|

Let’s have a look at the Illinois Policy Institute’s new poll

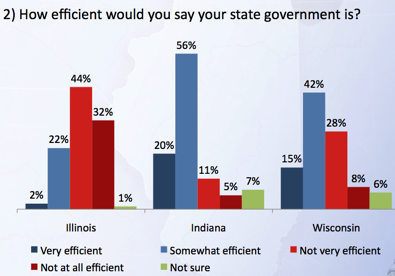

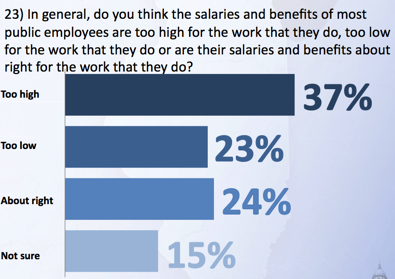

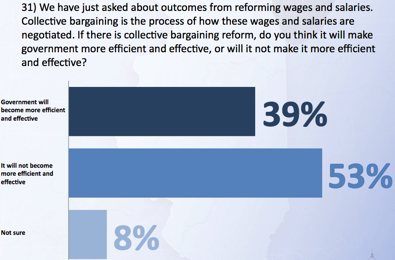

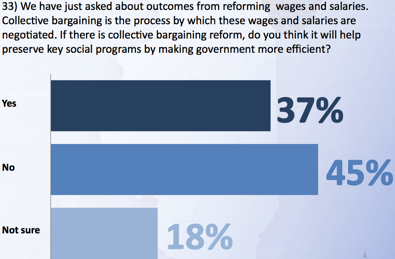

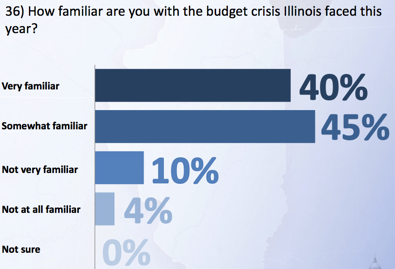

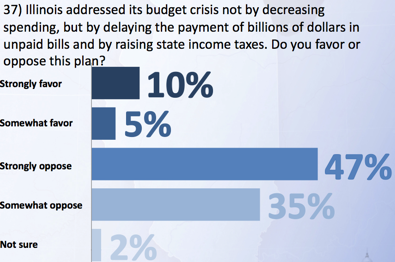

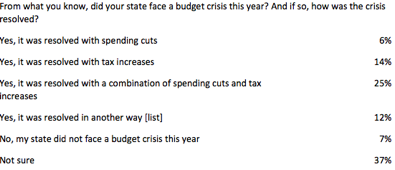

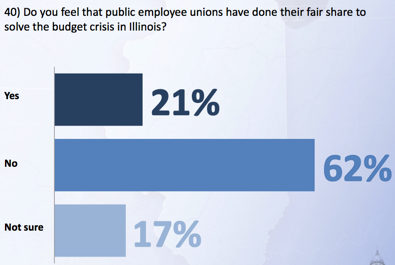

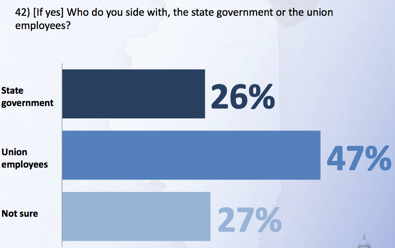

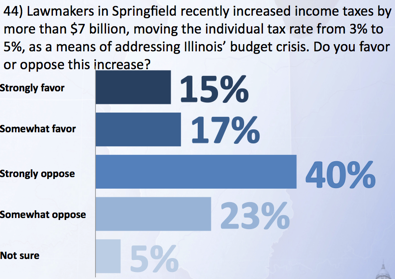

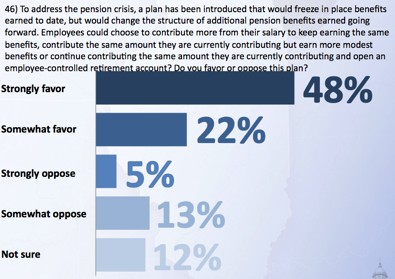

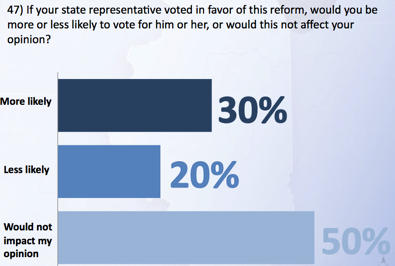

Wednesday, Sep 21, 2011 - Posted by Rich Miller * As promised, here are some of the results from a statewide poll conducted for the Illinois Policy Institute by Doug Schoen. The full poll can be read by clicking here. Graphic image results, which was what the IPI sent to inquiring reporters yesterday, can be viewed by clicking here. The universe is small, just 400 registered voters. It was taken August 29 through September 5th. There are no available crosstabs. They did provide some demographics, however, including 42 percent Democrats, 24 percent Republicans and 26 percent independents. That’s about right. 19 percent said they belonged to a union, and 61 percent of those said they belonged to a “public union.” * Right off the bat, you can see that Illinoisans have no illusions about how well their government runs…  Wisconsin and Indiana residents are obviously more pleased with their state governance. From the full results, they have the state’s right economic track at 23 percent and wrong track at 74 percent. * As you might expect, considering the source, much of the poll is aimed at state workers and unions. But Illinoisans are not reflexively anti-public worker. For instance a strong plurality say that public worker salaries are either too low or about right…  * The IPI skipped over some questions in its graphic presentation that it sent to reporters. The full report has those questions. For instance, 56 percent say public employee retirees should not have to “contribute more toward pension and healthcare benefits because of state and local government budget problems.” The public is also divided over the question of whether public employees are paying their fair share toward retirement costs, with 38 percent saying they are paying their fair share and 36 percent saying they aren’t. * And while there is some support for collective bargaining “reform,” a 53 percent majority opposes restricting collective bargaining rights. The public also doesn’t think that this reform will make much difference…  Also…  * Since the Statehouse receives middling coverage around Illinois, most legislators have grown accustomed to operating without much public knowledge. However, the public is obviously keeping track of the budget