* This is actually far worse than reported…

For the second year in a row, Illinois ranks dead last when it comes to saving money to pay promised worker pensions — and the hole is getting worse.

According to a new report being issued this morning by the Pew Center on the States, Illinois through fiscal 2009 had set aside just 51% of the $126 billion it will need to pay retired workers their pensions.

That ranks the Land of Lincoln last of the 50th states, with only West Virginia at 56% and Oklahoma at 57% within six points of Illinois. Financial experts say a prudent state ought to have 90% of the money on hand for pensions that it will need.

The shortfall actually is probably greater than the $62-billlion figure Pew is reporting because the ‘09 numbers are a blended average of returns over prior years, before the stock market crashed in 2009.

Fiscal Year 2009 ended on June 30th of that year. The Dow dipped to 7062, the lowest it had been since 1997, at the end of February, 2009…

FY 2009 was also Rod Blagojevich’s last budget. He wasn’t exactly responsible.

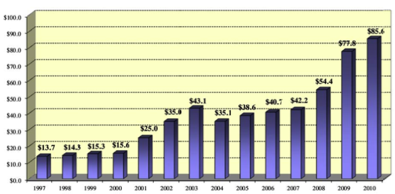

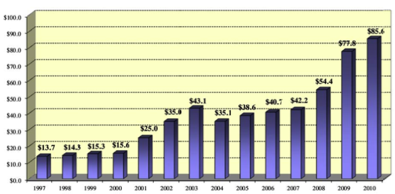

* But the Pew report is actually way off. According to the Commission on Governmental Forecasting and Accountability, total unfunded liability was $78 billion in FY 2009 (way above Pew’s $62 billion), and almost $86 billion by FY 2010.

Here’s a depressing COGFA chart of the state’s historical unfunded liability…

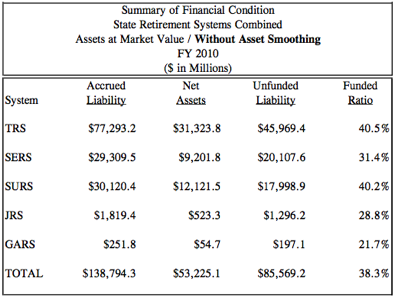

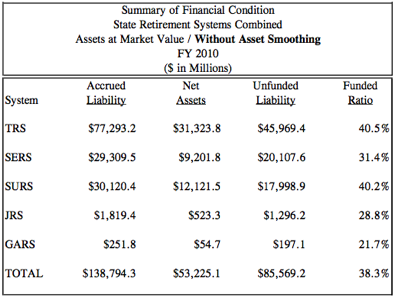

And check out the percentages for FY 10…

The Pew study estimated the shortfall at 51 percent for FY 09. COGFA has FY 10’s number at almost 62 percent.

* Another dramatic number…

When the pension shortfall is combined with the cost of retiree health care, states face a gap of $1.26 trillion between money on hand and what they’ll eventually owe. That’s about $9,500 for every household in the United States. The study did not include many local government pension plans, which face similar problems.

Oof. The Illinois numbers…

In response to questions from Schoenberg, DHFS said that as of January, nearly 82,000 retirees and survivors get coverage under the state health insurance program. Most of them are covered by Medicare, with state insurance serving as a Medicare supplement policy. But DHFS said more than 27,500 retirees and survivors are not covered by Medicare.

Whether a retiree pays premiums for that health care depends on when the person retired and how long they worked for the state. People who retired before Jan. 1, 1998, do not have to pay premiums. Those who retired after that date have to pay premiums, but the amount is reduced by 5 percent for each year of service. Someone who retires with 20 or more years with the state does not have to pay a premium for coverage. However, they are required to pay for dependents on their coverage and make co-payments and related service charges required by their health plan of choice.

- Obamas Puppy - Tuesday, Apr 26, 11 @ 9:45 am:

Gee that is what happens when underfund a plan that already underfunds the systems. Now watch the media and the business community turn this into another reason to reduce benefits. You could eliminate every pension benefit and still be stuck with this bill. Oh yeah that combined with no Social Security, attack on collective bargaining and the demonization of public educators. Come teach in Illinois it is fantastic!!!

