|

Graph of the day

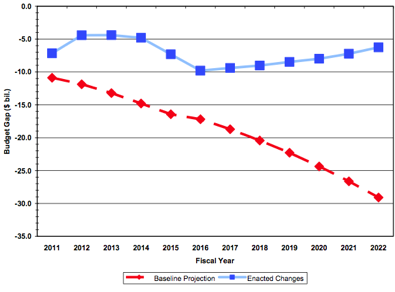

Wednesday, Jan 19, 2011 - Posted by Rich Miller * From the University of Illinois’ Institute of Government and Public Affairs, we have this graph showing state deficits with the tax hike (in blue) and without the tax hike (in red) through Fiscal Year 2022. Click the pic for a larger image…  That’s quite a huge deficit without that tax hike. The reason there is still a deficit in the IGPA’s graph even with the tax hike is that the state has not yet passed the bonding bill to pay off its overdue bills. And the deficit spikes again when the tax hike is set to expire. The IGPA is also concerned with the state’s new expenditure caps, noting that non General Funds accounts could be used to get around them. * Meanwhile, Comptroller Judy Baar Topinka wants to change the way the state pays those overdue bills…

* But she also said this…

I asked for her list of that billion dollars in painless, nobody-will-miss-them cuts. Her office says they’re working on it.

|

- wordslinger - Wednesday, Jan 19, 11 @ 10:03 am:

–Topinka says she can identify at least $1 billion in painless budget cuts – eliminating duplication, anachronisms and padding that no one would ever miss.–

Time’s a wastin.’ Don’t keep it a secret for long.

- Jo - Wednesday, Jan 19, 11 @ 10:08 am:

Painless to whom?

- Yellow Dog Democrat - Wednesday, Jan 19, 11 @ 10:11 am:

Either she’s identified a list of $1 billion in painless budget cuts or she’s working on it.

Which is it?

- Aldyth - Wednesday, Jan 19, 11 @ 10:15 am:

Painless budget cuts that no one will miss that come to a billion dollars?

After all the cuts that hurt so many people last year, I’m already getting stomach cramps at the thought.

- Rich Miller - Wednesday, Jan 19, 11 @ 10:20 am:

Cincinnatus, in case you’re curious, the reason you were deleted is because you cast aspersions on the study without knowing anything about their methodology. Try this… http://igpa.uillinois.edu/content/fiscal-futures-project

- JN - Wednesday, Jan 19, 11 @ 10:22 am:

If we cut Topinka’s billion, the tax hike would be palatable to downstate voters.

Right?

- Yellow Dog Democrat - Wednesday, Jan 19, 11 @ 10:24 am:

Topinka SHOULD be asking lawmakers to approve the $8 billion in borrowing to pay state vendors what they’re owed.

Under the Prompt Payment Act, we’re paying 12% interest per year to most state contractors and 24% interest per year to Medicaid providers.

Bonding would be much, much cheaper.

By January 31st, the Comptroller is required to report interest payments made due to payment delays.

12% of $8 billion is just shy of $1 billion.

I’d like to humbly suggest to Topinka that paying our freakin’ bills on time would be a painless way to cut spending.

- Yellow Dog Democrat - Wednesday, Jan 19, 11 @ 10:27 am:

@JN -

Good one.

If Tom Cross played for the Bears, the Packers wouldn’t stand a chance.

Cross has no offense and no defense, but he’s an expert at moving the goal posts.

- Pilgrim - Wednesday, Jan 19, 11 @ 10:36 am:

If Topinka can indeed lop off $1 billion in “painless” budget cuts—–maybe “Topinka for Governor” in 2014″?

- Jeff Wartman - Wednesday, Jan 19, 11 @ 10:37 am:

The biggest problem with U of I’s graph is that it leads some to assume that “doing nothing” and “raising taxes” are the only two possible choices. That is an incorrect assumption. There are plenty of raise to raise revenues and/or close the deficit without the income tax increase.

