. If we closed parks, maybe the entire marketing and advertising budget of the state could be cut too. Cut legislators and staff pay by 25% immediately and require them to pay for more of their benefits packages. Complete hiring freeze until anyone can figure out what promises the state can make going forward toward pensions and benefits. Sell the state’s air travel fleet and most of the passenger car fleet. There’s a lot of no-brainer things to consider cutting first.

But but but but but that doesn’t add up to $10 billion. That’s no excuse for ignoring those things could probably be cut.

Someone mentioned a careful review of each budget line-item. Exactly. Put it online too. Cullerton, Madigan, and Quinn obviously are not able to do it, so let the collective intelligence of the citizens of Illinois give some help.

They are making budget deals in back rooms, promising pork and initiative money and waste right now. Negotiating this budget behind our backs then crying into the microphone they are broke. The entire system should be opened up before they raise any taxes, but yeah, at least making an effort to get rid of obvious luxury items would give them an ounce of cover for a tax increase.

- Arthur Andersen - Monday, Jun 22, 09 @ 6:59 pm:

I have been pretty solidly in the corner with those who have said that State Government has been cut to the bone, and that we are due, if not past due, for a general tax increase just to cover the basic and essential State services.

The shrill and often loony, to borrow a word, “Cut-Cut-Cut” rhetoric put forth from the anti-tax crew has been particularly grating this go-round, or maybe it’s just AA’s advancing age.

The more I watch things unfold, though, the more I think that the “Cutters” may have a point.

The list of absolute joke projects (and the general means for how the dough was handed out) in the lege. pork bill is one fine example of spending money we don’t have for things we don’t need.

As only he could point out, Bill Black is also spot on when he says that Lincoln’s Challenge doesn’t need a new building if it’s de-funded. (The un-ending snark from The Speaker’s kids about how this is all Tom Cross’s fault is also getting old, and I’m not a big Cross fan.)

Mayor Daley appears to be on another planet, if not in another state, with his open-ended commitment to the Olympics. (”Don’t trust me-trust the insurance salesman here next to me who has it all figured out.”)

The Lite Guv has completely blown through the enormous goodwill he had just a few months ago. From the bad staffing choices to the total FUBAR on budget presentation to the Reform Lite Commission, the guy has not failed to disappoint. High Speed Rail? Does that mean Amtrak loses the money faster or what? Pat-we’re broke. No new trains or planes, k?

Why should this cast of characters be essentially given a pass on several tough budget votes in exchange for one tough tax vote? I’ve read the TAB report and respect Schnorf’s opinion on the potential for savings.

However, $200 million in savings is at this point like the punchline of that old lawyer joke-a good start. If the price for a tax increase is more overhead cuts, they may have to appear.