|

Behind the rankings: What the CEOs really want from us

Monday, May 17, 2010 - Posted by Rich Miller * Whenever a magazine issues rankings, be wary. Usually, they’re just using a gimmick to peddle subscriptions. CEO Magazine has gotten a lot of publicity lately here for its ranking of Illinois as 46th in the nation for business friendliness…

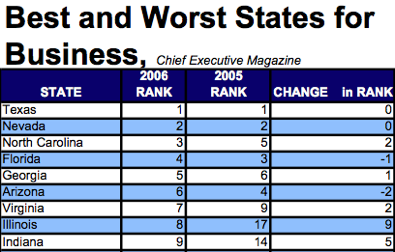

It isn’t mentioned in any of the media coverage, but what makes this ranking all the more stunning is that the magazine placed Illinois at 8th in the nation just four years ago…  So, Rod Blagojevich’s stewardship rocketed us ahead of Indiana, but Pat Quinn’s has us at the bottom of the barrel? Apparently, these CEO’s aren’t much for predictions if this state can fall so far so fast. What’s really going on here? I’ve been hearing a lot from business types the past year that what they desperately want from Illinois is some stability and predictability. If you’re gonna raise taxes, then do it already. If you’re gonna cut, then cut, for crying out loud. Get it over with and stop the confusion. The magazine’s publisher said pretty much exactly that last week…

Again, while I generally scoff at rankings like this, I think this one may be a good indicator of how CEOs actually think. Let’s look at some history. The 2005 and 2006 legislative sessions went fairly smoothly. Blagojevich was on his way to a relatively easy reelection based on a pledge not to raise taxes. As a result, Illinois ranked high on the list during both years (the first two years they published the rankings). But then 2007 hit and all heck broke loose. Blagojevich unveiled his wildly unpopular Gross Receipts Tax plan and refused to back away. The session quickly devolved into a bare-knuckled brawl that dragged into infinity and, as a result, Illinois’ CEO Magazine ranking dropped from 8th all the way down to 40th in just one year. It’s pretty clear that they value stability over almost all else, at least when it comes to Illinois. Unfortunately, they’re gonna have to wait. * Meanwhile, you just knew it had to happen sooner or later. The hyperbolic wild men at the Chicago Tribune editorial board would compare Illinois to Greece…

It’s a stupid but all too predictable comparison, as I’ve pointed out before…

Discuss.

|

- Logical Thinker - Monday, May 17, 10 @ 11:38 am:

I’m not sure why you are so bothered by the comparision to Greece. Sure, you can say that the numbers aren’t close when drawing parallels, but that does not account for where the state of Illinois is headed.

If that is taken in to account, we are very much like Greece. Our revenues are falling, our liabilities (both from defined benefit plans and entitlement spending), and our lack of political will to tackle the problem makes the likely outcome MUCH, MUCH worse than what is happening in Greece.

How long will it be until the public sector employees revolt when they realize their golden goose has been cooked and is no longer laying the golden eggs?

- Rich Miller - Monday, May 17, 10 @ 11:40 am:

===makes the likely outcome MUCH, MUCH worse than what is happening in Greece.===

Look at the numbers for crying out loud. Even with all the problems we’re having, we are still far, far away from Greece’s tragedy.

- Pot calling kettle - Monday, May 17, 10 @ 11:40 am:

I’m not a CEO, but the stability issue is pretty basic. I have been trying to harp on this for the last few weeks. It’s clear Illinois needs to raise revenue, but until we do it and settle down, the uncertainty will keep businesses away.

- Ghost of John Brown - Monday, May 17, 10 @ 11:41 am:

Couldn’t agree more on magazine ratings and not so clear reasons. Same thing can be said for “Best places to live”, etc.