- Roadiepig - Tuesday, Apr 26, 11 @ 9:57 am:

Seeing the numbers put in front of you using charts and graphs makes this mess even more depressing. I myself am less than a year from retiring and I worry every time I see how all the games playing and “pension holidays” perpatrated by our legislators have damaged state retiree’s futures. Its too late for someone with the years I have in to switch to a 401K type of pension (I have invested in deferred comp ) but I hope new employees are giving that option soon. Take that tempting pot of money away from the legislators and future governors!

- Cincinnatus - Tuesday, Apr 26, 11 @ 9:58 am:

So, the legislature over promises on pensions and healthcare, and then underfunds their promises. That pot of “promised” money is just too tempting an opportunity for shenanigans by these “leaders” we elect. Do these numbers surprise anyone?

Yet more reinforcement for changing public employees to fixed contribution retirement and healthcare systems used in the private sector. It may cost a little bit more up front, but will provide a much more stable environment.

And before anyone starts saying that Medicare is a problem, I know. It is another demonstration of the inability of the government to run anything more complicated than a one car funeral.

- heads up - Tuesday, Apr 26, 11 @ 9:58 am:

this shows that Edgar’s longterm reform of the pension systems looked great on paper but practically the GA was never disciplined enough to make those payments. In their defense the reform law put all the pain down the road. Typical.

Oof is right.

- Reality Check - Tuesday, Apr 26, 11 @ 10:02 am:

Pew nails the cause of this crisis:

“Just as failing to meet a monthly payment on a personal loan can result in higher payments down the road, a state’s failure to pay the annual bill for retirement benefits can mean it will have to pay more in the future.”

That’s exactly what Illinois politicians did for decades.

Now they want to break the pension promise to police and fire fighters, teachers and other public employees? 80% of who don’t even have Social Security to fall back on?

Working people shouldn’t be punished for the recklessness of politicians.

- Irish - Tuesday, Apr 26, 11 @ 10:05 am:

Check the link for a mainstream media source that gets it and explains for all to understand.

http://new.bangordailynews.com/2011/03/11/opinion/pension-problems-not-workers%E2%80%99-fault/

- Cincinnatus - Tuesday, Apr 26, 11 @ 10:19 am:

Reality Check,

I am unaware of any mainstream source that has advocated that previous promises made to public employees be breached. Can you provide some names?

- Reality Check - Tuesday, Apr 26, 11 @ 10:24 am:

Do you consider politicians, CEOs who are self-appointed “civic” guardians, their law firm and certain editorial boards to be “mainstream”?

If so, how much time have you got for the list?

- CircularFiringSquad - Tuesday, Apr 26, 11 @ 10:43 am:

Looks like the “pension promise” might have been a employer/employee hustle that let the pols collect “support” while the union fat cats gather the big bucks job.

Losers? Usual suspects workers & taxpayers

Meanwhile Corporate CEOs, lawyers and assorted private sector fat cats have plucked their share of the pie in the spirit of “free enterprise”

- jeff - Tuesday, Apr 26, 11 @ 10:44 am:

Working people shouldn’t be punished for the recklessness of politicians.

I know the writer meant the workers relying on these pensions, but we are all going to get hit and hit hard. There is not an easy fix and it will cause us a lot of pain. Do you think taxing my retirement at higher rate to pay for your pension is going to be painless to me?

- wordslinger - Tuesday, Apr 26, 11 @ 10:45 am:

I’m not buying the sky-is-falling rhetoric yet on public pensions; it’s a long-term issue, for sure, that has been turned into a club for an immediate right-wing assault on public employees.

Right now, it’s the flavor of the month. Remember the other recent ones? Impending mass muni bond defaults? State defaults and bankruptcies? U-hauls carting the state away?

The actuarial table snapshots are not great. But they are snapshots. Are the actual dollar amounts really as daunting, over time, given the size of the state economy and historic growth?

