[The following is a paid advertisement.]

Illinois utility companies are pushing for radical changes that put automatic utility rate hikes into state law.

Here’s the TRUTH about the legislation:

TRUTH – The bill would eviscerate consumer protection by eliminating traditional rate case reviews and mandating an automatic annual rate increase for all utility expenditures.

TRUTH – It would allow ComEd, Ameren, Peoples/North Shore Gas, and Nicor Gas to decide what “modernization” means - allowing utility companies to raise rates to pay for technology investments without regulatory or public review of costs or benefits.

TRUTH – It would put Illinois in the unique position of eliminating the ICC’s obligation and duty to balance the interests of consumers with that of utility companies.

TRUTH – Their promised investments are not significant over a 5-10 year period, are not clearly identified, have no enforceable performance standards, and no penalties for noncompliance.

AARP strongly opposes HB 14 the “Automatic Electric and Natural Gas Rate Increase” bill.

Illinois consumers and businesses simply cannot afford guaranteed profits for utility companies and the elimination of long standing and proven regulatory policies!

HB14 - The wrong bill at the worst time.

Comments Off

|

* OK, now we have some real numbers to look at. The Senate Republicans held a press conference today to outline the cuts they’d like to make to the budget to put it into balance. You can read the Senate GOP’s new plan by clicking here. The Sun-Times has a good overview…

Items on the Republican chopping block include cutting $1.3 billion in Medicaid costs by tightening eligibility for health-care programs like All Kids and FamilyCare, which were both signature initiatives under impeached, ex-Gov. Rod Blagojevich.

The GOP also proposed cutting school spending by 10 percent — or $725 million. The group expressed openness to freezing state-aid payments to school districts, scaling back poverty grants and trimming increases Quinn favors on early-childhood programs.

Radogno expressed support for state pension givebacks from existing workers that she said could yield $1.35 billion in savings for the state. Among them are requiring current employees to pay more toward their pensions, imposing the same pension reforms that went into effect Jan. 1 on new hires to the current workforce and setting up a 401(k)-style retirement program to which the state would provide a 6-percent match. […]

Other cuts Radogno and her caucus sought took aim at the state prison system, including ending $7 million in compensation to inmates that they can use to purchase “candy, cigarettes and cable TV.”

They want to stop funding the Illinois Arts Council, which is chaired by Shirley Madigan, wife of House Speaker Michael Madigan (D-Chicago), because the cash-strapped agency has “essentially suspended” the awarding of grants to artists and art organizations yet continues to have a full-time staff.

* From their proposal…

Take actions to reduce state payroll expenses. Options include:

• A statewide state government hiring freeze (Governor Quinn’s budget adds 950 headcount) which could save $50 million (although new headcount at the Dept. of Corrections should be considered to reduce overtime costs);

• Eliminating pay for three (of 13) state holidays each year such as election day (suggested by Taxpayer Action

Board); and

• Foregoing scheduled pay raises next fiscal year, FY12 (pay freeze was suggested by the Taxpayer Action Board). The labor contract includes minimum 5.25% pay increases in FY12, when coupled with estimated average 2.5% step increases on top of the base increases this amounts to almost 8% increases scheduled for next year. Foregoing those increases for one year could save almost $230 million GRF.

Targeted Savings: $300 million

I’m not sure how you can freeze pay and change holiday pay when 95 percent of state workers are covered under a union contract.

* The mayors won’t be happy with this…

Local Government Revenue Sharing

Review the over $6 billion that local governments receive in revenue sharing from the State of Illinois. They receive around 6% of income tax receipts, over half of all gas tax receipts, 20% of sales tax receipts on items other than food and drugs, 100% of sales tax receipts on food and drug purchases, and 100% of revenues from the Personal Property Replacement Tax. A $300 million reduction represents around 5% of those revenues. This approach has been suggested by many groups including the Governor’s Taxpayer Action Board, the Illinois Policy Institute and the Civic Committee.