Comparisons to Greece might be hyperbole now, but the rationale is similar. Greece spent and spent and kept racking up debt without thinking of how to pay it off in the future. Same thing can be said about Illinois (to a lesser degree) and the United States in general to a larger degree. Whether this is accomplished by spending cuts (preferred by me) or raising taxes (not preferred, but because of the mountain of debt we may have to), we need adults looking at the issue with the “testicular fortitude” to be honest about the results. So far, very little of that at the State or the Federal level.

- wordslinger - Monday, May 17, 10 @ 11:45 am:

I think most CEOs like a place where they can get the best individual deal. No question the lack of a personal income tax make Texas and Florida attractive to CEOs, though.

- Logical Thinker - Monday, May 17, 10 @ 11:46 am:

“Look at the numbers for crying out loud. Even with all the problems we’re having, we are still far, far away from Greece’s tragedy”

How far? Years? Decades?

We don’t have a budget for the state yet because the political parties can’t even agree on how to balance the budget. In the morning shorts today, you reference several articles which show the impact of the “deadbeat state” not paying their bills and the fallout already.

WE’RE OUT OF MONEY!!!!!

And yet, no one in Springfield seems to understand that and the politicans keep pretending like there is no crisis. Greece got a $1 Trillion bailout from other EU countries.

Who is going to bail us out?

- Rich Miller - Monday, May 17, 10 @ 11:50 am:

Dude, we’re decades away from something like that happening here. What we have right now is a temporary logjam created when a governor was ousted and the national tide turning against a tax hike.

Again, take a breath. If they don’t address these problems within the next, say, ten years, then start yelling “Greece.” Right now, it’s just goofy hyperbole.

- Six Degrees of Separation - Monday, May 17, 10 @ 11:50 am:

I can see the comparison of Chicago’s to Greece’s business climate in one way. When you need that building permit, or including your property in that TIF district, there might be a little “greece” involved.

- John Bambenek - Monday, May 17, 10 @ 11:53 am:

Sure, the numbers between Greece and Illinois are different, but, for instance, if we do have the pension holiday, they’ll need to sell assets to pay bills. That’s the bad place which means they are inches away from being basically insolvent.

The driving force behind Greece’s problems was no one wanting to buy its debt without huge interest rates. From that perspective, we’re not there. But Greece is a nation, we’re a state and they fiscal flexibility between the two is not the same.

For instance, many Greek businesses will stay in Greece. Illinois businesses can easily move to Indiana. The EU helps business migration (likely a contributing factor to Greece’s problems) but nationality still is a factor there also (see the reluctance of some EU nations to bail out what they viewed as a “Greek” problem, not as “their problem”).

If the budget that passed the Senate is what we end up having, we will face a $16-$18B deficit next year to start with. Perhaps as high as $20B depending on revenue shortfalls.

The Greek nation can also borrow a little easier than we can. We require a supermajority to borrow, a large part of the reason we don’t have a budget yet.

We COULD borrow our way out of this years deficit… but we’ll face a much larger problem down the road.

- Sueann - Monday, May 17, 10 @ 11:56 am:

I don’t know about us becoming like Greece, but I would like to see us become a bit more like New Jersey come next election. Just remember, we can do it too!

- Logical Thinker - Monday, May 17, 10 @ 12:00 pm:

================================================

Dude, we’re decades away from something like that happening here. What we have right now is a temporary logjam created when a governor was ousted and the national tide turning against a tax hike.

Again, take a breath. If they don’t address these problems within the next, say, ten years, then start yelling “Greece.” Right now, it’s just goofy hyperbole.

=================================================

So let me get this straight: the problems in Springfield as “temporary” even though this problem with the budgets has been going on for the last 5+ years?

Secondly, are you advocating the only solution being a tax hike? The very article you reference at the top of this thread shows how business CEO’s have cooled to Illinois. Do you think a tax hike will make the state more attractive?

For you to say that the crisis is 10 years off is naive. Moody’s published a report last week that said the US as a whole could have Greece-like problems by 2013.

