Our (painful) graph of the day

Tuesday, Feb 23, 2010 - Posted by Rich Miller

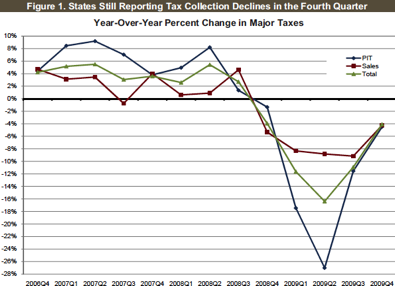

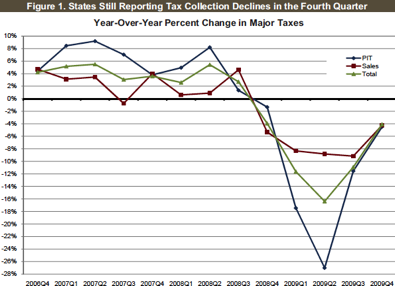

* Click the pic for a better look at this graph of year-over-year revenue receipts for major taxes. The blue line represents personal income taxes, the green line is total tax collection. This is for all states…

Yikes.

The graph is from the Nelson A. Rockefeller Institute of Government, which claims that Illinois’ tax receipts in the fourth quarter of last calendar year plunged 6.9 percent compared to the same quarter a year earlier.

From the dot points…

This is a record fifth consecutive quarter that total tax revenues and collections from two major sources — personal income tax and sales tax — declined on a year-over-year basis.

Oof.

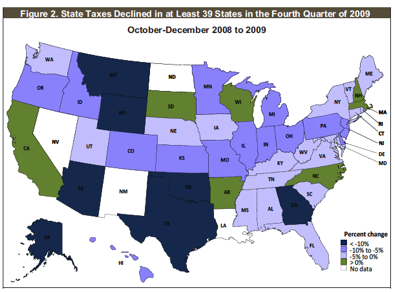

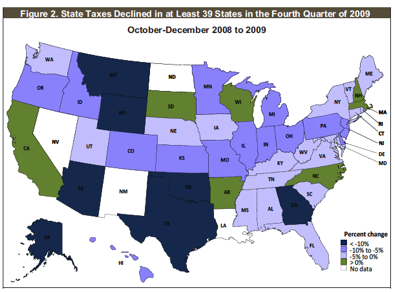

* A map showing how individual states fared. Again, click the pic for a better look…

The gloomy national state budget outlook…

Despite indications that the national recession may be over, the revenue situation remained gloomy in most states in the fourth quarter of 2009. Many states have been reporting shortfalls in revenue compared to projections used for this year’s enacted budgets. While stock indices are well above their lows and some other indicators point to strengthening in the economy, overall conditions remain weak. Nonetheless, retail sales and consumption have stabilized and we expect more states to begin seeing year-over-year growth in some revenue sources over the next few months, particularly the sales tax.

However, even with growth, tax revenue is likely to remain below its prerecession peak for quite some time. State tax revenue will continue to be insufficient to support current spending commitments, and more spending cuts and tax increases are most likely on the way for many states — particularly those that did not take significant actions to balance revenues and expenditures in their FY 2010 budgets.

Sound familiar?

Go read the whole thing.

- Fan of the Game - Tuesday, Feb 23, 10 @ 12:13 pm:

I’ve been saying for some time that since Stimulus funds to states are drying up, states will need to make cuts. That means school districts and colleges and municipalities will need to make cuts. That means that personal income tax receipts will continue to decline.

This will be the second wave of economic downturn. I don’t think it will be as deep as the last, but it will be felt.

- Blaise Pascal - Tuesday, Feb 23, 10 @ 12:21 pm:

What a terrible graphic, the ranges overlap and I can’t tell the difference between a -5% light blue state vs. a -5% pastel blue state. No wonder these economists got things screwed up.

- wordslinger - Tuesday, Feb 23, 10 @ 12:29 pm:

The full report is more depressing than the graphics.

The states that are in the “green,” meaning that that they experienced some growth, either raised some taxes or the increase was attributed to some posting glitches.

The one bright spot is that we might not hear the usual nonsense about the “wonder states” and their abilities to “create jobs.” It’s a national problem here. It’s worse in Europe.