crisis…  * It’s no surprise that the IPI would ask loaded questions in its poll. It is what it is. However, it’s even worse when they cross the line into deliberate falsehoods…  The public has a different view about how the problem was solved, however…  * Once again, back to public employees…  * According to the poll 70 percent had [not] heard about the lawsuit between AFSCME and the state. The lawsuit was not described, but those who said they had heard of it were then asked which side they backed. This will give you a good idea of how much contempt voters have for the state. Even though respondents believe that the union is not doing enough to help with the state’s problems, a clear plurality sides with the union over the state…  However, when the lawsuit is explained in the next question, 63 percent said the union should have to accept a pay freeze, while just 27 percent said the union should get its guaranteed pay increase. * This is one of two biggest surprises in the poll results. 32 percent actually favor the tax hike? I never would’ve thought it was that high…  * This is little surprise…  * Here’s the other, perhaps bigger surprise. Even though a clear majority favors pension changes, few actually say it would move their votes, and only by a paltry net of ten percent…  If that result is accurate, and the universe is quite small so I can’t say it is, then there’s no good political reason to go against the unions on this issue. Legislators might have a fiduciary reason for doing so, but the political benefit could be slight to nil. Then again, control of the House and Senate is decided in districts that are more independent-leaning, so the numbers could be stronger there. Discuss.

|

|

|

|

|

|

- Anon - Wednesday, Sep 21, 11 @ 1:32 pm:

I don’t understand the “falsehood” you’re accusing this poller of. Didn’t the budget extend payment cycles?

- Ray del Camino - Wednesday, Sep 21, 11 @ 1:32 pm:

As you suggest, Rich, let’s take all this with a grain of salt, given the small sample size and the ax this outfit has to grind.

- Anonny - Wednesday, Sep 21, 11 @ 1:41 pm:

I steadfastly refuse to believe any state bordering Illinois is a better place to live / work / set up a business in, than Illinois is.

- Coach - Wednesday, Sep 21, 11 @ 1:47 pm:

Looks like IPI is trying to rebuild credibility after the Bob Rita onslaught that didn’t turn out real well for them. Too bad they didn’t include a poll question about whether anybody should trust or pay any attention to an organization that accuses a sitting lawmaker of committing a felony (when he didn’t) and illegally occupying a seat in the legislature (when he may legally serve in the legislature, even if he committed a felony, which he hadn’t), and then waiting weeks before issuing a half-hearted retraction.