Targeted Savings: $300 million

* The Senate Republicans have pledged to put 15 votes on these cuts. Senate President John Cullerton responds…

“We applaud the Senate Republicans for coming to the table with suggestions on how to mend our fiscal crisis. It’s nice to hear them say something other than ‘no.’ Nevertheless, their efforts must go beyond more than press releases and photo ops. Releasing a list of possible cuts shouldn’t be the end of their participation in the budget process. I hope that this is just the beginning.

“To that end, I am reserving a series of appropriations bills for their use in hopes that they will use this opportunity to fully engage in the appropriations process. I believe that their proposals and commitment can be the base line for discussion on what we all agree is a necessary process of cutting waste and creating efficiencies.”

Finally, game on.

*** UPDATE 1 *** Unlike Senate President Cullerton, Gov. Quinn had some harsh words for the Senate Republicans today…

On Senate Minority Leader Christine Radogno’s call for $6.7 billion in cuts to his budget proposal, Quinn said the “apostles” of “draconian cuts” end up hurting the economy and job growth.

“I’m not listening to them,” he said, saying money for health care, human services and public safety were important.

Sheesh. Was that really necessary? I mean, what’s the harm in just listening to them? It’s gonna be a long four years, campers.

*** UPDATE 2 *** Quinn’s office just called to say that he is not ruling out dialogue with the Senate Republicans, but that he was “reassuring” reporters about how he won’t cut education by that much and slash vital programs.

They’re looking for an audio clip. Stay tuned.

*** UPDATE 3 *** From the governor’s press office…

We appreciate the Senate’s effort to identify additional savings. The challenge, however, is not coming up with myriad possibilities. As we examine their proposals, we must look at their consequences. If Illinois were to implement the cuts proposed today, Illinois would miss out on millions Illinois taxpayers have sent to DC in taxes; legal action would be taken against the state for violations of funding statutes, and conflicts of interest would be codified into state agencies; and economic recovery efforts that are creating jobs would be halted in their tracks.

Under the Governor’s leadership, Illinois is on the road to economic recovery. Announced today, after 13 months of straight declines in unemployment, Illinois’ unemployment rate is under 9 percent for the first time in two years. We lead the Midwest in job creation, and the Governor’s comprehensive plan to create jobs and economic growth is bearing fruit.

The Governor has cut spending at historic levels to help restore fiscal stability to Illinois, but spending reductions must be made carefully and with research to properly asses their impact. The Governor has asked for two years for realistic, responsible proposals for budget reductions. His team has been implementing budgeting for results, to look strategically at all programs to identify unnecessary state spending.

Senate Republicans advocate missing out on millions of dollars of federal matching funds – simply abandoning taxpayer money that should return to Illinois to help its citizens. Their proposals – including nearly $1 billion in cuts to education, $650 million loss in federal Medicaid match, and deep cuts to public transit services affecting 2 million people per day – will devastate our economy, infrastructure development, workforce training programs, and put thousands out of work.

We continue to welcome good-faith efforts to identify and reduce unnecessary state spending. We continue to invite all four caucuses to meet with us to discuss the serious challenges of stabilizing our budget and creating jobs for today and tomorrow, as well as the important and ongoing discussions regarding payment of the state’s overdue bills.

* Related…

* VIDEO: Sen. Minority Leader Radogno on budget cuts

* VIDEO: Sen. Althoff on budget cuts

* House committee votes to exempt casinos from smoking ban: House Bill 171 would exempt casinos from the 2007 Smoke Free Illinois Act, which banned tobacco smoking in public buildings and businesses.

* House committee passes gambling expansion bill: Illinois race tracks would be allowed to have slot machines, riverboat casinos would pay lower taxes and be allowed to buy more gaming positions under a gambling expansion bill that cleared a House committee this morning.