- steve schnorf - Tuesday, Feb 23, 10 @ 12:31 pm:

I see another message. In terms of what has happened to us, we are no worse off than most other states, but in terms of where it has left us, we are far worse off. Ergo, we haven’t dealt with it as well as most other states.

- PalosParkBob - Tuesday, Feb 23, 10 @ 12:46 pm:

This seems to provide a clear indication that expanding school reliance on state income tax funding is a fool’s journey.

While school districts are having to deal with late state payments for general state aid, the blow is lessened because real estate taxes continue to rise at at least the rate of inflation regardless of declines in real estate value.

Had we passed bills such as HB750 that would have massively increased income taxes “for education” and would have “swapped” income tax dollars for real estate reductions, schools would have had a less stable revenue stream and would have much greater cash flow issues.

If ever there was a case against increasing reliance on income taxes to fund education, certainly this is it!

- Gregor - Tuesday, Feb 23, 10 @ 12:50 pm:

I get it that if you raise taxes, the economy slumps and you don’t quite get all the taxes you expected. So you may need to hike the tax again, or set it higher in the first place, in anticipation… and there you get a spiral.

I think the way you counter that is that you HAVE to turn that tax revenue around, whatever the amount is, and put it to work ***immediately***, no messing around. Between the promises of a mini capital bill, or any capital bills, and the actual hands-on construction beginning, is a very long time to wait, where people start to count too far ahead on that stimulus. Like the line from the old song by the Vogues: “Livin’ on money that I ain’t made yet”.

Budget cuts or at least “level spending” are part of it too, but this hole is just too deep to climb out using cuts alone.

- Ghost - Tuesday, Feb 23, 10 @ 1:00 pm:

For all the cut tax people lets review shall we:

Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming have no income tax. Two others, New Hampshire and Tennessee, tax only dividend and interest income.

Three of the six states building their economies with no axes on the citizenry are in the worst shape, while another reported no data. Of the 7 worst staes, 3 have no income tax! So the no income tax states by percentage are doing substantialy worse then the states with an income tax.

Apparently no taxes do not create bountiful spending and money to operate the State.

- Fed up - Tuesday, Feb 23, 10 @ 1:05 pm:

If we have to raise taxes because revenues are down, why didnt Quinn and Madigan cut taxes in 07 when revenues were higher year over year. Their may be a need to raise taxes but 66% is just outrageous. Changes to pensions, and eliminating and consolidating some state offices and most state Boards and commissions needs to be done. This is a decades long mismanagment issue being outed by a decline in revenues.

- VanillaMan - Tuesday, Feb 23, 10 @ 1:27 pm:

There are 50 states. Not all the states are fairing similarly. Pointing out that the Great Recession effected us nationally, doesn’t mean the 50 states were effected equally. The difference among the states should be noted. States like California, Illinois and New Jersey are not in a similar fiscal condition as is Utah, Florida or Texas.

We should find no comfort in knowing that other states are also stumbling. There are no excuses for our own fiscal mismanagement.

When times are flush, we can cover up our mistakes with money. In times like these, we have to look at these mistakes, fix them and ensure that they are not repeated.

When this recession is over, we will still have massive debts to pay off from before the recession, plus the debts incurred during the recession. What kind of revenue growth will Illinois need to return to where it was twenty years ago? How realistic is it to expect that growth?

Propping up failing businesses, or trying to draw businesses from other states doesn’t answer the problem that has caused the decline of business growth in Illinois over the past twenty years. Every business has a cycle of birth, growth decline and death. If Illinois is not growing new businesses, we will lose everytime the Grim Reaper shows up to take away one of our former great businesses. Illinois has to become a fertile soil for new private industries.

We have to take advantage of the Great Recession to stop and realize that growing government doesn’t produce revenue - it eats it. Governments are non-profit. They don’t make money. The more we demand of government, the less we have. The only consolation is the fact that there are lawyers to ensure that you get a fair hearing if you discover that your slice of the dwindling pie is smaller than your neighbors. But eventually, there is more demand than pie and we end up arguing once more.

We made everything in Chicago a Century ago. Now three of the top four employers in Chicago are taxpayer based. This situation will eventually eat itself, and right now it is doing just that.