- wordslinger - Wednesday, Sep 21, 11 @ 1:59 pm:

–I steadfastly refuse to believe any state bordering Illinois is a better place to live / work / set up a business in, than Illinois is–

By any objective measure, you would be correct. In our mobile, free society, more people have chosen to live here, more people have chosen to work here, and more businesses have chosen to locate here than in any bordering state.

- Anonymous - Wednesday, Sep 21, 11 @ 2:10 pm:

“…then there’s no good political reason to go against the unions on this issue. Legislators might have a fiduciary reason for doing so, but the political benefit could be slight to nil.”

Rich-

Your analysis seems dead-on correct, but it is that kind of short-term political thinking which got the state into its current financial mess. Everything is wonderful until the music stops and there are no chairs left.

- just sayin' - Wednesday, Sep 21, 11 @ 2:20 pm:

In other poll results, 87% said they were glad IPI doing something other than falsely claiming a state lawmaker is ineligible for office due to criminal history.

- Mark - Wednesday, Sep 21, 11 @ 3:34 pm:

Regarding pensions. Specifically teacher pensions. Does most of the public know that in the 2010-2011 school year the Illinois State Board of Education (ISBE) reported that 64.6% (559 of 865) of school districts in IL consider teacher retirement to be board paid? Would most of the public even know what that means? It means in those 559 districts, the teacher is contributing little or nothing to their pension plan. It means the employer (school district) is making all or most of the “teachers” 9.4% contribution to the TRS pension plan. Well let’s see, how would the public know this. First you would have to find this report.

http://www.isbe.state.il.us/research/pdfs/teacher_salary_10-11.pdf

Then you would go to page 10 of the Adobe document (which is numbered page 6 in the report).

Then you would locate Table 10 which is titled, “Mean Percentage of Teacher Retirement that is Board Paid, by District Type and Size, and by Percentage os Districts that Consider Teacher Retirement to be Board Paid”.

Then you would add up the numbers. Of course you would have to know that “Board paid” means the school district, not the teacher, is making the contribution to the pension plan.

Of course if you look at the collective bargaining agreement for your school district, available on your districts website, you can determine if your school district is paying all or a portion, of the 9.4% “teachers contribution”, to the TRS pension plan. Assuming you can decipher the vocabulary used in the agreement.

- Bring Back Boone's - Wednesday, Sep 21, 11 @ 4:09 pm:

In regards to the poll question about the AFSCME lawsuit. Something like 30% of the respondents knew of the background. Rich, you state that this shows “the voters contempt for the state.” While this is likely to be true, couldnt you say that it’s a fair assumption that the majority of the people who are in that 30% probably have some stake in it- such as they’re already a public employee, part of union, etc.? I think that definitely creates a bias there.

- Rich Miller - Wednesday, Sep 21, 11 @ 4:10 pm:

Bring Back Boone’s, Boone’s is open. Time to change your name.

- Edison Parker - Wednesday, Sep 21, 11 @ 4:13 pm:

An even stronger plurality thinks public sector workers salaries are too high or just about right. The logic is exactly the same, just the spin is different.

- Boone's is Back - Wednesday, Sep 21, 11 @ 4:18 pm:

Done.

- Rich Miller - Wednesday, Sep 21, 11 @ 4:22 pm:

===The logic is exactly the same, just the spin is different. ===

No, it’s not. For crying out loud, if you can’t comprehend why one of these things is not like the other, then there’s no sense in talking to you.

- Edison Parker - Wednesday, Sep 21, 11 @ 4:31 pm:

Rich, thanks for the response, but I disagree with you. In order to make your point that Illinois residents don’t think salaries are too high, you combined two categories. It’s just as easy to combine them the other way. That’s the problem with statistics and polls. You can manipulate them how you want them to support your point, which you just did. But instead, it is easier to just resort to an ad hominem attack. Another wonderful fallacy. Try another one now.

- Rich Miller - Wednesday, Sep 21, 11 @ 4:39 pm:

===It’s just as easy to combine them the other way. ===

No, it’s not.

IPI, the poll’s sponsor, constantly harps about high public employee salaries. The Tribune and most other media outlets also harp on this point.

I cannot remember any major media outlet reporting a story about how public workers in Illinois make too little money. Not even Gov. Quinn will say that.