Again, our liabilities are increasing at a rate far greater than our ability to pay for them. Part of the Greek bailout was the stipulation that they (being the Greeks) needed to change their habits in 3 years. Front and center was their need to be fiscally disciplined and cut entitlements (Privatize health care–ironic, isn’t it–was one of them).

It’s not hyperbole; it’s reality.

- CircularFiringSquad - Monday, May 17, 10 @ 12:04 pm:

Capt Fax

The #s on Greece do confirm that size the debt is so small that it could not possibly rock world markets — but it has, sorta

This just confirms the Wall Street scam artists need a muzzle and some jail time.

There should also be end to derivative trading.

Oh let us not forget that taking financial advice from bankrupt companies that are the target of two federal probes is not a prudent thing to do.

- VanillaMan - Monday, May 17, 10 @ 12:05 pm:

It is understandable why a businessperson would look at Illinois and have second doubts, because few locations are perfect, and having second doubts is what smart people have.

We have unstable governments. Chicago will eventually get a new mayor, Cook county is out of it’s mind, and the State of Illinois is a national laughinstock. Businesses can overlook a level of government out of control, but not three levels. To top this all off, we have a 13 Trillion dollar national debt, and it is even more challenging to calm jittery nerves. Since 2008, businesses have had to deal with four levels of governmental instability when considering Chicago and Illinois as business locations.

If you are going to borrow millions, you look at things differently, than if you look at millions every fiscal year as a state legislator. Our state leaders are on record as seeing businesses as tax opportunities. As a businessman, you don’t need to locate where Pay To Play is so ingrained into the political culture.

Just as Michigan is seen as a “loser”, Illinois has to shed the negative images it has generated over the past few years. It isn’t doing that.

What we need in Illinois is a complete political revolution, and the removal of as many incumbants from public office as possible. If the new leaders demonstrate common sense and “conservative”, (as is the general definition, not political definition), government practices to repair Illinois fiscal disasters, then we will see a more positive reception by businesses. Right now, you are crazy to locate your businesses here when Texas and Georgia are so red hot and willing to make you happy.

- bobmail - Monday, May 17, 10 @ 12:06 pm:

Illinois comes out 46th overall, but if you just look at tax rates–which are based on data, not opinions–it’s a very different story. Illinois ranks:

27th on Corporate Income Tax

10th on Individual Income Tax

39th on Property Tax Index

41st on Sales Tax Index

If you use the interactive tool on the magazine’s website to rank Illinois just by corporate and personal income tax we are ranked as the 15th friendliest business climate. If you rank, Illinois just by property taxes and sales taxes, we rank 47th.

This suggests that our state’s outdated, regressive tax system is actually the problem and a solution like HB0750 would actually improve the business climate.

Check out the interactive map at http://www.chiefexecutive.net/states2010/map.asp

- Rich Miller - Monday, May 17, 10 @ 12:07 pm:

LT, your predictive powers are a bit off. Just a few days ago you predicted that you could “easily” see Scott Lee Cohen getting 20 percent of the vote. Take a freaking breath.

- Secret Square - Monday, May 17, 10 @ 12:08 pm:

“CEO’s need to know there’s continuity and stability with the regulation laws, fees, taxes”

In other words, it sounds to me like it would be better from a business point of view to just raise income taxes to, say, 5 or 6 percent and leave them there for the next 20 years, than to implement smaller “temporary” increases for only a year or two at a time, or to keep going on trying to see how long we can hold out with no increase at all (because everyone knows that’s not going to be forever).

- Yellow Dog Democrat - Monday, May 17, 10 @ 12:09 pm:

The best non-partisan and objective national research on tax policy comes from the Tax Foundation. And they rank Illinois’ tax climate as 30th in the nation, with an overall score of 5.01, just slightly higher than the national average of 5.00.

I like the Tax Foundation’s research because its the most comprehensive. They look at corporate taxes, individual taxes, sales taxes, unemployment taxes, and property taxes.