We’re broke. This doesn’t work anymore. It is time to change the status quo.

- 47th Ward - Tuesday, Feb 23, 10 @ 1:35 pm:

VM,

Never have so many words been used to say so little.

- Ghost - Tuesday, Feb 23, 10 @ 1:42 pm:

Fed Up it worse then that. The State has seperated several previosuly consolidated agencies, Gaming, Insurance, Racing etc increasing the costs for operating those agencies. They now have a bill floating around to seperate off Liquor and who knows what else to create yet another increase in operating costs and payroll.

- GA Watcher - Tuesday, Feb 23, 10 @ 2:01 pm:

Just came from a meeting at the Federal Reserve. Its economists predict state and local revenues will not rebound for another 2 and a half years.

- dupage dan - Tuesday, Feb 23, 10 @ 2:33 pm:

Ghost,

=Apparently no taxes do not create bountiful spending and money to operate the State.=

I think you have the whole “no-tax” thing figured out wrong. States that do not tax their citizens leave more money in the hands of its’ citizens, allowing the citizens to decide where to spend it. Since it is unlikely these citizens will send any of their hard earned money to the state voluntarily, the state won’t have any of these funds at their disposal. No funds to operate the State is true, but the state doesn’t create jobs - can’t create jobs. Not the real type that act as money multipliers which create more jobs. Only business can do that. Spending by the state does not create jobs. Get it?

- cassandra - Tuesday, Feb 23, 10 @ 2:38 pm:

I believe only about 1/3 of the federal stimulus monies have actually been disbursed, meaning there are many more billions to come. A jobs bill is in the works, although much smaller than many had hoped.Federal education funds will be available for those states that meet certain criteria, among them, I believe, not letting teachers unions run everything in education.

In their relentless pursuit of a forever income tax increase on the middle class, Democrats seem not to want to talk much about these and other types of federal relief on tap or soon to be. In addition to being very vague about what cuts they have made and what federal largesse is on the way,Dems haven’t been shy about protecting special constituencies like unionized state employees (no layoffs before June,2011, no furlough days either). If things are that bad, wouldn’t you think Quinn would retain some flexibility with respect to the size of the state workforce. Yet, he’s hiring away, and not just

on the front lines. State agencies are multiplying themselves (and staff, especially expensive administrative staff), new state buildings are reportedly in the works, legislators continue to think up new and expensive ways to spend our money–and advocate for large sums to support these ideas.

Just because the budget goes online tomorrow doesn’t mean it’s instantly transparent and we’ll roll over and give up our cash. We should still insist on shared sacrifice, and so far, middle class taxpayers (and corporations, maybe, although we’ll see) are the only ones likely to be tapped for the sharing.

- Just the Facts - Tuesday, Feb 23, 10 @ 2:43 pm:

So are VanillaMan and Cassandra really bots?

- Responsa - Tuesday, Feb 23, 10 @ 3:01 pm:

So nobody seems to have had the political will to stop Blago’s silly free rides for seniors, but suddenly there’s going to be the political will to raise the income tax to 5% and vote to make retirees pay income tax on their pensions and retirement funds?

- PalosParkBob - Tuesday, Feb 23, 10 @ 3:25 pm:

VM, well said, even if excessively loquacious.

It should be noted that the states where revenues are down, yet have no income tax, are highly dependent on certain segments of the economy.

For example, Florida revenues are highly dependent on the tourist industry, which really takes a beating during a nationwide recession. Their taxes are essentially paid by people from out of state, lessening the burden on their citizens.

Texas and Oklahoma make their money exporting energy and having the energy industry’s customers foot the bill.

Likewise for other troubled plains states.

Perhaps a more important and telling map would show which states have developed a sufficient “rainy day fund” with adequate cash reserves to weather the cyclical lows their revenue streams periodically suffer.

Anyone know which of the states have adjusted spending and saved enough of a reserve to avoid complete collapses in states like Illinois and California?

- VanillaMan - Tuesday, Feb 23, 10 @ 3:50 pm:

Just because the arguments are so familiar doesn’t make them wrong. Your dismissal of these arguments, however, are.

- 2010 - Tuesday, Feb 23, 10 @ 3:50 pm:

I agree with VanillaMan that when times are really good…is the government going to give us tax breaks? Or keep taking?