- MikeMacD - Wednesday, Jan 19, 11 @ 10:38 am:

What prevents a business that that has past due invoices to the state from getting “tax anticipation” bank loans. With the interest penalties that the state is paying it would seem that there is more than enough for the banks and this would help to alleviate cash flow problems for these businesses.

The Comptroller might issue “anticipation warrants” and the Treasurer could help by providing deposit preference to banks that make these loans.

Just thinking out loud. Perhaps this is already happening in some way.

- Cincinnatus - Wednesday, Jan 19, 11 @ 10:41 am:

Rich,

The revenue assumptions used in their modeling is not specified anywhere in their reports. It would appear that they use a static scoring model which does not take into effect the growth (or decrease) in revenues based on tax and spending policies. This is a similar approach to the methods used by the CBO. I think my deleted comments are still valid, and as I stated in my original post, this experiment in increased spending and taxed undertaken by the governor and the GA will be well worth watching over the next two years. One more caveat which I stated last week, the effects of Illinois spending/taxes/unfunded debt can be swamped by the revenue increases caused by an improving economy. Anything that slows the economic recovery in Illinois is a bad, bad thing.

- jake - Wednesday, Jan 19, 11 @ 10:45 am:

So our situation has moved from impossible to difficult. At least that is the right direction.

I think there are practical ways to get the rest of the way:

1. Make state pensions taxable income

2. Have retirees pay a portion of their insurance premiums, say up to 5% of their pension income.

3. Reforms to Workers Comp for public employees, to eliminate some of the ridiculous claims that have been well documented.

4. Pass a constitutional amendment to permit a graduated income tax, so that income tax on high incomes can rise to the levels that it already is in Wisconsin and Indiana, without hitting everybody else.

I would like to see IGPA run the numbers on the impacts of those moves. My bet is that together, they would close the gap without cuts to state services and state support for infrastructure. One should improve the efficiency with which those services and infrastructure are provided, but I do not think the level of those expenditures can be reduced without real damage. The reforms there should be with respect to better accountability for how the dollars are spent, rather than looking to reduce those dollars.

- just sayin' - Wednesday, Jan 19, 11 @ 10:50 am:

I’m guessing one of the things she won’t be talking about cutting will be things like her double-dip pension.

- dave - Wednesday, Jan 19, 11 @ 10:55 am:

Just thinking out loud. Perhaps this is already happening in some way.

It is already happening. Most, if not all, vendors are able to borrow against receivables. But only up to a limit. And that limit has long ago been reached.

The state has set up a program to facilitate some of this:

http://www2.illinois.gov/payments/Pages/default.aspx

- jake - Wednesday, Jan 19, 11 @ 11:01 am:

On the Illinois Week in Review radio show last week there was a consensus among the reporters that issuing bonds to pay down the backlog right now was a “no-brainer”. Other bloggers have stated the reasons that is so.

Rich,

Speaking of that show, they should invite you on to it. You would be a terrific addition.

- Rich Miller - Wednesday, Jan 19, 11 @ 11:02 am:

jake, they’ve invited me. I’m too busy.

- bored now - Wednesday, Jan 19, 11 @ 11:02 am:

jbt has always been good at the getting publicity part…

- Anonymous - Wednesday, Jan 19, 11 @ 11:12 am:

Unfortunately, her $1 Billion in cuts include eliminating the offices of Governor, Secretary of State, AG, and the Illinois General Assembly…

- frustrated GOP - Wednesday, Jan 19, 11 @ 11:13 am:

I would be curious to see the cash flow predictions for the next 24 months and how those impact borrowing expectations and bill pay down. At what point does the state get to close to even with bills, if ever in the next 24 months? It also might have some indication of their expected lose in business because of new tax policy.

At least if I were running the budget office, that is what I would have before moving down this road.