Ironically, Illinois has below average income taxes and above average sales and property tax rates, which would be rectified if we raised the incomes tax rate and expanded the sales tax base while lowering the overall sales tax rate and reducing the property tax burden.

Sound familiar? It should. It sounds an awful lot like HB 174.

- Ghost - Monday, May 17, 10 @ 12:09 pm:

=== For instance, many Greek businesses will stay in Greece. Illinois businesses can easily move to Indiana. ====

that is complete jibber jabber. A business exists in a location based principally upon demand in the are and market for the goods and services. If abusiness is willing to abandon a market it is not going to be more likely in a State then a Country. Your comments about national loyalty abandon the reality that people are tied to ethnic communities, friends, family etc.

That said, its all about the demand in a market. How many small towns in IL have a wal-mart and one ore more fast food places, gas stationes etc. Under your theory all of those business’s would relocate to Indiana or texas super saturating the market and driving each other into bankruptcy. If there is demand in a market, a buisness will open to supply the demand.

Pingback Stability Needed to Fix Illinois Economy | Illinois Alliance For Growth - Monday, May 17, 10 @ 12:19 pm:

[…] Today Rich Miller confirms that when reporting what business leaders are telling him: “I’ve been hearing a lot from business types the past year that what they desperately want from Illinois is some stability and predictability. If you’re gonna raise taxes, then do it already. If you’re gonna cut, then cut, for crying out loud. Get it over with and stop the confusion. The magazine’s publisher said pretty much exactly that last week… “There’s no doubt that uncertainty is not good for business and making investments–CEO’s need to know there’s continuity and stability with the regulation laws, fees, taxes,” he said. “So when things are in flux, it makes it hard for businesses to invest heavily in an area.” […]

- Small Town Liberal - Monday, May 17, 10 @ 12:20 pm:

Logical Thinker - Good lord man, now that I think of it, you could probably find some similarities between Illinois and the Roman Empire, and the Soviet Union, and the Aztecs. We should probably start freaking out about ending up like those people/places too.

- VanillaMan - Monday, May 17, 10 @ 12:23 pm:

For instance, many Greek businesses will stay in Greece. Illinois businesses can easily move to Indiana.

That is actually correct. You cannot just relocate outside Greece because it has an historic enemy to it’s east, historic enemies to it’s north, and water to it’s west and south. Consequentially, Greek isn’t spoken in neighboring countries. Big Greek businesses have already relocated outside Greece because Greece has alway had an economy too small for any Greeks with global market aspirations. These Greek businesspeople have learned English and do business in English. Their current president was raised in Minneapolis and returned to Greece after college. This is common. His problem is that he is a socialist who succeeded in government while there was tax money. Today, we see that a socialist without tax money is like a flat tire without an air pump. They have no contingency plans for this reality.

- John Bambenek - Monday, May 17, 10 @ 12:26 pm:

If VanillaMan is agreeing with me, I must be on to something… or the Cubs are bound to win the World Series this year.

- Small Town Liberal - Monday, May 17, 10 @ 12:32 pm:

- I must be on to something… or the Cubs are bound to win the World Series this year. -

I’d say those two possibilities are pretty equally likely.

- A.B. - Monday, May 17, 10 @ 12:39 pm:

Ghost

Your logic is accurate on the level of the small business, but I think the big businesses have to be the primary focus here.

Many of the smaller communities in Illinois are supported by larger local businesses. As an example around the Matoon area, Donelly was the big employer. However, when those businesses decide to leave, it is not based on lack of demand, it is a strategic decision based primarily on money. I.e. Caterpillar and Abbott Labs rumors.

When those businesses go, so do the jobs, which then filter down to destroy the small businesses, the big box stores, the chain restaurants, etc.

This is why we need to be taking steps to keep our current big businesses and attract more, rather than letting them go elsewhere.