83 Comments

|

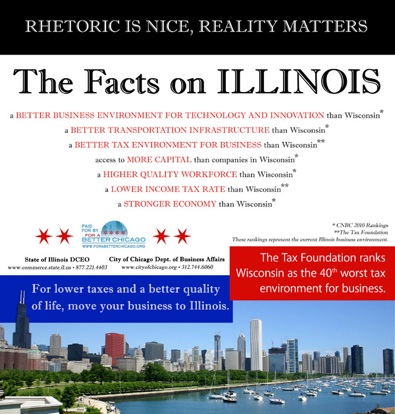

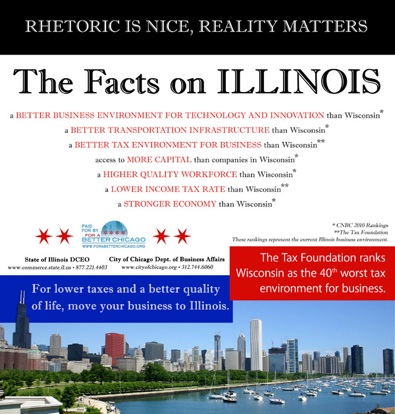

* The group For a Better Chicago ran an ad in New Jersey recently touting Illinois’ more favorable business climate. It’s next target is Wisconsin…

It’s been Scott Walker’s mantra since he started campaigning for governor: “Wisconsin is open for business.” But a new ad in the Wisconsin State Journal challenges that claim.

A half-page ad lists reasons why Illinois is “better” than Wisconsin. Reasons include a better tax environment for business, a higher quality workforce, and a stronger economy.

Initial reactions?

“That’s cute,” said Wisconsin’s Lieutenant Governor Rebecca Kleefisch.

This is the same group that is now picking favorites in aldermanic races. Click the pic for a better view…

* But not everyone agrees…

An Illinois company that makes items for trade shows is moving to Wisconsin, Gov. Scott Walker announced Thursday.

Catalyst Exhibits, Inc., will be moving from Crystal Lake to Pleasant Prairie, Wis., and bringing with it 105 jobs, the governor said. It will occupy a 144,000-square-foot facility and invest $2.5 million in the state, Walker said.

Catalyst Exhibits is a trade-show marketing company whose clients include TiVo, Siemens, Abbott Labs and Nokia. […]

Walker said the company will receive a $500,000 state grant to relocate to Wisconsin and the Kenosha Area Business Alliance is providing a $1.25 million low interest loan for building renovations.

*** UPDATE *** The unemployment rate dropped here last month…

The state of Illinois’ jobless rate fell to 8.9% in February, marking the 13th straight month of decline.

The February figure is 0.1 percentage point lower than January’s rate and 2.2 points below February 2010, according to preliminary figures released Thursday by the Illinois Department of Employment Security.

The last time the state had a jobless rate below 9% was in February 2009.

* Related…

* Mayor-elect Rahm Emanuel and Gov. Quinn: Quinn says they are the “progressive aggressive” team: “We have a progressive mayor-elect and a progressive governor and we want to be progressive and aggressive,” Quinn told reporters for Illinois news outlets, meeting with them after a session with the Illinois congressional delegation on Thursday.

* New front in ‘Amazon tax’ war: The state and a business group are teaming up to offer options to web merchants who were dumped by Amazon.com and Overstock.com after the state moved to force them to collect sales tax from their Illinois customers. With an assist from the Illinois Department of Commerce and Economic Opportunity, an affiliate of the Illinois Retail Merchants Assn. has set up an Internet site that will allow former Amazon and Overstock “affiliates” to directly connect with other retailers and keep their traffic up. Among those participating: Barnes & Noble, Best Buy, Sears and Home Depot.

* Huge number of foreclosures has made the system a mess, and it could get worse

9 Comments

|

Question of the day

Thursday, Mar 17, 2011 - Posted by Rich Miller

* From the Daily Herald…

Rep. Randy Ramey said Tuesday that he knows his plan to bring Arizona-style immigration laws to Illinois almost certainly won’t be called for a vote this year.

“I have been requesting,” the Carol Stream Republican said. “Been denied.”

Ramey’s proposal, like the one approved in Arizona, would give police more authority to look up someone’s immigration status, a move that could lead to deportation of an illegal immigrant.

* From the synopsis of Rep. Ramey’s bill…

Provides that for any lawful stop, detention, or arrest made by a law enforcement official where reasonable suspicion exists that the person is an alien unlawfully present in the U.S., a reasonable attempt shall, where practicable, be made to determine the immigration status of the person.