Therefore, “just about right” and “too little” are infinitely more closely related than “too much.” “Too much” is the default position by public opinion leaders and in every broadcast, newspaper story, etc. you’re likely to read.

Ergo, you’re full of it.

- JustMe - Wednesday, Sep 21, 11 @ 4:41 pm:

==It means in those 559 districts, the teacher is contributing little or nothing to their pension plan.==

A totally meaningless point. Either way, the teacher is paying for the pension by performing personal services. Or can you explain why it is better for the board if it pays a teacher $50,000 and then takes away $5,000 to contribute to their pension plan than if it pays the teacher $45,000 and contributes $5,000 to the pension plan itself? And I should warn you, that’s a trick question.

- Commonsense in Illinois - Wednesday, Sep 21, 11 @ 4:48 pm:

I find the question about state employee salaries a bit loaded. It might be a fairer question if there was some reference point of salaries of a particular public sector job compared to the same job in the private sector. But simply asking do they make too much “for the work they do” taints the question.

- ZC - Wednesday, Sep 21, 11 @ 5:50 pm:

It’s not as much the tax hike, it’s the economy. Lobbyists will scream about the tax hike, business groups will, people who write or call or actively lobby, Tea Party types - yes, yes, yes. And those intense constituencies are important.

But the general electorate is less anti-tax, in Illinois and elsewhere, than is sometimes believed. The Democrats in Springfield should be more worried about the tax increase than what the economy looks like a year from now.

- ZC - Wednesday, Sep 21, 11 @ 5:51 pm:

Sorry, that last sentence should have been reversed.

- Reality Check - Wednesday, Sep 21, 11 @ 5:57 pm:

@ZC And the economy is going to look worse if state and local governments keep laying people off.

- Mark - Thursday, Sep 22, 11 @ 12:09 am:

JustMe, every private sector employee would love it if their employer contributed 9.4% (or close to it) to their 401k plan; and the employee contributed little or nothing. Furthermore, the teacher unions (IEA, IFT) promote in the press the teachers contribute to their pension plan but not social security, but in many cases the teachers are not contributing (or contributing little) to either. The board paying the teachers contribution is a way to boost teacher take home pay while maintaining the required contribution to the pension plan. At the time that perk went into effect in the collective bargaining agreement, the teacher salary was not reduced. Thus, teacher take home pay increased. Furthermore, when that perk goes into effect in collective bargaining agreements, it’s not clearly disclosed to the public in plain English that the average Joe can understand, such as, “teachers receive 9.4% increase in take home pay because the board now makes the ‘teacher’ pension contribution of 9.4% to the pension plan.”

- IPI the GOP Schill - Thursday, Sep 22, 11 @ 3:38 am:

Once again, Rich you’ve cut to the chase…Andy McKenna and the donors of IPI are constantly wasting their resources on public relations snafus …they are an embarrassment to the free market movement…

Thank you for your diligence in highlighting their con game. Fortunately, lawmakers also see through the Mckenna, Tillman and Proft con game as well

- wordslinger - Thursday, Sep 22, 11 @ 7:54 am:

–Three Worst States to Conduct Business: California, New York, Illinois. No big deal though because one always consult with any Illinois state employee and find out why life is so much better in Illinois.–

Yet three of the five largest state economies in the United States. I guess all those businesses just don’t get it.

- reformer - Thursday, Sep 22, 11 @ 9:45 am:

MARK

Unions have negotiated the pension pickup over the years in lieu of salary hikes. If the boards prefer to pay 9.4% more in salary instead of the pension pickup, they are free to negotiate same.

- Mark - Thursday, Sep 22, 11 @ 3:03 pm:

reformer - I have yet to see a pension pickup in lieu of a salary hike in a teacher collective bargaining agreement. I have only seen both pension pickup and salary hike. Not to mention I have never seen the pension pickup being fully and clearly disclosed to the public, meaning it’s in the district/union press release that accompanies the collective bargaining agreement.

For instance, as I stated above, “teachers receive 9.4% increase in take home pay because the board now makes the ‘teacher’ pension contribution of 9.4% to the pension plan.”