- the Other Anonymous - Monday, May 17, 10 @ 12:40 pm:

What I find interesting are the states ranked as worse than Illinois: Massachusetts, New Jersey, Michigan, New York and, in last place, California.

The top 5? Texas, North Carolina, Tennesse, Virginia, and Nevada. Alabama ranks 20th in this survey.

Now ask yourself where would you rather live? The bottom states are far more attractive, imo, than the top states. And if you look at where the biggest business centers are — you’re looking at the bottom five states, mostly.

- John Bambenek - Monday, May 17, 10 @ 12:47 pm:

You’d rather live in Detroit, Anonymous?

- Secret Square - Monday, May 17, 10 @ 1:07 pm:

“The bottom states are far more attractive, imo, than the top states. And if you look at where the biggest business centers are — you’re looking at the bottom five states, mostly.”

True, but remember, many of the biggest business centers were established decades ago before commercial airline travel, air conditioning, irrigation, abolition of racial segregation laws, the rise of the oil and tourism industries, and the rise of the internet made living in the South and in the desert Southwest more attractive and practical to many business people.

- wordslinger - Monday, May 17, 10 @ 1:13 pm:

The Greek comparison is hilarious.

After a lifetime in bars and restaurants, I can tell you where Greek businesses relocated: Illinois, especially Chicago and the suburbs. Relatively small population disproportionately represented in those businesses here.

My pals in the business would add a little something to the debate about the “Greek” problem: For Greek entrepreneurs, evading taxes is a way of life. Cash is King Leonidas is Greek business, here and there, because there are no messy paper trails.

What you claim and what you really make is your profit margin.

- George - Monday, May 17, 10 @ 1:22 pm:

Let Tennessee and Alabama have the rankings, I’ll take the companies.

- Vote Quimby! - Monday, May 17, 10 @ 1:24 pm:

Greece is the (GOP) word…

- the Other Anonymous - Monday, May 17, 10 @ 3:06 pm:

John Bambenek asked:

You’d rather live in Detroit, Anonymous?

Grosse Pointe or Royal Oak, maybe. And at least you can drive over to Canada for cheap health care

The point — for me, at any rate — is that the rankings don’t match up with reality. The so-called best states have median household incomes ranging from $61,233 (VA, which has a lot of federal government employees) to $43,614 (TN); while the so-called worst states have median household incomes ranging from $70,378 (NJ) to $48,591 (MI, no surprise — a reason not to live in Detroit). Illinois’ median income ($56,235), btw, beats out TX, NC, and TN by $6-13,000, and just about ties NV. Click Here for those who insist on sourcing.

One wonders why the best states for business have lower incomes?

- Pelon - Monday, May 17, 10 @ 3:13 pm:

Greece may have a higher debt to GDP, but its debt to revenues is actually less than Illinois’. In 2009, Greece had a public debt of about $400 billion compared to about $110 billion in revenues. Illinois has about $140 billion in public debt, and about $30 billion in revenues. To get to the same debt/revenues ratio, Illinois would have to raise about $8.5 billion per year. Assuming that Illinois can easily raise that because it has a higher GSP ignores the fact that the federal government already claims a significant portion of the state’s output.

It is not unreasonable to conclude that Illinois and Greece both face similar situations. In both cases, the voters are unlikely to accept the combination of higher taxes and reduced spending necessary to keep the states solvent. In both cases, the likely outcome is a default on their obligations.

- Logical Thinker - Monday, May 17, 10 @ 3:14 pm:

Other,

You might want to consider putting a cost of living adjustment on those numbers. Is an income of $43k in TN comparable to $56k in IL? It’s hard to make such a blanket statement given the enormous disparities between geographic/demographic areas, however, if you look at IL with about 8 million of the 11 million residents in the 6-county area (higher wages) vs. population of TN (more spread out/rural), I think you’ll find that although the numbers indicate a large spread, it really isn’t that great.

Workers love those states too because cost of living is much lower. Homes cost a fraction of what they do here.