Once the government taxes you, forget it, you will never see that money again.

The system needs to be corrected now so once the deficit is paid and revenue is positive in this state we put monies away so you do not go back to the population and tax it again.

The state also needs to learn its lesson as the main funder for various not profits and organizations so when there are tough times - because we know there will be in the far, far future - these not profits and organizations have other funding streams to keep them afloat. Not just the taxpayer.

- Justice - Tuesday, Feb 23, 10 @ 3:55 pm:

I am not surprised by the outlook and the information Rich. I stopped spending 2 years ago and only spend on neccessities. With unemployment compensation being my only income it is only going to get worse. Quinn is paying his people from other agencies budgets and is still hiring expensive PSAs, while union and front-line workers are being laid off. It has sickened me to a point where moving to another state is my only option.

- dupage dan - Tuesday, Feb 23, 10 @ 4:03 pm:

Justice,

Sounds like you are in one tough spot. I wish you the best. Since the graph above shows many states in trouble, which one would you move to? While Wisconsin shows a little better situation I can tell you from personal knowledge that it ain’t cause they are rolling in $/jobs.

Good luck to you.

- cassandra - Tuesday, Feb 23, 10 @ 4:21 pm:

While the legislature could pass a time-limited tax hike there is no way that we could be certain they wouldn’t extend it. I don’t believe it is legally possible to lock in a one or two year only hike. So if you vote for an income tax hike, even if presented as short term, you have to assume it’s permanent. Given the state’s history of corruption and casual disbursement of state funds for political gain, that would be hard for many to do.

Justice, you are misinformed on the layoffs. Recently, Quinn signed an agreement with AFSCME not to lay off any state employees before June 2011, excepting only a very few whose layoffs were in progress when the agreement was made. In exchange, union members agreed to a delay in the disbursement of a small portion of their current negotiated raises (16 percent over the four year contract) Most state employees are covered by AFSCME. Front line state government workers are not being laid off. Front line nonprofit workers–maybe. I don’t know that anyone is collecting the numbers.

Unionized state workers are not required to take furlough days either. For better or for worse, this Democratic governor has clearly made the decision to remove the state bureaucracy from the “shared sacrifice” table.

- Just the Facts - Tuesday, Feb 23, 10 @ 5:04 pm:

The Illinois numbers are interesting. The rate of decline in corporate income tax collections and personal income tax collections slowed considerably from the third to the 4th quarter of 2009. However, the rate of decline in sales tax collections maintained relatively the same steep rate of decline.

It would be interesting to know the opinion of the state revenue folks as to their opinion of the difference in the rates of decline between sales tax and income tax during the fourth quarter. Fourth quarter income tax collection numbers include estimated tax payments for corporations, but no estimated tax payments are due for individuals in the fourth quarter. So, perhaps in the case of corporations they didn’t make much in the way of estimated payments in 4th quarter 2008 because things had already tanked by then. Perhaps in the case of individuals since they don’t have estimated payments due in the fourth quarter and most payments would be from the individuals who file on a fiscal year basis there just is never much in the way of receipts in the 4th quarter.

Schnorf would probably know the answers as to whether my speculations are off base.

By the way Vman, there is a difference between argument and blather.

- Justice - Tuesday, Feb 23, 10 @ 5:12 pm:

Or should I say the real “Justice.” If they want to use my handle please let me know. I had intended on changing it just as soon as Blago went to prison….

Okay…..Where in the world did this come from “….Despite indications that the national recession may be over,….” This has been mentioned before but it can’t possibly be based on fact. Where are the jobs? Unemployment is still at an all time high and we are fixen to get hit with the 5-year ARMs coming due next month or so. This recession is worsening and they keep trying to run the ‘it’s getting better folks’ routine. All I can say is you had better be keeping a very close eye on your retirement funds or any cash funds. When things get really nasty, they too might be in jeopardy.

The fact that other states raiseed their taxes doesn’t mean we should follow suit. The fact that our taxes are lower than others doesn’t justify us raising taxes.

We must slam the door shut hard on spending. It will be painful and we will take five to seven years to recover. We can but we must accept the pain now…..and vote ALL incumbents out…both parties!!