Where other than Illinois school districts does an employer pay the employees portion of a pension contribution? Once again, teachers in 64% of IL school districts contribute little to nothing to their pension plan. It should be a state law that boards cannot pay any portion of a teachers contribution to the pension plan. And boards should not increase teacher pay in return. Teacher Unions have been milking the taxpayer on this item. It’s a very sneaky way to increase teacher pay without the public knowing that teacher pay increased.

- JustMe - Thursday, Sep 22, 11 @ 4:17 pm:

==I have yet to see a pension pickup in lieu of a salary hike in a teacher collective bargaining agreement. ==

The Edgar administration did just that 20 years ago for state workers. 8 years ago, Blago took it away for merit comp, and in the next AFSCME agreement made the unionized workers start conributing again and gave them a pay raise to make up for it.

And I’ll ask the question straightforwardly this time: which was better for the state financially — Edgar’s decision to pick up the pension contribution in lieu of a raise, or Blago’s agreement to, in effect, give the raise and make the unionized workers make their own contributions? Show your math.

- Mark - Friday, Sep 23, 11 @ 4:49 am:

JustMe - Remember, I am just focused on teacher collective bargaining agreements. The topic is teacher collective bargaining agreements that I am discussing. I don’t have any information on the examples you cited. My concern is teachers receiving the perk of the Board paying all or a portion of the Teachers 9.4% TRS pension contribution, are getting a financial perk that the general public is not aware of, inflating teacher overall compensation over and above the general public’s perception. Let me explain. Most people who look into teacher compensation see the teacher base salary on www.familytaxpayers.org, and if they do some digging find trs.illinois.gov and learn that teachers contribute 9.4% to their pension plan. Nowhere can I find an example of “board paid” teachers contribution, what that means, and how that impacts take home pay. But it seems to go something like this. Let’s say a teacher is making $100,000 salary in school year 2010-2011. I picked that number because it’s easier to calculate, not saying what percentage of teachers make $100,000. So the researcher figures teachers are contributing 9.4% of that $100,000 salary to their pension plan, which happens to be $9,400. Thus teacher take home pay is $100,000 - $9,400 TRS pension contribution = $90,600 less whatever other deductions. Now let’s say in year 2, year 2011-2012, the teacher salary remains at $100,000 (for simplicity sake we are leaving the salary the same, the average annual increase is actually 6% per TRS). But, a new collective bargaining agreement has been negotiated, stating the board will pay the teachers’ 9.4% TRS pension contribution. Now in year 2011-12, the teachers are taking home $100,000 - $0 TRS pension contribution = $100,000 less whatever other deductions. The teacher just received a $9,400 (9.4%) raise. The teachers take home pay is now $9,400 more than it was a year earlier. The teachers overall compensation just increased. But, the public doesn’t know that by looking at the teachers salary and looking at trs.illinois.gov or even reading the joint union/district press release of the collective bargaining agreement. Only if the citizen reads the collective bargaining agreement, which are anywhere from say 50 - 75 pages (could be more, could be less), and can pinpoint the language that the pension contribution is now “board paid”, would the citizen learn what just occurred. And how many average citizens know to look for the words “board paid”?

Now, I get it that this was negotiated by the Union and Board/Administration. I am not saying anything illegal occurred. I am saying it’s misleading to the general public.

TRS is misleading the public in stating teachers contribute 9.4% to TRS. In many cases, tachers are not contributing 9.4% to TRS. Many districts are making the contribution “on behalf” of the employee, which means the employee is not making the contribution, the district is making the contribution. I understand that was arrived through collective bargaining. I don’t believe the board should pay any portion of the teachers 9.4% contribution, it should not be a negotiable item (not sure what to do about the 64% that already get this perk). I don’t agree with the way that the school district and unions are disclosing “board paid” teacher contributions to the public. TRS is not disclosing the technique to taxpayers. Or if they are, it’s buried somewhere where I couldn’t find it. If one reads TRS information, one would never get the impression that in 64 percent of school districts, teachers pay little or nothing to their pension plan (and if you want to add that was arrived at through collective bargaining, fine). Very, very misleading to the average person. If you are a teacher or public sector worker maybe you say to yourself, I wonder if the board is picking up any or all of the teachers 9.4% pension contribution. But to those of us outside that world, it never occurs to us the board would pay a portion of the teachers 9.4% pension contribution. It’s really incredible.