- Rich Miller - Monday, May 17, 10 @ 3:18 pm:

=== the likely outcome is a default on their obligations.===

States cannot default. Another misnomer pushed by the “I want to believe” crowd.

- Brennan - Monday, May 17, 10 @ 3:20 pm:

The math is simple. When you find yourself in an environment where public sector employee unions run the state, move to one where they don’t.

Tax rates play a role, but the unions in CA, NY, NJ, MI, and MA get whatever they want whenever they want. In Greece, the government just ran out of ways to hide the decline in revenue. Now they are cracking down on fakelaki, or the envelope system whereby those with means simply bypass what the state constructs as their “defined benefit model”.

Illinois isn’t broken. It’s fixed. Talk to Dan Proft.

- Rich Miller - Monday, May 17, 10 @ 3:31 pm:

===In 2009, Greece had a public debt of about $400 billion===

It’s far higher than that.

Also, according to Reuters, Greece’s net budget revenues are expected to be $79.60 billion: http://www.reuters.com/article/idUSATH00496320091105

- Secret Square - Monday, May 17, 10 @ 3:38 pm:

“One wonders why the best states for business have lower incomes?”

Well, one possible factor could be that we are talking about HOUSEHOLD income, not individual income. Household income depends not only upon how much individual jobs in the area are paying, but also upon how MANY people in each household are working.

It stands to reason that in areas where a high proportion of the workforce consists of well-educated married couples who are both employed, median income will be higher than it is in areas where the workforce may be less educated and comprised more heavily of single parents and one-income married couples (either by choice or because one spouse can’t find work).

- the Other Anonymous - Monday, May 17, 10 @ 3:40 pm:

Or perhaps, Secret Square, it’s that business CEOs think low wages are good for business.

I don’t have a good link now, but I think it’s fair to say that jobs in the “worst” states pay more than jobs in the “best” states.

- D.P. Gumby - Monday, May 17, 10 @ 3:53 pm:

People, you’re omitting a big portion of the Greek financial problem and solution is the Euro, which is also why the Trib analogy is so apples and coconuts. If Greece still had its own currency, that currency would be floating to reflect the devaluation in the country economy. But then, had Greece not joined the Euro, all of the cheap money wouldn’t have existed prompting all the cheap loans that put everyone in debt. Prior to the Euro, Greeks had little to no history of borrowing and debt. Be that as it may, the Euro Community in securing and bailing Greece should balance the instability. Fact the talking heads are still pointing to Greek as excuse for stock market is more emotional excuse than economic analysis. As for our CEO’s Chamber of Commerce political propaganda may be as influential as anything else.

- the Other Anonymous - Monday, May 17, 10 @ 3:59 pm:

Not to over-comment, but to Secret Squirrel’s suggestion that perhaps household incomes are higher in the “worst” states for business because of more two-income households:

Same analysis holds when you compare mean annual wages/salary from BLS numbers. The “best” states have mean wages ranging from $46,360 (VA) to $37,360 (TN); while the “worst” states go from $42,930 to $52,710 (MA). Illinois, btw, is $46,110, beating four of the five “best” states.

Again, one has to wonder about these rankings when people in the “worst” states earn more than people in the “best” states.

- Pelon - Monday, May 17, 10 @ 4:14 pm:

The figures I quoted, with the exception of the Illinois reveenues ar from the same wikipedia page you linked (source CIA World Fact Book).

== It’s far higher than that. ==

The $552.8 billion figure is external debt which includes public and private debt and excludes internal debt. If you count private debt, Illinois’ would by substantially above Greece’s.

== It’s far higher than that.

Also, according to Reuters, Greece’s net budget revenues are expected to be $79.60 billion: http://www.reuters.com/article/idUSATH00496320091105 ==

That article is referring to NET budget revenues which excludes social security and local governments.