- 47th Ward - Wednesday, Jan 19, 11 @ 11:16 am:

Did Topinka include merging the Treasurer and Comptroller’s offices in her report? That should save a few nickles, but it’s also a “no-brainer” and a good place for her to start.

- Angry Republican - Wednesday, Jan 19, 11 @ 11:20 am:

So even with a big tax increase there will still be a deficit. How is this a good thing?

- Jo - Wednesday, Jan 19, 11 @ 11:24 am:

Angry Republican -

It gives you plenty of more opportunities to cut!

- jake - Wednesday, Jan 19, 11 @ 11:26 am:

Re: So even with a big tax increase there will still be a deficit. How is this a good thing?

Angry Republican, It is better to be at the bottom of a six-foot deep hole than a sixty-foot deep hole.

- Jo - Wednesday, Jan 19, 11 @ 11:26 am:

The deficit in the chart includes unpaid bills. The trend line going up means that the structural deficit is eliminated, and we would slowly be paying down the backlog of bills (vendors start getting paid in 11 months, instead of 12, then 10 months, then 8 months).

If you borrow to pay down some or all of that backlog, then you do a double-wammy of getting rid of the full deficit, and then provide a nice little mini stimulus boost to the economy of low- and medium-wage workers who provide state services.

- downstate hack - Wednesday, Jan 19, 11 @ 11:33 am:

Anonymous - Wednesday, Jan 19, 11 @ 11:12 am:

Unfortunately, her $1 Billion in cuts include eliminating the offices of Governor, Secretary of State, AG, and the Illinois General Assembly…

And the Problem there is??????

- Bond_player - Wednesday, Jan 19, 11 @ 11:33 am:

Some do not think that the State’s economy is going to recover for a very long time. D.Mcintyre, at 24/7 Wall Street says

“The collapse of the state’s industrial base has been so great that its economy will not recover anytime soon.”

Taking a weeks pay out of the working consumer ain’t gonna help things

- Cincinnatus - Wednesday, Jan 19, 11 @ 11:34 am:

At least in my eyes, one of the most appalling things about the tax increases was a spending “cap” that allows for a 2% INCREASE in government spending. This one little talked about fact says that the Governor and the GA really don’t give a damn, or at best don’t understand, about the message that the citizens sent in November.

Everyone says that huge budget cuts have already been made by Quinn. The fact that nobody quite knows what they are also speaks volumes. One can expect the cuts to be meaningless in bringing about long-term reductions in government spending, and are more likely budgeting tricks that show cuts but are indeed not.

Will Quinn use the looming budget disaster to take on entitlement reform? How about pensions? Government size? These are the questions on the front of the taxpayer’s minds, and the things that Quinn and the GA cannot/will not answer.

Everyone says that Republicans should say what to cut. Why should they? Is there any reason to believe their suggestions would get a fair hearing in Springfield? Do the Republicans control any level of the state government? I say to the Democrats that you’re in charge and the one thing they have done (raise taxes) even by these unknown methodology charts still show YOU HAVE A PROBLEM. What are the DEMOCRATS going to do about it?

- Louis G. Atsaves - Wednesday, Jan 19, 11 @ 11:36 am:

So using the model that graph is based on we would have needed to raise personal income taxes to 7% to balance things out. Along with other taxes. Or am I misreading the chart along with the article and the other articles it cites?

- zatoichi - Wednesday, Jan 19, 11 @ 11:42 am:

MikeMac, that is happening as dave’s reference describes. Some banks are limiting lines of credit based on state recievables. Numerous vendors are claiming cash flow hardship to get expedited payments or close. A vendor can sell their receivables to a large financial group, but the state is still paying those prompt payment penalties of 12% and 24% for bills over 60 days regardless of who owns the paper/bills. The only way to avoid the penalties is to fully pay the bills within 60 days. That will only happen when the cash is available to cut the checks in the Comptroller’s office.

Topinka’s painless $1B would be a nice list to see. The cries of why weren’t these $1B cuts done before would start immediately.