The Center for Economic Policy Research posits that a lot of the pension fever is hype, and that the problem is manageable based on historic equity market and GDP growth.

==In most states the unfunded liabilities are well under 0.2 percent of future income. This implies that increased revenue equal to 20 cents of every $100 of future output would be more than sufficient to eliminate the shortfall. Even in the states with largest shortfalls, the burden appears manageable. In Ohio, the shortfall is equal to 0.47 percent of future output, in Illinois it is 0.37 percent of future

output, and in Mississippi and Rhode Island it is equal to 0.36 percent.==

The full report is here.

http://www.cepr.net/index.php/publications/reports/the-origins-and-severity-of-the-public-pension-crisis

- Cincinnatus - Tuesday, Apr 26, 11 @ 10:50 am:

Reality Check,

I’ll settle for ONE name of a mainstream person or organization who has advocated that past promises be broken. Even the bogeyman Tea Party believes that contracts should not be broken.

- PaGo - Tuesday, Apr 26, 11 @ 10:52 am:

Saw this on a TV news show couple months ago (small Alabama town not paying pensions). Don’t think it can’t happen on a larger scale, especially in this State.

http://www.huffingtonpost.com/2010/12/23/pension-crisis_n_800652.html

It’s sickening.

- Bill - Tuesday, Apr 26, 11 @ 10:58 am:

Word is right.

The coming waves of inflation will decrease the value of the current pension debt even without the growth that will inevitably take place. Draconian cuts to current employee benefits are not necessary. The state has already screwed new employees to the point that they will be paying for their own pensions and the debt for older employees pensions as well. The state will pay nothing as usual.

It is easy for idealogues to demonize public employees, blame pensioners for their own inadequacies, and ride the tea party wave to avoid paying their fair share. Everything is cyclical. This too shall pass.

- fed up - Tuesday, Apr 26, 11 @ 11:00 am:

How about we send the General Assembly home for 3 years and only come in for a week a year to complete the budget. No new laws, how much money would we save?

- Reality Check - Tuesday, Apr 26, 11 @ 11:03 am:

Amen wordslinger.

@Cinc, it’s a funny game you’re playing, trying to twist my words into some silly distinction about “past” promises.

Morality isn’t about what you can get away with — it’s about right and wrong. And however you spin it, changing the rules on fire fighters, police, teachers and other public employees — most of who don’t even have Social Security to fall back on — is wrong.

- Pat Robertson - Tuesday, Apr 26, 11 @ 11:10 am:

==Do you think taxing my retirement at higher rate to pay for your pension is going to be painless to me?==

Well, Jeff, considering that Illinois does not tax your pension at all, I don’t see that as much of a concern. If the law does change, they’ll be taxing state retiremnent income, too, so you’ll all be sharing the pain.

- wordslinger - Tuesday, Apr 26, 11 @ 11:13 am:

From the SJR edit board:

–As the General Assembly returns to work in the coming weeks — the House on Tuesday, the Senate on May 3 — we urge lawmakers to pass House Bill 149 — or some form of it — and initiate the inevitable court challenge that will yield an answer. The bill does not seek to cut benefits directly, instead giving employees hired before this year the option of paying more to keep their benefits the same or choosing between two alternate plans that offer lesser benefits.–

Cinci, that’s backed by plenty of non-bogeymen. Does that pass your test, or do you want to parse it a little tighter?

- Cincinnatus - Tuesday, Apr 26, 11 @ 11:15 am:

Reality Check,

If you believe past promises should be projected into the future, and no change can be made to current contracts, you should then propose a way to get us out of the mess since the status quo is clearly unsustainable.

I would contend that it is morally wrong to saddle the children of 95% of the people in Illinois to sustain the lavish pensions and healthcare promises that have been made to a favored minority in the past by the GA. It is not the workers who have the morality problem, nor the taxpayers. It is the so-called “leaders” in the state, and the elite that enables them.