* The Question: Do you agree with this provision? Explain fully and please take a very deep breath before commenting. Also, do your very best to stick to the question. I’m not at all interested in reading long, nasty rants about illegal immigration. You’ll just be deleted or banned, or both.

108 Comments

|

[The following is a paid advertisement.]

Most agree that Illinois needs to modernize its electric grid to meet the demands of the digital age. Forty-four states ─ and even Guam ─ have some type of Smart Grid investment program in process. But Illinois is stalled. To stay economically competitive, we must catch up.

But grid modernization in Illinois is stalled by an outmoded regulatory process that discourages exactly the kind of long-term, comprehensive planning that’s needed to get modernization done.

The Energy Infrastructure Modernization Act (HB 14) proposes a better system for setting utility rates. It provides even more transparency and accountability than current regulation with more frequent regulatory review and new performance metrics to keep utilities accountable.

Some have suggested that modifying regulatory oversight is synonymous with reducing regulatory oversight. That’s simply not true. HB14 is not about less regulation it’s about smarter regulation.

Every resident and business in Illinois will benefit if lawmakers, regulators, utilities and consumer groups can come together over the next few weeks to develop a policy path that drives modernization of our grid, while protecting consumers as strongly as ever.

Comments Off

|

Gordon bows out, Blagojevich pounces

Thursday, Mar 17, 2011 - Posted by Rich Miller

* Our “reform” governor has had problems explaining this appointment, so he caught a break when she bowed out yesterday…

A former lawmaker is resigning from a job that Democratic Gov. Pat Quinn gave her only days after she voted for his 67 percent tax hike, the governor’s office confirmed today.

Former Rep. Careen Gordon withdrew her name from consideration for an $85,886-a-year spot on the Illinois Prisoner Review Board. Quinn had nominated her for the position, but her ability to win confirmation in the Senate was in doubt.

Critics charged the timing between her vote on the tax hike and her appointment by Quinn were too cozy. Both Quinn and Gordon have said there was no connection.

* And the Blagojevich clan got in on the action…

Patti Blagojevich said Wednesday that there is no difference between what her husband is accused of and the alleged deal between Gordon and Quinn.

“Here’s somebody who…made a vote to get herself a job. And on the other hand, you talked about jobs, investigated things with your lawyers. Discussed things and never took any action but you’re under indictment for pretty much the same thing,” said Patti Blagojevich on the radio.

“She may be correct. It’s pay for play,” said [Pat Brady, Illinois Republican Party chairman].

Political reformer Dawn Clark Netcsh disagrees.

“If you are going to tell the governor you can never appoint someone who is in office at one time, who might have voted the way you thought was the right way to vote, that’s absurd. I don’t find that to be an example of what we thought to be pay to play,” said Netsch.

Being caught trying to allegedly shake down a children’s hospital CEO for a contribution in exchange for releasing state funding is just a bit different than this. Also, Blagojevich was caught on tape talking about out and out trading a US Senate appointment for jobs for himself and his wife. Despite the obvious appearance problem, there is no evidence at this time that either Gordon or Quinn were that explicit. Rod Blagojevich was a crass crook. He’s also a convicted liar.

* Gordon’s defense…

In late October, she told The Daily Journal: “At this point now, I can’t ask the people who live in my district for more money until the state of Illinois shows that they are good at money management. I haven’t voted for a tax increase and I have showed I won’t vote for a tax increase until we show that.”

In a telephone interview Saturday [after her vote for the tax hike], she said: “The income tax increase signed by the governor goes farther than that. The money has to go to pay bills, with no new programs. There also are spending caps (2 percent per year) and the provision is if the increase goes over that the tax increase is null and void.

“Over the next two years, there will have to be a minimum of $800 million in cuts each year to meet that spending cap.”

That explanation is a heck of a lot more plausible than Blagojevich’s excuses. It still stinks, but this is no “Pay to play on steroids.”