- Cincinnatus - Wednesday, Jan 19, 11 @ 11:45 am:

Louis,

It should be apparent by now that the personal income tax model being used in Illinois is completely broken, and no amount of increases will provided Illinois with the stability it needs. Who among the governmental elite are talking about massive spending cuts to reduce the size of government and the deficit? Who is talking about a new tax scheme which is business-friendly, and is broader based so that economic instabilities would be damped and revenues would grow?

- Rich Miller - Wednesday, Jan 19, 11 @ 11:48 am:

Louis, the structural deficit created the overdue bills. The tax hike essentially eliminates the structural deficit, but the overdue bills remain. This is a one-time expense to get rid of those bills, ergo the borrowing proposal.

- just sayin' - Wednesday, Jan 19, 11 @ 11:57 am:

I realize the constitution has to be amended to consolidate the posts of treasurer and comptroller. Topinka says she’s for that.

Even if anyone gets serious about that, it will obviously take time and wouldn’t kick-in until after the 2014 election at the earliest.

But why can’t Topinka just agree to consolidate the duties now? In other words, consolidate the day to day operations of the 2 offices to the maximum extent possible. Get rid of overlap and unneeded employees, and do it now. Her office would still exist constitutionally for whatever official acts must be done. But Dan would handle all operations and office management. Topinka could take a corresponding pay cut to reflect cut in work load.

Yes, I know it will never happen, but that’s what someone serious about consolidating the operations and making cuts would do.

- Grandson of Man - Wednesday, Jan 19, 11 @ 12:02 pm:

I have a list of Quinn’s spending reforms. One item on the list is pension reform that Quinn’s people are projecting will save taxpayers $200 billion over 35 years. I don’t know whether this is accurate, but if substantial savings occur, this will be a great help and could hopefully create a balance between those who want a non-union state workforce and the unions.

- Cincinnatus - Wednesday, Jan 19, 11 @ 12:14 pm:

- Rich Miller - Wednesday, Jan 19, 11 @ 11:48 am:

“Louis, the structural deficit created the overdue bills. The tax hike essentially eliminates the structural deficit, but the overdue bills remain. This is a one-time expense to get rid of those bills, ergo the borrowing proposal.”

Rich,

We’re back to the deleted post! The structural deficit isn’t eliminated, as the chart shows. Now, I also question the deficit numbers UofI shows because we do not know how they are scoring the effect on revenues based on a given tax rate. I contend that their limited static scoring methodology (which I assume they use since I cannot find their discussion on their projection methods) may project higher revenues than Illinois will actually experience. At that point, we will ADD to the deficit the charts show, increasing the structural deficit again.

Now should we borrow more? And what assumptions are Quinn using on debt service and interest rates on these new stop-gap loans. Normally, these types of revenue bonds fluctuate on their interests and costs based on the ever changing state financial picture. The costs of these bonds may weigh heavily on future deficit projections.

Illinois is not on a good path.

- MikeMacD - Wednesday, Jan 19, 11 @ 12:16 pm:

Re: Comptroller / Treasurer merger:

I actually like the idea that the people who keep the books can’t touch the money. Then again, I’m old fashioned when it comes to financial controls.

- Yellow Dog Democrat - Wednesday, Jan 19, 11 @ 12:16 pm:

@Cincinnatus:

There have been massive spending cuts, significant pension reforms, and significant Medicaid reforms. Blame Quinn for not articulating them, the media for not reporting them, and yourself for not noticing…in that order.

As for a broader-based tax scheme, Blago proposed it. The Gross Reciepts Tax. The business community hollered that it would “Drive Business out of Illinois.” Other policies the business community says are “driving business out of Illinois”:

– The 40-hour work week

– the minimum wage

– anti-child labor laws

As sure as the sun will rise, lobbyists for Illinois business associations will complain that we’re driving business out of Illinois.