- Cincinnatus - Tuesday, Apr 26, 11 @ 11:22 am:

wordslinger,

If I remember the context from last week’s discussion, the SJR is not proposing that the promises be broken, but that the challenge be made so that the issue can be settled once and for all. Furthermore, one of the options in HB149 is that current participants in the pension program can elect to remain in the current program with no changes. This clause is proposed as part of the transition proposed in the bill to a fixed-contribution plan.

Several groups have objected to HB149 as unconstitutional on its face for even allowing employees to choose a new path, even though they need not do so. In other words, those groups are supporting the status quo.

- wordslinger - Tuesday, Apr 26, 11 @ 11:27 am:

–one of the options in HB149 is that current participants in the pension program can elect to remain in the current program with no changes.–

But, at an additional cost, thereby reducing its value.

- Cincinnatus - Tuesday, Apr 26, 11 @ 11:31 am:

wordslinger,

I believe the costs of the plan have always been subject to legislative revision and have been adjusted several times in the past, no? I might be wrong here, but I think I remember reading that last week on CapFax.

- Reality Check - Tuesday, Apr 26, 11 @ 11:42 am:

Cinc said propose a way to get us out of the mess since the status quo is clearly unsustainable.

The status quo is politicians failing to keep their end of the bargain, even as child protection workers, nurses, disability caregivers and other public employees always paid their own sizable contributions faithfully and in full.

Yes, it’s way past time for that to change.

What do I propose? That politicians keep their promise and pay what they owe.

And that people like you, Cinc, spend more energy figuring out how to uphold that promise (I might suggest progressive taxation) and less trying to rationalize changing the rules on cops, fire fighters, teachers and more.

- 47th Ward - Tuesday, Apr 26, 11 @ 11:47 am:

===It is another demonstration of the inability of the government to run anything more complicated than a one car funeral.===

This is why I find you so obnoxious Cinci. Did you just land here from another planet? Government programs like Social Security and Medicare lifted millions of senior citizens out of poverty, giving them dignity in their old age. Millions of children are fed and given access to healthcare. No one starves in this country. We’ve eradicated diseases like polio and TB.

The food you eat is the safest anywhere on the planet. The air you breathe and water you drink are not contaminated. We have the finest highways and best airports in the world. Millions of rural Americans have electricity, and our fastest growing cities are in desserts. Our military is the greatest armed forces the planet has ever known.

All of this is the work of government. It is far from perfect, but it works. You and others who think government is the problem are living in a fantasy if you think we can replace it with the market.

America is still the best country on the planet, thanks to our government, not in spite of it.

- Reality Check - Tuesday, Apr 26, 11 @ 11:48 am:

Cincinnatus: costs of the plan have always been subject to legislative revision and have been adjusted several times in the past, no? I might be wrong here

You are wrong here.

“[T]he Pension Clause not only makes a public employee’s participation in a pension system an enforceable contractual relationship, but also constitutionally protects the pension benefit rights contained in the Illinois Pension Code when an employee joins a pension system, including employee contribution rates.” Illinois Senate parliamentarian Eric Madiar

- dupage dan - Tuesday, Apr 26, 11 @ 11:58 am:

Reality Check @11:42am,

=What do I propose? That politicians keep their promise and pay what they owe=

How do we interpret that comment - “politicians pay what they owe”? To the pension fund? Are you suggesting that the GA pony up personal cash to make up the difference in the pension funds? Wow, you must think they make alot more than they do for them to make up 10s of billions of dollars in the shortfall. Or do you suggest they make sure that the pension is paid in full every year (presumabely ‘from now on’). How does that make up the current shortfall? Raise taxes to make up the difference? How, then does that reconcile to your comment that the politicians “pay what they owe”. If the taxes are raised, how is it, then, that the politicians are paying what they owe?

Please clarify.

- Katiedid - Tuesday, Apr 26, 11 @ 12:02 pm:

Cincinnatus - You are correct that the contribution rates for some of the plans have been adjusted over the years, including raising employee contribution rates, but ALWAYS in conjunction with them receiving something else. In other words, if the employee contribution rate increased, then the benefits were also increased at the same time.