- dave - Tuesday, Feb 23, 10 @ 5:31 pm:

** I don’t believe it is legally possible to lock in a one or two year only hike.**

Yes it is.

- Angry Chicagoan - Tuesday, Feb 23, 10 @ 6:10 pm:

Are we even counting GDP right if the state tax revenues are still going down so fast? These numbers simply do not square with the reported GDP in the 3rd and 4th quarter. Are the proceeds from the stimulus to contractors, workers etc. going as directly into debt pay-down as the proceeds from a tax cut could? If so, given the level of consumer and corporate debt the government is going to have to do a lot more simply to keep things on life support.

- Angry Chicagoan - Tuesday, Feb 23, 10 @ 6:13 pm:

@Just the Facts; didn’t see your post before I hit send. I think there’s a bit of stimulus activity going on. Workers benefiting from stimulus money are being paid, but they’re avoiding discretionary spending — namely, what the Illinois sales tax covers. Just their housing, basic services, groceries, all of it mostly or entirely non taxable under the sales tax. States with a broader based sales tax will probably see the sales tax recover more quickly but still, a good many of the basics whose consumption is mandatory, like housing and groceries, are tax-free for the most part.

- duh - Tuesday, Feb 23, 10 @ 6:13 pm:

Well, duh, when people do not have jobs (10%) unemployment in this state, factories closing, new businesses look the other way, can our lawmakers not see what is going on here? If you are unemployed you pay no income tax and you have very little money so you don’t got out to eat, movies, buy cars, appliances-surely one does not need a Harvard degree to see this.

- Rick - Tuesday, Feb 23, 10 @ 6:34 pm:

The state finances are in the toilet due to our legislature’s poor stewardship.

One Illinois Governor in prison and another one on his way.

State services and state payments have slowed to a crawl.

But hell at least you cant text while driving now. Cheer up everyone.

- steve schnorf - Tuesday, Feb 23, 10 @ 6:37 pm:

Dave, theoretically it is, but a General Assembly can’t bind a future GA thru statutory language.

- Park - Tuesday, Feb 23, 10 @ 7:06 pm:

Guess it’s time to cut programs. Good luck with that in an election year.

- NO JUSTICE - Tuesday, Feb 23, 10 @ 8:22 pm:

Justice is that better? Cassandra…please get your facts straight there are over 200 that have been and will be without jobs on 03.15. I know what I am talking about! And to add insult to injury Quinn hired 4 more PSAs ($90,000 plus) and has bought the agency I work for NEW FURNITURE AND LEASED A NEW BUILDING.

- Anonymous - Tuesday, Feb 23, 10 @ 10:30 pm:

Dupage dan,

so private citizens build highways, the internet and provide for the military etc.

huh who new, and here I though government created all those jobs.

silly me for not knowing about jobs the way you do. good thing we have this privatley funded internet to use to discuss these things….

- PalosParkBob - Tuesday, Feb 23, 10 @ 11:48 pm:

We’ve had this discussion before regarding a temporary tax increase to dig us out of this hole after pared down and sustainable spending plans are established.

A temporary tax to fund a specific purpose is legal, as the pork laden “capital bill” attests.

The state can sell bonds to meet this specific purpose, and the proceeds from new video gambling and fee increases have been assigned to the sole purpose of paying off the capital bonds.

Usually, once the bonds are paid off, the taxes and fees that paid them off are supposed to end.

If an income tax increase IS needed,the state could ostensibly sell bonds to pay off payment backlogs and get current with pension funding obligations.

An income tax could be enacted for the specific purpose of paying off these funding bonds.

Once the bonds are paid off, the income tax increase, or “surtax”, would end.

Of course, if the state doesn’t get it’s financial house in order and get spending in line with other revenues, a significant tax increase would only allow us to AVOID necessary choices and further shrink our jobs and economic base.

Raise taxes, scare off or destroy private business, lose private sector jobs, lose income tax revenues due to the lost jobs, find the state in another crisis for which income tax increases are the “only” solution.

Rinse, wash, repeat and watch Illinois go down the drain.

- VanillaMan - Wednesday, Feb 24, 10 @ 9:22 am:

Geez you guys.

You sound like Paul Green reading one of my papers.