Despite the fact that Illinois created 200,000 private sector jobs in 2010, far more than any surrounding state.

Why? Simply put, if the IMA, Illinois Chamber or Retail Merchants Association ever had the nerve to admit that Democrats are doing a good job, they’d be defunded by their rabidly Pro-Republican funders. Guys like the Jimmy John’s founder.

Remember last summer when Doug Whitley had the nerve to suggest that Democrats made significant reforms to pensions, McCormick Place and Illinois’ telecom laws? Boy, was he silenced quickly.

- Louis G. Atsaves - Wednesday, Jan 19, 11 @ 12:45 pm:

I’ve gone back and reviewed the information provided with the graph a second time. Assuming borrowing will erase the current deficit shown, what is the explanation for the deficit in 2015, 2016 and beyond as projected?

If we raise the blue bar by $5 billion over that time frame to try to account for the current stack of unpaid bills, it still shows a continuing deficit from 2015 going forward.

Which begs the question I asked earlier about a 7% personal income tax as being a solution, using the model before us. Am I still missing something?

- Rich Miller - Wednesday, Jan 19, 11 @ 12:46 pm:

===what is the explanation for the deficit in 2015, 2016 and beyond as projected?===

It’s in the post. That’s when the tax hike expires.

- Louis G. Atsaves - Wednesday, Jan 19, 11 @ 12:47 pm:

I guess I need to add to the mix the elimination of “temporary” for the current income tax increases in looking at the model. Somehow I still can’t get it to add up.

- Leave a light on George - Wednesday, Jan 19, 11 @ 1:03 pm:

@Jake

=I think there are practical ways to get the rest of the way:

1. Make state pensions taxable income

2. Have retirees pay a portion of their insurance premiums, say up to 5% of their pension income.

3. Reforms to Workers Comp for public employees, to eliminate some of the ridiculous claims that have been well documented.

4. Pass a constitutional amendment to permit a graduated income tax, so that income tax on high incomes can rise to the levels that it already is in Wisconsin and Indiana, without hitting everybody else.

I would like to see IGPA run the numbers on the impacts of those moves. My bet is that together, they would close the gap without cuts to state services and state support for infrastructure. One should improve the efficiency with which those services and infrastructure are provided, but I do not think the level of those expenditures can be reduced without real damage. The reforms there should be with respect to better accountability for how the dollars are spent, rather than looking to reduce those dollars.=

Are there NO reductions in expenditures you could go along with?

Also, it appears that you want to levee an income tax on the pensions of retired state employees only. That seems rather discriminatory. You do realize that no one receiving a pension in this state pays income tax on it.

- Fed up - Wednesday, Jan 19, 11 @ 2:10 pm:

With the state still struggling with debt even with the new Quinn tax are other revenue enhancements like the cigarette tax or gambling expansion still being considered.

- Smitty Irving - Wednesday, Jan 19, 11 @ 2:33 pm:

47th Ward -

Ever hear of Orville Hodge?

- 47th Ward - Wednesday, Jan 19, 11 @ 2:44 pm:

As a matter of fact, I have Smitty.

I’ve heard of Paul Powell too. Does that mean we shouldn’t have a Secretary of State’s office either? Or maybe you mean we should separately elect the Secretary of Drivers Services, the Secretary of Corporate Records and the Secretary of Lobbyist Reporting?

What’s your point? That we can’t trust one elected official to oversee treasury and accounts payable so we need to have two?

- Angry Republican - Wednesday, Jan 19, 11 @ 2:45 pm:

Texas is forecasting a $15B shortfall over their next budget cycle; the first draft budget proposal cuts $13.7B in spending with no tax increases. Illinois won’t even ATTEMPT to cut $100M in spending let alone $1B. Since our state leaders believe we can tax our way out of the problem, they should have raised taxes high enough to run a surplus.

- Rich Miller - Wednesday, Jan 19, 11 @ 3:04 pm:

===Illinois won’t even ATTEMPT to cut $100M in spending===

Just flat-out wrong and completely ignorant. Do a Google search before commenting here again, please.