- Cincinnatus - Tuesday, Apr 26, 11 @ 12:02 pm:

47th,

You seem to miss my point that the government can establish rules, and that is a proper role of government, but they can’t run anything.

Social Security was never intended as a retirement program for all people. FDR said so, look it up. It is the constant finagling by elected officials and government bureaucrats that changed it from a safety net to a potential drag on the economy.

Medicare is bankrupting the economy. Competing visions of how it should be “fixed” are being debated, ObamaCare v. RyanCare. However, healthcare costs ARE being effectively handled by the private sector simply because the private sector sends the responsibility to the employee who provides downward pressure on costs (not enough unfortunately, but government COULD help with tort reform and buying across state lines, for instance). As far as government RUNNING a healthcare program, it can. Medicare s the proof.

How about Medicaid? Hows the government doing there? There is a recent study that says the by looking at the health outcomes of Medicaid recipients, there is absolutely no difference between their health outcomes and the uninsured.

The EPA is doing a fine job assuring food safety. We argue all the time about the reach of the EPA, but our food is safe. Of course, the actual food is grown, processed and distributed by the private sector. I also want to remind you about Alar on apples, not the EPA’s finest moment.

Great airports in spite of the sleeping controllers. Only two of the seven instances reported recently have resulted in disciplinary action. Think that would be the case in the private sector?

The military is the best thing our government does, no doubt. Non-unionized too.

America is the best country on the planet in spite of our government because our Founders were smart enough to limit the reach of the government. That single step promoted the individual spirit, and the sense of community to help our neighbors.

Unlike you, who seem to look to the government to solve problems, I look to the people to solve those same problems in a much more efficient manner. Government is an overhead to the actual work of America, and must be minimized just like any other overhead cost.

- Tinman - Tuesday, Apr 26, 11 @ 12:12 pm:

This underfunding of Illinois retirement system has been going on for decades. These funds have never been well funded. So does that mean they are running out of money. No, but they do need to be improved. Current returns on investments are beginning to uptick the funded level. What is happening now is the political gamesmanship of certain groups to undermine the contract the public has with their employees. Divide and knock down public employees.This is too complicated of a subject just have a few lines here. But people are being played.

- wordslinger - Tuesday, Apr 26, 11 @ 12:22 pm:

===It is another demonstration of the inability of the government to run anything more complicated than a one car funeral.===

Such elevated discourse. Where do you hearty, self-sufficient, anarchists live, anyway? Out in the woods somewhere?

- Reality Check - Tuesday, Apr 26, 11 @ 12:23 pm:

Are you suggesting that the GA pony up personal cash to make up the difference in the pension funds?

Sorry, I assumed people understood that the employer contribution is to be paid by the employer. In the case of the state, cities, counties etc, the employer’s purse strings are held by politicians. Who should pay what they owe.

- Sam I am - Tuesday, Apr 26, 11 @ 1:17 pm:

The refusal to acknowledge the problem and take action now to reign in the unsustainable costs of these programs ensures that the entire rotten system implodes in the future. People who are counting on this money in ten years or so should prepare themselves for not getting what they were promised. The deniers are your worse enemies.

- Sam I am - Tuesday, Apr 26, 11 @ 1:18 pm:

worst

- PublicServant - Tuesday, Apr 26, 11 @ 2:53 pm:

The only thing that’s clearly unsustainable is the overuse of the word. Wordslinger stated it succinctly at his 10:45AM post above.

- jans - Tuesday, Apr 26, 11 @ 4:55 pm:

In 2010, IL’s TRS (Teacher Retirement System) reports that it is only 48.4% funded (“smoothed assets” $37 billion, liabilities $77 billion. It may actually be worse. One report listed “market value as $31.3 billion). The main reasons for this are:

1. For several years the state did not contribute its full share. It is now contributing a larger portion to make up for this.

2. In 2008 and 2009 TRS investments lost value (in fact about 1/4th of market value - and they started reporting a “smoothed value” instead). TRS assumes the largest source of funds will be return on investment (It assumes 8% per year).