== States cannot default. Another misnomer pushed by the “I want to believe” crowd. ==

States can and do default (although, I don’t believe it has happened since the 1800s). They cannot declare bankruptcy, but that simply means creditors cannot force a liquidation of state assets or otherwise use the legal system to force the state to pay its obligations.

- the Other Anonymous - Monday, May 17, 10 @ 4:21 pm:

oops, sorry: I should have written “Secret Square,” not Squirrel. Too many Saturday morning cartoons!

- wordslinger - Monday, May 17, 10 @ 4:23 pm:

Greece is a European Community problem. Germany and France brought everyone into the party in the hopes it could keep them from fighting like they had for the previous centuries.

You’re only as strong as your weak link, and Greece was a weak link.

- Secret Square - Monday, May 17, 10 @ 4:39 pm:

Actually, Other Anonymous, you got my name right… but come to think of it, “Secret Squirrel” wouldn’t be a bad blog handle. You can tell I watched too much TV in the 70s also

- Brennan - Monday, May 17, 10 @ 5:21 pm:

=Greece is a European Community problem. Germany and France brought everyone into the party in the hopes it could keep them from fighting like they had for the previous centuries.

You’re only as strong as your weak link, and Greece was a weak link.=

Greece actually cheated its way into the Euro with the help of Goldman Sachs and JP Morgan Chase.

=Prior to the Euro, Greeks had little to no history of borrowing and debt.=

That would be false. Prior to the Euro the Greeks were running a current account deficit of 13% which you cannot do without borrowing. Perhaps you are applying a Shariah Finance definition where as it’s not really borrowing if you just call it something else.

Illinois’ debt situation has exploded with the Democrats in control of the Senate, House, and the Governorship. Naturally the recipients of this explosion are public sector employees with a union that protects their gains as well as elects the leaders of the Democratic party.

Read “The New New Left” by Steven Malanga. This predicament is spelled quite clearly.

The state has 18 months to take advantage of low interests rates. After that it’s going to cost a lot more to finance this debt. Tax revenues will have to increase. It’s right now to decide whether those revenue increases come from increased growth in GDP or simply stealing it from a dwindling pool income generators.

- wordslinger - Monday, May 17, 10 @ 5:31 pm:

–Naturally the recipients of this explosion are public sector employees with a union that protects their gains as well as elects the leaders of the Democratic party.–

Brennan, as much as I’d like to fire Dupage Dan and VMan for their chronic nincompoopness and screwing around on the job, that’s simply not true. C’mon man, the numbers are easily accessible. You fire every state employee, you’re still in the hole.

Education, health, human services and corrections. That’s where the money goes. And kicking the can on pensions.

State employees aren’t the problem. The problem is promising too much with too little. And that’s a bipartisan problem.

- Brennan - Monday, May 17, 10 @ 9:18 pm:

=Education, health, human services and corrections. That’s where the money goes. And kicking the can on pensions.=

Sound like jobs that are not filled by monopolized labor? They are. And they are union.

When you negotiate and concede in the bubble you have to be prepared to recede when the bubble bursts. Public sector labor is no more immune than private sector labor from these realities other than the fact that the public sector largely has a contract they negotiated with their politically supported public officials.

It doesn’t matter if public sector workers are screwing around on the job. They cost too much at 40 hours a week.

For example, the CTA charges $2.25 for a paid fare. It costs them over $9 for the same fare.

Only in government is this a feasible policy.

- the Other Anonymous - Tuesday, May 18, 10 @ 8:56 am:

Brennan, wordslinger makes an irrefutable point. Total amount spent on salaries for regular positions in Illinois in FY2009 was less than $5 bln. So even if we fire every single regular employee — including the ones that are not part of any union — we have not fixed the deficit. Click here to see.

Health care (i.e., Medicaid payments to doctors and hospitals), pensions (which are guaranteed by the staet consitution), and education (also guaranteed in the state constitution) are the items that drive the state budget deficit.