- Smitty Irving - Wednesday, Jan 19, 11 @ 3:12 pm:

47th -

My point is the current setup was structured that way for a reason, and if we are going to combine those offices (like Texas had, apparently), since this is Illinois we’ll have to pay a “corruption tax” and put in a level of safeguards not necessary in other states … reducing, if not potentially eliminating, any savings … .

- 47th Ward - Wednesday, Jan 19, 11 @ 3:12 pm:

===Illinois won’t even ATTEMPT to cut $100M in spending let alone $1B===

There it is again. Maybe you’re Angry because you can’t read. Illinois will cut about $3 Billion with a B in this year’s budget. But don’t take my word for it, take the U of I’s report from last year:

“Governor Quinn proposed a substantial increase in the personal income tax to help balance the FY 2010 budget, but was unable to get support from the legislature to pass it into law. Instead, on July 15, 2009, the legislature passed and the governor signed a budget without a tax increase

that included:

• $3.5 billion in borrowing to cover pension

payments to be paid back over five

years

• $1.8 billion in federal stimulus money

• $0.4 billion in “fund sweeps,” or transfers

from special fund balances

• $2.1 billion in spending cuts

• another $1.1 billion in spending cuts to

be made later in the year.13

If I knew how, I would have put the last two bullet points in bold. Please read the full report here: http://igpa.uillinois.edu/IR_2010/PDF/pg14-27z_FiscalCondition.pdf

Now, can we at least agree that cuts have been made? The cuts may not be deep enough for you, but you can’t say they haven’t happened.

Sheesh.

- Ahoy - Wednesday, Jan 19, 11 @ 3:24 pm:

Did anybody see the full page ad in yesterday’s SJ-R from the mayor of Indianapolis? It was a letter to businesses in Illinois asking them to come to Indiana. I don’t know how to post it or I would.

- Demoralized - Wednesday, Jan 19, 11 @ 3:34 pm:

@Angry Republican:

You are comparing apples and oranges. Texas has a bienniel budget and their GRF budget is $87 billion. Their shortfall is 1/6th of their budget. No small amount, but not even in the same league as Illinois’ deficit, which is 1/2 of the GRF budget.

- lincoln lover - Wednesday, Jan 19, 11 @ 3:36 pm:

Jake - You do realize that NO pensions are subject to state income tax, regardless of public or private? Also, not all state retirees get free insurance. An employee must work for the state for 20 years before they qualify for free insurance (free for the retiree: dependents must still pay premiums). According to SERS, the average retiree has 15 years of service, that means they are paying %25 of the premium already. The average retiree draws $20,000 per year, that means they are already paying close to $100 per month, plus any premium for their spouse ,and, at least $100 for medicare. There are other pension systems in the state, but this is the one I belong to. Sure doesn’t sound like the average retiree is rakin’ it in, does it??? And do you honestly think that State employees are the only ones that reap benefits from workman’s comp? If so, you should talk to my sis who is the office manager for a workman’s comp lawyer. She would set you straight in no time!

- jake - Wednesday, Jan 19, 11 @ 3:44 pm:

@ Leave a Light on George

=Are there NO reductions in expenditures you could go along with?

Also, it appears that you want to levee an income tax on the pensions of retired state employees only. That seems rather discriminatory. You do realize that no one receiving a pension in this state pays income tax on it.=

For the first point, I think it is hard to say that the State spends too much money on roads and other infrastructure in general when the roads in many places are bad, that the State spends too much money on education when many high schools aren’t offering the advanced classes that kids need to compete for good colleges, that the State spends too much money on social services when many people are falling through the cracks, that the State payroll is too large when in fact it is smaller per capita than practically all other states, that the State spends too much on higher education when our leading university (which is a profit center as the faculty bring in much more in grants than the State contributes to the university) can’t afford to hire new faculty to replace retiring ones. In all of these cases the State could do a better job of allocating resources, but the key to maximizing the public good is better accountability for how the money is spent, rather than slash indiscriminately at the budgets as they stand.