3. End of career salary spiking (such as 6% pay raises for the last 3 years) has become common. This allows teachers and administrators to get larger pensions at little cost to the local district, and without funding the pension system to cover this pension bump.

Any solution to this problem will be seen as “unfair” by some group. Teachers were promised. But, taxpayers never agreed to pay.

- jans - Tuesday, Apr 26, 11 @ 4:56 pm:

The IL constitution, Article XIII section 5 states “Membership in any pension or retirement system of the State… shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.” Of course it also limits government obligations to what is affordable… Article VIII section 2a, says “…Proposed expenditures shall not exceed funds estimated to be available for the fiscal year as shown in the budget.” Implied in this is that the government may not obligate itself in future years to more than is anticipated. Given the current state of IL’s finances, our politicians have broken at least one of these rules.

A permanent solution will most likely require a constitutional amendment.

Taxpayers simply cannot pick up the tab. That leaves two options. Increase the portion current teacher pay into the system, or decrease the payouts via some formula to limit total payouts to what each fund can afford. It could be a cap, a percent of what should be paid or some combination.

Before you feel too sorry for the retired teachers, note that as of June 30, 2010 there were 4,352 government pensions in excess of $100,000 per year, while IL’s median family income is around $57,000.

- wordslinger - Tuesday, Apr 26, 11 @ 5:25 pm:

=–Any solution to this problem will be seen as “unfair” by some group. Teachers were promised. But, taxpayers never agreed to pay.==

Simply not true. Taxpayers/voters passed a Constitution, refused another Constitutional Convention, and have elected the folks who’ve been making the decisions.

C’mon, there are no victims here. We’re all big boys and girls. There are some responsibilities with contracts and citizenship.

But everything can be negotiated. The unions know that. The state still holds the ultimate hammer of contracting everything out and throwing public employees out of work.

Can we grow up and get real here and just continue the dialogue? There’s been some heavy lifting done in the last few months in a number of areas. Keep it going.

But let’s not count on the great leaders of the Civic Committee, bedrock establishment types who’ve adopted ignorant Tea Party tactics.

IllinoisisBroke.com certainly is flush — they’re on the radio all day long peddling the fiction that public employees have robbed you blind and insulted your sister. They are a creature of the Civic Committee of the Commercial Club of Chicago.

http://www.civiccommittee.org/members/index.html

- jans - Tuesday, Apr 26, 11 @ 5:40 pm:

Taxpayers may have thought they were protected. In Illinois, the politicians can not raise property taxes without a voter referendum. Income tax has traditionally been low - went from 3% to 5% 1/1/2011 and it is still not enough. Many use fees have been introduced or increased over the past decade or two.

Politicians did the best they could to hide IL’s fiscal solvency by juggling the books - delaying payments.

The root of the problem is forced unionization and dues for public sector employees, dues that the union leadership uses to fund their favorite politicians - Thus picking who they have to negotiate with… No one has been representing the taxpayer. But, the taxpayers are catching on.

- steve schnorf - Tuesday, Apr 26, 11 @ 10:09 pm:

jans, you must be new. The state isn’t “making up” for past undercontributions; it’s still undercontributing by roughly $4 1/2B per year. We’re going further in the hole, not catching up.

As ws points out to you, yes we did agree to pay this by electing the people who established the laws and budgets, just like “we” made marijuana illegal, whether you personally favor that or not.

And, btw, yes property taxes can be raised without referenda.

Bone up. Most people on here are serious.

- jans - Tuesday, Apr 26, 11 @ 11:16 pm:

I am not sure what the contribution formula is officially, but according to page 7 of the Essential facts about TRS: http://trs.illinois.gov/subsections/general/pub13.pdf in 2010

Member contributions = 899.4 mill

Employer contributions = 171.4

State of Illinois = 2,080.7 mill (or 2 bill)

So currently the state is contributing more than the employees.

For details see http://trs.illinois.gov/subsections/general/actuarialreports.htm You will see that the main reason the funds are going “further in the hole” is due to lack of investment income.