And we haven’t even discussed the State of IL fair share contribution that is made “on behalf” of the school districts, which as TRS is designed, is larger than the teachers 9.4% contribution. So in 64% of IL school districts, the district is contributing the 9.4% teacher contribution, the district is also contributing their .58% contribution, the State of IL fair share contribution is say 10% (varies by year, it’s an actuarial calculation), there is investment income (or loss), and the teacher themselves contributed zero. Now there are arguments that the State of IL skipped its payments. But at least you get such a sizeable contribution sometimes - most private employees don’t get anywhere close to 9% or 10% contribution from their employer to their retirement plan. And there are arguments the board paid 9.4% was negotiated during collective bargaining (no private employer pays the employees pension contribution - well I suppose there is an exception somewhere but it would have to be a very small % not 64%). Basically through the State of IL fair share contribution on behalf of the employer (school district), the teacher is receiving over 100% “matching” as it would be called in a private sector 401k plan. On averge. And in 64% of districts, the teacher is contributing zero to their pension plan (yes I realize it is negotiated through collective bargaining to be zero). And we haven’t even talked about end of career salary increases or exchanging 2 years of unused sick pay for 2 years of service credit to retire 2 years early. We haven’t discussed it’s a defined benefit not defined contribution plan. We haven’t discussed the pension is guaranteed in the “pension protection clause” in the State of IL constitution as of 1970 Constitutional Convention (before that it was not guaranteed). And so you have people private sector employees paying taxes so public sector employees will receive benefits that the private sector employee will not receive. And in many cases, I would argue most cases, the private sector employee has no idea they are paying for all these benefits.

- Mark - Friday, Sep 23, 11 @ 5:28 am:

I just remembered, 64% of the districts are considered “board paid”. 64% of the districts not contributing zero. Board paid is not always zero. My apologies. In some cases “board paid” means the teacher contributes nothing. Sometimes though “board paid” means, I think, the district is contributing what I could call a small amount. You can get the data on the ISBE site I listed previously.

And, I anticipate someone will talk about “board paid” being a benefit. Yes it is a benefit. The benefit is the employer (disrict) not employee is paying the 9.4% pension contribution to the TRS pension plan. The benefit means the 9.4% is not a payroll deduction. You can use whatever vocabulary you want, “in lieu of”, “benefit”, “negotiated”, etc., the bottom line, is teacher take home pay increases when “boad paid” is enacted, because the board is making the agreed upon payment to the TRS pension plan, not the teacher.

The public deserves to know the overall compensation of an employee that is being paid with taxpayer dollars. That’s the main point with my posts. My main point is not that teachers are getting paid too much. Once the public knows how much a teacher is getting paid, then the public can decide if that’s too much or not. And the public deserves to know the overall compensation in the plainest possible language, with minimial technical terms. It’s astonishing the number of different types of pay and benefits that a teacher receives. It’s so much simpler just to increase base salary, rather than delving into “board paid” some or all of the 9.4% teacher contribution. And now I would imagine someone is going to englighten us as to the benefit to the board, of having “board paid” some or all of the 9.4% teacher contribution to the pension, rather than increasing teacher base salary. Just remember to include how that benefit to the board, affects teacher take home pay and the benefit to the boad, to the salary the teacher received and pension contribution made by the teacher during the prior year.

- JustMe - Friday, Sep 23, 11 @ 8:24 am:

==And now I would imagine someone is going to englighten us as to the benefit to the board, of having “board paid” some or all of the 9.4% teacher contribution to the pension, rather than increasing teacher base salary. ==

Your own example answers that question. By picking up the retirement contribution on the teacher with the $100,000 salary, rather than giving the teacher the equivalent, the board winds up with total out-of-pocket cost that is almost identical to giving the raise, and the teacher winds up with almost identical take-home pay, but the teacher’s pension will be based on $100,000, not $109,400. That’s why it’s financially better.

For other state employees, who participate in Social Security, the state also saves by taking on the retirement contribution rather than giving the equivalent raise because the state has to pay FICA on the raise, but not on its own contribution to the retirement plan. The employee doesn’t pay FICA on the state’s contribution, either. So picking up the contribution both reduces the eventual penson and leaves about 12% more current cash in the pockets of the state and the employee compared to giving the equivalent raise.

- Mark - Tuesday, Sep 27, 11 @ 12:41 am:

Other than 64% of school districts in 2010-2011, what other state or local government employers currently pick up some or all of the employee’s pension contribution?