As for the second point, I will take that as a friendly amendment. By all means, tax all pensions.

- Yellow Dog Democrat - Wednesday, Jan 19, 11 @ 3:47 pm:

@Angry Republican, Demoralized -

First of all, Texas’ structural budget deficit is estimated at $27 billion, not $15 billion.

Now, let’s take a look at those $13.7 billion in cuts:

- Closing four state colleges;

- Eliminating financial aid for all college freshman, 70,000 students over two years;

- Cutting funding for local schools by 1/3 - $5 billion;

- 10% cut in reimbursements for doctors, hospitals and nursing homes who provide care;

- Elimination of early childhood education funding.

Now, let’s look at the impact of those cuts:

- an untrained workforce unable to attract employers;

- middle class families forced to dig deeper into their pockets to pay for college, and low-income students trapped in poverty because they can’t afford it;

- local property tax hikes to pay for schools;

- Doctors, hospitals and nursing homes shift costs to employers and other private insurance plans;

- Increased special education costs, drop-out rates, poverty and crime.

Yep, give those folks in Texas a medal.

- Pelon - Wednesday, Jan 19, 11 @ 3:57 pm:

YDD,

Unless the IGPA has really miscalculated, those same cuts are eventually coming to Illinois. The only question is how long can we wait before we are forced to make them?

- Yellow Dog Democrat - Wednesday, Jan 19, 11 @ 4:13 pm:

@Pelon -

Ever heard of the phrase “Penny wise, pound foolish?”

Cutting investments in education doesn’t save you money, it COSTS you money in the long run.

The #1 factor businesses consider when trying to decide where to locate isn’t the tax structure, its the skill and training of the workforce.

Illinois was ranked 15th in New Economy Jobs this month not because of our tax structure, but because 1 in 3 Illinois workers has a college degree.

Look, we can either choose to race to the bottom or race to the top. But we can NEVER win a race to the bottom because we can’t compete with cheap overseas labor.

I say, let’s angle for the top: the smartest workforce, the healthiest workforce, the best infrastructure, the safest communities, the best quality of life.

Build THAT, and they will come.

- Pelon - Wednesday, Jan 19, 11 @ 4:43 pm:

YDD,

That is similar to the argument that cutting taxes will result in a more robust economy and greater tax revenues. They both may be true and may be viable alternatives for a state with a balanced budget and time to let those changes work. In our case, we don’t have either of those luxuries.

- Yellow Dog Democrat - Wednesday, Jan 19, 11 @ 5:12 pm:

@Pelon -

Unlike Trickledown Economics, I’m not basing my argument on someone’s book, thesis paper or economic theory.

According to business owners, the skill and training of a state’s workforce is their #1 consideration.

See Site Selection Magazine, 11/2010 issue.

- Pelon - Thursday, Jan 20, 11 @ 7:15 am:

YDD,

I’m not disagreeing (or agreeing) with your premise. The problem with your approach is that it would take time that we don’t have. It just isn’t reasonable to expect that we can grow our way out of the problem in a reasonable amount of time.

- Yellow Dog Democrat - Thursday, Jan 20, 11 @ 7:50 am:

@Pelon -

I’m not saying we didn’t need to raise our taxes now. On the contrary, I think eliminating our structural budget deficit now is critical if we want to make the necessary investments in our workforce.

Since Reagan, Republicans have gotten away with providing inadequate investments in workforce training, and then saying “See? Public education doesn’t work.”

No kidding, Sherlock. You get what you pay for.

I will say that if we’d listened to Dawn Clark Netsch (and later Jim Edgar) and raised the income tax to 4.25% back in the mid-90’s, our schools and our workforce would be in much better shape and much more competitive globally than they are today.