27 Comments

|

Unstraight numbers

Thursday, Mar 17, 2011 - Posted by Rich Miller

* It’s really getting difficult to take the Senate Republicans seriously…

An effort to repeal the 66 percent Illinois income tax increase approved earlier this failed in a Senate subcommittee Wednesday.

Sen. Matt Murphy, R-Palatine, sponsored the measure, which was defeated 2-1 in a subcommittee where Democrats had the majority. […]

The brief committee debate pitted Senate President John Cullerton, D-Chicago, who contended that repeal would mean legislators would have to cut an additional $7.2 billion from the budget, versus Murphy, who called the tax increase “a job-killer.”

“You would not need to cut $11 billion. The number would not be that high,” said Murphy, who later suggested that undoing the tax increase would require $8 billion to $9 billion in budget cuts next year.

OK, let’s do some math. Last week, the SGOPs said this…

“We have determined after careful review that in order to reverse the course, we’re going to have to make additional cuts of between 4 and 6 billion dollars to what the governor has proposed,” said Senate Minority Leader Christine Radogno (R-Lemont).

So, replace the approximately $7 billion in expected revenues from the tax hike with budget cuts. Then, add the $4-6 billion in additional cuts that Murphy and his colleagues said are absolutely needed to balance next fiscal year’s budget and you get $11-13 billion. That’s a bit different than the “$8 billion to $9 billion” in cuts that Murphy said yesterday would be needed to balance the budget. Also, without that income tax revenue, more bills won’t be paid this fiscal year, which will make the hole next year even bigger. Maybe $2-3 billion bigger. So now we’re talking up to $16 billion in cuts.

Matt Murphy is one of my favorite legislators, but he needs to get his numbers straight.

* Meanwhile, I told subscribers about this the other day…

The Illinois Senate’s revenue estimate is $1 billion more than the number the Illinois House approved as the ceiling for state spending in the next fiscal year.

The Senate arrived at its projection of almost $34.3 billion by taking the nearly $34.9 billion estimate from the legislature’s Commission on Government Forecasting and Accountability (COGFA) and trimming away about $600 million in revenues that would require a break from the federal tax code. The General Assembly has not approved the change needed for those revenues to be realized.

The House has opted for a more conservative estimate of almost $33.2 billion. Gov. Pat Quinn estimates the state will have almost $34 billion to spend on next year’s budget. Quinn’s projection also includes money from the proposed change to the tax code.

COGFA Director Dan Long said the commission’s estimate is more than Quinn’s because of a timing issue with revenues from the recent income tax increase. Long said that some of the money from the increase expected in the current fiscal year will not actually come in until FY 2012. He said the shift is not reflected in Quinn’s numbers.

* Other numbers stuff…

* College Illinois managers say prepaid tuition fund is stable - Plan projected to have 31 percent shortfall, according to news report

* School district finances rebound - Annual state report says fewer districts are in trouble

* House committee decides where state money will go: The general revenue fund is estimated by the House to have $33.2 billion available for fiscal year 2012. Of that, 28.742 percent would go to elementary and secondary education, 5.158 percent is for general services, 8.761 percent for higher education, 50.361 percent for human services and 9.978 percent for public safety.

* GOP senator: Cigarette tax not needed for capital project: Gov. Pat Quinn’s office also does not appear worried about a work stoppage this summer. Spokeswoman Kelly Kraft said building new roads and buildings is helping to bring in money by putting people to work.

* State should fold on video gambling, Cullerton says - Illinois should end controversial plan even before it gets off the ground, Senate president says

* Out with video gambling and in with higher cigarette taxes: State Sen. Kyle McCarter, R-Lebanon, said it would be wrong to reverse course on video gambling because people have already began to make investments in the business.

* Cigarette tax hike advances in Illinois Senate: “People have relied on our representations that we did a deal [on video gaming], the governor signed it and they invested money in this state,” said Senate Minority Leader Christine Radogno, R-Lemont. “Here we are again, yanking the rug out from under people.”

* Cigarette tax increase is a ‘no go‘ for now

* Schools or Jails

37 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|